Understanding China's NFT Market: Tech Giants Enter Amid Hype and Constraints

TechFlow Selected TechFlow Selected

Understanding China's NFT Market: Tech Giants Enter Amid Hype and Constraints

China and the United States have adopted relatively different focuses in the development of the blockchain industry. The U.S. financial environment is relatively open, so current blockchain practices emphasize financial applications, while China's blockchain policies tend to focus on serving the real economy.

Author: Sino Global Capital

Translation: TechFlow, authorized Chinese premiere

Compared to the explosive growth of NFT ecosystems overseas, China's domestic NFT market is only just beginning. Recently, companies such as Tencent, Alipay, Souyun Technology, ZeroOne Universe, and others have started creating their own NFTs and launching NFT artworks.

Current Trends in China’s NFT Market:

1. Most Chinese NFTs are built on tokenless blockchains and use RMB rather than cryptocurrency for payments. Platforms without recognized cryptocurrencies are expected to face less regulatory scrutiny.

2. China's NFT ecosystem resembles a corporate initiative, driven at the national level and supported by enterprise organizations. So far, tech giants like AntChain (Alibaba) and Zhixin Chain (Tencent) have established their own underlying blockchains, with some adopting protocols like Near and Conflux as foundational layers.

3. The Chinese NFT space is being propelled by individual creators and influencers, including crypto curators like Cao Yin and Sun Bohan, and crypto artists such as Reva and Song Ting.

4. Notable Chinese NFT projects that recently gained attention include MaoDaoNFT, Riverman, and LoserChick in the GameFi sector. Undoubtedly, NFT development is gaining momentum toward the mainstream and will have revolutionary and disruptive impacts on emerging and existing industries. Currently, China’s domestic NFT market remains in its infancy. While NFTs aid in copyright protection, they also face challenges regarding compliance and alignment with business models.

Differences Between China's Current NFT Landscape and the West

China's blockchain industry generally focuses on commercial and governmental applications, with relatively slow progress on the consumer side—though there are a few success stories. China's NFT market is primarily led by two groups: crypto natives and "outsiders" drawn in by internet giants experimenting with NFTs.

Key Events in China’s NFT Space in 2021

1. Beeple’s “Everydays: The First 5,000 Days” sold for $69.34 million at a Christie’s auction.

2. BCA (Block Create Art) launched China’s first offline crypto art exhibition: “Virtual Niche—Have You Ever Seen Memes in the Mirror?”

3. The Metaverse boom, dubbed “the end of June Internet,” sparked a new wave of thinking around digital product economies led by Axie Infinity’s GameFi spring and the widely discussed “play-to-earn” model.

4. Chinese-made NFTs, such as Alipay NFT skins, began reselling and speculation on Xianyu, a secondhand marketplace.

5. Chinese NFT brands like MaodaoNFT and Riverman own intellectual property assets and have received support from influential figures or celebrities.

Why Chinese Tech Giants and Traditional Financial Firms Care About NFTs

1. Industry experts generally believe NFTs open up a new, unique way of representing value for digital assets, expanding the imagination around digital ownership.

2. Domestic enterprises’ initial forays into NFTs indicate growing recognition of their value. Overall, NFT digital products launched by Tencent and Alipay follow a consortium chain approach, mainly based on popular IPs in audio, painting, and other fields, aiming to encourage and promote IP protection for digital creations. Users are granted only collecting and display rights, with no secondary trading or gifting allowed.

3. Beyond gaming, potential future directions for NFTs could include derivatives, equity certificates, tickets, and more.

Key Use Cases:

China’s NFT market is primarily led by tech giants such as “BAT” (Baidu, Alibaba, Tencent), which are gradually entering the NFT space from their core competencies. Alibaba leverages its payment advantages, while Tencent stands out in music.

Alibaba:

1. With the launch of Alipay NFT skins and Alibaba’s NFT marketplace “Guangqian,” Alibaba has made significant strides and is leading the trend in China’s NFT market.

2. 8,000 Dunhuang Flying Apsaras Alipay payment code skin NFTs were listed on Xianyu, Alibaba’s secondhand e-commerce platform backed by Ant Financial, with peak prices reaching 700,000 RMB per piece (approximately $107,700).

3. Alipay issued 16,000 “Wu Liuqi” Alipay payment code skin NFTs and collaborated with the Dunhuang Academy to release an NFT called “Auspicious Deer King,” limited to 8,000 pieces, now sold out.

4. Alipay partnered with Near Protocol to launch an NFT virtual building named “Tuli Fu” during the Taobao Maker Festival. 310 digital real estate NFTs issued by artist Huang Heshan sold out within two days, totaling over 360,000 RMB (about $55,300).

5. Alibaba Auction launched its own marketplace “Guangqian,” a proof-of-existence service powered by Conflux technology.

Tencent:

1. Tencent PCG officially launched its NFT marketplace application “Huanhe.” The platform promoted its debut with 300 NFTs of vinyl records based on Tencent’s popular celebrity talk show “The Rap of China,” each priced at 18 RMB ($2.80).

2. On August 20, Tencent’s NFT trading platform “Huanhe,” in collaboration with GGAC partner artist Zhou Fangyuan, officially released the “Digital Ethnic Encyclopedia” NFT series, issuing 56 types of NFTs with a total volume of 3,136 units.

3. Tencent Music launched its own NFT marketplace service, “TME Digital Collectibles,” currently in internal testing on QQ Music. In collaboration with renowned singer Hu Yanbin, it released the 20th-anniversary commemorative vinyl NFT titled “Monk,” offering a limited run of 2,001 copies through a lottery-based reservation system on QQ Music.

Centralized Exchanges (CEX)

Mainstream Chinese exchanges are also actively involved in NFTs. For example, Binance and Huobi have both launched their own NFT platforms: Binance Smart Chain NFT (launched June 24); Huobi incubated the NFT marketplace Ibox.com.

Metaverse Becomes a Phenomenon

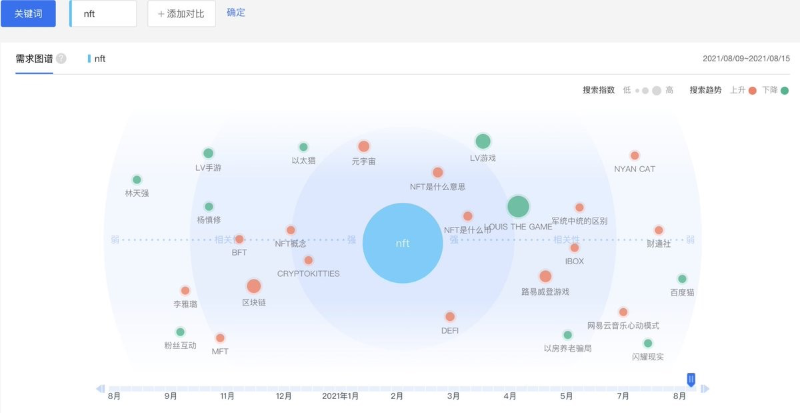

After Tencent announced its official partnership with the overseas hit game Roblox, the concept of the metaverse reached unprecedented popularity. According to Baidu search indices, the keyword “NFT” is primarily associated with terms like metaverse, DeFi, cryptokitties, and LOUIS THE GAME. In terms of actual users, NFTs have achieved conceptual “crossing over,” but not necessarily widespread adoption among holders.

Luxury Brands + Traditional Industries: 1+1 > 2

Luxury brands entering the NFT space have been covered by mainstream Chinese media, with public interest increasingly focused on the integration of traditional industries and NFTs—for instance, Louis Vuitton and Burberry’s presence in NFTs and online games.

Conclusion

NFTs will become a core economic component of the next-generation digital economy. The emergence of compliant NFTs based on consortium chains signifies, in a sense, that China’s industrial NFT sector is exploring secondary markets. Meanwhile, under the backdrop of China’s strict stance on cryptocurrency, balancing regulatory boundaries with market enthusiasm remains the biggest challenge for major tech giants. Blockchain initiatives launched by companies like Alibaba and Tencent are helping establish a path toward NFT compliance in China.

Industry insiders suggest that Chinese tech giants adopting NFTs may mean Chinese users now have a new channel to purchase digital art using RMB—and potentially, in the future, via digital RMB.

Regulation remains the primary challenge facing NFT development today. The domestic NFT industry is still in the experimental phase and faces multiple tests. Industry professionals generally agree that while Chinese enterprises have deployed NFT markets and are exploring blockchain applications for consumers, they continue to face numerous risks and challenges along the way.

China and the United States have pursued relatively different priorities in blockchain development. The U.S. financial environment is more open, so current blockchain practices emphasize financialization, whereas China’s blockchain policies tend to focus on serving the real economy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News