Goldman Sachs重磅:Bitcoin will eventually lose its "crown"! Replaced by—Ethereum

TechFlow Selected TechFlow Selected

Goldman Sachs重磅:Bitcoin will eventually lose its "crown"! Replaced by—Ethereum

Goldman Sachs believes that Ethereum, with the rapid development of NFTs and DeFi, as well as technological iterations, has the potential to overcome Bitcoin's first-mover advantage.

Goldman Sachs believes that, considering factors such as real-world utility, user base, and speed of technological iteration, Ethereum is highly likely to replace Bitcoin as the dominant cryptocurrency.

Regarding market trends, Goldman emphasizes a key difference between the current cryptocurrency market and the 2017–2018 bull run: the participation of institutional investors. However, with recent signs of slowing institutional involvement (declining inflows into crypto ETFs) and the continuous emergence of alternative coins, retail investors are once again taking the lead in driving the market.

Goldman notes that this shift from institutional to retail dominance increases the likelihood of a significant market downturn. High market volatility will persist until cryptocurrencies develop genuine economic use cases independent of price speculation.

Ethereum has enormous potential

Goldman states that the Ethereum system supports smart contracts and offers developers a platform to build new applications. Most decentralized finance (DeFi) applications today are built on the Ethereum network, and most non-fungible tokens (NFTs) are purchased using Ethereum.

Compared to Bitcoin, Ethereum handles significantly higher transaction volumes. As Ethereum's use in DeFi and NFTs expands, it is establishing a first-mover advantage in practical applications of blockchain technology.

Goldman highlights that Ethereum can also securely and privately store nearly any type of information on a decentralized ledger. This data can be tokenized and traded, meaning the Ethereum platform could evolve into a major marketplace for trusted digital information.

Currently, investors can already sell digital art and collectibles online via NFTs, but this represents only a small fraction of its potential real-world applications.

Goldman believes that in the future, individuals could store their medical data on Ethereum and sell it to pharmaceutical research companies. Digital records on Ethereum could include personal assets, medical histories, or even intellectual property rights.

Ethereum also offers the benefits of a decentralized global infrastructure server. Unlike centralized servers operated by companies like Amazon or Microsoft, this could provide a viable solution for securely sharing personal data.

Bitcoin’s scarcity alone cannot support its role as a store of value

The primary argument supporting Bitcoin’s role as a store of value lies in its limited supply. However, Goldman argues that successful stores of value depend more on sustained demand than mere scarcity.

Major value-preserving assets today maintain relatively stable supplies: gold, for example, has grown at about 2% annually for centuries, yet remains widely recognized as a reliable store of value. In contrast, far rarer elements like osmium are not used for storing value.

Goldman emphasizes that fixed and limited supply may encourage hoarding, forcing new buyers to outbid existing holders, which fuels price volatility and creates financial bubbles. More important than finite supply is preventing sudden and unpredictable surges in new supply. While Ethereum has no hard cap on total supply, its annual issuance growth is capped—meeting this crucial criterion.

Rapid technological advancement undermines first-mover advantage

Proponents of Bitcoin’s long-term dominance argue it holds an insurmountable first-mover advantage and a large user base.

However, Goldman points out historical precedent: in fast-evolving industries with growing demand, early leads are often short-lived. Established players that fail to adapt to changing consumer preferences or competitive innovations risk losing their position (e.g., Yahoo vs. Google).

Today’s overall cryptocurrency market has a highly unstable active user base. In such an environment, where technology evolves rapidly, systems unable to upgrade quickly risk becoming obsolete.

In terms of user base, Ethereum gained a substantial number of active users in 2017 and now reaches approximately 80% of Bitcoin’s user scale.

Technologically, Ethereum is undergoing rapid protocol upgrades—faster than Bitcoin—transitioning from proof-of-work (PoW) to proof-of-stake (PoS).

Goldman notes that PoS greatly improves energy efficiency by rewarding validators based on the amount of ether they hold (rather than computing power), effectively ending the electricity-intensive mining race.

Bitcoin currently consumes as much energy as the entire Netherlands. If Bitcoin’s price rises to $100,000, its energy consumption could double. From an ESG perspective, this poses significant challenges for Bitcoin as an investment.

On security and stability, Goldman acknowledges all cryptocurrencies remain in early stages, with rapid technological changes and unstable user bases.

While there are security concerns during Ethereum’s PoS validation process, Bitcoin is not 100% secure either. Currently, the top four Bitcoin mining pools control nearly 60% of the network’s hash rate, creating concentration risks and potential for fraudulent transactions.

Ethereum also faces many risks, and its dominance is not guaranteed. For instance, delays in the Ethereum 2.0 upgrade might prompt developers to migrate to competing platforms.

The market will remain volatile until real utility emerges

Goldman observes that a key distinction between today’s crypto market and the 2017–2018 bull cycle is the presence of institutional investors—a sign that traditional finance is beginning to embrace digital assets.

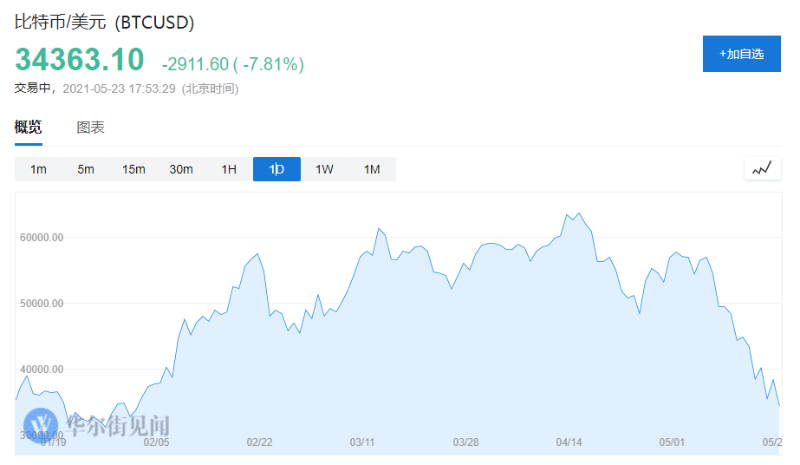

Bitcoin continues to exhibit extreme volatility, having dropped 30% in a single week recently.

At the same time, institutional investor activity has recently slowed (with reduced inflows into crypto ETFs), while alternative coins continue to proliferate—indicating a renewed retail-driven market.

Goldman warns that this shift from institutions to retail investors increases the risk of a sharp market correction. The current high volatility will continue until cryptocurrencies develop tangible, real-world economic uses beyond price speculation—marking the dawn of a new era for digital assets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News