In-depth Analysis of Polkadot Staking: Nominator Pool Rewards Grow Rapidly, DOT Price Moderately Correlated with Staking Rate

TechFlow Selected TechFlow Selected

In-depth Analysis of Polkadot Staking: Nominator Pool Rewards Grow Rapidly, DOT Price Moderately Correlated with Staking Rate

The nomination pool simplifies the communication of NPoS, especially Polkadot staking, to token holders.

Author: dotinsights

Introduction

The PoW consensus protocol has proven inefficient due to high resource consumption and slow transaction speeds, prompting next-generation blockchains to increasingly adopt PoS protocols. Polkadot developed a variant of PoS called "Nominated Proof-of-Stake" (NPoS), where token holders can back validators with their tokens. Nominators receive staking rewards when the selected validators behave honestly, but their stakes are slashed if the validators act maliciously. This mechanism economically incentivizes nominators to select trustworthy validators and contribute to the security of the Polkadot network.

To lower the barrier for staking participation and further decentralize the network, Polkadot introduced nominator pools in November 2022. Nominator pools allow token holders to stake with a minimum of just 1 DOT and delegate nomination management to pool operators. As a result, there are now four ways to perform native DOT staking: running a validator, direct nomination, creating a nominator pool, or joining an existing nominator pool.

Seven months after the launch of nominator pools, SubWallet and Dotinsights have released the first Polkadot staking report, providing an in-depth analysis of staking across all levels. We would like to thank Parity Technologies, Subsquid, Polkaholic, and Polkawatch teams for their support and contributions to this report.

Key Observations

-

Starting from 1.25 billion DOT on November 1, 2022, the total DOT supply steadily increased to 1.32 billion DOT by May 31, 2023, with an average weekly growth rate of 0.19%.

-

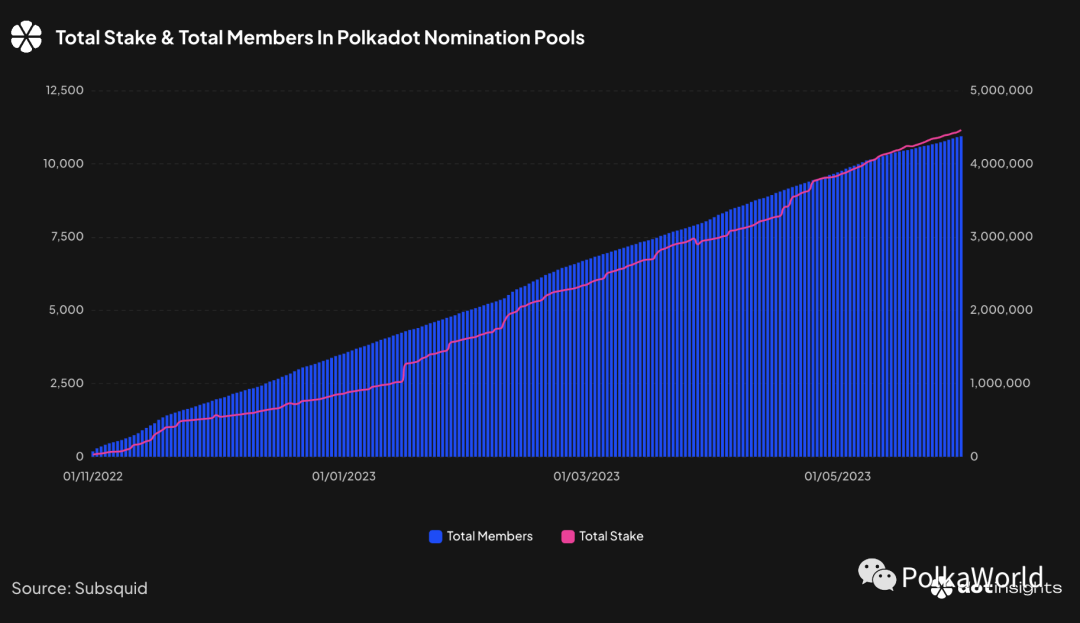

Polkadot's total nominator pool stake officially surpassed 4 million DOT in early May, with over 10,000 total pool members. Daily pool rewards surged from 3.22 DOT on November 2, 2022, to a peak of 2,830 DOT on May 22, 2023.

-

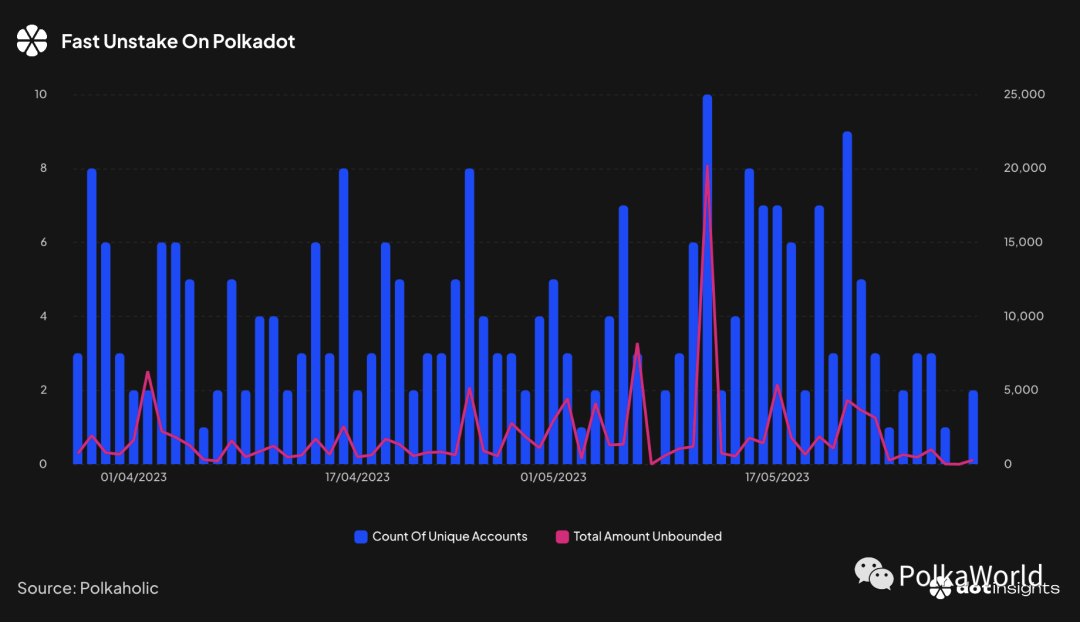

The recently implemented fast-unbonding feature has begun seeing initial usage. By May 31, 2023, a total of 122.23K DOT had been withdrawn via fast unbonding.

-

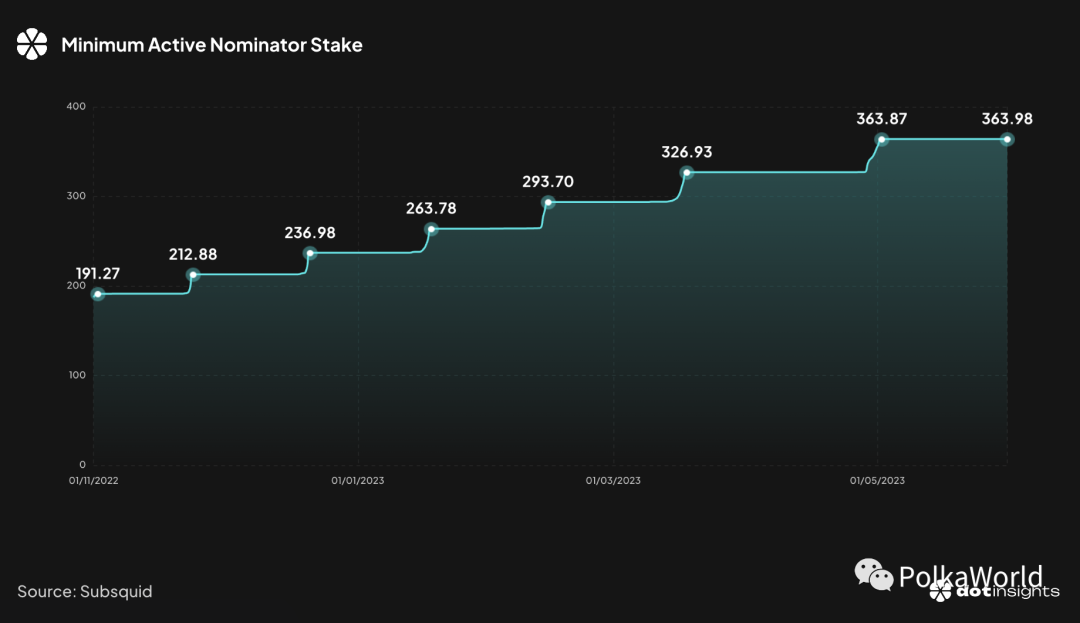

Over the seven-month period starting in November 2022, Polkadot’s minimum active nominator stake nearly doubled, increasing from 187.35 DOT to 363.98 DOT. On average, it rose significantly by 15.01 DOT every 21 to 40 days.

-

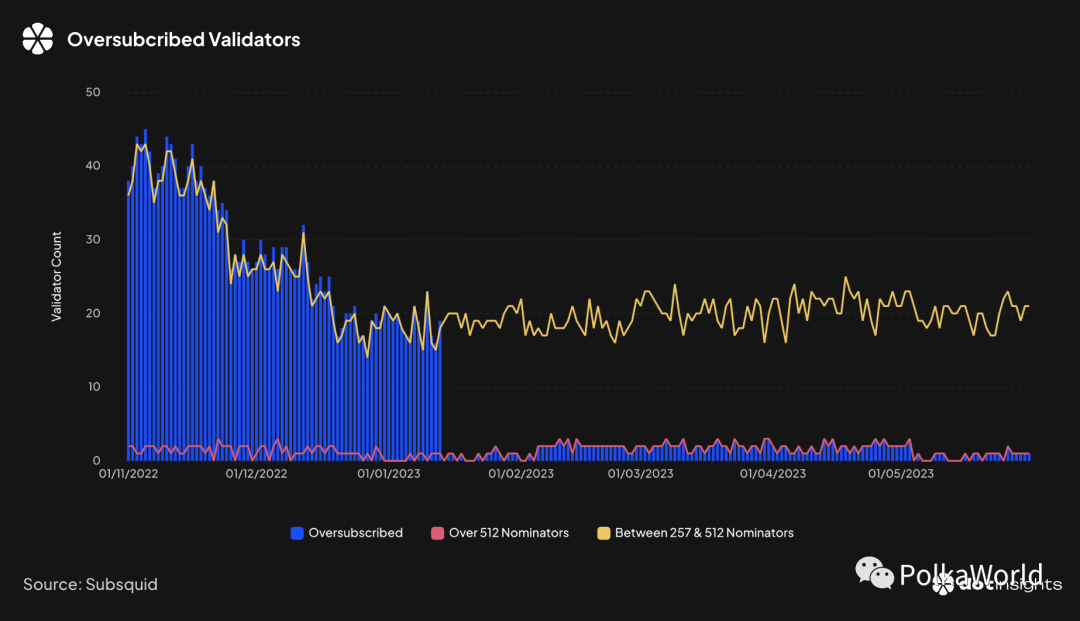

The number of oversubscribed validators dropped sharply by a factor of 15 starting mid-January, when the maximum number of rewardable nominators per active validator was increased from 256 to 512.

-

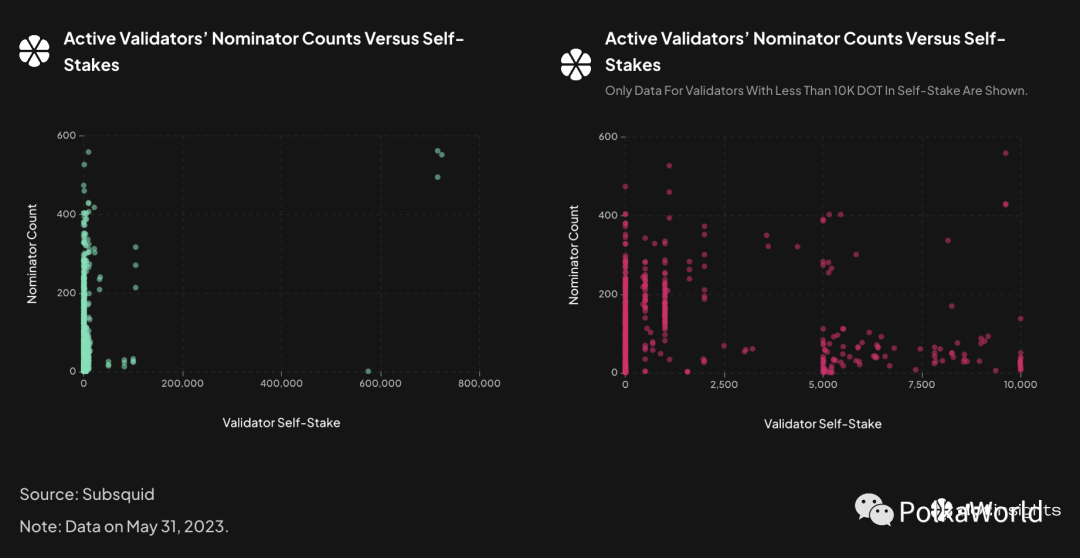

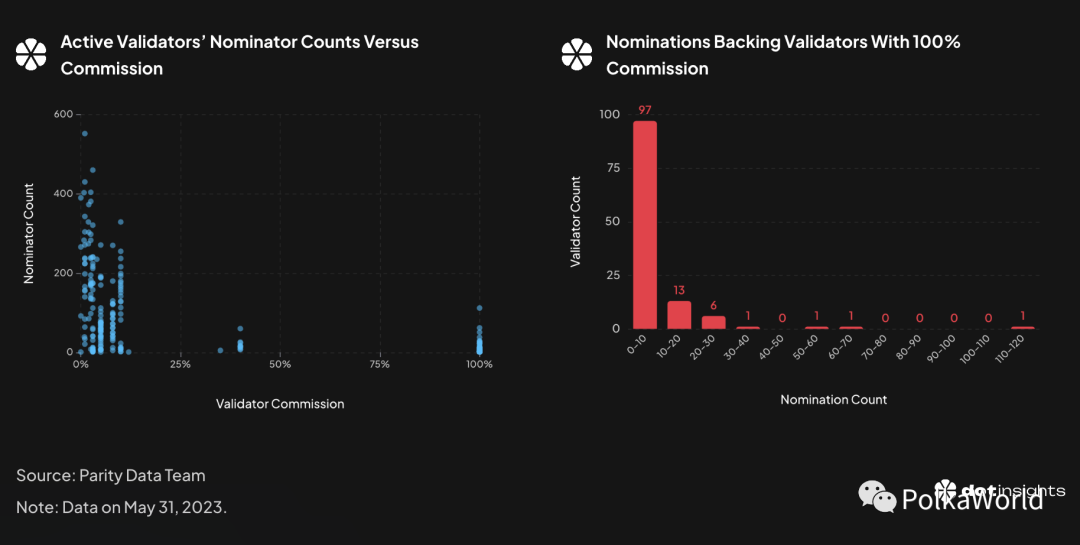

Validator self-stake and commission rates are among the criteria used by nominators when selecting validators. Specifically, most nominators tend to support validators with lower self-stakes and lower commission rates.

-

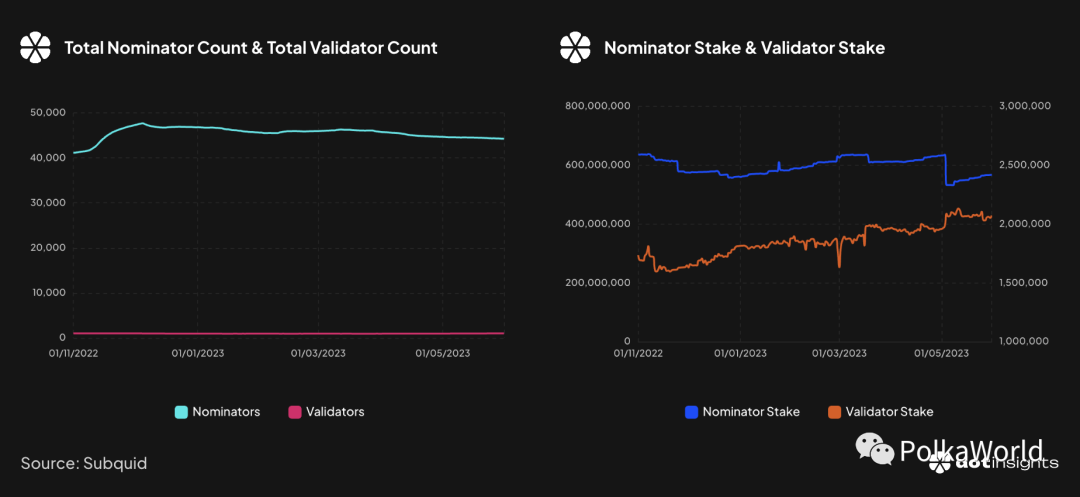

The total number of validators remained relatively stable between 917 and 990, while the total number of nominators spiked sharply in November 2022 and peaked at 47,672 on December 5, 2022. Since then, it has gradually declined, stabilizing at 44,241 by May 31, 2023.

-

Validator stakes fluctuated between 1.59 million and 2.13 million DOT. In contrast, nominator stakes experienced greater volatility, such as a reduction of 103.40M DOT in total stake on May 4.

Staking Overview

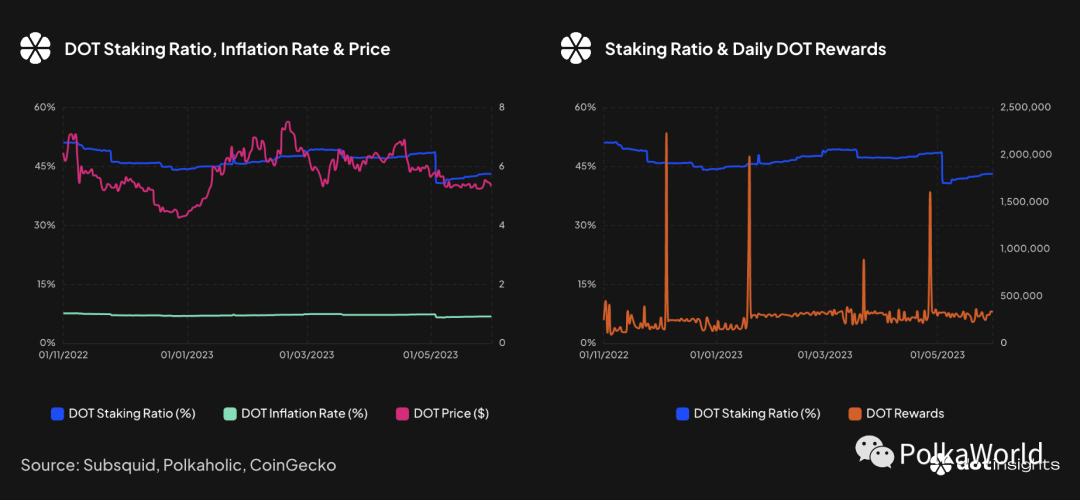

Overall, there is a moderate correlation between DOT price and staking rate (Pearson correlation coefficient r = 0.47). However, price fluctuations sometimes precede changes in staking ratio, such as at the end of November 2022, January 2023, and early May 2023. The staking rate plummeted from 48.68% to 40.78% on May 4, causing the DOT inflation rate to drop from 7.37% to 6.58%, while yield rose from 15.14% to 16.13%. Theoretically, when the staking rate falls below the ideal threshold of 50%, the inflation rate decreases and yields increase to encourage more token holders to stake.

PolkaWorld Note: There is a statistical relationship between DOT price and staking ratio. Pearson correlation coefficient measures the strength of linear relationships between two datasets, ranging from -1 (perfect negative correlation) to +1 (perfect positive correlation), with 0 indicating no correlation. In this case, the coefficient is 0.47, indicating a moderate positive correlation. That means when the staking ratio increases, DOT price tends to rise, and vice versa. However, note that correlation does not imply causation.

In contrast, there is no significant correlation between staking rate and daily DOT rewards (Pearson correlation coefficient r = -0.003). Daily DOT rewards show four extreme peaks (on December 5, January 19, March 22, and April 27), caused by multiple high-stake validators receiving rewards. Aside from these spikes, the reward pattern remains relatively stable throughout the period.

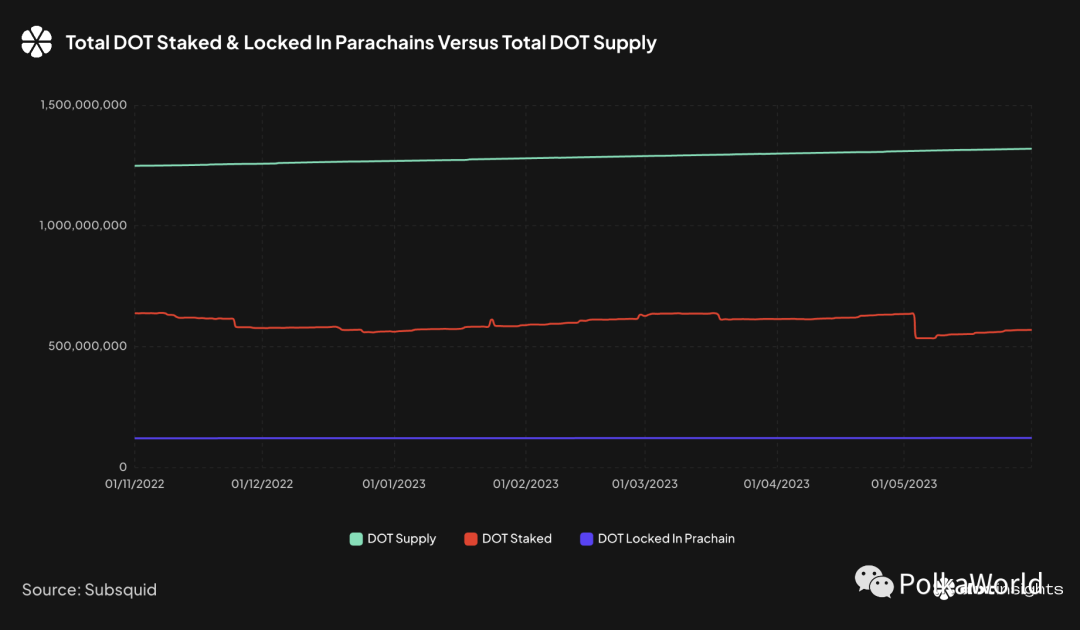

The total DOT supply grew from 1.25 billion on November 1, 2022, to 1.32 billion on May 31, 2023, averaging a weekly growth rate of 0.19%. The total amount of DOT locked in parachain slots grew more slowly, rising from 120.01 million to 121.43 million, increasing its share of total supply from 9.62% to 9.21%. Notably, the trends of total DOT supply and DOT locked in parachain slots are highly similar, with a Pearson correlation coefficient of r = 0.95.

Unlike supply and parachain-locked DOT, total staked DOT shows greater volatility. It started at 638.13 million (staking rate 51.13%) on November 1, 2022, and ended at 569.13 million (staking rate 43.14%) on May 31, 2023, with several large fluctuations. Most of these changes—except for two drops in mid-March and early May—were driven by activity from large holders.

The decline in total staked DOT is particularly interesting. On November 25, 2022, four “whales” unbonded a combined 35.51M DOT—specifically 10.79M, 8.99M, 9.19M (this whale later unbonded another 30.6M DOT on January 24, 2023), and 6.54M DOT. These funds were withdrawn and transferred out 28 days later. Coincidentally, these four whale accounts shared a proxy account, which also served as a proxy for a Kraken account.

Conversely, the two declines in March and May were not due to unbonding but rather validator rotation. Every day, a new set of 297 active validators is selected from over 900 candidates, meaning some validators are removed and others added. Normally, such rotations do not cause major shifts in total stake. However, on March 19 and May 4, the incoming set of active validators had significantly less nominator backing than the previous cycle, resulting in total stake drops of 24.32M DOT and 103.30M DOT, respectively.

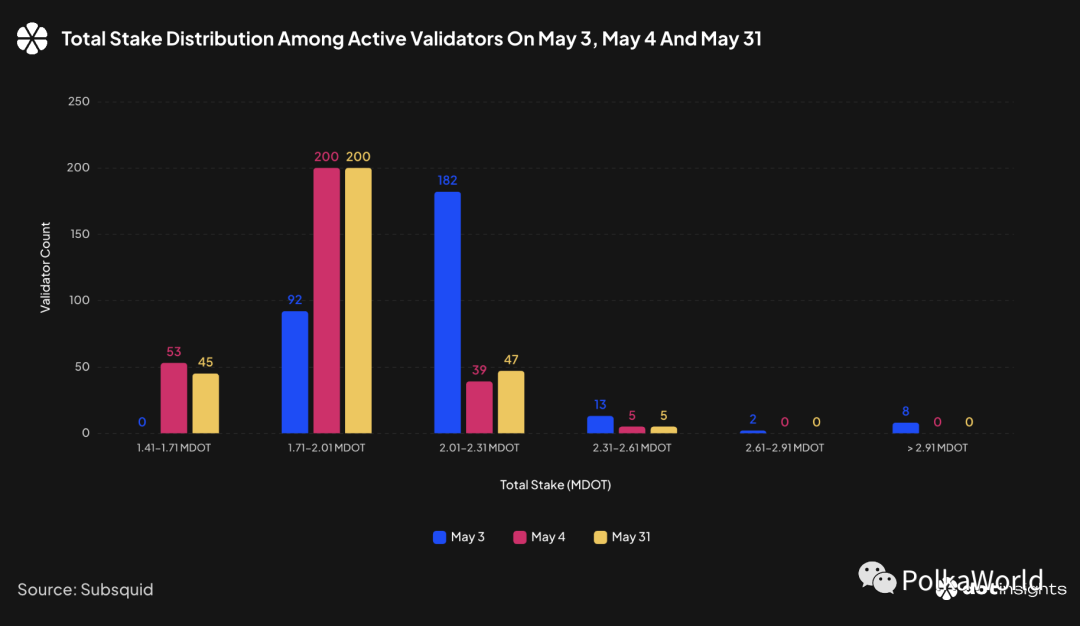

During the May 4, 2023 rotation, 48 validators were replaced. While each outgoing validator had at least 1.81M DOT in total stake backing them, the newly activated validators averaged only 2.10M DOT. This led to a significant shift in the distribution of stake among active validators. The number of validators with less than 2.01M DOT in total stake surged from 92 on May 3 to 253 on May 4, while those with 2.01–2.61M DOT dropped sharply from 195 to 44. Notably, the removal of two validators each backed by 12.21M DOT greatly narrowed the distribution range, evident in the standard deviation decreasing from 867.29K DOT to 182.19K DOT.

Validators and Nominators

Validator Rotation and Network Vulnerability

Although the total number of validators changed little, fluctuating between 917 and 990, the total number of nominators saw a sharp increase in November 2022, peaking at 47,672 on December 5, before gradually declining to 44,241 by May 31, 2023. In terms of staking amounts, there is no correlation between validator stakes and nominator stakes. Validator stakes remained primarily between 1.59M and 1.90M DOT until March 17, after which they increased to the 1.91M–2.13M DOT range. On May 4, nominator stakes decreased by 103.40M DOT, while validator stakes increased by 102.46K DOT, raising the validators’ share of total stake from 0.31% to a peak of 0.39%.

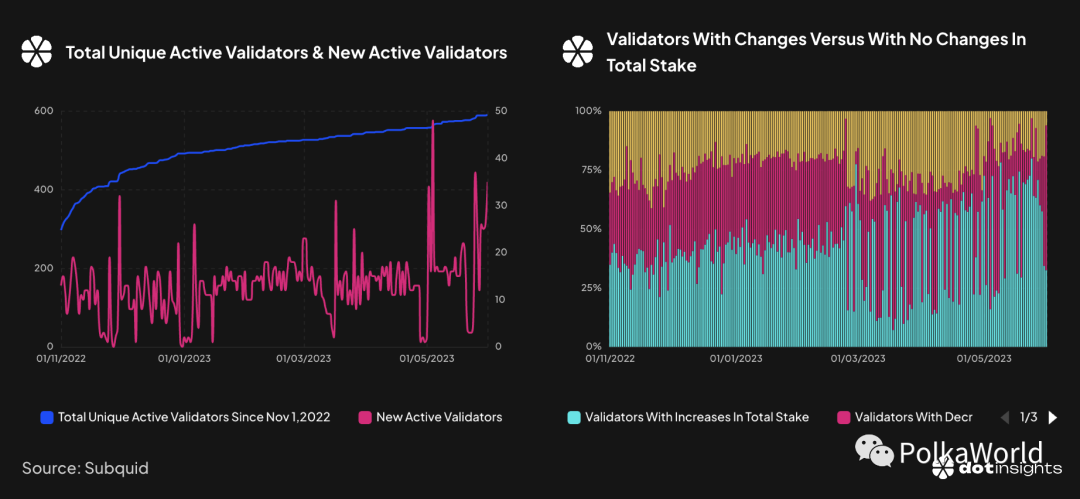

As noted earlier, the set of 297 active validators changes at the start of each new era. Examining the number of new active validators daily, the average is 13. Even at its peak on May 4, only 48 new validators joined the active set, representing just 16.16% of the total. This indicates insufficient diversity among active validators; in fact, since November 2022, the cumulative number of unique active validators has grown only from 297 to 591, while the total number of validators reached 987 by May 31.

Note that starting February 23, 2023, the distribution of total stake among validators (in terms of unchanged, decreased, and increased shares) showed greater volatility than in prior periods, partly due to more dramatic fluctuations among newly active validators.

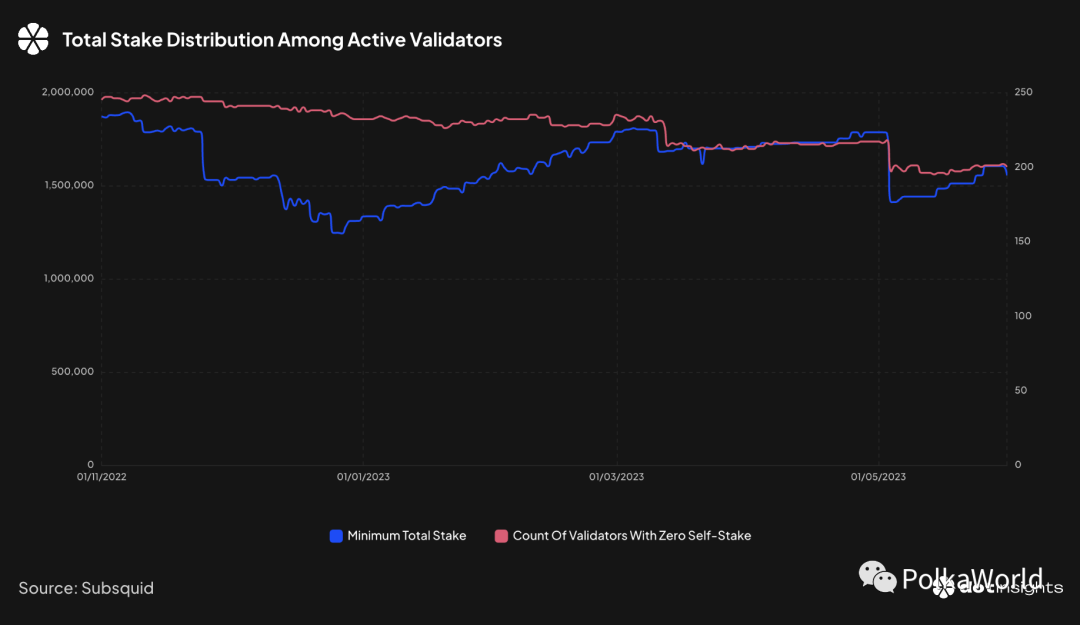

In each era, the lowest total stake among active validators reflects the vulnerability of the Polkadot network. Since November 2022, the two largest drops in minimum total stake occurred on November 25, 2022 (from 1.79M to 1.53M DOT) and May 4, 2023 (from 1.78M to 1.41M DOT), coinciding exactly with the two major drops in total staked DOT. The network experienced its most vulnerable moment on December 27, 2022, when the lowest total stake fell to 1.24M DOT.

Nominator Data

Notably, the number of validators with zero self-stake remains relatively high, averaging 76.69% of all active validators per era. Theoretically, if such validators misbehave, all penalties fall entirely on nominators. Data suggests that validator self-stake is a criterion considered by nominators. On May 31, 2023, 200 active validators with zero self-stake received 8,552 nominations, averaging 42.55 per validator, whereas the other 97 validators received 13,703 nominations, averaging 141.27 per validator. Most nominators prefer validators with self-stakes below 10,000 DOT. This pattern is understandable, as popular validators face harsher penalties compared to those with lower backing.

Additionally, validator commission rates appear to be another factor in nominator selection. Unsurprisingly, nominators favor validators with lower commissions. On May 31, 2023, 167 validators with commissions below 15% received 21,299 out of 22,255 nominations—a significant 95.70%. In contrast, 120 validators charging 100% commission received only 765 nominations, 113 of whom had zero self-stake. Setting zero self-stake and 100% commission is a common strategy among large stakeholders to deter other nominators and maximize their own staking rewards.

The number of oversubscribed validators showed a downward trend during the last two months of 2022. In mid-January 2023, following Polkadot’s runtime upgrade to 9340, the maximum number of rewardable nominators per active validator increased from 256 to 512, leading to a sharp decline in oversubscribed validators. Starting January 14, 2023, only 0–3 validators were considered oversubscribed daily, compared to 15–45 before the upgrade—a remarkable 15-fold reduction.

Rewards and Fast Unbonding

Due to limits on the number of nominators who can earn staking rewards (maximum 22,500 nominators across all validators per era, capped at 512 per validator), the threshold for receiving rewards—known as the minimum active nominator stake—is dynamic. Over the seven months since November 2022, this threshold nearly doubled, rising from 187.35 DOT to 363.98 DOT (the latter value unchanged since May 3, 2023). It increased significantly by an average of 15.01 DOT every 21–40 days. Therefore, token holders are advised to join active nominator pools to receive consistent rewards.

For nominators not earning rewards, a new feature called fast unbonding may offer a solution. Implemented on Polkadot after referendum #111 passed on March 28, 2023, fast unbonding allows nominators whose stake has been inactive on Polkadot for at least 28 days to withdraw immediately. On average, four distinct accounts use this feature daily. By May 31, a total of 122.23K DOT had been withdrawn via fast unbonding, including 20.25K DOT withdrawn by 10 separate accounts on May 12 alone.

Nominator Pools

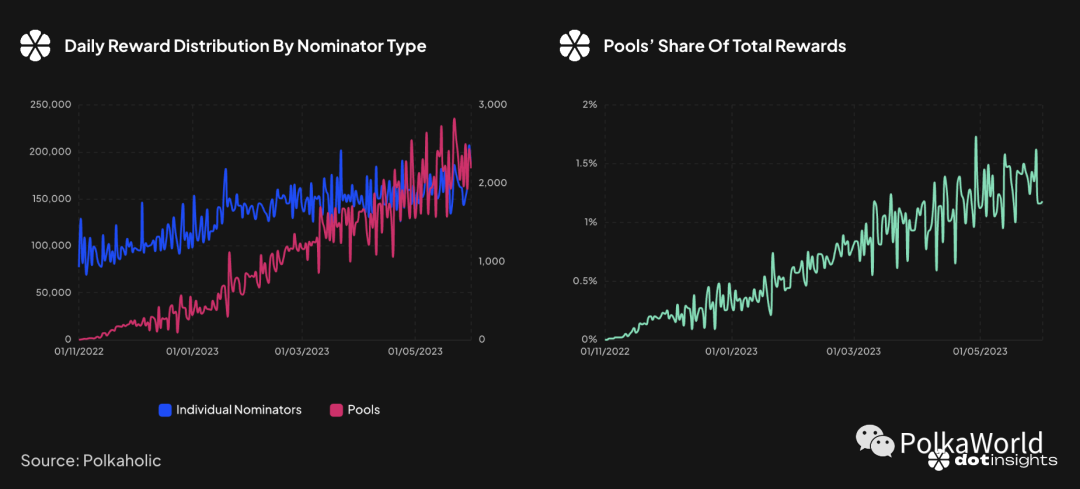

Polkadot’s nominator pools officially surpassed 10,000 total members on May 7, 2023, with total stake reaching 4M DOT the following day. On average, pools gained 52 new members and 22K DOT per day. Daily pool rewards also grew rapidly, increasing from 3.22 DOT on November 2, 2022, to a peak of 2.83K DOT on May 22, 2023. While still negligible compared to individual nominator rewards—which mostly remain between 87.78K and 178.50K DOT—the growing pool rewards and relatively stable individual rewards have gradually increased pools’ share of total rewards to the 1%–2% range.

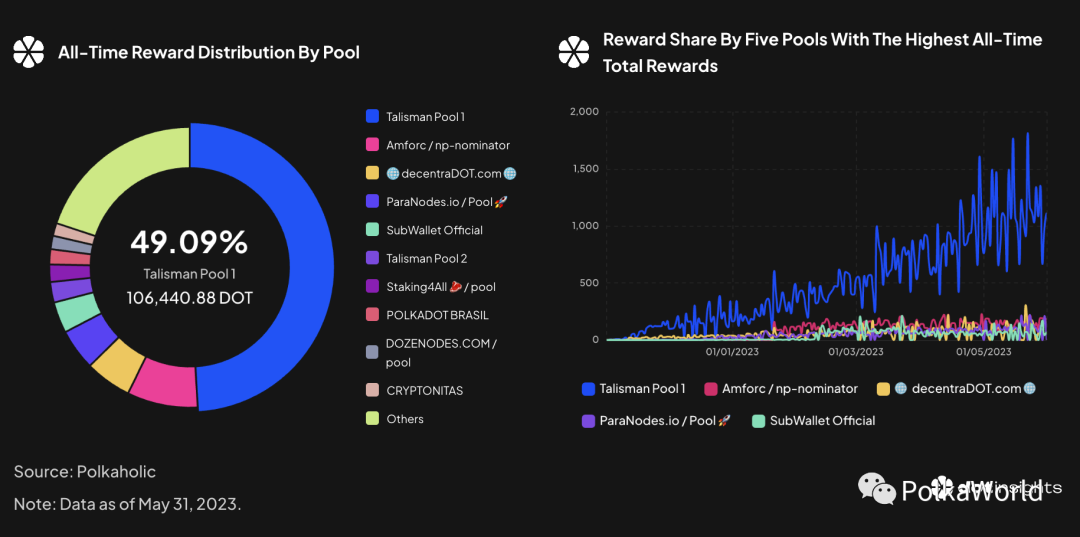

Examining individual pools, Talisman Pool 1 has clearly led since November 2022, earning 106.44K DOT in rewards—an average of 504.46 DOT per day—accounting for 49.09% of all pool rewards. This is 6.03 times that of second-ranked Amforc (83.72 DOT/day) and 9.15 times third-ranked decentraDOT.com (55.15 DOT/day). ParaNodes.io and SubWallet Official followed closely with 48.84 DOT and 36.91 DOT per day, respectively. Given that Talisman Pool 1 had accumulated the largest stake (2.40M DOT) and highest member count (3,546) among all pools by May 31, 2023, this outcome is unsurprising.

Conclusion

Overall, over the past seven months, we have witnessed the introduction and remarkable growth of Polkadot’s nominator pools—a simpler and more economically accessible alternative to direct staking. Combined with the fast-unbonding feature (a new functionality allowing stakers to bypass the 28-day unbonding period), nominator pools have made the concept of NPoS, and particularly Polkadot staking, much easier for token holders to understand and participate in. With several planned improvements expected in the coming months, nominator pools are poised for even greater growth and will likely make significant contributions to the future development of staking on Polkadot.

On the other hand, the sudden 103.40M DOT drop in nominator stake in early May has drawn attention to a key aspect of the NPoS design: validator election. The process of electing validators serves two main goals: fair representation of nominators and maximizing network security. Thus, power and influence among validators should be distributed as evenly as possible. In light of these objectives, removing highly staked validators from the active set during this major stake reduction event appears aligned with the election mechanism. However, this incident raises a critical question: how can such validators be prevented from entering the active set in the first place? Hopefully, this issue will be addressed in future extensions of the NPoS scheme.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News