SBF strikes again: FTX Ventures acquires 30% stake in SkyBridge Capital

TechFlow Selected TechFlow Selected

SBF strikes again: FTX Ventures acquires 30% stake in SkyBridge Capital

FTX Ventures, the venture capital arm of FTX, will acquire a 30% stake in SkyBridge Capital, the firm founded by former White House communications director Anthony Scaramucci, which has been aggressively entering the cryptocurrency market since last year. Regarding this transaction,

According to a report by the Financial Times, FTX Ventures, the venture capital arm of FTX, will acquire a 30% stake in SkyBridge Capital, a firm founded by former White House communications director Anthony Scaramucci, which has aggressively entered the crypto market since last year. Both parties expressed excitement about future collaboration on Twitter.

SkyBridge Capital began investing in the crypto sector at the end of 2020. In April this year, founder Anthony Scaramucci stated that half of the $3.5 billion managed by SkyBridge was tied to crypto assets. He said he hoped to become a "crypto asset management company" and expected its assets under management to triple to $10 billion in the future.

However, due to the downturn in the crypto market, SkyBridge appears to have been affected as well. The firm’s Legion Strategies fund has seen returns decline by 30% this year, prompting it to suspend investor redemptions in July.

Nonetheless, Anthony Scaramucci remains confident in crypto assets. He pointed out that many institutions, including BlackRock and Coinbase, are beginning to establish Bitcoin trusts, signaling strong underlying institutional demand for the crypto market.

Regarding this acquisition, Anthony Scaramucci expressed great enthusiasm:

"I'm incredibly excited—what a fantastic day. Sam is a visionary, and we’ll talk, collaborate, and realize our shared vision together."

Details of the deal have not been disclosed, but Anthony Scaramucci said that $40 million from the proceeds would be used to purchase cryptocurrencies, which he intends to hold long-term.

Keep Buying, Keep Expanding

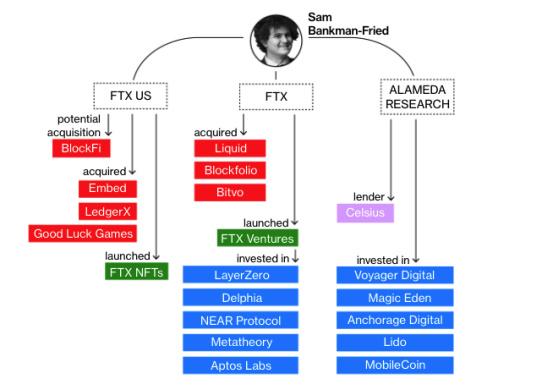

According to a compilation by Bloomberg, SBF has been buying the dip throughout this year, including:

1. Feb 2, 2022: FTX acquired Japan-compliant exchange Liquid, later rebranded as FTX Japan

2. Mar 22, 2022: FTX US acquired Good Luck Games, integrated into FTX Gaming

3. May 2, 2022: SBF purchased $648 million worth of Robinhood shares (~7.6%)

4. Jun 17, 2022: FTX acquired Canadian exchange Bitvo, entering the Canadian market

5. Jun 17, 2022: Alameda provided Voyage Digital with approximately $485 million in loans

6. Jun 22, 2022: FTX US acquired Embed to launch FTX Stocks service

7. Jun 30, 2022: FTX US provided BlockFi with a $640 million loan, including $240 million convertible into equity

SBF's crypto expansion map, Source: Bloomberg

With this latest acquisition, SBF will have completed at least eight deals this year.

On another front, FTX has also made regulatory progress globally. At the end of July, FTX Exchange FZE, a subsidiary of FTX, received approval from Dubai regulators to offer derivatives trading services to institutional investors.

There are also reports suggesting that FTX may acquire a stake in South Korea’s crypto exchange Bithumb.

Earlier this month, FTX US Derivatives hired Jill Sommers, former CFTC commissioner, to assist with future regulatory compliance and integration into traditional financial markets.

Overall, this acquisition of a 30% stake in SkyBridge continues the strategy of FTX founder SBF to expand aggressively during bear markets, further cementing his role as the crypto market’s lender of last resort.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News