Enseignements tirés de l'analyse rétrospective des actifs cryptographiques hors Bitcoin lors des précédents marchés haussiers

TechFlow SélectionTechFlow Sélection

Enseignements tirés de l'analyse rétrospective des actifs cryptographiques hors Bitcoin lors des précédents marchés haussiers

Comment survivre aux pièges du marché haussier ?

Rédaction : BowTied Bull

Traduction : Blockchain Grand Public

Alors que nous entrons en 2025, selon la tradition, nous prenons l’habitude de faire le bilan du passé tout en regardant vers l’avenir.

En repensant aux années passées dans l’industrie des cryptomonnaies, nous pouvons observer un phénomène intéressant : tous les quatre ans environ survient une « saison des altcoins ». Pendant cette période, tout dans le secteur semble monter. Vous pourriez même entendre parler de votre oncle alcoolique qui a fait fortune en achetant un token basé sur un mème animal, peut-être même complètement ivre lorsqu’il a effectué l’opération.

En 2025, la véritable « saison des altcoins » n’est pas encore pleinement arrivée. Bien qu’il soit impossible de prédire à quel point celle-ci sera folle, je tiens à rappeler ici que les mouvements des altcoins ont tendance à devenir rapidement incontrôlables, mais aussi à s’arrêter brusquement. En cas d’effondrement, la chute pourrait dépasser -99,99 % — voire aller jusqu’à la disparition totale.

Mais avant cela, tout le monde est plongé dans une atmosphère de prospérité et de divertissement. Alors, jetons un regard rétrospectif sur les précédentes saisons des altcoins : comment se sont-elles déroulées ? Peut-on en tirer des leçons utiles ?

Saison des altcoins 2012–2013 : Les premiers investisseurs passionnés, capitalisation maximale atteinte à 15 milliards de dollars

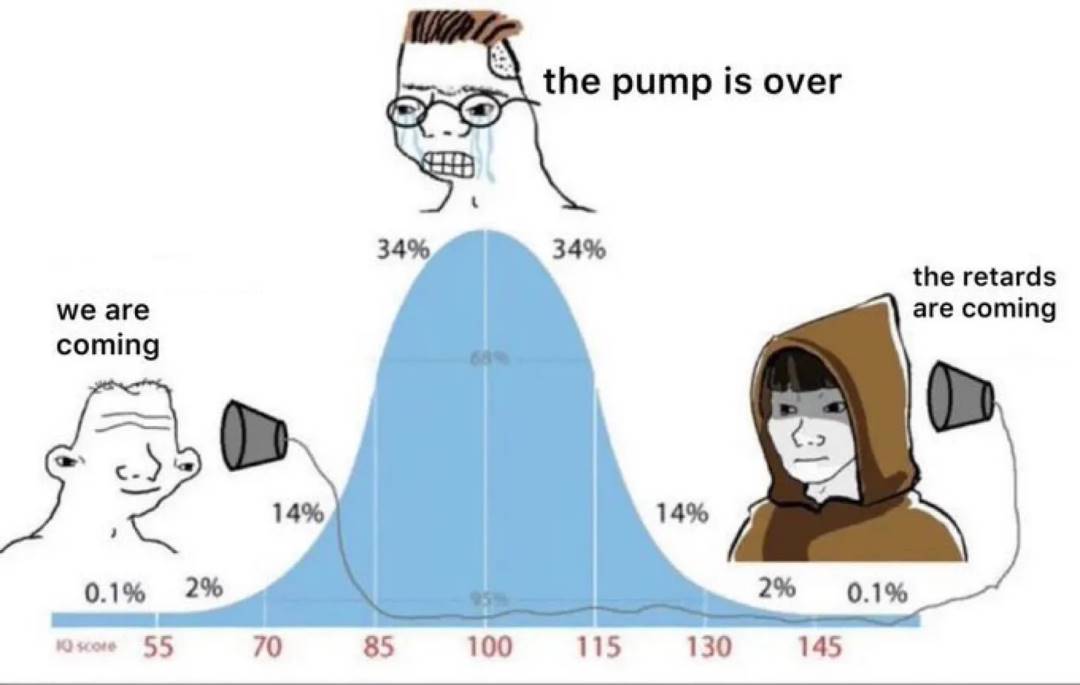

Nous savons que les suiveurs aveugles risquent fortement de refaire surface sur le marché. Cela s’était déjà produit en 2013, avec des mouvements particulièrement intéressants.

Pendant la « saison des altcoins » de 2013, Bitcoin était encore au stade préliminaire de son développement, avec une capitalisation boursière totale d’environ un milliard de dollars, et une transaction importante (whale) ne représentait que 100 000 dollars. À l’époque, la bourse Mt. Gox était encore opérationnelle, et les investisseurs étaient souvent des personnes actives dans les événements liés aux cartes à jouer Magic: The Gathering (ce qui explique également le contexte de l’affaire Mt. Gox).

L'idée émergeait alors d'accélérer les transactions Bitcoin en réduisant le temps entre chaque bloc, ce qui était considéré comme une innovation profonde.

Litecoin : il existe toujours aujourd’hui. Son concept principal (proposé par Charlie Lee) consistait à réduire le temps de bloc de Bitcoin, passant de 10 minutes à 2,5 minutes.

Le prix de Litecoin est passé d’environ 10 centimes à 48 dollars, soit une hausse d’environ 47 900 %. Il a connu une nouvelle forte augmentation en 2017, puis Charlie Lee a vendu toutes ses positions au sommet, affirmant publiquement que « le réseau Bitcoin allait bien sans lui ». (Tout le monde sait ce que signifie quand un fondateur vend 100 % de ses avoirs.)

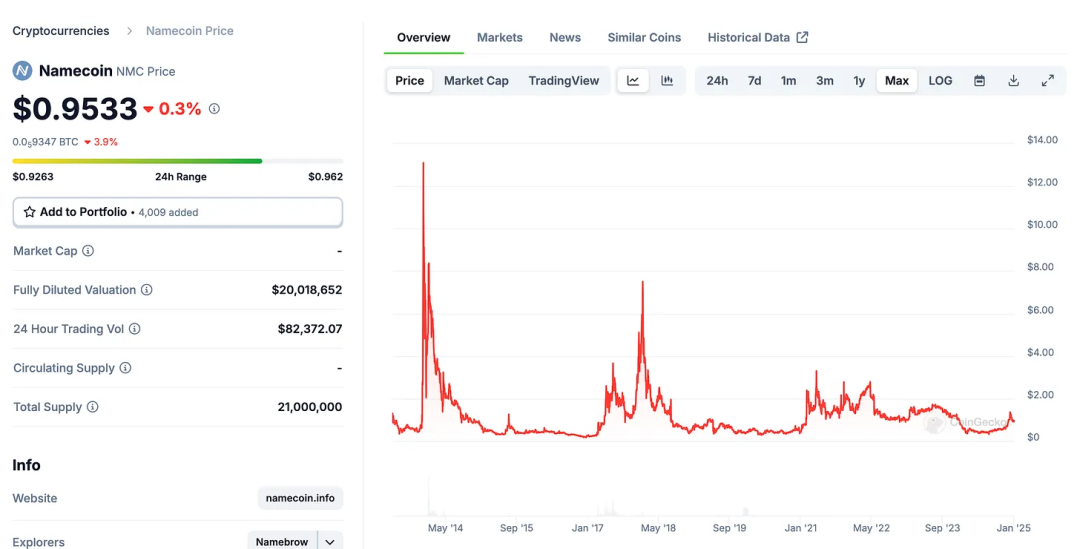

Namecoin : une fourche (fork) de Bitcoin visant à créer un système de noms de domaine décentralisé (semblable au concept d’ENS utilisant l’extension « .eth »). Son prix a grimpé jusqu’à environ 13 dollars avant de chuter rapidement. De son plus bas à son plus haut, il a augmenté d’environ 30 fois. En réalité, il existe encore aujourd’hui, coté à environ 1 dollar.

Peercoin (PPC) : l’un des premiers tokens utilisant le mécanisme de preuve d’enjeu (Proof-of-Stake) — un mécanisme désormais utilisé pour sécuriser ETH — a connu deux hausses notables. La première en 2013, la seconde en 2017 durant la frénésie des ICO Ethereum. Son prix a atteint environ 7 dollars, soit un gain de 60 à 70 fois. Naturellement, il n’a jamais été adopté massivement et est retombé à 0,42 dollar. (Mais aujourd’hui, on peut dire que, sauf cas extrêmes comme Bitconnect ou LUNA, aucun projet restant sur le marché ne tombera vraiment à zéro.)

La frénésie : Bitcoin a finalement atteint 1200 dollars, entraînant avec lui la hausse de nombreuses cryptomonnaies grâce à l’intérêt croissant du public. Tout projet publié sur BitcoinTalk pouvait connaître une envolée spéculative rapide. Aujourd’hui, la situation la plus similaire serait probablement un memecoin promu par une célébrité ou portant son nom.

Effondrement de Mt. Gox : lorsque Mt. Gox a fait faillite, la fête s’est terminée. Ce krach a été causé par un piratage majeur, entraînant une chute massive du prix du Bitcoin, d’environ 85 à 90 % (selon la manière dont on définit le plancher), tandis que les altcoins ont perdu plus de 99 % de leur valeur.

Saison des altcoins 2017 : Frénésie des ICO et montée d’Ethereum, capitalisation maximale atteinte à 800 milliards de dollars

Pendant la période baissière suivante, plusieurs événements intéressants ont eu lieu. Ethereum, conçu comme une plateforme de contrats intelligents, avait pour objectif de créer une monnaie programmable. Il s’agissait d’une véritable innovation, car elle permettait non seulement de transférer des tokens, mais aussi de créer des contrats intelligents, changeant ainsi radicalement les règles du jeu.

Comme beaucoup de choses dans le domaine des cryptomonnaies, Ethereum n’était pas exempt de risques courants. Le DAO (organisation autonome décentralisée) d’Ethereum a été piraté, subissant une perte de plus de 100 millions de dollars, ce qui a conduit à un fork de la blockchain, créant ainsi deux chaînes distinctes : ETH et ETC. Certains pensent encore aujourd’hui que cette bifurcation était une erreur, mais nous n’allons pas entrer dans ce débat ici ; il s’agit simplement d’un rappel historique.

Vers 2016, les gens ont compris qu’il était possible d’émettre de nouveaux tokens sur la blockchain Ethereum, ce qui a donné naissance auxoffres initiales de jetons (ICO). Dans une ICO, les projets vendaient directement leurs tokens aux investisseurs. En 2017, la fièvre des ICO a explosé, faisant apparaître de nombreux projets frauduleux que vous pouvez imaginer.

Ethereum (ETH) : comme ces tokens devaient être achetés avec ETH, cela a propulsé le prix d’ETH, qui est passé d’environ 8 dollars à 1400 dollars en janvier 2018 — un rendement presque inimaginable à l’époque. Actuellement, ETH se négocie autour de 3650 dollars.

Ripple (XRP) : toujours considéré comme la « monnaie des banques », Ripple reposait sur l’idée qu’il remplacerait du jour au lendemain SWIFT (Society for Worldwide Interbank Financial Telecommunication), devenant ainsi la norme financière de facto. Bien que centralisé (mais la plupart des gens s’en moquaient), il a attiré des millions de dollars. XRP est passé d’environ 1 cent à 3,80 dollars, et se négocie actuellement à 2,41 dollars.

Curieusement, la base d’investisseurs de XRP reste principalement composée de petits investisseurs individuels. Lors de la dernière vague haussière, on a pu observer un phénomène similaire : XRP dominait TikTok, générant de nombreuses discussions, avec des questions comme : « Et si sa capitalisation atteignait celle du Bitcoin ? » Ces discussions sur une capitalisation de quatre mille milliards de dollars semblent quelque peu absurdes.

Litecoin (LTC) : comme mentionné précédemment, Litecoin a de nouveau grimpé, atteignant temporairement 360 dollars. Même après que Charlie Lee ait vendu toute sa position, LTC a de nouveau culminé à 384 dollars en 2021 !

EOS : a levé 4 milliards de dollars via une ICO, se présentant comme le « tueur d’Ethereum ». Son prix a atteint 22 dollars, mais n’a jamais réussi à battre ce sommet depuis.

NEO : un autre projet se proclamant « tueur d’Ethereum », surnommé « l’Ethereum chinois », dont le prix est passé de 0,20 dollar à 200 dollars, offrant un retour de 1000 fois.

Bitcoin Cash : Roger Ver, figure connue dans la communauté Bitcoin, a participé au débat sur les gros blocs et soutenu Bitcoin Cash. Au bloc 478 559 en août 2017, chaque détenteur d’un BTC recevait un Bitcoin Cash. Grâce au soutien de Roger Ver, le prix de Bitcoin Cash a grimpé à environ 3800 dollars, mais il a progressivement disparu des radars.

Autres prétendus « tueurs d’Ethereum » : durant cette période, divers autres tokens ont été promus comme « tueurs d’Ethereum » (ADA, Tron, etc.). Si un projet disposait d’un « livre blanc », cela semblait suffire à faire grimper son prix de 10x, voire 100x. D’autres tokens comme Filecoin et Tezos ont également été lancés à cette époque.

Arnaques aux rendements : si vous pensez que BlockFi, LUNA, Celsius et Voyager ont été les premières arnaques à rendement, vous vous trompez ! La première grande escroquerie pyramidale à rendement a été Bitconnect, causant des pertes de millions de dollars à de nombreuses personnes.

Intervention des régulateurs : comme lors du cycle de 2021, l’intervention des autorités et l’explosion des schémas pyramidaux ont une fois de plus détruit l’industrie. La SEC américaine a commencé à enquêter sur des projets comme EOS, le marché a subi un recul solide de 85 %, et en mars 2020, le prix du Bitcoin est tombé à environ 3500 dollars.

À cette époque, la majorité des tokens n’étaient que des arnaques, et le marché des altcoins a donc connu un effondrement quasi total, approchant les -99,999999 %. Si votre token apparaissait dans une publicité du Super Bowl, son prix pouvait instantanément quintupler. VIBE en est un exemple typique.

Le prix de VIBE est passé de 0,04 dollar à plus de 2 dollars, mais sa capitalisation totale est finalement tombée à seulement 262 dollars.

Saison des altcoins 2021 : DeFi, NFT et Memecoins, capitalisation maximale atteinte à 3 billions de dollars

En 2021, pour des raisons bien connues, tout le monde travaillait à domicile, fixant sans but son ordinateur ou son téléphone. Le gouvernement américain a imprimé 10 billions de dollars, rien que du côté des dépenses publiques.

Les projets DeFi ont popularisé le minage de liquidités, les NFT ont fait entrer les images JPEG dans le grand public (vendues à plusieurs millions de dollars), et les memecoins ont atteint des valorisations absurdes. Bitcoin a franchi la barre des 69 000 dollars, ETH a atteint 4800 dollars, et la capitalisation totale du marché crypto a dépassé 3 billions de dollars en novembre 2021.

Dogecoin : initialement une blague, son prix a pris une trajectoire exponentielle grâce à l’intérêt d’Elon Musk, devenant un sujet populaire sur Reddit. Aujourd’hui, il est presque devenu la monnaie-mème d’Elon, symbolisant un département inefficace du gouvernement. Son prix est passé de 0,5 cent à 74 cent, soit une hausse d’environ 15 000 %.

Solana : présenté comme le prochain « tueur d’Ethereum », attirant l’attention grâce à ses transactions rapides et ses frais bas. Cette promotion a été largement menée par SBF (désormais en prison). Le prix est passé de 1 dollar à environ 260 dollars, soit une hausse de 26 000 %.

Shiba Inu : un memecoin imitant Dogecoin, qui a créé des dizaines de millionnaires. En partant d’une capitalisation presque nulle, sa hausse a atteint 500 000 %.

Tokens DeFi : les tokens DeFi comme AAVE, UNI, SUSHI, YFI ont connu des gains allant de 10x à 50x. La valeur verrouillée dans la finance décentralisée (TVL) a dépassé des centaines de milliards de dollars. Aujourd’hui, le TVL de nombreux projets DeFi est même supérieur à ce qu’il était à l’époque !

NFTs :

CryptoPunks : vendus à plusieurs millions de dollars, le CryptoPunk le moins cher valant plus de 100 ETH.

Bored Ape Yacht Club (BAYC) : est devenu un phénomène culturel, avec des prix planchers atteignant des niveaux incroyables.

Folie des airdrops : pour certains anciens utilisateurs de projets, posséder un simple domaine .eth d’une valeur de 100 dollars pouvait rapporter un airdrop de 40 000 dollars. Vous pouviez même gagner 2 % de rendement en une journée ou une semaine en franchissant un pont (en effectuant certaines actions). Des projets NFT comme BAYC distribuaient massivement d’autres séries de NFTs très valorisés, avec des airdrops totalisant des milliards de dollars.

Encore plus fou… presque tous les tokens montaient, des tokens comme SAFEMOON étaient vantés par des personnalités comme Dave Portnoy. Des célébrités comme Snoop Dogg et Paris Hilton faisaient la promotion de divers projets. Tom Brady et Stephen Curry promouvaient des exchanges de cryptomonnaies. Même FTX, désormais en faillite, avait payé pour acheter les droits de nommage de l’équipe NBA Miami Heat.

Escroqueries pyramidales : de nombreuses arnaques pyramidales ont vu le jour. Bien que certains aient accusé notre communauté d’y être associée, ce n’était pas le cas. Heureusement, beaucoup ont pu éviter des pertes importantes. Investir dans ces produits et confier vos actifs à autrui n’a jamais été une décision sage.

Spirale de la mort : avec la raréfaction de la liquidité (les fonds qui soutenaient auparavant ces projets ont cessé d’arriver), nous avons assisté à l’effondrement des arnaques pyramidales mentionnées ci-dessus. De plus, FTX s’est effondré après avoir volé les fonds des utilisateurs, suivi par une nouvelle intervention réglementaire de la SEC américaine. Ces grandes fraudes et ces « tontines » ont finalement conduit à une ère de régulation stricte des canaux d’entrée et de sortie du marché crypto.

Leçons clés

1) Prenez vos bénéfices à temps : le marché évolue rapidement, et la cupidité peut facilement s’emparer de vous. Si vous vous surprenez à penser « j’aurais dû acheter deux fois plus de ce token », alors il est probablement temps de vendre la moitié de votre position et de réaliser vos gains. Vendre en Bitcoin, en Ethereum ou en stablecoin, peu importe — l’essentiel est de ne pas être avide.

2) Les cycles de spéculation se répètent : chaque saison des altcoins repose sur un récit dominant : fork de Bitcoin, ICO, DeFi, NFT ou memecoin. Une fois que vous avez identifié un thème, mieux vaut vous y tenir, car les connaissances accumulées dans ce domaine disparaissent souvent rapidement à la fin du cycle. Plutôt que de sauter d’un projet à l’autre, concentrez-vous sur un domaine précis pour remporter la victoire finale.

3) La gestion des risques est cruciale : les rendements peuvent être élevés, mais chaque personne est différente. Vous n’êtes pas moi, et je ne suis pas mon voisin. Élaborez un plan adapté à votre situation et tenez-y bon. Ne modifiez pas vos objectifs sous prétexte qu’une personne ayant 100 000 dollars affirme que 10 millions ne suffisent pas pour prendre sa retraite.

4) Ceux qui survivent prospèrent : les altcoins vont et viennent, mais Bitcoin et Ethereum dominent à chaque cycle. Un projet qui existe depuis longtemps a un risque bien moindre de tomber à zéro. Si Solana parvient à trouver en 2025 des applications concrètes allant au-delà de Pump.fun, il pourrait aussi atteindre ce niveau de résilience.

Avons-nous appris quelque chose des arnaques pyramidales ? Pas vraiment. D’après ce que nous observons, les gens ne comprennent toujours pas le principe de « Not Your Keys, Not Your Coins (pas vos clés, pas vos pièces) ». Vous pouvez acheter des actions crypto ou d’autres actifs cryptos à effet de levier via un courtier, mais sachez que si vous détenez ces actions ou ETF, vous ne possédez réellement aucune cryptomonnaie. Vous ignorez totalement comment ces sociétés ou projets gèrent vos actifs.

En période de hausse, on critique souvent ceux qui ne participent pas à la spéculation autour du dernier memecoin à la mode. Bien que ces comportements spéculatifs semblent très actifs maintenant, si vous observez attentivement, vous remarquerez que ceux qui restent fidèles à leur stratégie et gardent leur calme accumulent progressivement des résultats.

En comparaison, les spéculateurs qui rêvent uniquement d’un gain x10 pour s’enrichir rapidement attirent certes l’attention à court terme, mais leurs capitaux et leurs stratégies ne peuvent en aucun cas rivaliser avec ceux des grands investisseurs anonymes qui investissent régulièrement chaque mois, accumulant patiemment leur richesse. Ces derniers possèdent généralement des bases financières plus solides et une vision à long terme plus claire. En fin de compte, les performances du marché et les données prouveront quelle stratégie mène réellement au succès.

Je vous souhaite bonne chance en 2025.

Bienvenue dans la communauté officielle TechFlow

Groupe Telegram :https://t.me/TechFlowDaily

Compte Twitter officiel :https://x.com/TechFlowPost

Compte Twitter anglais :https://x.com/BlockFlow_News