How do dollar macro factors influence the direction of the crypto market?

TechFlow Selected TechFlow Selected

How do dollar macro factors influence the direction of the crypto market?

There is a macro variable that alone influences over 50% of cryptocurrency price movements.

Author: Tascha Labs

Translated by: TechFlow Intern

One macro variable alone explains over 50% of cryptocurrency price movements. What does this mean for the value of your token wallet? The variable I’m referring to is the U.S. dollar.

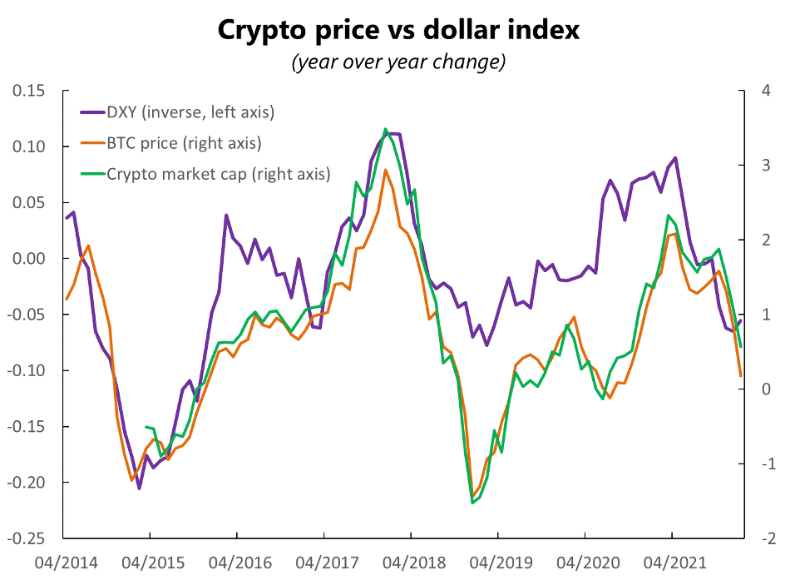

I compared BTC prices and crypto market capitalization against a basket of macro factors. The dollar’s value—represented by the DXY index—shows the strongest correlation with cryptocurrencies.

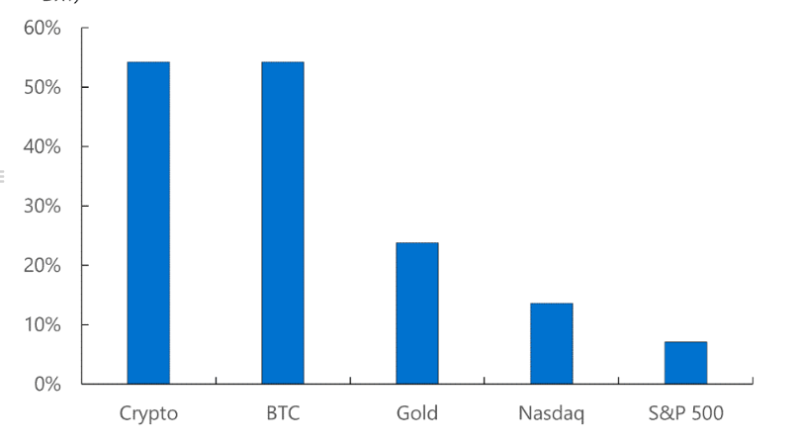

DXY alone explains 54% of year-over-year changes in BTC price.

DXY up → Crypto down, and vice versa.

In 2018—the onset of the last crypto bear market—it coincided precisely with a major reversal in the dollar's trend. Then, as the dollar began falling in early 2019, BTC resurrected from death. This raises the question: Are cryptocurrencies driven by BTC halving events as they make you believe, or by the dollar's valuation cycle?

You might say, crypto prices are denominated in dollars. So naturally, when the dollar rises, crypto falls. Or perhaps you think crypto is a risk-on asset while the dollar is risk-off. Of course, they should be negatively correlated. That seems logical enough, right?

Indeed, there’s also a negative correlation between DXY and commodities (since most commodities are priced in dollars), and between DXY and stock markets (as equities are risk-driven assets).

But DXY only explains 24% of gold price moves and just 7% of S&P 500 changes—it correlates with crypto an entire order of magnitude more strongly. Why?

It's a combination of factors. Mechanically, as the dollar strengthens, it becomes more expensive to earn yield in other currencies via stablecoins, reducing demand for crypto.

More importantly, the dollar’s value acts as a barometer for many macro forces—from global risk appetite and monetary conditions to growth outlooks and central bank actions—all of which impact crypto.

In other words, even if DXY itself doesn’t “cause” crypto price changes, it serves as a summary indicator for many underlying drivers. Think of it like “dimensionality reduction” in data science, if you will.

Therefore, if you want to anticipate how your crypto portfolio might perform in the medium term, monitoring the dollar’s valuation trend and its drivers is highly useful.

Driver 1: U.S. Current Account

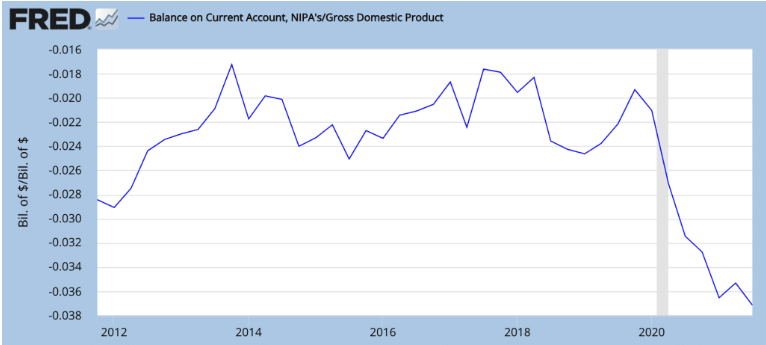

Your college economics textbook says that if a country imports more than it exports (i.e., runs a current account deficit), its currency should depreciate.

In fact, since the pandemic, the U.S. current account has been deteriorating, while the dollar’s value has declined.

However, post-pandemic economic recovery is slowing, government spending is being cut back → import demand decreases → current account deficit narrows this year → supports dollar value.

Thus: Dollar Bulls: 1, Dollar Bears: 0.

But in reality, the current account has relatively little impact on the dollar compared to other currencies, because so many goods are priced in dollars. In an overly financialized world, financial markets exert greater influence on the dollar’s value—which brings me to:

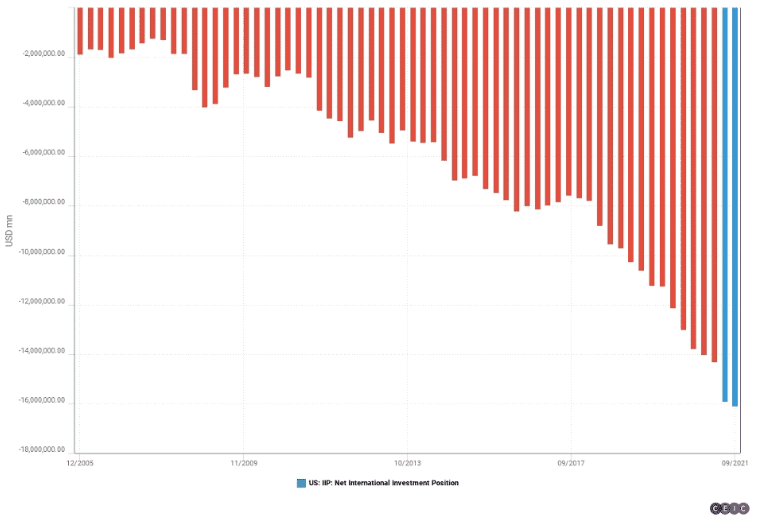

Driver 2: U.S. Capital Inflows

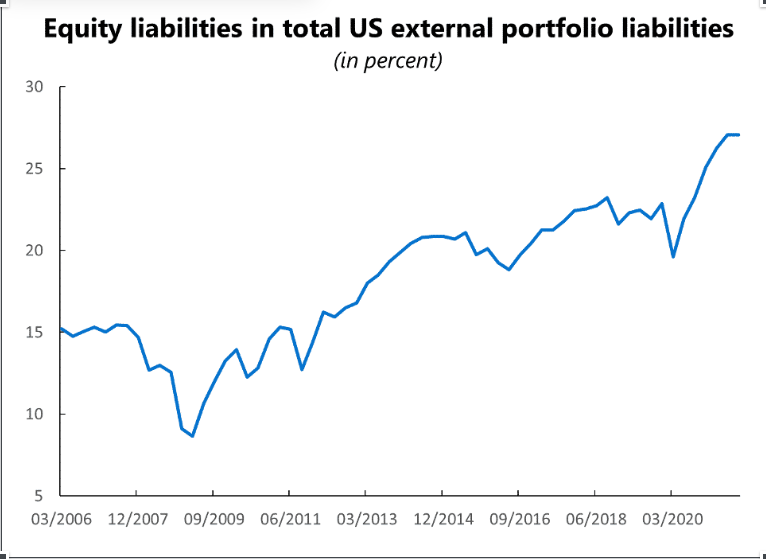

The U.S. is a net recipient of securities investment inflows. Money flowing into U.S. assets supports dollar demand.

An increasing share of this capital flows into U.S. equities, which have significantly outperformed most other global markets, attracting investors worldwide.

However, as you know, due to impending Fed tightening and signs of economic slowdown, stocks have taken a severe hit. A prolonged bear market pushes investors to seek greener pastures → capital exits U.S. markets → dollar demand drops → dollar depreciates.

Whether we’ll see broad-based equity declines is debatable. But with no strong evidence to the contrary, we assume it will happen.

So now: Dollar Bulls: 1, Dollar Bears: 1.

Driver 3: Fed Rate Hikes

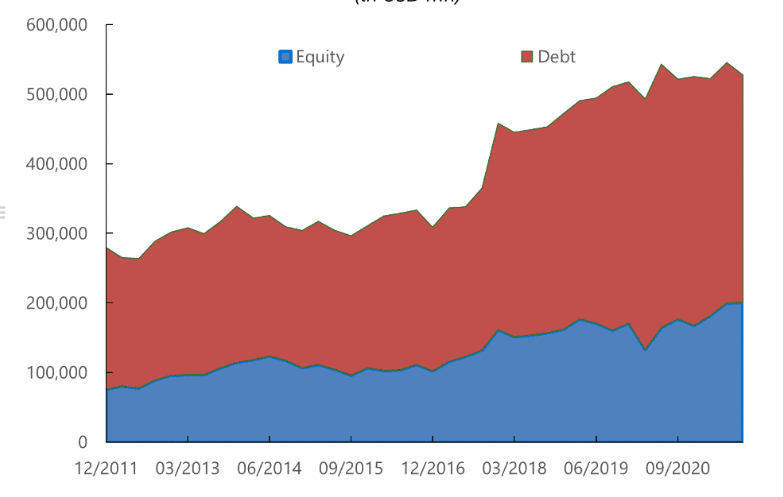

The U.S.’s long-standing low-rate environment fueled carry trades—borrowing cheap dollars to buy higher-yielding foreign assets. This was a key driver behind rising foreign asset holdings by U.S. banks and financial institutions.

This works flawlessly—until your dollar funding cost rises. Rate hikes → reduce carry trade profits → less capital outflows from the U.S. → stronger dollar demand → dollar appreciation → further squeeze on carry trades → a self-reinforcing reflexive loop.

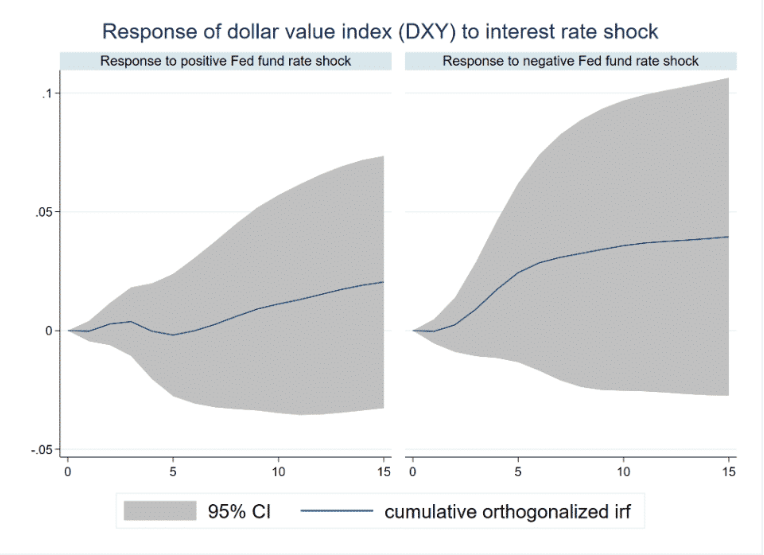

But as shown below, historical estimates of DXY’s response to interest rate shocks (based on 2010–2021 data) show that rate hikes (left chart) have a weaker effect on dollar appreciation than rate cuts (right chart) have on depreciation.

That is, the effect is “you rise, I fall.” This contrasts sharply with the impact of quantitative easing/tightening, as you’ll soon see.

For now: Dollar Bulls: 2, Dollar Bears: 1.

Driver 4: Fed Quantitative Tightening (QT)

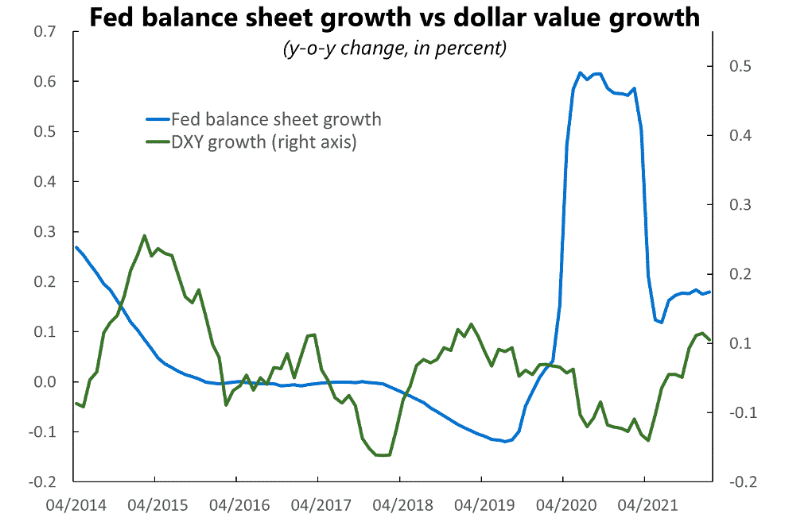

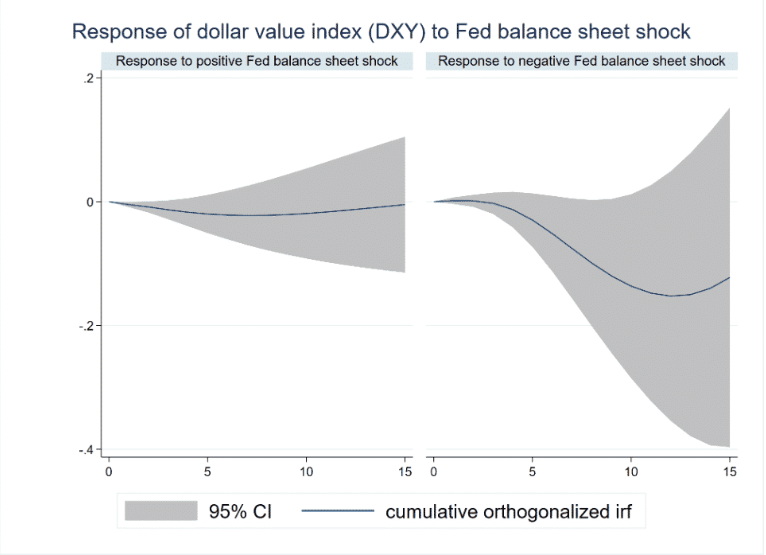

The Fed’s asset purchases have effects similar to rate changes. QT (quantitative tightening) → dollar strength; QE (quantitative easing) → dollar weakness. But QT’s impact is stronger, as it directly affects market liquidity and the far end of the yield curve.

Historical data shows that QT-driven dollar appreciation (right chart) tends to be much stronger than QE-driven depreciation (left chart).

If we take these estimates at face value, QT’s impact on the dollar lasts about 10 months before fading. This implies that if QT begins in July this year, it will keep the dollar strong until May next year.

In any case, we now have: Dollar Bulls: 3, Dollar Bears: 1.

The dollar bulls are winning—and have been since last May—while crypto momentum weakens. (Dollar up, crypto down.)

Ukraine has given DXY another boost. At current pace, it’s heading toward breaking above 100—a long-term resistance level—within six months.

But will its upward path remain smooth in the coming months? I remain skeptical.

Let’s not forget: rate hikes and QT haven’t even started yet. While the Fed’s balance sheet growth has slowed significantly since last May, it’s still expanding—liquidity remains abundant in markets.

Yet everyone is trying to front-run the Fed. The Nasdaq dropped 20% from December to its recent lows, while crypto fell over 40%—despite neither rate hikes nor QT having materialized under real market conditions.

I expect a strong market rebound between now and sometime in July—the latest QT could begin. (Rate hikes are minor; QT is major.)

This suggests BTC dominance may dip again before June.

Depending on Ukraine, QT plans may shift. If delayed to cushion oil price impacts on the economy, markets would cheer—but likely only briefly.

Regardless, my view is a short-to-medium-term market rebound amid heightened volatility, but by year-end—once QT is underway—DXY will rise further and crypto will decline further.

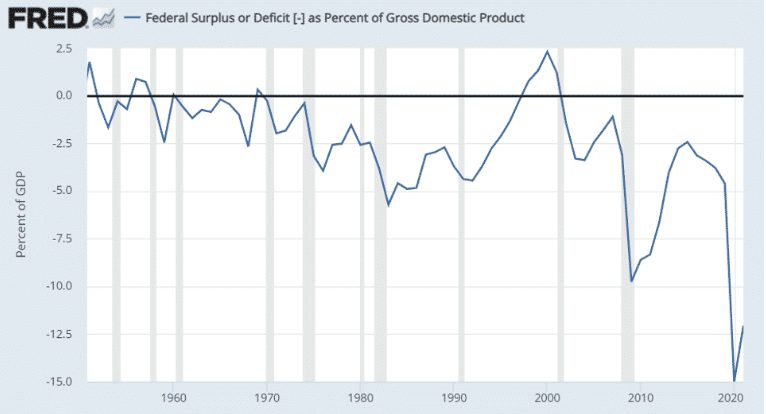

Still, let’s not lose sight of the big picture. For over three decades, the dollar has been in a long-term downtrend. Why?

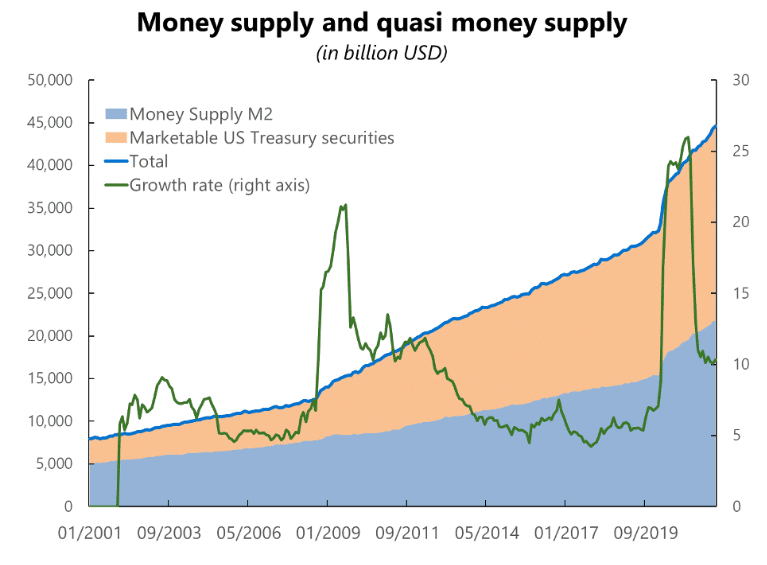

There are many reasons, but ultimately it comes down to supply and demand. If supply of dollars exceeds demand, the price must fall. And I’m not just talking about physical dollars, but also dollar substitutes—like U.S. government securities.

U.S. Treasuries and other debt instruments are increasingly treated by investors as money—media of exchange and stores of value. This trend is supported by central bank-induced volatility suppression, which helps stabilize the value of these “quasi-monies.”

This means actual money supply should include M1, M2, plus outstanding public debt. With ever-rising U.S. government debt, this true money supply is now twice the official M2—and growing faster.

Assuming money demand stays constant, to predict where the dollar is headed long-term, simply ask yourself:

1) Will the trajectory of public debt reverse?

2) Will more non-dollar assets be used globally as money?

My answers: 1) No, 2) Yes. Due to aging populations and automation, government spending must rise, leading to more debt—and more quasi-money issuance. As for global money, I don’t know—but I’ve heard of something called cryptocurrency.

TLDR:

1/ Dollar value and crypto are closely linked: dollar up → crypto down

2/ The dollar should appreciate this year

3/ QT-driven dollar strength lasts ~10 months

4/ Expect short-to-medium-term market rebound, but proper bearishness later in 2022

5/ Long-term, the dollar is in a downtrend

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News