Selling merchandise hasn't brought Axie Infinity back to its peak

TechFlow Selected TechFlow Selected

Selling merchandise hasn't brought Axie Infinity back to its peak

For Web3 games to emerge from the downturn, they must return to the fundamentals of gaming itself.

By Mu Mu

After blue-chip NFTs like Pudgy Penguins and Doodles expanded into merchandise sales, Axie Infinity—the pioneer of Web3 play-to-earn gaming—is now also selling physical goods.

Recently, Axie launched an online store, commercializing 4,877 in-game NFTs into plush toys, T-shirts, hoodies, cartoon stickers, and other merchandise. To boost sales, Axie is offering a free Mystic Axie NFT to the first 5,000 buyers.

Expanding into new markets remains a key challenge for Web3 brands today. Combining NFTs—and the Web3 games that generate them—with physical products has become one way to increase influence and generate economic value.

Unfortunately, after launching its merchandise line, Axie saw no significant rise in NFT trading volume or community growth. This Web3 gaming IP still hasn’t truly reached Web2 audiences. In contrast, the return of Axie Classic, the original game mode, not only boosted engagement but also drove up the price of its AXS token.

Clearly, if Web3 games want to recover from their slump, they must return to their core: the gameplay itself.

When NFTs Don't Sell, Sell Plush Toys Instead

If you know anything about Web3 gaming or GameFi, you’ve probably heard of Axie Infinity—often called “Axie” or affectionately “A-Xie” in Chinese-speaking communities.

This cute-looking TCG (trading card game) was once used by millions of Filipinos during the pandemic to supplement their income. Its “Play-to-Earn” model made it the flagship example of Web3 gaming.

Created by Sky Mavis, Axie Infinity has two core features: players buy NFT-based characters to complete tasks and battle, level up their NFTs, and earn in-game tokens (AXS); then they can sell either AXS or NFTs for profit.

This model even spawned side businesses such as character rentals through guilds, where players rent Axies to others. A longer-tail derivative is using NFTs as collateral to borrow crypto assets like USDT, BTC, or ETH.

Thus, "Game" acquired "Finance"—giving birth to the concept of GameFi.

At its peak in 2021, Axie achieved a staggering $17.5 million in daily revenue, with over 1.5 million daily active users (DAU). Its 30-day revenue hit $300 million—surpassing most traditional games in profitability.

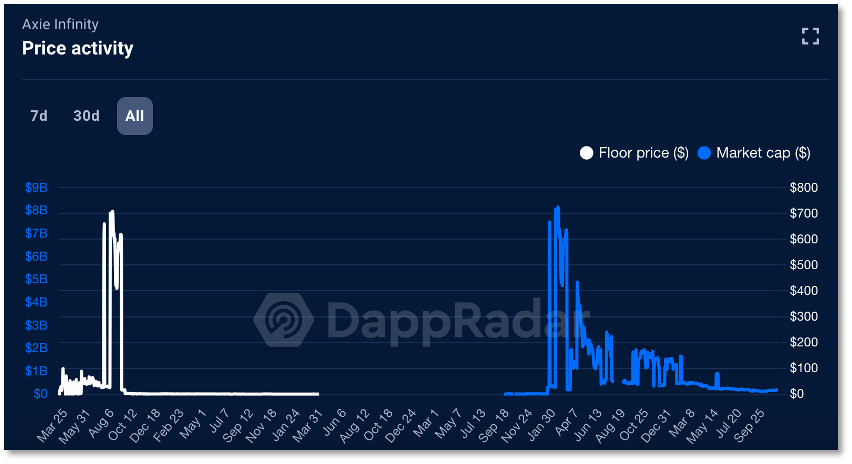

But Axie didn’t stay at the top for long. Within just over half a year, growth stalled, and no subsequent marketing campaign could restore its former glory. According to Crypto Slam, by November 2023, Axie’s monthly sales had plummeted to just $28,000. Data from DappRadar shows that both the floor price and market cap of Axie NFTs had crashed to historic lows.

Axie NFTs' floor prices and market cap have fallen far from their highs

Axie proved that blockchain games could reach millions of DAUs. The next challenge? Breaking into the tens of millions. Some industry insiders believe this requires Web3 games to expand their reach into traditional Web2 gaming audiences.

At the end of November this year, Axie began taking steps in that direction, launching an online store selling badges with the project logo, shirts, hats, accessories featuring Axie characters, Squishmallow-style plush toys, and figurines priced at $300. Both cryptocurrency and fiat payments are supported.

Beyond selling merchandise, Axie is encouraging its UGC ecosystem by lifting commercial use restrictions on 4,877 NFTs from the Mystic and Origin series. Owners of these NFTs can now sell their own designs via the store. They can even use their Axie characters to launch real-world Axie-themed ventures such as cafes, restaurants, or comics.

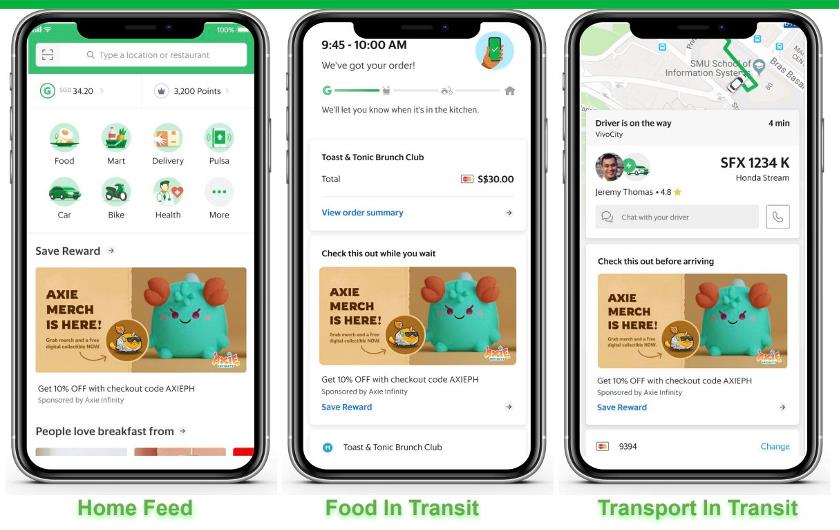

Even more aggressively, Axie Infinity partnered with Grab, the Philippine ride-hailing app, to launch a user rewards program—opening a distribution channel through mainstream Web2 applications. Users can access Axie’s online store directly within the Grab app.

Axie provides an entry point to its online store on Grab

Additionally, Axie has teamed up with game studios including Tribes Studio, Bali Games, Directive Games, and Bowled.io, allowing them to build games using the Axie IP.

It's clear that Axie is striving to expand the boundaries of its Web3 gaming IP, seeking deeper connections with the Web2 world to enhance brand awareness and attract new traffic.

IP Expansion Falls Flat—Game Improvements Drive Growth

So, have these efforts brought Axie meaningful growth?

Data suggests otherwise. Since launching its online store, Axie has seen no noticeable increase in community size or traction among Web2 users. In fact, out of 11.9 million Axie character NFTs, fewer than 5,000 have had commercial rights unlocked—just 0.04% of the total.

Looking at Axie’s activity over the past six months, it’s evident that real increases in daily active users came not from merchandising—but from improvements to the game itself.

On November 22—just before the online store launched—Axie brought back its classic version, Axie Classic, with major upgrades: allowing AXP character inheritance, increasing the AXS reward pool, introducing the ultimate prize “Mystic Axe,” and lowering barriers to entry by removing the “energy” requirement, enabling unlimited gameplay.

Axie Classic relaunch

The revamped Axie Classic reignited enthusiasm among veteran players and attracted new ones. Within days, weekly active users reached 100,000, and the AXS token price rose steadily.

Compared to launching physical NFT merchandise, improving gameplay delivered faster and more tangible results. Axie has experienced this benefit before.

On September 6, Yield Guild Games (YGG), a major play-to-earn guild, successfully completed Axie Infinity’s first “Super Task” event on the Ronin network, earning 112,000 AXS tokens (worth approximately $472,000). That incentive temporarily boosted Axie’s activity levels.

All of this indicates that Web3 gaming IPs are far from achieving mainstream breakthroughs. Marketing campaigns mostly stir existing communities, while reaching new Web2 users remains significantly harder than engaging seasoned Web3 players.

No one denies that merchandise helps raise brand awareness, but first you must succeed in your core business and earn the title of “popular.” For Web3 games, IP expansion isn’t a lifeline—it’s merely icing on the cake, and timing is critical.

During the golden age of American animation, Mickey Mouse’s fan club gained 1 million members in under four years—but only after Disney first captured audiences’ hearts with compelling animated stories. Only then did they extend Mickey into comics and video games. By 2010, Mickey-related merchandise accounted for 40% of Disney’s $1 billion consumer products revenue.

The Bored Ape Yacht Club illustrates how timing affects IP success. After noticing early exposure in Web2 markets, Yuga Labs quickly pushed collaborations with traditional brands, attracting marketing teams from companies like Li-Ning in China, accelerating BAYC’s crossover into the mainstream.

Had Axie launched its merchandise store at the height of its popularity, expanding its brand reach, it might have evolved into an IP transcending Web3 gaming.

Unfortunately, that moment has passed. Everything must be rebuilt from scratch. Today, what truly creates stickiness for Web3 games is gameplay quality, mechanics, user experience, and even yield returns—factors far more crucial than launching a merchandise line. The recent surge in popularity of Web3 game BigTime proves this point.

Crypto KOL @0xJamesXXX argues: “Stop obsessing over building IP and adding so-called utility.” He emphasizes that what matters most in any NFT community is “people.” A project with strong community consensus and real value creation has already outperformed 99% of NFT projects.

IP is not a magic formula. The challenge facing Web3 games today is clear: should they focus on building products that genuinely interest Web3 users, or try to appeal to entirely new Web2 audiences using traditional internet strategies?

Now, Axie is attempting to do both. But for this IP to break through again, it will have to wait for the game itself to go viral once more.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News