With OpenSea dominating the market, what are Looksrare and X2Y2's core competitive advantages?

TechFlow Selected TechFlow Selected

With OpenSea dominating the market, what are Looksrare and X2Y2's core competitive advantages?

From CryptoKitties to today, NFTs have entered a stage of rapid development.

1. Competitive Landscape of NFT Exchanges

(1) Rapidly Growing NFT Market

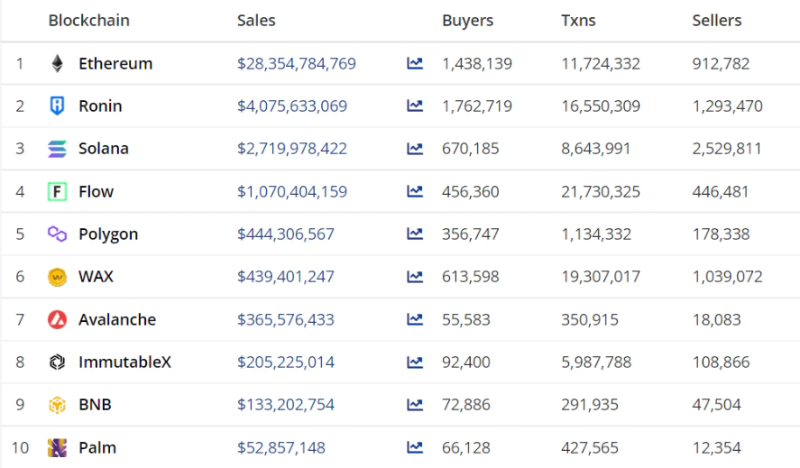

As of June 30, 2022, the cumulative trading volume in the NFT industry has reached $67.818 billion, with over 50,000 NFT traders participating in on-chain transactions daily. The figure $67.818 billion might not seem impressive at first glance—but what if you were told that just a year ago, this number was only $1.3 billion? In just one year, the cumulative trading volume of NFTs has increased nearly 50-fold.

(Data source: cryptoslam.io)

(2) Three Phases of Competition Among NFT Exchanges

In such a rapidly growing ecosystem, participants are fiercely competitive. The current state of competition among NFT exchanges resembles the DEX competition during the DeFi Summer era.

Phase One: Each public chain develops its own NFT marketplace—examples include Opensea on Ethereum, Magic Eden on Solana, and Treasureland on BSC.

Phase Two: Starting from Ethereum, copycat platforms and challengers continuously emerge to compete with market leaders. In DeFi, Sushiswap challenged Uniswap; in NFT exchanges, Looksrare and X2Y2 challenge Opensea.

Phase Three: The dominant product on each chain expands cross-chain. For example, Uniswap expanded to Polygon, and Opensea added compatibility with Solana.

(3) Competitive Landscape on Ethereum

From the data shown in the chart above, it is clear that Ethereum is the primary battlefield for NFT trading, and I believe it will remain the main arena for NFT exchange competition in the near future. Therefore, the following analysis focuses primarily on Ethereum.

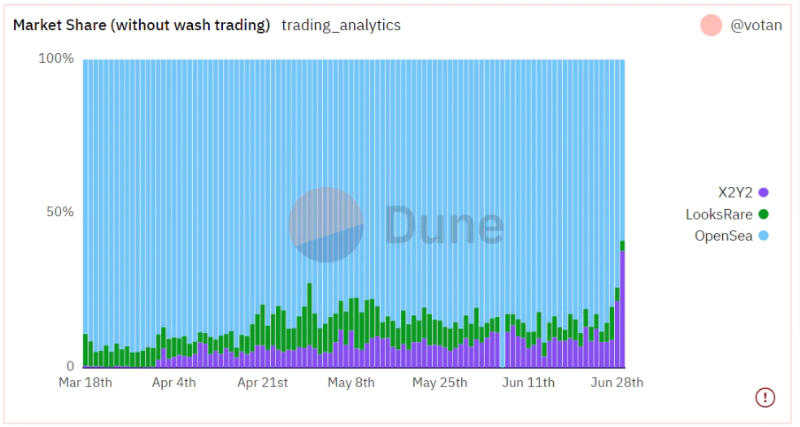

Currently, there are three major NFT exchanges on Ethereum: Opensea, Looksrare, and X2Y2. Over the past month, their average trading volume shares were approximately 85%, 6%, and 9% respectively (after excluding wash trading). In reality, each platform’s share may be slightly lower than these figures because only these three are included in the total here. However, other NFT exchanges on Ethereum have trading volumes far below these three and thus aren't worth discussing. As the chart shows, Looksrare and X2Y2 have indeed captured some market share from Opensea, but overall, Opensea still maintains a dominant position, and its advantage is unlikely to be shaken in the short term.

(Data source: dune.com/votan/X2Y2-NFT-Marketplace)

2. Development Paths in NFT Exchange Competition

Both Looksrare and X2Y2 were launched in early 2022, amid a wave of backlash against Opensea. This backlash began when Opensea raised funds at a $13.3 billion valuation and its CFO suggested plans for an IPO, angering blockchain users who had participated in Opensea trades expecting a token airdrop. Users felt betrayed by Opensea. Following this uproar, projects like OpenDAO, Looksrare, and X2Y2 emerged. Branding themselves as “For the people, by the people,” they attracted users by distributing airdrops to early Opensea users and continued to incentivize participation through staking rewards, transaction mining, listing incentives, etc., eventually capturing a portion of Opensea’s market share.

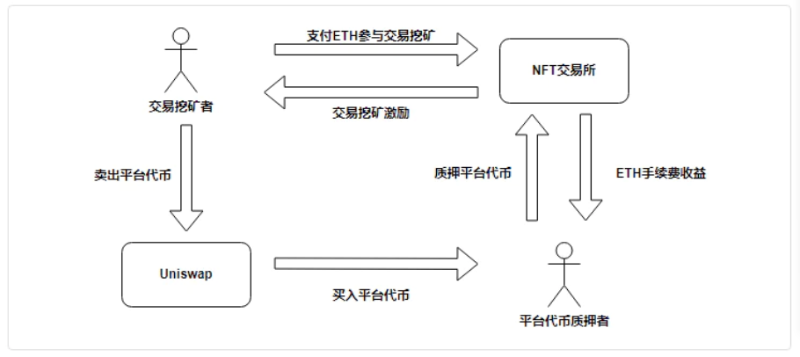

(1) Transaction Mining Incentives

1. Transaction mining is the most direct and effective way to boost platform trading volume

Transaction mining rewards users with platform tokens for trading activity, encouraging them to trade repeatedly to earn more tokens. A user's trading cost consists mainly of two parts: trading fees (platform fee + creator fee) and Gas Fee. As long as the incentive exceeds the cost, arbitrage opportunities exist, prompting traders to engage in wash trading until those opportunities disappear.

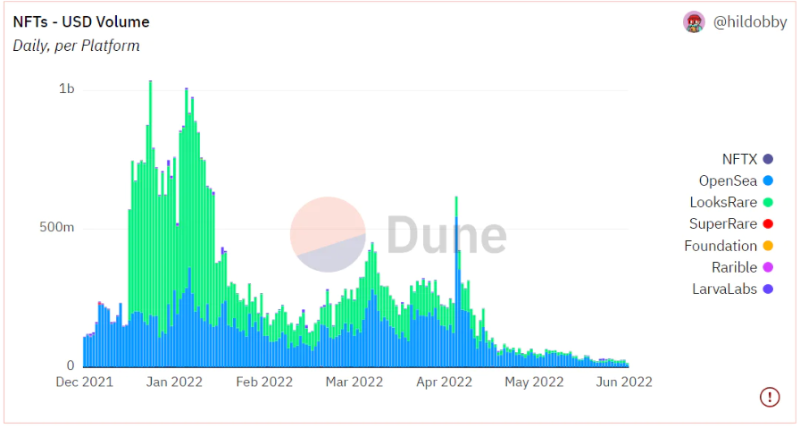

The effect of transaction mining is remarkable. After launching transaction mining in January, Looksrare saw its trading volume skyrocket, briefly surpassing Opensea.

(Data source: dune.com/hildobby/NFTs)

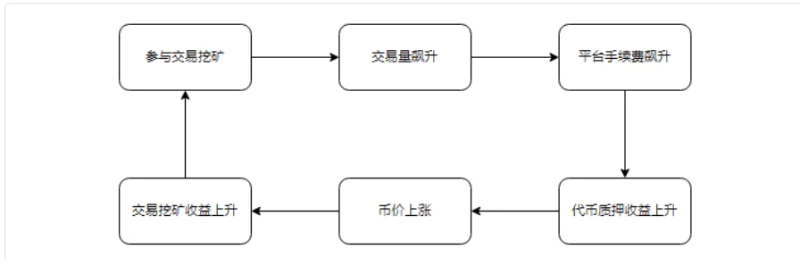

Transaction mining can easily create a positive feedback loop in the initial phase: after launch, trading volume rises sharply, leading to higher platform fees, which are fully captured by token stakers, increasing staking returns and driving up token prices. Higher token prices increase the value of mining incentives, attracting more arbitrageurs to generate even more volume—creating a virtuous cycle. Of course, the reverse leads to a death spiral. After April, Looksrare's market share declined significantly. Aside from macro factors, a key reason was the halving of its transaction mining rewards, causing both trading volume and token price to plummet—a classic "double whammy."

X2Y2 clearly recognized transaction mining as a crucial tool for boosting trading volume. In April 2022, X2Y2 abandoned its innovative listing reward model and shifted toward a transaction mining approach similar to Looksrare. You can see that before April, X2Y2’s trading volume was negligible compared to after implementing transaction mining.

(Historical trading volume data for X2Y2, Data source: Dappradar)

2. NFT transaction mining is a user acquisition tactic, not a moat

Transaction mining originated in the DeFi space, where dYdX was a pioneer. In derivatives trading, transaction mining helps improve liquidity and price discovery. Arbitrage participants not only profit from mining but also contribute liquidity, becoming counterparties for real traders. In contrast, NFT transaction mining often involves self-trading between wallets and contributes nothing to NFT liquidity.

NFT transaction mining typically unfolds in two phases:

-

Phase One: Many users participate actively, engaging in trades to earn rewards;

-

Phase Two: Whales enter the scene, using a few high-value NFT transactions to squeeze out retail miners.

In Phase One, transaction mining attracts many new users to try the product—similar to Web2 practices like “billions in subsidies” or “coffee for 10% off.” If the product offers a good user experience, there’s a chance to retain these new users, enabling successful project cold-starts. During this phase, both trading volume and genuine user engagement rise.

In Phase Two, once whales realize the mining incentives are safe and sustainable in the short term, they join in. Their strategy involves selecting an NFT with no creator fee, setting the listing price to thousands of ETH, and conducting several round-trip trades to claim rewards. This process neither improves liquidity nor supports small traders. At this stage, transaction mining serves primarily to maintain baseline trading volume metrics and provide steady ETH cash flow to stakers.

By Phase Two, transaction mining essentially becomes a mechanism where the protocol sells newly unlocked tokens daily, converting them into ETH and distributing proportionally to current stakers. At this point, transaction mining no longer brings significant new users. However, thanks to earlier user acquisition, the platform has accumulated a user base and brand recognition. The second phase keeps business metrics looking relatively “healthy.”

This phase is both a period of gradual complacency and a quiet window for product development. Even without active development, the platform can maintain previous performance levels. But this is false prosperity. At this stage, both investors and teams should shift focus from raw trading share to real user growth and user feedback. From another perspective, since performance pressure is low and metrics satisfy investors, it becomes an ideal time to quietly refine the product.

The duration of this phase depends heavily on the design of the mining incentives. The day incentives decline marks the end of Phase Two. Clearly, Looksrare’s Phase Two ended around mid-May this year—after halving its mining rewards, trading volume collapsed, staking yields dropped, and the token price followed, creating a “Davis double hit.”

When the frog realizes it's being slowly boiled, it's already too late. Recently, Looksrare users have noticed the team finally iterating and optimizing the product, introducing some genuinely thoughtful new features. But they missed the golden window for improvement. The best way to prevent a death spiral is to never let it start. For X2Y2, transaction mining will last two years with fixed rewards, so its Phase Two will be longer. Whether X2Y2 can use this time to refine its product, enhance user experience, and capture more traffic and users will determine its future success.

Overall, transaction mining cannot be universally judged in the blockchain industry—DeFi transaction mining delivers far greater value to projects than NFT transaction mining. Therefore, any NFT exchange aiming for long-term growth must not treat transaction mining as a moat. Once transaction mining enters Phase Two, revenue comes mainly from selling newly unlocked tokens—an unsustainable model. While transaction mining can attract many real users initially, it is never a durable competitive advantage that allows a project to rest easy.

(2) Listing Reward Incentives

Listing rewards refer to incentives given to NFT holders who list popular NFTs at reasonable prices on the platform—even if the NFT doesn’t sell.

1. Evolution of Exchange Incentive Models

The evolution paths of Looksrare and X2Y2 regarding listing rewards are particularly interesting:

Looksrare: Transaction mining → Transaction mining + Listing rewards

Looksrare launched on January 11 with transaction mining only. On April 20, it adjusted its incentive model, allocating part of the transaction mining rewards to listing rewards.

X2Y2: Listing rewards → Transaction mining

X2Y2 launched on February 15 with an innovative listing reward model. However, due to initial rule flaws, it failed to meaningfully boost trading. After several fixes, X2Y2 canceled listing rewards on April 1 and redirected those funds to transaction mining.

2. Are listing rewards effective?

The logic behind listing rewards is simple: incentivize NFT holders to list assets on the platform. Just like a mall with diverse products naturally attracts shoppers, a rich inventory should draw buyers.

First, clarify the goal: all incentives aim to grow users and boost trading volume. So effectiveness should be measured by trading volume. Looking back at X2Y2’s historical volume chart, you’ll notice that during the period when listing rewards were active, trading volume remained extremely low.

X2Y2 Historical Trading Volume Data

(Historical trading volume data for X2Y2, Data source: Dappradar)

Why? Let’s categorize listing reward participants into two groups:

Group One: Users who genuinely want to sell their NFTs. Their main goal is to sell quickly at their desired price. They won’t limit listings to X2Y2 or Looksrare just because of listing rewards—they’ll list simultaneously on Opensea. Given Opensea’s traffic dominance, their listings are more likely to sell there (though aggregators have improved this situation, discussed later). Thus, X2Y2 and Looksrare pay listing rewards without boosting actual sales. Additionally, since users want quick sales, listing durations are short, resulting in minimal rewards. Price-insensitive users may still prefer listing solely on Opensea despite knowing about rewards elsewhere.

Group Two: Users who don’t want to sell but wish to earn rewards via listings. Their goals are:

(1) Prevent their NFT from being bought

(2) Maximize listing duration.

To prevent abuse, platforms impose rules—e.g., listing price capped at a percentage above floor price, or only qualifying collections receive rewards. Under these constraints, speculators list at the maximum allowed price to avoid sales. This inflates listing counts but does little to promote actual trading.

You might wonder: if listing rewards aren’t very effective, why did Looksrare shift toward them? The answer will come later.

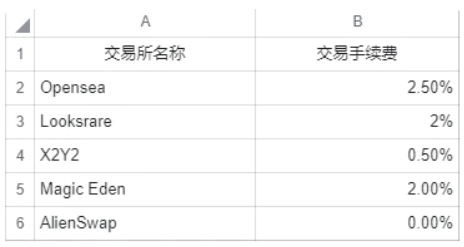

(3) Competition on Trading Fees

There are two main fees in NFT trading: one is the exchange fee (hereafter called “trading fee”), and the other is the creator fee collected by the NFT creator. Note that there is no universal protocol for setting creator fees—creators must manually configure them per platform. For new exchanges, creators often haven’t set fees, so none are collected.

In any highly competitive market, price wars ensue. NFT exchanges compete based on these two fees.

1. Trading Fee Wars

Opensea, as the dominant leader, charges the industry’s highest 2.5% trading fee, effectively setting an upper limit. Challengers like Looksrare and X2Y2 set lower fees to gain market share. Other platforms, like Alienswap, even offer 0% trading fees, joining the price war.

Interestingly, despite clear pricing advantages over Opensea, these platforms haven’t gained much market share.

Here we introduce the concept of switching cost—the implicit cost for users moving from Product A to Product B.

For NFT traders, switching costs are extremely low. Learning new platforms is easy due to nearly identical front-end designs across exchanges. Theoretically, rational traders should flock to lower-fee platforms—especially with aggregators like Gem solving the traffic problem for smaller exchanges, making fee advantages even more compelling. Yet, theory and reality diverge widely. Where’s the disconnect?

One reason is information asymmetry—many traders simply don’t know cheaper alternatives exist.

A deeper reason: most NFT traders aren’t price-sensitive. Amid extreme NFT price volatility (“double your money” or “zero overnight”), a 1%-2% fee difference feels negligible. Compared to traditional art auction houses like Christie’s charging 10%-20% commissions, NFT fees around 2% don’t seem excessive—especially since PFPs are currently viewed more as digital art.

However, as the market matures, traders may increasingly find 2% fees unbearable—especially when compared to stock trading fees of ~0.03%. With the rise of GameFi, NFTs may evolve from profile pictures to in-game production assets. In such cases, every fraction of a percent in fees impacts investment payback periods, amplifying the advantage of low-fee exchanges.

Overall, I believe fee wars among NFT exchanges will intensify. Even monopolistic giants like Opensea may have to lower fees. Remember, Opensea earns about $600 million annually just from fees—an extremely profitable business attracting fierce competition. If Opensea maintains its 2.5% fee, the competitive edge of low-fee exchanges will only grow.

2. Creator Fees

If trading fee competition is open warfare, creator fees operate in the shadows. Creator fees typically range from 0% to 10%. As mentioned, creators must manually set these per platform, creating an unintended loophole. Most creators only set fees on Opensea. For newer or smaller exchanges, they often neglect to do so. This means sellers on X2Y2 or Looksrare can receive ~10% more than on Opensea for the same NFT sale. Hence, you’ll often see the same NFT listed at a higher price on Opensea—because only Opensea collects creator fees.

It’s called a “dark zone” because no exchange dares openly advertise zero creator fees (as it harms creators), yet privately, it becomes a key marketing tactic. That said, exchanges avoid provoking backlash—when creators do request fee setup, exchanges usually comply.

Thus, the creator fee advantage only works for small exchanges early on. Once an exchange scales, creators will learn to set fees there too. In the future, underlying protocol upgrades might allow creators to define royalty splits directly in the NFT standard, eliminating this temporary advantage for smaller platforms.

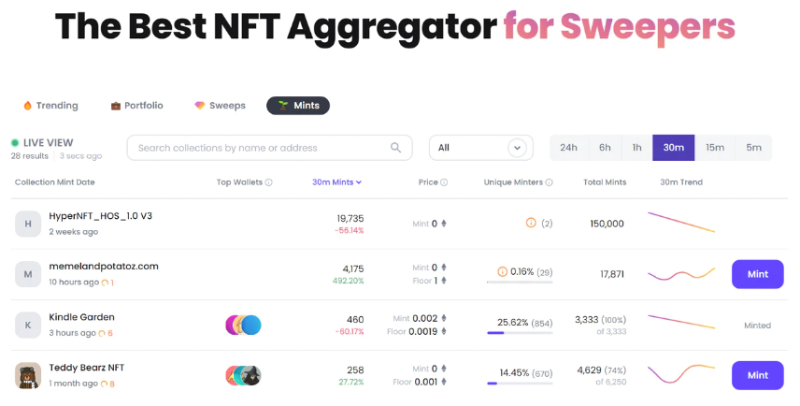

3. Frontend Battle: Aggregators

With the emergence of Opensea competitors, a new product arose: NFT trading aggregators. NFT aggregators led by Gem and Genie have rapidly captured NFT trading entry points with overwhelmingly superior frontend experiences.

Take Gem as an example: Gem.xyz is an NFT exchange aggregator. It doesn’t host listings or facilitate trades itself. Instead, it aggregates listings from Opensea, Looksrare, X2Y2, and others. When you search for an NFT collection on Gem, it displays all available listings across exchanges and offers a cart function to batch-purchase NFTs, saving gas fees.

Gem became popular simply because it’s incredibly useful and crypto-native. You can tell Gem’s product team deeply understands NFT users—every feature update hits a real pain point.

This reflects industry maturation. Over the past few years, blockchain success was measured purely by profitability—users cared little about UX. A product’s quality was judged mostly by its token price. The rise of products like Gem signals that Web3 users now prioritize user experience.

Looking ahead, once aggregators like Gem amass large user bases, exchanges like Opensea, Looks, and X2Y2 could become mere backend providers. One day, you might buy an NFT or trade a token on a trending app, unaware that the underlying logic passes through various NFT exchanges or DeFi protocols—none of which matter to the end user.

Getting back to NFT exchanges, it’s fair to say Looksrare and X2Y2 owe much of their gains from Opensea to Gem. Gem provides massive traffic to smaller exchanges. As long as a small exchange has listings priced competitively, traders will find and execute trades. The longstanding traffic issue for small exchanges appears solved.

This also explains why Looksrare adopted listing rewards despite X2Y2 proving their limited effectiveness. The arrival of aggregators like Gem and Genie solved the buyer traffic problem for small exchanges. Previously, platforms needed both sufficient sellers and buyers. Now, they only need to nurture seller relationships—ensuring more sellers list reasonably priced NFTs. Buyers are handled by aggregators. This is likely the main reason behind Looksrare’s incentive shift.

4. What Is the Core Competitiveness of an NFT Exchange?

(1) Listing Volume (Liquidity)

Nothing new under the sun. In today’s internet-driven world, no one can ignore the importance of traffic. We can break down an NFT exchange’s traffic into two components: buyer traffic and seller traffic.

1. Buyer Traffic

Many argue Web3 offers new solutions to traffic problems—aggregators being the prime example in NFT trading. Platforms like Gem solve the buyer traffic issue for small exchanges. NFT marketplaces seemingly no longer need to worry about attracting buyers—as long as they have listings, aggregators will surface them.

Aggregators appear to be saviors for small NFT exchanges. But do exchanges truly no longer need their own buyer traffic?

This assumes Gem remains neutral and doesn’t abuse its traffic control power. Like how Meituan and Ele.me, after winning market share, began leveraging their bargaining power to extract profits from merchants. Capital is profit-driven. Any exchange relying indefinitely on aggregator traffic is likely the first to be eliminated.

Aggregators exist because multiple exchanges exist; small exchanges survive thanks to aggregator-provided traffic. It’s symbiotic. But once the honeymoon ends, I expect aggregators to collectively target non-compliant exchanges. Worse, Gem—the largest aggregator—is now owned by Opensea. When your biggest traffic source is controlled by your top competitor, don’t count on lasting support.

2. Seller Traffic

While buyer traffic can rely on aggregators, seller traffic is the true battleground. As long as Gem and Genie don’t widely misbehave, sufficient well-priced listings ensure solid trading volume.

Clearly, Looksrare recognized this in April and introduced listing incentives to attract NFT sellers. X2Y2, while dropping listing rewards, launched a 0% trading fee campaign in April and maintained a 0.5% fee afterward. A quick note: trading fees are typically borne by sellers. Buyers usually don’t care about fees since the displayed price is what they pay. Sellers are sensitive to fees. Thus, both listing incentives and lower trading fees represent concessions to sellers—platforms sacrificing margin to attract more listings.

Beyond seller incentives, proactive marketing, collaboration with NFT projects, and capitalizing on real-time trends are vital channels for building seller traffic. From “grinding for whitelists” to today’s “free mints,” NFT markets constantly generate new trends. Traders chase hot opportunities. If an exchange partners closely with project teams to guide holders to list on specific platforms, especially during viral events, it can drive substantial traffic.

3. Buy-Sell Synergy

Unlike traditional e-commerce platforms, NFT exchanges feature buy-sell synergy—one user may buy an NFT today and list it tomorrow. This is precisely why buyer traffic matters: if all your buyers come from aggregators, why would they return to *your* platform to sell?

(2) User Experience (Product Iteration Capability)

User experience is a strong moat in Web2, but less valued in Web3—or more narrowly, the blockchain industry. My first time using Curve felt like going back to when my village first got internet.

The last crypto wave was DeFi. Back then, a project’s value was judged solely by its ability to make users money. A great product—even with a terrible frontend like Curve—was praised if it delivered profits. No amount of good UX could save a project that didn’t generate returns.

The rise of products like Gem signals that Web3’s next narrative will center on user experience. No matter how brilliant the protocol or infrastructure, adoption hinges on usability—someone has to actually use it.

The next phase of blockchain competition may see teams spend months building smart contracts, only to be “wrapped” by a sleek, user-friendly aggregator that captures the lion’s share. We’ve already seen early signs of this with the CVX wrapper phenomenon.

From CryptoKitties to today, NFTs have entered a phase of rapid development—new trends, narratives, and user needs emerge daily. With limited development resources, teams must possess sharp instincts to identify lasting, authentic demands and assess ROI for each feature. Only then can iteration capability translate into genuine user satisfaction—the real moat.

Again, take Gem: during the free mint craze, Gem built a mint data leaderboard and added a one-click mint button directly on its site—solving user pain points around mint selection and data tracking. This is just one recent update, but it shows how great products leverage development strength to iterate. Even Opensea, after acquiring Gem, rolled out its new Seaport protocol and refreshed its long-stagnant frontend with several long-overdue features. First-mover advantage matters, but sustained, well-directed product iteration is the key to maintaining dominance.

Due to composability and decentralization, traditional Web2 moat theories no longer apply. Web3 competition is fiercer because migration costs are low—or even zero. Users freely choose preferred products. To retain users, teams must stay vigilant, continuously iterate, understand users, and meet their needs—only then can they succeed.

(3) Social Attributes

Whoever integrates NFT communities into their exchange will build the strongest moat.

The social value of NFTs has yet to be captured by NFT exchanges. NFT communities live mostly on Discord, with announcements made via Twitter and Discord. The user experience remains fragmented.

Imagine an NFT exchange with built-in Discord-like functionality: clicking an NFT collection shows project updates and announcements; buying an NFT automatically grants community access without re-verification; one side of the screen shows price charts, the other shows community chat. This is just a preliminary idea—future product models aren’t the focus today.

Why is embedded community the ultimate moat? In Web3, assets belong to users. An NFT can be listed on any exchange—migration cost is nearly zero. A user can trade on Exchange A today and move to B tomorrow. But while NFTs can migrate, communities cannot. Even if users buy elsewhere, they’ll return to the exchange with the community. That’s how a moat forms. When Coinbase launched its NFT marketplace, it emphasized social features—but only at the level of user followings, not community building. Still, it was an attempt to capture NFT social value.

Conclusion

One reason I wrote this article is that I believe the future of the NFT market extends far beyond current imagination. Today, Opensea seems unshakable—but stretch the timeline to three or five years, and perhaps a completely different set of NFT exchanges will dominate. Reflecting on how crypto exchange competition evolved over the past decade, this scenario isn’t just a horror story—it’s plausible. I sought to identify keys to exchange success to validate my investment thesis, but upon finishing, something still feels missing.

Another reason is my fondness for Looksrare and X2Y2’s tokenomics. Traditional finance professionals favor projects generating stable cash flows. Regular readers know I’ve long followed NFT exchanges. The reason is simple: if CZ came to you ten years ago with a whitepaper asking for investment in Binance equity, would you invest? You probably wouldn’t. But given a second chance, would you refuse again? More likely, you’d miss out—like SBF did.

Lastly, none of this constitutes investment advice. DYOR.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News