A Brief Analysis of Cosmos 2.0: More Mature Than Ethereum in 2017 and Favored by Various Infrastructure Services

TechFlow Selected TechFlow Selected

A Brief Analysis of Cosmos 2.0: More Mature Than Ethereum in 2017 and Favored by Various Infrastructure Services

Cosmos is the most complete ecosystem I've ever seen; its processes of development, collaboration, expansion, and evolution remind me of Ethereum in 2017, but with higher maturity.

Author: Curious J

Translated by: TechFlow

Cosmos is the most complete ecosystem I’ve ever seen—the pace of its development, collaboration, expansion, and evolution reminds me of Ethereum in 2017, but with significantly greater maturity.

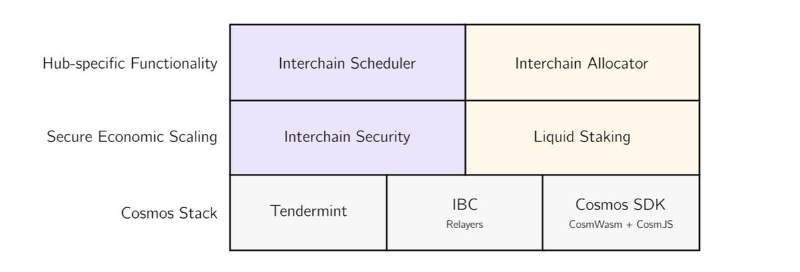

$ATOM 2.0 Evolution

New tokenomics enabling new utilities for liquid staking, schedulers, distributors, and interchain security. The Cosmos Hub will continue to exist, but now it has a real identity and purpose: attracting new chains to join and secure, becoming a reserve of IBC assets.

Native $USDC is coming to Cosmos—this may be the most underestimated event so far.

It avoids the death spiral; despite being centralized, it has consistently driven liquidity in crypto.

Infrastructure

Ledger is committed to supporting this ecosystem—it will support 25 Cosmos chains by year-end, directly integrate their dApps into Ledger Live, and also become a validator on these chains.

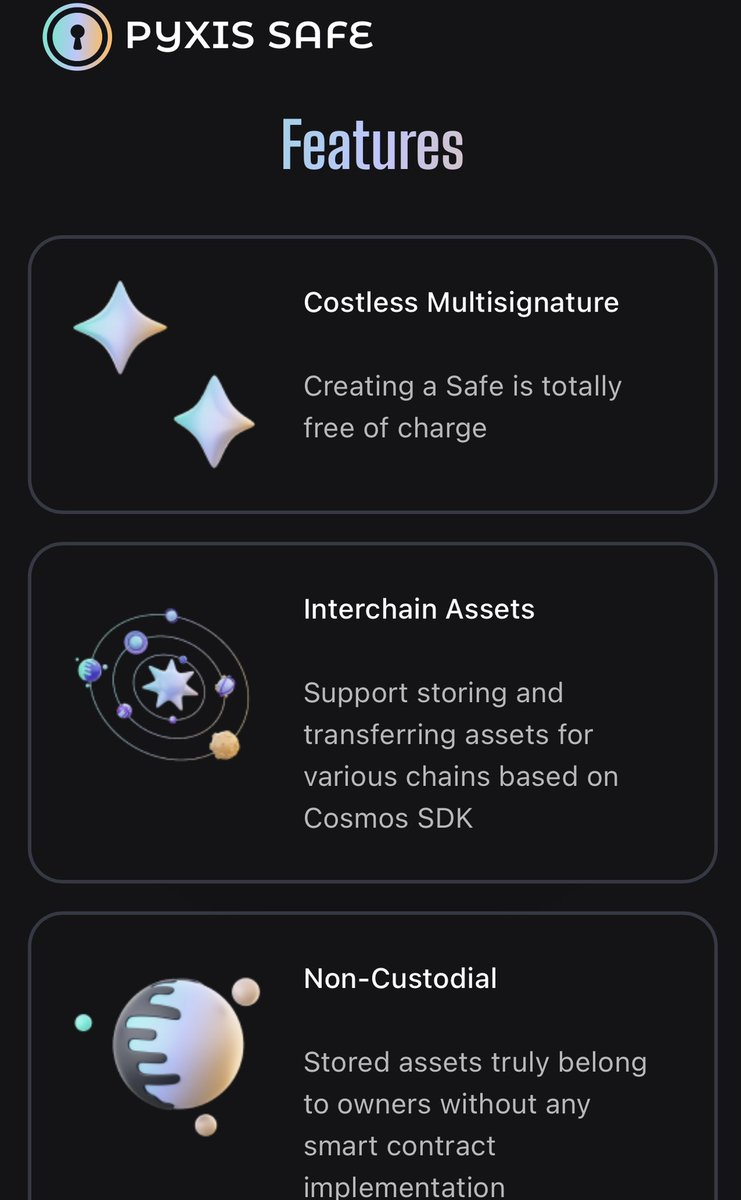

Regarding wallets, we’ll also have multisig support similar to Gnosis Safe. There’s no smart contract risk or inherent blockchain risk here.

Akash continues lowering entry barriers and maintenance costs for cloud hosting, enabling individuals—not just institutions—to participate in these services.

This will play a significant role for chains, validators, and the entire ecosystem.

Security

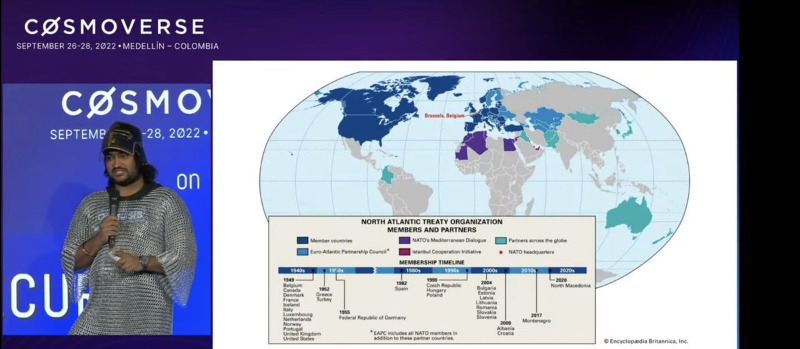

Chains like Osmosis, Juno, and Evmos will provide security and receive security from each other.

They are both Hubs and Zones, both providers and consumers of security—tightly interconnected, forming a structurally secure ecosystem: akin to NATO.

Mars Protocol launched its own chain, initially deploying DeFi protocols on Osmosis. The Mars chain will coordinate lending across other chains, without holding liquidity itself—it serves as an intermediary chain.

Cross-chain accounts evolve thanks to IBC. Tokens can be sent from Osmosis to Juno and automatically swap, reducing manual cross-chain steps—or directly provide liquidity instead of routing through Osmosis again. Governance voting works similarly.

Beyond Cosmos

Axelar and Gravity Bridge aim to transfer NFTs across non-Cosmos chains, potentially listing them on OpenSea.

IBC will be extended to Polkadot and Near.

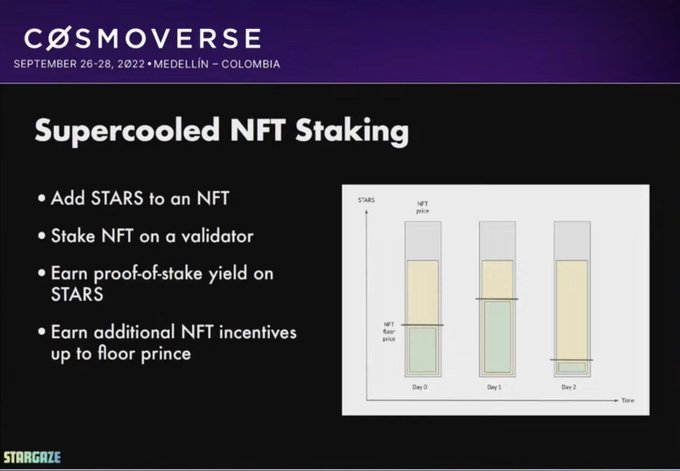

NFT Evolution

By paying $Stars, you can create or stake your NFT directly on-chain—even IP-managed NFTs now have markets, thanks to the versatile Flix.

DeFi 2.0

Index tokens, ETFs, commodities, and interchain stablecoins.

Cosmos DeFi feels like it’s just beginning—we’re ushering in a whole new era where all these new DeFi tokens enter Cosmos.

Osmosis Upgrades

1. TWAPs (Time-Weighted Average Pricing)

2. Queries: Fetching data from other chains into Osmosis smart contracts

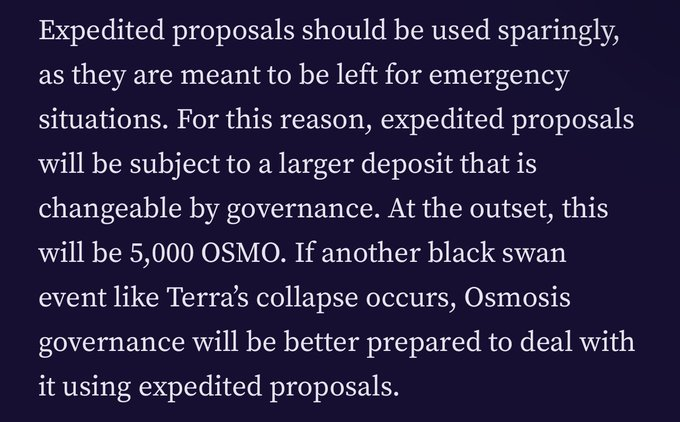

3. Accelerated proposals (e.g., emergencies like Terra)

4. Stablecoin swaps

5. Order book

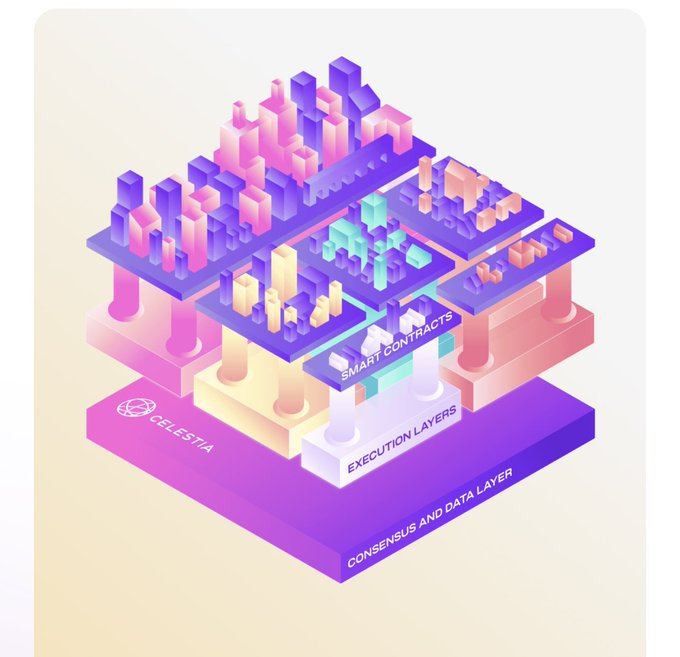

Celestia Evolution

Celestia aims to elevate this ecosystem to a new level by adding modularity to monolithic chains: separating execution, consensus, and smart contract layers for Rollups to enable faster transactions. Ultimately, independent chains could replace websites.

New Chains

Even Circle will launch its own Cosmos chain—interest in building blockchains on Cosmos has never been stronger.

Clearly, this ecosystem is undoubtedly one of the most compelling places to participate in our Web3 journey.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News