Misappropriated 22,000 ETH, Launched 10 Shit Projects in 4 Years: Machi Big Cut Andy Huang's Crypto Past

TechFlow Selected TechFlow Selected

Misappropriated 22,000 ETH, Launched 10 Shit Projects in 4 Years: Machi Big Cut Andy Huang's Crypto Past

An overview of M.J. Brother's activities in the cryptocurrency space, a brief summary of Formosa, his subsequent projects, other participants in these projects, and as always — evidence to substantiate these claims.

Written by: Investigations By ZachXBT

Translated by: Advac L., BlockTempo

On the evening of June 16, ZachXBT, a well-known Twitter influencer famous for exposing rug pulls, published a post titled “The Story of Machi Big Brother: 22,000 ETH Misappropriated and Over 10 Failed Projects.” He claimed to have uncovered evidence of Machi Big Brother’s (Jeffrey Huang) involvement in multiple scams and alleged that both Huang and George Hsieh had each misappropriated 22,000 ETH. He further accused Machi Big Brother (Huang Li-Cheng) of launching 10 worthless projects in the crypto space over the past four years, including Mithril, Formosa Financial, Cream Finance, and others.

In the early hours today, Jeffrey Huang (Jeff Huang), a prominent Taiwanese entrepreneur and international crypto influencer, was exposed in a detailed analysis by the renowned KOL ZachXBT, who suspects strong links between "Machi Big Brother" and over ten scam projects, presenting evidence he collected.

Shortly after, Machi Big Brother responded on Twitter, clarifying that ZachXBT's allegations were incorrect:

"This is false information. If he weren’t anonymous, I would sue him for defamation!"

Below is the full Chinese version of ZachXBT’s investigative report. This does not represent BlockTempo’s stance.

Brief Introduction

Jeffrey Huang, better known online as Machi Big Brother, is a former Taiwanese-American musician and tech entrepreneur who allegedly misappropriated 22,000 ETH from Formosa Financial in 2018. In the four years since Formosa Financial collapsed, Jeff has launched over ten pump-and-dump token and NFT projects. The following will cover Machi Big Brother’s activities in the cryptocurrency world, a brief overview of Formosa Financial, his subsequent projects, associated individuals, and—of course—the evidence supporting these claims.

Over the past year, “Machi Big Brother” (also known as Jeff Huang), one of the largest Bored Ape Yacht Club (BAYC) holders, has gained fame in the NFT space. Yet few are aware of his dark history in the cryptocurrency industry…

Background

Jeffrey Huang, also known as “Machi Big Brother,” is a Taiwanese-American rapper and tech entrepreneur. In 1991, he co-founded LA Boyz, a popular rap trio that rose to fame. Active throughout the 1990s, LA Boyz released 13 albums and became a sensation across Asia before disbanding in 1997.

Following the success of LA Boyz, Huang founded the hip-hop group “Machi” in 2003, which also achieved great success. MACHI Entertainment became one of Asia’s leading hip-hop record labels and operated as a subsidiary of Warner Music Taiwan. Eventually transitioning from music into technology, Huang co-founded 17 Media (M17), the parent company of the live-streaming app 17 Live, established in 2015 and now one of Asia’s most popular live-streaming platforms.

In 2017, Huang entered the cryptocurrency space with Mithril, the first of a series of questionable ventures marked by vague team structures, ethical concerns, and consistent, mechanical pump-and-dump tactics. Let’s dive deeper.

Project One: Mithril ($MITH)

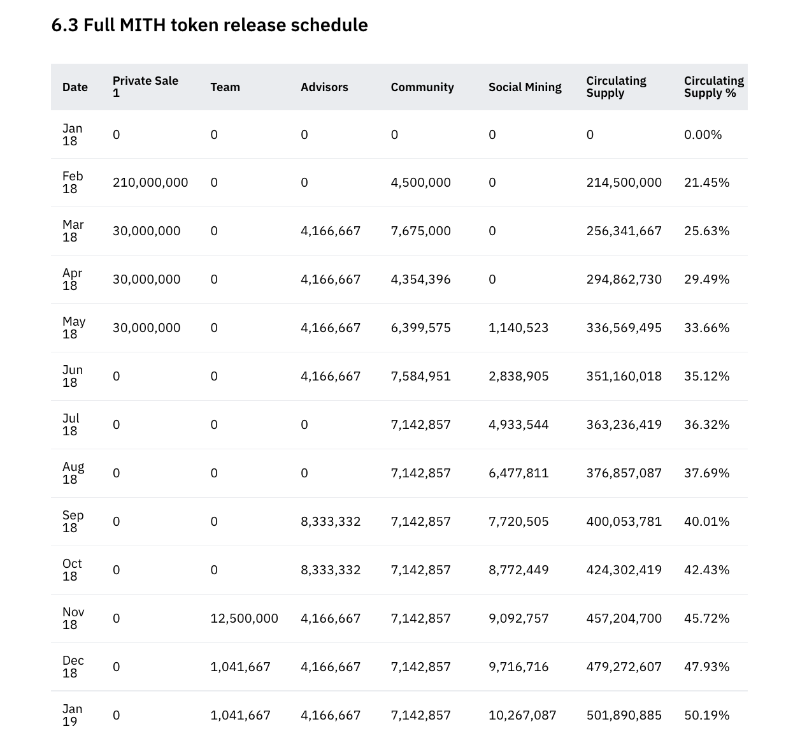

At the end of 2017, Machi Big Brother launched Mithril, a decentralized social media platform designed to directly reward content creators using its native token, MITH. Mithril conducted a private token sale on February 21, 2018, raising $51.6 million (60,000 ETH), representing 30% of the total token supply. In February 2018, 70% of these privately sold tokens were unlocked at TGE, with the remaining 30% unlocking over the next three months. Mithril was listed on the centralized exchange Bithumb in April 2018. By May 2018, fully unlocked MITH tokens accounted for 89% of the circulating supply, creating massive sell pressure.

Image source: Binance Research

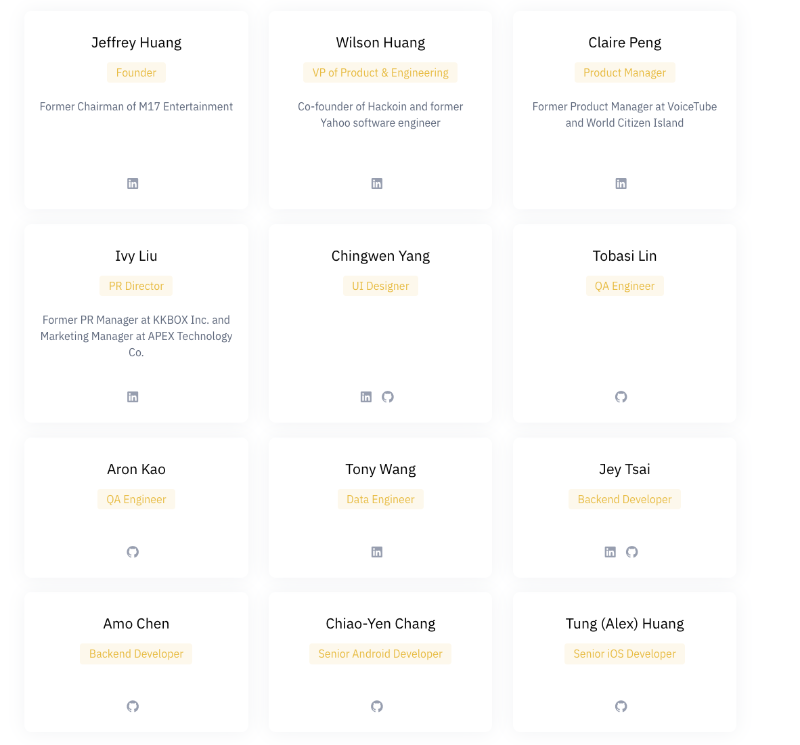

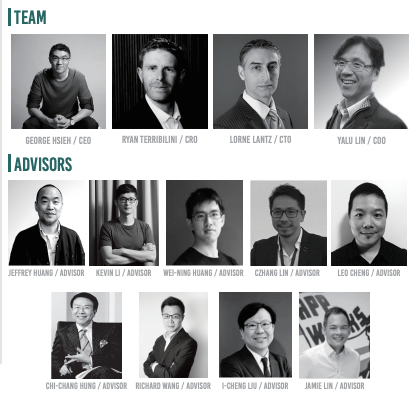

Mithril Team

Project Two: Formosa Financial

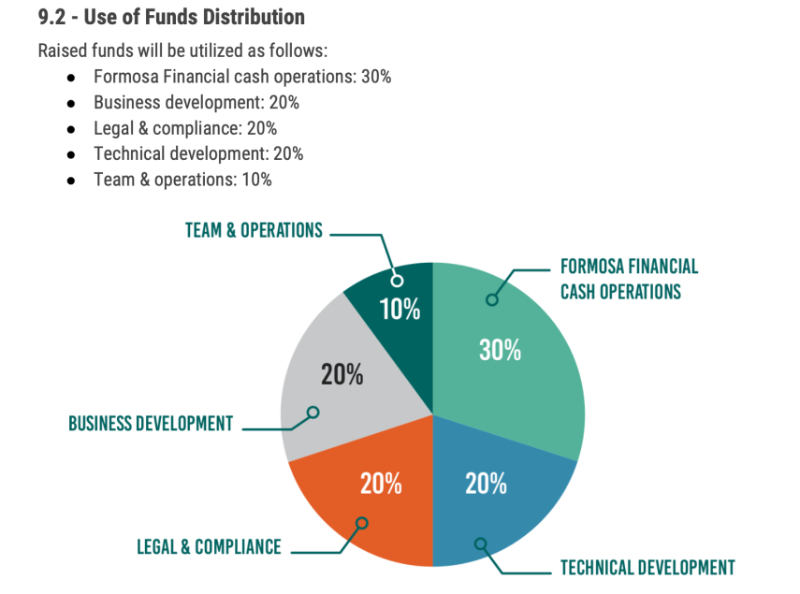

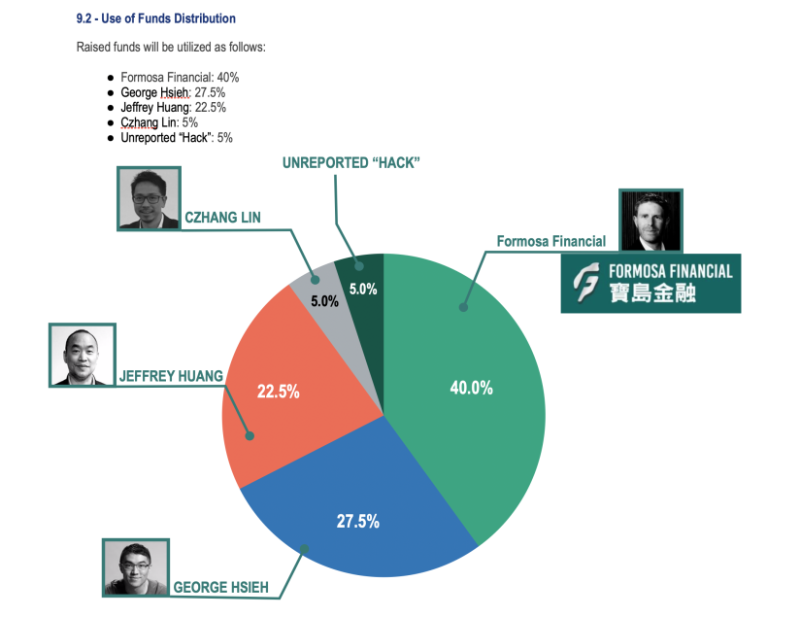

Starting in early 2018, Jeffrey Huang collaborated closely with Taiwanese politician George Hsieh, Czhang Lin, and Ryan Terribilini to launch Formosa Financial—a treasury management platform built for blockchain companies. Formosa Financial held an angel round in the last week of April 2018, raising 22,000 ETH. A private sale concluded on May 31 raised another 22,000 ETH. These sales represented 30% of the total token supply. In total, Formosa Financial raised $23 million (44,000 ETH). Notable investors included Binance, QCP Capital, Lemnis Cap, Block One, Mithril/Jeff Huang (remember this), Maicoin, Wilson Huang, Leo Cheng's Syndicate, Blockstate, and Block One.

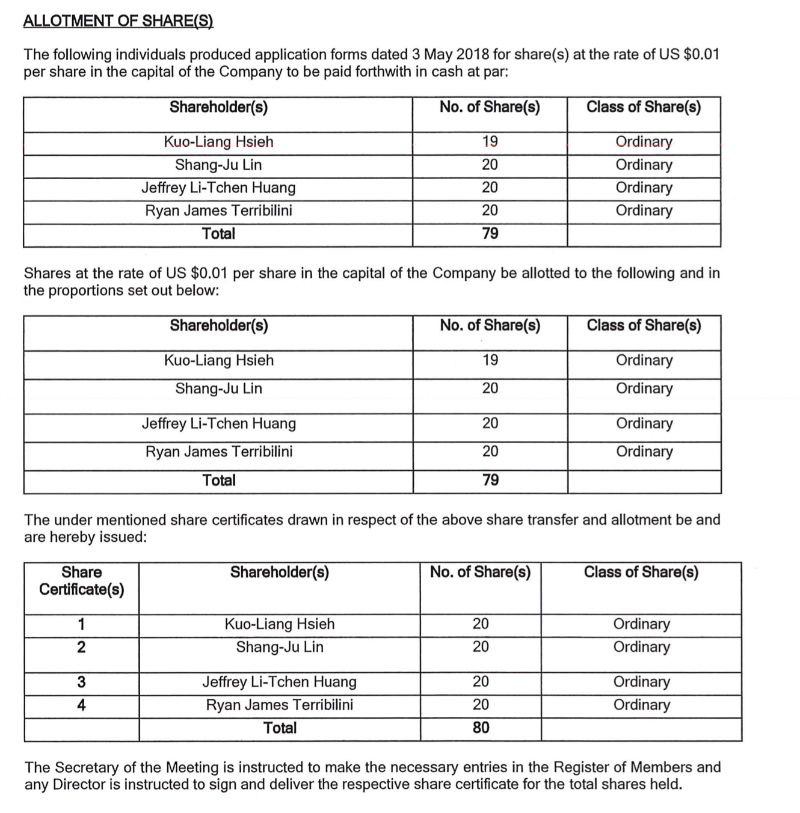

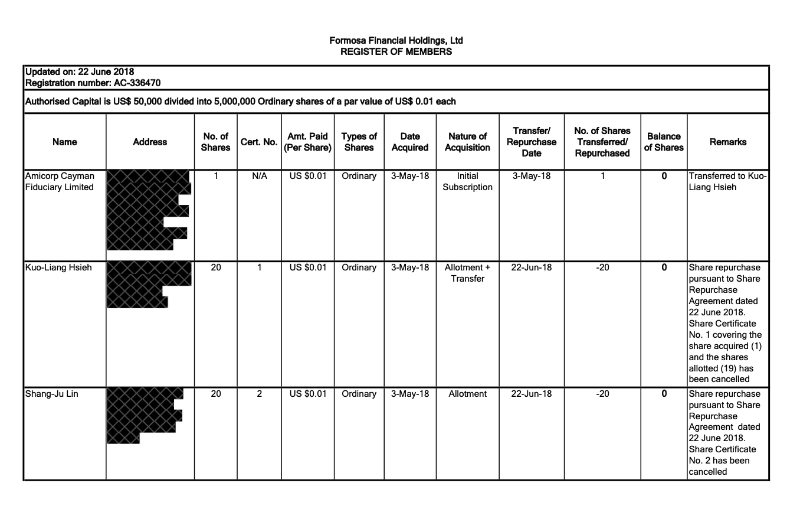

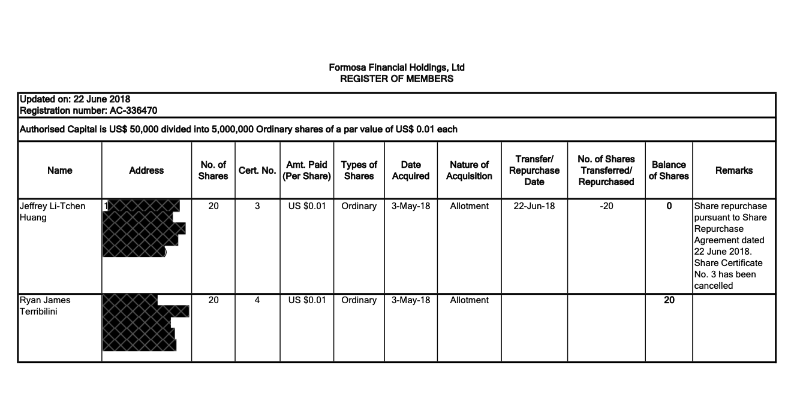

Equity Distribution

Formosa Team

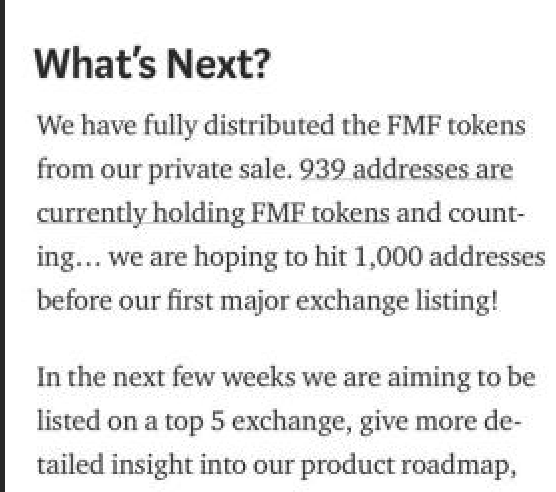

Investors were pitched the idea that FMF tokens would quickly be listed on top-tier exchanges.

Excerpt from deleted Medium article

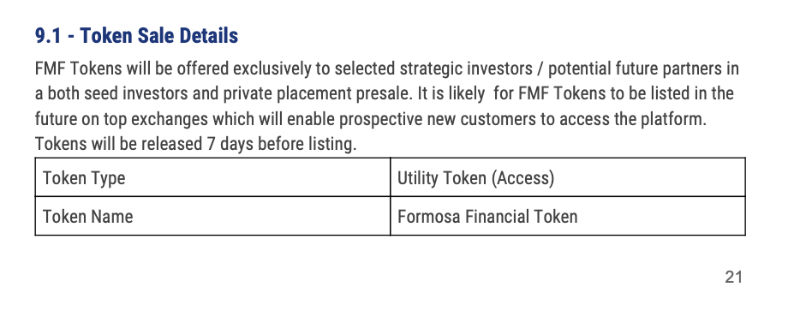

Excerpt: Token allocation for potential investors in the whitepaper

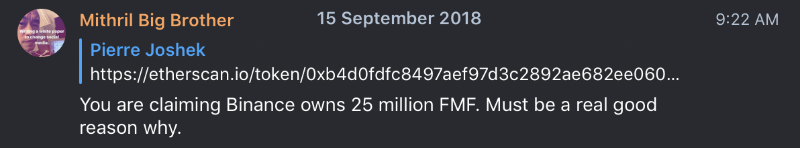

Suggesting listing on Binance

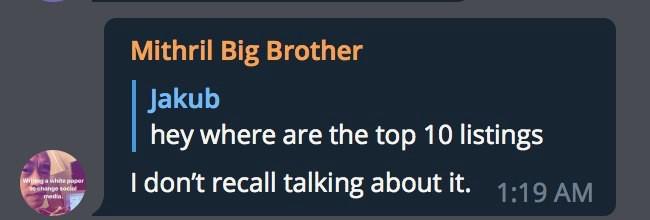

Machi Big Brother denies later

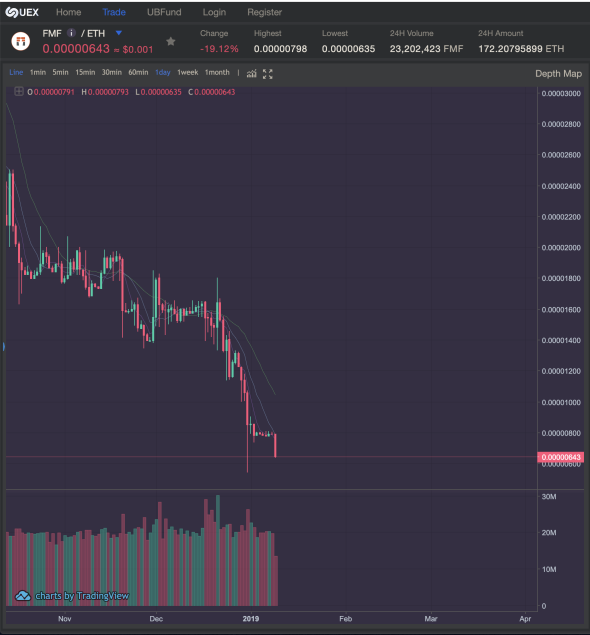

FMF launched on the decentralized exchange IDEX in June 2018 and immediately plummeted. It wasn’t until September 2018 that it appeared on centralized exchanges (IDEX, UEX).

FMF Token Trading on IDEX

Meanwhile, 17 Media was originally scheduled to go public on the New York Stock Exchange (NYSE) on June 7, 2018. However, due to unspecified settlement issues with investors, the IPO was postponed after failing to raise $115 million. ZachXBT contacted an unnamed source to uncover the reason:

"M17’s halted trading and current status as a private entity are unrelated to regulators or Citibank mistakes.

M17 ultimately failed to meet audit and reporting requirements and could not overcome bid thresholds on their books because people couldn’t adapt to this business model."

After the failed IPO, Huang expressed frustration on Facebook, attacking both Citibank and Deutsche Bank, which were involved in the offering.

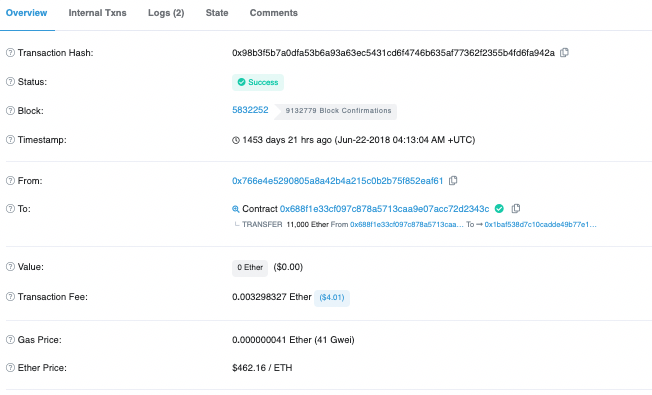

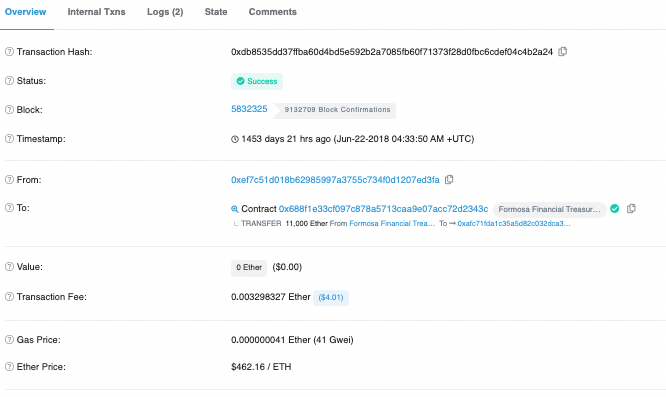

Three weeks after the FMF ICO, Formosa Financial took a sharp downturn. On June 22, 2018, the project’s treasury wallet was drained twice—each time extracting 11,000 ETH. Unbeknownst to investors, co-founder George Hsieh, acting as sole director, unilaterally initiated a dual share buyback.

Share Buyback on June 22, 2018

Share Buyback on June 22, 2018 (2)

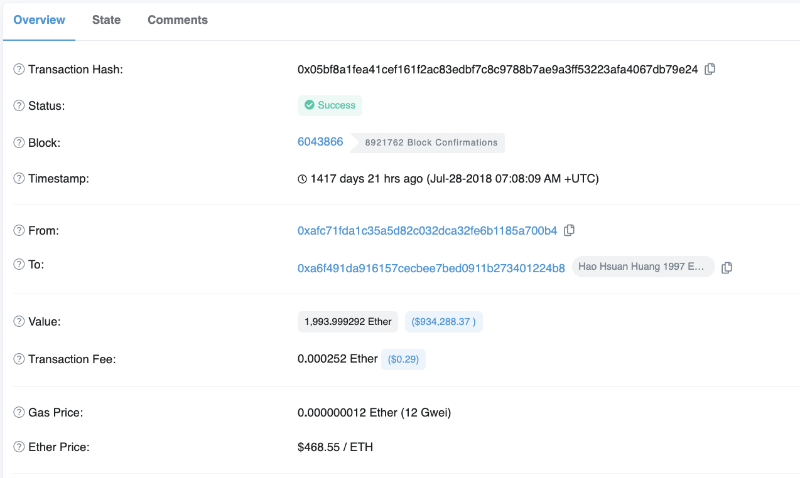

Transaction Record #1

Transaction Record #2

George Hsieh, Jeffrey Huang, and Yalu Lin all resigned from official roles, leaving co-founders Ryan Terribilini as CEO and Lorne Lantz as CTO.

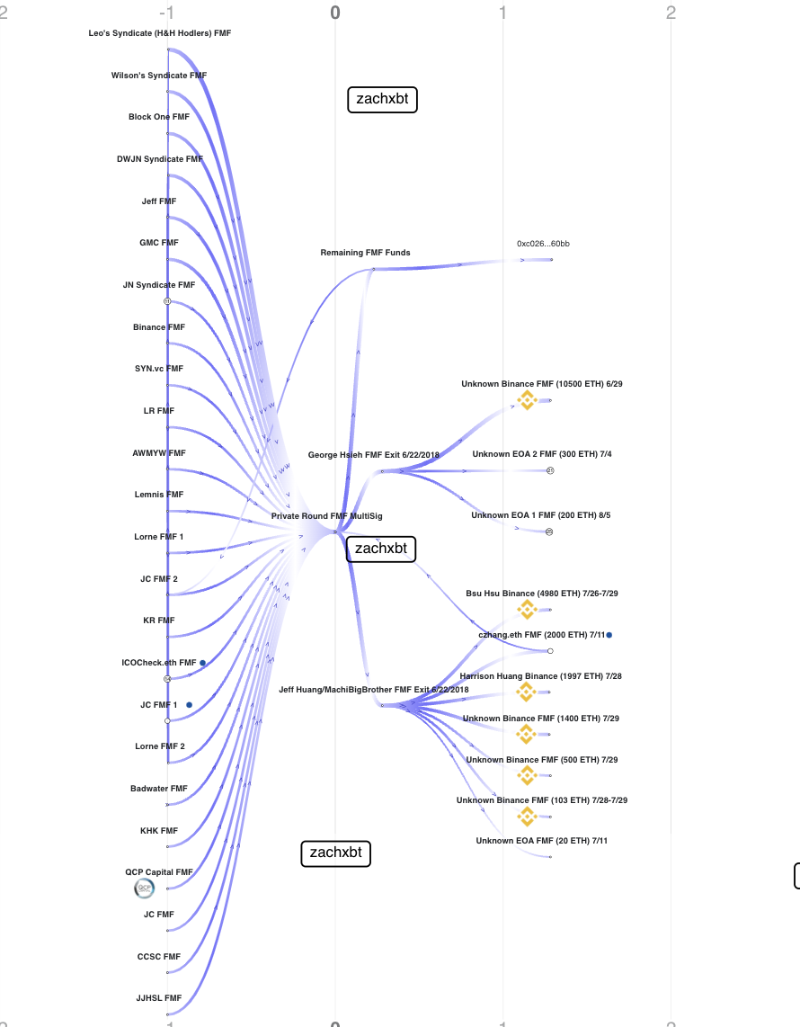

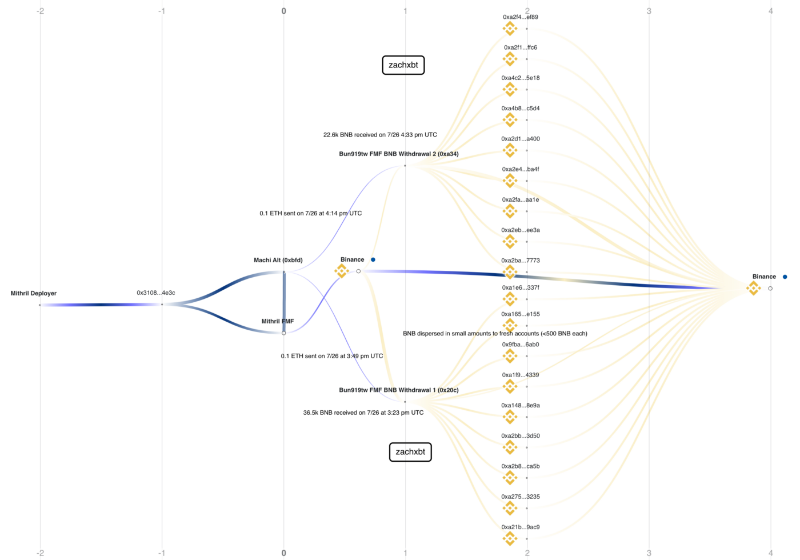

Breadcrumb diagram by ZachXBT

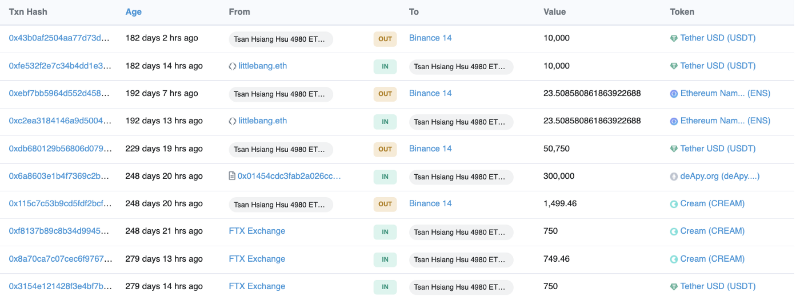

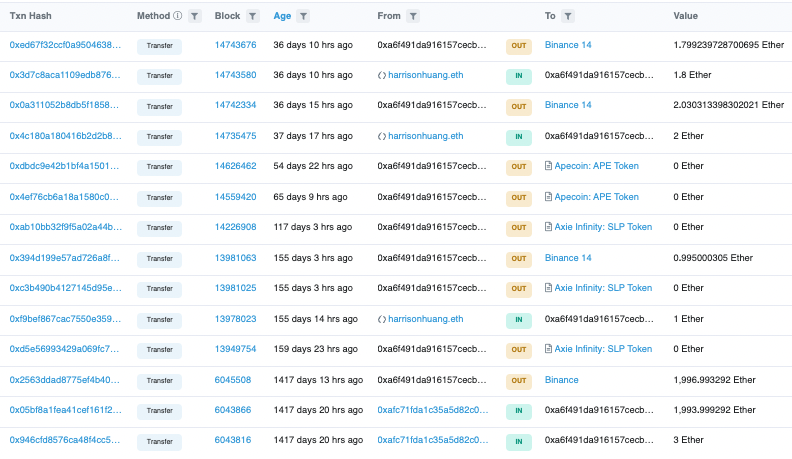

This chart shows ETH flowing into the multi-sig wallet from angel/private round funding prior to the two 11,000 ETH withdrawals by Huang and Hsieh on June 22, 2018.

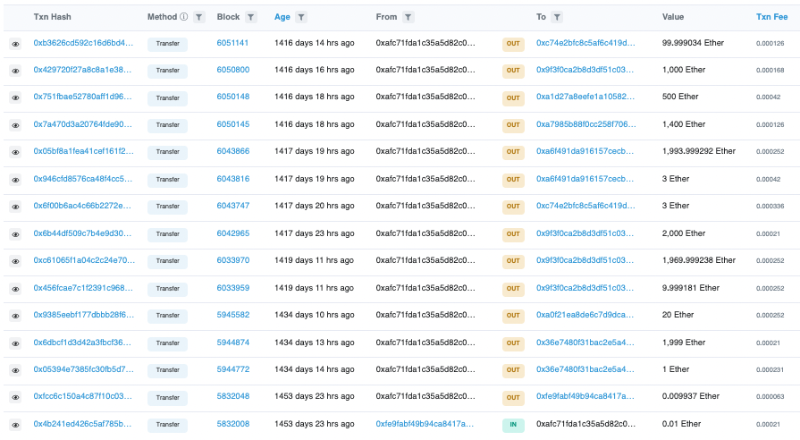

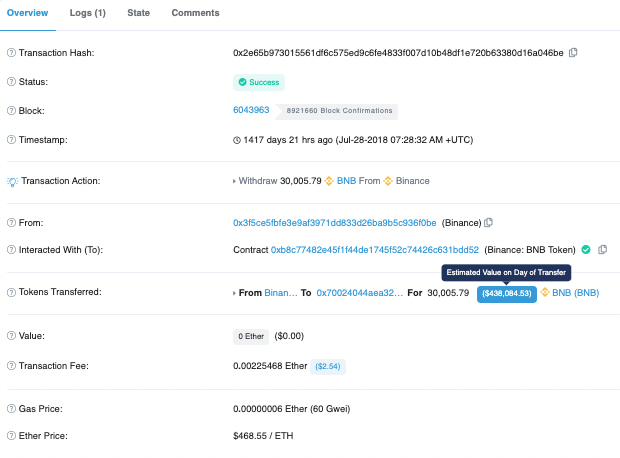

On June 29, 2018, George Hsieh transferred 10,500 ETH to a Binance account. The KYC authenticity of this Binance account remains unverified.

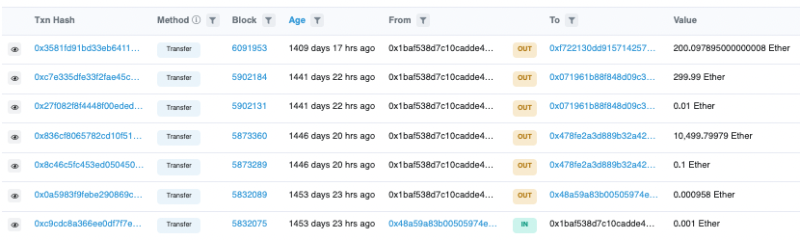

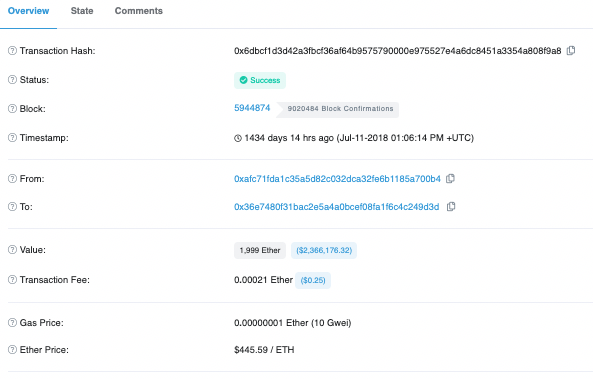

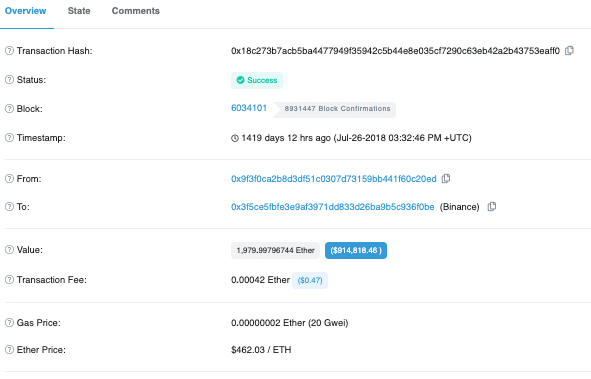

As for Huang, the 11,000 ETH he withdrew remained idle for a while before being transferred in late June and early July to various Binance accounts: 4,980 ETH, 1,997 ETH, 1,400 ETH, 500 ETH, and 103 ETH. Among these, 2,000 ETH were sent to czhang.eth, and 20 ETH allocated to an EOA wallet.

Questions remain: Who owns these Binance accounts and wallets? Let’s dig deeper and examine some of these ETH outflows!

1. 4,980 ETH outflow from July 26–29, 2018: Records show this Binance account frequently received inflows from two sources: FTX and littlebang.eth

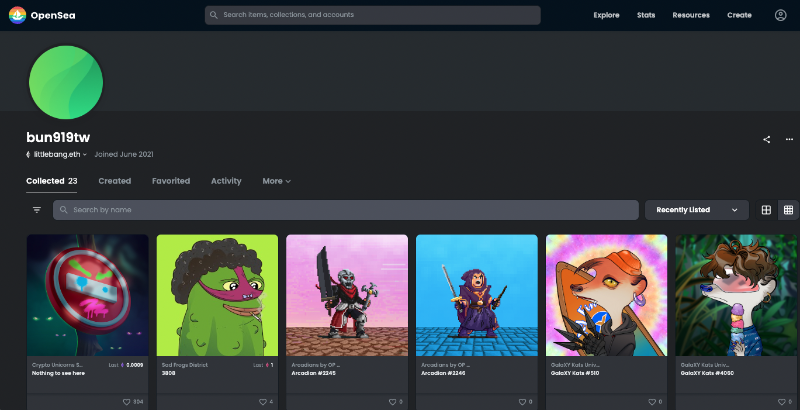

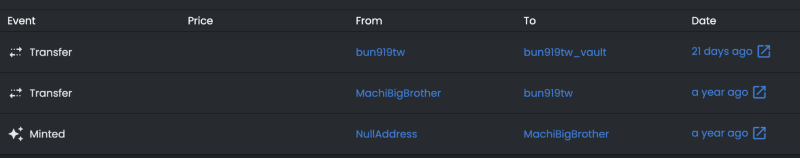

1a) Looking up littlebang.eth on OpenSea reveals the username “Bun919tw”

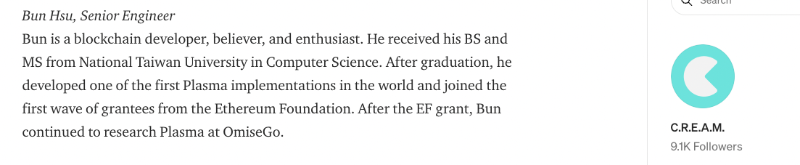

Excerpt from Cream Finance Medium article

b) A quick Google search reveals “bun919tw” is actually Bun Hsu, core engineer at Cream Finance (Cream being another project by Huang).

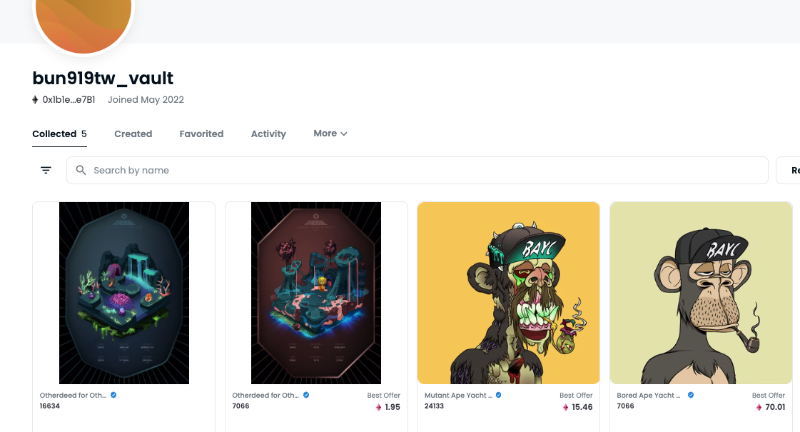

c) Bun Hsu’s Twitter profile picture is Bored Ape #7066, gifted to him by machibigbrother.eth (Jeff’s public wallet).

Bored Ape #7066

d) Bun Hsu also happened to trade multiple Jeff-related projects such as FMF, SWAG, CREAM, SQUID, PHOON, MCX, and MIS/MIC.

Why would someone not part of the Formosa team receive 4,980 ETH just three weeks after the ICO—and also trade tokens from other Machi Big Brother projects and receive a BAYC from him?

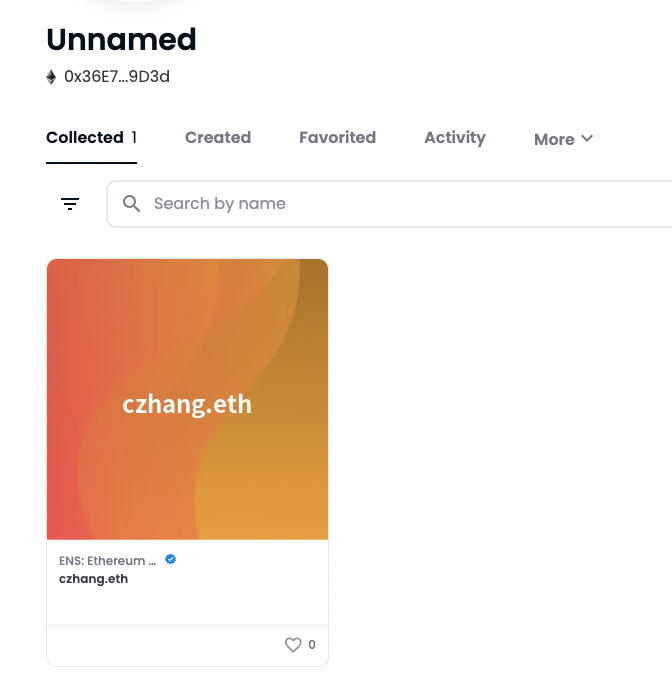

2. 2,000 ETH outflow on July 11, 2018: Blockchain records show this transaction was received by czhang.eth (Czhang Lin). Mr. Lin served as an advisor to Formosa Financial until June 22.

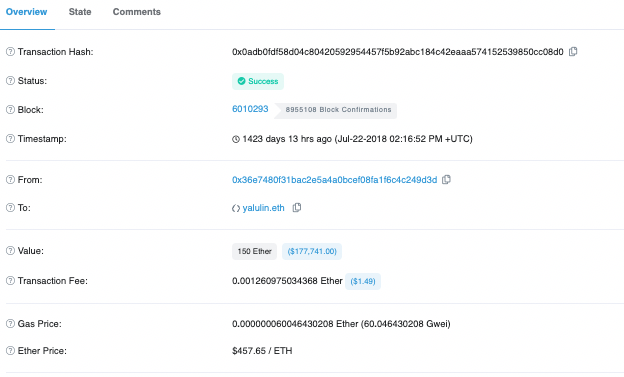

a) Three weeks after receiving 2,000 ETH, Czhang sent 150 ETH to his brother Yalu Lin (COO of Formosa Financial) on July 22, 2018.

Again, why would advisors and COO of Formosa get paid to build the project?

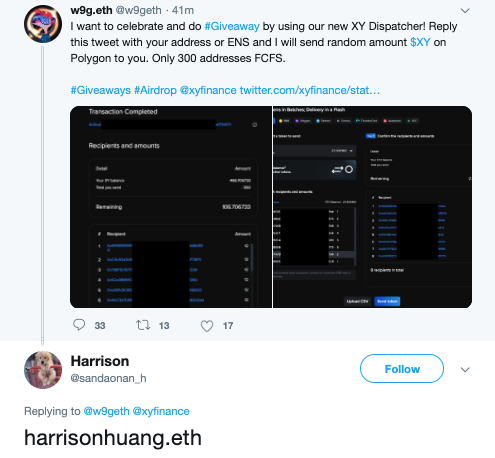

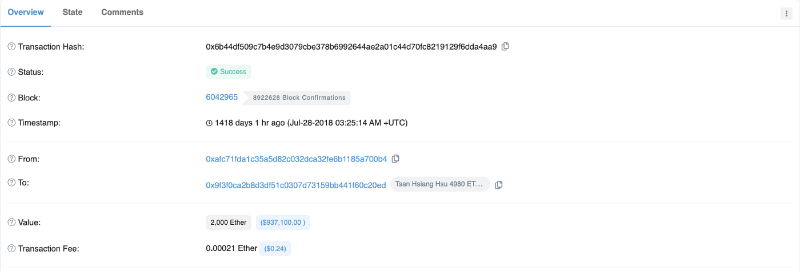

3. 1,997 ETH outflow on July 28, 2018: The only inflow to this Binance account came from harrisonhuang.eth, which frequently interacted with w9g.eth (Wilson Huang), VP of Engineering at Mithril and founder of XY Finance and GalaXY Kats.

Wilson sends NFT to Harrison

MAYC sends Mutant Ape to Wilson

a) A quick Twitter search for harrisonhuang.eth suggests this is his account, as he posted his ENS address replying to Wilson.

Twitter connection

Harrison was not listed as a team member on Formosa Financial’s whitepaper or website. Again, we see a pattern of individuals with no public ties to Formosa receiving project funds.

The rest of the Binance accounts receiving funds from Huang lead to dead ends—these accounts haven't interacted with any external or personal addresses recently, only moving assets between CEXs.

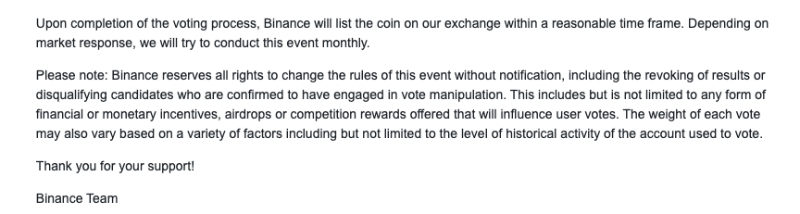

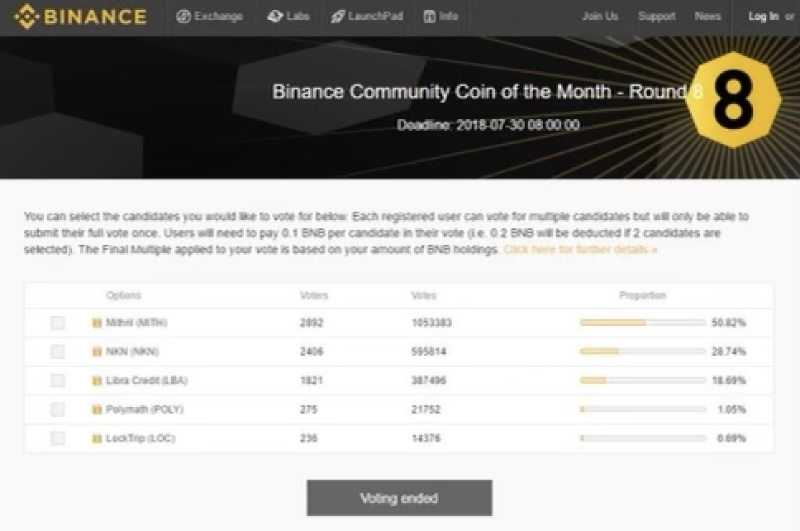

On July 26, 2018, Huang and Mithril were caught cheating in Binance’s monthly community coin vote. A user named Lucky found evidence showing Mithril received over 80,000 votes funded by just two or three addresses.

The voting mechanism worked like this: 1 BNB = 1 vote, with a maximum of 500 BNB/vote per account (so max 500 votes per voter). However, Binance stated that creating fake accounts and spreading BNB widely would result in automatic disqualification.

During this Mithril campaign, Huang used the same address tied closely to the Formosa Financial ICO, which held $8.6 million worth of MITH. The image below shows the bulk BNB transfer wallet receiving ETH as gas from the wallet of Mithril’s largest whale at the time.

Mithril Breadcrumbs flow map by ZachXBT

Worse yet, the large amount of BNB used to cheat the community vote coincided with the day Bun Hsu received 1,980 ETH—in fact, deposited into his Binance account less than an hour before voting.

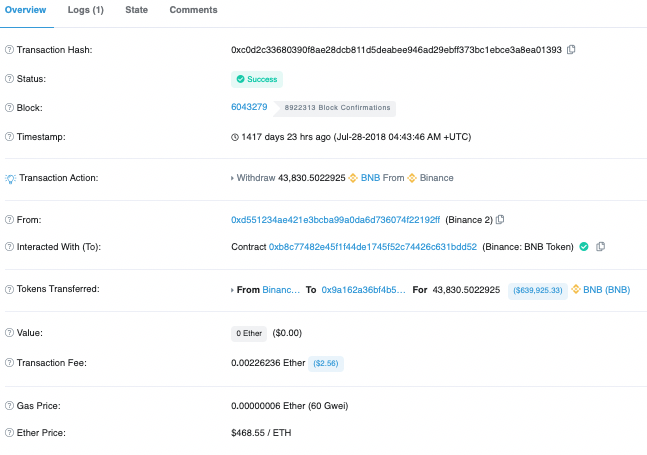

Examining on-chain transactions, I found additional instances where BNB was distributed in smaller amounts (500 BNB or less) to Binance, aligning with the timeline of FMF fund theft.

1a. 3:25 AM UTC on July 28 – 2,000 ETH deposited to Bun Hsu’s Binance account

1b. 4:43 AM UTC on July 28 – 43.8k BNB withdrawn from Binance (likely Bun)

2a. 7:08 AM on July 28 – 1,994 ETH deposited to Harrison Huang’s Binance account

2b. 7:28 AM UTC on July 28 – 30k BNB withdrawn from Binance

Again, these addresses are linked to Huang/Mithril. Unfortunately, this is likely where most of Formosa Financial’s funds ended up.

Mithril won the vote

After Binance filtered out suspicious votes

Once again, this shows where Formosa’s funds went.

Here’s where they went:

By fall 2018, communication with Huang, Czhang, and other key FMF team members became increasingly distant, without proper explanations or project updates. FMF continued to crash, and the sudden abandonment by key team members left the project crippled.

Wash-trading bots on IDCM

Project Three: Machi X

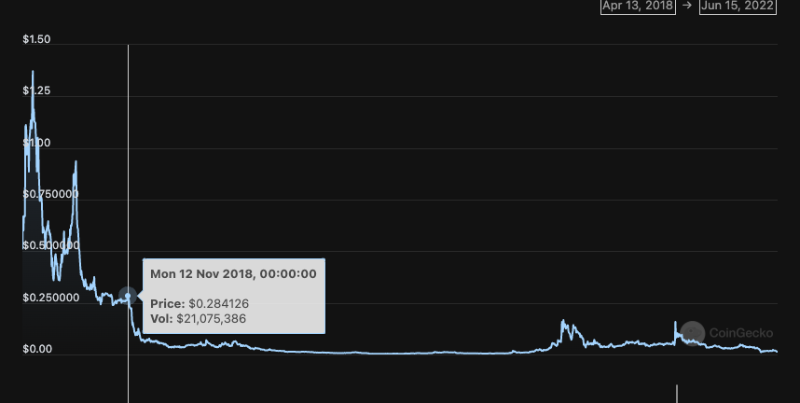

In October 2018, Huang and Leo Cheng launched Machi X, an intellectual property rights exchange, but struggled to secure funding due to the poor performance of Huang’s earlier projects—Mithril and Formosa Financial.

Mithril was listed on Binance in November 2018, coinciding with the unlock of team tokens. By then, MITH had already dropped over 80%, and development was completely abandoned by 2020.

Price chart. Source: Coingecko

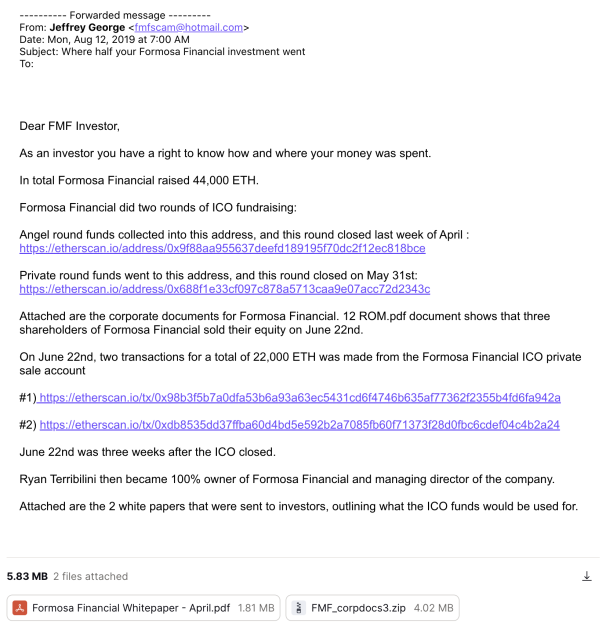

It wasn’t until over a year later that Formosa Financial investors finally learned what happened to their investment. On August 12, 2019, investors received an anonymous email revealing that 22,000 out of 44,000 ETH from the Formosa ICO private wallet had been withdrawn just three weeks after the ICO. Internal documents proving this were attached.

In this leaked 2019 recording, former Formosa CEO Ryan Terribilini shares his perspective on how Jeff and George misused the funds.

I reached out to several VCs and angels who invested in the project to understand why they didn’t take legal action against Huang and Hsieh. This mainly comes down to Huang and Hsieh being seen as powerful figures in Taiwan—investors I spoke with feared repercussions if they spoke up. Others simply didn’t want to deal with the mess due to cross-jurisdictional complications. All agreed—they just wanted to forget it ever happened.

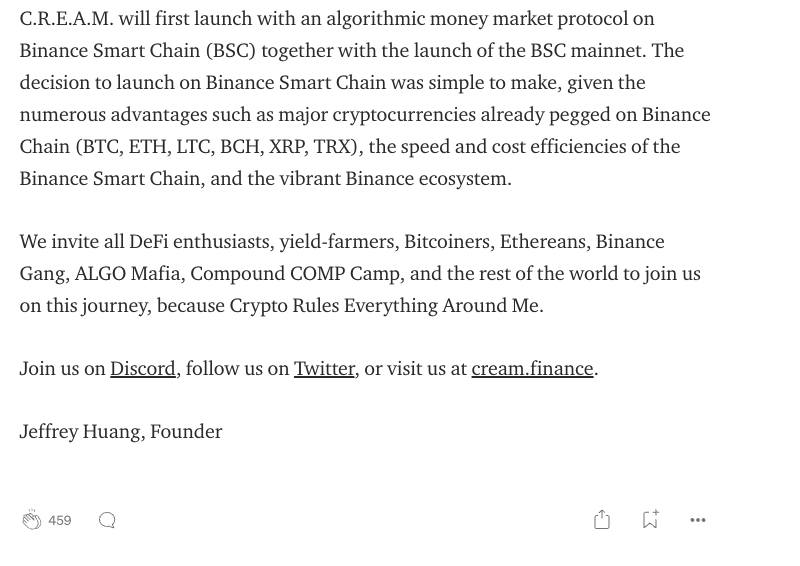

Project Four: Cream Finance

In 2020, the crypto market heated up again. In early July 2020, Huang forked Compound Finance with Leo Cheng to create Cream Finance. Bun Hsu, Jeremy Yang, and Stanley Yang were all part of Cream’s development team. To date, Cream Finance has suffered three major hacks due to technical oversights, losing over $192 million.

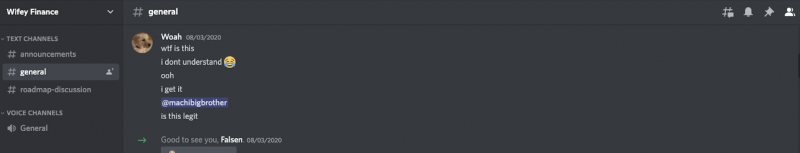

Project Five: Wifey Finance

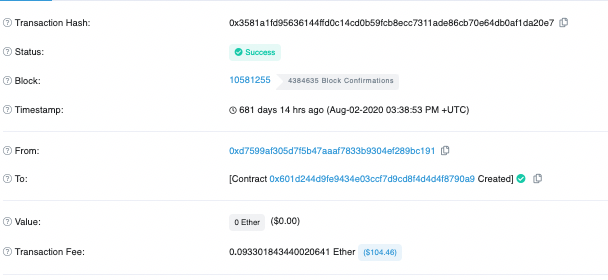

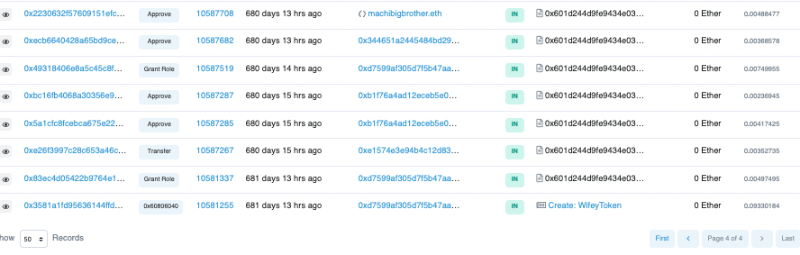

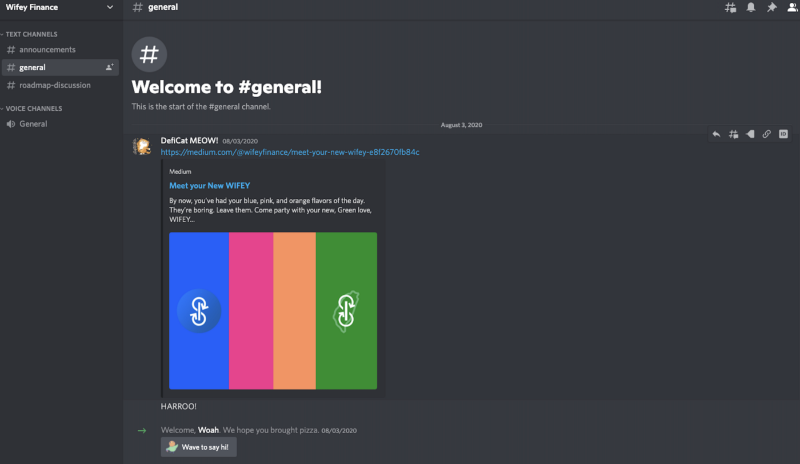

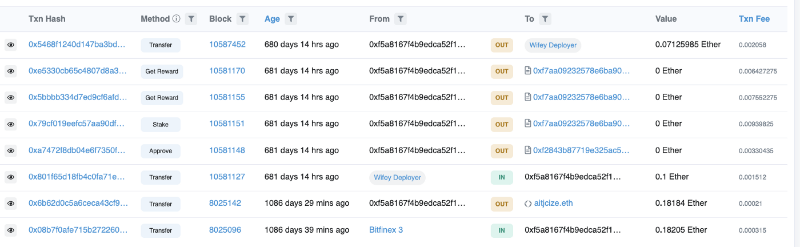

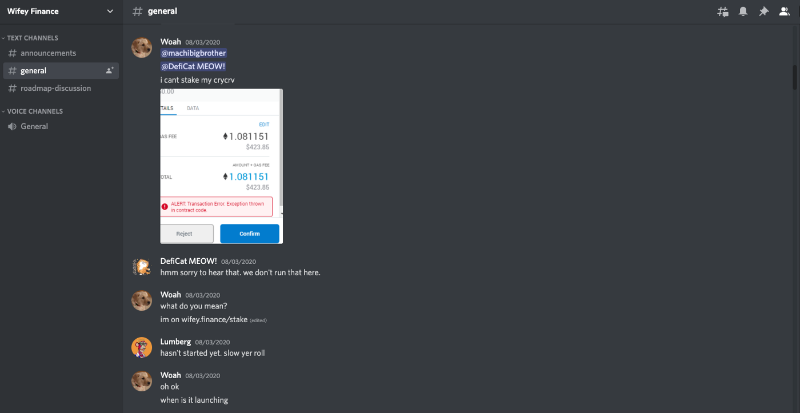

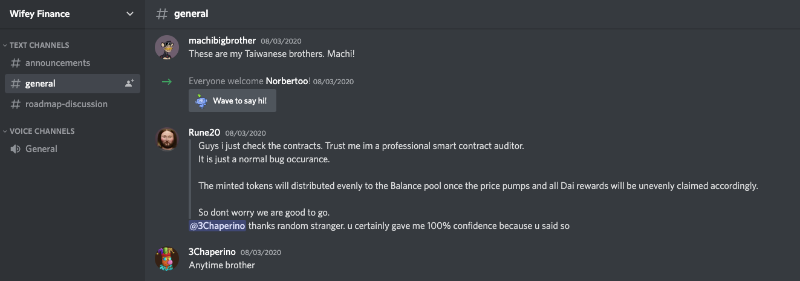

In August, an “anonymous team” launched Wifey Finance, a Yearn Finance fork. Machi Big Brother, Leo Cheng, and Wilson Huang all happened to be among the first members in the Wifey Discord channel. Transaction records show the Wifey deployer repeatedly sent funds to Wilson Huang. Four days later, Wifey Finance was abandoned.

Smart contract created on August 8, 2020

Machi’s address was one of the earliest traders

Machi was among the first to join Discord

Wilson Huang receives funds from Wifey Deployer

Then Leo Cheng (Lumberg) showed up

No posts or activity in Discord since August 7, 2020. Wifey lasted five days.

Project Six: Swag Finance

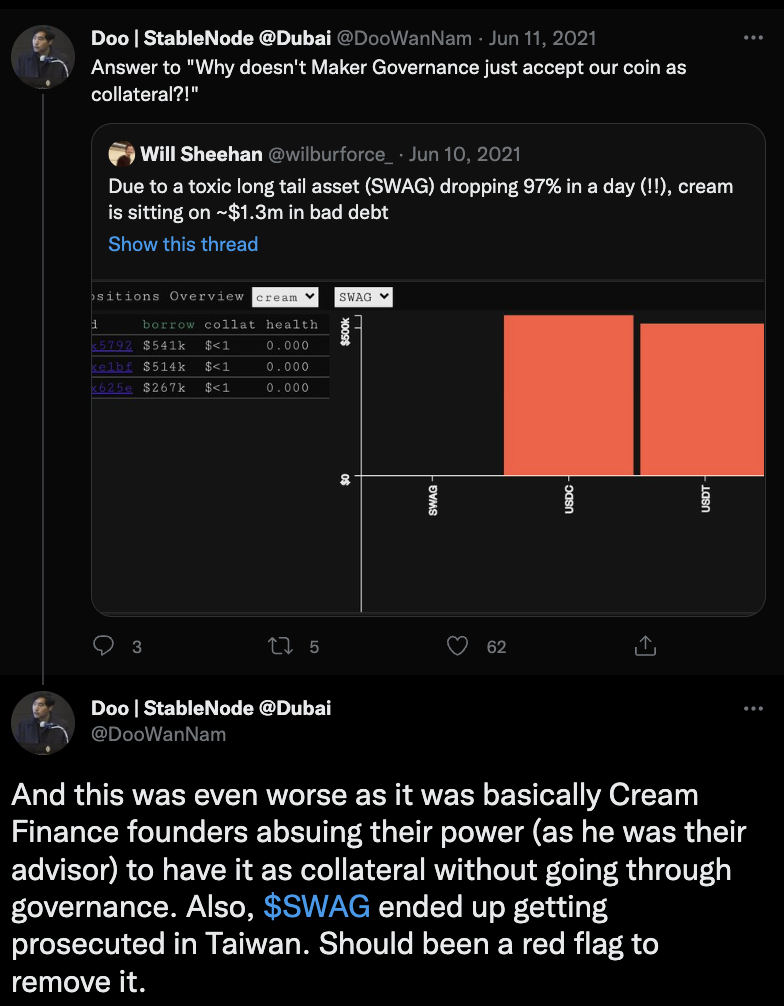

Another project launched by Machi Big Brother, Swag.live—an adult entertainment site—introduced a governance token in early October 2020. Controversy erupted on Twitter when Swag was quietly listed as collateral on Cream Finance without transparency. Within weeks, the token was mined, dumped, and delisted from Cream.

Swag controversy

Mine, dump, crash

Swag delisted from Cream 1.5 months after launch

Read more: Veteran crashes — SWAG drops 99.99% in half an hour! To counter "malicious dumping," the team urgently launches a $250K buyback plan

Project Seven: Mith Cash

On December 30, 2020, Huang and Mithril returned with a new project: Mith Cash, a fork of the Basis Cash protocol (an algorithmic stablecoin). Just days after launch, Mith Cash’s TVL surged to $1 billion before crashing as token holders cashed out rewards. Mith Cash ultimately met the same fate as Basis Cash. Like Huang’s other projects, the team was “anonymous,” and Huang claimed to be merely an advisor.

MITH Cash token price chart. Source: CoinMarketCap

Project Eight: Typhoon Cash

Shortly after Mith Cash collapsed and burned, Machi Big Brother returned with Typhoon Cash, a Tornado Cash fork. The Typhoon team claimed to be anonymous, but it was widely known that Huang and his associates were behind it. At launch, flaws were obvious. Anyone could stake in the anonymity pool and remain anonymous, but to claim rewards, deposits had to be doxxed—rendering the concept of anonymous coins meaningless. Weeks after mining began, the project was abandoned, with members fleeing Telegram and Discord channels.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News