14 Market Bottom Signals: How Many Have Been Confirmed So Far?

TechFlow Selected TechFlow Selected

14 Market Bottom Signals: How Many Have Been Confirmed So Far?

What do we still have left to be struck down?

Written by: Jack Niewold

Translated by: TechFlow intern

A month ago, I asked a group of crypto OGs how to spot a market bottom. I proposed 14 bottom signals—only 4 were confirmed back then. Let's see how things stand now.

TL;DR: 10 out of 14 bottom signals have been confirmed:

1. Major fund bankruptcies: Confirmed (previously not)

Yes, it’s bad. The largest-ever cryptocurrency hedge fund, 3AC, collapsed and successfully triggered a chain reaction of failures.

2. Extreme boredom: Confirmed (previously not)

Yesterday I ran a Twitter poll with four options: Panic, Anger, Depression, Hope.

Hope won, but among the unlisted options, there was one clear consensus: boredom.

3. Breaking below the 200-week moving average: Uncertain (previously not)

This one is tricky—we’ve broken below the 200-week SMA, but the weekly candle hasn’t closed yet.

Fun fact: The last time total crypto market cap traded below the 200-week SMA was in March 2020.

4. Retail investor disinterest: Confirmed (previously yes)

Yes, retail interest has largely disappeared.

If you look at exchange trading volumes, sentiment indicators, or reports from major banks, most retail trading metrics have declined significantly.

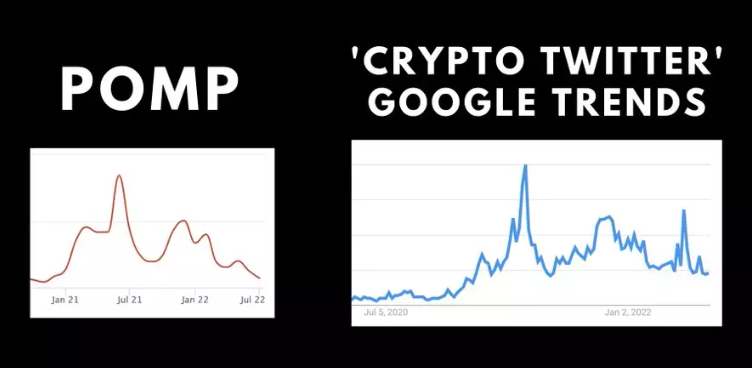

5. Quiet crypto social media: Confirmed (previously not)

This has definitely been felt over the past few weeks. Despite ongoing activity, there’s been a notable drop. Below:

- Follower growth over time

- Google Trends for "Crypto Twitter"

6. Disappearance of Web2-crypto integrations: Not yet confirmed

Several notable integrations remain active and progressing:

- Twitter PFPs

- FB Metaverse

- Instagram NFTs

- Stripe crypto payments

7. Monthly RSI deeply oversold for multiple months: Not yet confirmed

Not there yet. We’d need to see several more months of stagnant declines or a large downward candle to reach those levels.

8. Silence: Uncertain

I’m fairly certain we haven’t reached this stage yet. Social media engagement, YouTube/podcast views, and trading volumes still indicate activity.

9. Bullish funds selling unlocked positions: Confirmed (previously yes)

This was already “confirmed” as most VCs invested in LUNA were hit hard and began dumping. Recently, the situation worsened further.

10. No one attending conferences: Not yet confirmed

Hardly happening so far. Conferences are still going strong. NFT NYC was definitely a must-attend event. With ETHCC approaching, we’ll see if the conference community remains vibrant.

11. Talk shifting to blockchain businesses: Confirmed (previously not)

Hard to measure, but I’ve recently heard more about blockchain-based enterprises—perhaps linked to Maker DAO/Lummis legislation? Maybe it’s no longer about enterprise blockchain, but rather about RWAs (real-world assets).

12. Anger turning into apathy: Confirmed (previously not)

Also difficult to quantify, but I believe sentiment has shifted. The biggest spectators have left. Crypto Twitter has honestly become slightly interesting again. College-dropout anime PFP guys are going back to school. The ecosystem is healing naturally.

13. Widespread industry layoffs: Confirmed (previously not)

The following companies have all conducted layoffs:

Coinbase: 1,100 employees laid off

Crypto.com: 250 employees laid off

BlockFi: 200 employees laid off

Bitpanda: 300 employees laid off

Even TIME Magazine is covering crypto layoffs.

14. Fear/panic: Confirmed (previously yes)

Altcoins down 95%, Luna death spiral, centralized lenders collapsing, $2 trillion in wealth erased? Yes, this happened—and is still happening.

So what’s left that could still hit us?

- Disappearance of Web2 integrations

- Monthly RSI deeply oversold

- Silence

- No one attending conferences/events

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News