Discussing Voice's current status and the hidden gossip behind the $30 million domain name

TechFlow Selected TechFlow Selected

Discussing Voice's current status and the hidden gossip behind the $30 million domain name

It's also a legend about patience—after waiting for 18 years, it sold for nearly 200 million RMB.

Warren Buffett once said: "The market is a tool that transfers money from the impatient to the patient."

But the old man in the picture below definitely didn't say this:

Hi everyone, I'm Peipei, who's missing some gold in my five elements. Today I saw someone sharing the message above in a group chat—it randomly tickled my funny bone, so I’m reposting it. I think aside from those heavily intoxicated, no one would actually believe this.

I wrote an article about EOS this week and noticed people asking about Voice. Since we’re all just waiting for Grayscale to open shop and pump the market on this slightly dull weekend, let’s talk about some overseas updates I’ve seen, plus a little juicy gossip behind the voice.com domain name.

Regarding Voice’s current status, I can only put it in four words:

Not impressive at all.

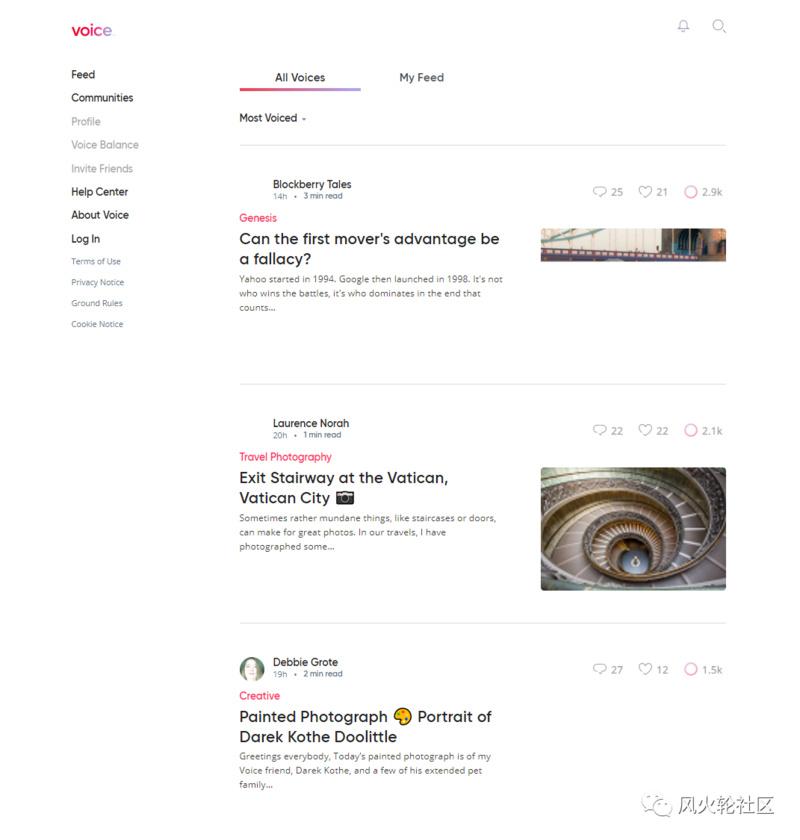

Below is a screenshot of the homepage in test version:

I sorted posts by “Voice It” votes, meaning these top three received the most tokens—supposedly the hottest content right now. But notice how even the third post only has over 1,000 “upvotes,” with comments barely reaching twenty-something.

Clearly, the testing phase is quite cold. I've also seen tweets where users mention trying the app briefly before uninstalling it.

Additionally, when invitation-only registration opened on August 15 (coincidentally exactly three months ago today), many Chinese users rushed in to spam and farm test tokens. Below is a screenshot of the homepage back then:

Compared to that period, you don’t see any Chinese users anymore—likely due to the recent wave of account bans.

So from a website perspective, there’s currently little hope for this app.

However, Voice’s CEO recently gave an interview to an overseas community explaining some developments (search "everythingeos" on YouTube for the full video). Here are a few key points I’ll highlight briefly:

1. Voice is built on the EOSIO chain and operates in a multi-chain format. If I understand correctly, this means its tokens will reside on one chain while content is stored on another.

This differs from our initial understanding of Voice. Also, note the distinction between EOSIO and EOS—they're somewhat like IPFS and Filecoin, where the former is underlying technology and the latter is a public blockchain. Applications built on EOSIO can be entirely independent of the EOS mainnet and its community.

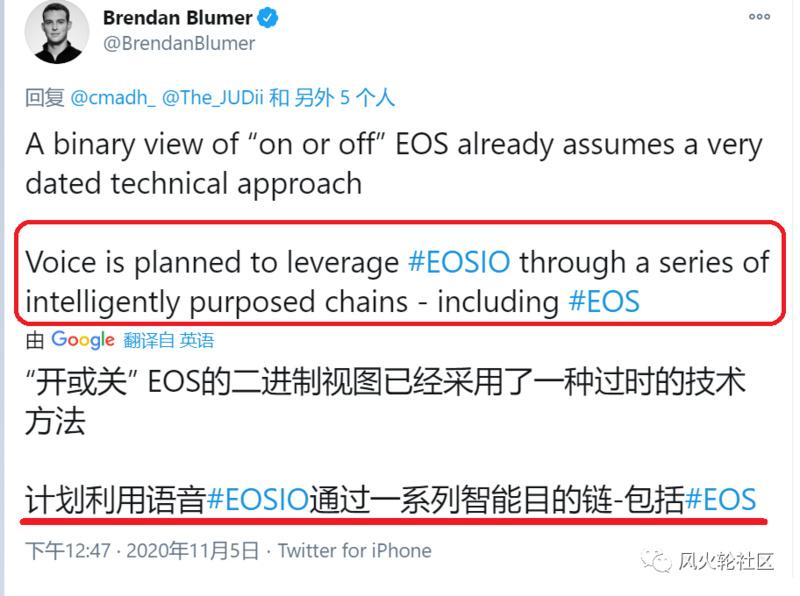

That said, B1—the largest shareholder of Voice—has recently clarified their position:

Voice will use a series of EOSIO chains, including the EOS mainnet.

Here’s my guess—just guessing—that they’ll still need to deploy tokens on the mainnet. After all, a significant portion of Voice’s early user base still comes from the EOS community. Plus, people have held RAM and other resources for over a year; surely they didn’t do it just for fun [facepalm]...

And two more points requiring +[doge protection]:

2. Most of Voice’s major moves may not come until next year. That’s what their CEO said—marketing efforts, bringing in more users. But judging from current community reactions, we shouldn’t get our hopes up. Let’s take it as it comes.

3. A small hint dropped during the interview: Voice plans to raise funds again next year, possibly a substantial amount. The CEO couldn’t reveal much yet—whether it’ll be traditional private rounds or another round targeting crypto investors. Would you invest? Feel free to comment below.

As for my personal thoughts on the product now, there are plenty of pain points. In particular, setting the front page to display only one or two or three pieces of content feels like terrible UX—this is 2022, after all.

That said, I do see they’re actively improving user experience. For example, they quickly implemented a suggestion from the Chinese community regarding the registration page. Also, they initially had five sorting options but later reduced it to three.

Alright, that’s about it for Voice’s current state. To sum up:

Everything remains uncertain—stay tuned for next year!

Now let’s dive into the gossip around the Voice domain name. The story of this $30 million domain sale is something many of you have probably heard before—we’ve mentioned it two or three times ourselves. But recently, I stumbled upon an article revealing a few lesser-known details, which I find quite fascinating. Sharing them here specially:

1. voice.com was first registered on August 30, 2001, originally owned by a Chinese individual, hosting a musical instrument website, as shown below:

That blinding color scheme and strong ethnic aesthetic [facepalm]—back when internet surfing was still a luxury, we’ll just have to accept it with sympathy.

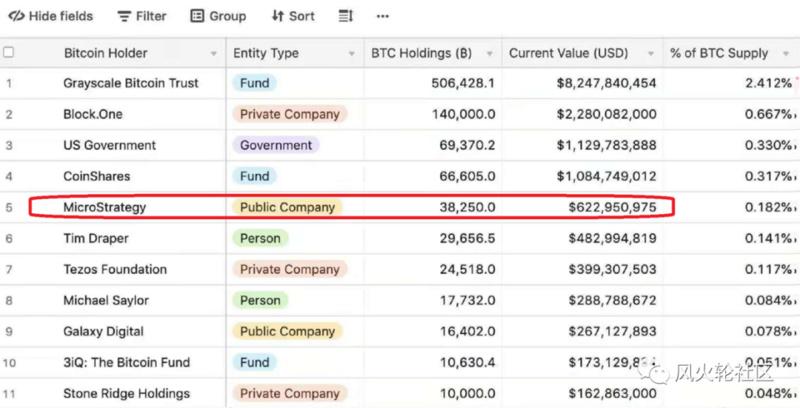

2. Later, voice.com was acquired by MicroStrategy. Coincidentally, MicroStrategy made headlines this year for buying large amounts of Bitcoin twice, periodically trending across crypto circles. Below is a widely shared chart among bloggers showing U.S. corporate BTC holdings:

But what many may not know is that although MicroStrategy is a well-established data analytics firm, in earlier years it invested heavily in domains—especially short dictionary-word domains like Courage.com, Speaker.com, Glory.com, etc.

Eventually, profits from selling these domains surpassed those from its core business—an example of getting rich through unconventional means. Michael J. Saylor, the company’s CEO, once said:

Selling domain names as intangible assets is like selling art—the value depends entirely on how much the buyer values it. If you think it’s worth $10 million, then it is $10 million.

One wonders if he applies the same mindset to his current 38,000 BTC holdings—will he wait until $100K or higher before considering a sale?

Another lesser-known fact outside crypto circles: voice.com wasn’t listed for sale publicly. Instead, it was used internally by MicroStrategy, primarily as the front-facing domain for a subsidiary offering voice services to clients.

It wasn’t until that project shut down that the domain became available in 2019. B1 encountering it was truly a matter of fate and luck. Reports suggest the price was finalized around May-June, and shortly after closing the deal, they launched the site and held a press conference. One wonders what BM would’ve used for his presentation if negotiations had failed or been delayed by just a few days [facepalm].

3. MicroStrategy initially received a $150,000 offer for voice.com, which kept increasing until finally settling at $30 million—a figure many found outrageous, even suspecting improper dealings.

But the initial lowball offer is actually common strategy—to test whether the seller is desperate for cash or indifferent. Of course, Michael already had hundreds of millions sitting in his account. He reportedly only agreed to engage with the buyer once offers exceeded $20 million.

Some call this a legendary tale of patience—waiting 18 years to sell for nearly 200 million RMB, equivalent to a passive income of 10 million RMB per year.

Conclusion

1. Who knows what kind of future awaits Voice beneath these legends and coincidences [facepalm]? Domains often reflect a founding team’s ambition. When evaluating projects, beyond assessing the team, the domain itself serves as another visible indicator. Projects launching with food-themed names this year, for instance, are clearly just for entertainment—suggesting the founders themselves lack long-term commitment.

2. Crypto assets remain incredibly complex. Even today, every blockchain and project remains an information silo, leading to widespread misunderstanding. As a result, many resort to the simplest metric: price. Whoever pumps fastest must be the strongest.

Lately, I keep hearing friends ask, “Oh no, I’m holding EOS—should I switch?” Personally, holding EOS right now is essentially casting a vote—not the kind of node voting during bounty seasons, but rather betting against mainstream sentiment. Betting that the crowd is wrong—for thinking B1 holding Bitcoin is bad, for dismissing stagnant prices as failure, for failing to grasp the complexity of account systems and their hidden potential.

If your views align with the majority, then sure, go ahead and swap. But if you’re willing to bet the crowd is wrong (provided you genuinely believe so), then maybe hold on a bit longer. Just like today’s story, though, it requires both patience and luck.

On a slightly brighter note, holding EOS now allows you to earn yield through DFS voting. There have always been ways to earn extra tokens—no need to feel too pressured.

References:

Patience and Luck: The Story Behind the $30 Million Domain Name Voice.com

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News