4 Reasons Ethereum Is "Undervalued" Compared to PayPal

TechFlow Selected TechFlow Selected

4 Reasons Ethereum Is "Undervalued" Compared to PayPal

Analysts believe that Ethereum's current price does not tell the whole story — compared to PayPal, it is severely undervalued. Analysts provide four reasons for this view.

Author| Anjali Jain

Translation| Anima

Since its launch, the Ethereum network has attracted interest from investors and developers due to its security, superior functionality, and growth potential. At the time of writing, it is priced at $1,862—less than half of its May peak of $4,356. However, analysts believe its current price doesn't tell the full story.

In a recent video, analyst Lark Davis compared it to top online payment system PayPal to emphasize how severely undervalued the asset is. At the time of the report, PayPal had a market capitalization of $340.2 billion—over $100 billion more than Ethereum’s $217.41 billion.

Why is Ethereum considered undervalued? Analysts cite four key reasons:

1. Transaction Settlement

When comparing transaction volume and value between the two platforms, this valuation appears unjustified. In just the first quarter of 2021, the Ethereum network settled $1.5 trillion worth of transactions, while PayPal processed $936 billion for the entire year of 2020. At current rates, Ethereum settles in one month what PayPal takes an entire year to process.

The chart below shows quarterly growth in daily transaction volume on the network, highlighting its significant future growth potential.

Even Bitcoin falls far behind Ethereum in daily settlement volume. According to Money Movers, Bitcoin settles around $9.93 billion per day, while Ethereum's settlement volume exceeds three times that amount.

2. Users

When it comes to total users per platform, PayPal clearly leads. In Q1 2021, it had 392 million active user accounts. Although Ethereum has 160 million unique addresses, most users hold multiple accounts, so the actual number of individual users may be about one-third of that figure.

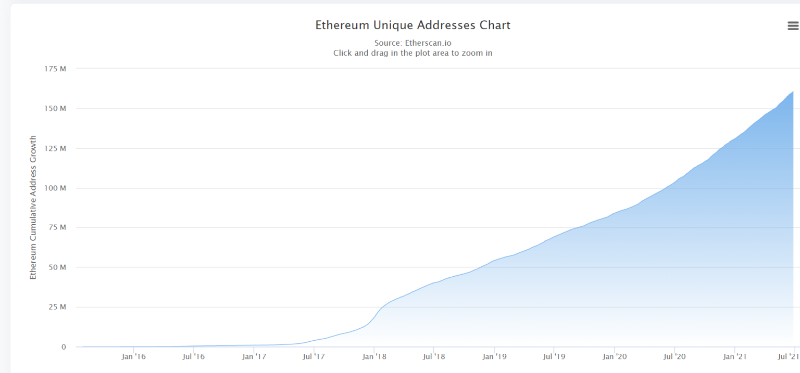

However, the Ethereum network adds approximately 225,969 new users per day. It should also be noted that PayPal has been accumulating users since its founding in 1998—compared to Ethereum’s six-year history. The chart below illustrates the growth in network users.

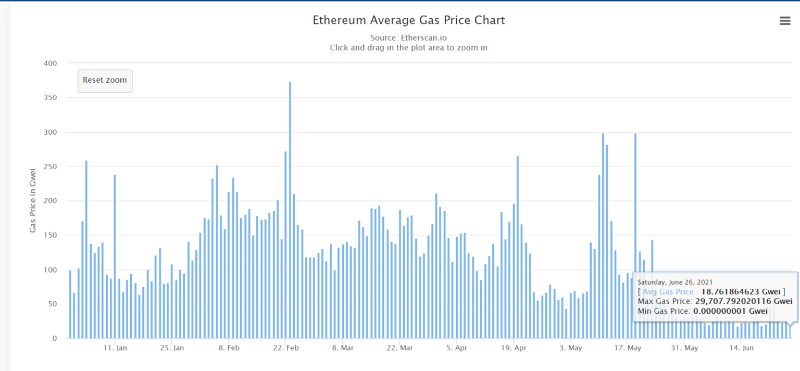

Regarding fees, PayPal charges different rates depending on the user, ranging from 2.9% to over 4% of transaction value. At the time of writing, Ethereum gas fees stood at 18.76 Gwei.

While these may rise with network demand, analysts point to major upcoming developments such as the transition to proof-of-stake consensus, Layer-2 solutions like Polygon that enable fractional asset transactions, and the anticipated introduction of sharding by 2022, which is expected to significantly reduce gas fees.

3. Transaction Fees

Moreover, as an asset class, PayPal offers zero percent dividends, and any future payouts would be in U.S. dollars—not PayPal stock. In contrast, since the launch of Ethereum staking in December last year, stakers have earned an average annual return of around 8% in ETH.

It is speculated that once Ethereum merges with Ethereum 2.0, this yield could rise to 25%. Additionally, Ethereum offers a stronger value proposition, as ETH rewards can be re-staked to compound returns over time. Even DeFi applications built on the Ethereum network offer lucrative staking rewards in USDC or other assets, often exceeding 5–10%.

Analysts added: “The Ethereum blockchain is much more than just a simple payment method. It is a complete ecosystem of financial products.”

4. Adoption

Growing adoption of Ethereum by major financial institutions further underscores its future potential. For example, the European Investment Bank issued $121 million in digital bonds on Ethereum in April. More recently, the Bank of Israel selected the network to issue tokens representing the digital shekel.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News