Odyssey is here, do you really understand Arbitrum?

TechFlow Selected TechFlow Selected

Odyssey is here, do you really understand Arbitrum?

Only those who withstand self-doubt and maintain continuous reflection and contribution to the industry ultimately enjoy the dividends and fruits of crypto's development.

Author: 0xCryptolee, CIG Builder

Technical Review: Jason (Arbitrum)

Editor: Wu Ji, Head of CIG Labs

Following the collapse of the Luna/UST algorithmic stablecoin, the market entered a sustained downturn, followed by a series of liquidity crises at institutions such as 3AC, Celsius, and BlockFi. Under these multiple blows, BTC has fallen below the peak of the previous bull market, and many altcoins have lost most of their market capitalization.

At this moment, skepticism has surged within the crypto community. Many people begin to waver about leaving the space, while others question the future of crypto and web3. Amid repeated downturns and growing doubts, many investors have been shaken out of the market and long-term departed from crypto. However, historical experience shows that only those who withstand self-doubt and continue thinking critically and building in the industry ultimately enjoy the benefits and fruits of crypto's development.

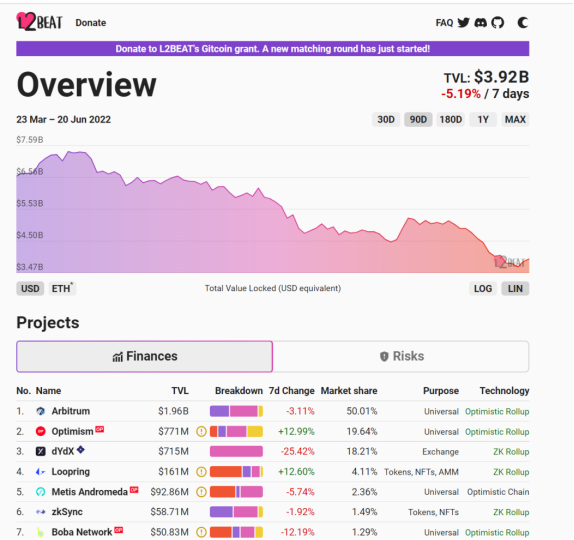

TVL changes across Layer2 ecosystems

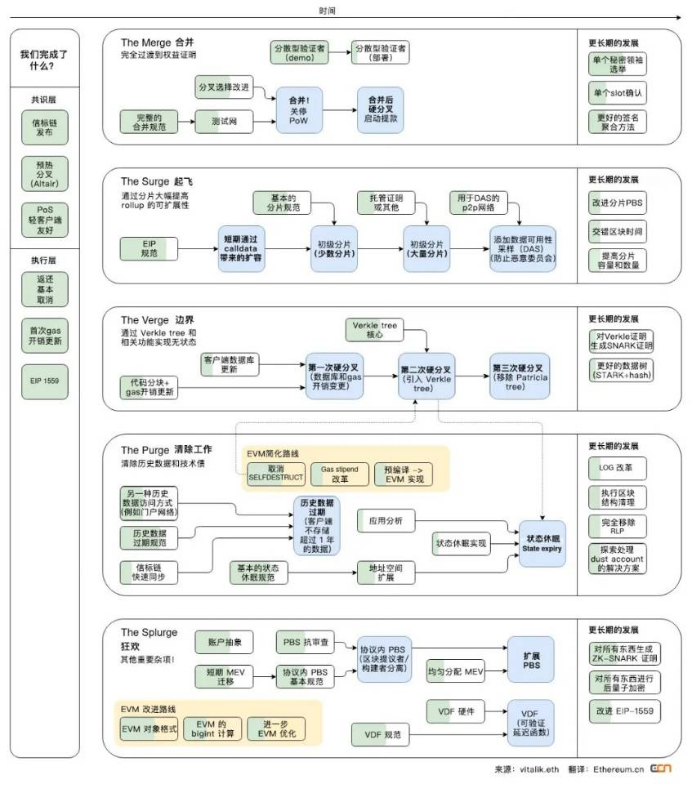

Since Vitalik published “An Ethereum Rollup-Centric Roadmap,” sharp observers have realized that Rollups will serve as the core of Ethereum applications and ecosystem, handling execution-layer functions—this represents Ethereum’s future trend and the foundational infrastructure for the metaverse.

Chinese version of the Rollup-centric Ethereum roadmap

As the largest and most mature Rollup Layer2 in the Ethereum ecosystem today, Arbitrum holds a first-mover advantage over other Layer2 solutions. Its future development, backed by Ethereum’s security and decentralization, is likely to maintain its lead over competing public chains and broader Layer2 alternatives. The Arbitrum Odyssey campaign is currently underway—if you're as intrigued by Arbitrum as I am, consider reading this article to deepen your understanding, sharpen your insights, and strengthen your conviction during this prolonged bear market.

TVL trends in the Arbitrum ecosystem

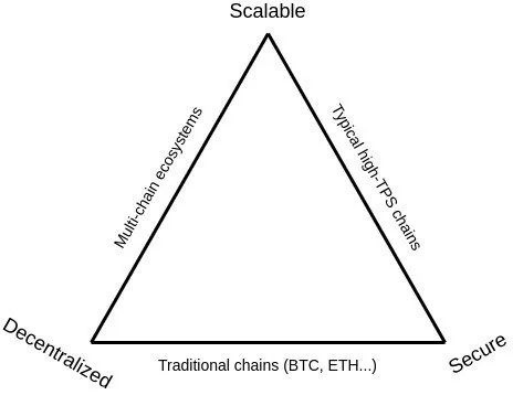

I. Revisiting the Impossible Triangle

Anyone involved in crypto or blockchain has likely heard of the "impossible triangle"—the idea that a blockchain cannot simultaneously achieve decentralization, security, and scalability. Any blockchain design must choose two of these three properties, sacrificing one to some degree.

Ethereum prioritizes security and decentralization, making performance a recurring vulnerability exploited by newer competitors. Rivals leveraged Ethereum’s performance limitations and capitalized on funding momentum to capture part of Ethereum’s user traffic and ecosystem, rapidly rising to prominence and creating a multi-chain competitive landscape.

Due to its role as a smart contract platform, Ethereum has already compromised significantly on block time compared to Bitcoin’s 10-minute interval. Under PoW, Ethereum’s block time averages around 13 seconds; after transitioning to PoS, it was fixed at 12 seconds—the maximum optimization possible for performance via block timing. Shorter block times or larger block sizes would make P2P network synchronization difficult, threatening network security. With thousands of nodes, Ethereum clients require sufficient time to synchronize across the P2P network; otherwise, delays could easily cause forks, undermining both security and decentralization.

In contrast, most alternative chains and sidechains sacrifice decentralization for high performance and TPS, using only a small number of nodes to reach consensus and produce blocks. This reduces synchronization time and increases block space, boosting performance and attracting users.

The blockchain impossible triangle

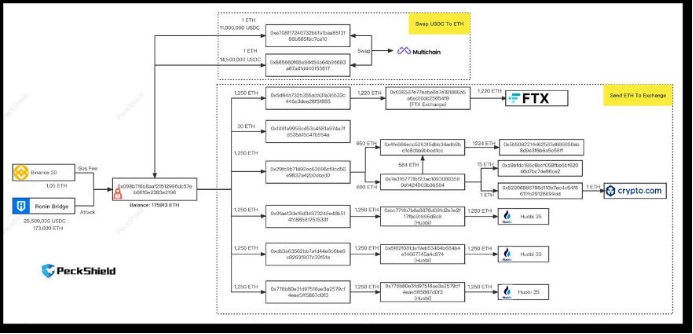

Now, some might argue that this trade-off isn’t so bad—after all, it offers better user experience. But such high-performance experiences come at a steep cost. Take Ronin—the sidechain built exclusively for Axie Infinity. On March 31, 2022, Sky Mavis, Ronin’s developer, announced that hackers had stolen 173,600 ETH and $25.5 million in cash from its cross-chain bridge, totaling losses of $610 million.

Post-incident analysis revealed that attackers obtained private keys from both Ronin validator nodes and the Axie DAO validator, enabling them to forge withdrawals and steal assets from the bridge. The Ronin bridge relied on nine validator nodes, but the attacker gained control of just five nodes to successfully drain the funds. This demonstrates how high performance achieved by sacrificing decentralization and security can be extremely fragile under extreme conditions.

PeckShield’s analysis of stolen asset flow paths

With all that said, let’s revisit the original vision behind blockchain—to help us cut through the noise and see clearly. In 2008, Satoshi Nakamoto created BTC. While we don’t know his exact motivations, BTC’s emergence established a fact: a decentralized, highly secure digital currency now directly challenges central bank-issued money.

Despite its long and winding path of growth and experimentation, we cannot yet predict whether it will succeed. But we do know it embodies humanity’s aspirations for decentralization. Following Bitcoin, Ethereum stands as the most decentralized blockchain. Its developers and community have consistently prioritized decentralization and security—a key factor behind Ethereum’s success. People build and participate in blockchains because they want a system that is decentralized, secure, and resistant to single-point control. Ethereum continues down this path, which may well form the foundation for a future metaverse coexisting with the physical world. The metaverse enables borderless, location-independent human interaction, and its foundation must also be decentralized and sufficiently secure.

Ethereum and its ecosystem appear to be the best bet for the future. But does that mean we should stop improving Ethereum’s performance? Not at all! Earlier Ethereum scaling solutions like Plasma and sidechains took relatively less secure routes. It wasn’t until the emergence of Rollups and modular blockchains that the impossible triangle finally began to show signs of flexibility.

II. Modular Blockchains

Modular blockchains refer to the separation of blockchain layers—execution, consensus, and data availability—to enhance scalability and performance. Before the Merge, Ethereum’s mainnet served as the execution layer, running the virtual machine to update global state and execute smart contracts—essentially where DApps run and transactions are processed. After the Merge, the Beacon Chain replaced the PoW mechanism as the consensus layer, responsible for selecting validators to propose new blocks. Unlike the old mining model requiring repetitive hash computations, post-Merge Ethereum selects validators randomly to propose blocks. By separating block proposers from builders, the network further mitigates malicious behavior. Thus, consensus and execution layers are now decoupled.

Currently, monolithic blockchains bundle consensus, execution, and data availability into a single layer. Rollup designs, however, move execution off-chain—processing transactions and state transitions off-L1—while uploading transaction data to Ethereum to ensure data availability. This achieves separation between the execution and data availability layers.

Just as CPUs evolved toward modularity, monolithic blockchains are progressing in the same direction. This represents the optimal path for resolving blockchain’s trilemma, with Rollups playing a pivotal role in overcoming the impossible triangle.

III. Rollup Scaling

Rollup, endorsed by Vitalik as the premier Layer2 scaling solution, is widely regarded by the community as Ethereum’s best current path forward. There are two dominant Rollup approaches today: Optimistic Rollup and ZK-Rollup. OP-Rollup uses fraud proofs to ensure security, with leading implementations including Arbitrum and Optimism. ZK-Rollup relies on zero-knowledge proofs, with prominent general-purpose solutions like zkSync and StarkNet. Additionally, there are specialized approaches such as Obscuro’s TEE Rollup aiming to scale Ethereum.

Rollups work by moving computation and partial data storage off the mainnet, alleviating congestion on L1. Only the final computation results are sent back to Ethereum as calldata, containing the minimal data needed to reconstruct the Rollup chain state. Fraud proofs and zero-knowledge proofs ensure the correctness of this data, allowing Rollups to inherit Ethereum’s security. Rollup scaling has become the most promising avenue for Ethereum expansion, with Arbitrum occupying a critical position in this ecosystem.

IV. Deep Dive: Arbitrum’s Architecture

1. Ethereum Layer1 Mainnet Contracts

As previously mentioned, Rollups ensure data availability by uploading data to the Ethereum mainnet. How is this accomplished? On Ethereum, Arbitrum has deployed several core contracts: Inbox, Outbox, ETHBridge, and the Rollup contract.

● Inbox Contract: Think of this as Arbitrum’s mailbox on Ethereum, storing calldata submitted by the Sequencer. Validators or other participants can use this data to locally reconstruct the full Sequencer chain.

● Outbox Contract: This handles messages sent from Layer2 back to Layer1. For example, after withdrawing assets via Arbitrum’s official bridge and completing the seven-day challenge period, users must claim their funds from the bridge to finalize the transfer back to Ethereum.

● ETHBridge: This contract manages Arbitrum’s official bridge. When users deposit assets into the bridge, those assets are locked on Ethereum, while corresponding tokens are transferred to Arbitrum via retryable tickets.

● Rollup Contract: This executes fraud proofs on Ethereum. Once an on-chain dispute is identified, the Rollup contract re-executes contested transactions to verify their validity, penalizing malicious actors by slashing their staked assets.

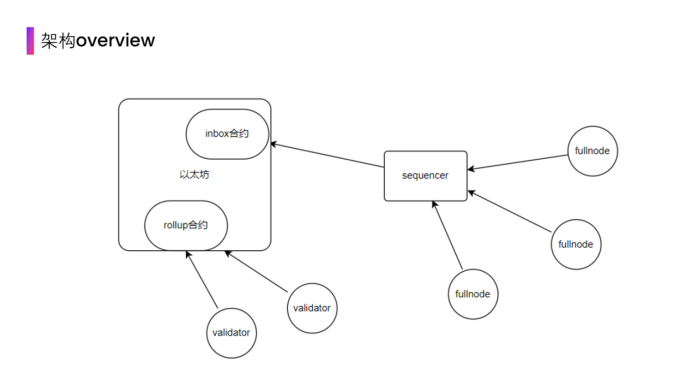

Arbitrum architecture

2. Sequencer Chain

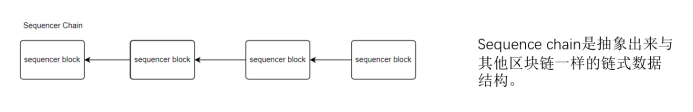

The Sequencer Chain refers to the blockchain formed when the Sequencer (a full node that batches and orders Layer2 transactions—functionally equivalent to a block producer in Layer2 networks) packages transactions into Layer2 blocks and links them sequentially. Its data structure resembles that of a typical blockchain. All Layer2 transaction data is stored via the Sequencer Chain. When a user initiates a transaction, it is sent via RPC (Remote Procedure Call) to an RPC node, which forwards it to the Sequencer. Upon receipt, the Sequencer immediately processes and confirms the transaction, achieving initial confirmation on Layer2.

After collecting transactions over a period, the Sequencer bundles them into a batch, compresses the data, and uploads it as calldata to the Sequencer Inbox contract on Ethereum’s Layer1. This ensures data availability resides on Ethereum while execution moves to Layer2—completing the second-level confirmation on Layer2. Now, let’s explore some key questions regarding the Sequencer’s operation.

Arbitrum Sequencer Chain

● Question One: Since the Sequencer doesn’t compete via consensus and is controlled by Arbitrum’s team, does this make Layer2 centralized?

● Question Two: How does the Sequencer handle MEV (Maximal Extractable Value)?

● Question Three: If the Sequencer goes down, what happens to Layer2 transactions?

First, addressing Question One: Currently, the Sequencer is operated by the Arbitrum team. This is due to the project being in its early stages—centralized control helps ensure secure upgrades and smooth progress. While this introduces some centralization risk, the data uploaded to the inbox contract allows any user to fully reconstruct Layer2 transaction history and safely withdraw assets back to Layer1. At the level of asset ownership, security remains strong because it ultimately relies on Layer1’s security. As the project matures, the Sequencer will gradually decentralize, transitioning to community and team co-management. Arbitrum is already collaborating with Chainlink on decentralized sequencers, paving the way for future decentralization.

Regarding Question Two, understanding MEV composition is key. MEV includes gas fees and sandwich attack profits. Currently, since the Sequencer is run by Arbitrum, transactions are ordered strictly by arrival time—eliminating sandwich attacks. The Sequencer only collects fees for Layer2 computation, storage, and gas required to upload calldata to the mainnet inbox. Once the Sequencer decentralizes, randomly selected participants will take turns as sequencers, and MEV extraction will emerge naturally. However, Arbitrum’s roadmap aims to promote fair and minimized MEV extraction.

For Question Three: Does a Sequencer outage halt all Layer2 transactions? No. Arbitrum was designed with this scenario in mind. If the Sequencer fails, users can send transactions directly to Ethereum’s Delayed Inbox contract via Layer1 RPC calls, ensuring transactions are still processed and recorded.

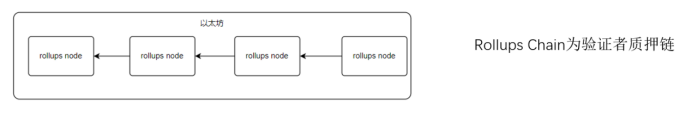

3. Rollup Chain

Earlier, we discussed how Layer2 transactions are bundled by the Sequencer and sent as calldata to the Layer1 inbox. But who verifies whether this data is truthful? Could the Sequencer cheat by inserting fake transactions? This is where Optimistic Rollup’s unique fraud proof mechanism comes into play. All data uploaded by the Sequencer to the inbox is publicly visible and subject to network-wide monitoring—the foundation of fraud proofs.

Malicious actors can never know how many participants are actively auditing the chain. This leads to the introduction of another chain: the Rollup Chain, also known as the validator chain. Anyone with sufficient resources can run a local instance of the Sequencer Chain using the calldata from the inbox contract, since this data contains everything needed to reconstruct Layer2’s state. Users can replay all transactions locally to verify the Sequencer hasn’t acted dishonestly.

But should everyone maintain the Arbitrum state? Obviously not. Only major stakeholders—like exchanges holding large amounts of assets on Arbitrum—are likely to run local replicas to safeguard their holdings. That’s why multiple Sequencer Chains exist, though only the one operated by Arbitrum itself serves as the primary network backbone.

The Rollup Chain, on the other hand, is a chain generated by validators staking on the network state—it runs on Ethereum Layer1. For example, over a given period, validators stake ETH on the state uploaded by the Sequencer to the Inbox contract—effectively betting that the transaction history is accurate.

If all transactions are valid, the chain state progresses normally. But if someone stakes on an incorrect state, a conflict arises between honest and malicious validators. The Rollup Chain then splits. Honest and malicious parties use a binary search-like method to isolate the disputed transaction. These verification steps occur on Layer2. Once the disputed segment is identified, the Rollup contract on Layer1 re-executes the contested transaction to adjudicate the claims. The malicious party loses their staked ETH, part of which is rewarded to the honest validator for protecting the network.

To prevent network attacks, a portion of slashed ETH is burned, discouraging collusion between honest and malicious validators. This is how the Rollup Chain and fraud proofs work. In short, numerous participants locally monitor Layer2 state; when malicious activity is detected, fraud proofs ensure the chain advances correctly. The challenge period lasts seven days—after which transaction states are finalized and irreversible. This constitutes the third-level confirmation for Layer2 transactions, which becomes finality under the assumption that Ethereum itself does not fork.

Arbitrum Rollup Chain

4. Nitro

Currently, Arbitrum operates on Arbitrum One. Offchain Labs developed AVM using the Mimi language—an EVM-compatible virtual machine allowing Ethereum dApps to seamlessly migrate to Arbitrum. Because Arbitrum achieves bytecode-level EVM compatibility, developers can deploy their applications on Arbitrum with little to no code changes.

Nitro is an upgrade to Arbitrum One. With Nitro, Arbitrum improves its gas model to more closely resemble Ethereum’s mainnet, offering a better experience for both developers and users. Additionally, Nitro removes AVM and replaces it with Go-Ethereum compiled via WASM. Go-Ethereum, written in Go, is the most widely used Ethereum client on the mainnet today. This upgrade enables more efficient fraud proofs on Layer2 and enhances user interaction. All changes are implemented smoothly—the most noticeable effect for users is that Arbitrum simply becomes easier to use.

5. Anytrust

Anytrust is a chain implemented by Arbitrum on top of the Nitro stack. These two are expected to launch around the same time and operate concurrently. Anytrust is maintained by a committee of nodes. Compared to traditional sidechains, Anytrust requires fewer trust assumptions. Traditional sidechains need over 2/3 of nodes to be honest for security, whereas Anytrust leverages Rollup functionality—requiring only a minimal number of honest nodes to remain secure. Even if many members refuse to cooperate, the chain can fall back to Rollup mode to continue operating. Once the committee resumes normal operations, it switches back to Anytrust mode.

Anytrust targets high-frequency applications like blockchain gaming. Although Nitro provides significant scalability, Anytrust offers additional options for developers seeking to balance performance needs with ecosystem sustainability, giving them greater flexibility in building projects and ecosystems.

V. Look to the Long Term

During market downturns and cooling sentiment, we’re inevitably affected and may lose confidence. But learning to question helps us grasp the essence amid chaos. Truly disruptive innovations aren’t defeated by market volatility—only more revolutionary innovations can surpass them. Rollup technology is a groundbreaking solution to Ethereum’s scalability problem, directly addressing its performance bottlenecks and real needs. Maintaining faith in Rollups—and in Arbitrum—is essential. Ethereum’s scaling journey is long and challenging, but thankfully, talented teams continue pushing forward, building products. In this environment, we should stay calm, reflect deeply, and think about how to contribute to solving existing problems. Doing so sharpens our minds and uncovers astonishing innovations along the way!

References

https://ethresear.ch/t/introducing-obscuro-a-new-decentralised-layer-2-rollup-protocol-with-data-confidentiality/11353

https://mp.weixin.qq.com/s/V5iI3LOqR0HAUDsJsP49lQ

https://m.8btc.com/article/6740032

https://mp.weixin.qq.com/s/U2p_mYQwgA2NdyicPzbx1Q

https://learnblockchain.cn/article/3614

https://mp.weixin.qq.com/s/mMBGqUwsyJ3bEYXxrwVM1w

https://mp.weixin.qq.com/s/uc3u-OdD5vRiczzlTb4W0Q

https://medium.com/offchainlabs/arbitrum-nitro-sneak-preview-44550d9054f5

https://github.com/OffchainLabs/nitro

https://ethereum-magicians.org/t/a-rollup-centric-ethereum-roadmap/4698

https://nownodes.io/blog/detailed-review-of-arbitrum/

Data Sources:

https://l2beat.com/

https://ethereum.cn/

https://defillama.com/chain/Arbitrum

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News