Polkadot's H1 financial report sparks controversy: $87 million spent on marketing, nearly half of total expenses, with only $1.1 million in revenue

TechFlow Selected TechFlow Selected

Polkadot's H1 financial report sparks controversy: $87 million spent on marketing, nearly half of total expenses, with only $1.1 million in revenue

Despite official claims that the treasury has sufficient reserves to last two years, the large expenditure of $87 million has raised community concerns.

Author: Nancy, PANews

Polkadot's financial reports have always sparked controversy in the past, and this time is no exception. Recently, Polkadot’s release of its 2024 H1 Treasury report on its official governance forum triggered widespread dissatisfaction among investors. Despite claims that treasury reserves are sufficient to last two years, a massive expenditure of $87 million has raised significant concerns within the community.

H1 Spending Exceeds Previous Two Years Combined; Marketing Accounts for 42%

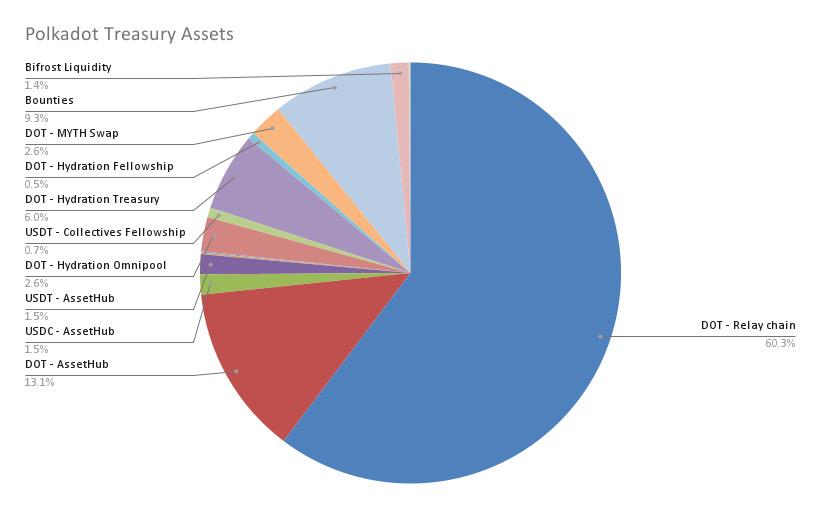

According to the balance sheet released by the Polkadot community, the Treasury manages assets totaling $245 million (38 million DOT). Data from the Polkadot block explorer shows that as of July 2, the Treasury holds over 36.5 million DOT—nearly 22.5% less than its historical peak.

Of this amount, $188 million (29 million DOT) consists of liquid assets, including $8 million in stablecoins USDT and USDC, primarily distributed across Relaychain, AssetHub, and Hydration. Additionally, $47 million (7.3 million DOT) are designated assets allocated by the Treasury for specific purposes; $6.4 million (1 million DOT) is reserved exclusively for Omnipool (Hydration’s flagship AMM); and $3.7 million (580,000 DOT) is allocated as loans with a one-year term to DeFi ecosystem projects.

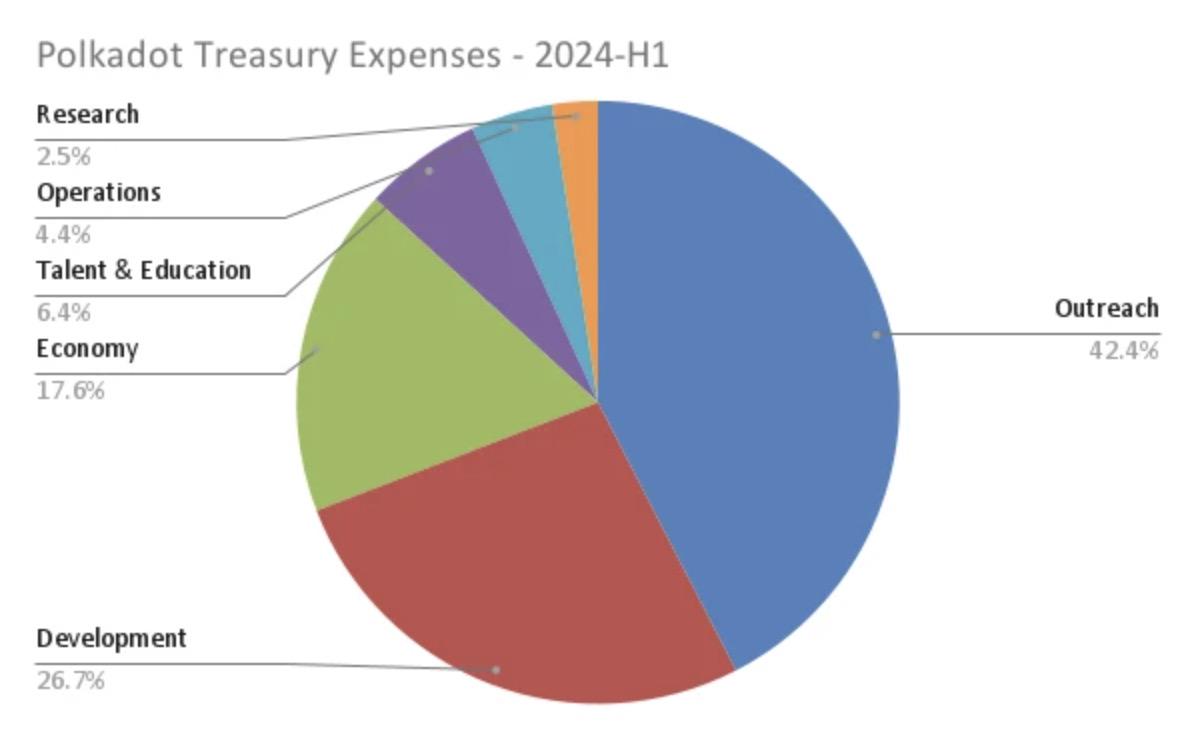

The report notes that compared to traditional entities, Polkadot’s treasury balance sheet performs exceptionally well, with ample surplus. However, in terms of spending, the Treasury disbursed $87 million (11 million DOT) in the first half of 2024 alone—far exceeding the combined total of $46 million spent in both 2022 and 2023.

In terms of specific expenditure categories, funds were mainly allocated to six areas: promotion (42.4%), development (26.7%), economics (17.6%), talent and education (6.4%), operations (4.4%), and research (2.5%).

Promotion accounted for $37 million, primarily covering advertising and media, online and offline community-building activities, and major conferences. Advertising costs totaled $21 million—including $10 million in sponsorship fees, $4.9 million paid to marketing and PR firms, and $4 million spent on digital ads—while event-related expenses reached $7.9 million, including $4.5 million for various events, $3.9 million for business development, and $3.2 million for media production.

Development spending amounted to $23 million, including $5.1 million for Polkadot protocol and SDK feature development, $4.1 million for data services and indexing, $3.9 million directed to SubWallet, Talisman, and Nova wallets, and $2.3 million invested in governance initiatives.

Economic expenditures totaled $15 million, with DEX platforms Hydration and Stellaswap each receiving 1 million DOT to be distributed over one year.

Talent and education received $5.5 million, funding initiatives such as the Polkadot Blockchain Academy and hackathons.

Operations cost $3.8 million, covering governance and legal structuring.

Research spending came to $2.1 million.

The report states that at the current rate of expenditure, Polkadot’s treasury has approximately two years of funding reserves. However, since DOT accounts for 76.7% of the treasury holdings, price volatility introduces uncertainty into this projection.

Heavy Marketing Spend Draws Community Backlash; Key Metrics Show Decline

The publication of the financial report immediately triggered backlash from the Polkadot community.

Some community members argue that despite Polkadot’s aggressive marketing spending, there has been little noticeable impact. For example, @trading_axe pointed out that Polkadot appears to be allocating $300,000 per month to KOLs, yet no substantive or valuable content has emerged. This marketing model is fundamentally flawed—not only do many influencers with over 100,000 followers lack active audiences, but most post not because they believe in the project, but purely for compensation.

Ignas, co-founder of Pink Brains, also criticized Polkadot for spending $37 million on promotion to attract new users, developers, and enterprises, yet remaining largely unknown on platforms like X. Examples include Polkadot’s $1.9 million sponsorship of IndyCar driver Conor Daly and a $6.8 million sports sponsorship deal with Inter Miami CF.

Polkadot spent $1.9 million sponsoring IndyCar driver Conor Daly

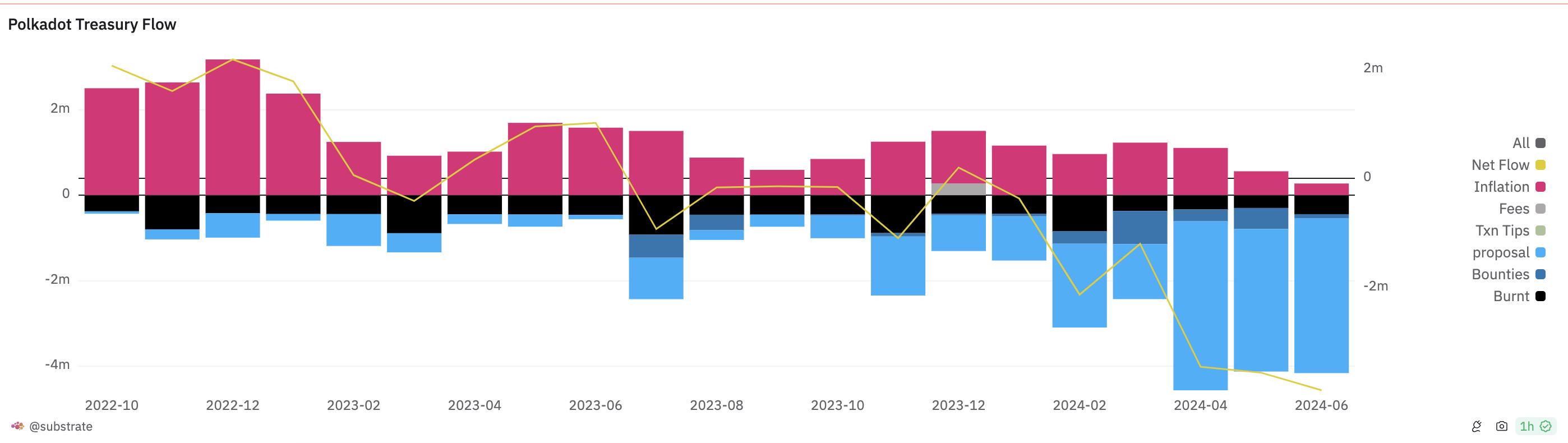

Ignas believes that at Polkadot’s current burn rate, it could face insolvency in under two years. According to Polkadot’s own data, its revenue in the first half of the year was only 171,000 DOT (worth over $1.09 million), barely covering 1.5% of its expenditures. Moreover, Dune data indicates that since July 2023, Treasury inflows have been in negative territory, with the deficit widening—over 10.91 million DOT flowed out in Q2 alone.

Beyond spending issues, Polkadot currently faces multiple challenges, including high inflation, which some believe could hinder its growth. Ignas noted that the DOT token supply increases by 10% annually, with most newly minted tokens used to fund staking rewards. Assuming a $10 billion market cap, this means $1 billion flows to stakers every year—an expensive cost for network security. However, proposals to reduce inflation have repeatedly failed. In April, the Polkadot community voted on proposal #706 to cap the total DOT supply at 2.1 billion, but the motion was rejected due to majority opposition.

From a data perspective, Polkadot’s transaction activity has also declined this year. According to Dune, Polkadot recorded 16.97 million transactions in June—only 51.8% of its volume at the beginning of the year. Monthly active accounts dropped by 53.2%, falling from 516,000 at the start of the year to just 241,000 now. That said, this may partly be attributed to the fading popularity of earlier meme coin trends.

Overall, this financial report exposes serious issues in Polkadot’s fiscal management, including disorganized spending and low efficiency, underscoring the urgent need for greater accountability.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News