Lui Tai: From Pop Star to "Monkey Father," How Did This NFT Big Player Rise?

TechFlow Selected TechFlow Selected

Lui Tai: From Pop Star to "Monkey Father," How Did This NFT Big Player Rise?

Machi Big Brother, Stanley Huang—if you care about NFTs, you've definitely heard this name.

Interview & Writing: Heavenraven

Machi Big Brother, Jeffrey Huang—If you follow NFTs, you've definitely heard this name.

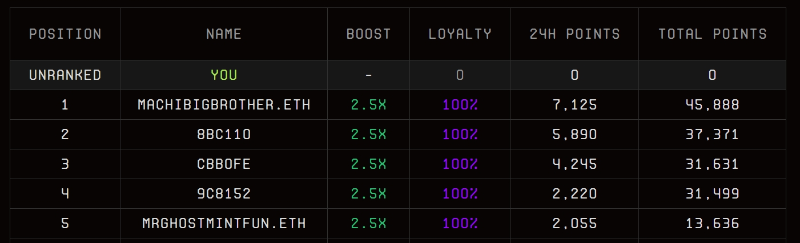

During Blur's points farming campaign, Huang often ranked at the top. Recently, he sold a total of 1,010 NFTs—including BAYC—in just two days, netting 11,680 ETH (approximately $18.6 million), shaking up the entire NFT market. BAYC dropped over 8%, affecting liquidations for many NFTs on BendDAO and showcasing the brother’s power and influence.

From Mithril coin during the 2017 ICO wave, to CREAM in DeFi Summer, and now as a major player in the NFT ape scene, Huang has always been riding the wave.

How exactly was this "Big Brother" forged?

With that question in mind, we’re sharing fashion media outlet Heavenraven’s 2022 interview with Jeffrey Huang about all things NFT. Here is the full article:

Whether you're a hip-hop fan or a blockchain enthusiast, the name Jeffrey Huang, aka Machi Big Brother, carries serious weight.

In 2003, the hip-hop group Machi burst onto the scene, and their catchphrase “My machi zitao?” became a nationwide sensation. Afterward, the business-savvy Big Brother expanded his ventures into various fields—from fashion brands and nightclubs to live-streaming platforms—each leaving a strong mark.

In recent years, he has gradually shifted focus from entertainment to the blockchain industry. Today, we’ll hear how he got started in cryptocurrency and NFTs.

How did you first get into crypto?

Jeffrey Huang: Back in 2017 when I was running 17 Live, crypto started heating up and everyone was doing ICOs. I told my shareholders we should jump on this trend! But they all said it was a scam. Okay, fuck it—I decided to do it myself.

So in 2018, I launched Mithril (MITH) and introduced social mining—rewarding users with tokens for uploading photos or videos. We were ahead of our time, but because we moved too fast, many details weren’t properly thought through, and eventually the token price crashed. It was unfortunate, but I learned a lot. Later, I went on to build CREAM.

But wasn't CREAM hacked before?

Jeffrey Huang: Yeah, that one really hurt. I took an expensive lesson and realized just how deep DeFi waters can be. At the time, we lost around $140 million in the hack. But we worked hard to compensate affected users, and today CREAM continues to generate profits.

In November 2020, I made the decision to hand over control of CREAM to Andre Cronje, founder of Yearn. That was a great move—Andre is truly brilliant, and I felt completely confident passing it to him. Then, with the pandemic hitting and staying home with nothing to do, I began focusing heavily on NFTs.

Yes! This is exactly what we want to hear about—NFTs.

Jeffrey Huang: I first touched NFTs around 2018—I even considered slicing up music tracks and selling them as NFTs online. But again, I was too early, so I pivoted to DeFi instead. The real reason I dove fully into the NFT market was because of a friend—a Taiwanese girl named Emily Yang, who is a well-known NFT artist. She had a project selling digital art to raise funds for the #StopAsianHate movement. Such a meaningful cause deserved support! So I rallied a few friends, united under her nickname “pplpleasr,” forming the organization known as PleasrDAO.

At first, it was just for fun. But as more influential figures and financially capable entrepreneurs joined PleasrDAO, we decided to turn it into a decentralized art investment collective. For example, when hacker-legend Edward Snowden released his NFT titled *Stay Free*, we believed in its value and were determined to win it no matter the bid. The auction was intense—we almost gave up hope, but in the final five minutes, a friend reached out asking how much we needed and offered help. In the end, we secured it for $5.4 million. We also own the original Doge meme NFT.

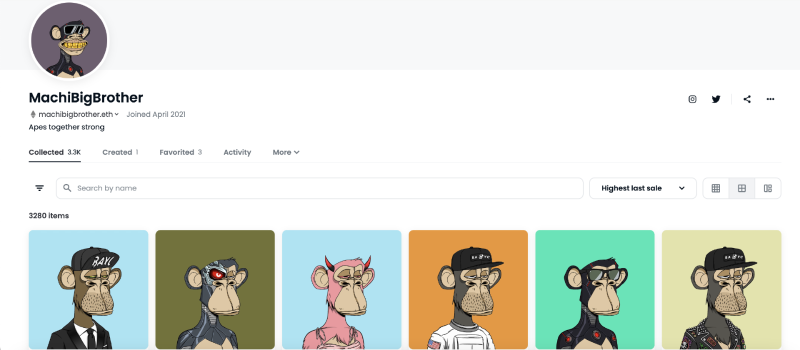

What about Bored Ape Yacht Club (BAYC)?

Jeffrey Huang: I’d actually been watching BAYC for a long time. There were many days available to mint, and on the last day, I minted 40 apes by myself in the middle of the night. Then I called some friends to join. Sam, co-founder of 17 Live, went wild—he minted 120 apes right away, WTF! I couldn’t let that slide, so I doubled down and kept going. After minting, I bought more on the secondary market—paying one ETH, two ETH per ape, no hesitation. In the end, I accumulated nearly a hundred apes. By morning, when other PleasrDAO members woke up complaining they missed out, I figured the fun was in sharing—so without thinking twice, I gifted over 30 away.

You basically started the ape trend among celebrities, didn’t you?

Jeffrey Huang: I remember Kai Kai (Ko Chen-tung) was the first celebrity I gave one to. Pauline’s ape came from me too. Pauline has good taste—she picked one of my rarest, ranked within the top 50 or so. At the time, they weren’t as expensive as they are now, but still not cheap—around ten thousand dollars each.

Then you see Stephen Curry buying one, Snoop Dogg, even Eminem—all joining in. That’s the power of community, and that’s what makes crypto exciting. BAYC isn’t my project, but if you like it, you can contribute using your influence. You spread awareness and bring more people into the space.

But beyond profile pictures, what else can NFTs do?

Jeffrey Huang: NFT stands for non-fungible token, and its applications can be broad—property deeds, art copyrights, even identity verification could become NFTs. The technology already exists. The real challenge lies in policy—do governments understand this? Are they willing to move in this direction? That remains uncertain.

Also, most people still treat it like entertainment. They either think it’s a scam or bubble, or only care how much their coins or NFTs will appreciate. Who cares about decentralization anyway? That’s normal. When Web 1.0 first emerged, nobody could imagine what it would become. Everything evolves through stages.

Brother, can you reveal your NFT holdings?

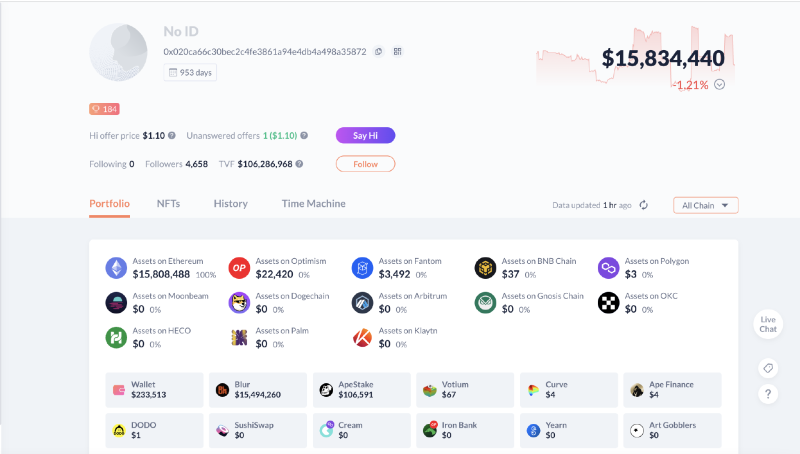

Jeffrey Huang: Giving numbers feels tacky. One of the cool things about blockchain is transparency—just go check my wallet yourself.

Note: Huang's wallet address is machibigbrother.eth (0x020cA66C30beC2c4Fe3861a94E4DB4A498A35872)

As of February 21, the wallet holds over $15 million in on-chain token assets, more than 3,100 NFTs, and a total portfolio value exceeding $50 million.

Finally, any advice for NFT newcomers?

Jeffrey Huang: People always say: NFA (Not Financial Advice). When others profit, they won’t thank you; when they lose money, they’ll blame you. My suggestion: if you’re interested, spend time lurking on Twitter, Medium, Discord—see what people are talking about. If you don’t understand something, Google it. Eventually, you’ll learn where information flows and which way trends are moving. Even if you lose money, it’s all part of the learning process.

It’s just like learning skateboarding or street dance. If you keep asking questions and worrying about risks without actually trying, you’ll never discover the tricks. Set your risk tolerance, then dive in and keep learning!

Epilogue:

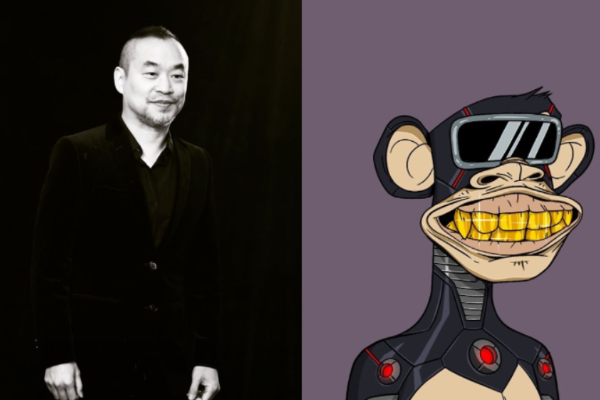

When we finally asked Machi Big Brother if we could take a few photos, he said he’s older now and doesn’t like being photographed—but offered his digital avatar (his Bored Ape PFP) instead. “Everyone knows the Bored Ape, and everyone knows I’ll always support it. I even joked once that I’m the ‘ChairApe of the Bored.’ Letting the virtual stay virtual—isn’t that the true magic of blockchain?”

“So no need to take photos—just use my monkey from Instagram and my wallet.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News