Top 5 Most Decentralized Crypto Projects: Polkadot Ranks Second, ETH 2.0 Falls Behind Due to Lido-Driven Centralization

TechFlow Selected TechFlow Selected

Top 5 Most Decentralized Crypto Projects: Polkadot Ranks Second, ETH 2.0 Falls Behind Due to Lido-Driven Centralization

A fully decentralized blockchain is the holy grail that Web3 enthusiasts pursue every day. Today, I'll dive deep into the top 5 most decentralized crypto projects.

Written by: Jake Pahor

Compiled by: TechFlow

Fully decentralized blockchains are the holy grail that Web3 enthusiasts pursue every day. Today, I’ll dive deep into the top 5 most decentralized crypto projects.

When researching a project, one of the key factors to evaluate before investing is its level of decentralization.

Today, I will examine leading cryptocurrency projects through the lens of decentralization and provide fresh data and statistics.

So, what is decentralization, and why is it so important?

According to the Oxford Dictionary, decentralization refers to transferring control of an activity or organization from a single authority to several locations working collectively. Decentralization is one of the foundational pillars upon which Web3 is built.

There are several major benefits to implementing a decentralized model:

- No single point of failure

- Reduced corruption

- Promotes equality among participants

- Financial inclusivity

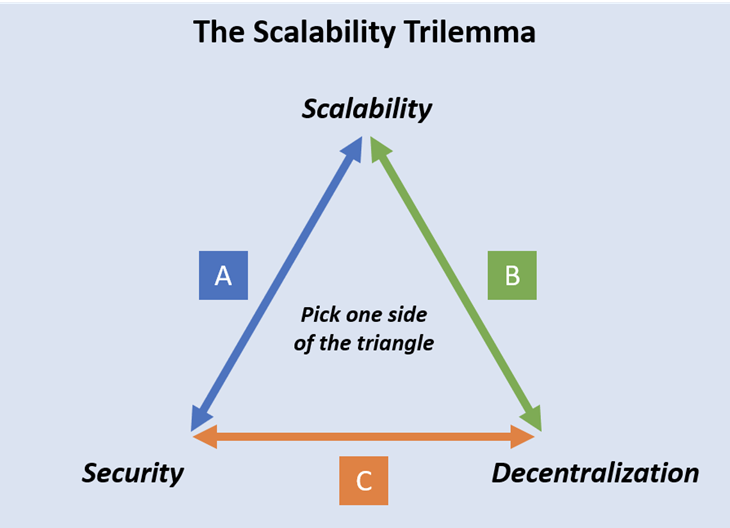

Of course, full decentralization also comes with some drawbacks, such as the scalability trilemma:

- Scalability vs. Security

- Scalability vs. Decentralization

- Security vs. Decentralization

Every project in this space is trying to solve the trilemma and deliver a solution that satisfies all three criteria without compromise.

I believe whoever solves this first will become a massive winner and emerge as the market leader in the next bull run.

Decentralization isn’t a simple yes/no binary. As Coinbureau outlined in their video, there are five layers of decentralization to consider:

1. Developer Layer

2. Token Layer

3. Infrastructure Layer

4. Blockchain Layer

5. External Layer

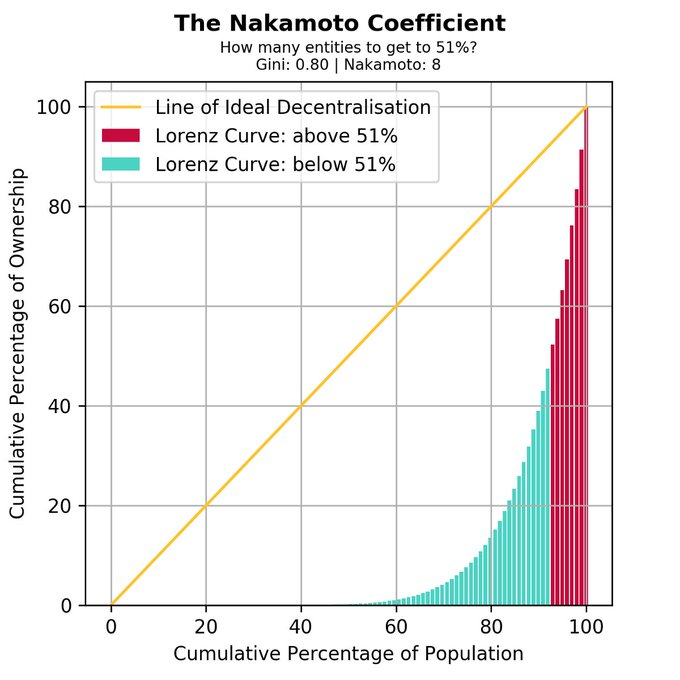

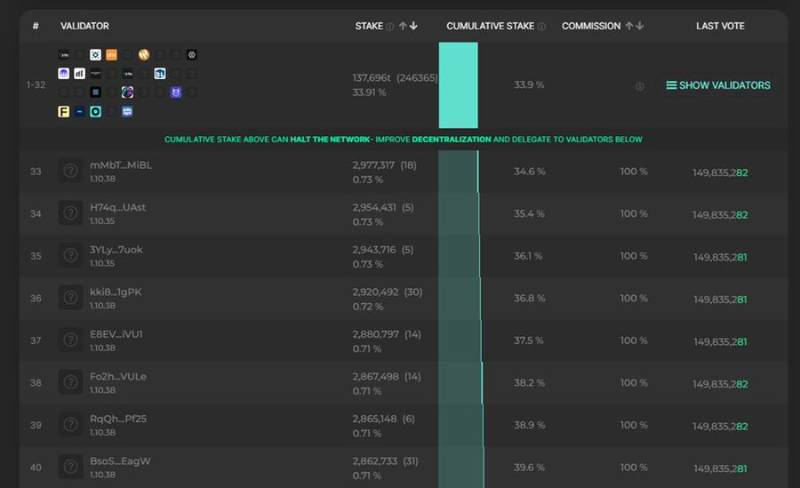

The Nakamoto Coefficient is a way to quantify the degree of decentralization in a blockchain, first proposed by Balaji S. Srinivasan in 2017.

The Nakamoto Coefficient represents the number of validators (nodes) that must collude to successfully disrupt the normal operation of a given blockchain. The higher the Nakamoto Coefficient, the more decentralized the network.

For Proof-of-Work (Bitcoin), the widely accepted threshold is 51% of nodes. For Proof-of-Stake (ETH 2.0 and other L1s), the accepted threshold is at least 34% of validators (more than one-third).

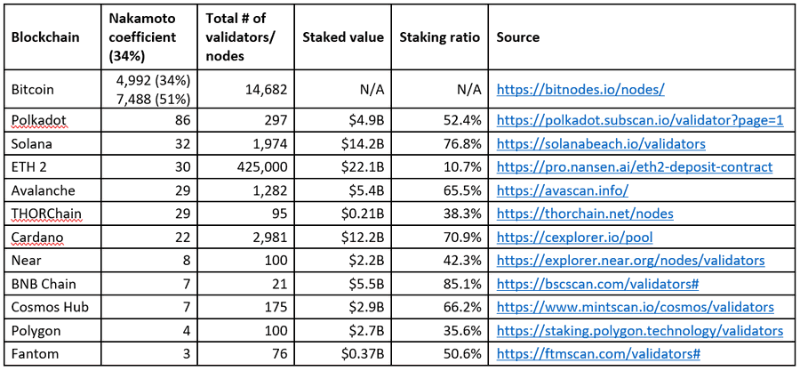

I carefully examined various data sources and compiled the status of 12 top cryptocurrency projects (as of September 9, 2022) into the table below.

As you can see, BTC remains the king of decentralization.

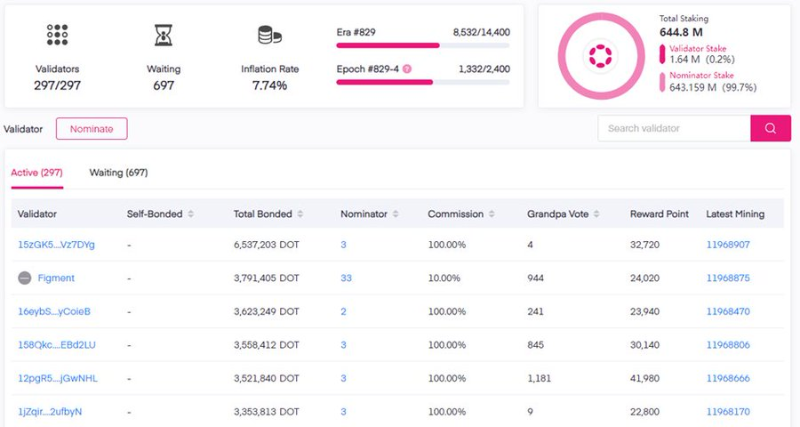

Polkadot

$DOT ranking second is definitely a pleasant surprise. Clearly, when reviewing documentation and interviews, Gavin Wood and the team have made decentralization one of their top priorities.

Solana

$SOL is also surprising, landing in third place. After multiple outages on its blockchain, the project has been under intense pressure this year.

However, they do have a large and diverse validator pool, backed by significant institutional support. That said, the project still faces centralization issues regarding transaction storage, infrastructure, and reliability.

ETH 2.0

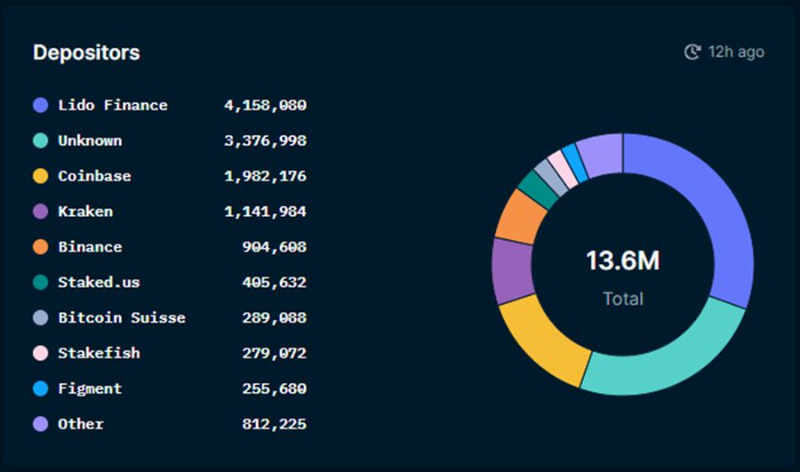

Determining ETH 2.0’s coefficient is a bit tricky because each node can run multiple validators (minimum stake: 32 ETH). To find the minimum number of nodes controlling 34% of staked ETH, I analyzed all ETH2 deposit data from the Nansen dashboard.

Lido Finance = 30.6% of all staked ETH. As of the latest update, Lido has 29 independent node operators (as of June 5). To reach 34%, you only need to add one more node operator from Coinbase or Kraken, bringing the total to approximately 30 nodes.

I must admit, the concentration of deposits via Lido is somewhat concerning. However, Lido is transparent about this and states they are actively developing a “decentralization roadmap.”

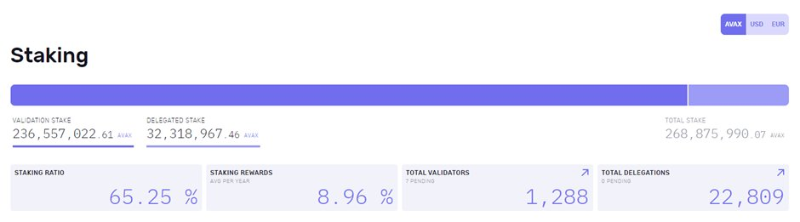

Avalanche

$AVAX enters the top five with a Nakamoto Coefficient of 29.

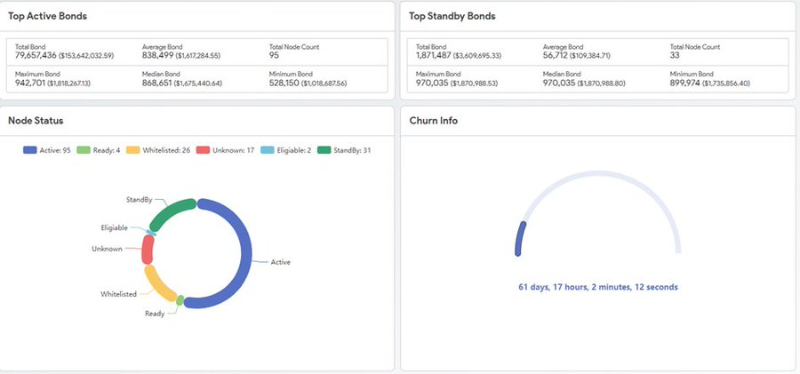

Beyond these, I’d like to give a big shoutout to THORChain and would love to rank it higher, but its total staked value and validator count are too low. Nonetheless, the project has consistently focused on decentralization, which is evident in its product design.

None of these blockchains are perfect—there are certainly varying degrees of issues beneath the surface of decentralization. Yet, seeing so many great projects actively working to improve decentralization gives me hope that we will eventually claim this holy grail of Web3.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News