Quick Look at X2Y2, OpenSea's Rising Challenger: Incentivizing NFT Listings to Solve Supply and Demand Issues

TechFlow Selected TechFlow Selected

Quick Look at X2Y2, OpenSea's Rising Challenger: Incentivizing NFT Listings to Solve Supply and Demand Issues

Unlike LooksRare, which incentivizes users to trade with heavy spending, X2Y2 does not offer trading rewards. Instead, it primarily addresses the fundamental supply and demand issue by incentivizing users to list NFTs, while providing token stakers with all platform trading fees (2%) and token rewards.

Text by: Karen

As the leading NFT marketplace, OpenSea dominated approximately 90% of the market for much of last year. However, persistent controversies surrounding rumors of going public, centralized governance, and frequent service outages have kept OpenSea under scrutiny—precisely why this long-near-monopolized sector has still left a "window open" for new entrants.

LooksRare, which surged in popularity last month through innovative tactics like token airdrops, trading rewards, and staking incentives, achieved significant breakthroughs in trading volume and user growth within a short period. However, about 87% of LooksRare's trading volume meets CryptoSlam’s criteria for wash trading. Moreover, starting the evening of February 9, daily LOOKS trading rewards will be reduced to less than half their current level over the following three months. This reduction will inevitably impact trading activity on LooksRare, along with changes in staking yields and potential downward pressure from token selling.

While LooksRare’s challenges highlight that artificially inflated volumes are unsustainable, its rapid rise offers valuable lessons. Can X2Y2, a newly launched NFT marketplace that gained attention via an innovative public sale mechanism and has already rolled out a beta version, learn from these experiences and “build on strengths while addressing weaknesses”? What unique features does its product offer? This article explores these questions.

What is X2Y2? What’s Its Progress?

X2Y2 aims to build a truly decentralized NFT marketplace that shares revenue with users. Last week, X2Y2 launched its beta version on Ethereum, allowing users to trade NFTs during testing with zero transaction fees and no royalties. Current test features include fixed-price listings, offers, and collection-wide offers.

X2Y2 plans to upgrade existing functionalities and continuously introduce new ones, such as real-time push notifications for buying/selling, auctions, bulk listing, batch purchasing, rarity rankings, bulk transfers, and mass listings. The official version will charge users a 2% transaction fee, but all fees collected will be fully distributed to token stakers.

Unlike LooksRare, which incentivizes trading through generous trading rewards, X2Y2 does not offer trading rewards. Instead, both its airdrop claim rules and staking incentives primarily encourage users to list NFTs, aiming to address supply and demand imbalances on the platform. Notably, total NFT listing rewards exceed token staking rewards by more than double. Additionally, token stakers will receive all platform transaction fees (2%) and additional token rewards.

According to information disclosed during a previous AMA session, the X2Y2 team is anonymous, and its marketing partner is Winkrypto, a Singapore-based crypto marketing firm. X2Y2 will not conduct a private sale. To eliminate concerns about exit scams, all ETH raised through its ILO (Initial Liquidity Offering) will be added as liquidity on Uniswap, and the corresponding LP tokens will be permanently burned. Specific details of the ILO are explained in the next section.

X2Y2 Tokenomics

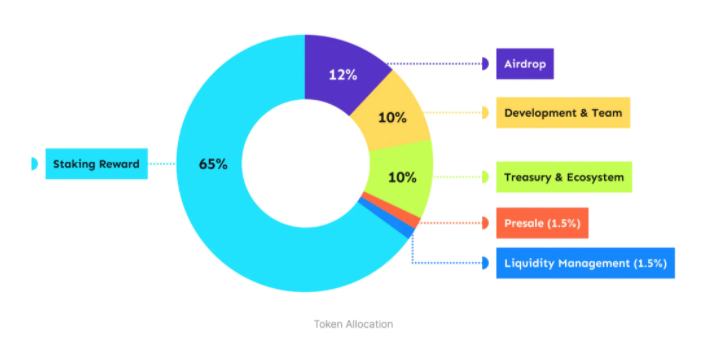

X2Y2 has a total supply of 1 billion tokens, allocated roughly as follows:

1) Staking rewards account for 65% (including both X2Y2 token staking and NFT staking rewards, released over 720 days);

2) Airdrops make up 12% (no vesting required);

3) Development and team allocation accounts for 10% (2.5% released every 180 days, first release after 180 days, fully released over four cycles);

4) Treasury and ecosystem allocation accounts for 10% (1.25% released every 90 days, fully released over eight cycles);

6) Pre-sale allocation is 1.5% (linearly released over 360 days by block);

7) Liquidity management accounts for 1.5% (1% paired with 1,500 ETH from ILO sales to form LP tokens, which will then be burned; the remaining 0.5% used for LP staking rewards).

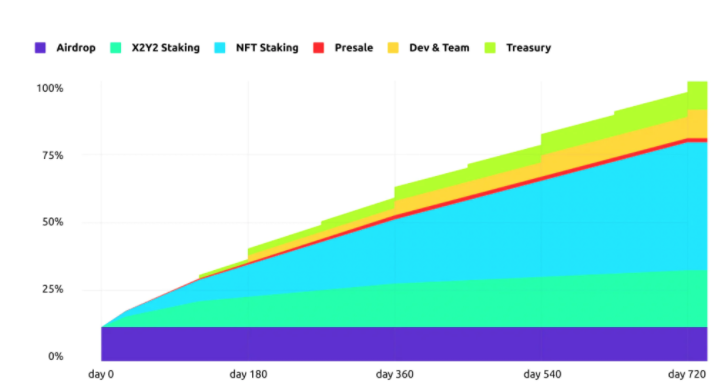

X2Y2 Token Distribution Model

Regarding staking rewards—the largest portion of the token distribution—X2Y2 has split the updated 65% allocation into two parts: 20% for X2Y2 token staking rewards and 45% for NFT staking rewards. NFT staking rewards are earned by listing NFTs at reasonable prices on X2Y2, specifically designed to incentivize users to list items. The actual reward amount depends on the ratio between the user’s staked value and the total staked value across the platform.

Additionally, considering factors such as NFT type and price, the exact NFT staking reward also depends on a multiplier and the probability of the listed NFT being sold. The latter considers variables including recent trading frequency of the collection, the difference between listing price and historical/floor prices, whether the item was delisted after posting, whether it belongs to a blue-chip NFT collection, and listing duration.

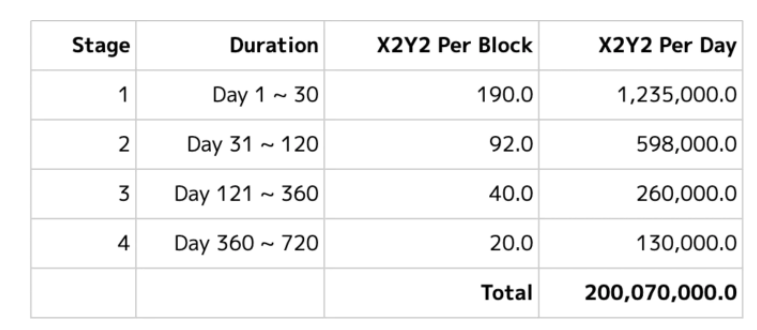

All rewards will be distributed over 720 days. Within the total token staking rewards, the first 30 days offer the highest payouts, releasing 1.235 million tokens per day. For the following three months, daily rewards drop to around 48% of the initial level. In addition, token stakers also receive the previous day’s platform transaction fees. NFT staking rewards are distributed equally each day, with nearly 625,000 tokens issued daily. Details are as follows:

X2Y2 Token Staking Reward Distribution Plan

X2Y2 Platform NFT Staking Reward Distribution Plan

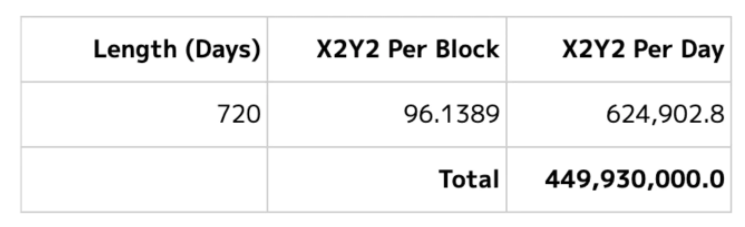

For airdrops, according to the Litepaper, X2Y2 will distribute tokens to over 860,000 OpenSea users (snapshot taken at block height 13,916,166). To mitigate whale dominance, X2Y2 will give 1,000 X2Y2 tokens to each OpenSea user who traded 30 ETH or more, while users with less than 30 ETH in trading volume will receive airdrops proportionally based on their share of total volume.

Airdrop Distribution Plan

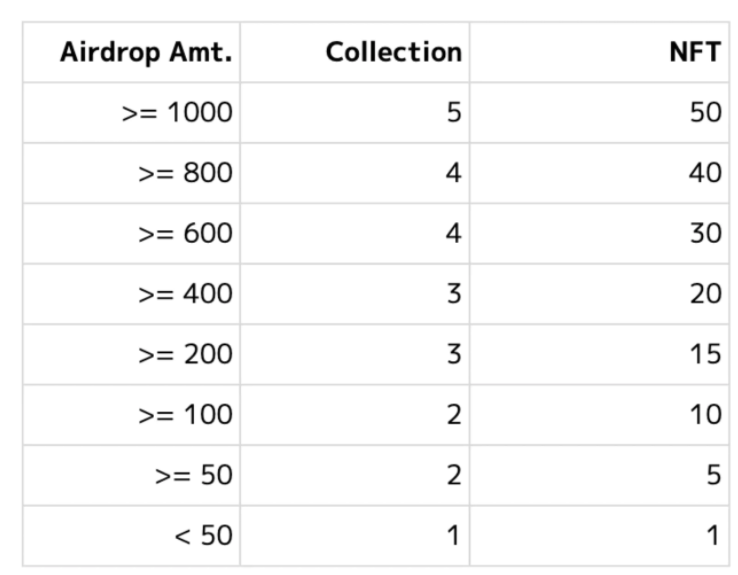

Moreover, X2Y2 has set claim conditions based on users’ eligible airdrop amounts. For instance, users eligible for over 1,000 tokens must list at least 50 NFTs across five or more collections on the platform. Clearly, whether through NFT staking rewards or airdrop rules, X2Y2 is doing its best to incentivize users to list more NFTs, thereby enhancing tradability on the platform.

Airdrop Claim Conditions

Regarding the ILO (Initial Liquidity Offering) on February 14, X2Y2 will open whitelisting to 1,000 beta testers and community members (selected via lottery), selling 15 million X2Y2 tokens (1.5% of total supply) divided into 1,000 lots, each priced at 1.5 ETH. These tokens will unlock linearly over 360 days by block. As previously mentioned, the 1,500 ETH raised will be paired with another 10 million X2Y2 tokens to provide liquidity on Uniswap, and the resulting LP tokens will be burned on February 15. Additionally, whitelist participants can claim an X2Y2 Genesis NFT.

From the overall token release schedule, 12% of the total supply (airdrops) will be released on day one. Before the team’s first 2.5% release at day 180, releases will mainly consist of the two staking reward types and the block-by-block unlocking of ILO tokens. During the first 30 days, daily releases include 1.235 million X2Y2 token staking rewards, ~625,000 NFT staking rewards, and 41,666 tokens from ILO unlocks—totaling over 1.9 million tokens released daily.

X2Y2 Token Release Schedule

How Does It Differ From OpenSea and LooksRare?

In terms of product experience, X2Y2’s current interface resembles LooksRare—relatively simple, with functionality expected to improve in future updates.

On transaction fees, both X2Y2 and LooksRare charge 2% (slightly lower than OpenSea’s 2.5%), with no listing fees. Both platforms return all transaction fees entirely to token stakers.

Regarding incentives and user acquisition, LooksRare—which launched last month—divides rewards among traders, token stakers, and LP stakers into three categories: trading rewards, staking rewards, and LP rewards. This encourages a “trade-stake-trade” loop to boost user engagement, trading volume, and staking activity.

In contrast, X2Y2 offers no trading rewards at all. Rewards are primarily directed toward token stakers and, more broadly, users who list NFTs. Perhaps X2Y2 believes that the success of an NFT marketplace largely hinges on having more tradable and purchasable NFTs available. As long as the platform hosts a greater quantity and diversity of listed NFTs compared to competitors, it will naturally attract traders.

In other words, both X2Y2 and LooksRare ultimately aim to draw users to trade and stake on their platforms, but they differ in incentive design. X2Y2 focuses on solving the fundamental supply-demand imbalance, whereas LooksRare sought to heavily incentivize trading habits early on. Yet token rewards will eventually diminish and run out. When that day comes, the platform that better addresses supply and demand dynamics will stand out. Until then, in the short to medium term, user attraction through incentives, staking appeal, project choices, and user experience remain equally critical.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News