비트코인 외 암호자산의 과거 몇 차례 불장에서의 복기 리뷰가 주는 시사점

글: BowTied Bull

번역: 백화블록체인

2025년이 다가오며 새해를 맞이하는 시점에서 우리는 흔히 과거를 돌아보고 미래를 전망하곤 한다.

암호화폐 산업의 지난 시간을 되돌아보면 흥미로운 현상을 발견할 수 있는데, 바로 4년마다 한 번씩 '알트코인 시즌'(山寨季)이 찾아온다는 점이다. 이 기간 동안 산업 내 모든 것이 상승세를 타고, 술에 취한 삼촌이 동물 이모티콘 같은 메멘코인에 투자해서 큰돈을 벌었다는 소문도 심심찮게 들릴 정도다. 설사 그가 술에 취한 상태에서 거래를 했다 해도 말이다.

하지만 지금 2025년 시점에서 진정한 알트코인 시즌은 아직 본격적으로 시작되지 않았다. 이번 알트코인 시즌이 얼마나 광기 어린 모습을 보일지는 아무도 예측할 수 없지만, 여기서 한 가지 주의를 당부하고 싶다. 알트코인 시장의 흐름은 일반적으로 급속도로 통제 불능 상태에 빠지기도 하고, 갑작스럽게 종료되기도 한다. 일且 폭락이 시작되면 단순히 -99.99% 하락에 그치는 것이 아니라 완전히 사라질 가능성도 있다.

그러나 그런 폭락 이전까지는 모두가 번영과 오락의 분위기에 취해 있다. 그렇다면 지난 알트코인 시즌들을 다시 한번 돌아보며, 그들이 어떻게 발전했는지 살펴보고 유의미한 교훈을 얻을 수 있을까?

2012-2013 알트코인 시즌: 초기 열광 투자자들, 시가총액 최대 150억 달러

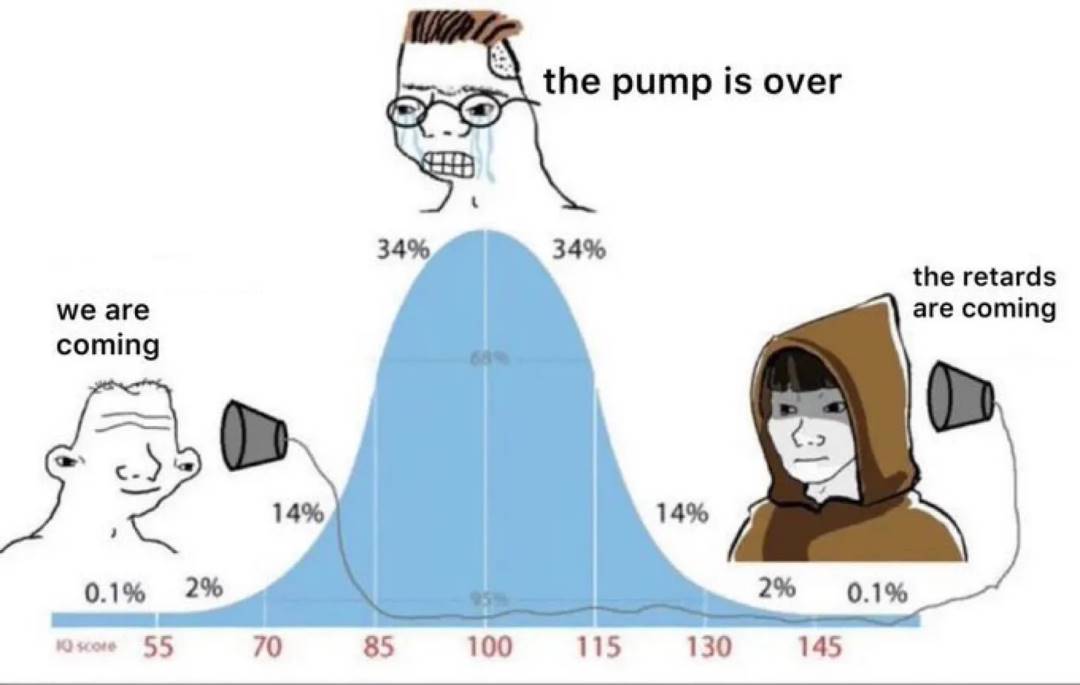

현재 시장에서 무작정 따라가는 추종 투자자들이 다시 나타날 가능성이 크다는 것을 알고 있다. 이런 현상은 2013년에도 이미 발생했으며, 당시 상황은 매우 흥미로웠다.

2013년 알트코인 시즌 당시, 비트코인은 여전히 초기 성장 단계에 있었고, 전체 시가총액은 약 10억 달러 정도였다. 고래 한 명의 거래 규모도 대개 10만 달러 정도에 불과했다. 당시 CEX Mt. Gox는 여전히 운영 중이었으며, 투자자들은 대부분 트레이딩 카드 게임 <매직 더 개더링>(Magic: The Gathering) 행사에 자주 출몰하는 사람들이었다(이는 나중에 Mt. Gox 사건의 배경이 되기도 한다).

당시 사람들은 비트코인의 거래 속도를 개선하기 위해 블록 생성 시간을 줄여야 한다고 주장했는데, 이를 당시에는 획기적인 혁신으로 여겼다.

라이트코인(Litecoin): 현재까지 존재하고 있으며, 그 핵심 아이디어(Charlie Lee 제안)는 비트코인의 10분 블록 시간을 2.5분으로 단축하는 것이다.

라이트코인의 가격은 약 10센트에서 48달러까지 치솟았으며, 약 47,900% 상승했다. 이후 2017년 또 한 번 크게 상승했고, Charlie Lee는 정점에서 자신의 모든 지분을 매각하며 "내가 없더라도 비트코인 네트워크는 잘 작동한다"고 언급했다(창립자가 보유 지분 100%를 처분한다는 것이 어떤 의미인지 모두가 알고 있다).

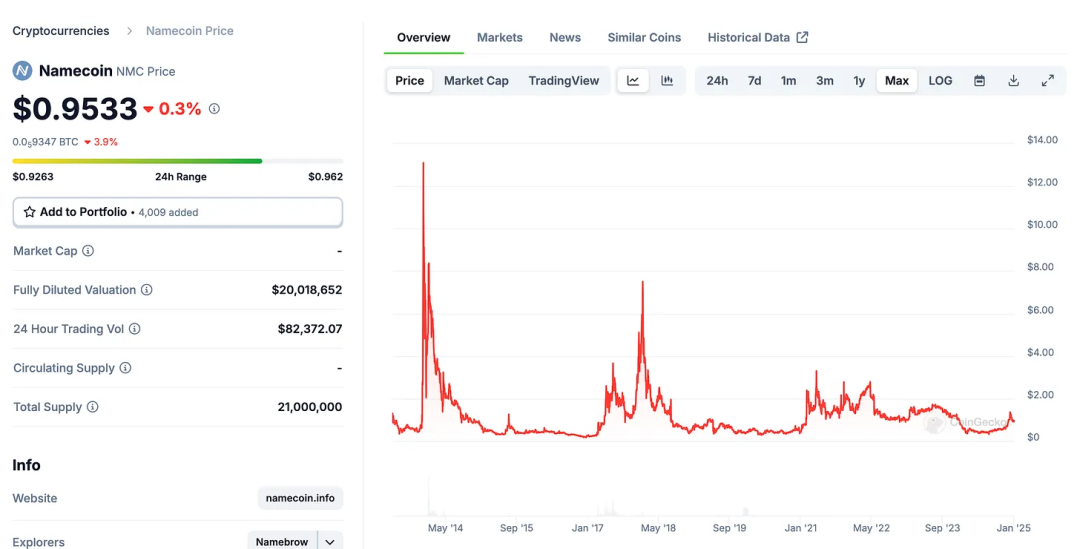

Namecoin: 비트코인의 포크 코인으로, 분산형 네트워크 도메인(.eth 확장 개념과 유사한 ENS)을 만들려는 시도였다. 가격은 한때 약 13달러까지 급등했으나 곧바로 하락했다. 최저점 대비 최고점까지 약 30배 상승했다. 실제로 이 프로젝트는 여전히 존재하며, 현재 거래 가격은 약 1달러 근처다.

Peercoin (PPC): 최초의 지분 증명(PoS, Proof-of-Stake) 토큰 중 하나로(이 메커니즘은 현재 ETH 보안에도 사용됨), 두 차례의 급등을 경험했다. 첫 번째는 2013년, 두 번째는 2017년 ETH ICO 열풍 때였다. 가격은 한때 약 7달러까지 올라 60~70배 상승했으나, 결국 주류 채택은 실패했고 가격은 0.42달러로 하락했다. (단, 현재 판단으로는 Bitconnect나 LUNA와 같은 순수 폰지 사기 외에는 시장의 다른 대부분 프로젝트가 완전히 제로로 돌아가진 않을 것으로 보인다.)

열풍: 비트코인이 결국 1200달러까지 도달했고, 암호화폐에 대한 관심 증가로 인해 다양한 암호화폐들이 함께 상승했다. BitcoinTalk에 글 하나 올리는 것만으로도 순전한 투기로 급등할 수 있었다. 오늘날 가장 비슷한 사례라면 아마도 유명인이 홍보하는 메멘코인이거나, 유명인 이름을 딴 메멘코인 정도일 것이다.

Mt. Gox 붕괴: Mt. Gox가 붕괴하면서 잔치는 끝났다. 이 사건은 대규모 해킹으로 인해 발생했으며, 비트코인 가격은 약 85~90% 급락했고(바닥을 어떻게 보느냐에 따라 다름), 알트코인들의 하락률은 99%를 훨씬 상회했다.

2017 알트코인 시즌: ICO 열풍과 이더리움의 부상, 시가총액 최대 8000억 달러

이후 약세장 기간 동안 여러 흥미로운 사건들이 발생했다. 이더리움은 스마트 계약 플랫폼으로 탄생하여 프로그래밍 가능한 화폐를 만들겠다는 목표를 세웠다. 이는 진정한 혁신이었는데, 단순히 토큰을 이동시키는 것을 넘어 스마트 계약을 생성함으로써 게임의 판도를 완전히 바꿔놓았다.

암호화폐 분야의 많은 사물들과 마찬가지로, 이더리움 역시 흔한 위험 요소를 동반했다. 이더리움의 DAO(탈중앙화 자율조직)는 해킹을 당해 1억 달러 이상의 손실을 입었고, 결국 블록체인 분叉를 초래하여 ETH와 ETC 두 개의 체인이 생겨났다. 지금도 일부는 당시 분叉 결정이 잘못됐다고 주장하지만, 우리는 이 문제에 대해 깊이 논의할 생각은 없으며 단지 역사적 사실을 간략히 회고할 뿐이다.

약 2016년경, 사람들은 이더리움 블록체인 위에서 새로운토큰을 발행할 수 있다는 것을 깨닫게 되었고, 이것이 바로최초 토큰 발행(Ico)의 탄생 배경이 되었다. ICO에서는 프로젝트팀이 직접 투자자에게 토큰을 판매했다. 2017년, ICO 열풍이 본격적으로 터졌고, 상상할 수 있는 거의 모든 사기 프로젝트들이 우후죽순처럼 등장했다.

이더리움(ETH): 이 토큰들을 발행하려면 ETH가 필요했기 때문에 ETH 가격은 급등했고, 약 8달러에서 2018년 1월 1400달러까지 치솟았다. 당시로서는 상상조차 할 수 없는 수익률이었으며, 현재 ETH는 약 3650달러 선에서 거래되고 있다.

리플(XRP): 리플은 여전히 '은행용 코인'으로 여겨지며, 그 이론은 리플이 하루 아침에 SWIFT(국제자금결제시스템)를 대체하여 사실상의 금융 표준이 될 것이라는 것이었다. 리플은 중심화되어 있지만(대부분의 사람들은 신경 쓰지 않았다), 수백만 달러의 자금을 끌어모았다. 리플 가격은 약 1센트에서 3.80달러까지 치솟았으며, 현재는 2.41달러 선에서 거래되고 있다.

이상하게도 리플의 투자자층은 여전히 주로 개인 투자자들이다. 최근 한차례 상승장에서도 유사한 현상을 볼 수 있었는데, 리플이 TikTok에서 주목받으며 활발한 논의가 이어졌다. 심지어 "만약 리플의 시가총액이 비트코인 수준에 도달하면 어떻게 될까?"라는 질문과 함께 "4조 달러 시가총액"에 대한 논의가 벌어지기도 했는데, 다소 이해하기 어려운 현상이었다.

라이트코인(Litecoin): 앞서 언급했듯이, 라이트코인은 다시 한 번 상승했으며 가격이 한때 360달러까지 치솟았다. Charlie Lee가 자신의 모든 라이트코인을 매각했음에도 불구하고, 2021년에는 다시 384달러까지 고점을 찍었다!

EOS: EOS는 ICO를 통해 40억 달러를 조달하며 '이더리움 킬러'를 자처했다. 가격은 한때 22달러까지 급등했지만, 이후로는 신고점을 갱신하지 못했다.

NEO: 또 다른 '이더리움 킬러'를 표방한 프로젝트로 '중국의 이더리움'이라 불렸다. NEO의 가격은 0.20달러에서 200달러까지 상승하며 1000배의 수익을 기록했다.

비트코인 캐시(BCH): Roger Ver은 비트코인 커뮤니티 내 유명 인사이자 대용량 블록 논쟁의 주요 인물로, 비트코인 캐시를 지지했다. 2017년 8월 블록 478,559에서 1개의 비트코인을 보유한 사용자는 1개의 비트코인 캐시를 받았다. Roger Ver의 지지로 비트코인 캐시의 가격은 한때 약 3800달러까지 치솟았지만, 이후 점차 사람들로부터 잊혀져갔다.

기타 이더리움 킬러들: 이 시기 다른 토큰들도 '이더리움 킬러'라며 홍보되었다(예: ADA, Tron 등). 토큰에 '화이트페이퍼' 하나만 있으면 가격이 10배, 100배씩 폭등하는 듯 보였다. Filecoin과 Tezos 같은 다른 토큰들도 이 시기에 출시되었다.

수익형 사기: BlockFi, LUNA, Celsius, Voyager가 최초의 수익형 사기라고 생각한다면 오산이다! 사실 최초의 대규모 수익형 폰지 사기는 Bitconnect였으며, 수많은 사람들이 수백만 달러를 잃었다.

규제 당국 개입: 2021년 사이클과 마찬가지로, 규제 당국의 개입과 폰지 사기 폭로가 다시 한번 산업 전체를 무너뜨렸다. 미국 증권거래위원회(SEC)는 EOS와 같은 프로젝트들을 조사하기 시작했고, 시장은 견고한 85% 조정을 경험했다. 2020년 3월경 비트코인은 약 3500달러까지 하락했다.

당시 대부분의 토큰은 사기였기 때문에 알트코인 시장은 거의 -99.999999%에 가까운 폭락을 겪었다. 그 시절 슈퍼볼 광고에 등장하는 토큰은 가격이 즉시 5배 이상 급등하기도 했다. 예를 들어 VIBE가 전형적인 사례였다.

VIBE의 가격은 0.04달러에서 2달러 이상까지 치솟았지만, 결국 시가총액은 고작 262달러로 추락했다.

2021 알트코인 시즌: DeFi, NFT, 메멘코인, 시가총액 최대 3조 달러

2021년, 잘 알려진 이유로 인해 모두 집에서 일하며 컴퓨터와 스마트폰만 바라보며 무료한 시간을 보냈다. 미국 정부는 10조 달러를 찍어냈고, 이는 오직 미국 정부의 지출 규모에 불과하다.

DeFi 프로젝트들이 유동성 마이닝을 주도했고, NFT는 JPEG 이미지를 주류로 만들어 수백만 달러에 팔렸으며, 메멘코인의 가치 평가도 터무니없는 수준에 도달했다. 비트코인은 69,000달러를 돌파했고, ETH는 4800달러에 도달했으며, 암호화폐 전체 시가총액은 2021년 11월 3조 달러를 넘어서기도 했다.

도지코인(Dogecoin): 처음엔 농담처럼 시작되었지만, 일론 머스크의 관심을 받으며 가격이 포물선을 그리며 상승했고, 포럼 플랫폼 Reddit에서 인기 주제가 되었다. 이제는 거의 일론의 메멘코인이자 정부 효율성 부서를 상징하는 존재가 되었다. 가격은 약 0.5센트에서 74센트까지 치솟아 약 15,000% 상승했다.

Solana: 다음 '이더리움 킬러'로 홍보되었으며, 빠른 거래 속도와 저렴한 수수료로 큰 관심을 끌었다. 이 모든 것은 주로 SBF(현재 수감 중)에 의해 홍보되었다. 가격은 1달러에서 약 260달러까지 치솟아 26,000% 상승했다.

시바이누(Shiba Inu): 도지코인을 모방한 메멘코인으로, 수많은 백만장자를 만들어냈다. 거의 제로에 가까운 시가총액에서 시작했다고 보면, 가격 상승률은 500,000%에 달했다.

DeFi 토큰: AAVE, UNI, SUSHI, YFI 등의 DeFi 토큰은 10배에서 50배까지 상승했으며, 탈중앙화금융(DeFi)의 TVL(총 예치자산)은 수천억 달러를 돌파했다. 현재 많은 DeFi 프로젝트들의 TVL이 당시보다 오히려 더 높은 수준이다!

NFT:

CryptoPunks: 수백만 달러에 판매되었으며, 가장 저렴한 CryptoPunk도 100 ETH 이상의 가격에 거래된다.

Bored Ape Yacht Club(BAYC): 문화적 현상이 되었으며, 최저가조차 믿기 힘들 정도로 높은 수준에 도달했다.

Airdrop 광란: 어떤 프로젝트의 오랜 사용자는 단지 100달러짜리 .eth 도메인 하나만 있어도 4만 달러의 에어드랍을 받을 수 있었다. 다리를 건너는 행위(특정 작업 수행)만으로 하루 혹은 일주일에 2%의 수익을 얻는 것도 가능했다. BAYC와 같은 NFT 프로젝트는 수십억 달러 규모의 고가치 NFT 시리즈를 추가로 에어드랍하기도 했다.

더 미친 것은... 거의 모든 토큰이 상승했으며, SAFEMOON과 같은 토큰은 Dave Portnoy 등의 지지를 받았다. Snoop Dogg와 Paris Hilton 같은 유명인들도 다양한 프로젝트를 후원했다. 톰 브래디와 스테픈 커리는 암호화폐 거래소를 홍보했다. 심지어 파산한 FTX조차 마이애미 히트의 구단명 판권을 사들였다. FTX(이미 파산)는 NBA 마이애미 히트의 경기장 명명권까지 매입하기도 했다.

폰지 사기: 엄청난 수의 폰지 사기 프로젝트들이 등장했다. 일부는 우리가 이런 사기와 연루되었다고 비난하지만, 사실 우리는 전혀 관여하지 않았다. 다행히 많은 사람들이 큰 손실을 피할 수 있었다. 이러한 제품에 투자하고 자산을 타인에게 맡기는 것은 결코 현명한 선택이 아니다.

데스 스파이럴: 유동성이 고갈되기 시작하자(이전까지 이러한 프로젝트들을 지원했던 자금이 더 이상 나타나지 않음), 앞서 언급한 폰지 사기들의 붕괴를 목격하게 되었다. 또한 FTX가 사용자 자금을 횡령한 혐의로 파산했고, 이어 미국 증권거래위원회(SEC)가 다시 한번 규제에 나섰다. 대규모 사기와 갈취 사건들이 연이어 발생하며, 암호화폐 산업의 입출금 통로는 엄격한 규제 시대로 접어들게 되었다.

핵심 교훈

1) 수익 실현하기: 시장은 빠르게 변하며, 당신은 쉽게 탐욕에 사로잡힐 수 있다. 만약 당신이 "내가 그 토큰을 두 배 더 샀더라면 좋았을 텐데"라고 느낀다면, 그 순간 반쯤 매도하고 수익을 안정적으로 확보하는 것이 현명하다. 비트코인, 이더리움, 스테이블코인 어느 것으로 수익을 실현하든 상관없다. 중요한 것은 탐욕하지 않는 것이다.

2) 과열 사이클은 반복된다: 각 알트코인 시즌마다 하나의 서사(narrative)가 존재한다: 비트코인 포크, ICO, DeFi, NFT 또는 메멘코인. 당신이 어떤 서사를 발견했다면, 끝까지 고수하는 것이 좋다. 해당 분야에서 쌓은 지식은 사이클이 끝날 무렵 급속히 사라지기 때문이다. 여기저기 뛰어다니는 것보다 특정 분야에 집중해 최종 승리를 거두는 것이 낫다.

3) 리스크 관리가 중요하다: 수익은 매우 매력적이지만, 각자의 상황은 다르다. 나는 당신과 다르고, 이웃과도 다르다. 자신에게 맞는 계획을 세우고 고수하라. 10만 달러를 가진 사람이 "1000만 달러로는 은퇴하기 부족하다"고 말한다고 해서 목표를 계속 바꾸지 말라.

4) 생존자들이 번성한다: 알트코인은 생겨났다가 사라지지만, 매 사이클마다 비트코인과 이더리움은 지배적 위치를 유지한다. 오랜 시간 존재해온 프로젝트라면 제로로 돌아갈 위험이 비교적 낮다. 예를 들어 솔라나(Solana)가 2025년에 Pump.fun을 넘어서는 실제 활용 사례를 찾는다면, 이 수준에 근접할 수도 있다.

우리는 폰지 사기에서 무엇을 배웠는가? 사실상 아무것도 배우지 못했다. 우리가 목격한 바에 따르면, 사람들은 여전히 'Not Your Keys, Not Your Coins'(네 키가 아니라면, 네 코인이 아니다)라는 개념을 이해하지 못한다. 증권사에서 암호화폐 관련 주식이나 레버리지 자산에 투자할 수는 있지만, 기억해야 한다. 암호화폐 ETF나 주식을 보유하고 있다고 해서 실제 암호화폐를 소유한 것은 아니며, 당신이 투입한 자산이 어떻게 처리되는지도 알 수 없다는 점을 말이다.

강세장에서는 최신 메멘코인에 참여하지 않아 비난받는 경우도 많다. 비록 지금의 투기가 아주 뜨겁게 보일지 모르지만, 자세히 보면 자신의 전략을 고수하며 침착한 사람들은 이미 꾸준히 자산을 쌓아가고 있다.

반면, '10배 수익'으로 빠르게 부를 이루겠다는 투기꾼들은 단기적으로 주목받을 수 있지만, 그들의 자산 규모와 전략은 매달 꾸준히 투자하며 자산을 축적하는 익명의 고액 보유자들과 비교하면 훨씬 못 미친다. 이러한 고액 보유자들은 일반적으로 더 탄탄한 재무 기반과 더 명확한 장기 계획을 가지고 있다. 결국 시장의 흐름과 데이터는 어떤 전략이 진정한 성공을 가져오는지 증명하게 될 것이다.

마지막으로 여러분 모두에게 2025년 좋은 운이 함께하기를 기원한다.

TechFlow 공식 커뮤니티에 오신 것을 환영합니다

Telegram 구독 그룹:https://t.me/TechFlowDaily

트위터 공식 계정:https://x.com/TechFlowPost

트위터 영어 계정:https://x.com/BlockFlow_News