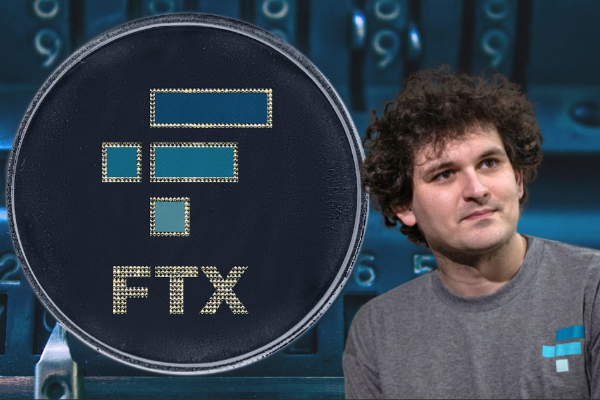

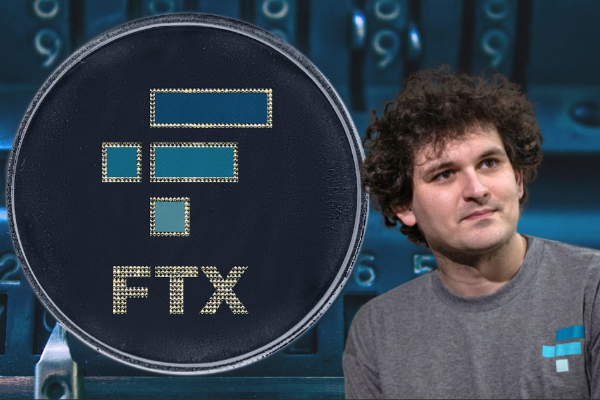

CNN Exclusive Interview with SBF: On the Criteria for Aiding Crypto Firms and Denial of Coinbase Acquisition Rumors

TechFlow Selected TechFlow Selected

CNN Exclusive Interview with SBF: On the Criteria for Aiding Crypto Firms and Denial of Coinbase Acquisition Rumors

SBF believes the crypto market is moving toward a healthier situation.

FTX CEO Sam Bankman-Fried recently sat down for an exclusive interview with CNN to discuss the current state of the crypto market and FTX's expansion plans. Host Julia Chatterley even jokingly asked whether SBF was planning to acquire Coinbase. So, what exactly did they talk about?

SBF appeared on CNN’s "First Move" last Wednesday, July 7. First Move is a program dedicated to global business, economic, and financial news. The interview covered topics including the current state of the crypto market, rumors around FTX acquisitions, why SBF is providing support to struggling crypto firms, and future expansion strategies.

Liquidation Is Painful, But Healthy in the Long Run

Julia Chatterley opened by asking about the current state of the crypto market:

I think it's painful and challenging for the crypto industry right now — but do you also see a certain level of “health” emerging?

SBF believes the crypto market is moving toward a healthier state. Over the past two years, some institutions and capital grew too aggressively. Now, the market is unwinding that excessive leverage and weeding out companies with insufficient capital reserves.

Once you reach a point where even well-capitalized players start having problems, I think the market can no longer be considered healthy.

Right now, the market is clearing out excessive leverage and removing players with balance sheet issues. In that sense, I believe this process is healthy for the market.

In fact, SBF expressed similar views during a recent interview with Reuters.

He noted that the liquidation of over-leveraged positions causes liquidity crunches, but the worst phase of such a crunch appears to be behind us — a view supported by stabilizing prices. That said, this doesn’t mean the bear market is over; future trends will still depend heavily on macroeconomic factors.

What Are the Criteria for Supporting Crypto Companies?

Recently, lending platform BlockFi secured a $250 million revolving credit facility from FTX. SBF has previously stated he is willing to lend to other firms to help draw a line under the ongoing crisis.

To this, Julia Chatterley asked:

I’m sure people are knocking on your door every day shouting, “Hey, will you invest in us?”

So you must be filtering out companies that are weak, unprofitable, or even insolvent, right?

SBF acknowledged that lending isn't charity — careful evaluation is essential.

FTX’s standard is to identify companies with “solid business fundamentals.” These firms are fundamentally sound but face temporary liquidity issues. Providing short-term loans helps protect their users and prevent systemic contagion.

You hit the nail on the head — that’s exactly what we’re doing. Lending isn’t just about rescuing companies. Among the firms we’ve studied, some are destined to fail, and bankruptcy may be the right outcome for them.

Our key criterion is strong underlying business performance. These loans are simply short- to medium-term liquidity solutions.

Meanwhile, SBF clarified some market rumors. He emphasized that beyond company fundamentals, the main goal is protecting users — which is why mining operations and mining hardware businesses are not within FTX’s scope of interest.

There’s been a lot of speculation lately about FTX bailing out miners, which is understandable given mining’s central role in crypto.

But let me be clear: we have no interest in the mining hardware space. There are no users to protect there — anyone can buy new mining equipment to replace lost capacity. It’s not a sector with systemic risk.

Will You Acquire Other Companies at This Low Point? Like Coinbase?

According to SEC filings, SBF acquired 56 million shares of Robinhood in May, making him the company’s third-largest shareholder. While SBF denied any acquisition intentions, it naturally sparked speculation.

SBF clarified that this was purely an investment. He deeply respects Robinhood founder Vlad Tenev and his team, and while there have been no active discussions about acquisition, he didn’t rule out other opportunities.

Julia Chatterley noted that buying stakes during downturns makes strategic sense and asked:

People are very interested in your Robinhood investment — are there other companies you’d like to invest in?

Could we perhaps add Coinbase to that list?

SBF immediately laughed and denied any intention to acquire Coinbase.

He pointed out that FTX is currently operating well, so there’s no need to rush into acquiring companies like Robinhood or others and placing ourselves in unfamiliar operational environments. However, he added that he remains open to collaboration with various firms.

Answering this could fuel more rumors, so I won’t go there.

But I will say that partnerships with any company are possible.

Is FTX Profitable This Quarter?

Coinbase reported its Q1 earnings last month, posting a net loss of $430 million amid halved revenue and rising expenses.

Julia Chatterley asked:

During this period of market turmoil, is FTX’s trading business profitable?

Because I think this is exactly the time when profitability separates good companies from average or bad ones.

The answer is yes. SBF confirmed that FTX has been profitable for several consecutive quarters, including the most recent ones. He attributes this to “steady expansion”.

Yes, we’ve done it — including in recent quarters, we’ve remained profitable for a sustained period.

I think the key to sustainable profitability lies in stable growth. Of course, I’m not saying expansion is wrong — especially when timing and conditions are favorable — but expansion is inherently risky and can leave you vulnerable. Unless we find a truly compelling opportunity and can invest in a way we like, I won’t expand recklessly.

SBF specifically highlighted hiring and team expansion. He previously noted that while expanding during bull markets may seem logical, his research shows rapid scaling complicates inter-departmental coordination and lowers hiring standards. The result is poor communication among colleagues — eventually leading to a culture where no one wants to communicate, even with incentive programs in place.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News