Bank Accounts and the Metaverse: Where Will We Store Value in the Future?

TechFlow Selected TechFlow Selected

Bank Accounts and the Metaverse: Where Will We Store Value in the Future?

"25% of our users have never had a bank account before, which means the Axie wallet is their first access to financial services."

Author: Andrew Beal

Translation: Alex Zhang

This week I read an article on The Verge about Axie Infinity—a blockchain game sweeping through the Philippines—where the founder shared an interesting statistic: "25% of our users have never had a bank account before, meaning their Axie wallet is their first financial service."

That resonated with me because we've seen how the idea of a bank account has evolved significantly over the past 20 years since the internet emerged. Today, people store value across many different platforms.

I can't help but think Axie differs from previous innovations in bank accounts—like PayPal, Venmo/CashApp, and super apps such as WeChat, Go-Jek, and Grab—because it's natively built on blockchain.

When you embed blockchain technology into the internet, something fascinating happens... financial services shift from vertical to horizontal.

Thanks to public blockchains, every website, mobile app, or even game now has access to financial infrastructure underneath—if they want it.

Axie Infinity isn’t the first non-financial service application to unintentionally become a de facto banking platform for a group of people. Messaging apps, followed by ride-hailing apps (all in Asia), have successfully evolved from single-purpose tools into ubiquitous super apps.

But we’ll see more of this—any app with a transactional or revenue component can function as a bank account and host its own economic ecosystem.

Bank Accounts

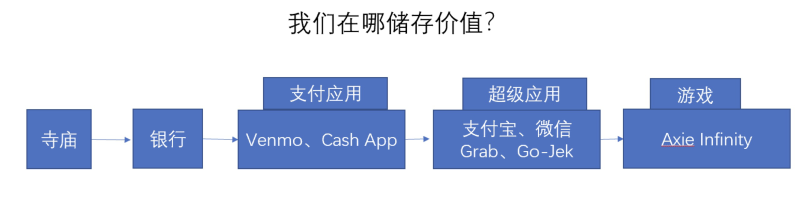

The concept of a bank account dates back thousands of years. Before monetary economies existed, we had barter systems—people exchanged goods like livestock, grain, or agricultural products. When these items became numerous, they were heavy and inconvenient to carry, so people sought secure places to store their assets. Temples served this purpose, as they were already well-guarded. You’d leave your belongings there, and the temple would track who stored what.

Over time, institutions specifically dedicated to banking emerged, but the core concept of a bank account remained largely unchanged. As more regions adopted money-based economies, bank accounts continued to offer security and convenience.

Before the internet, traditional bank accounts remained largely unchallenged.

At their core, bank accounts do two things: keep your money safe and make it accessible when you need it.

While most of us still maintain checking and savings accounts at banks, we also hold balances on other platforms. Fintech created internet-native user experiences with value-capture effects—like peer-to-peer payments—turning them into mobile bank accounts. PayPal, then Venmo and Cash App, dominate P2P payments in the U.S. In Asia, it’s super apps like WeChat and Alipay.

Non-bank apps won because they offered better customer experiences. Take Go-Jek and Grab—I love this example.

Ride-hailing apps gained popularity between 2012 and 2019. While Uber dominated the U.S., Go-Jek and Grab achieved similar success in Southeast Asia, with Grab actually acquiring Uber’s Southeast Asian operations in 2018.

These companies quickly realized users were maintaining cash balances within their apps. Go-Jek and Grab unintentionally became bank accounts. Since these apps were already ubiquitous in their markets, expanding into broader payment functions and convincing merchants to accept them was easy.

Today, you can use the app to hail rides, order goods, buy groceries, invest, or even purchase insurance.

This tells me people put their money where it’s most convenient. There are multiple ways to create convenience. Super apps take a “one-stop shop” approach—one app offering all essential products and services.

Axie Infinity

As Casey Newton from The Verge put it, Axie Infinity is Pokémon on the blockchain. The game features turn-based battles among teams of three cartoon monsters called Axies; each Axie has powers derived from its type (bug, bird, plant, etc.) and various body parts. Pokémon on the blockchain.

By playing the game, you earn SLP, one of two in-game currencies, which can be converted into fiat or used to buy in-game items.

As I mentioned earlier, 25% of Axie players had never had a bank account before. Combined with a MetaMask wallet, Axie becomes their first financial service.

Now, the Philippines does have banks, but for many people, they’re not practical. The average annual household income in the Philippines is around $7,000. Simply maintaining a bank account and paying associated fees can be prohibitively expensive.

What makes Axie unique is that players both earn and get paid within the same app. Economically, there must be a compounding effect. I wonder what proportion of Axie earnings are reinvested into the game versus cashed out.

Vertical vs. Horizontal

I said public blockchains turn financial services from vertical to horizontal—and I owe you an explanation.

Financial services is an industry whose supporting infrastructure is owned by corporations. It operates as a vertical product and service stack. Financial regulation acts as a gatekeeper, restricting who can provide these services.

Blockchain turns this horizontal because core financial functions—settlement, exchange, credit—are now embedded into the internet itself.

One of the best examples of horizontal financial impact is how Axie Infinity players can lend or borrow Axies for yield without relying on a lending platform—financial services can be permissionlessly embedded directly into the gaming experience.

Another cool implication is that it gives online communities of any size the tools to build their own economies.

The internet is an incredible horizontal force—it’s global, permissionless, and industry-agnostic.

The metaverse is also horizontal—a borderless virtual internet space.

When you combine financial services with the metaverse, you create a sandbox economy that inherits all the internet’s traits: global, open, and available 24/7.

Horizontal layers can become powerful equalizing forces globally. They eliminate many geographic advantages and disadvantages. Being born in a first-world country comes with clear benefits—access to education, professional opportunities, and financial services—but as blockchain and the metaverse mature, some of these disparities may gradually level out.

My hunch is that people living in countries with fewer economic opportunities will migrate first. They stand to gain the most, and many are already willing to physically relocate for better prospects.

In the metaverse, there’s no friction. No plane tickets or visas needed—just an internet connection. People in first-world countries like the U.S. will likely migrate into these new economies more slowly, simply because they have less incentive to do so.

Scattered Thoughts

Will the next generation even have bank accounts?

Definitely not in the form we know today. Honestly, I think the next iteration of digital and social media platforms might just become that.

With public blockchains and DeFi protocols, every application—web or mobile—can embed financial services into its user experience. One big question is how regulation will affect integration.

Maybe someone will build a "boxed economy" API suite (perhaps they already are) that solves regulatory challenges for teams that don’t want to be regulated like banks or fintech firms.

This also suggests financial services regulation will change dramatically over the next decade.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News