Bixin Ventures: Why Did We Invest $10 Million in Benfen?

TechFlow Selected TechFlow Selected

Bixin Ventures: Why Did We Invest $10 Million in Benfen?

Benfen Chain is the world's first public blockchain designed for stablecoin payments, positioned as a Web3 version of the Swift system, built specifically for use cases like stablecoin payments.

Author: Bixin Ventures

BenFen is a stablecoin-based ecosystem composed of the high-performance foundational public chain BenFen Chain (infrastructure layer), native stablecoin BUSD, BenPay, BenPay DEX, merchant services, and more.

As countries roll out regulatory policies for stablecoins, we believe the external environment for cross-border payments and other stablecoin-driven scenarios is maturing—potentially replacing traditional payment systems. Positioned as a Web3 version of the Swift network, BenFen focuses exclusively on stablecoin use cases and aims to reshape the future of cross-border payments through its proprietary high-performance blockchain.

TL;DR

-

Cross-border payment systems based on interbank communication networks suffer from long settlement times and high fees. Blockchain-based payment systems offer an effective solution.

-

BenFen Chain is the world’s first public chain dedicated to stablecoin payments, positioned as a Web3 alternative to Swift, purpose-built for stablecoin applications.

-

High security, throughput, and low gas fees: BenFen Chain uses the Move programming language and a DAG-enhanced consensus mechanism to achieve tens of thousands of TPS, sub-0.5-second latency, and gas fees under $0.001—placing it among the top-tier blockchains globally.

-

Innovative stablecoin issuance and stabilization mechanisms: 50% of the governance token BFC is permanently allocated to the treasury for issuing the native stablecoin BUSD. Elastic supply mechanisms, exchange rate reversion mechanisms, and other stabilization tools ensure price stability.

-

BenPay: A super app integrating on/off-ramping, exchange, staking/lending, offline spending, and on-chain red packet transfers. Unlike Ethereum and Solana, which treat ETH and SOL as first-class citizens, BenFen positions BUSD as the primary utility within its ecosystem—for gas fees, staking, and more.

-

Sleek user experience: Supports zkLogin, allowing users to sign in directly via Google or Apple accounts—eliminating the need for seed phrases.

-

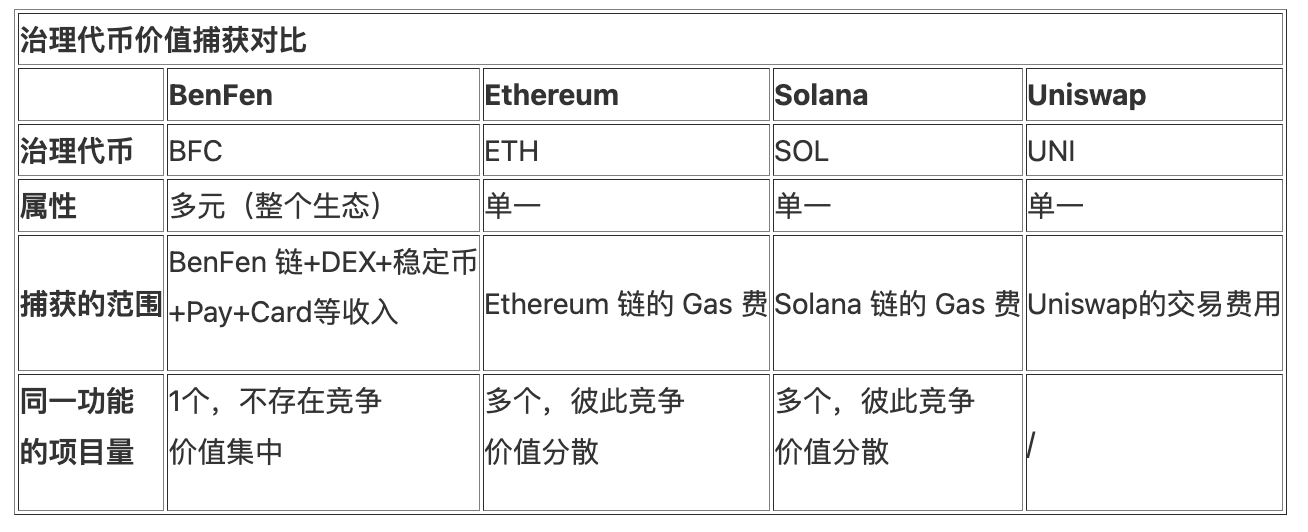

High-value governance token BFC: The BFC token captures value across the entire BenFen ecosystem—including BenFen Chain, multiple stablecoins (BUSD, BINR, BJPY, BEUR, etc.), BenPay DEX, BenPay, BenPay Card, and merchant services. From a valuation standpoint, BFC's worth should equal the sum of all these components.

-

Compared to other stablecoin solutions (infrastructure + stablecoin design), BenFen’s combination of a high-performance base layer and native stablecoin BUSD leads in security, throughput, latency, gas fees, and user onboarding experience.

-

BenFen is a high-potential project in a rapidly growing sector, with strong competitiveness, high user stickiness, and vast market potential. With robust chain performance, ultra-low latency and gas fees, revenue-supported valuation, excellent UX, and a growing ecosystem spanning stablecoins, payments, cards, P2P, and merchant services, BenFen presents compelling investment value.

Introduction to BenFen

Leveraging Stablecoins to Solve Persistent Cross-Border Payment Challenges: High Fees and Long Settlement Cycles

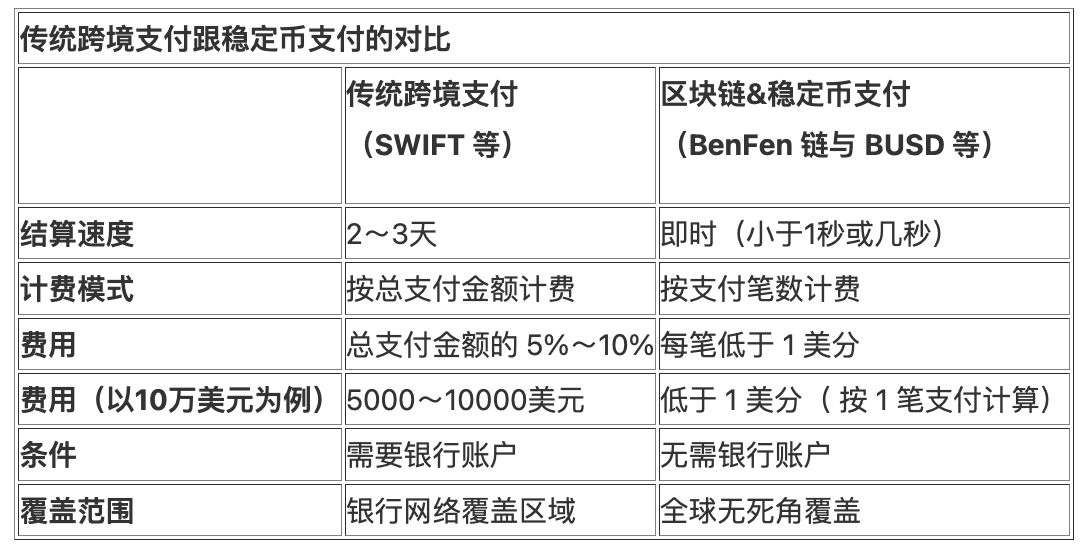

According to data from the Society for Worldwide Interbank Financial Telecommunication (SWIFT), traditional cross-border payments take 2–3 business days and incur fees of 5%–10% of the transaction amount. This model is costly and inefficient, severely hindering global finance and trade.

Moreover, since traditional cross-border payments rely on banking networks—and banks often avoid operating in unprofitable impoverished regions—approximately two billion people remain unbanked, deprived of basic financial rights.

Blockchain and stablecoin-based payment solutions directly address these issues. These systems typically consist of a foundational infrastructure layer (a public chain) and a stablecoin issued on-chain. The blockchain functions similarly to SWIFT, while the stablecoin acts like the dollar within SWIFT. Combined, they enable near-instant settlement (under one second or a few seconds), fees at the cent level, no need for bank accounts, and 24/7 global coverage without blind spots.

BenFen Chain: A Web3 Version of SWIFT, Built Specifically for Stablecoin Payments

Building a cross-border payment system first requires secure, high-performance, low-cost infrastructure—a foundational public chain. However, existing chains face challenges related to low security, high fees, or poor performance. For example, Ethereum, Arbitrum, and Base use Solidity for application development, which is less secure than Move. Additionally, Ethereum suffers from over 10-second latency and gas fees exceeding $20.

To fully overcome these limitations, BenFen chose not to build atop existing chains but instead developed a new Move-based public chain from scratch, along with upper-layer applications. After over two years of development by a team of nearly 100 engineers, BenFen achieved transaction throughput in the tens of thousands per second and latency under 0.5 seconds. It also launched key components such as the native stablecoin BUSD, BenPay, BenPay DEX, and BenFen Oracle. As a Web3 version of SWIFT, BenFen Chain is purpose-built to advance cross-border payments via stablecoin-centric architecture.

Using the Move Programming Language for Enhanced Security

The Move language was originally developed for Facebook’s Diem project. Its strict type system catches many common errors at compile time. The unique concept of “Resources” ensures assets can only be used for their intended purposes, preventing reentrancy attacks and resource leaks. Furthermore, fine-grained access control allows permissions to be restricted based on user roles, blocking unauthorized access.

Move promotes immutable data structures and functional programming paradigms, reducing code complexity. It also provides formal verification tools that perform static analysis and validation to identify and fix potential security vulnerabilities.

Move includes the Move Specification Language (MSL), enabling precise program behavior descriptions. Programs described in MSL are compiled via the Move-to-Boogie compiler into Boogie—an intermediate language with formal semantics—then verified using automated theorem provers to ensure compliance with specifications.

Thanks to modular design, advanced abstractions, custom data types, flexible permission controls, and cross-platform compatibility, Move enables BenFen Chain to support diverse application needs. BenFen further enhances developer efficiency by providing a standard library with over 40 commonly used modules, including account management, transfers, and transactions.

Improved Consensus Mechanism and Cost Optimizations Enable Higher Performance & Lower Gas Fees

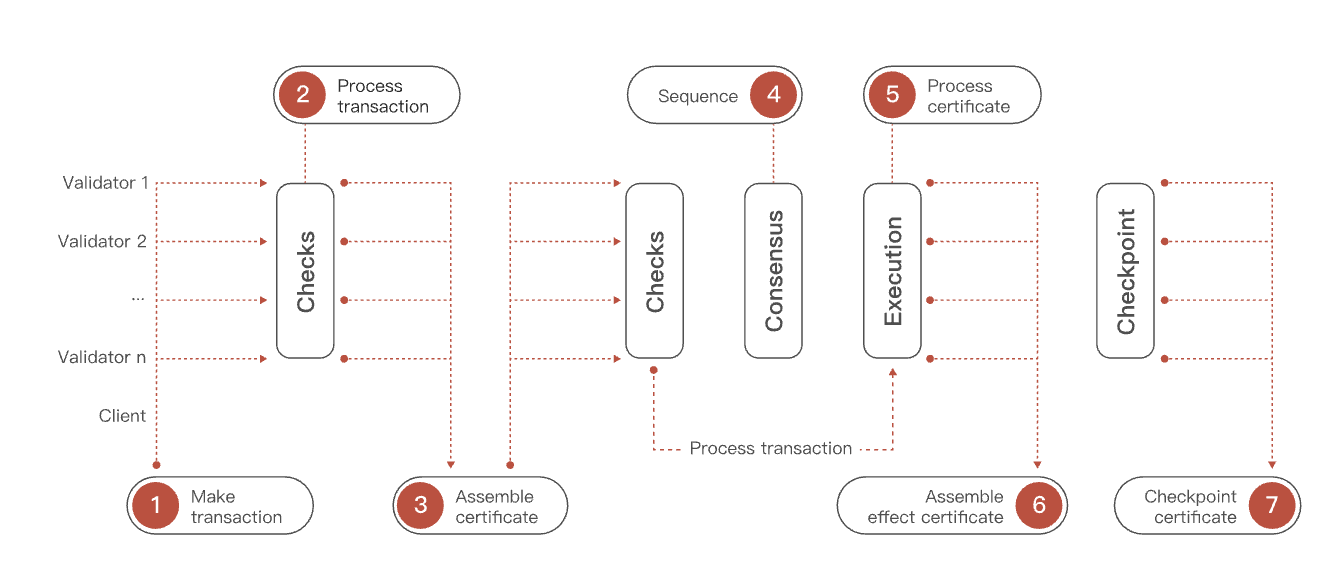

To achieve higher performance and lower gas fees, BenFen Chain combines DAG-based consensus with a no-consensus approach. When users create and sign transactions using their private keys, those transactions are sent to every validator in the network. Validators perform validity checks and return signed responses to the client. The client then collects replies from a majority of validators to form a transaction certificate.

For transactions involving user-owned objects, the certificate can be processed immediately without waiting for consensus engine confirmation. All certificates are ultimately finalized via a DAG-based consensus protocol executed by validators on the BenFen chain. Each consensus submission creates a checkpoint, ensuring long-term network stability. This optimized process enables BenFen Chain to achieve sub-0.5-second transaction latency and throughput in the tens of thousands per second.

BenFen Chain Flowchart Source: BenFen Whitepaper

Regarding gas fees, the Move language inherently reduces costs. Object-based storage models and the consensus mechanism further contribute to fee reduction. Gas fees generally consist of computation and storage costs. BenFen Chain refunds storage fees when prior stored objects are deleted during transactions. In addition to supporting BFC for gas payments, BenFen Chain also allows BUSD and BJPY to pay gas fees. These optimizations bring gas fees below $0.01 per transaction.

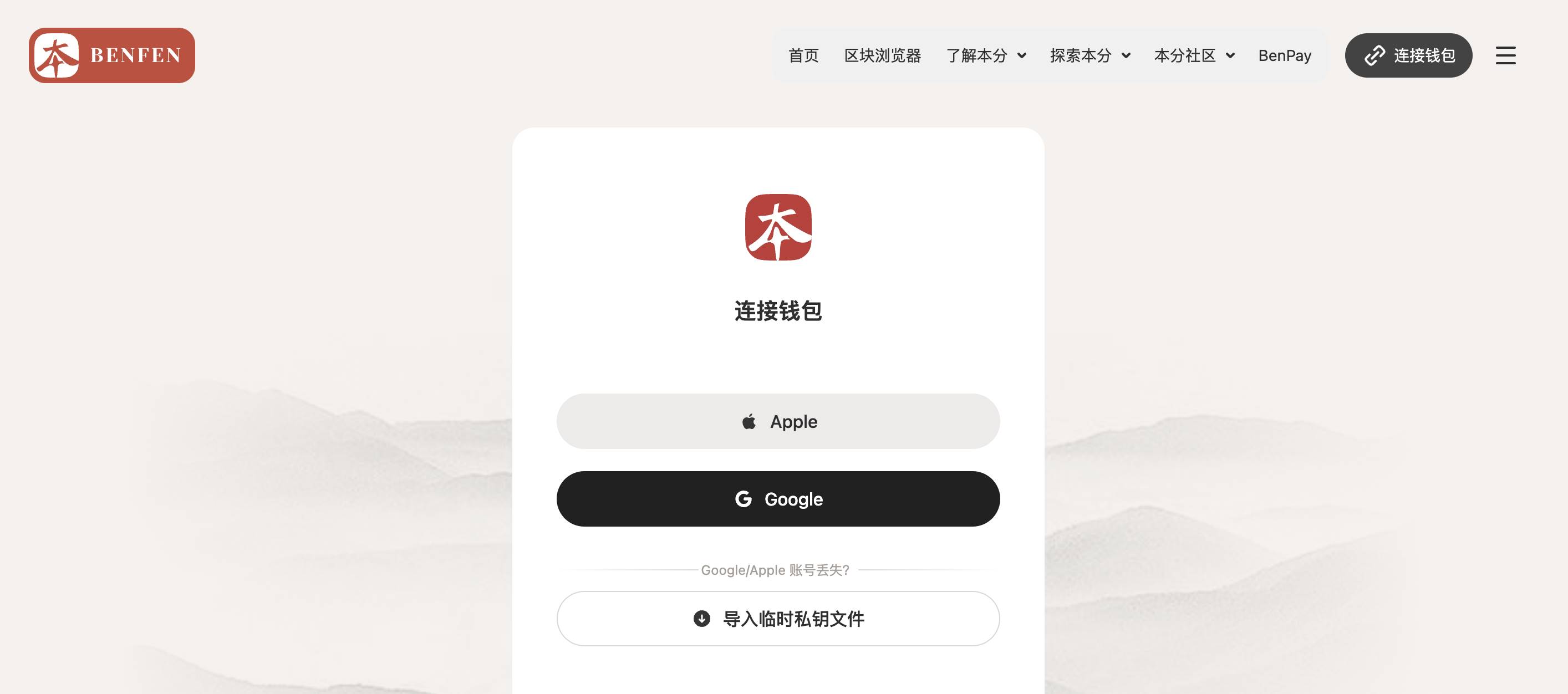

No Seed Phrases Needed: zk-Login Support Enables Sign-In via Google/Apple Accounts

Traditional Web3 onboarding often requires managing seed phrases—a cumbersome process that hinders adoption. BenFen Chain supports zk-Login, enabling one-click login via Google or Apple accounts without seed phrases, dramatically lowering the barrier for Web2 users.

zk-Login allows users to generate a BenFen address using third-party OAuth providers. Importantly, these OAuth providers cannot access the user’s temporary private key.

zk-Login Interface Source: Official Website

Native Stablecoin Supporting Gas Fees and On-Chain Staking

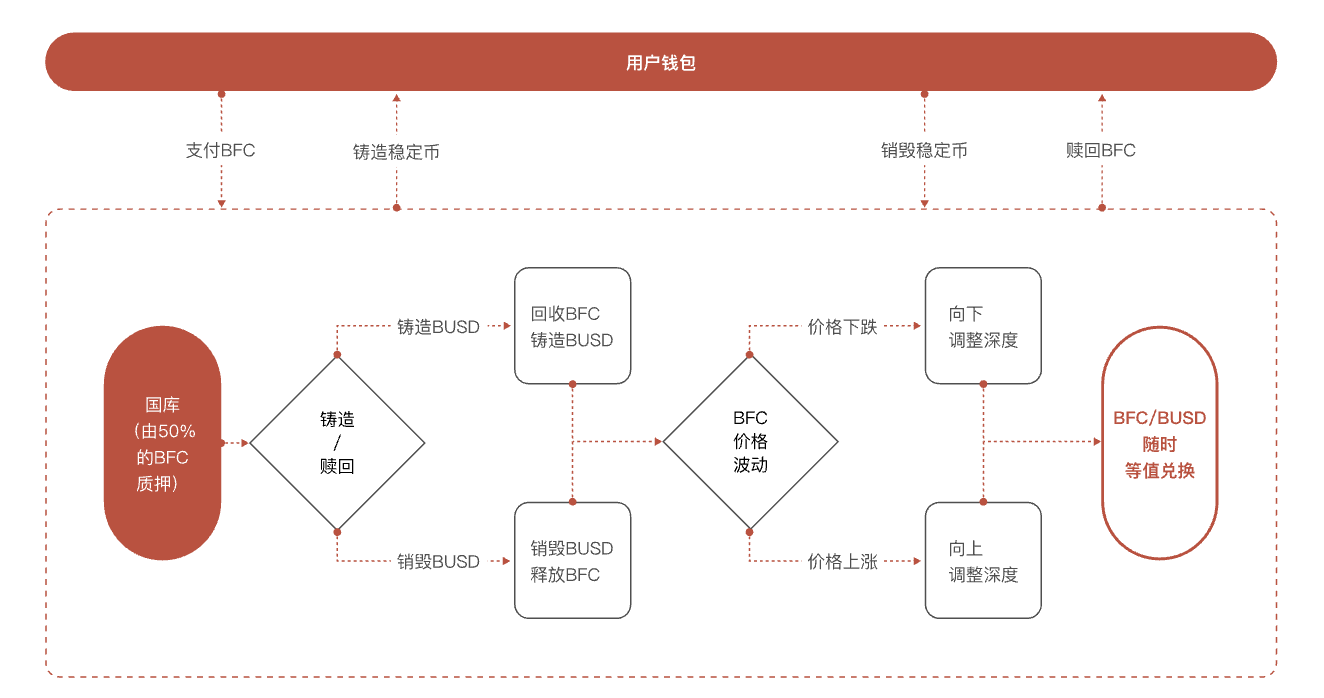

BenFen will launch multiple stablecoins. BUSD is minted by staking 50% of the BFC tokens held in the treasury. Elastic supply is managed through BenPay DEX, while dynamic liquidity mechanisms help maintain relative exchange rate stability.

When minting BUSD, BenPay DEX burns BFC; when redeeming BUSD, BenPay DEX releases BFC back into circulation. This process may cause BFC price fluctuations. To stabilize prices, the system adjusts depth dynamically—increasing depth when prices fall and decreasing it when prices rise. From the user perspective, users pay BFC to obtain stablecoins and redeem BFC when burning stablecoins.

BUSD Minting and Redemption Process Source: BenFen Whitepaper

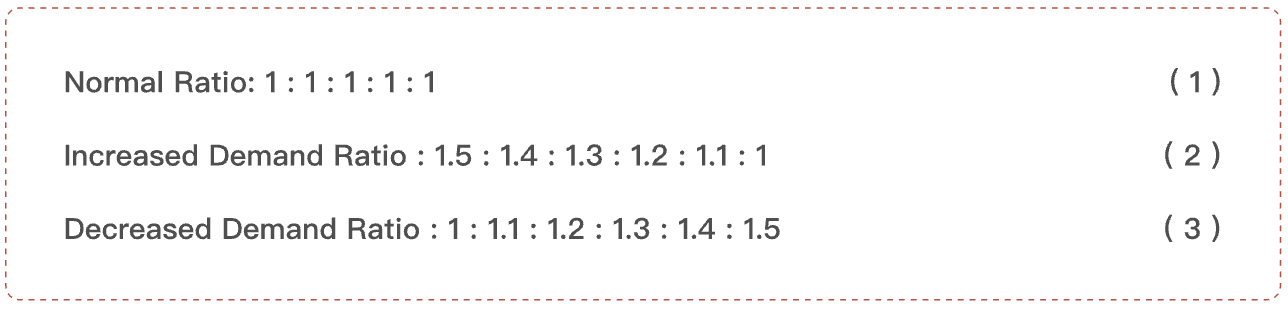

Regarding depth adjustments: if BUSD trading volume increases, the system automatically adds liquidity to reduce friction. Conversely, if volume drops, liquidity is reduced.

Through dynamic liquidity management, the BenFen stablecoin protocol can partially guide price trends—for instance, increasing liquidity to curb price surges or reducing it to prevent excessive declines. The specific liquidity adjustment ratios are shown below.

Liquidity Adjustment Ratio

For other stablecoins, BenFen issues fiat-pegged variants using its native exchange rate oracle. For example, with BJPY, users first acquire BFC via minting or cross-chain swaps, then use the oracle price feed to mint BJPY. When users no longer need BJPY, they initiate redemption and receive BUSD at the current oracle rate, thereby reducing BJPY liquidity in the market.

BenPay: A Super App Integrating On/Off-Ramping, Exchange, Staking/Lending, Offline Spending, and Red Packet Transfers

BenPay is the core application of the BenFen ecosystem, centered around payment use cases. To simplify user onboarding, BenFen offers a full suite of integrated services. Users can use BenPay P2P for deposits and withdrawals, BenPay DEX for token swaps, and BenPay Card for offline spending. BenPay DEX uses oracles to fetch real-time prices, enabling spot and perpetual contract trading. For merchants, BenPay Merchant provides a crypto payment gateway supporting collections and refunds.

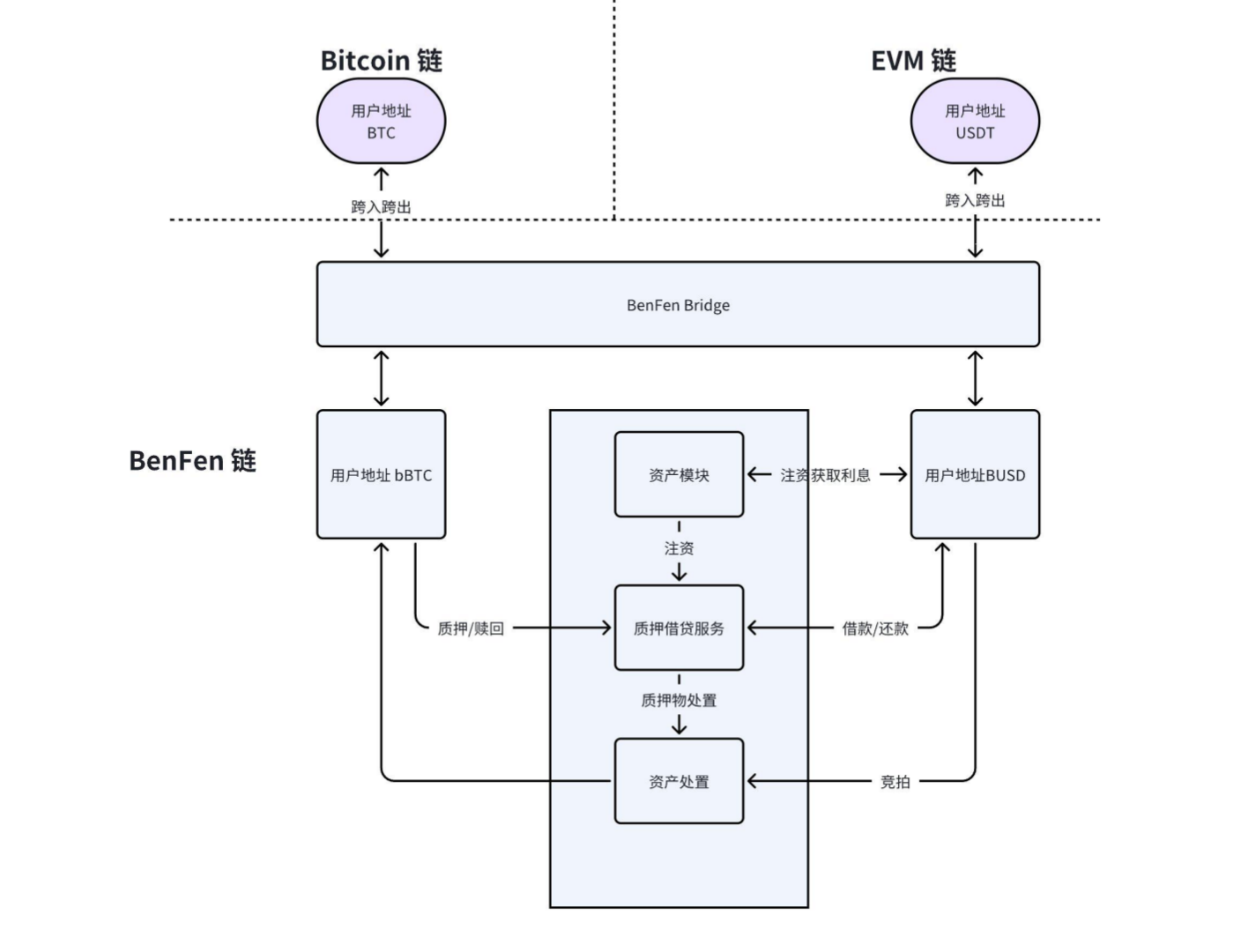

During bull markets, users may wish to retain BTC holdings while accessing liquid funds. Using BenPay’s staking-lending feature, users can stake BTC to borrow USDT. They receive bBTC on the BenFen Chain, stake it, borrow BUSD, then bridge BUSD to USDT via BenFen Bridge and transfer it to their EVM-compatible wallet address.

Diagram of BenPay’s Staking-Lending Functionality

BenPay also supports peer-to-peer transfers similar to WeChat’s red packet and money transfer features. When sending red packets, users can choose between regular or randomized ("luck-based") distributions. The sender sets a password prompt and pays a small gas fee to distribute the red packet to others.

BenPay Red Packet Illustration

High-Value Governance Token BFC Fully Captures Ecosystem Value

From a valuation perspective, a blockchain’s value equals the discounted sum of future gas fees, while a DEX’s value reflects the discounted sum of future trading fees—similar principles apply to stablecoins and payment platforms.

Unlike other chains where governance tokens capture only chain-level value (e.g., ETH capturing Ethereum gas fees, UNI capturing Uniswap fees), BenFen’s BFC token captures value across the entire ecosystem—including the chain, stablecoins (BUSD, BINR, BJPY, BEUR, etc.), BenPay DEX, BenPay, BenPay Card, and merchant services. Therefore, BFC’s total value equals the sum of all these components, making it significantly more valuable.

Additionally, most ecosystems host multiple competing projects for the same function—for example, multiple DEXs like Uniswap, Balancer, and Sushi. This internal competition leads to value dilution. Given that dominant models (like CLMM DEXs) are already mature, BenFen opts to develop only one product per function within its ecosystem, avoiding redundancy and maximizing value capture efficiency.

Diversified Ecosystem: From On/Off-Ramping and Asset Entry to Exchange and Offline Payments

BenFen boasts a diversified ecosystem including:

-

BenPay DEX: A swap application within the BenFen ecosystem offering multi-token trading.

-

BenFen Bridge: A decentralized cross-chain bridge enabling users to move assets into the BenFen ecosystem.

-

BenPay Card: Allows users to spend cryptos offline. Users can top up BUSD and make physical purchases. BenPay Card also supports top-ups in other cryptocurrencies and payments in multiple fiat currencies.

-

BenPay Merchant: A crypto payment channel offering enhanced functionality such as fiat-to-BUSD purchases, instant P2P transfers, merchant payment solutions, and refund processing.

-

BenFen KYC: An on-chain identity authentication and authorization system aggregating verifications from major KYC providers, enabling one-click multi-platform KYC checks and peer-to-peer identity validation.

-

BenFen P2P: A secured escrow trading platform addressing the lack of reliable on/off-ramping channels.

Token Utility and Allocation

BenFen plans to issue 1 billion BFC tokens, distributed as follows:

- 5% (50 million BFC) for staking rewards

- 5% (50 million BFC) for community incentives and the BenFen Foundation to support contributors and fund foundation operations and growth

- 37.84% (378 million BFC) for node rewards, distributed through mining

- 2.16% (21.59 million BFC) allocated to the development team to incentivize and support core developers and ongoing project development

- 50% (500 million BFC) reserved for the stablecoin treasury to maintain price stability and liquidity of BenFen’s stablecoins

Investment Rationale and Business Analysis

Scale and Potential: Stablecoin Transfer Volume Could Reach $38 Trillion Annually by 2030

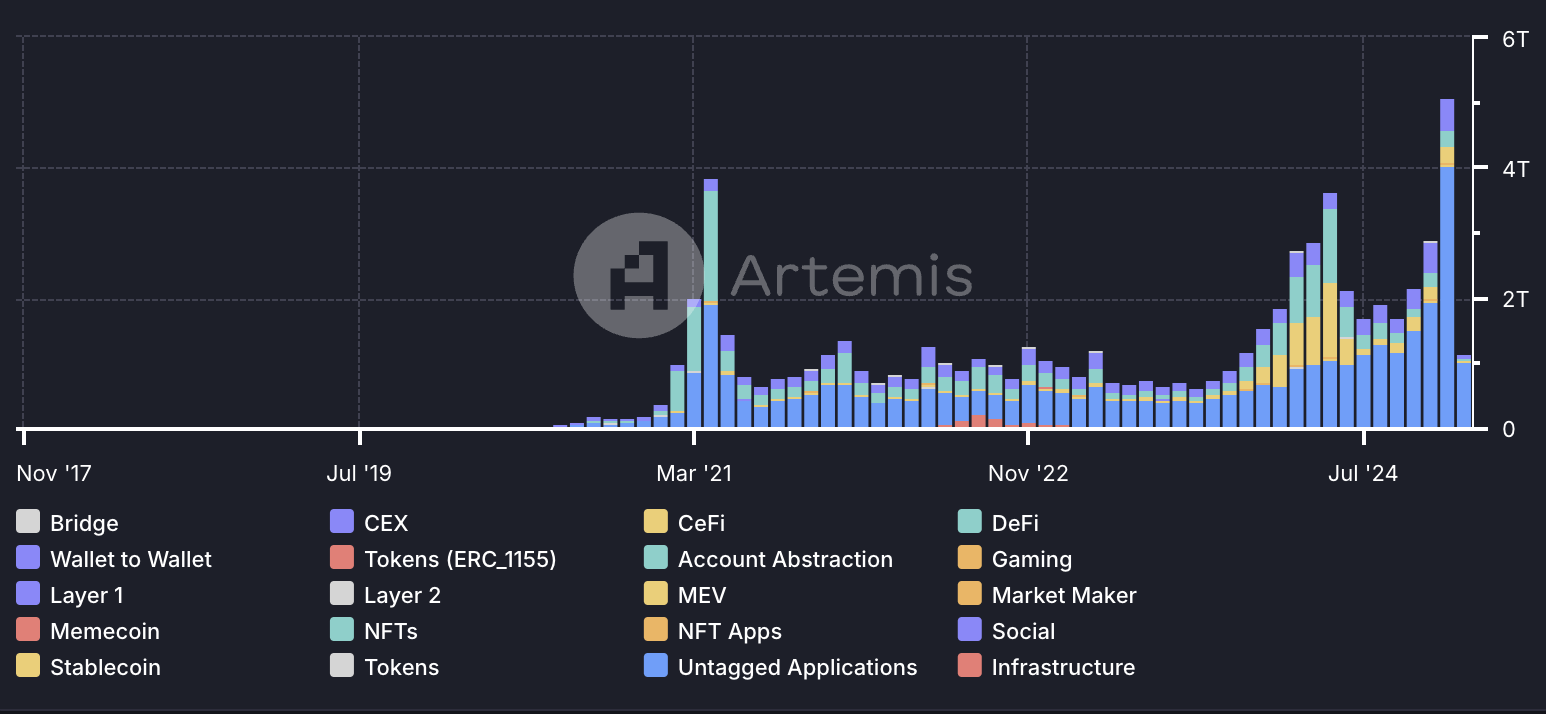

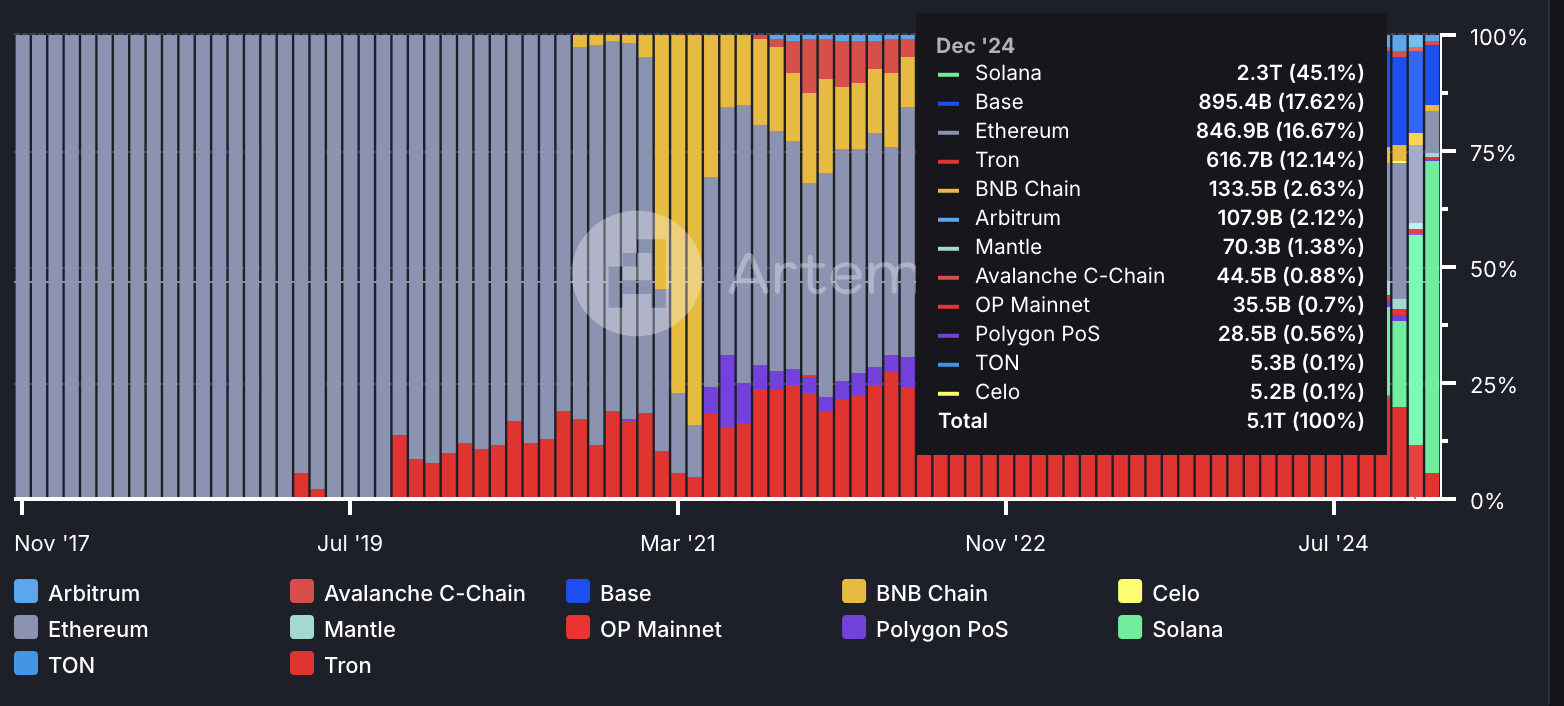

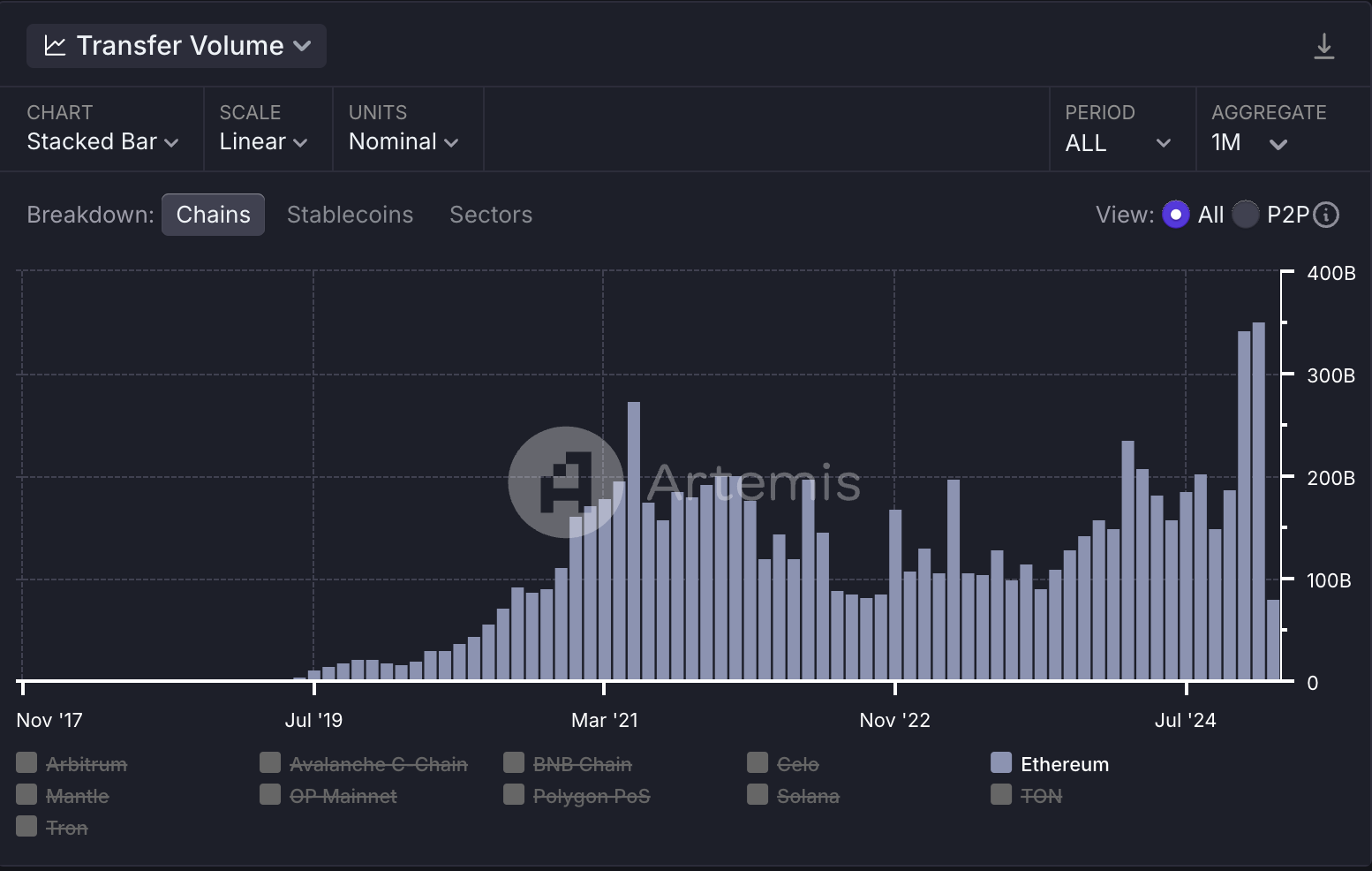

Historically, according to Artemis data, stablecoin monthly settlement volume reached $5.1 trillion in December 2024 (averaging ~$170 billion daily), more than tripling from $1.2 trillion in December 2023. In December 2021, this figure was just $218.2 billion—representing over 22x growth in three years.

Looking ahead, VanEck forecasts that global stablecoin daily settlement volume could reach an astonishing $300 billion by 2025, driven largely by adoption from tech giants and payment networks like Visa and Mastercard. Remittance markets are also expected to grow explosively—for example, stablecoin transfers between the U.S. and Mexico could increase fivefold.

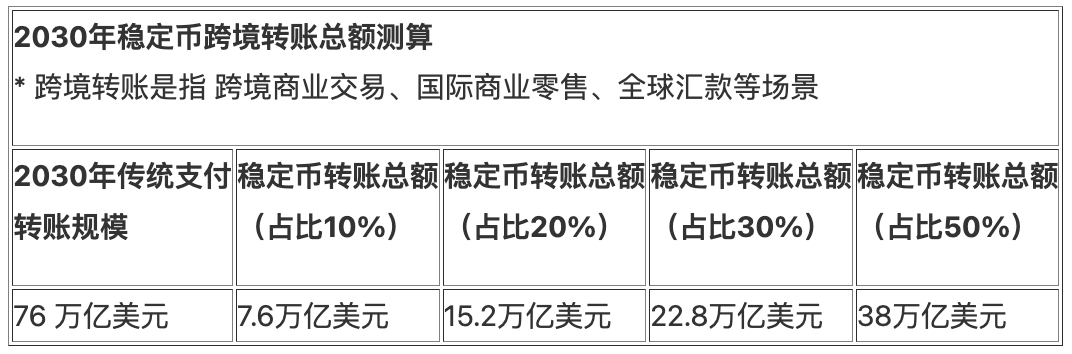

Monthly Stablecoin Settlement Volume Source: Artemis

In the longer term, according to IFAD, FXC Intelligence, and Statista, cross-border commercial transactions, international retail, and global remittances totaled $45 trillion in 2023 and could rise to $76 trillion by 2030. Given stablecoins’ advantages—instant settlement, low cost, 24/7 availability, and transparency—they are poised to partially replace traditional payment methods. Assuming stablecoins capture 10%, 20%, 30%, or 50% of this total by 2030, annual stablecoin transfer volume could reach as high as $38 trillion.

Competitive Landscape: USDT and USDC Dominate; Solana, Base, and Ethereum Rank Top Three in Infrastructure

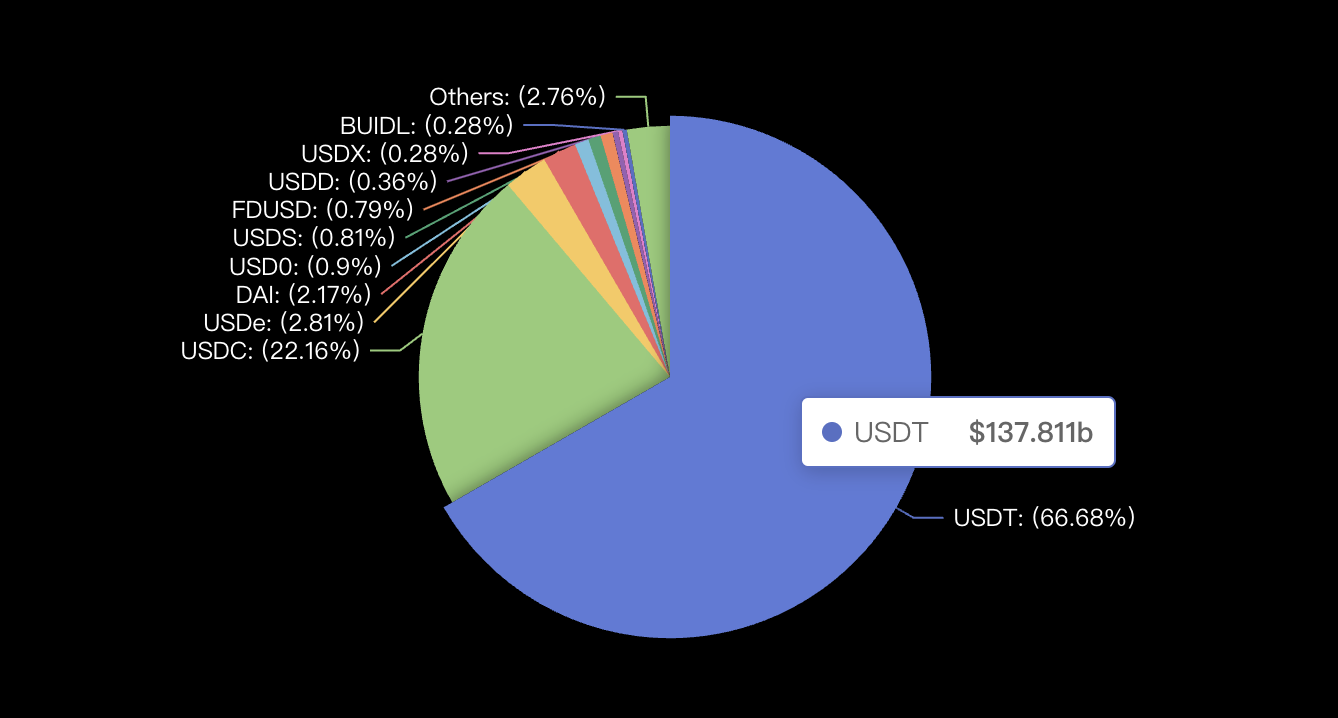

In terms of issuance size, DeFillama data (as of January 2025) shows USDT leading with $137.8 billion (66.7% market share). USDC ranks second with $45.8 billion (22.16%). USDe comes third with $5.81 billion (2.81%), followed by DAI with $4.48 billion (2.17%).

Stablecoin Market Share by Issuance Size Source: DeFillama

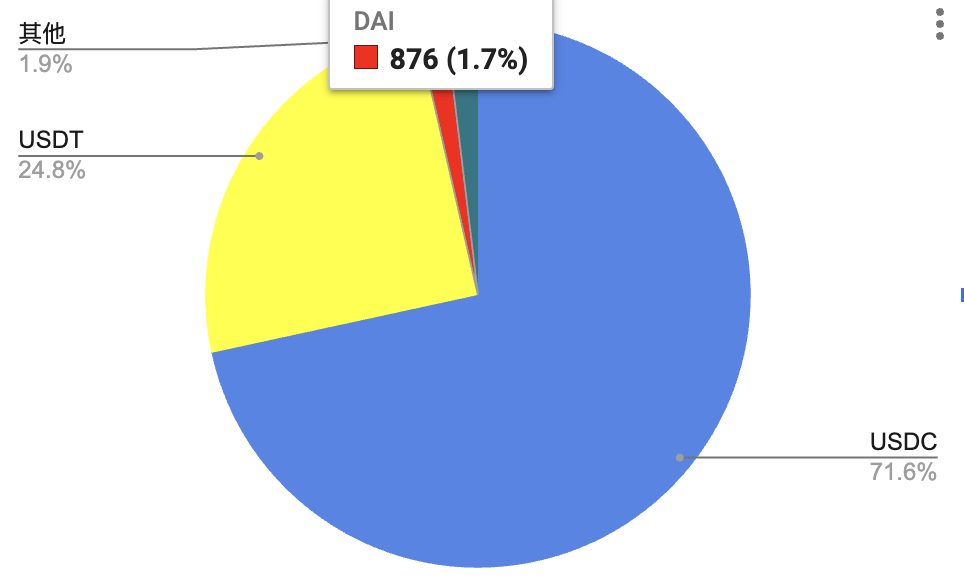

In settlement volume, Artemis data from December 2024 shows USDC leading with $3.6 trillion monthly settlements (71.6% share). USDT follows with $1.3 trillion (24.8%), and DAI with $87.6 billion (1.7%).

Stablecoin Market Share by Settlement Volume Source: Artemis

On the infrastructure side, Artemis data from December 2024 shows Solana leading with $2.3 trillion in monthly settlement volume (45.1% share). Base follows with $895.4 billion (17.62%), and Ethereum with $846.9 billion (16.67%).

Stablecoin Infrastructure (Base Layer Chains) Competition Source: Artemis

Comparison Across Key Metrics with Competitors

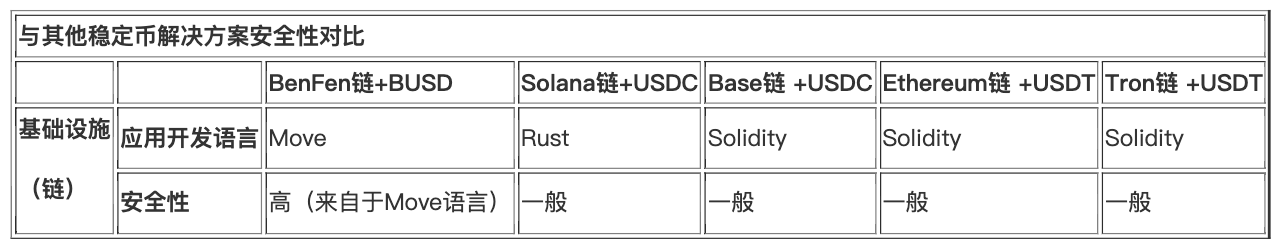

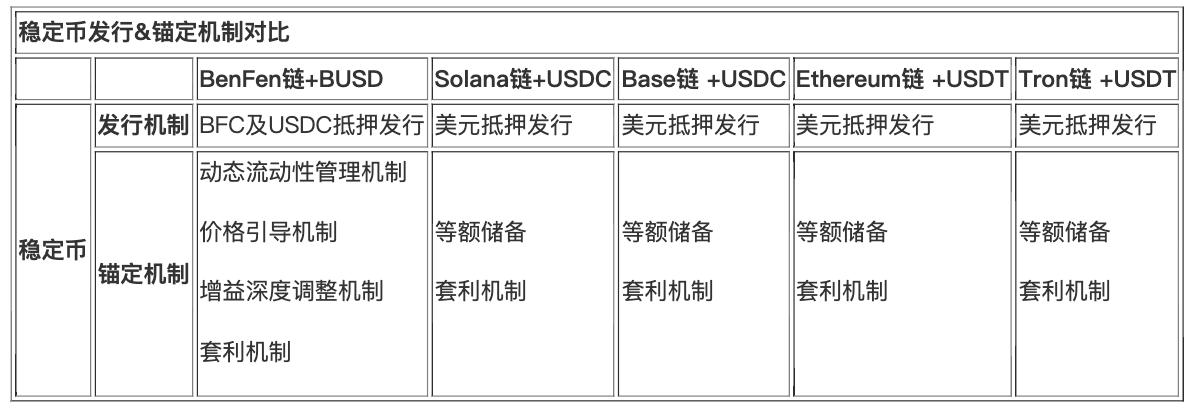

Since stablecoin applications depend not only on the stablecoin itself but also on underlying infrastructure (the blockchain), we selected several leading stablecoin solutions—Solana+USDC, Base+USDC, Ethereum+USDT, and Tron+USDT—as benchmarks to compare against BenFen Chain and BUSD across multiple dimensions.

Infrastructure

The infrastructure for stablecoins primarily refers to the underlying blockchain, whose characteristics—security, performance, and cost—directly impact application development.

In terms of security, BenFen Chain uses Move as its smart contract language, which offers higher inherent security compared to Solidity (used by Ethereum) and Rust (used by Solana).

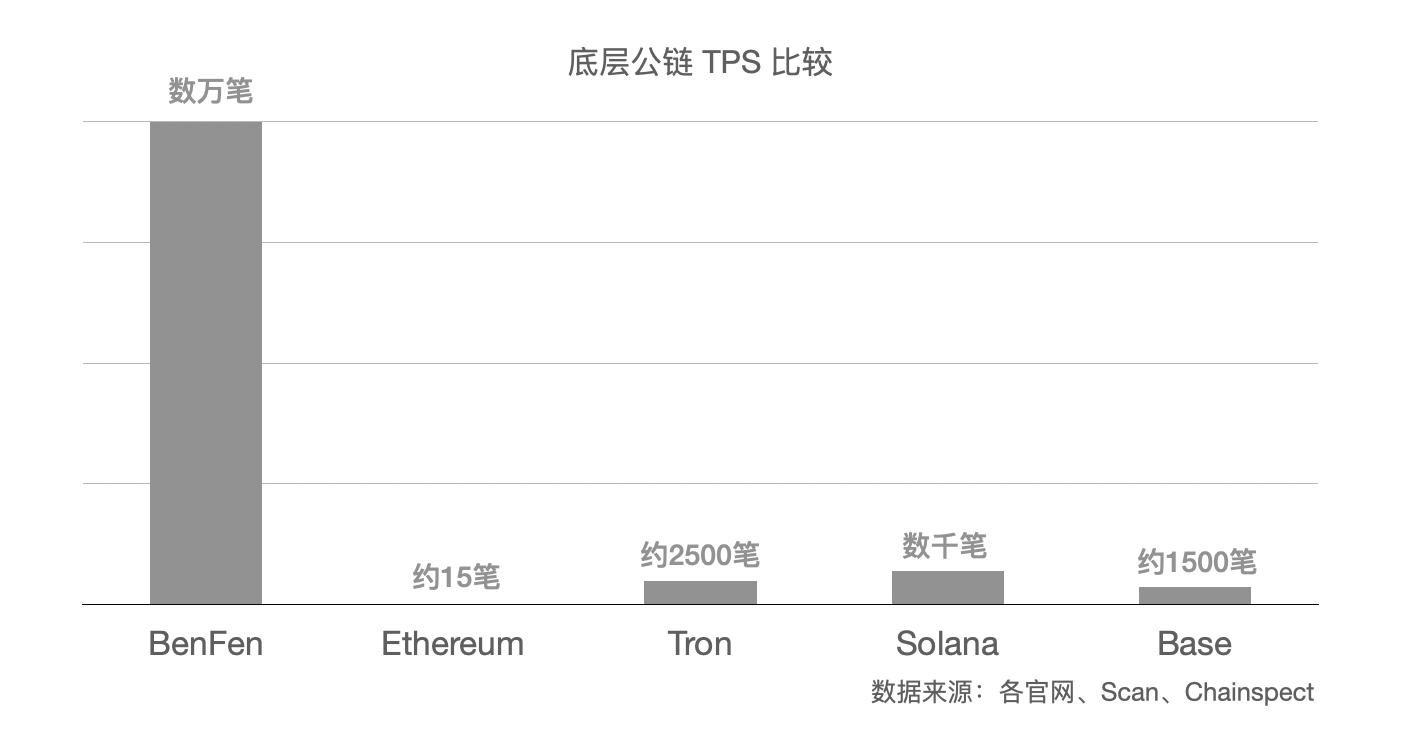

In TPS, BenFen Chain achieves tens of thousands of transactions per second, surpassing other chains. Higher TPS enables larger-scale payment and transfer operations.

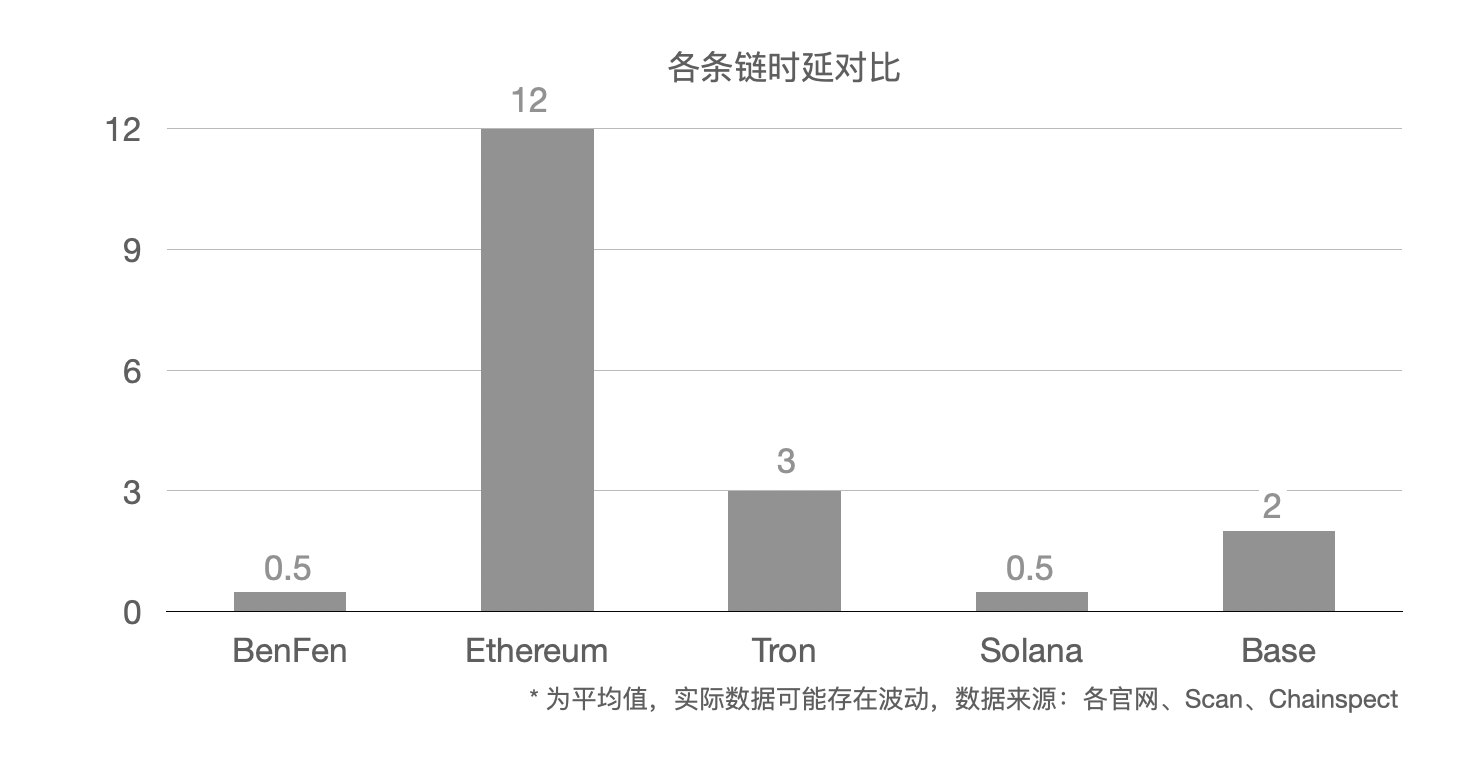

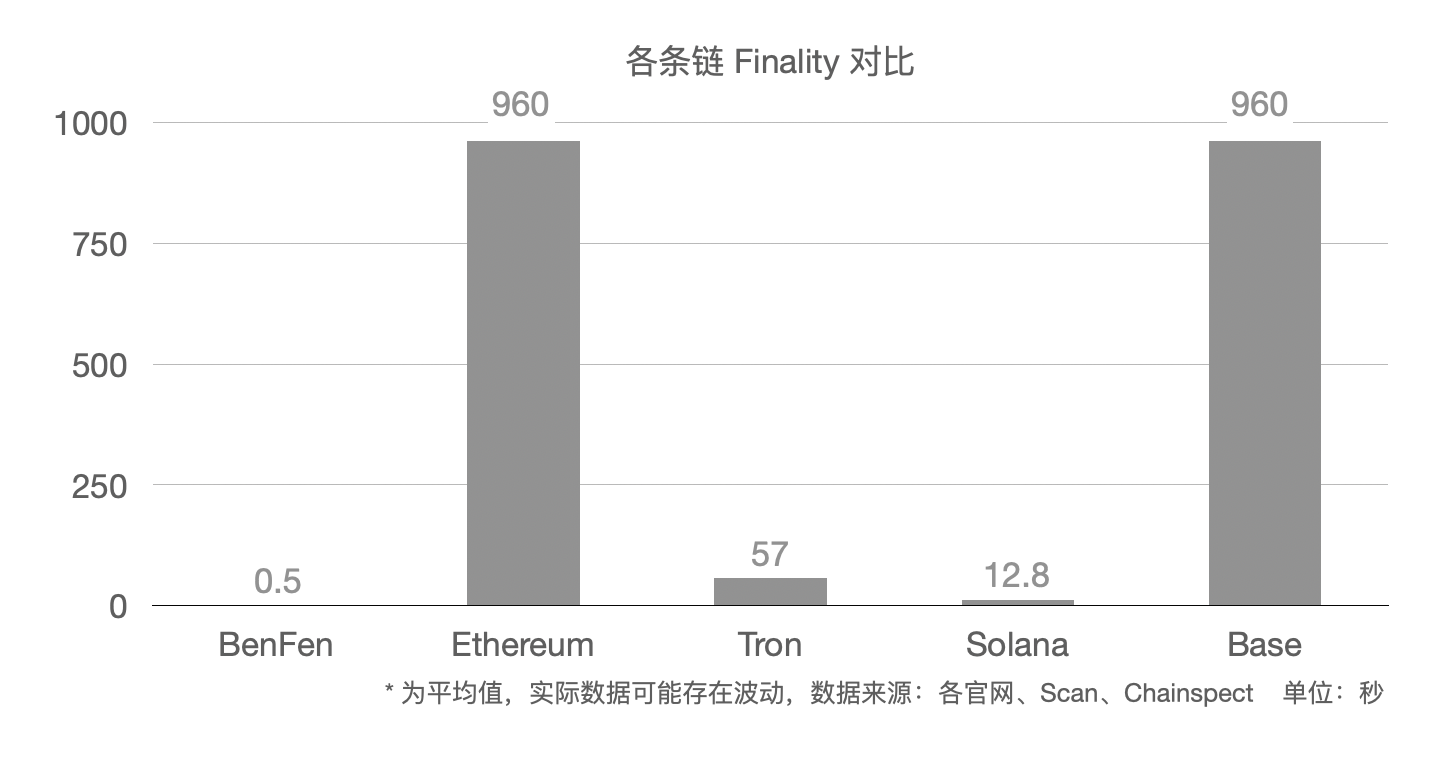

In latency, BenFen Chain delivers 0.5-second finality, placing it at the industry forefront. Lower latency translates to faster, smoother user experiences.

In finality, BenFen Chain’s single-layer architecture means finality closely matches latency—giving it a significant edge. Finality refers to the time it takes for a transaction to be permanently recorded on-chain. Shorter finality improves security, reliability, and user experience.

In contrast, L2s like Base must submit transactions to Ethereum for final settlement, meaning their finality depends on Ethereum—often taking over 15 minutes.

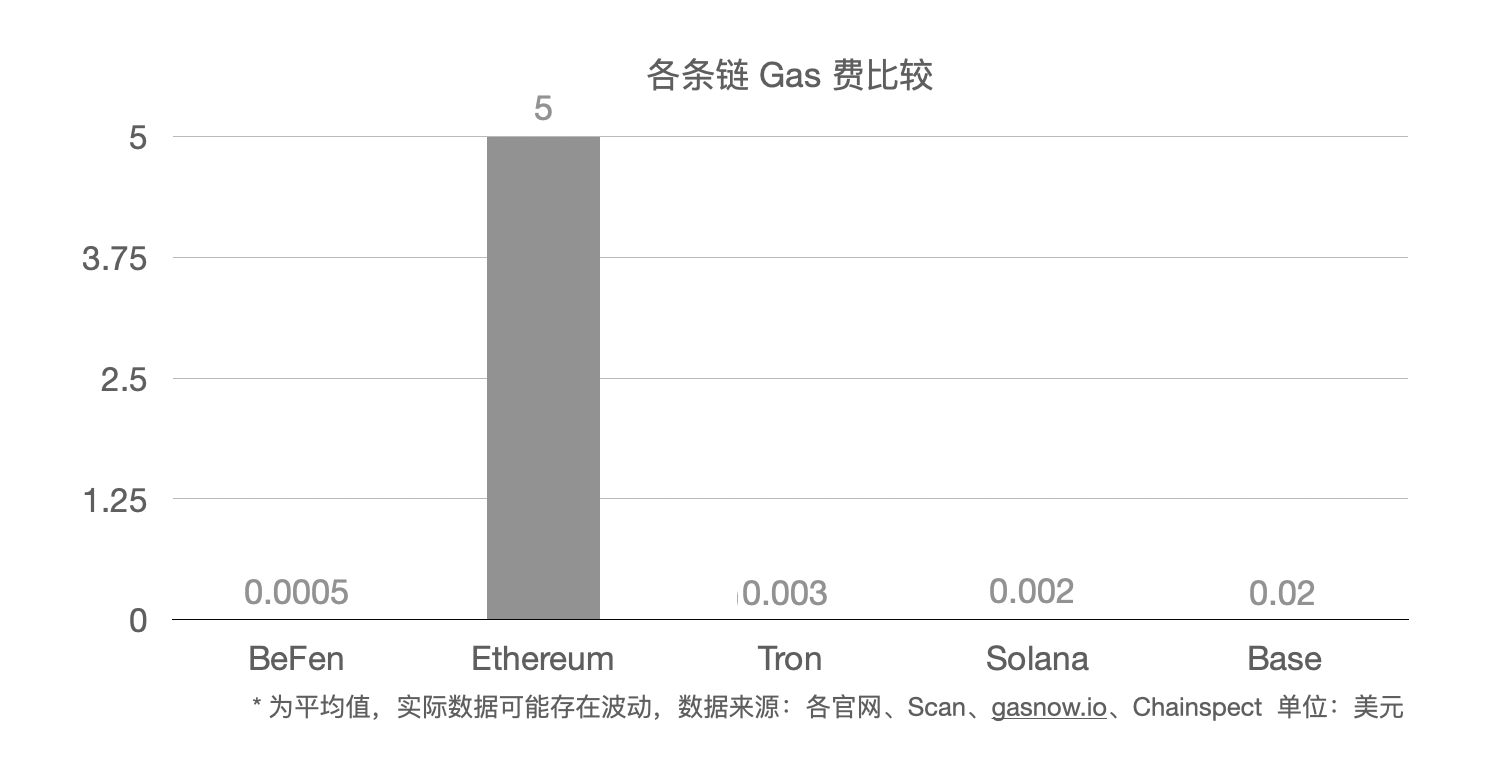

In gas fees, BenFen Chain offers extremely low costs—under $0.001 per transaction—compared to Ethereum’s average of ~$5. Lower fees enhance real-world usability in everyday payment scenarios.

Stablecoin Mechanism

While other stablecoins rely solely on USD-backed collateral, BenFen allows both 1:1 USDC collateralization and BFC-staked issuance of BUSD.

In terms of peg stability, BUSD employs dynamic liquidity management, price guidance mechanisms, depth adjustment algorithms, and arbitrage incentives to maintain price stability.

User Adoption

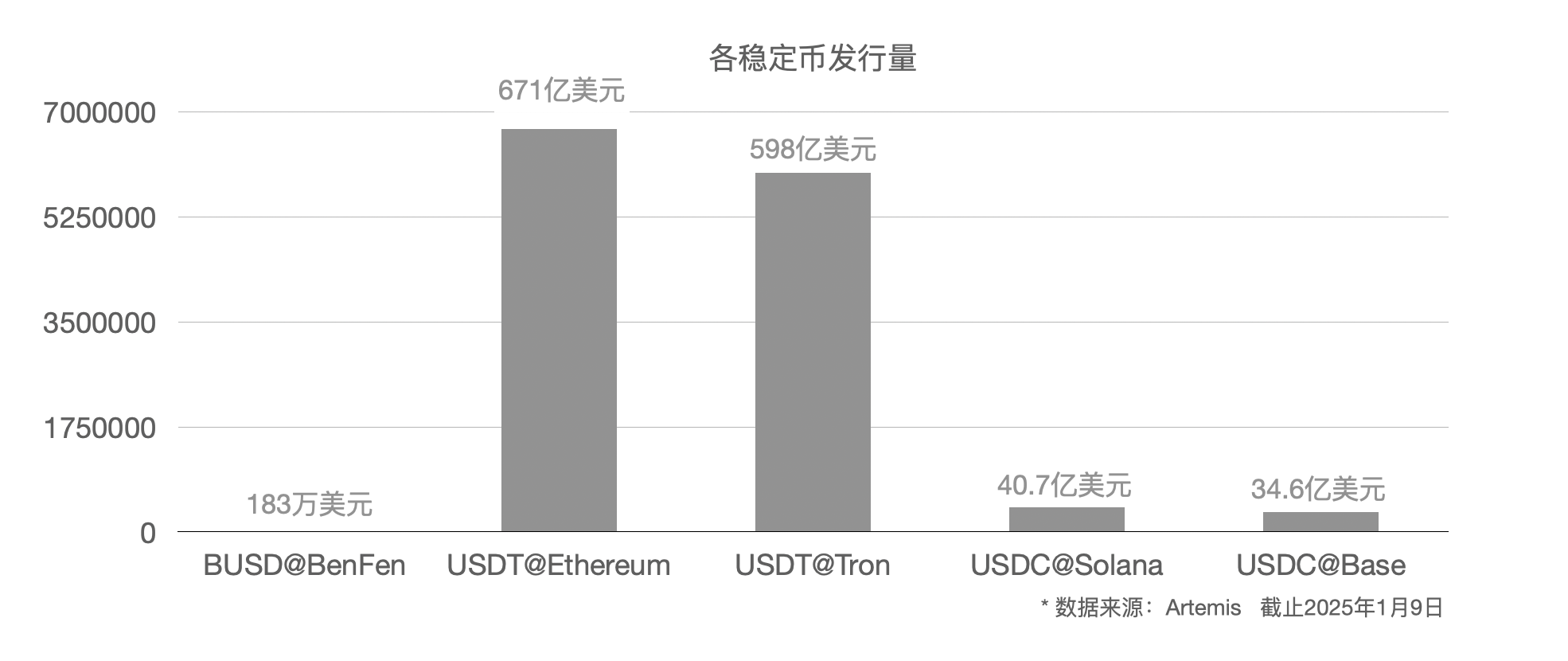

In issuance volume, BenFen is still early-stage with only $1.83 million in total BUSD issued. By comparison, USDT has $67.1 billion issued on Ethereum (ranked first) and $59.8 billion on Tron (second). USDC has $4.07 billion on Solana and $3.46 billion on Base, ranking third and fourth respectively.

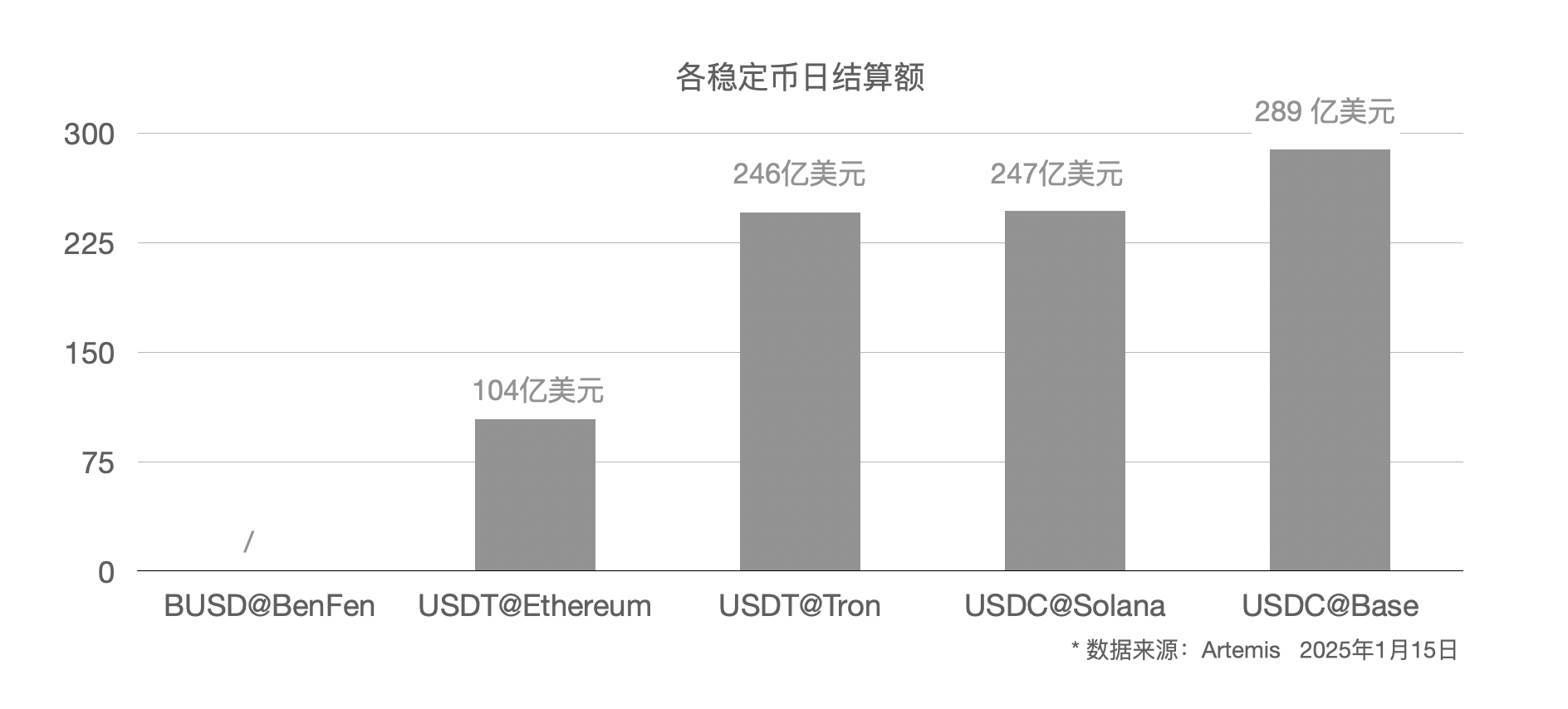

In settlement volume, BUSD on BenFen is negligible due to its recent launch. USDC on Base leads with $28.9 billion in daily settlements, followed by USDC on Solana with $24.7 billion. USDT on Tron and Ethereum sees $24.6 billion and $10.4 billion daily, ranking third and fourth.

Key Competitor Profiles

Solana + USDC

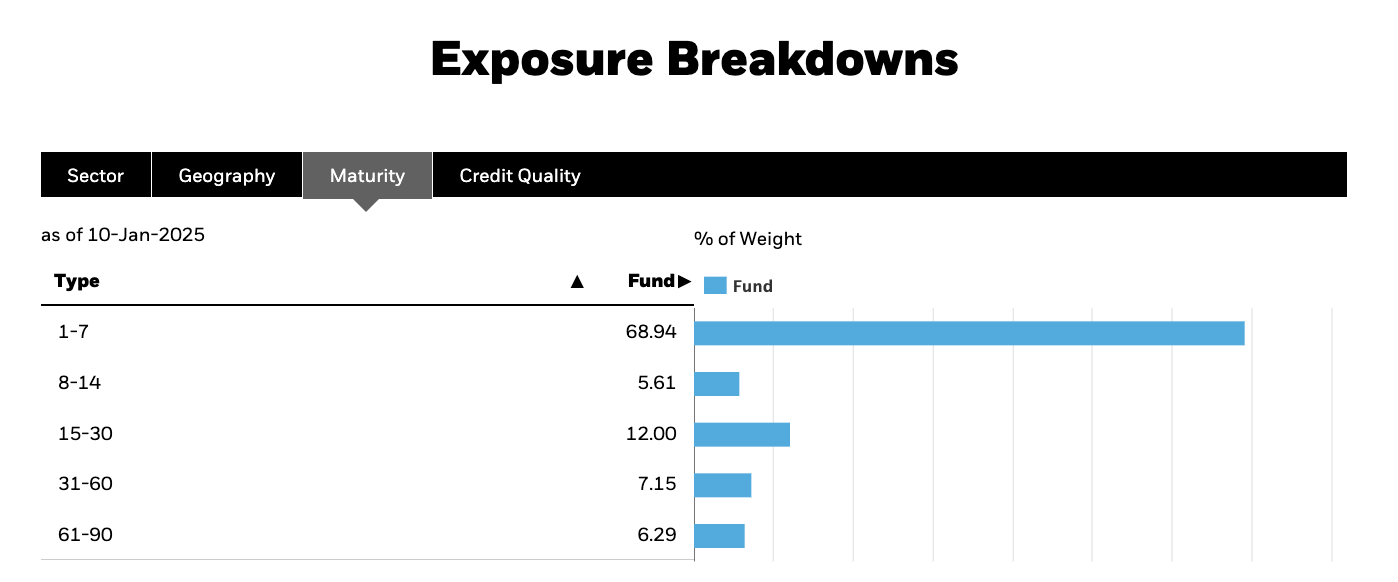

Despite having only $4.37 billion in issuance, USDC on Solana achieves $247 billion in daily settlement volume. This impressive performance stems from two main factors: First, Solana’s high TPS and low gas fees provide solid infrastructure for stablecoin applications. Second, Circle maintains high transparency and compliance—regularly publishing reserve details, undergoing audits by Deloitte, and entrusting BlackRock to manage most of the reserves for yield generation. Risk-wise, 68.94% of assets mature within 1–7 days. Users can view earnings reports directly on Circle’s website.

BlackRock’s Liquidity Management for USDC Reserves Source: BlackRock Website

Additionally, strategic collaboration between Circle and the Solana Foundation—especially incentive programs promoting USDC adoption—has accelerated growth. Some DeFi projects directly subsidize USDC usage to attract developers to build on Solana. The introduction of the Cross-Chain Transfer Protocol (CCTP) has further enhanced USDC’s liquidity and usability. Circle has also simplified smart contract integration, making USDC easier to adopt for developers.

However, Solana uses Rust for application development, which is less secure than Move.

Base + USDC

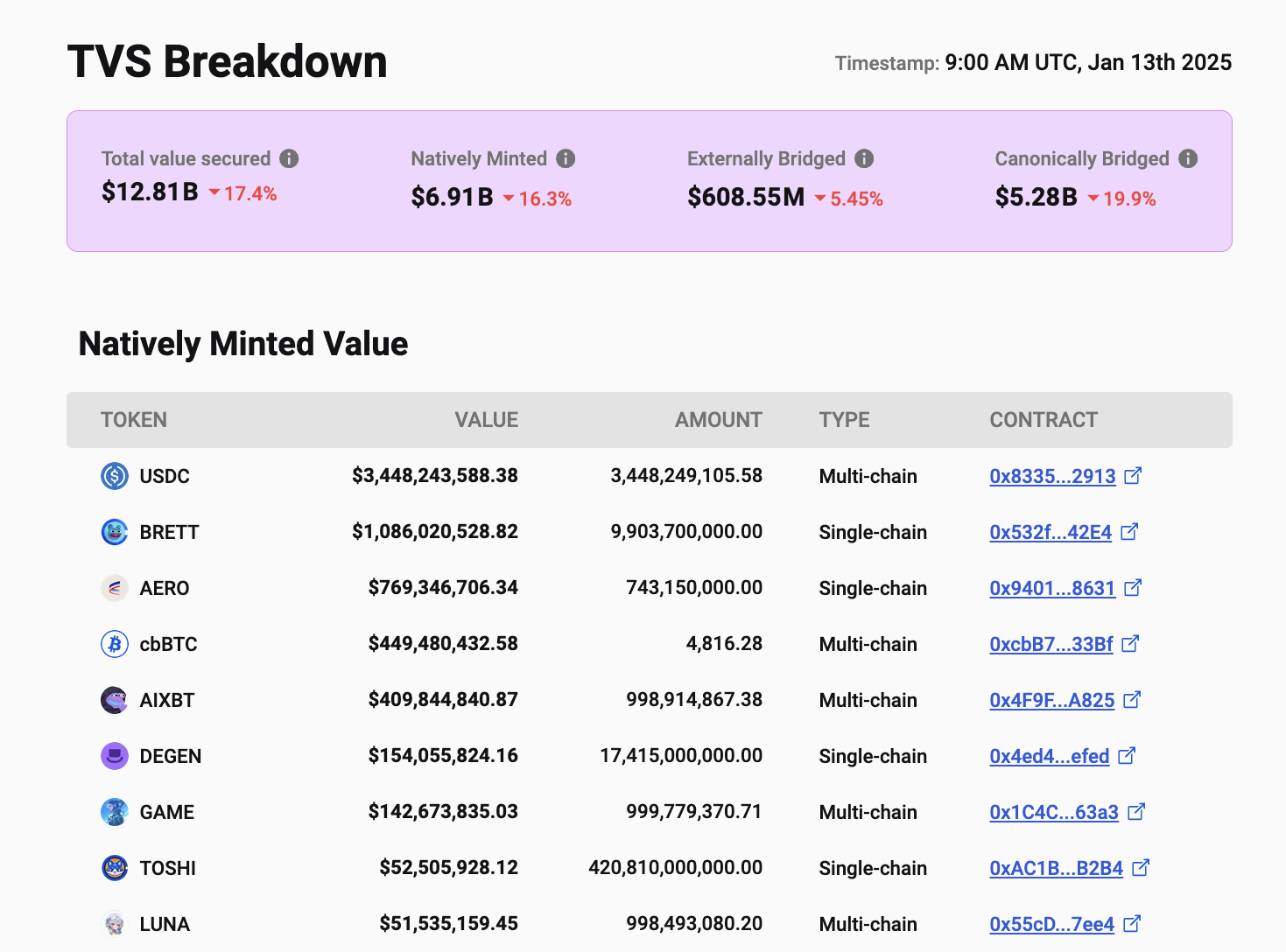

The Base + USDC solution has seen explosive growth in recent months, reaching $28.9 billion in daily settlement volume—the highest among peers—despite having only $3.47 billion in issuance.

In Q2 2024, Coinbase faced severe headwinds: transaction revenue dropped 50% year-on-year, USDC issuance shrank 41% over five months, and ETH staking faced SEC scrutiny. Under mounting regulatory pressure, Coinbase doubled down on Base Chain as a strategic breakthrough.

With continued investment from Coinbase, total value locked (TVL) on Base Chain has reached $12.8 billion, with USDC being the largest asset at $3.448 billion.

Asset Distribution on Base Chain Source: L2Beat

Overall, the Base + USDC solution enjoys several advantages: First, Coinbase’s extensive resources ensure unwavering support for Base. Second, regulatory compliance creates barriers to entry—Base benefits from Coinbase’s stringent compliance framework, and USDC’s high compliance standards make it the preferred stablecoin on Base, deterring competitors. Third, Base’s high TPS and low gas fees make it ideal for stablecoin applications.

However, Base uses the OP Stack with Solidity for dApp development, which is less secure than Move. Moreover, because final settlement occurs on Ethereum Layer 1, finality exceeds 10 minutes, reducing overall system reliability.

Ethereum + USDT

Ethereum + USDT represents one of the earliest stablecoin solutions. While USDT issuance on Ethereum totals $67.2 billion, daily settlement volume stands at $10.4 billion—just 15.4% of issuance. In contrast, Solana + USDC sees daily volume 5.6x its issuance, and Base + USDC reaches 8.3x.

Although USDT’s monthly settlement volume shows upward trends, its growth lags significantly behind USDC on Solana and Base.

USDT Monthly Settlement Volume on Ethereum Source: Artemis

The main reason lies in Ethereum’s inherent limitations—low throughput, high gas fees, long latency, and extended finality—which increase friction and reduce usage frequency. As a result, Ethereum lags behind high-performance, low-fee chains in capturing stablecoin growth.

Tron + USDT

Due to its significantly lower transaction fees, Tron has captured a large share of the stablecoin transfer market. USDT issuance on Tron reached $59.7 billion—second only to Ethereum—with daily settlement volume hitting $24.6 billion, or 41% of issuance. Unlike Ethereum, where transfers are driven by on-chain application demand, Tron’s activity is primarily fueled by low fees—making it the preferred method for moving funds off exchanges. In late 2024, Justin Sun proposed a zero-gas stablecoin transfer scheme tailored for financial and payment use cases. Driven by stablecoin transfers, Tron’s on-chain user base has surpassed 200 million.

For Tron, revenue comes mainly from two sources: stablecoin transfers and meme coin trading. Stablecoin transfers are central to Tron’s business model and hold strategic importance. Tron will continue to strengthen this segment.

For USDT, Tron is its largest transfer platform—undoubtedly critical. However, in competition with USDC, the latter holds a clear advantage on Solana and Base.

Competitive Advantages of BenFen Chain + BUSD

Focused Positioning on Stablecoin Use Cases

The BenFen Chain + BUSD solution is dedicated exclusively to stablecoin applications—such as PayFi, cards, gas payments, and P2P—whereas other chains and stablecoins serve broader ecosystems including DeFi, GameFi, Social, Meme, and AI, lacking focused optimization.

Integrated Super App BenPay: Combines On/Off-Ramping, Exchange, Staking/Lending, Offline Spending, and Red Packet Transfers

BenFen has built BenPay—a comprehensive super app with a closed-loop ecosystem. Within BenPay, users can seamlessly perform on/off-ramping, exchange, staking/lending, offline spending, and red packet transfers—meeting multiple needs within a single application.

Security Advantage from Move Language

By adopting Move for application development, BenFen gains superior security through strict typing and resource-oriented design—preventing common vulnerabilities. Given that stablecoin applications involve high-value assets, security is paramount.

Performance and Low Gas Fees via Consensus Improvements and Cost Optimization

Stablecoin applications require high-performance, low-cost infrastructure. BenFen achieves tens of thousands of TPS, 0.5-second latency, and sub-$0.001 gas fees—far outperforming Ethereum. This robust foundation enables scalable stablecoin adoption.

High-Value Governance Token BFC

Unlike fragmented value capture models (e.g., ETH capturing only gas fees, UNI capturing only DEX fees), BenFen’s BFC token captures value across the entire ecosystem—chain, DEX, BenPay, card, merchant services, etc.—making its intrinsic value the sum of all ecosystem components, thus far more valuable.

Smoother User Onboarding: zk-Login Eliminates Need for Seed Phrases

Seed phrases remain a major barrier to Web3 adoption. BenFen supports zk-Login, allowing users to access the chain and apps using just their Google or Apple account—bypassing complex seed phrase management and accelerating mainstream adoption.

Growth Drivers and Trends: Blockchain & Stablecoin Advantages Plus Regulatory Support

Blockchain & Stablecoin Solutions Outperform Traditional Payments

Since Bitcoin and Ethereum emerged, blockchain technology has operated stably for years. Stablecoins like USDT, USDC, and DAI have powered countless applications—lending, DEXs, staking—proving the system’s reliability. Meanwhile, traditional systems like Swift continue to face criticism for slow settlement and high fees.

Therefore, blockchain and stablecoin solutions are increasingly positioned to replace legacy cross-border payment systems.

Regulatory Support: Favorable Policies in the U.S., Europe, Japan, and Beyond

Following the U.S. election, over half of Trump’s transition team supports crypto. As these officials take office, pro-crypto policies are expected to emerge. Meanwhile, Europe has enacted MiCA (Markets in Crypto-Assets Regulation). Hong Kong, Japan, Singapore, and the UK have also introduced stablecoin legislation.

These developments signal global efforts to regulate and legitimize the stablecoin market, guiding it toward greater compliance.

Key Risks

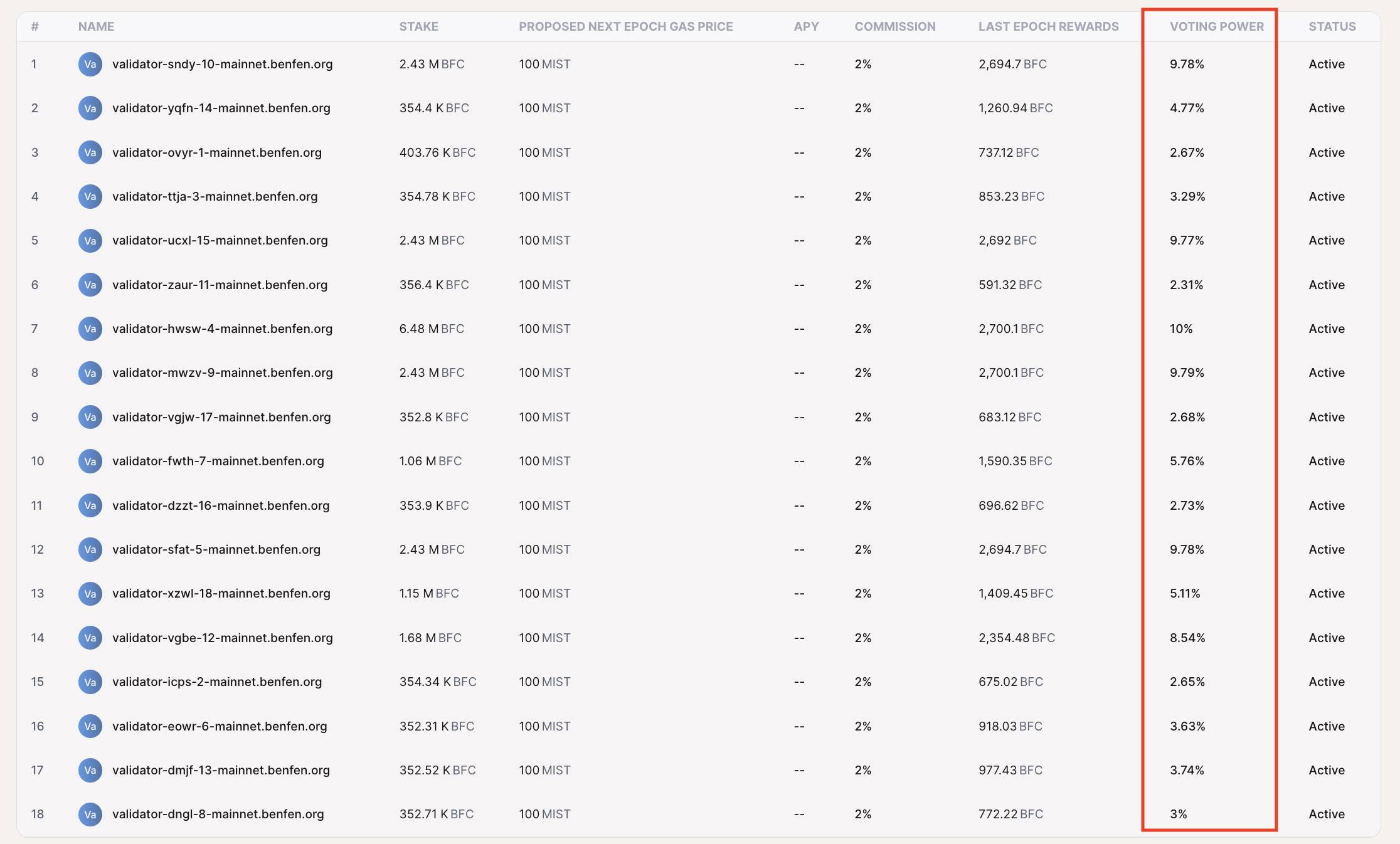

Validator Centralization Risk

Currently, BenFen has only 18 active validators—fewer than most public chains—posing some centralization risk. However, voting power is relatively evenly distributed (ranging from 2% to 10%), mitigating concentration risks to some extent.

Voting Power Distribution Source: BenFen Explorer

Smart Contract Security Risk

All public chains and dApps face smart contract risks. While BenFen’s use of Move significantly improves security, the inherent complexity of smart contracts means localized vulnerabilities may still exist.

Valuation

Investment Thesis Pillars

a) Stablecoin use cases—including cross-border payments, P2P on/off-ramping, and offline spending—represent strong, large-scale, and high-potential demand.

b) Regulatory environments are opening up. New policies and frameworks create fertile ground for industry growth—especially with pro-crypto leadership entering government roles under the Trump administration, enhancing policy tailwinds.

c) BenFen’s solution—combining a high-performance base layer, multi-currency stablecoins, and integrated payment tools—perfectly meets core stablecoin application requirements: security, fast settlement, low cost, and seamless onboarding.

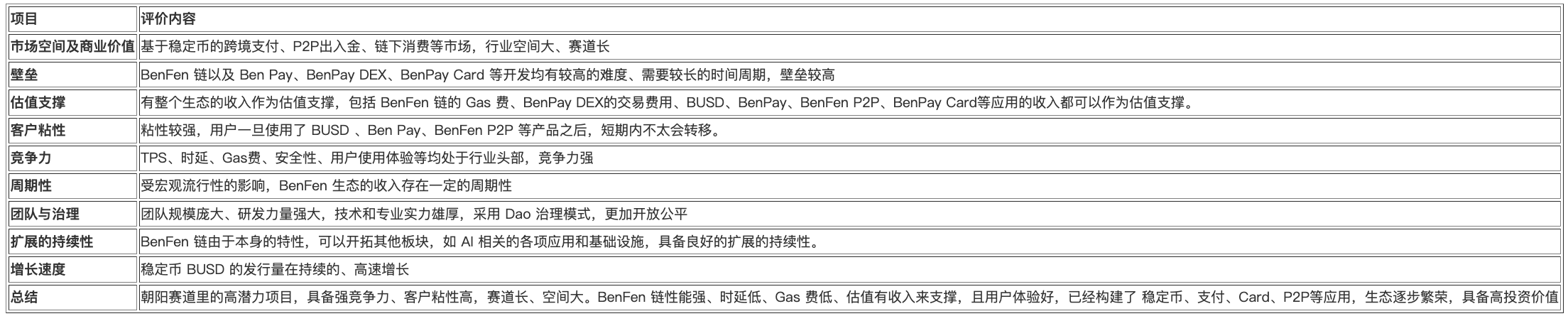

High Investment Value Assessment

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News