Jump Crypto Past and Present: Wall Street's Original Crypto Outlaws, Evil Harvesters or Paradigm Innovators?

TechFlow Selected TechFlow Selected

Jump Crypto Past and Present: Wall Street's Original Crypto Outlaws, Evil Harvesters or Paradigm Innovators?

How Chicago-style market makers became on-chain infrastructure enablers?

Author: Fearless Crypto

There's a long-running online debate: Why did DeepSeek emerge from a quantitative trading firm?

Few topics have been discussed for so long and remained as controversial as quant firms:

Market manipulators & money printers vs. Tech pioneers & infrastructure builders

From a technological standpoint, it was precisely top-tier institutions like High-Flyer Quant (the parent company behind DeepSeek) — with their relentless pursuit of microsecond advantages in high-frequency trading, deep research into low-latency, high-performance trading systems, and massive financial resources — that catalyzed the application of algorithms and AI in finance, thereby advancing humanity’s technological paradigm.

Humanity has previously experienced two such paradigm shifts where financial trading and technological progress converged. Jump Trading happened to be both a participant and driver in each of these transformations.

The first shift was the move from offline, over-the-counter trading to online electronic trading. The internetization of trading enabled algorithmic arbitrage and high-frequency strategies. At that time, three traders from the Chicago Mercantile Exchange spotted the opportunity and founded what would become Jump Trading in 1999, quickly rising to become one of the world’s leading quant firms.

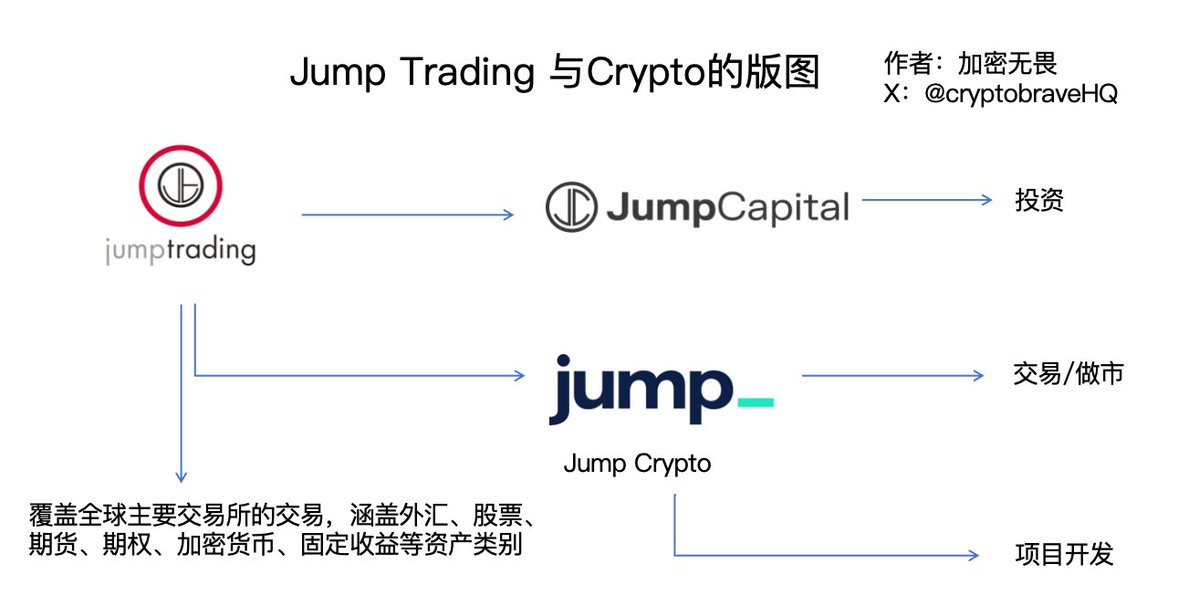

The second shift came with the rapid rise of cryptocurrencies, which attracted institutional interest in this global, decentralized market — giving birth to Jump Crypto. Across crypto trading, market making, investment, and project development, Jump introduced Wall Street-style, system-level operational tactics, aiming to replicate its traditional finance dominance in the new crypto era and dominate the market.

However, after the last cycle’s collapse — including regulatory investigations into Jump Crypto for its role in manipulating Terra (UST & LUNA), the sudden fall of ally FTX, and Solana’s price plunging by more than half — Jump Crypto fell silent.

Recently, after years of quiet, Jump Crypto @jump_ made a bold public statement, announcing a full transformation from liquidity provider to core driver of on-chain infrastructure. It also rarely disclosed details about its involvement in U.S. crypto policy lobbying, aiming to rebuild market trust through technological innovation and regulatory collaboration in the new crypto cycle. [1]

This article explores the past and present of Jump Trading and the Jump Crypto ecosystem across three chapters. Approximately 4,000 words, no ads, reading time around 10 minutes.

I. Trading! Trading! Jump Was Born for Trading

In 2022, a Caixin report titled “The Elephant in the Room in China’s Futures Market: Foreign High-Frequency Traders Stirring Up Storms” publicly introduced mysterious foreign high-frequency trading firms — including Jump Trading — to the Chinese public.

Jump Trading controlled dozens of shell companies operating under trade firm names to conduct professional high-frequency market making. For years, it ranked at the top in trading volume for certain commodity contracts on Chinese futures exchanges. In 2020 alone, Jump Trading doubled its profits in China’s futures market to 2 billion RMB (approx. $280 million). In the spot market, Jump Trading became the largest member of the Shanghai Gold Exchange, with annual trading volume exceeding the combined totals of ICBC and Bank of China.

This only reflects Jump Trading’s scale and profitability within mainland China. The firm maintains teams across major global financial markets, ensuring participation in key exchanges worldwide across asset classes including forex, equities, futures, options, and cryptocurrencies.

Among these, Jump’s earliest and largest operations were in the foreign exchange market — which shares many similarities with crypto: massive liquidity, near 24/7 global operation, decentralized structure, lack of centralized licensed exchanges (most forex platforms are registered in offshore jurisdictions or small nations), and diverse participants.

To maintain an edge in complex and volatile environments, Jump Trading has long invested heavily in algorithm development, data analytics, and high-performance computing (HPC). It recruits globally, attracting elite talent from mathematics, physics, and computer science, securing its leadership in quantitative finance and financial technology innovation.

In a way, this also explains why DeepSeek emerged from a quant firm.

Interestingly, another well-known crypto derivatives exchange, Bybit, also started in forex — though while Jump operates as a trading firm, Bybit built an exchange.

Another curious fact: due to the strong parallels between forex and crypto markets, Jump initially treated crypto as a mere experimental playground — a kind of toy market — where interns could freely test ideas, while keeping this segment isolated from core operations.

But as Bitcoin surged and the crypto market exploded, this "toy" quietly changed everything.

II. Jump Crypto — The First-Generation Wall Street Crypto Syndicate

This year, a highly discussed post on Xiaohongshu revealed that a Chinese student interning at a U.S. quant firm earned a daily salary of $7,500 — shocking many readers. Yes, per day!

And this wasn’t even the highest-paid intern — some from NYU and other top schools reportedly earned millions cumulatively. The firm? Jump Crypto.

Even more striking: when Jump Trading launched Jump Crypto in 2021, its new president, Kariya, was just a 25-year-old Indian-American who had been an intern at Jump only months earlier.

Kariya gained recognition during negotiations with Terra (UST), proposing a bailout strategy that ultimately earned Jump $1 billion. He was promoted to president shortly thereafter.

After its founding, Jump Crypto established three core divisions: trading/market making, investments, and development — each profoundly shaping the crypto industry. Some describe it as: a Chicago-style HFT firm, a venture capital fund, and a software studio rolled into one.

In trading and market making, Jump Crypto was among the largest liquidity providers on major crypto exchanges during the last cycle.

Its active market-making capabilities were unquestionably top-tier. It openly or covertly manipulated tokens like LUNA and SOL, leveraging elite-level market cap management to generate massive profits alongside projects. Using substantial capital, it absorbed circulating supply of altcoins, pumped prices, and captured gains via derivatives — or directly traded major coins based on discretionary calls, generating huge returns.

Jump Crypto was also a primary source of on-chain liquidity. Beyond supplying nearly $1 billion in liquidity to the algorithmic stablecoin UST, it deployed significant capital into DeFi mining and TVL farming, becoming one of the largest whales and greatly expanding its industry influence.

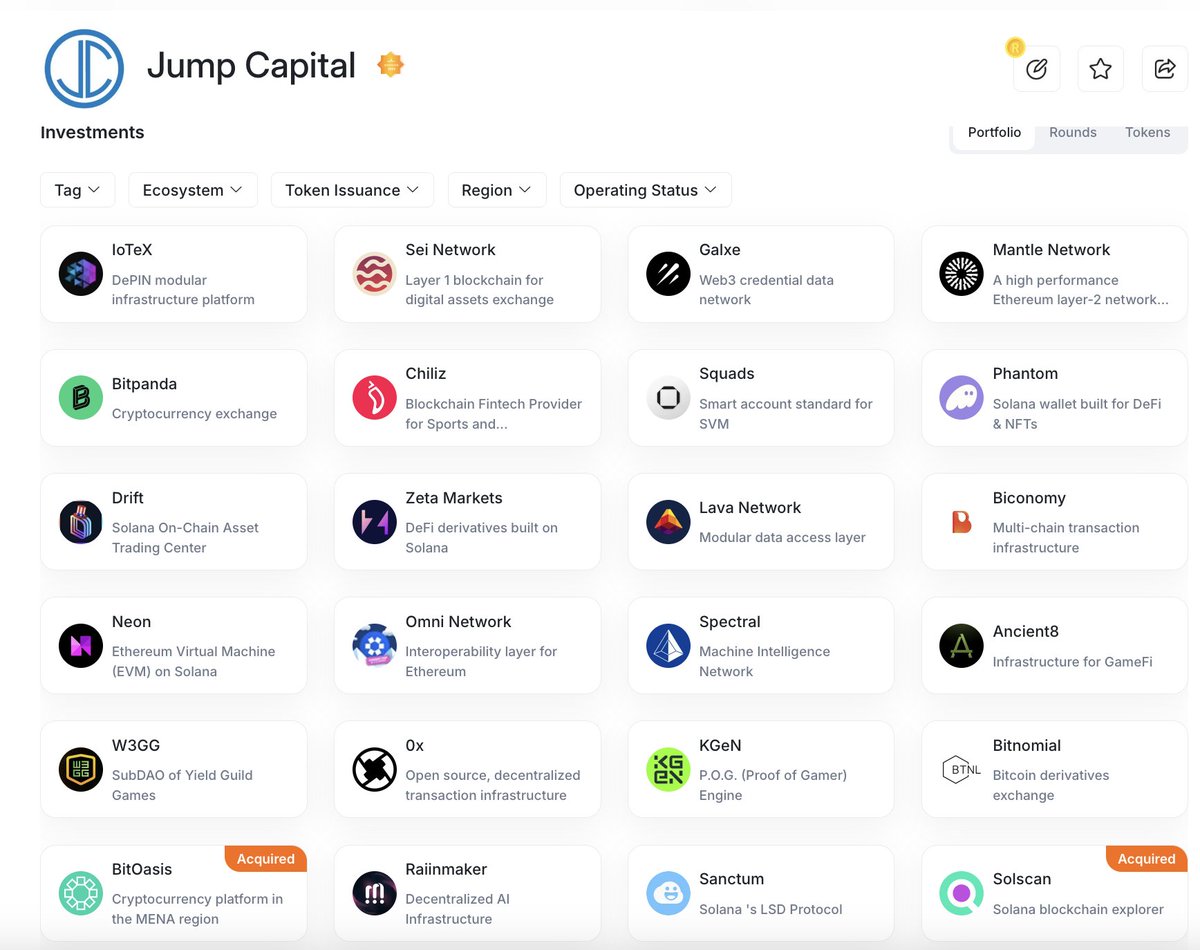

In investments, Jump Capital directly backed hundreds of projects in tech, AI, and blockchain, with over 40% in blockchain. Notable portfolio companies include Phantom (Solana’s largest wallet), ConsenSys (leading blockchain software firm), Bitgo (institutional digital asset custodian), and TradingView (price charting and analysis platform).

In technical development, Jump Crypto applied its trading mindset internally, building projects like Firedancer — Solana’s next-generation client — as well as Pyth (oracle network) and Wormhole (cross-chain bridge).

In essence, Jump Crypto touched nearly every aspect of the ecosystem — investment, trading/market making, and project development. The only thing it didn’t do was launch its own exchange. When it comes to trading-related activities, it did it all.

With its Wall Street-style, system-level manipulation tactics, combined with powerful capital operations and superior trading capabilities during the last cycle, it opened terrifyingly diverse revenue streams — earning it the title of the first-generation Wall Street crypto syndicate.

III. From Transaction-Driven Builder to Core Driver of On-Chain Infrastructure

On May 22 this year, at the Solana Accelerate 2025 event in New York, the chief scientist from Jump Crypto’s Firedancer Studio delivered a talk titled “Increase Bandwidth, Reduce Latency.”

Supporters believe that Firedancer — developed by Jump over many years — will give Solana an unbeatable edge in the race to attract global financial markets onto blockchains. Its theoretical throughput? One million transactions per second — orders of magnitude faster than any current blockchain system.

Yet, so far, only partial features have launched, and the final release date remains unconfirmed. Currently, only a small number of validators are running early versions.

Still, this highlights a critical realization: Jump is aggressively building infrastructure around crypto trading.

After Jump Crypto faced regulatory scrutiny in 2022, Kariya — the former intern turned president — soon left the company. Jump Crypto gradually exited most of its crypto market-making operations.

Since then, the market-making landscape has stabilized into a triopoly led by GSR, Wintermute, and Flow Traders, with other notable players like DWF and Presto Labs holding significant shares.

Though there have been ongoing rumors that Jump Crypto is fully reviving its crypto business, little concrete action has followed. Reclaiming its former market share in crypto market making will likely require intense competition.

Hence, Jump Crypto has chosen to re-enter the scene not as a market maker, but as a core driver of on-chain infrastructure.

This aligns with Jump’s long-standing philosophy: use trading to identify problems, then engineer solutions. As Jump Crypto declares: “Now is the perfect time to build a new financial rail and a new layer of organizational coordination.”

These initiatives stem from real-world limitations and challenges encountered in on-chain trading or development. Instead of accepting these constraints, Jump acts on its motivation and conviction to overcome them.

Beyond developing foundational tools like Firedancer, Pyth, and Wormhole, Jump has also expanded into security infrastructure. This includes Cordial Systems, an in-house self-custody wallet operations platform providing enterprise-grade digital asset wallet solutions for Jump and several centralized exchanges. Its internal security team, Asymmetric Research, has helped mitigate over $5 billion in potential losses and responded to more than 100 security incidents.

Notably, Jump Crypto has also unusually disclosed its progress in U.S. crypto policy advocacy, aiming to rebuild market trust in the new cycle through technological innovation and cooperation with regulators.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News