Sino Global Capital: Why We Are Bullish on the Indian Cryptocurrency Market?

TechFlow Selected TechFlow Selected

Sino Global Capital: Why We Are Bullish on the Indian Cryptocurrency Market?

In this report, we will outline why these factors, combined with others, create an environment in which we believe India can become one of the most important cryptocurrency markets in the world.

Original author: Sino Global Capital

Translation: TechFlow

Introduction

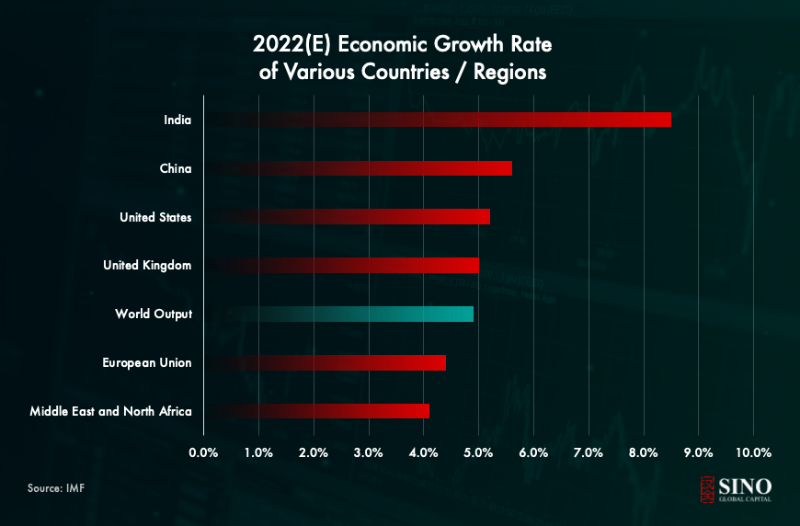

Entering 2022, India boasts a large and rapidly growing economy, with government programs projected to expand by 9.2%, reaching $3.1 trillion this year. According to the International Monetary Fund (which estimates a more conservative growth rate of 8.5%), India will retain its title as the world’s fastest-growing economy in 2022, surpassing China’s projected 5.6% growth.

According to data provider IHS Markit, this growth is expected to continue in the near future: “India’s nominal GDP in dollar terms is projected to rise from $2.7 trillion in 2021 to $8.4 trillion by 2030.” This implies that within a decade, India will surpass Japan to become the second-largest economy in the Asia-Pacific region, trailing only Germany and the UK globally.

While Sino Global Capital is generally optimistic about India’s growth trajectory, broad economic expansion alone does not constitute a compelling argument for India’s cryptocurrency market.

A Brief Overview of India:

1) With a population of 1.35 billion growing at an average annual rate of 1%, India is the most populous democracy in the world (World Bank).

2) According to the United Nations, India’s median age was 28.4 in 2020, compared to 38.4 in China and 38.3 in the United States.

3) Although India is an ancient civilization with a rich cultural history, it has existed as a modern independent nation only since 1947.

4) According to NHA, India has 1.18 billion mobile users, 700 million internet users, and 600 million smartphone users.

5) 80% of Indians over the age of 15 have bank accounts (World Bank Global Findex Report 2017).

6) "India Stack" refers to a suite of open APIs and digital public goods designed to unlock foundational economic elements—identity, data, and payments—at scale, delivering significant gains in financial inclusion (IMF).

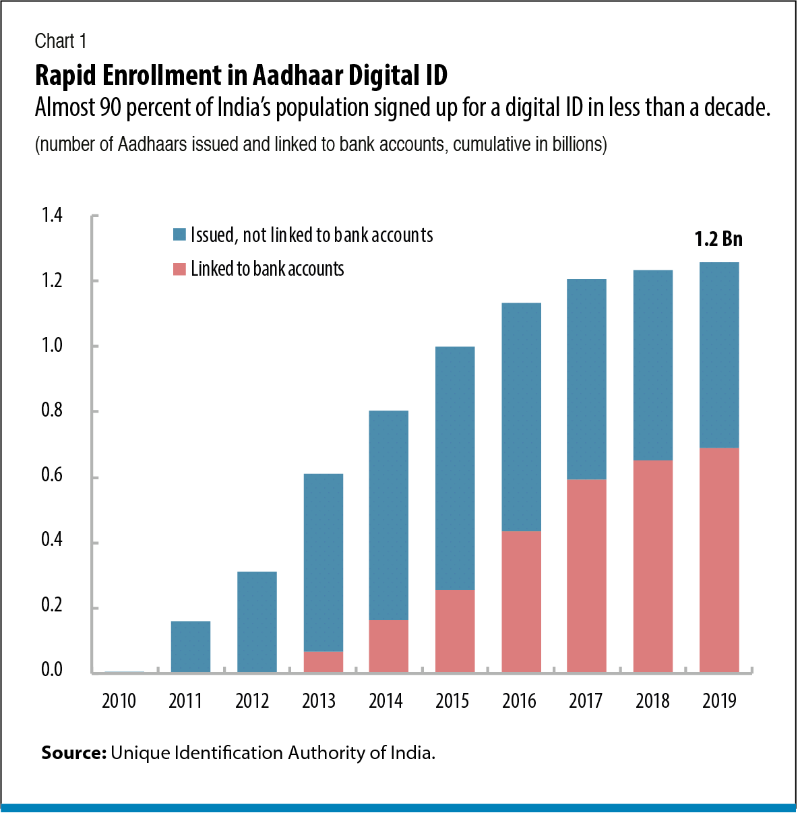

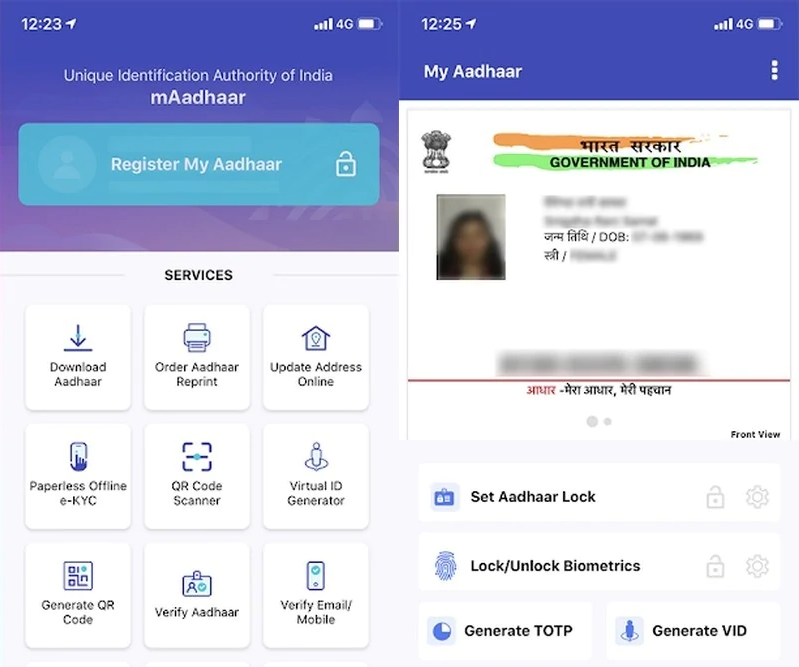

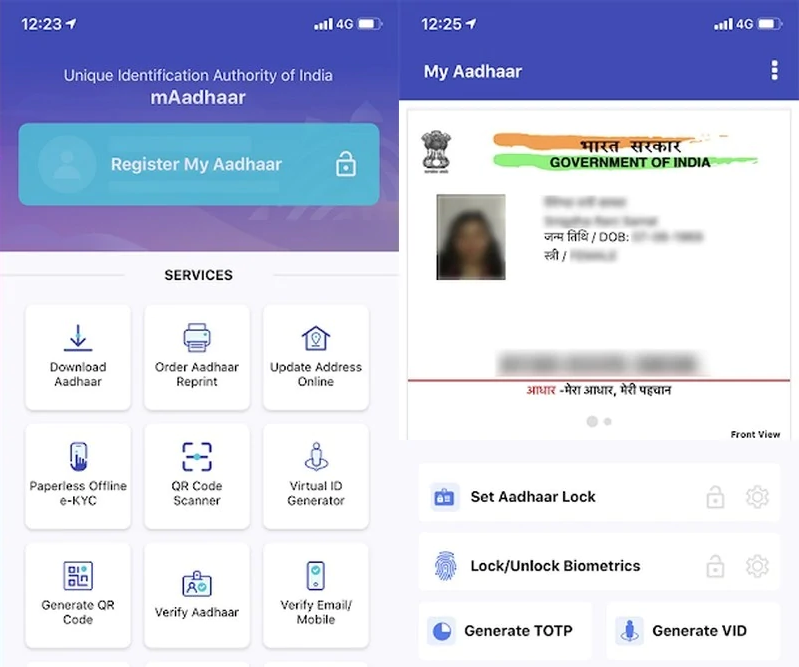

- Aadhaar [digital ID] is a unique 12-digit number assigned using biometric data to each Indian citizen and serves as the primary identifier for rolling out various government welfare programs and schemes. Nearly 1.2 billion people—almost 90% of India’s population—registered for digital IDs within less than a decade.

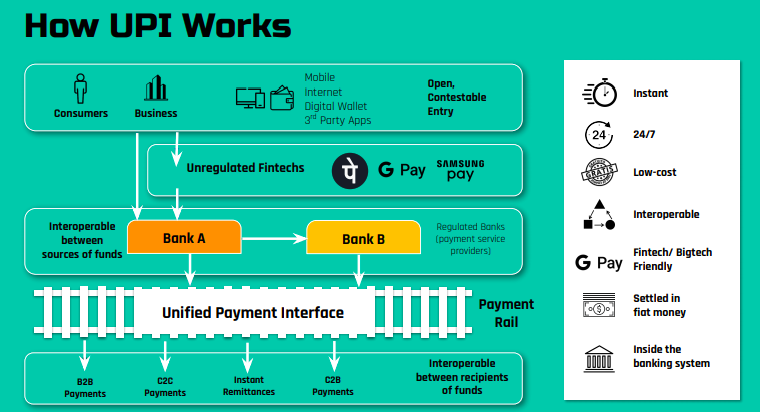

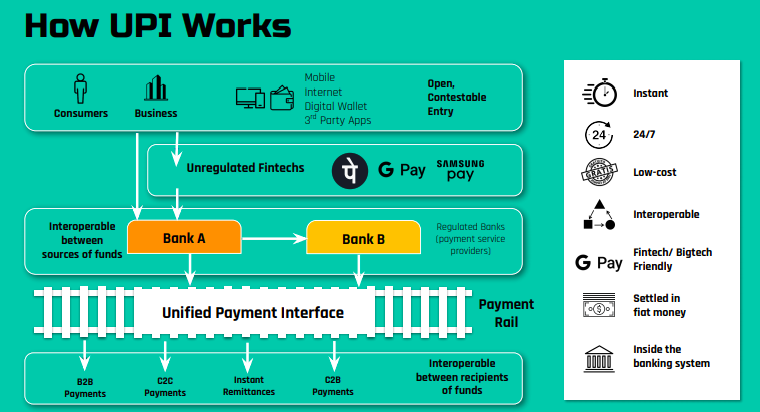

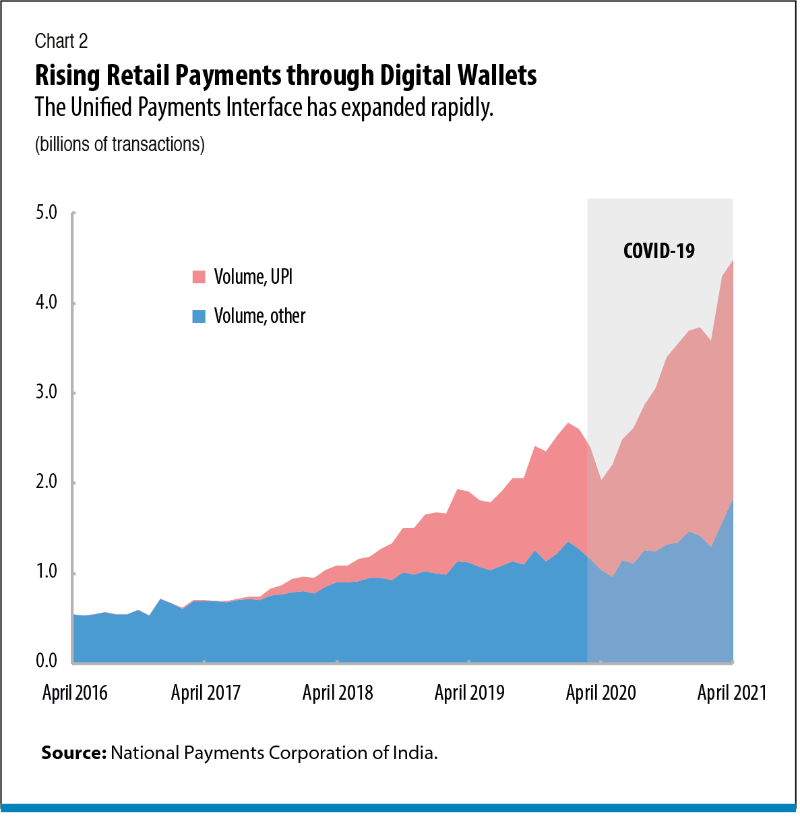

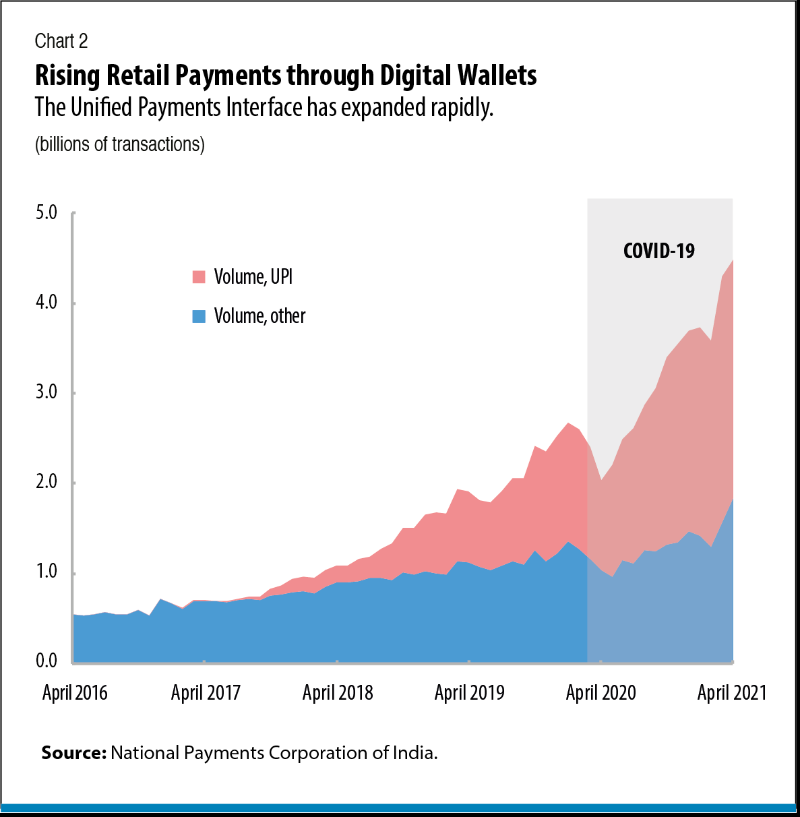

- Unified Payments Interface (UPI) is a new layer in India’s retail payment system, offering bank customers near real-time fund transfers. UPI is India’s dominant payment mechanism, recording 4.6 billion transactions worth ₹82.6 billion ($10.18 billion) in December 2021.

- The third paperless layer of the stack enables digitization of official documents and information, reducing paper-based bureaucracy and improving efficiency and integrity.

- No single component of India Stack is entirely unique. However, its comprehensiveness has successfully built, bottom-up, a more inclusive digital economy.

• In 2020, India’s National Stock Exchange surpassed CME Group of the United States to become the world’s largest derivatives exchange by volume. In 2019, trading volume on Indian exchanges grew 58% to approximately 6 billion derivative contracts.

India excels across multiple strategic dimensions, providing strong reasons to be optimistic about its future. In this report, we outline why these and other factors combine to create an environment where India could emerge as one of the world’s most important cryptocurrency markets.

Background

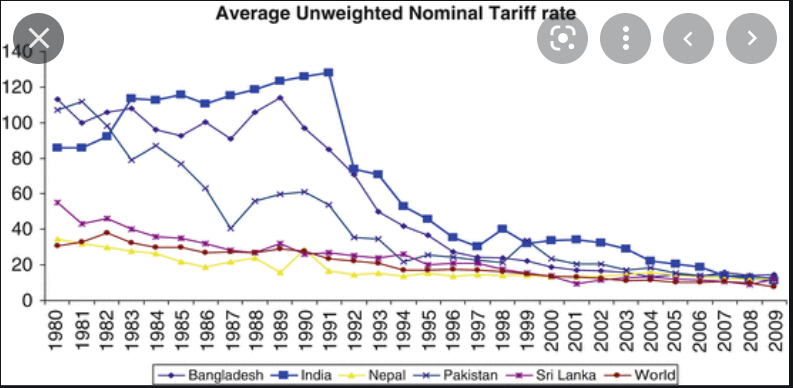

In the latter half of the 20th century, many Asian countries experienced rapid economic development while India lagged behind. This was largely due to the country’s protectionist, over-regulated socialist policies and the License Raj system. The License Raj was a complex system of licenses and regulations required to start and operate a business in India, including restrictions such as needing specific permits to launch new enterprises or increase production capacity, and additional permissions for hiring and firing workers. High tariffs, limited import quotas, and outright bans on certain items effectively shut off imports. By the 1980s, India was among the highest-tariff countries in the world.

These tariffs and other restrictions left one of the world’s largest nations isolated from the global economy, deprived of meaningful economic growth, natural competition, and foreign investment.

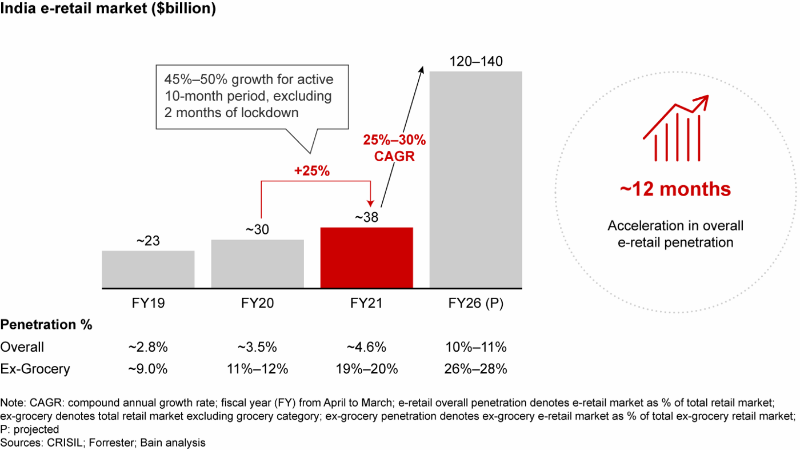

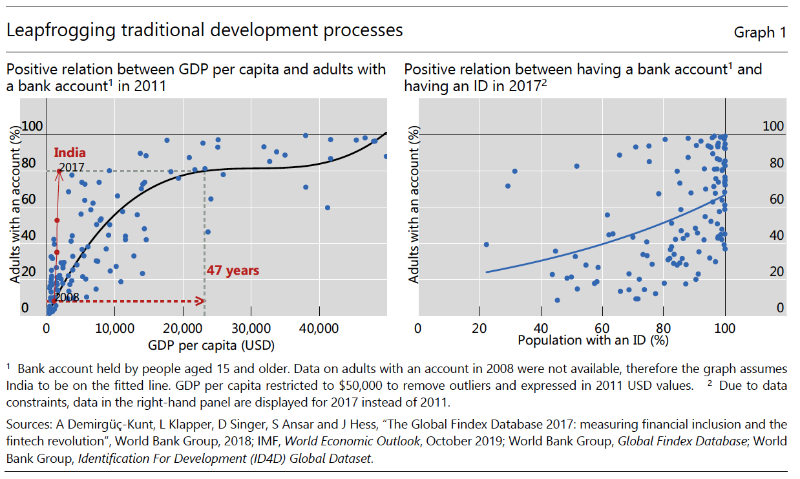

The impact of the License Raj continued to haunt India into the 21st century. Due to high costs associated with providing banking and financial services, expensive compliance and “Know Your Customer” requirements, and nearly 400 million Indians lacking any form of personal identification, only about 35% of Indian adults had bank accounts in 2011, according to World Bank estimates. Hundreds of millions remained disconnected from the formal financial system, resulting in significant losses in productivity, tax revenue, and socioeconomic development. As you’ll see below, conditions have dramatically changed over the past three decades, particularly since the LPG (Liberalization, Privatization, and Globalization) reforms.

Digital India – Foundations for Web3

Mature, interoperable digital infrastructure creates opportunities for new digital products, services, and conveniences unimaginable in traditional cash-based economies. These core technologies include:

1) Internet and broadband

2) Mobile telecommunications and digital communication suites, including applications

3) Data centers and networks

4) Enterprise portals, platforms, systems, and software

5) Cloud services and software

6) Operational security, user identity, and data encryption

7) APIs and integration

We will first focus on internet and mobile penetration rates, as these form the foundational infrastructure for any nation’s digital economy. Then, we will examine the digital infrastructure and pipelines—the API and integration layers of India Stack—that connect India’s digital economy and position it as a uniquely fertile ground for Web3 innovation. Finally, we discuss India’s upcoming CBDC, the “digital rupee.”

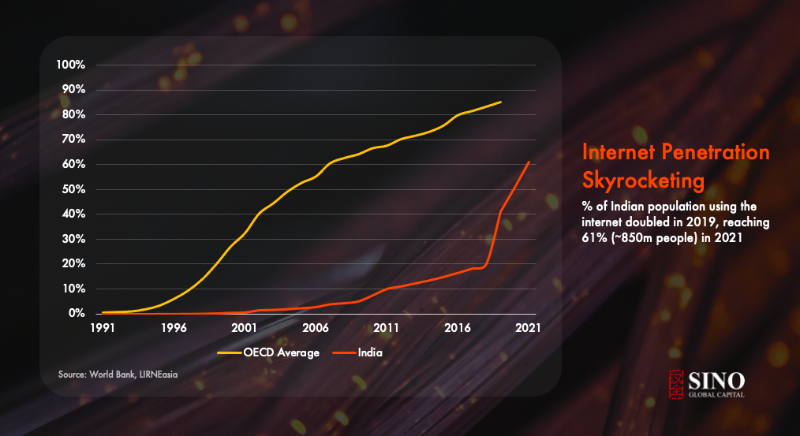

Internet

According to the World Bank, lockdowns due to Covid-19 and initiatives to improve rural internet access have driven recent increases in internet adoption, enabling India to catch up to OECD averages. In 2021, the proportion of Indians using the internet surpassed 60% for the first time and is likely to keep rising.

Establishing a reliable foundation for a nation’s digital revolution yields numerous positive secondary and tertiary effects. Robust and dependable digital infrastructure leads to exponential growth in startup creation, software production, open-source projects, and sophisticated fintech platforms.

Mobile/Smartphones

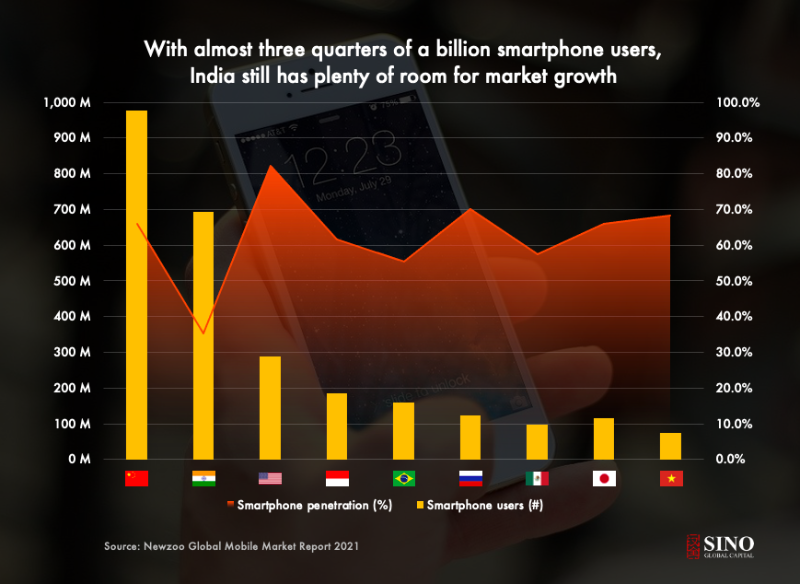

India ranks second globally in the number of smartphone users, with significant room to deepen smartphone penetration nationwide.

According to a KPMG and India Cellular and Electronics Association report, India is expected to have 820 million smartphone users by 2022. Domestic smartphone sales in India exceeded 33 million units in Q2 2021, an 82.3% increase over two years. India’s outlook for digital technology adoption is strong, with an estimated 300–400 million new mobile users expected over the next decade.

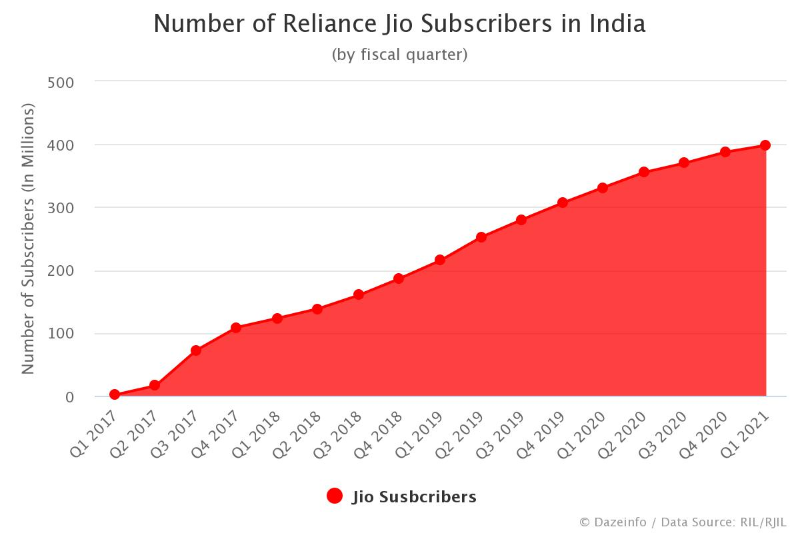

The 2016 launch of Reliance Jio triggered a ripple effect across the telecom industry, catalyzing recent growth in India’s mobile market. Jio offered heavily discounted data pricing, significantly accelerating India’s data consumption. Jio’s rollout was immediately successful, setting a world record by acquiring 16 million users in its first month—September 2016—by offering free high-speed internet for one year. Jio’s market moves catalyzed an era of cheap data prices in India, as competitors were forced to slash rates to compete. Rising consumer demand for affordable high-speed data caused Jio’s user base to quadruple within four years.

As a result, India’s per-user monthly data consumption rose from an average of 400MB before Jio’s plans to 11GB afterward. Today, the global average price per GB of data is $5.09. In India, 1GB costs just $0.09.

The proliferation of smartphones and affordable data plans presents a golden opportunity for businesses to tap into a vast user base just entering the digital economy. Netflix capitalized on this unique market condition by launching a mobile-only plan tailored for Indian consumers—the first time the company has ever offered such a service.

Domestic Indian crypto companies have also seized this opportunity. CoinSwitch Kuber, a Bangalore-based global cryptocurrency exchange aggregator and trading platform, executed a mobile-first strategy and now receives all its traffic via mobile devices.

As Web3 becomes increasingly mainstream, we expect to see more applications adopting mobile-first UI/UX designs to cater to the massive market of smartphone users, casual gamers, and mobile banking customers. India will be a key region for the development and user growth of future consumer-facing applications.

APIs: India Stack

Organizations developing digital applications benefit from comprehensive, well-supported tech stacks. For India’s government, enterprises, startups, and independent developers, a novel shared tech stack—IndiaStack—was developed to address the unprecedented challenge of bringing over a billion citizens into the digital age within a generation.

Exponential growth in India’s internet and mobile users accelerated the adoption of IndiaStack. With the rapid expansion of digital consumers, the scale and activity of digital markets like online banking and e-commerce have increased accordingly.

IndiaStack provides an open-source API suite that offers a common platform for software development across both private and public sectors in India. Specifically, by creating a standardized framework for compatible and collaborative development, IndiaStack’s open API suite acts as critical infrastructure that accelerates digital onboarding for over a billion Indians.

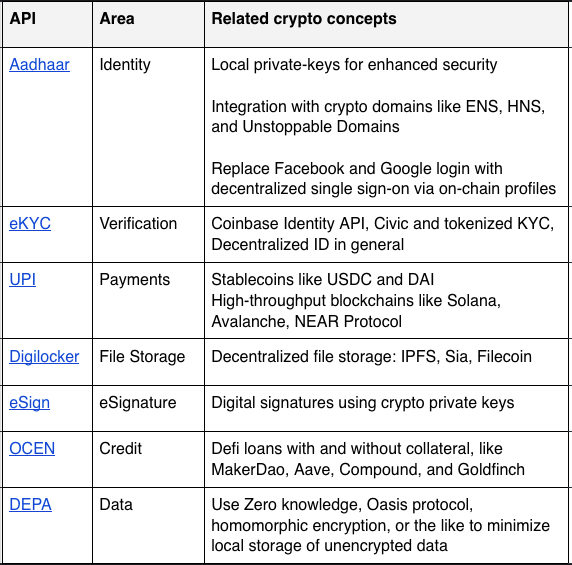

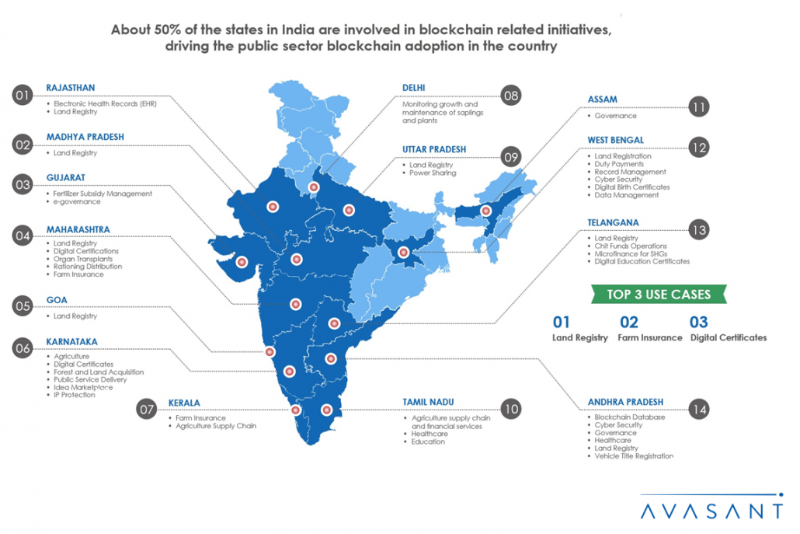

Each layer of the IndiaStack API suite is designed to meet India’s specific national and demographic needs. This has unlocked several economic primitives, forming a comprehensive foundation for a Web3 Cambrian explosion. We detail some of these below.

Identity and Authentication

IndiaStack democratized access to digital identity by linking the biometric digital ID issued by India’s Unique Identification Authority (known as Aadhaar) with Indian residents after verification. Aadhaar serves as both an identification tool and authentication enabler. This unique ID gives individuals a digital identity allowing them to verify themselves anytime, anywhere, without carrying physical documents.

Unlike driver’s licenses or voter registration cards, Aadhaar cards were not created with any specific use case in mind. Instead, they are universally accepted government-issued IDs suitable for multiple purposes.

Banks and financial institutions accept Aadhaar as valid KYC and authentication documentation, such as proof of address or national ID. Indians also use Aadhaar to access government services and benefits, such as pension fund disbursements.

This identity authentication functionality is equally useful when conducting KYC for crypto entities, including CEXs, crypto interest accounts like BlockFi, and fiat on/off ramps.

Payments – UPI

The Unified Payments Interface (UPI) is a system that aggregates multiple bank accounts (from participating banks) into a single mobile app, allowing users to access multiple banks and payment functions under one roof.

Like many other countries, Covid-19 pushed many Indian consumers online, accelerating the use of non-cash payments. During this period, UPI payments surpassed all other methods to become the dominant payment mechanism, reaching ₹73 billion ($9.9 billion) in 2021.

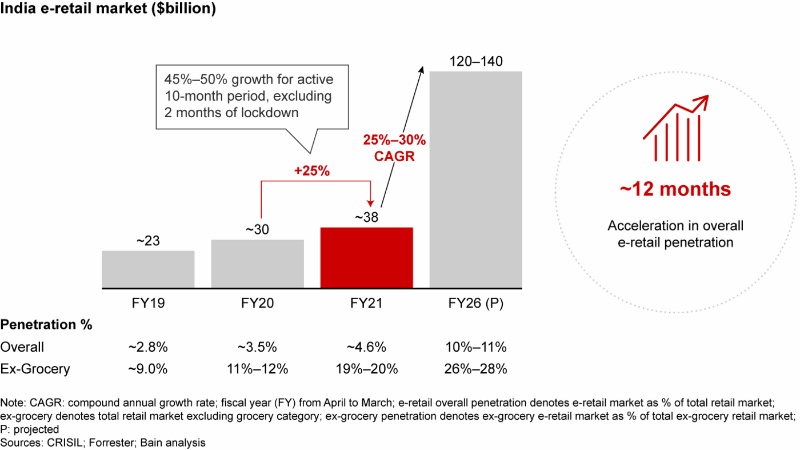

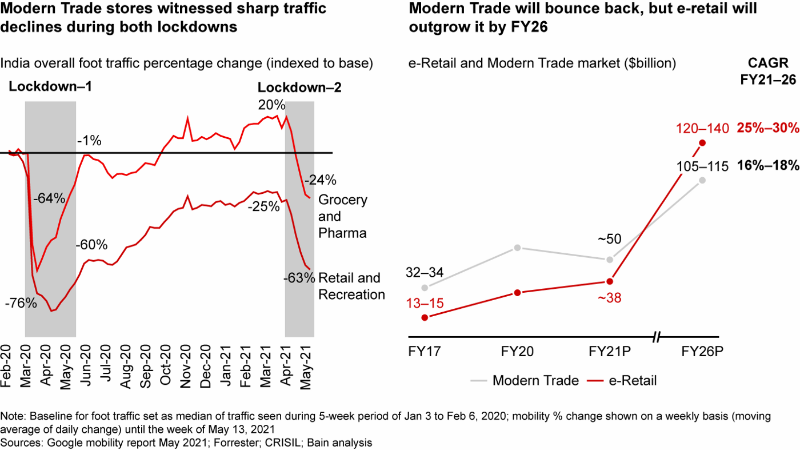

The growth of UPI coincides perfectly with the massive rise in e-retail (B2C), underscoring its value.

UPI has brought a revolution in online payments and mobile banking in India. Notably, while in most countries digital payment platforms are dominated by middle- and upper-class users, UPI’s high-penetration growth has been driven by previously unbanked individuals—even roadside kirana stores (small shops typically serving one street or neighborhood) now accept digital payments.

This widespread market digitization makes it easier for individuals and businesses to transition to Web3, reducing the perceived risk compared to users in other markets more accustomed to traditional cash payments.

India’s CBDC

In 2017, a high-level inter-ministerial committee recommended introducing a central bank digital currency (CBDC) in India.

In July 2021, the Reserve Bank of India (RBI) held a webinar discussing the benefits and risks of CBDC and concluded: “Introducing a CBDC could bring substantial benefits, such as reduced reliance on cash, improved taxation due to lower transaction costs, and reduced settlement risk. A CBDC could provide a stronger, more efficient, credible, regulated, and fiat-backed payment option.”

In the 2022–2023 budget speech, Finance Minister Nirmala Sitharaman announced that India would launch its own official digital currency within the next one to two years, adding that the introduction of a CBDC would significantly advance India’s digital economy. The digital rupee may mirror the functionality of electronic wallets currently operated by private companies while becoming an officially sovereign-backed currency.

What It All Means

Over recent years, IndiaStack has evolved continuously, adding more features and forming a suite whose value exceeds the sum of its parts. The digital infrastructure built in India has greatly improved financial inclusion metrics. According to the Bank for International Settlements: “From the low levels of financial inclusion and formal identity recognition in India in 2008, it is clear they faced enormous challenges over a decade ago. Based on the bank account data mentioned above and its relationship with per capita GDP, if India had grown through traditional means alone, it would have taken 47 years to bring 80% of adults into the banking system.”

Source: Bank for International Settlements

Source: Bank for International Settlements

IndiaStack has also positively impacted the private sector. APIs and digitization have significantly boosted output among Indian software firms and spurred innovation. IndiaStack’s vast ecosystem has substantially lowered entry barriers across various digital industry segments. Beneficiaries include existing financial intermediaries, established software companies, and emerging fintech startups. Fintech startups have become major players—for example, Paytm, BharatPe, PayNearby, and Setu. Setu is a software startup founded by alumni of India Stack. The company provides plug-and-play APIs for financial products and offers developers a sandbox to test their applications. International companies have also seized opportunities—Walmart, for instance, acquired Flipkart, India’s e-commerce giant, and now owns PhonePe, the market leader in UPI transactions.

India has greatly benefited from the synergies and economic opportunities created by its technological development. Indeed, there is a view that given the interconnected “pipes” of IndiaStack, India’s recent leaps in financial inclusion and digitization have even surpassed those of developed nations, which despite having advanced banking and technological infrastructures often suffer from institutional silos and lack cohesive, industry-wide integration.

Currently, although IndiaStack does not directly integrate cryptocurrencies or DeFi technologies, we believe it can incorporate digital payments and enhance KYC capabilities. As Balaji Srinivasan put it: “Enable new forms of debt and equity financing domestically in India, connecting them to global pools of crypto capital. Doing so would help fill the over $250 billion funding gap for MSMEs, give startups access to the booming financial internet, and enable fast payments for remote workers and remittance recipients.”

Source: https://balajis.com/add-crypto-to-indiastack/

Regardless of whether cryptocurrencies are integrated in the future, IndiaStack already possesses cohesion, and combined with growing internet and mobile penetration, lays a solid foundation for mature, data-driven Indian markets eager to build products and services atop Web3 protocols.

India’s Web3 Awakening

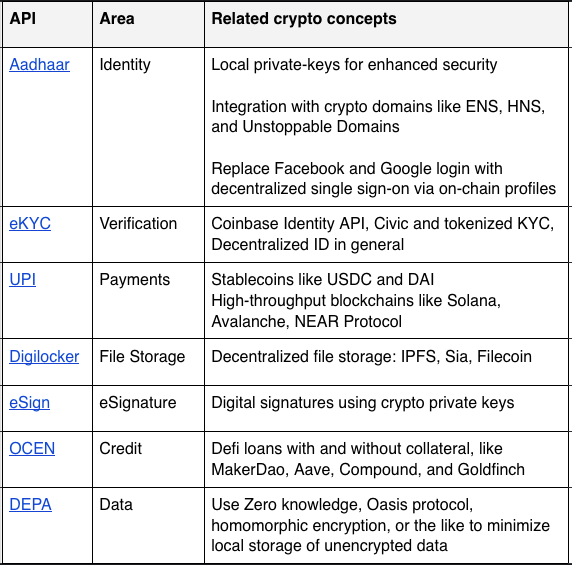

Recently, Chainalysis estimated that based on significant peer-to-peer platform transaction volumes—and adjusted for purchasing power parity and internet-using population—India ranks second globally in cryptocurrency adoption.

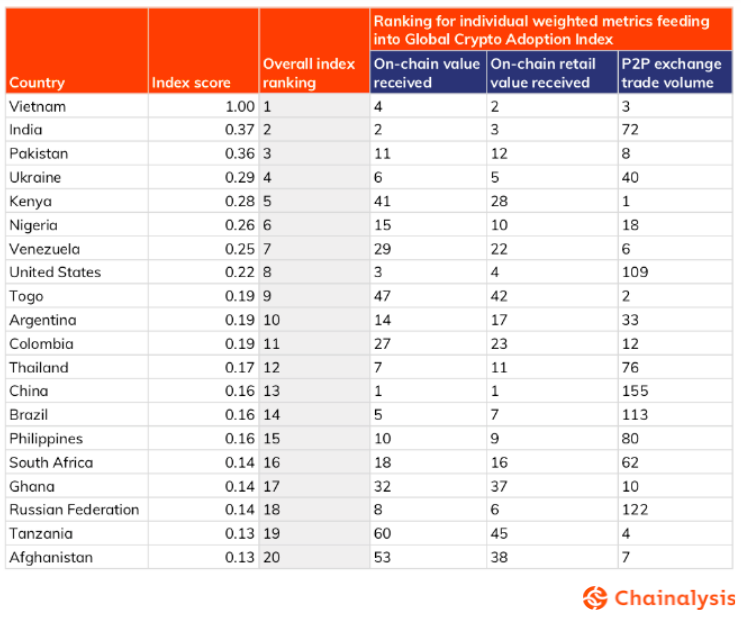

The importance of blockchain technology has also been recognized by the public sector, with various Indian states implementing blockchain projects for public services.

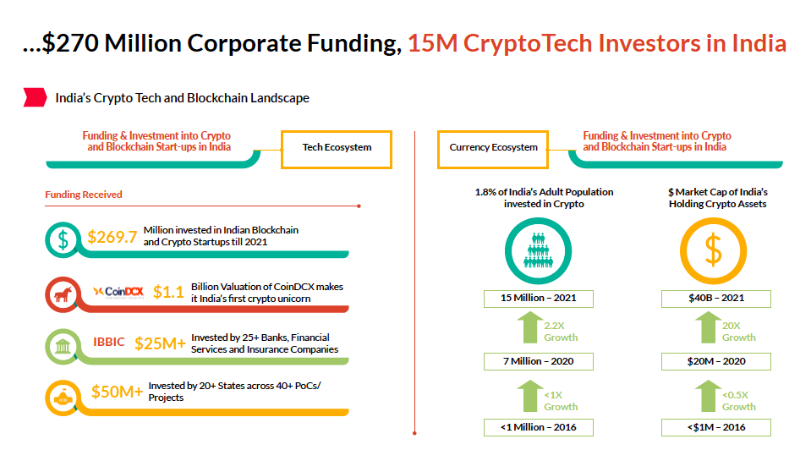

Over 15 Million Retail Crypto Investors in India

1) Data from CoinSwitch shows that as of August 2021, the average age of Indian cryptocurrency investors was 24. Moreover, over 65% of users list cryptocurrency as their preferred investment alongside traditional fixed deposits.

2) In 2021, account registrations from users in tier-2 and tier-3 cities drove over 2,000% user growth for several CEX companies.

India’s Web3 participation rate remains at only 7.5%. However, trends like NFTs and gaming serve as mainstream catalysts, and favorable regulations signal promising growth in India’s Web3 awareness share. Furthermore, as India improves regulatory clarity and legalization, domestic registered and regulated brokerage firms like Zerodha are likely to offer professional services widely across the Indian market—benefiting both the country and global crypto adoption.

Bollywood’s Breakthrough NFTs

In recent months, several Indian celebrities have launched their own official NFT collections. Notable NFT enthusiast Amitabh Bachchan auctioned his first collection in November 2021, and Salman Khan announced in October a partnership with the NFT marketplace Bollycoin.

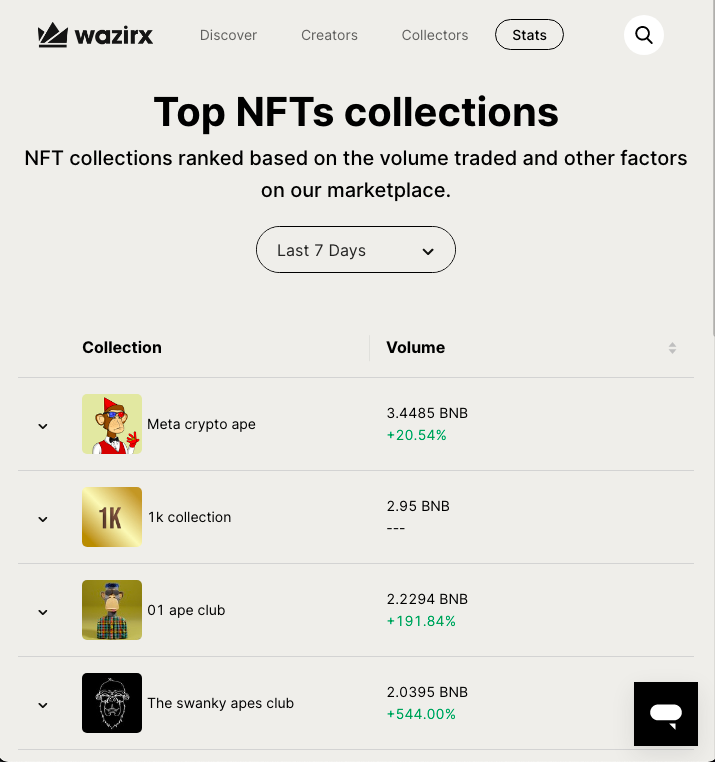

Startup WazirX launched its NFT platform in April 2021, selecting 15 creators from 15,000 applicants. To date, around 1,000 artists and 400 collectors have joined, with nearly 20,000 artists on the waitlist. From July to October 2021, WazirX’s native NFT platform recorded over $400,000 in sales, with revenue expected to reach seven figures in 2021.

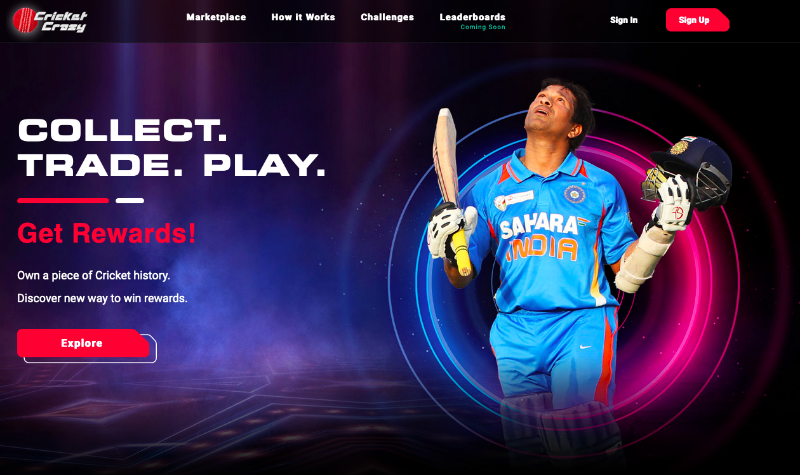

On the sports front, Faze Technologies has partnered with the International Cricket Council (ICC) to create exclusive digital collectibles (using NFTs) for cricket via FanCraze.

Cricket Foundation—the first crypto ecosystem dedicated to the sport—was co-founded by former cricketer Parthiv Patel and Pruthvi Rao. The foundation launched CricketCrazy, an NFT marketplace for cricket, in October 2021.

The NFT craze has transformed sports, Bollywood, and other creative industries, giving athletes, celebrities, and creators direct access to independent collectors and democratizing the exhibition process. Many Indian artists showcase diverse content and styles on NFT platforms like Foundation, Opensea, Rarible, Kalamint, and others.

Additionally, various NFT events took place in 2021, the most notable being NFTKochi on December 18 in Kochi, Kerala—the commercial capital of coastal India. It was India’s largest NFT conference, art exhibition, and festival. The event gathered prominent artists and NFT collectors and was highly successful. See timeline: https://twitter.com/SinoGlobalCap/status/1473319708963536896.

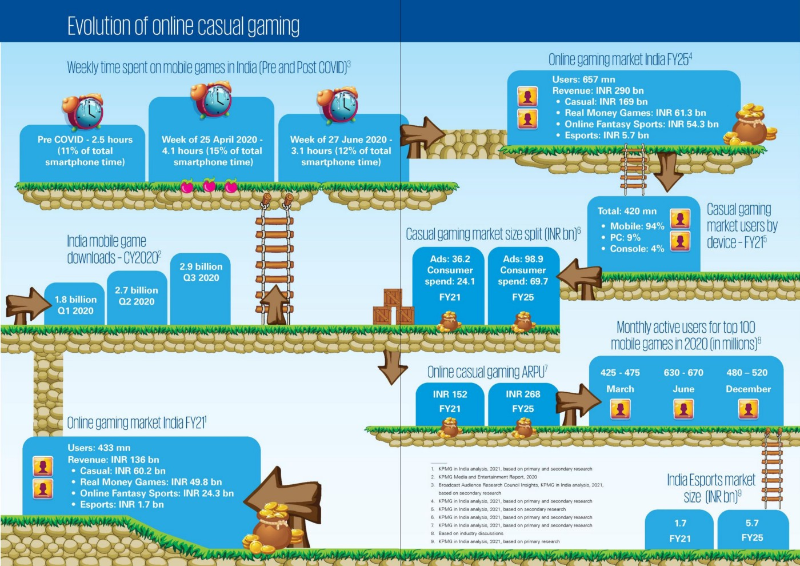

India’s Gaming Industry

According to a KPMG report, the number of online gamers in India grew from approximately 250 million in 2018 to about 400 million by mid-2020, and the industry’s value is expected to triple, reaching $3.9 billion by 2025. Over 50% of India’s population is under 25, and gamers in this age group account for 60% of the country’s total gaming audience (https://www.investindia.gov.in/team-india-blogs/rise-indian-gaming-industry-tekken-ludo-king).

1) Mobile gaming currently dominates India’s gaming industry. The total market value of India’s gaming industry is $1.6 billion, with mobile games accounting for over 90% of the market share, expected to grow to $3.9 billion by 2025.

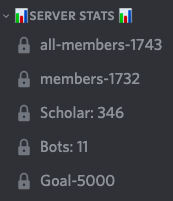

2) Axie Infinity’s “scholarship” program has expanded across India, with nearly 350 verified “students” on the Axie India Discord server. Indeed, Axie has been transformative for many Indians, positively impacting many players’ lives during the Covid-19 pandemic.

3) YGG and other major guilds are actively recruiting players and partners from the Indian subcontinent and have even launched a dedicated sub-DAO: Indi.gg.

Fantasy Sports

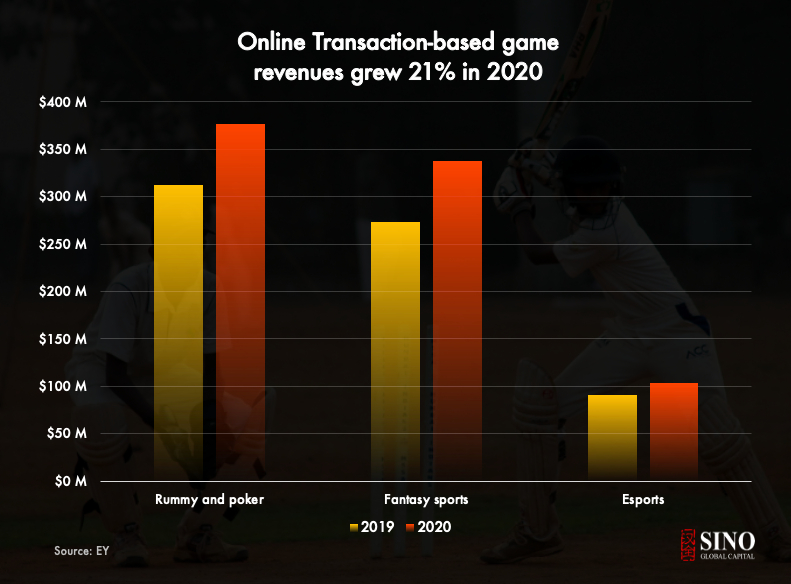

According to the Ficci-EY report “Playing by New Rules,” India’s fantasy sports market grew 24% in 2020 despite pandemic-related restrictions and the absence of major sporting events. This growth occurred primarily during the 13th season of the IPL (Indian Premier League) cricket tournament in Q4 2020, delighting fans. The current user base stands at 100 million and is expected to reach 150 million by the next IPL. A key factor driving the recent rise of transaction-based games (games involving payments rather than monetized ads or certain in-app purchases) is the growth of India’s digital payments ecosystem.

Fantasy sports are both popular and controversial in India. In August 2021, India’s Supreme Court dismissed an appeal against a Rajasthan High Court ruling, determining that Dream11, a popular online cricket betting fantasy game, is a game of skill and not gambling. This ruling helped clarify the legality of fantasy sports and encouraged greater participation among sports enthusiasts.

Under the Supreme Court’s ruling, games whose outcomes are heavily influenced by chance are deemed illegal, while skill-based games primarily determined by a player’s mental abilities are mostly considered legal. This clarification provided much-needed certainty to the fantasy sports industry and fueled rapid market expansion. According to Ficci-EY analysis, India’s fantasy sports industry is expected to reach $2.5 billion in 2022.

According to the recently released “Business of Fantasy Sports” report by the Federation of Indian Fantasy Sports (FIFS) and KPMG, fantasy sports operators generated total revenue of approximately ₹2.4 billion ($340.47 million) in FY2020, up from ₹920 million ($131.64 million) in FY2019—a roughly threefold increase. This has opened the floodgates in India, with multiple platforms like MPL, Zapak, and Criplay aggressively acquiring users. Supported by current and former members of India’s national cricket team, more blockchain-based fantasy platforms are being built and gaining support.

Blockchain gaming has not yet reached critical mass in India. However, the opportunity presented by play-to-earn should not be ignored—it offers professional gamers a new career path that is gradually gaining momentum. NFTs and DeFi continue to transform value creation in gaming. Below, we mention several Indian projects currently working on crypto gaming.

Crypto Workshops – Desi Developers and Democratization of Talent

India’s economic development is increasingly tied to its technological output, particularly in software and engineering. According to GitHub, India has an army of 5.8 million developers—the second-largest developer community globally—earning the country a reputation for affordable, high-quality software production.

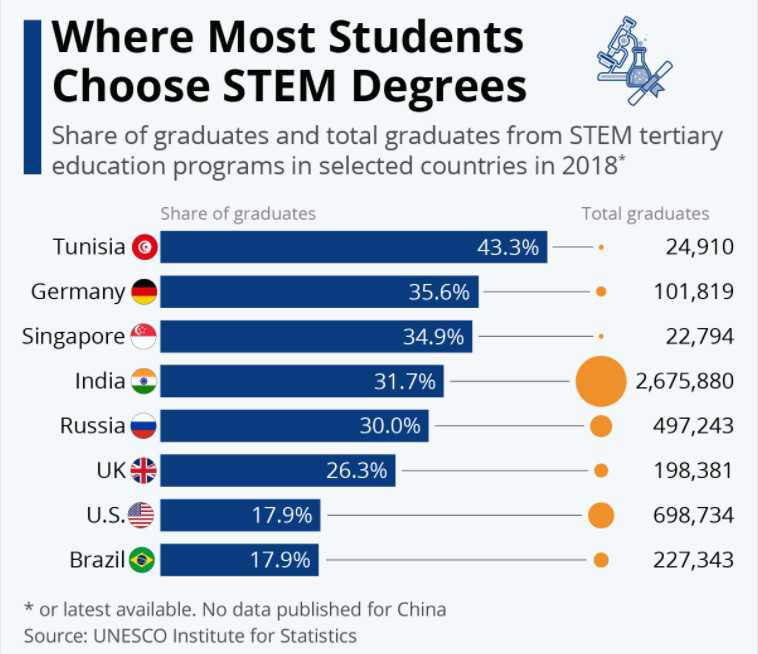

According to UNESCO, India produces approximately 2.7 million STEM (science, technology, engineering, and mathematics) graduates annually—nearly four times the number in the United States (~700,000).

Although UNESCO does not publish Chinese data, the World Economic Forum stated in 2016 that China actually graduates 4.7 million STEM students annually—far exceeding India’s earlier reported 2018 figure. However, according to the (U.S.) National Science Foundation, China’s classification of engineering and science fields is quite broad, making data comparisons difficult. A U.S. government agency estimated in 2014 that China graduates about 1.6 million science and engineering students annually.

Notably, relatively few students at America’s most prestigious schools (i.e., Ivy League) pursue STEM majors, especially computer science. In contrast, India’s top institutions—especially IITs and IIMs—are predominantly STEM-focused, known for their fiercely competitive admissions, rigorous curricula, and extremely difficult entrance exams. These high standards foster a culture of excellence and create an ideal recruiting ground for tech-based startups.

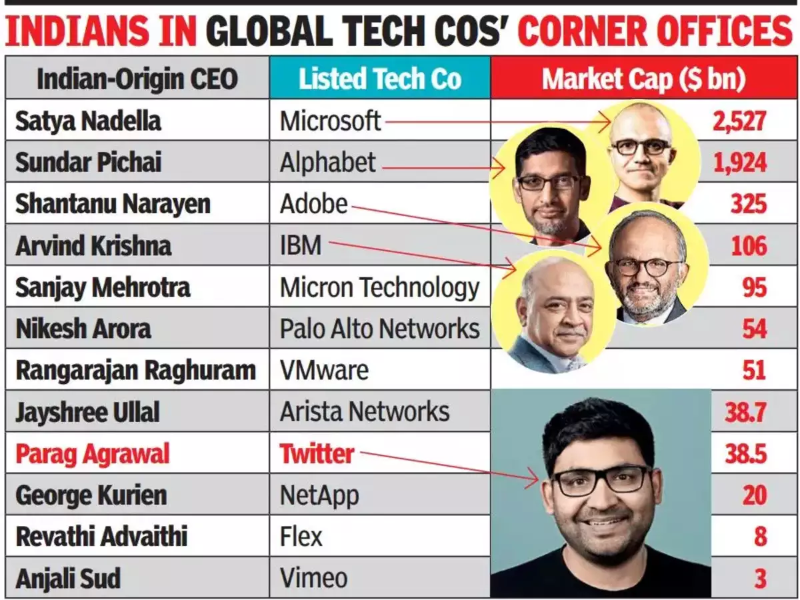

Indians have made a significant impact on leadership and innovation in Silicon Valley.

Source: Times of India

Source: Times of India

Source: 2021 Silicon Valley Software Engineering Talent Report

Source: 2021 Silicon Valley Software Engineering Talent Report

Web3 caters to India’s abundant Gen-Z talent by offering rich opportunities. The democratization of talent and the global scale of blockchain development normalize collaboration with elite global developer teams, attracting many ambitious Indian students.

Top institutions like IIIT Bangalore, IIIT Hyderabad, and IIITM Kerala now offer comprehensive courses on blockchain architecture and Web3 protocol design. Students and faculty at these institutions often possess strong foundational technical skills, positioning them well for transitioning into Web3 development. The high standards and rigorous curricula of IITs are recognized as world-class both in India and abroad, making these institutions prime recruitment grounds for companies seeking young talent. Smart young students considering their career paths will surely find the Web3 industry highly utilitarian and unparalleled in income potential. On the employment front, Indian trade association NASSCOM estimates in its 2021 Cryptotech Report that over 50,000 people in India are currently working in Web3 (e.g., financial infrastructure, software development, analytics, and other functions), with projections to grow to about 800,000 by 2030.

India’s Unicorn Companies

1) According to Observer Research Foundation, over 350 blockchain startups currently operate in India.

2) In 2021, India’s traditional startup ecosystem produced an average of three unicorns per month, bringing the national total to 81—an all-time record.

3) According to Hurun India, India has become an ideal habitat for unicorns, rising to third place globally.

4) India’s first Web3 unicorn was CoinDCX (https://qz.com/india/2046046/how-coindcx-became-indias-first-cryptocurrency-unicorn/), launched in 2021. CoinDCX, a cryptocurrency exchange and the first Indian blockchain company to break ten digits in valuation, focuses on mass consumer adoption through a cleverly executed retail-centric business model—reflected in its $1.1 billion valuation.

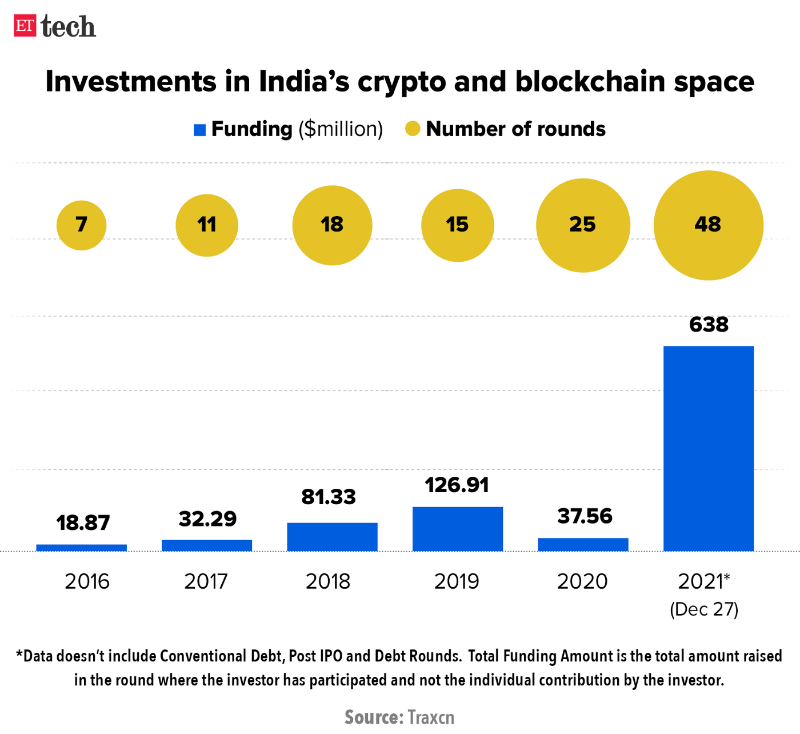

5) This impressive growth has been supported by over $630 million in investments specifically targeting Indian blockchain companies.

6) According to NASSCOM, institutional investment amounts have also grown to over $25 million, with dozens of banks, asset management firms, and insurance companies participating in early-stage Web3 fundraising.

7) Revenue from Web3 unicorns stems from breakthrough milestones in user registration, almost entirely driven by retail users.

Polygon: Desi Crypto’s Masterpiece

Polygon began as Matic. Matic, a leading force in Ethereum scaling, was founded in 2017 by Jaynti Kanani, Sandeep Nailwal, Anurag Arjun, and Serbian programmer-entrepreneur Mihailo Bjelic. As India’s flagship Web3 ecosystem, Polygon’s legacy cannot be overstated.

In January 2021, India’s Ministry of Electronics and Information Technology released a draft national strategy on Indian blockchain products. The report predicted that at least one blockchain-based enterprise globally would reach a $10 billion valuation by 2022—but India’s own Polygon surpassed the $10 billion mark as early as mid-2021.

Polygon has also taken significant risks in building an independent L1 ecosystem, operating almost entirely under India’s uncertain regulatory environment. Organizationally, Polygon distinguishes itself by actively supporting projects within the Matic ecosystem to develop and drive broader Indian Web3 momentum.

To achieve their ambitious goals, Polygon has sponsored and hosted over 200 hackathons in India over the past two years. Through their developer support program, Indian blockchain developers receive technical, financial, talent acquisition, and outreach assistance. Additionally, Polygon supports emerging projects led by India-based teams through their Matic Ecosystem Initiative, such as Marlin Protocol.

Polygon’s Empire: Expansion Beyond L2

Business Development: Matic’s rebranding to Polygon marked a strategic shift toward becoming an aggregator of Layer 2 solutions and a flexible suite of on-chain functionalities (including rollups and other scaling mechanisms).

Acquisitions: In 2021, Polygon acquired Hermez Network, reinforcing its ambition to implement a comprehensive on-chain solution for all Ethereum scaling technologies. Shortly after, it announced Polygon Miden, an EVM-compatible rollup powered by zk-STARKs. To date, Polygon has spent over $1 billion on zero-knowledge technology development.

Partnerships: The project has multiple collaborations in India, most notably with the consulting arm of Infosys Ltd—one of India’s largest IT companies. The joint initiative, M-Setu, is an open-source bridge enabling enterprises to perform cross-chain operations on the Ethereum blockchain.

Polygon Studios

Polygon Studios is a targeted initiative aimed at contributing to the growth of Polygon’s gaming metaverse and NFT ecosystems. The initiative supports blockchain game builders with infrastructure and offers grants to attract artists and investors to its NFT ecosystem. Specifically, the Polygon Studios entity intends to release SDKs for developers, invest in small companies, market the platform as an accelerator, and expand technical support for developers. Polygon Studios recently hired Ryan Wyatt, YouTube’s head of gaming, to lead the team—providing a “vote of confidence” for the platform.

Regulatory Environment – Timeline

Before discussing the regulatory environment, it’s important to note that Indian law has never banned cryptocurrency, nor has holding cryptocurrency ever been illegal at any point.

2013–2017: Phantom Threats

Indian law initially acknowledged the existence of cryptocurrencies through notices issued by the Reserve Bank of India. These notices informed “users, holders, and traders” of the risks associated with cryptocurrencies. Beyond that, little action was taken.

2018: RBI Pushback

Following the initial notices, the Reserve Bank of India issued a statement on April 5, 2018, ordering all its regulated entities (banks, non-banking financial companies, and payment system providers) to cease dealings in virtual currencies and stop providing services facilitating such transactions or settlements. Additionally, any regulated entity currently offering such services must discontinue them within three months of the notice’s issuance. In 2018, a writ petition challenging the RBI’s notice was filed.

2020: A New Hope

On March 4, 2020, in the case of Internet and Mobile Association of India v. Reserve Bank of India, India’s Supreme Court ruled in favor of a permissionless Web3 ecosystem. This judgment serves as a key indicator of public-sector recognition of the strategic and economic value of cryptocurrencies.

2020 also saw the release of “Blockchain: The India Strategy,” the first part of a two-part strategic document draft. The strategy recognizes blockchain technology as a means to improve business and governance processes. It acknowledges cryptocurrency as a unique asset class that can represent network ownership (like company shares) and serve as a fundamental unit of value exchange.

2021: Rise of Regulation

In January 2021, India’s Ministry of Electronics and Information Technology released the sequel to the National Strategy on Blockchain document, over a year after the first draft. Ambiguities around tokens, lack of KYC norms, exclusion from the digital signature framework, and insufficient data protection regulations were highlighted as regulatory gaps in legacy systems. The sequel outlined a series of potential blockchain applications aligned with national interests, including logistics, supply chain management, identity management, e-voting, IoT device management and security, microcredit for self-help groups (SHGs), and more.

At the beginning of January, the Reserve Bank of India released a booklet titled “Payments and Settlement Systems in India: Journey in the Second Decade of the Millennium 2010–2020,” defining CBDC as “the digital form of legal tender denominated in sovereign currency and appearing as a liability on the central bank’s balance sheet. It is electronic money that can be exchanged or converted for cash and traditional central bank deposits of equivalent denomination.”

On March 24, 2021, India’s Ministry of Corporate Affairs issued a notification amending Schedule III of the Companies Act, 2013. Schedule III specifies how businesses must generate profit and loss statements and balance sheets for submission to the government. The updated Schedule III requires Indian companies to report the following:

1. Profits or losses from cryptocurrency transactions;

2. Amount of cryptocurrency held on the reporting date;

3. Any deposits or advances provided by individuals for cryptocurrency trading or investment.

In response to reports that certain banks were still citing the

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News