Perspectives du Nouvel An d'Onchain Wizard : toujours optimiste sur les Perp DEX, à l'affût des nouvelles opportunités sur les Layer 1

TechFlow SélectionTechFlow Sélection

Perspectives du Nouvel An d'Onchain Wizard : toujours optimiste sur les Perp DEX, à l'affût des nouvelles opportunités sur les Layer 1

L'année prochaine sera un marché de sélection de jetons.

Source: Onchain Wizard

Translated by: TechFlow

This article reflects my positioning for 2023, shared with all of you. These are summary statements; in the coming months, I will dive deeper into these ideas to provide more context behind my thinking. Please note that most of these involve high risk, so please DYOR—this is not financial advice. I intend to hold and purchase the tokens mentioned below, so clearly, I am biased.

Long ETH / Short BTC

This is certainly not contrarian thinking—I believe it's valid. Since The Merge, ETH’s supply-side structure has clearly improved, while BTC must contend with

(1) significant selling pressure from miners,

(2) selling pressure from Mt Gox,

(3) any noise around GBTC.

ETH/BTC has traded flat for five consecutive months. I believe that as macro/fiscal conditions improve in the second half of 2023, ETH may begin to challenge BTC.

BONE

I believe SHIB’s Shibarium blockchain launch in 2023 will attract considerable attention from DOGE/SHIB meme coin holders and could very likely spark a Degen frenzy on-chain. Smart money will continue accumulating tokens ahead of its launch, with BONE currently at a fully diluted valuation (FDV) of $196 million.

If real activity emerges on the new chain, BONE could become a relatively attractive speculative asset compared to other chains. Tweets related to BONE have seen strong engagement, indicating retail interest remains despite the crypto winter. Therefore, assuming next year turns out to be a “better” one, I see BONE as an interesting beta-risk investment.

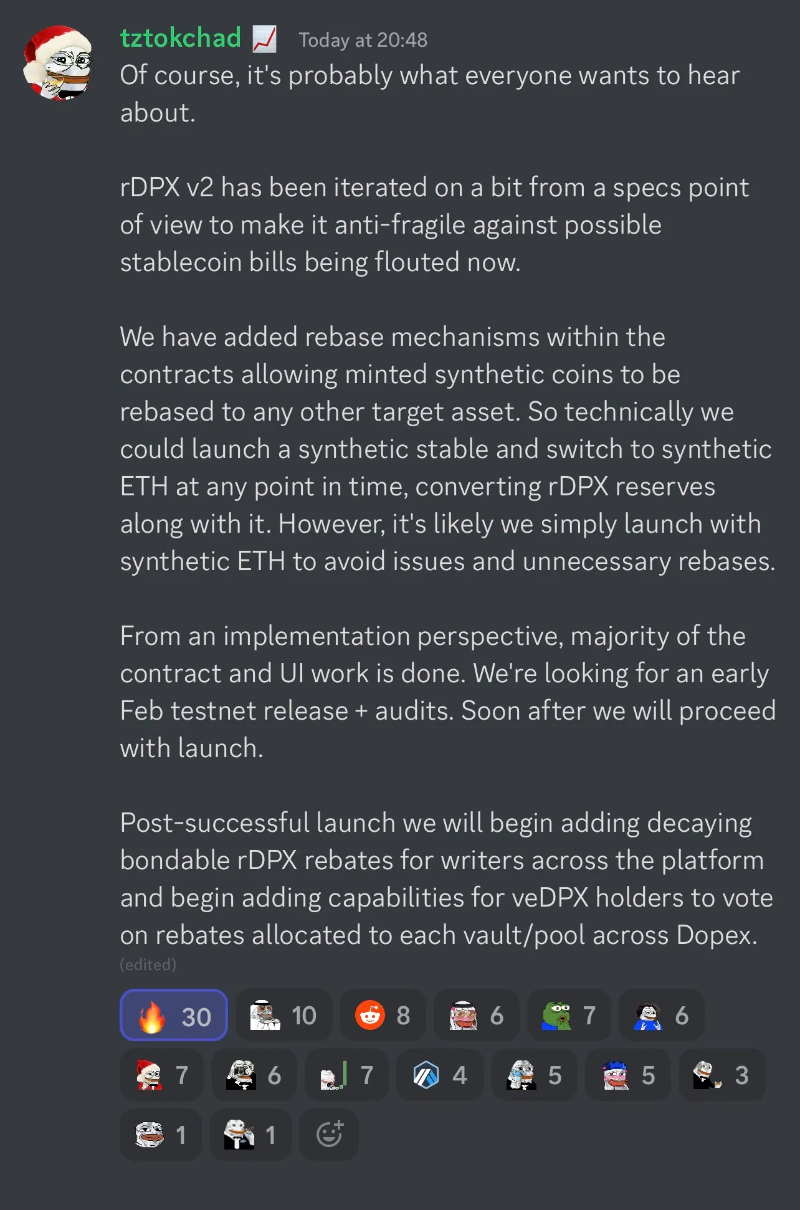

rDPX

The upcoming v2 upgrade is the main catalyst for rDPX, which will launch its testnet and undergo audits in early February before full rollout. Smart money has been accumulating the token, and its community remains one of the strongest I’ve seen during this bear market.

With a market cap of approximately $43 million, I believe a successful V2 launch, improved financials, and additional product releases on the Dopex roadmap mean the token has at least $100 upside potential sometime next year (more if we enter an "echo bubble"). Currently, its token emissions have also been paused for several months, making the supply-side dynamics quite solid.

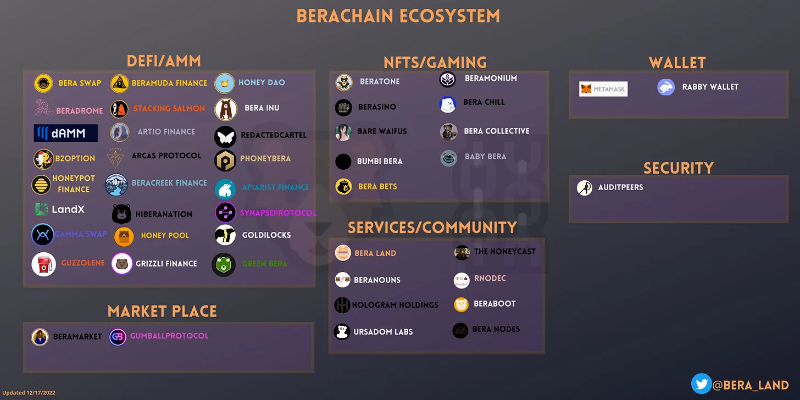

Berachain

I previously introduced Berachain here, explaining why I find its architecture and community more compelling than other new chain launches. As ecosystem projects build on the chain, there will be numerous small-cap token opportunities once the mainnet launches sometime next year. Alternatively, you can try earning an airdrop via NFTs/Honeylist or purchasing tokens during their public sale.

Long GMX/GNS, Short DYDX

Another trade idea. To date, only GNS and GMX pose clear threats to DYDX in terms of market share and yield competition.

Meanwhile, DYDX faces an unpleasant token unlock schedule in 2023, starting in February. After the FTX collapse, more users are shifting toward on-chain trading. This trade expresses my long-term bullish view on DEX perp adoption while hedging downside risks due to DYDX’s harsh unlock schedule throughout the year.

UNIDX / Perp DEX Aggregator (Warning: Degen)

Every new project is launching a Perp DEX, but eventually, a killer app will emerge—one that aggregates all perpetual products in a single place.

Traders will pay higher fees to leverage trade from a single source (I know I would), and from what I understand, Unidex is building exactly this aggregation product. This is a theme I’m highly bullish on.

Factor Dao / FCTR (Also degen)

I’m bullish on everything Arbitrum, but I’m not interested in yet another GMX fork, something that aggregates GMX yields, or delta-neutral GMX vaults.

Given Arbitrum has become a hub for DeFi projects, I believe this project could fill an untapped gap in the asset management vertical. Their mainnet is reportedly launching in Q1 2023, and I’m excited to see how it evolves (and eager to use it myself).

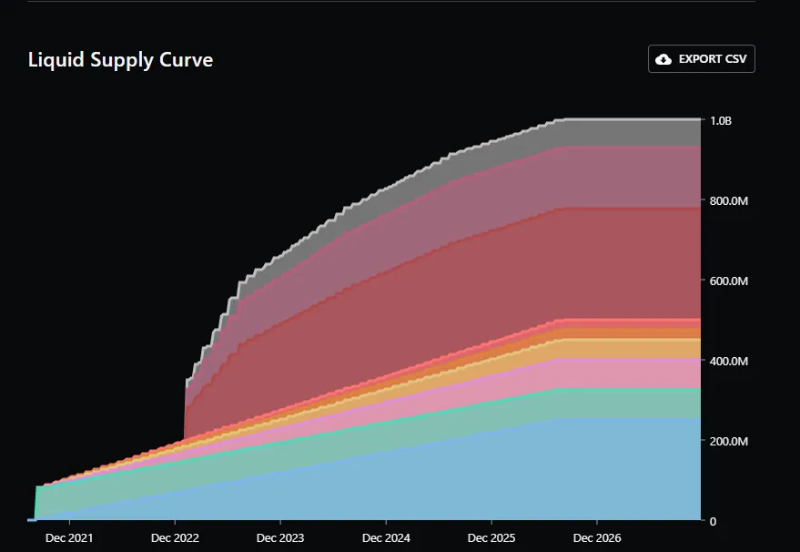

Shorts

I believe next year will be a "token picker's market," where tokens with poor emission and unlock schedules will see their value diluted over time. Meanwhile, stronger, better-positioned projects can actually thrive. To round out my preferred portfolio, I’m considering shorting some weaker tokens to hedge against downside risks in my long positions.

These include:

1. STEPN / GMT (FDV: $1.5B / Circulating Market Cap: $150M);

2. IMX (FDV: $800M / Circulating Market Cap: $296M);

3. APE (FDV: $3.5B / Circulating Market Cap: $1.2B).

Clearly, there will be better ideas emerging throughout the year than those I’ve listed here, but these represent my strongest convictions, potential growth areas, and how I’m thinking about structuring my 2023 portfolio. (Not financial advice.)

Bienvenue dans la communauté officielle TechFlow

Groupe Telegram :https://t.me/TechFlowDaily

Compte Twitter officiel :https://x.com/TechFlowPost

Compte Twitter anglais :https://x.com/BlockFlow_News