After Project Crypto, from stocks on-chain to everything on-chain?

TechFlow Selected TechFlow Selected

After Project Crypto, from stocks on-chain to everything on-chain?

Overnight, users in the crypto industry suddenly found they could use their stablecoins to purchase on-chain stocks of Nvidia and Tesla, as if tumbling down a rabbit hole into a wondrous alternate world.

1. Introduction

On July 31, Paul S. Atkins, Chairman of the U.S. Securities and Exchange Commission (SEC), delivered a speech in Washington, D.C., titled "U.S. Leadership in the Digital Finance Revolution," unveiling a plan called "Project Crypto"—a reform initiative aimed at bringing U.S. financial markets fully on-chain.

Atkins stated he would consider regulatory exemptions for tokenized securities issued within the United States where appropriate, ensuring American investors aren't excluded. He added that broker-dealers with Alternative Trading Systems (ATS) should be allowed to offer non-security crypto assets, crypto asset securities, traditional securities, and other services on their platforms, enabling market participants to build "Super-Apps." To support on-chain trading of tokenized securities, he suggested that "Reg NMS may need to be revised and its distortions in today’s market corrected."

This podcast episode was actually recorded before Atkins’ speech. Yet even without the formal launch of this plan, the onboarding of U.S. capital markets onto blockchain—epitomized by U.S. equities going on-chain—has already been gaining momentum. From Dinari to xStocks, from Gemini to Robinhood, overnight, crypto users suddenly found they could use stablecoins to buy on-chain versions of Nvidia and Tesla stocks, as if tumbling down the rabbit hole into a wondrous new world.

"In perhaps three to five years, traditional stock exchanges and crypto exchanges may become direct competitors—Nasdaq vs. Binance, HKEX vs. Coinbase." "The significance of on-chain U.S. equities may not just be an alternative channel, but potentially a true financial infrastructure." "Whether brokers, asset managers, or exchanges, users fundamentally rely on trust and local experience. The market is unlikely to consolidate into one dominant super-platform; there will always be second, third, and fourth players capturing their own share and thriving."

These insightful perspectives come from three guests on the sixth episode of Zhiwubuyan: experts from frontier tech investing, internet brokerage, and on-chain stock startups. Now, let's dive in together and explore the vast frontier of everything going on-chain.

Guest Didier/Zheng Di

Frontier tech investor, runs the knowledge community "Dots Institutional Investor Community" on Zhishanzhuan

Guest Sherry Zhu

Global Head of Digital Assets at Futu Group, formerly spent over five years at the Hong Kong Securities and Futures Commission (SFC), overseeing crypto policy and licensing

Guest Zixi Zhu

Founder of Stable Stocks, an on-chain stocks project, former employee at Matrix Partners and co-founder of 10K Ventures, X: Zixi.sol

Host Hazel Hu

Host of the podcast "Zhiwubuyan", over six years of experience as a financial journalist, core contributor at the Chinese Public Goods Fund (GCC), focused on real-world applications of crypto. X: 0xHY2049; Jike: Yiyue the Unbothered

Host Ivy Zeng

Host of the podcast "Zhiwubuyan", previously worked in VC post-investment, discovered passion for payments through pop-up city, currently leads growth at a neobank. X: IvyLeanIn; Jike: Spoon in the Cup; Xlog: ivyheretochill

Sponsor

This episode is sponsored by Cobo, the largest digital asset custody and wallet solutions provider in the Asia-Pacific region.

Facing the new wave of global payments, Cobo empowers enterprises to build cryptocurrency payment acceptance capabilities, offering full-stack payment solutions covering underlying wallets, risk control, and compliance.

Visit https://www.cobo.com/ for more information or click “Read More” to schedule a demo.

2. User Demand and Profiles for On-Chain Stock Trading

Ivy: Before diving in, let’s do a quick poll: Do our guests currently have U.S. stock accounts? Which app do you use? And are you considering investing in on-chain U.S. stocks?

Sherry: I'm a heavy user of Futu. I initially chose Futu because of its excellent product experience, and later joined the company precisely because I was impressed by its product strength. I’ve always been very interested in innovative products like on-chain U.S. equities.

Currently, most tokenized U.S. stocks offered are derivative-based, better aligned with the habits of native crypto users rather than traditional U.S. equity investors who care about voting rights and dividends. However, these on-chain derivatives do open up broader application scenarios—for example, serving as base-layer assets in DeFi Lego stacks. As long as such products solve real user pain points, I believe the market will respond positively.

Zheng Di: I used IB (Interactive Brokers) primarily at first, but recently started using Moomoo, Futu’s international version. Chinese firms tend to design interfaces more suited to Chinese users’ preferences.

I think internet brokers are truly benefiting from this market cycle. In contrast, traditional centralized exchanges (CEX) face greater challenges, as most crypto speculation has led to severe losses, while U.S. stock investors have generally profited handsomely—so much so that many CEXs have started operating Xiaohongshu accounts to drive traffic.

Ivy: Then Mr. Di, would you consider trading on-chain U.S. stocks now or in the future?

Zheng Di: It’s definitely possible. On-chain trading is relatively more convenient.

First, money in crypto circles and funds in traditional brokerage accounts operate in two separate systems that rarely interconnect—you’re essentially fighting on two fronts. The friction in depositing and withdrawing funds is significant, especially with fiat currencies. Even in places like Singapore or the U.S., where on/off-ramping is relatively easier, costs remain high.

For instance, OTC (over-the-counter) deposits incur fees of several basis points; using licensed exchanges like Coinbase in Singapore adds about 1% in transaction fees and 9% consumption tax. When the bill arrives, you might just faint.

So most people prefer to keep these two pools of funds separate and avoid frequent cross-system transfers. If on-chain platforms can provide sufficiently deep liquidity for U.S. stock trading, it would certainly be worth considering.

Zixi: I mainly use Tiger Brokers because when I was studying, Futu hadn’t yet launched services in Singapore, while Tiger supports PayNow deposits, which is very convenient. I also tried RockFlow before, but its deposit and withdrawal speeds were too slow.

Ivy: Today we're discussing on-chain U.S. stocks—the key question is, who really needs this product? Zixi, before deciding to enter this space and start your venture, you must have conducted far more market research than we have. Could you share your insights?

Zixi: Of course. I categorize users of on-chain U.S. stocks into three groups:

-

Newbie Users: These users are mainly located in countries with strict foreign exchange controls, such as China, Indonesia, Vietnam, the Philippines, and Nigeria. They hold stablecoins but face various restrictions preventing them from opening overseas bank accounts and buying traditional U.S. stocks. On-chain U.S. stocks bypass complex KYC and on/off-ramp processes, allowing them easy access to U.S. equities.

-

Professional Users (Pro): They hold both stablecoins and overseas bank accounts, possibly with accounts at Futu or Tiger. But their pain point lies in the low leverage offered by traditional brokers—for example, Tiger only offers 2.5x leverage. On-chain, however, high leverage can be achieved via higher LTV (loan-to-value) ratios—e.g., 90% LTV enables 9x leverage.

-

High-Net-Worth Users (Pro Max): These individuals hold long-term U.S. stock assets and earn interest, dividends, or gains from price appreciation through margin financing in traditional brokerage accounts. With us, we tokenize their stocks—e.g., into sTSLA, sNVDA (stablecoin-backed Tesla or Nvidia)—and then these tokens can be used as LP positions, collateral for lending, or even cross-chain operations.

Hazel: Thank you, Zixi. Sherry, being closest to traditional stock investors, from the perspective of internet brokers, what user demands cannot be met by off-chain solutions?

Sherry: Here are some common pain points:

-

Low capital efficiency: Traditional securities transactions follow T+1 or longer settlement cycles, slowing down capital turnover—especially across markets, where fund transfers take even longer.

-

Trading hour limitations: U.S. markets open at night, making it exhausting for Asian users to monitor. Many desire 24/7 trading windows.

-

High investment thresholds: High-priced stocks like Tesla and Nvidia are inaccessible to users seeking small-scale, regular investments.

On-chain stocks open up possibilities such as real-time settlement, fractional investing, 24x7 trading, and on-chain collateralized lending—scenarios difficult for traditional finance to cover.

Of course, Futu is also innovating to address these issues:

-

Launched a unified purchasing power mechanism, calculating users' total cash, securities, and money market fund assets across multiple markets in real time for cross-market trading;

-

Introduced night trading, nearly achieving 5x24 coverage;

-

Offered Fractional Shares (micro-investing), allowing purchases of Tesla stock starting at $5.

However, I must emphasize that despite continuous innovation, our foundation remains centralized architecture. The emergence of blockchain could indeed bring deeper structural changes, potentially reshaping the entire financial infrastructure.

3. Long-Term Trends in Tokenizing Stocks

Hazel: Mr. Di, earlier we heard some data—for example, XStocks has a total market cap of about $30 million, with daily trading volume growing by tens of millions. As a researcher and investor, how do you interpret these on-chain U.S. stock figures?

Zheng Di: Currently, activity in on-chain U.S. stocks is concentrated on a few centralized exchanges like Gate and Jubi, which together account for 70%-80% of trading volume.

Conversely, products partnered with Kraken haven’t performed notably on-chain, despite extensive official announcements—such as holding licenses through subsidiaries in Bermuda. Overall trading volumes remain low.

From a compliance standpoint, if we rank them, Robinhood is the most compliant, Dinari is mid-tier, and Kraken adopts a more aggressive approach.

An important regulatory development: SEC Commissioner Hester Peirce recently stated that if retail investors are to be granted access to stock token trading, it must occur on platforms holding national securities exchange licenses—meaning only NYSE or Nasdaq-like entities. Otherwise, access must be limited to qualified investors. This statement could significantly impact projects like Dinari and Coinbase.

In the long run, I believe the convergence of stocks and crypto is inevitable. Within perhaps three to five years, traditional stock exchanges and crypto exchanges may become direct competitors—Nasdaq vs. Binance, HKEX vs. Coinbase.

At that point, traditional exchanges may move their trading infrastructures on-chain, drastically reducing back-end settlement costs.

Then we must ask: Will on-chain roles serve as front-end tools directly facing users, or become backend infrastructure for brokers and exchanges? Both are possible.

One scenario: Retail users trade directly via on-chain products. Another: Users still place orders through familiar apps, brokers, or front-end operating systems, but the entire underlying trading logic runs on-chain. This trend is irreversible.

Take Robinhood, for example. While it currently uses Contracts for Difference (CFDs) to "lightweight and quickly deploy compliant" stock token trading, its business model naturally favors on-chain structures. Therefore, I believe Robinhood’s first phase is CFDs, and its second phase will inevitably transition to full on-chain trading.

Currently, trading of on-chain stock tokens mostly occurs within centralized exchanges (CEX), with fully on-chain scenarios still rare. Yet another possibility exists: users interact with CEX or broker front-ends, but the backend trading and settlement infrastructure already operates on-chain. This "superficially centralized, fundamentally on-chain" model may represent the best compromise—aligned with current user habits while embracing new technological architectures.

In the short term, on-chain barriers remain high; novice users are unlikely to directly interact with blockchains. Perhaps when AI agents mature and security improves, users could autonomously trade on-chain assets via AI—but that’s still years away. Until then, enabling indirect access to on-chain assets through user-friendly CEX or broker platforms may dominate. We’re still in an early stage, but this path is certain and holds explosive potential.

4. Acquiring Users for On-Chain U.S. Stocks: A Web2-Web3 Marketing Hybrid?

Hazel: One follow-up on user demand—how do you attract these users? Since on-chain U.S. stocks inherently span Web2 and Web3, does marketing become a kind of "Frankenstein"? Zixi, as a startup, how do you approach your GTM (go-to-market) strategy?

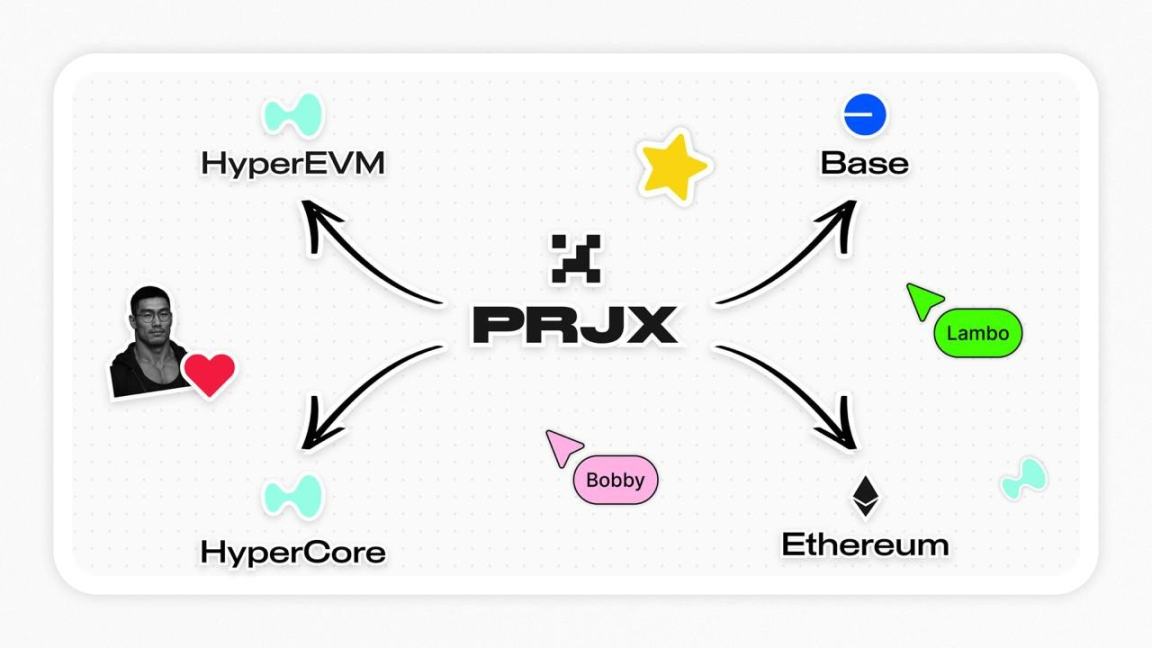

Zixi: Our product functions as a broker from day one. Retail users send USDT to our wallet address; when placing an order, we transfer funds via Coinbase to a U.S. bank account, then into Nasdaq to execute trades. After execution, based on confirmation from the broker, we mint a 1:1 backed stock token on-chain for the user. Throughout this process, information flow and asset flow are separated—we rely on information flow to ensure trustworthy on-chain mapping.

Our user acquisition strategy operates on two levels:

-

On-chain level: We have a product called vote, where users stake tokens like sTSLA and sNVDA. We then allocate these tokens to various DeFi protocols—lending, DEX market-making, etc. We share profits with market makers and return most (80–90%) to users.

-

Operational level: We rely heavily on Web3-native tactics such as trading mining and liquidity mining. These growth mechanisms resonate deeply with crypto-native users.

Sherry: I think the two directions Zixi mentioned are excellent. Let me add a third: institutional arbitrage demand.

Market makers and quant funds also show interest in on-chain U.S. stocks and can participate via arbitrage mechanisms. However, institutions are more sensitive to regulatory frameworks and must meet internal compliance requirements to join.

Thus, I see the growth trajectory as follows:

-

Initially relying on Web3-native ecosystems to bootstrap users and attract capital flows through on-chain mechanics;

-

Mid-term rapid product iteration in regulatory gray zones;

-

Long-term maturation leading to a Matthew effect, redefining capital flow paradigms.

You could argue there’s an element of “regulatory arbitrage” here, but it may ultimately force reforms—just as USDT’s early wild growth eventually drove regulatory and financial structural changes. The significance of on-chain U.S. stocks may go beyond being just an “alternative channel”—it could become genuine financial infrastructure.

5. Global Expansion of Chinese-Focused Enterprises

Ivy: Zixi, when we spoke about this direction a month ago, on-chain U.S. stocks were just emerging. But in the past fortnight, everyone suddenly “woke up”—internet brokers launching new features, exchanges rushing in, market热度 rising rapidly. As a professional startup, how do you view competition? What differentiation opportunities exist?

Zixi: Players in on-chain U.S. stocks can be roughly divided into three categories:

-

U.S.-based projects like Dinari and Robinhood. Dinari has stronger compliance foundations, focusing on the domestic U.S. market; Robinhood, constrained by compliance, is currently piloting only in Europe, with weak presence in APAC.

-

European projects like Backed Finance. They typically partner with exchanges, following a B2B2C model, focusing on Europe. Their reach to Asian, particularly APAC, retail users remains distant.

-

Chinese-speaking startup teams like ours, who from the outset understand APAC, Southeast Asia, and the Middle East. Many of our team members have lived or worked in these regions, giving us natural insight into local users, languages, cultures, and compliance paths.

Frankly, entering U.S. or European markets isn’t easy for us either. But our deep familiarity with local markets gives us a strong edge in institutional onboarding and retail communication. For example, many users ask: You’re targeting Chinese users—why use Futu or Tiger instead of Interactive Brokers? These local brands serve as trust anchors.

You’ll find that whether brokers, asset managers, or exchanges, users fundamentally rely on “trust + local experience.” The market is unlikely to form a single “unified super-platform”; there will always be second, third, and fourth players capturing their share and thriving.

Ivy: So it sounds like the on-chain U.S. stock market remains competitively fragmented, with each player having unique advantages. Sherry, could you share Futu’s global expansion strategy? Specifically in Web3, what capabilities does Futu currently have?

Sherry: Sure. Futu has made significant efforts in globalization in recent years. Outside Hong Kong, we operate under the “moomoo” brand. Since entering the U.S. market in 2018, we’ve expanded into Singapore, Australia, Japan, Canada, and Malaysia, and recently entered New Zealand via an Australian license. Globally, we now have over 26 million registered users, client assets in the hundreds of billions, and annual trading volume nearing $1 trillion.

In Web3, we’ve been early movers, focusing on several areas:

-

Hong Kong: Since August 2023, Futu has supported trading of major cryptocurrencies (e.g., BTC, ETH). This year, we launched deposit/withdrawal functionality, allowing users to instantly convert crypto in their wallets to fiat for investing in traditional assets like Hong Kong or U.S. stocks, or withdraw to banks. This greatly solves the problems crypto users face with “difficult withdrawals, high fees, and non-compliant channels.”

-

Additionally, Futu established a licensed exchange in Hong Kong called "Cheetah Trading", which received the SFC’s Virtual Asset Trading Platform (VATP) license in January and is now undergoing follow-up regulatory assessments.

-

Singapore: moomoo became the first local digital broker to obtain the Monetary Authority of Singapore’s digital asset trading license. We launched crypto trading in July last year and will roll out deposit/withdrawal services this year, with plans to support more tokens.

-

United States: Already holds MTL licenses or exemptions in over 40 states, offering trading in over 30 major cryptocurrencies.

Going forward, we aim to expand Web3 services into all countries where our securities business operates, realizing our vision of “one app, one account, invest in global assets” within a compliant framework.

Hazel: Recently, some Hong Kong-listed virtual asset概念股 surged. How do you view this market enthusiasm?

Sherry: Indeed, this reflects market optimism toward traditional financial institutions entering Web3—a classic bull market signal. But we should stay cautious:

Some brokers have merely upgraded from Type 1 licenses, essentially still acting as brokers offering virtual asset services through integrated accounts. There are already 43 institutions in Hong Kong with such qualifications, per SFC disclosures. Under this model, brokers must be tied to licensed virtual asset exchanges, limiting their service scope and tradable tokens to those offered by upstream exchanges.

Futu holds both Type 1 and exchange licenses, aiming to build an “integrated upstream-downstream” ecosystem, creating synergies in stablecoin applications and asset issuance.

But remember: licenses are entry tickets, not guarantees of success. Long-term competitiveness will belong to platforms that organically integrate both worlds, leverage strong customer bases to create ecosystem effects, and sustain innovation.

Hazel: Zixi, what compliance licenses are involved in your operations at Stable Stocks? What’s your strategy?

Zixi: Our team doesn’t directly hold licenses yet, but we collaborate with partners through license authorization, split into two parts:

1) Broker-Dealer Licenses

This area is highly scrutinized by the SEC. Our off-chain execution involves real stock trades—classified as tokenized securities—so we must operate under licensed institutions. Licenses we use include:

-

Hong Kong Type 1 license;

-

U.S. Broker-Dealer license;

-

Australia’s AFSL (Australian Financial Services License), among others.

These are held by our partners, who allow us to operate jointly within compliance frameworks.

2) MSB-Class Payment Service Licenses

Because we handle the flow of USDT or fiat from Coinbase into banking systems and then to exchange bank accounts—touching compliant on/off-ramps—we also require:

-

U.S. Money Service Business (MSB) licenses;

-

Similar payment licenses in other jurisdictions to legally justify user fund sources and destinations.

Additionally, if we launch asset management products in Hong Kong, we may apply for a Type 9 license; for expansion into Dubai or Abu Dhabi, we’d seek VARA, ADGM, or similar virtual asset operation licenses.

6. Robinhood and the Ambitions of U.S. Brokerages

Hazel: We’ve discussed Chinese brokers and crypto-native startups, but another critical player is U.S.-based internet brokers themselves. Robinhood stands out as a prime example. Mr. Di, I know you’re deeply familiar with Robinhood’s business model and history. Could you break down its development path, revenue structure, and why it ventured into on-chain U.S. stocks or CFDs?

Zheng Di: Robinhood is a highly “divided” company. On one hand, its zero-commission model and young user base evoke “envy”; on the other, many view its model as somewhat “harvesting韭菜.” It differs sharply from traditional internet brokers like Interactive Brokers (IBKR).

IBKR’s revenue structure is relatively stable, primarily from:

-

Interest income (including interest on idle customer cash and securities lending), accounting for 60–70%;

-

The remaining 30–40% comes from trading commissions and fees.

In contrast, Robinhood’s revenue mainly stems from:

-

Payment for Order Flow (PFOF);

-

And a portion of interest income (they’re actively increasing this ratio, e.g., boosting Gold membership penetration to 12.3%).

Yet Robinhood cannot fully abandon PFOF because its users differ fundamentally from IBKR’s:

-

IBKR serves institutions and high-net-worth investors who are price-sensitive and highly attentive to fee structures;

-

Robinhood targets younger, volatility-seeking retail investors who are less price-sensitive but value “ease of use” and “thrill.”

This determines Robinhood’s PFOF revenue model—you’re unknowingly “charged,” but you don’t realize it.

Zheng Di: Let’s illustrate with data: When Robinhood executes stock trades, market makers like Citadel Securities rebate it 0.8 basis points (0.008%); for options, the rebate jumps to 8 basis points—ten times higher.

For crypto trades, rebates from former partners like Binance.US, C2, Jump reached about 35 basis points—45 times that of stocks, 4.5 times that of options.

That’s not all. Robinhood also earns from smart routing premiums and slippage—adding another 20 basis points. So each crypto trade nets Robinhood roughly 55 basis points—already half of Coinbase’s retail trading fees. Yet users perceive Coinbase as expensive due to explicit fees, while Robinhood, as a broker rather than an exchange, hides its charges.

This explains why Florida’s Attorney General investigated Robinhood a few years ago, suspecting false advertising. Claiming “zero-commission trading” while charging via PFOF and hidden slippage raises concerns.

Recently, I discussed with some institutions: Why would European users choose Robinhood for CFD-based U.S. stock trading instead of local brokers?

I replied simply: Because Robinhood claims zero commissions. Europe lacks such aggressively priced zero-commission brokers. Robinhood’s only visible cost is a 1‰ EUR/USD exchange fee; everything else appears free. But through methods like quoting Tesla shares at $200.05 or $201 when the spot is $200, they quietly pocket extra dollars—users hardly notice. Thus, Robinhood’s “zero-commission” model carries substantial hidden costs.

Hence, Robinhood’s profits stem from self-quoting and hidden fees. Consequently, its business model relies heavily on user traits—young, risk-tolerant, financially unsophisticated. Naturally, this benefits Robinhood’s shareholders.

Hazel: Could you further explain? Many listeners may not grasp Robinhood’s CFD model. Can you simplify what CFDs are and how they track underlying stock prices?

Zheng Di: Sure. Think of a CFD as a perpetual contract with 1x leverage, settled in cash—your position persists until closed.

But it’s essentially an “air contract”—you can’t withdraw it, nor receive actual stock delivery. Its viability depends on an “anchor”—the real stock price.

Anchor prices are obtained in two ways:

-

Arbitrageurs eliminate price differences, but this causes impermanent loss—a flaw in many DeFi models;

-

Oracle-fed pricing—this fueled Chainlink’s rise during the last bull market.

But Robinhood clearly doesn’t want arbitrageurs taking profits. Its market is closed-loop—self-quoting suffices. I saw in Backed Finance’s documentation that they use oracles once every 24 hours, mostly relying on proprietary oracles, with emergency oracle intervention triggered when spreads exceed 10%. To prevent arbitrage, they impose redemption caps—for top-tier institutional investors, monthly subscription/redemption totals are capped at 30 million Swiss francs.

Likely, Robinhood employs a similar mechanism. When prices deviate significantly, custom oracles trigger adjustments—but Robinhood sets these prices, effectively “calling the shots.”

Thus, their zero-commission model profits from spreads and slippage—entirely invisible to users.

Moreover, unlike Dinari or xtock’s 1:1 asset mapping, Robinhood’s CFDs are legal, compliant securities derivatives. Compliance-wise, they stand firm—no issues of asset custodianship. Recall the GME incident, when Robinhood faced a $3.7 billion funding gap, nearly collapsing. Later, U.S. Congress and SEC departments probed Robinhood. Since then, Robinhood has remained under intense scrutiny.

For example, Robinhood holding actual stocks in the U.S. isn’t to collateralize CFDs, but to hedge its short positions—since CFDs amount to bets between Robinhood (short) and clients (long). Hence, holding real stocks hedges that risk. This entire design—compliance, risk control, profit structure—is remarkably clear. Arguably, this model is “cleaner” than on-chain token mapping. Still, I believe Robinhood will eventually move on-chain—on-chain products yield far higher rebates and profit margins.

7. Examining the Impact of Tokenizing Stocks on Revenue Sharing

Ivy: Earlier, Mr. Di explained how Robinhood achieves on-chain U.S. stocks and tracks prices. Zixi, could you explain how Stable Stocks handles price feeds? Who are the stakeholders involved? How do you manage prices during weekends or market closures? And what happens when on-chain prices diverge from real stocks?

Zixi: As mentioned, briefly: Users can buy U.S. stocks through our broker. The moment a user purchases a U.S. stock on-chain, we simultaneously buy the real stock off-chain via partner brokers and mint a corresponding 1:1 backed token.

Many ask: Don’t you need oracles to sync prices? In our model, on-chain trading prices are essentially broker prices. User trades directly reflect real-market prices—no de-pegging risk. Significant spreads are theoretically impossible.

Of course, not everyone can engage in arbitrage (e.g., cross-market or scalping). But if we connect more broker APIs in the future—enabling accounts at Futu, Tiger, and night trading—the spread will narrow further.

Weekends and holidays pose special challenges. Off-chain markets close, but on-chain markets remain open.

Our current idea is to calculate a reference price using a weighted formula, such as:

Friday closing price × α + on-chain average trading price × β

We’re refining this model with our team to ensure it’s reasonable and reflects market expectations.

Ivy: You mentioned this differs from older models like Mirror Protocol. Could you elaborate on the differences?

Zixi: Yes. I’ve used both Mirror Protocol and Synthetix. Their core issue: low liquidity efficiency. Synthetix requires 80% over-collateralization—depositing 100 USDT may only mint synthetic assets worth 20. Capital efficiency is extremely low.

We, however, achieve full 1:1 mapping of real off-chain stock purchases. Once bought off-chain, we mint the corresponding token. Like stablecoins, this ensures higher liquidity efficiency. We aim to let on-chain users access quality assets, achieving true “financial inclusion.”

Hazel: Specifically, how does Stable Stocks make money? How is revenue shared among stakeholders like brokers, blockchains, and exchanges?

Zixi: Our revenue model currently has three components:

1) Broker Transaction Fees

We operate as a proprietary broker, similar to Futu. Without using PFOF (payment for order flow), we must charge “full fees”—standard trading commissions. Since we don’t profit from selling order flow, our fees are slightly higher than Robinhood’s or Futu’s.

Additionally, we act as an OTC service provider. Holding an MSB license allows us to legally offer OTC trading, not sourcing liquidity from black markets. Volumes are still low, so VIP users pay lower rates, while regular users pay more.

We also charge on-chain transaction fees, expected between 0.05% and 0.1% (not finalized). Overall, average platform fees hover around 0.4%.

2) On-Chain Business Model: Market Making and Liquidity Provision

On-chain, our primary revenue comes from market making and liquidity provision. We’re building a MakerDAO-like Make Liquidity Pool—users delegate assets to us, and we distribute liquidity to professional market makers, DEXs, and lending protocols.

It mirrors Lido’s staking model for Ethereum:

-

Ordinary users can’t become nodes or traders themselves;

-

So they entrust assets to us;

-

We centrally allocate liquidity, hedge risks, and capture protocol subsidies.

Users receive yield receipts. We split their stocks across different strategies for liquidity deployment—this yield becomes another revenue stream for our platform.

3) Off-Chain Collaboration and Lending Business

Future revenues will also come from physical stock lending. This stems from collaborations with brokers—e.g., offering stock pledge and wealth management services to clients.

Ivy: Let’s revisit this question with Mr. Di. How do you see tokenizing stocks impacting broker revenue models? What new revenue-sharing structures might emerge among brokers, issuers, and public chain exchanges?

Zheng Di: Excellent question—best viewed from two angles: legal definition and business model.

Legally, no matter how you put it on-chain, it’s still a security. Even if only economic rights are transferred, excluding full shareholder rights, it’s still classified as a security—and regulated accordingly.

But from a business model perspective, whose rebate does on-chain stock trading belong to? Is it calculated at traditional stock rates (0.8 BP) or DEX-level rates (35 BP)? That depends on the on-chain matching party’s ability to control slippage and profit margins.

Today, numerous on-chain tools can prevent “slippage” and “front-running,” but front-end novice users struggle to perceive these actions. Even if back-end costs drop significantly, front-end pricing may not decrease proportionally.

Consider payments: Stripe acquired Bridge, a stablecoin payment provider. Bridge charges B2B clients 1.2‰ to 2.5‰, while Stripe’s traditional card network fees are 2.8%–3%. Post-acquisition, Stripe repackaged stablecoin services as a new product, pricing it at 1.5%.

This seems like a “price cut,” but actual costs are just 0.12‰ to 0.25‰. Even adding fiat on/off-ramp and OTC costs, it won’t exceed 0.8‰. Stripe still profits handsomely—“prices just didn’t drop much.”

Same logic applies to Robinhood. If stocks go fully on-chain, they may abandon low-margin off-chain rebates, leveraging ultra-low on-chain transaction costs to reduce expenses while maintaining “reasonable” front-end pricing—charging 5 or 10 BP, vastly exceeding current levels.

Even if on-chain rebates are only 8 BP, that’s ten times the off-chain 0.8 BP. Robinhood will undoubtedly embrace this model—it offers massive revenue upside.

But this hinges on regulatory evolution. If regulation lags, it remains a gray zone—intermediaries can keep exploiting information asymmetry to “harvest” naive users. This may be the future Robinhood hopes for.

Hazel: I recall discussing with GPT earlier—GPT believed regulators would “see through” and regulate PFOF rebates if the substance is securities. But you said GPT was dead wrong. Thoughts?

Zheng Di: I stand by my view: even if regulators act, it’ll be slow. The U.S. hasn’t outright banned market maker rebates—only mandated “transparency.”

Currently, the EU, UK, Canada, Australia, and Singapore have banned this model, but the U.S. hasn’t. Robinhood resembles an investment bank’s sales desk; Citadel resembles its trading desk. Traditional banks coordinate internally—Robinhood and Citadel are just “external partners.” If rebates are banned, Robinhood and Citadel could simply merge into one entity and bypass the rule.

In the real political landscape, Republicans largely ignore this, while Democrats care more. I thought regulatory progress awaited next November’s midterm elections and a Democratic comeback—never expected Florida to investigate so fast.

Still, Florida can’t directly regulate PFOF—it must frame the probe around false advertising: Robinhood claims “zero-commission trading” but extracts substantial revenue via order flow sharing. That’s their only viable angle.

Worth watching whether this spreads nationwide. But overall, I believe an outright ban is nearly impossible. At most, platforms may be required to disclose more information. Currently, rebates for U.S. stocks and options are merely disclosed—not strictly prohibited. With partisan divides, legislative change won’t happen quickly.

7. Reviewing Hong Kong’s Virtual Asset Regulation History

Hazel: Back to Hong Kong—could Sherry explain the regulatory logic behind crypto-related businesses? You spent years at the SFC and participated in licensing—can you walk us through Hong Kong’s licensing philosophy?

Sherry: Hong Kong’s SFC began regulating virtual assets quite early. During the 2017 ICO boom, many countries’ regulators were still debating whether virtual assets were legitimate or worth legislating—some even believed crypto would fade as a passing fad.

But Hong Kong made a judgment: crypto won’t disappear—regulation is unavoidable. The challenge was—how to regulate? Legally, the SFC lacked authority to license such assets. Elsewhere, many used payment licenses to lightly cover anti-money laundering aspects.

Hong Kong differed. The SFC had decades of experience regulating traditional finance and weathered numerous blowups. Thus, in 2018, it introduced a core principle: “Same business, same risk, same regulation.” Meaning: many crypto projects essentially replicate traditional financial activities—if risks are similar, regulatory standards shouldn’t be lowered.

But legislation hadn’t begun, while the industry evolved rapidly. So the SFC developed two practical regulatory strategies—what I call the two “comprehensives.”

The first “comprehensive” refers to depth of regulation. We identified virtual asset trading platforms (crypto exchanges) as the highest-risk segment, especially concerning custody, security, conflicts of interest, and market manipulation. In 2019, without legislative backing, the SFC referenced existing Type 1 (securities trading) and Type 7 (automated trading services) licenses under the Securities and Futures Ordinance to design a voluntary licensing framework.

This framework was highly comprehensive, covering core risk controls in exchange operations—customer asset custody, hot/cold wallet ratios, cybersecurity, AML, market conduct rules, etc. A few firms became the first Sandbox participants.

Only in June 2023 did Hong Kong’s Anti-Money Laundering Ordinance formally take effect, upgrading this framework into a mandatory licensing regime.

I recall frequently sharing our experience with global regulators during those years. Many asked about our technical standards: “Why set hot/cold wallets at 98/2?” “How’s your insurance designed?” Even today, many regulators still reference Hong Kong’s framework.

The second “comprehensive” refers to breadth of extension. Beyond exchange licensing, we extended oversight across the entire virtual asset value chain—covering brokers, asset managers, advisors, and more.

For example:

-

Type 1 licensed brokers can offer virtual asset trading via integrated accounts or act as introducing agents for exchanges.

-

Type 4 advisory firms can provide crypto investment advice.

-

Type 9 asset managers can upgrade their licenses to manage crypto funds if over 10% of their fund’s assets are in crypto.

Ivy: You mentioned exchange-related regulations—but what about “stocks going on-chain”? Are traditional internet brokers or capital market exchanges allowed to do this in Hong Kong? What’s the regulatory process?

Sherry: Hong Kong has a very clear restriction here. Section 19 of Hong Kong’s Securities and Futures Ordinance grants HKEX a statutory monopoly. This means: whether off-chain or on-chain, any trading matching of Hong Kong stocks must be conducted solely by HKEX.

In other words, no other platform may legally operate a Hong Kong stock trading business

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News