JPMorgan turns against Wall Street: stockpiling silver, positioning in gold, shorting the dollar's credit

TechFlow Selected TechFlow Selected

JPMorgan turns against Wall Street: stockpiling silver, positioning in gold, shorting the dollar's credit

JPMorgan Chase locks down physical liquidity in the West with one hand, creating panic; with the other hand, builds a safe haven pool in the East, reaping profits.

By: Sleepy.txt @sleepy0x13

JPMorgan Chase, the most loyal "gatekeeper" of the old dollar order, is personally tearing down the very walls it once vowed to defend.

According to market rumors, by late November 2025, JPMorgan Chase relocated its core precious metals trading team to Singapore. If geographical migration is merely superficial, then at its core this move represents an open defection from the Western financial gold system.

Looking back over the past half-century, Wall Street was responsible for constructing a vast illusion of credit with dollars, while London—the "heart" of Wall Street’s financial empire across the Atlantic—maintained pricing dignity through deeply buried vaults underground. The two complemented each other, jointly weaving an absolute control network over precious metals in the Western world. And JPMorgan Chase should have been the final and strongest line of defense.

A faint trail reveals what has long been hidden. Amid official silence on these rumors, JPMorgan quietly executed a stunning asset shift: approximately 169 million ounces of silver were moved from the "deliverable" category to the "non-deliverable" category within COMEX vaults. Roughly calculated using publicly available data from the Silver Institute, this equates to nearly 10% of global annual supply—effectively locked away on paper.

In the brutal game of commercial competition, scale itself is the strongest statement. To many traders, this mountainous hoard of over 5,000 tons of silver looks less like inventory and more like chips stockpiled by JPMorgan ahead of a battle for pricing power in the next cycle.

Meanwhile, thousands of kilometers away, Singapore's largest private vault, The Reserve, opportunistically launched its second phase, boosting total storage capacity to 15,500 metric tons. This infrastructure upgrade, planned five years earlier, gave Singapore sufficient confidence to absorb massive wealth flooding out from the West.

JPMorgan locks down physical liquidity in the West with one hand, creating panic; with the other, builds a sheltered reservoir in the East to reap rewards.

What drove this giant to defect is the undeniable fragility of the London market. At the Bank of England, gold withdrawal timelines stretched from days to weeks, while silver lease rates spiked as high as 30%, a historical peak. For those familiar with the market, this signals one thing clearly: everyone is scrambling for physical metal, and vault inventories are starting to run short.

The shrewdest dealers are often the vultures most sensitive to the scent of death.

In this harsh winter, JPMorgan displayed the instincts of a top-tier dealer. Its departure marks the imminent end of a half-century-long alchemical game—turning paper into gold. When the tide recedes, only those clutching heavy physical assets will hold tickets to the next thirty years.

The End of Alchemy

The root of all trouble was planted half a century ago.

In 1971, when President Nixon severed the dollar’s link to gold, he effectively pulled the last anchor from the global financial system. From that moment on, gold was downgraded from hard currency into a financial asset redefined by Wall Street.

In the following decades, bankers in London and New York invented a sophisticated "financial alchemy." Since gold was no longer money, they could create endless contracts representing gold—just like printing banknotes.

This is the vast derivatives empire built by LBMA (London Bullion Market Association) and COMEX (New York Mercantile Exchange). In this empire, leverage reigns supreme. Each bar of gold sleeping in a vault corresponds to 100 delivery slips circulating in the market. And in the silver arena, the game is even wilder.

This “paper wealth” system functioned for half a century solely due to a fragile gentleman’s agreement: most investors only sought price spreads and would never attempt to withdraw actual metal.

Yet those who designed this game overlooked a "gray rhino" charging into the room—silver.

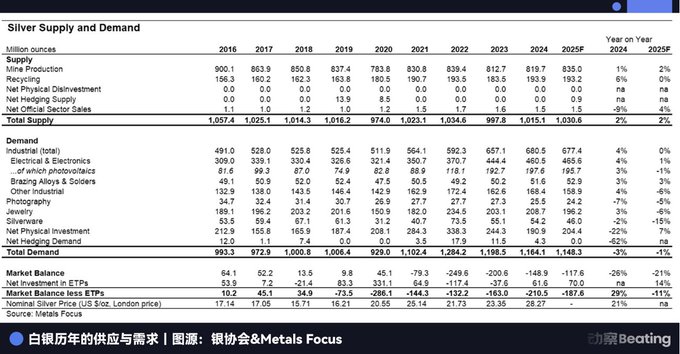

Unlike gold, which lies buried as eternal wealth, silver plays the role of a consumable in modern industry. It is the blood vessel of solar panels and the nervous system of electric vehicles. According to the Silver Institute, the global silver market has been in structural deficit for five consecutive years, with industrial demand accounting for nearly 60% of total demand.

Wall Street can generate infinite dollars with a keyboard, but cannot conjure a single ounce of conductive silver out of thin air.

When physical inventories are devoured by the real economy, billions of paper contracts become rootless trees. By the winter of 2025, this façade was finally pierced.

The first warning light came from price distortions. Under normal futures logic, forward prices usually exceed spot prices—a condition known as "contango." But in London and New York, extreme "backwardation" emerged. Buying a six-month silver contract meant smooth sailing; wanting physical silver delivered today required paying steep premiums and enduring waits lasting weeks.

Lines formed outside the Bank of England’s vaults. COMEX registered silver inventories fell below safety thresholds. The ratio of open interest to physical inventory briefly surged to 244%. The market finally grasped the terrifying truth: physical metal and paper contracts had split into parallel universes. One belongs to those with factories and vaults, the other to speculators still dreaming in the old paradigm.

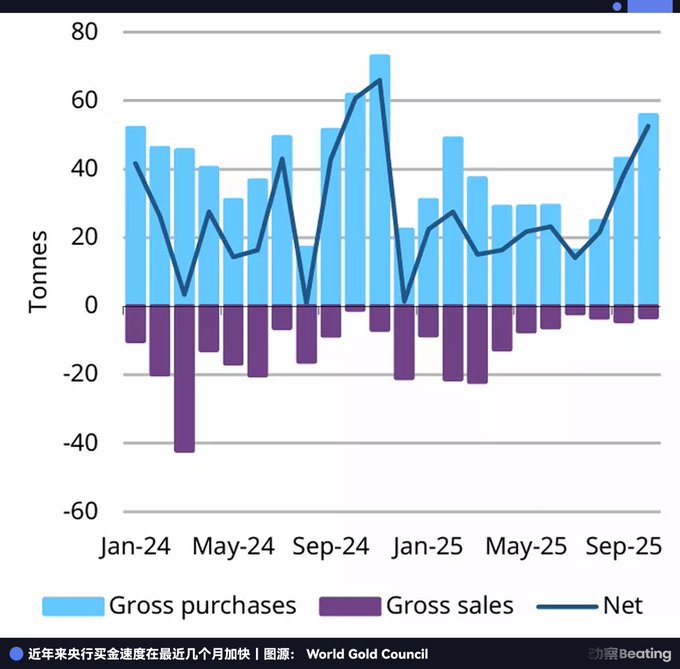

If silver shortages stem from industrial giants devouring supply, then gold outflows result from a national-level "bank run." Central banks—once staunch holders of dollars—are now leading the queue.

Despite gold prices hitting record highs in 2025, causing some central banks to tactically slow purchases, strategically, “buying” remains their sole action. According to the World Gold Council (WGC), global central banks collectively net-purchased 254 tons of gold in the first ten months of 2025.

Let us examine this buyer list.

Poland, after pausing gold purchases for five months, suddenly returned in October, buying 16 tons in a single month, raising its gold reserves to 26%. Brazil increased holdings for two consecutive months, pushing total reserves to 161 tons. China has appeared on the buyer list for 13 consecutive months since resuming accumulation in November 2024.

Nations are exchanging precious foreign exchange for heavy gold bars and shipping them home. Previously, everyone trusted U.S. Treasuries as “risk-free assets.” Now, they’re rushing to buy gold—the only shelter against “dollar credit risk.”

Although mainstream Western economists continue defending the paper gold system, claiming it provides efficient liquidity and that current crises are temporary logistical issues,

paper can no longer hide fire—and now it can’t hide gold either.

When leverage reaches 100:1 and that sole “1” begins being firmly withdrawn by central banks, the remaining “99” paper contracts face unprecedented liquidity mismatch.

The London market is now trapped in a classic short squeeze: industrial giants scramble for silver to secure production, while central banks lock up gold as strategic national reserves. When all counterparties demand physical delivery, pricing models based on credit collapse. Whoever controls physical metal controls price definition.

And JPMorgan Chase—the former “grand magician” most skilled in manipulating paper contracts—clearly saw this future before anyone else.

Rather than becoming a martyr to the old order, it chose to become a partner in the new. This habitual offender, fined $920 million over eight years for market manipulation, did not leave out of moral awakening, but made a precise bet on global wealth flows for the next three decades.

It is betting on the collapse of the paper contract market. Even if not immediate, the excessively leveraged structure will inevitably be unwound layer by layer. Only the tangible metal in storage remains truly safe.

Defecting from Wall Street

If the paper-based precious metals system were a glittering casino, then over the past decade, JPMorgan wasn't just the bouncer maintaining order—it was also the croupier most adept at cheating.

In September 2020, to settle U.S. Department of Justice charges of manipulating precious metals markets, JPMorgan paid a record $920 million in settlements. Thousands of pages of investigation files revealed JPMorgan traders as masters of spoofing.

They routinely used an extremely cunning tactic: instantly placing thousands of sell orders to create the illusion of an impending price crash, inducing retail investors and high-frequency robots to panic-sell; then canceling the orders at the last moment and aggressively buying up distressed assets at rock-bottom prices.

Statistics show that Michael Nowak, JPMorgan’s former global head of precious metals, and his team artificially triggered tens of thousands of sudden crashes and spikes in gold and silver prices over eight years.

At the time, outsiders attributed this behavior to typical Wall Street greed. But five years later, with the puzzle piece of 169 million ounces of silver inventory now visible, a darker interpretation circulates in markets.

To some, JPMorgan’s past manipulations can no longer be seen as mere attempts to profit from high-frequency trading spreads. Rather, it resembled a slow, deliberate accumulation campaign—crashing prices on paper markets to create the illusion of suppressed valuations, while quietly amassing physical positions behind the scenes.

This former guardian of the old dollar order has now transformed into its most dangerous gravedigger.

In the past, JPMorgan was the largest short in paper silver, acting as the ceiling suppressing precious metals prices. But now, having completed the shift to physical holdings, it has overnight become the biggest bull.

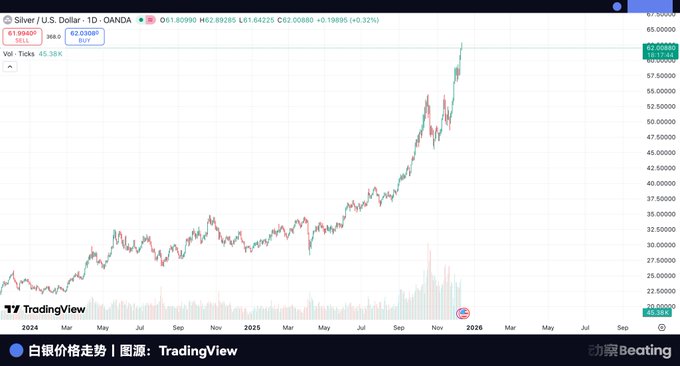

Market gossip abounds. Rumors suggest JPMorgan itself was the hidden force behind silver’s recent surge from $30 to $60. While unproven, such speculation alone indicates how perceptions have shifted: it is no longer seen as a paper silver short-seller, but as the largest holder of physical assets.

If this narrative holds, we may witness the most brilliant and ruthless coup in business history.

JPMorgan knows better than anyone that U.S. regulatory pressure is tightening relentlessly, and the paper contract game—once lucrative—is now nearing its end, possibly threatening not just profits but personal liability.

This explains its strong preference for Singapore.

In the U.S., every transaction risks being flagged as suspicious by AI surveillance systems. But in Singapore, inside private fortresses independent of any national central bank, gold and silver are completely de-politicized. There is no long-arm jurisdiction, only extreme protection of private property.

JPMorgan’s breakout is far from a solo mission.

As rumors spread, a quiet consensus has already formed among Wall Street elites. Though no physical mass relocation occurred, strategically, giants synchronized their shifts: Goldman Sachs set an aggressive 2026 gold price target of $4,900, while Bank of America went further, forecasting $5,000.

In the era of paper gold dominance, such targets sounded absurd. But viewed through the lens of physical reality—central bank buying trends, vault inventory changes—these figures begin to warrant serious consideration.

Smart money on Wall Street is quietly repositioning: reducing gold shorts, increasing physical exposure. They won’t dump all their Treasuries, but gold, silver, and other physical assets are gradually being added to portfolios. JPMorgan moved fastest and most decisively—not just to survive, but to win. It refuses to sink with the paper gold empire and instead aims to bring its algorithms, capital, and technology to a place that holds both gold and the future.

The problem is, that place already has its own master.

When JPMorgan’s private jet lands at Changi Airport, looking northward, it will find a far larger rival already building towering walls.

Tide Rushing Forward

While London traders fret over drying liquidity in paper gold, thousands of kilometers away along Shanghai’s Huangpu River, a vast physical gold empire has already completed its primitive accumulation.

Its name: the Shanghai Gold Exchange (SGE).

Within the Western-dominated financial map, SGE is a complete anomaly. It rejects the virtual games based on credit contracts in London and New York. From inception, it adhered to a near-obsessive iron rule: physical delivery.

These four words act like a steel spike driven precisely into the weak point of the Western paper gold game.

In New York’s COMEX, gold is often just a string of fluctuating numbers, with most contracts closed before expiry. But in Shanghai, the rules are “full payment” and “central clearing.”

Every transaction must be backed by real gold bars sitting in vaults. This eliminates infinite leverage and makes shorting gold extremely difficult—you must first borrow actual gold before selling it.

In 2024, SGE delivered astonishing results: annual gold trading volume reached 62,300 tons, a 49.9% increase from 2023; transaction value soared to 34.65 trillion yuan, up nearly 87%.

While COMEX’s physical delivery rate remains below 0.1%, the Shanghai Gold Exchange has become the world’s largest physical gold reservoir, continuously absorbing global gold stocks.

If gold inflows represent national strategic reserves, then silver inflows reflect China’s industrial “physiological hunger.”

Wall Street speculators may bet on prices via paper contracts, but as the world’s largest photovoltaic and new energy manufacturing base, Chinese factories don’t want contracts—they need real silver to keep production lines running. This rigid industrial demand turns China into the world’s largest precious metal black hole, steadily consuming Western inventories.

This “west-to-east gold flow” route operates busy and discreet.

Take the journey of a single gold bar. In Ticino, Switzerland, the world’s largest refineries (like Valcambi and PAMP) operate around the clock. They perform a special “blood transfusion”: melting and refining standard 400-ounce gold bars shipped from London vaults, then recasting them into 1-kilogram bars with 99.99% purity—“Shanghai Gold” specification.

This is not merely physical remolding, but a transformation of monetary attributes.

Once recast into 1-kilogram bars stamped with “Shanghai Gold,” these bars are almost impossible to return to the London market. Returning them would require costly re-melting and re-certification.

This means that once gold flows eastward, it becomes like river water entering the sea—never to return. Tides rush forward, endless waves rolling on forever.

On tarmacs of major global airports, armored convoys bearing Brink’s, Loomis, or Malca-Amit logos serve as the carriers of this great migration. They continuously deliver these recast gold bars into Shanghai’s vaults, forming the physical foundation of a new order.

Whoever controls physical assets holds the话语权. This is the strategic depth behind SGE leader Yu Wenjian’s repeated emphasis on establishing the “Shanghai Gold” benchmark price.

For decades, global gold pricing has been locked into London’s 3 PM fix—an expression of dollar hegemony. But Shanghai seeks to break this logic.

This is a highest-level strategic hedge. As China, Russia, the Middle East, and others form a covert “de-dollarization” alliance, they need a new common language. Not yuan, not rubles—but gold.

Shanghai is the translation center for this new language. It tells the world: if the dollar is no longer trustworthy, trust the gold in your own warehouse; if paper contracts may default, trust Shanghai’s principle of cash-and-carry.

For JPMorgan, this is both a major threat and an opportunity too significant to ignore.

To the west, there is no return—only depleted liquidity and tightening regulation. To the east, it must confront the colossal presence of Shanghai. It cannot conquer it directly, because its rules belong to neither Wall Street nor its turf—the fortress walls are too thick.

The Final Buffer Zone

If Shanghai is the “heart” of the Eastern physical asset empire, then Singapore is the “frontline” in this East-West confrontation. It is not merely a geographic transit hub, but the last carefully chosen defensive line for Western capital facing Eastern ascent.

Singapore, this city-state, is investing nearly obsessively to transform itself into the 21st century’s “Switzerland.”

Le Freeport, located beside Changi Airport’s runway, offers the clearest window into Singapore’s ambition. This freeport, possessing independent judicial status, functions as a perfect legal and physical “black box.” Here, gold flows free of cumbersome administrative oversight. From aircraft landing to bar storage, the entire process occurs within a fully enclosed, tax-free, and highly private loop.

Simultaneously, another super-vault named The Reserve has stood ready since 2024. Spanning 180,000 square feet, it boasts a total design capacity of 15,500 tons. Its appeal lies not just in meter-thick reinforced concrete walls, but in a special privilege granted by the Singapore government: full exemption from consumption tax (GST) on investment-grade precious metals (IPM).

For market makers like JPMorgan, this is an irresistible lure.

But if taxes and vaults were the only factors, JPMorgan could have chosen Dubai or Zurich. Its ultimate choice of Singapore reflects deeper geopolitical calculations.

For Wall Street, moving core operations directly from New York to Shanghai would be tantamount to “defection”—a political suicide in today’s volatile international climate. They urgently needed a pivot point: a haven that grants access to the vast Eastern physical market while ensuring political safety.

Singapore is the perfect choice.

It straddles the Strait of Malacca, linking London’s dollar liquidity with physical demand from Shanghai and India.

Singapore is not just a safe harbor, but the largest transit hub connecting two fractured worlds. JPMorgan seeks to establish here a round-the-clock trading loop: price fixing in London, hedging in New York, warehousing in Singapore.

However, JPMorgan’s plan isn’t flawless. In the battle for Asian pricing power, it cannot bypass its fiercest rival—Hong Kong.

Many mistakenly believe Hong Kong has fallen behind in this race, but the opposite is true. Hong Kong holds a core advantage Singapore cannot replicate: it is the sole gateway for RMB to go global.

Via the “Gold Shanghai-Hong Kong Connect,” the Chinese Gold and Silver Exchange Society (CGSE) connects directly with the Shanghai Gold Exchange. This means gold traded in Hong Kong can directly enter mainland China’s delivery system. For capital genuinely seeking access to the Chinese market, Hong Kong is not “offshore”—it is an extension of “onshore.”

JPMorgan chose Singapore, betting on a “dollar + physical” hybrid model, attempting to build a new offshore hub atop the ruins of the old order. Meanwhile, legacy British institutions like HSBC and Standard Chartered double down on Hong Kong, wagering on a “RMB + physical” future.

JPMorgan believes it has found a neutral refuge, but in the meat grinder of geopolitics, no true “middle ground” exists. Singapore’s prosperity is fundamentally a spillover effect of Eastern economies. This seemingly independent luxury yacht is already locked within the gravitational field of the Eastern continent.

As Shanghai’s pull grows stronger, as RMB-denominated gold expands, and as China’s industrial machine consumes ever more physical silver, Singapore may cease to be a neutral haven. JPMorgan will then face yet another fateful decision.

Restarting the Cycle

The rumors about JPMorgan may eventually receive an official explanation—but that no longer matters. In the business world, sharp capital always senses seismic shifts第一时间.

The epicenter of this quake lies not in Singapore, but deep within the global monetary system.

For the past fifty years, we grew accustomed to a “paper contract” world dominated by dollar credit—a time built on debt, promises, and illusions of infinite liquidity. We believed that so long as printing presses turned, prosperity could endure.

Now, the wind has changed completely.

When central banks spare no cost to repatriate gold, when global industrial titans grow anxious over securing the last slivers of industrial silver, we witness the return of an ancient order.

The world is slowly but surely shifting from ethereal credit money back to tangible physical assets. In this new system, gold measures credibility, silver measures industrial capacity. One represents the floor of security, the other the ceiling of production.

In this long migration, London and New York are no longer the sole destinations, and the East is no longer merely a factory. New rules are being written, new centers of power emerging.

The era in which Western bankers defined the value of gold and silver is fading. Gold and silver remain silent, yet answer every question about our times.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News