Crypto KOL: How to Invest in a Bear Market and Position for the Next Bull Run?

TechFlow Selected TechFlow Selected

Crypto KOL: How to Invest in a Bear Market and Position for the Next Bull Run?

If you stay committed to researching and actively participating, a bear market is the best time for your net worth.

Written by: Lady of Crypto

Translated by: TechFlow intern

Disclaimer: This article reflects the author's personal views only and does not constitute financial advice.

If you keep researching and stay actively involved, bear markets are actually the best time for building net worth. This isn't an article about surviving a bear market—it's a guide on how to profit from it.

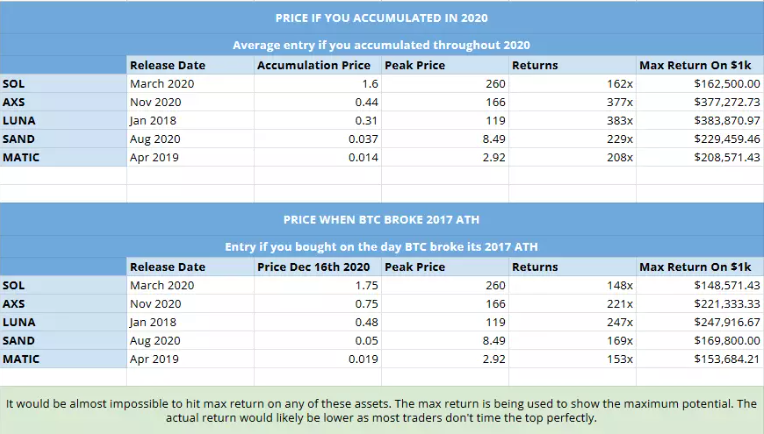

You need patience. $SOL, $AXS, $LUNA, $SAND, and $MATIC were just a few cryptocurrencies that delivered over 150x returns between 2020 and 2021. All of these launched during bear markets and didn’t surge until $BTC broke its all-time high. You don’t need to buy now.

If your stablecoins are sitting idle, stake them. Every dollar you earn could multiply 150x in the next bull market. Here are key points to keep in mind:

- Use secure stablecoins such as USDC

- Diversify staking exposure across five protocols

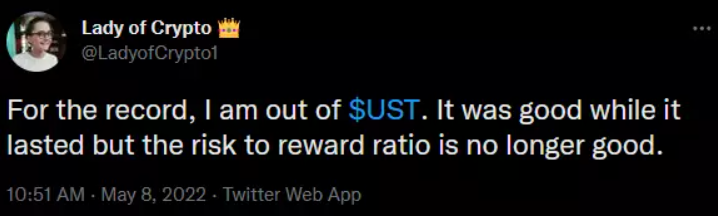

- Unstake immediately at first sign of trouble—like UST depegging

Analyze the sectors you believe will explode next. In 2020, I dove deep into GameFi and was richly rewarded. These are my primary investment focus areas for the next cycle:

- L1/L2

-- GameFi, e.g., X-to-earn

-- Launchpads

-- Privacy

Once you know which sectors to target, you can focus your efforts. Build positions in proven low-risk projects within each sector—such as $ETH and $SOL in L1—and reserve stablecoin capital for new projects launching during the mid-to-late stages of this bear market.

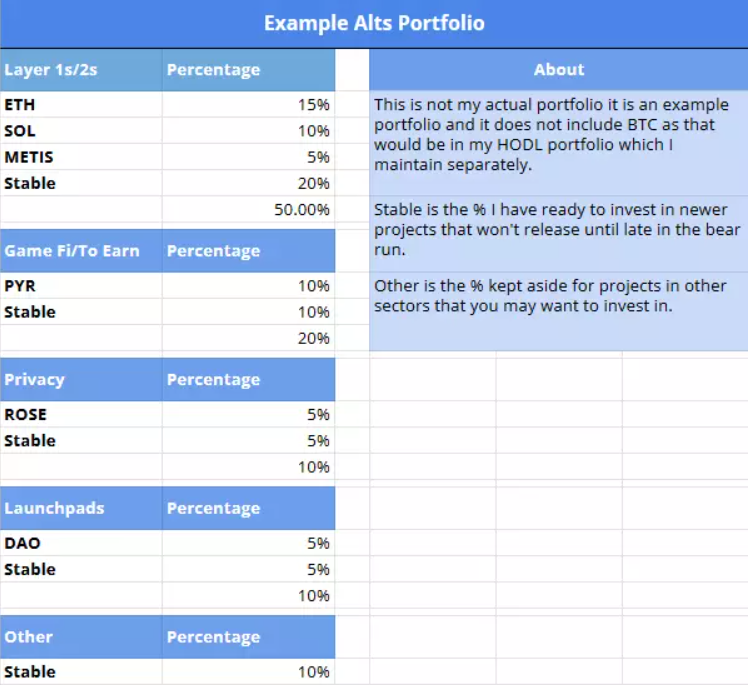

Low-risk projects are those you consider safe; high-risk new projects are the ones that might go to zero or deliver 1000x. The example portfolio below illustrates allocation ratios to low-risk assets and the portion of stablecoins reserved for high-risk opportunities. Note: this example applies to the depths of a bear market—not today’s conditions.

My low-risk picks:

- L1/L2: $ETH, $SOL, $AVAX, $MATIC, and $METIS

- GameFi / X-to-earn: $PYR, still researching others

- Launchpads: $DAO, though I haven't bought yet

- Privacy: $ROSE and $AZERO (also L1s)

This is not financial advice—just my personal opinion.

What if you don't have money right now?

Don't panic. Keep working. Deploy only the amount you can afford to lose. You still have months to prepare.

When to buy?

Investments in low-risk projects like those listed above should be accumulated gradually. I only started slowly adding exposure on June 14th. Currently, my total invested capital is less than 10% of my overall portfolio. Even 12 months from now, it may still be under 30%.

Advanced strategy: Within the current bear market trend, I add positions when prices stabilize at support levels, and take partial profits when prices rise 20%-50%. For example, I bought $SOL at 27 and took profits within the 20%-50% return range. When it drops back to 27 or lower, I’ll begin buying again. However, advanced strategies aren't suitable for everyone—please conduct your own analysis and manage risk carefully.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News