Bankless Founder's Conversation with a Cosmos Community OG: A Comprehensive Analysis of Cosmos

TechFlow Selected TechFlow Selected

Bankless Founder's Conversation with a Cosmos Community OG: A Comprehensive Analysis of Cosmos

The collision between the Ethereum community and the Cosmos community.

Recently, Ryan Sean Adams and David Hoffman, co-founders of Bankless, engaged in a theoretical discussion about Cosmos with two OGs from the Cosmos community—Sunny Aggarwal and Zaki Manian. In my view, this podcast episode is highly insightful, as the participants represent the Ethereum and Cosmos communities respectively, clearly highlighting the differences between these two ecosystems.

Key topics discussed in this episode include:

-

Core theory of Cosmos

-

Ethereum vs Cosmos

-

Reflections on monetary premium

-

Osmosis and liquidity premium

-

Stablecoins in the Cosmos ecosystem

-

L2 vs Cosmos

-

Cosmos vs Polkadot

-

MEV issues and solutions

-

ATOM 2.0

-

Mesh & Interchain Security

-

The future of Cosmos

Since the podcast runs for approximately two hours, a full transcript would be excessively long. Therefore, I have distilled only the key points.

1. Core Theory of Cosmos

According to Sunny Aggarwal, the Cosmos community believes that the future of blockchains will not be dominated by a few chains, but rather will consist of many diverse blockchains—most of which will be application-specific chains. Just as the real world does not have one single settlement layer, neither will the blockchain world. Instead, there will be multiple settlement layers, each serving as the native settlement layer for its own assets, thereby granting them sovereignty. Rollups or other systems do not possess the same level of sovereignty as independent chains. In essence, Cosmos does not aim to build a "world computer" like Ethereum, but rather seeks to create many "community computers" and connect them together.

Zaki Manian added that Cosmos was created to counter the "fat protocol" thesis—the idea that the value of applications built on top of a blockchain accrues to the underlying protocol’s token, making such tokens the most valuable due to network effects. In contrast, Cosmos posits that value should be captured at the application layer—the layer closest to users. Thus, Cosmos has developed technical stacks to help developers build optimal application layers.

2. Ethereum vs Cosmos

Regarding the differences between Ethereum and Cosmos, David Hoffman and Zaki Manian offered biological analogies.

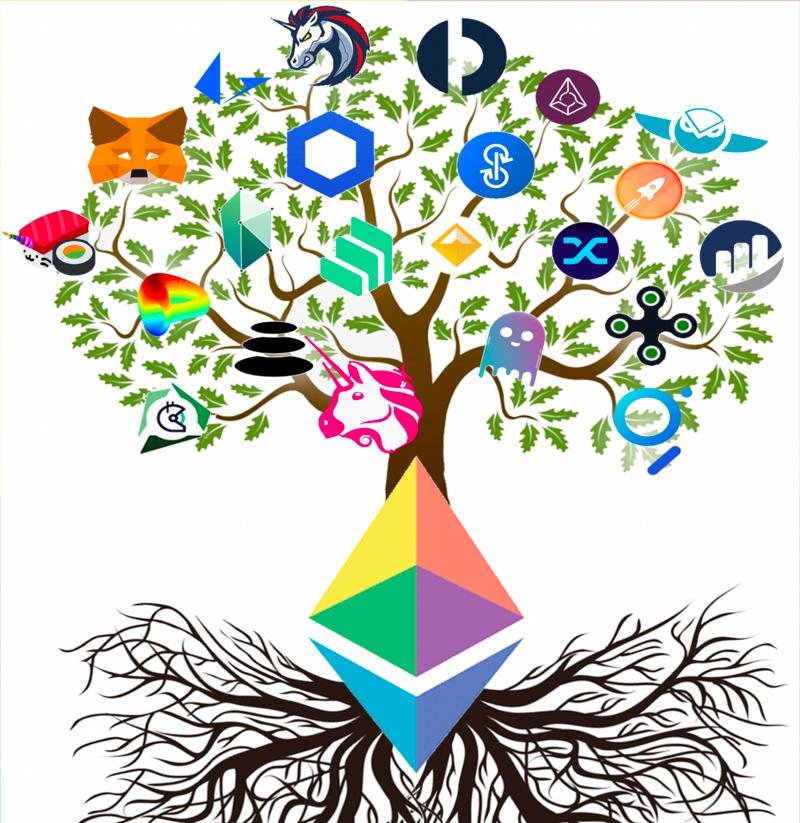

David Hoffman: Ethereum began as a monolithic chain, and now hosts numerous Layer 2 networks, with Layer 3s expected in the future. The entire Ethereum ecosystem resembles a massive tree: L1 forms the core trunk, L2 and L3 are branches, and applications are leaves that absorb sunlight (value) and provide organic nutrients (economic value) back to the trunk. Under this model, Ethereum’s Beacon Chain remains the central foundation of the ecosystem.

(Image courtesy of David Hoffman)

Zaki Manian: The Cosmos ecosystem follows a different model—one that is mesh-like, resembling the mycelium networks spreading beneath forests. This network exists symbiotically alongside trees (like Ethereum). Philosophically, Ethereum emphasizes monetary premium, which is difficult to achieve and requires a secure, decentralized, censorship-resistant system. Ethereum’s Beacon Chain serves as the root chain providing monetary premium and security for everything built atop it. In contrast, the mesh security model proposed by Sunny enables Cosmos chains to provide mutual security for one another.

(Image source: mapofzones)

Note: When explaining the bidirectional mesh security model, Sunny Aggarwal used NATO as a real-world analogy—each member state maintains its own sovereignty and governance, without interfering in others’ politics, yet collectively benefits from a shared security framework.

3. Trade-offs Around Monetary Premium

Ryan Sean Adams: Chains in the Cosmos ecosystem sacrifice monetary premium—especially the design of the Cosmos Hub, which deliberately avoids capturing monetary premium. In contrast, the Ethereum community places great importance on monetary premium, viewing it as a critical security mechanism. The once-popular "fat protocol" theory has evolved into what is now called "fat money."

The key idea here is that if you can establish monetary premium at the base-layer asset, you gain free security, enabling resilience against competing Layer 1 blockchains.

Sunny Aggarwal: The Cosmos ecosystem is essentially a hidden branch of Bitcoin maxis—we aim to build application layers for Bitcoin. In my view, Bitcoin itself is an application chain, and the entire Cosmos ecosystem builds various application layers around Bitcoin. Through a protocol called Babylon, Bitcoin and Cosmos are linked, allowing Bitcoin’s network to provide security (e.g., against long-range attacks) to Cosmos and any PoS chain. From this perspective, Bitcoin becomes the beneficiary of monetary premium within the Cosmos ecosystem.

Furthermore, the mesh security model within Cosmos offers a non-rent-seeking way to obtain economic security.

Ryan Sean Adams: Connecting Bitcoin to the Cosmos ecosystem requires trusting validators of application chains, thus losing the original security guarantees of the Bitcoin network—a challenge for monetary premium.

Sunny Aggarwal: Building a secure bridge between Bitcoin and Cosmos is currently a major focus. We’re also working to support Jeremy Rubin in improving things like OP_CTV so that cross-chain bridges can become trust-minimized, similar to IBC. Regarding mesh security, gold (Bitcoin) holds the largest monetary premium, with the highest individual market cap. However, the combined market caps of the world’s top 10 companies exceed that of gold. Therefore, I believe economic security doesn’t need to come from monetary premium, but rather from productive assets.

4. Osmosis and Liquidity Premium

David Hoffman: Given the design of the mesh security model, what prevents one Cosmos chain from becoming the central hub of the network, gaining network effects and liquidity premium, thereby deviating from the mycelium vision? (For example, Osmosis is currently the liquidity center of the entire Cosmos ecosystem.)

Sunny Aggarwal: IBC, as a communication protocol, allows every Cosmos chain to interoperate. Osmosis, as an early successful application chain, is currently the activity and liquidity hub of the ecosystem. But in the future, more successful application chains will emerge, each becoming a center within their respective domains, forming a true mesh network. The mesh security model enables collaboration among application chains, preventing any single chain from becoming a dominant security center.

David Hoffman: OSMO currently enjoys perhaps the best liquidity across the Cosmos ecosystem, making it function increasingly like a currency within Cosmos. Unlike UNI on Uniswap—which hasn’t become a monetary premium asset—could Osmosis’s liquidity premium grow too high and undermine the mesh network vision?

Sunny Aggarwal: Currently, OSMO is the paired asset in most pools, but I don’t believe this will persist. We're moving toward concentrated liquidity and orderbook-style systems where stablecoins will serve as primary base pairs instead of volatile OSMO. Additionally, we're connecting more ecosystems and bringing in diverse assets.

5. Stablecoins in the Cosmos Ecosystem

Ryan Sean Adams: Cosmos is integrating stablecoin assets—for instance, Circle recently announced launching native USDC on Cosmos. What are your thoughts on this development?

Zaki Manian: One major difference between Ethereum and Cosmos is that most core developers in Cosmos also build applications, whereas Ethereum’s core developers focus primarily on the base-layer blockchain. At developer conferences, you can see clear separation between core protocol developers and application developers. My own project, Agoric, builds stablecoins, and I’m also working on the USDC chain—a universal asset issuance chain for USDC. This helps make the system mesh-like rather than centralized around one hub. By issuing USDC natively on a consumer chain within Cosmos and connecting it via IBC, every chain in the ecosystem gains access to native USDC without paying rent.

Ryan Sean Adams: I find this very meaningful. Compared to Bitcoin, I actually prefer the idea of USDC on Cosmos, because USDC is inherently a centralized dollar IOU—it doesn’t aim to offer sovereign-grade security nor is it a crypto-native asset. So placing it within Cosmos makes sense, as it doesn’t truly sacrifice monetary sovereignty.

6. L2 vs Cosmos

Ryan Sean Adams: Regarding the multi-chain future, there are currently two visions: the Ethereum-style and the Cosmos-style. I'm not sure both can coexist. Let me first outline the Ethereum vision I'm familiar with: in the future, various application chains will exist as L3s built atop L2s, leveraging Ethereum L1 as the source of security—thus enjoying Ethereum's economic security without needing their own validator set.

Sunny Aggarwal: To me, this resembles an empire-colony model. Cosmos builds sovereign systems.

Zaki Manian: That’s certainly a meme-worthy take. As early as 2014, early Cosmos participants tried to convince the Ethereum community to adopt the Cosmos vision, but developers were more focused on infrastructure like sharding. Only recently has the ecosystem begun prioritizing the application layer. Technically, blockchains can be divided into three parts: execution environments, data availability systems, and bridging systems. Ethereum aims to build an integrated system using fraud proofs and zero-knowledge proofs, offering a data availability layer called danksharding, then connecting all execution environments.

In contrast, Cosmos provides the IBC cross-chain communication protocol, enabling you to go anywhere. For example, Celestia, in a sense, is part of the Cosmos ecosystem—it’s an application chain focused on data availability (DA), and through it, a rollup-style ecosystem can be built. We provide toolkits for developers to build execution environments.

One key difference between Ethereum and Cosmos is that most execution environment toolkits in Ethereum aren't free. This was a major reason why dydx left Ethereum and migrated to Cosmos—because Cosmos offers these tools freely as public goods available to all.

Sunny Aggarwal: Compound once attempted to launch an application chain in the Polkadot ecosystem, choosing the Substrate architecture and spending a year on it, but ultimately abandoned the effort. Robert Leshner later said they might have succeeded had they chosen the Cosmos SDK. From an app builder’s perspective, building with Cosmos SDK is faster. Ethereum focuses more on cutting-edge base-layer technologies like zero-knowledge proofs, but implementation is slower. Cosmos focuses more on higher-level aspects like state machines, prioritizing cross-chain composability and user experience/functionality for application chains, adding fraud and validity proofs later. It’s a trade-off.

7. Cosmos vs Polkadot

Ryan Sean Adams: Back in 2017–2018, two projects focused on interoperability emerged: Cosmos and Polkadot. You mentioned Compound’s failed attempt to build on Polkadot. Do you think Cosmos has already won this competition?

Zaki Manian: In terms of market cap, DOT is currently ahead, and USDC will launch natively on Polkadot first. However, Polkadot lacks an application capable of absorbing $1 billion in USDC in the short term, while Cosmos has dydx that can. This is exactly what happens when you bring the best apps into your ecosystem.

Ryan Sean Adams: Polkadot seems to pursue a middle path between Ethereum and Cosmos—it doesn’t offer smart contract functionality, but instead handles consensus for the entire network, providing shared security. Cosmos, by contrast, adopts a leaderless model. In this sense, Ethereum represents one extreme in the crypto ecosystem, and Cosmos the other—two parallel philosophies with no intersection.

(This reminds me of Vitalik’s “convexity” theory—he argues that convex decision-making is better for certain choices like technical direction, while compromise may introduce unnecessary complexity.)

8. MEV Issues and Solutions

David Hoffman: Speaking of application chains, Dan Elitzer recently wrote an excellent article about Uniswap, noting that only about one-third of economic value is captured by liquidity providers (LPs), another third is burned in gas fees, and the remaining third leaks to MEV forms like frontrunning. In other words, using Uniswap leaks significant economic value. Can you explain how application chains in Cosmos address some of these MEV issues?

Sunny Aggarwal: This is exactly what Osmosis does. We use threshold-encrypted mempools to eliminate harmful MEV extraction like sandwich attacks. In open mempools, actors can read everyone else’s transactions, copy strategies, and arbitrage via frontrunning—this is a problem caused by public mempools. However, there’s also “good” MEV that doesn’t extract value—for example, arbitrage opportunities arising from price differences between Osmosis and centralized exchanges. Another example will be the Mars protocol launching a lending platform on Osmosis, where liquidation triggers become MEV opportunities. These are good forms of MEV. Our strategy is to eliminate bad MEV while enabling good MEV (via automated on-chain bots) and redistributing the resulting profits to OSMO stakers.

9. ATOM 2.0

Ryan Sean Adams: We’ve discussed a lot about Cosmos theory. Now let’s talk about the recently released ATOM 2.0 whitepaper and its economic changes.

Zaki Manian: We now have the application chain theory—but what is the application of the Cosmos Hub itself? It seems to lack one. After extensive discussion, we concluded that ATOM needs to become a better ecosystem asset—essentially, we need to give it an application. Hence the economic model changes: ATOM is no longer an exponentially inflationary token; we’re shaping it to behave more like a monetary asset.

10. Mesh Security & Interchain Security

Ryan Sean Adams: Regarding the application of the Cosmos Hub, isn’t it essentially “interchain security”—meaning Cosmos Hub validators help validate other application chains and provide them with security?

Zaki Manian: There are two models for shared security: “interchain security” and “mesh security.” Some application chains serve high-value users (e.g., USDC) but don’t want to deal with tokenomics—they have strong incentives to become consumer chains, renting Cosmos Hub validators and contributing value to the Cosmos Hub and broader ecosystem. Another high-demand use case for interchain security involves security-sensitive applications like liquid staking, which would benefit greatly from connecting to the Cosmos Hub.

Sunny Aggarwal: Historically, credible neutrality has been crucial. Switzerland, one of the world’s wealthiest nations, achieved prosperity through neutrality. I initially believed the Cosmos Hub should serve as a credibly neutral system—renting out security and earning revenue. This is the role I envision for the Cosmos Hub within the mesh security vision.

David Hoffman: Is the idea of interchain security meant to be an initial phase? Once application chains achieve product-market fit and accumulate value, could they then afford their own security burden and transition to the credibly neutral “army” system (i.e., mesh security)?

Zaki Manian: I believe the unique aspect of our shared security vision is designing the system for seamless upgrades—just like standard app upgrade processes in Cosmos. You can join interchain security with minimal technical overhead, or choose to leave it. We aim to ensure a diverse, pluralistic ecosystem.

11. The Future of Cosmos

Ryan Sean Adams: Looking ahead 5–10 years, what do you envision for Cosmos and the broader crypto ecosystem?

Zaki Manian: My hope is that when the vision is realized, most cryptocurrency users won’t even know whether they’re using something from Cosmos, Ethereum, or Solana. The market won’t suffer from attacks or frontrunning, but will function as a true digital marketplace. I don’t care about branding—I just want the tools we’ve built for Cosmos to play a vital role in achieving this goal. I also believe Ethereum plays an important role in this broader vision. If we succeed, we’ll have open-source digital markets enabling global economic collaboration—an idealistic utopia I envision.

Sunny Aggarwal: As I mentioned earlier, I deeply appreciate organic Hayekian systems. About a month or two ago, over 50% of the crypto market cap was supported by PoS systems—that’s great. But now I’m thinking about what’s next. I believe we can build something better than proof-of-stake—a consensus protocol based on web-of-trust mechanisms that is even more decentralized than PoS. I don’t have all the answers, but I want to keep dismantling centralized systems and building more organic, mesh-like structures.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News