EOS Leaves in Disappointment: Rebrands as Vaulta to Pivot into a "Web3 Bank," Paving the Way for Ecosystem Project exSat

TechFlow Selected TechFlow Selected

EOS Leaves in Disappointment: Rebrands as Vaulta to Pivot into a "Web3 Bank," Paving the Way for Ecosystem Project exSat

When the Vaulta token replaces EOS, RAM scarcity surpasses the native token, and the exSat independent ecosystem turns the tables, a shell-swap style ecological transformation has quietly begun.

Author: Frank, PANews

EOS, once hailed as the "Ethereum killer," has officially announced a rebranding to Vaulta, launching a strategic shift centered on becoming a Web3 bank. Moving from public blockchain infrastructure to institutional-grade banking services, the EOS Foundation has drawn inspiration from exSat's reconstruction of the Bitcoin ecosystem—and is using this rebranding opportunity to fully shed its historical baggage.

Is this transformation driven by defeat in the fiercely competitive public chain arena, or fueled by ambition to capture the future of compliant Web3 finance? As Vaulta tokens replace EOS, RAM scarcity surpasses that of the native token, and the exSat ecosystem gains dominance, a shell-driven ecological metamorphosis has quietly begun.

With Canadian asset custodians on board, can Vaulta complete its transition to a Web3 bank?

The recent brand upgrade announcement for EOS highlights several key points: first, the new Web3 banking narrative; second, the roadmap for achieving it; and third, potential changes in tokenomics.

The rationale behind pivoting to Web3 banking emphasizes three factors cited in the announcement: rising global adoption of cryptocurrency, the continuous growth in stablecoin market capitalization, and the promising potential of RWA markets. Judging from these drivers, Vaulta’s new goal appears to mirror XRP’s trajectory—an evolution seemingly shaped by external crypto market dynamics.

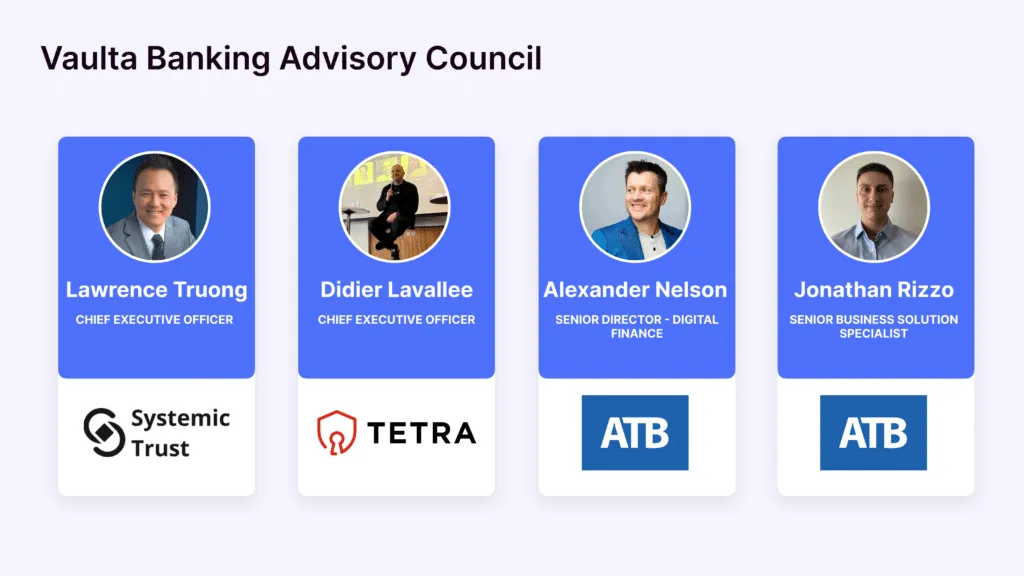

Additionally, Vaulta announced the creation of a Banking Advisory Committee—though the committee’s role and position within ecosystem governance remain unspecified.

Judging by the backgrounds of its members, these institutions are not traditional banks but primarily digital asset custodians with strong regional ties—all hailing from Alberta, Canada. ATB Financial, the largest financial institution in Alberta, founded in 1938, holds $65.5 billion in assets and serves over 830,000 customers. The other firms are newer digital asset custody companies established within the past few years, whose AUM figures have not been publicly disclosed.

While these partners hold Canadian regulatory licenses, their regional focus raises questions about alignment with Vaulta’s global Web3 banking vision.

An EOS upgrade in name only—Vaulta paves the way for exSat

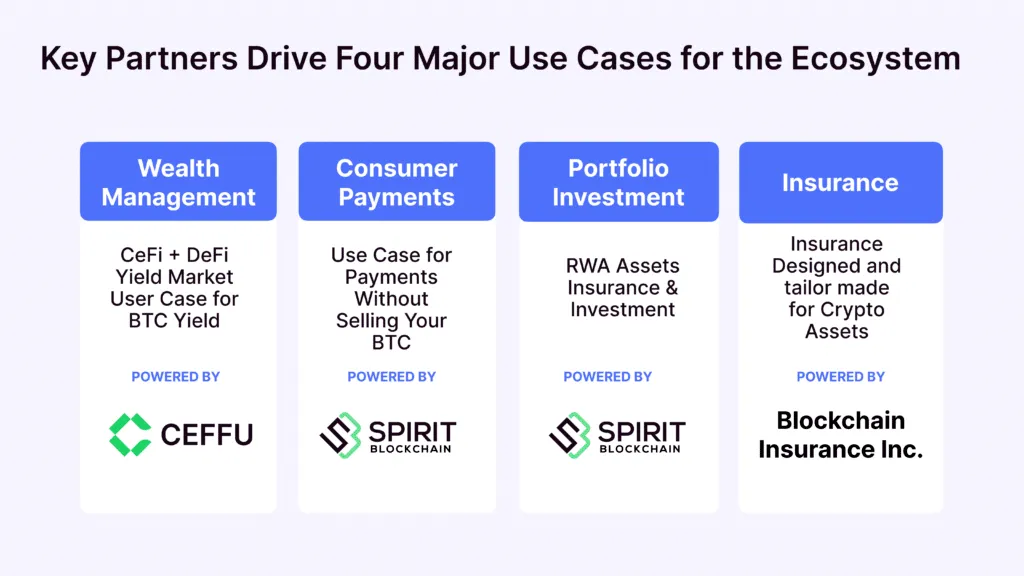

Vaulta’s new strategy identifies four core business pillars: wealth management, consumer payments, securities investment, and insurance. Of particular note is the exSat offering under wealth management targeting institutional clients.

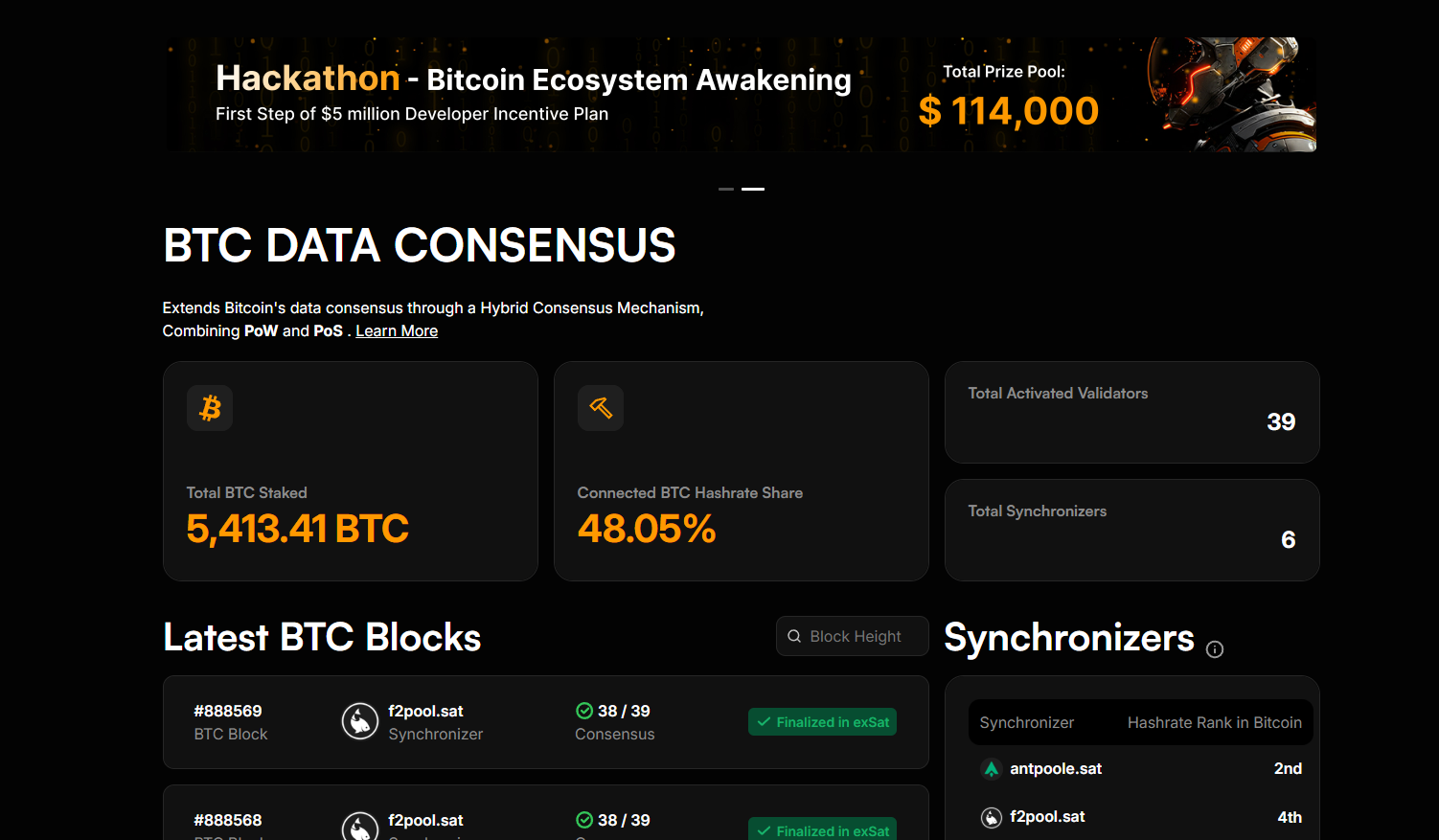

exSat, launched in 2024 as part of the EOS ecosystem, is a Bitcoin scalability project acting as a “Docking Layer” that connects the Bitcoin mainnet with Layer-2 scaling solutions. It leverages EOS RAM to store and process Bitcoin data, enhancing Bitcoin’s performance and interoperability. Its primary value lies in enabling faster, lower-cost Bitcoin transactions and creating space for DeFi applications within the Bitcoin ecosystem.

The project has already surpassed EOS in impact. As of March 20, exSat had 5,413 BTC staked and a TVL of $587 million—far exceeding EOS mainnet’s $174 million.

Given this, it’s no surprise that the brand upgrade focuses heavily on exSat rather than EOS itself. In fact, exSat operates with an independent consensus mechanism combining PoS, PoW, and DPoS, currently supported by 39 validators—including major players like Certik, Hashkey, Bitget, F2Pool, OKX, Matrixport, and Tron. With these characteristics, exSat has effectively evolved into a standalone public chain built atop EOS infrastructure, relying on EOS RAM and blockspace while functioning independently.

Introducing the Vaulta token: diminished utility, growing RAM scarcity

On the tokenomics front, EOS will be replaced by the Vaulta token. However, the new token will see a significant reduction in governance power. This is evident from how the rebranding was pushed through directly by the EOS Foundation without a community vote—indicating that governance on the EOS network is effectively defunct.

The announcement states: “Vaulta token holders stake their tokens to earn rewards and actively participate in governance by voting for block producers responsible for network consensus and security. As Vaulta grows, token holders of all sizes can join discussions and submit proposals.” Yet in practice, the main benefit for token holders appears limited to staking rewards. Governance participation essentially means electing block producers—a function inherent to the DPoS consensus model, not true governance. When—or whether—holders will gain meaningful decision-making power remains at the discretion of the Foundation.

Considering EOS’s current token price and low TVL, these block rewards likely serve only to maintain basic network operations, with little incentive for broader ecosystem development beyond supporting exSat. While the announcement confirms a 1:1 swap from EOS to Vaulta tokens, it does not clarify whether additional Vaulta tokens will be issued beyond the existing EOS supply.

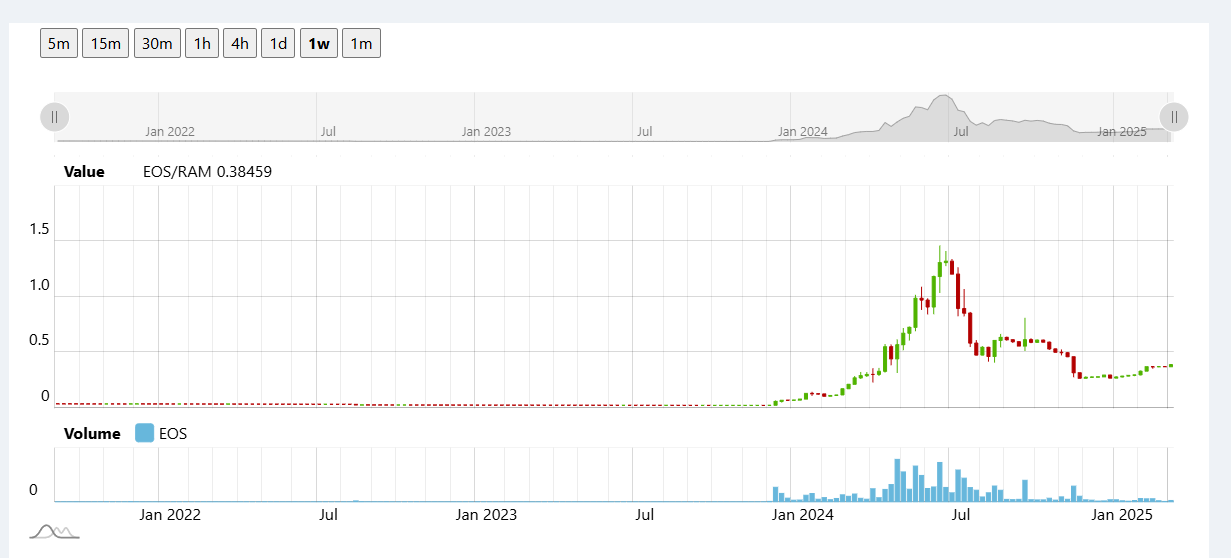

Meanwhile, RAM is gaining prominence as a more scarce and valuable resource than the native token. “As Vaulta expands its role in decentralized finance and Web3 banking, the inherent scarcity of RAM coupled with rising demand places holders in a uniquely advantageous position,” the announcement notes.

RAM refers to the operational memory within the EOS network, required by all applications running on it—including exSat. Given that the total RAM supply is designed to have zero inflation, it has become a strategic resource whose practical utility and value potential now appear to exceed that of the token itself.

In terms of price performance, RAM has also proven far more stable than the EOS token.

A $4 billion ICO giant fades into history

At its core, the most significant aspect of this rebranding is the complete abandonment of EOS’s original vision. After years of failed ecosystem development, EOS has conceded defeat in the race among public chains. Fortunately, EOS’s technical performance remains solid. The new Vaulta brand represents an integration of EOS’s existing infrastructure with the successful exSat network launched last year. Whether Vaulta’s Web3 banking venture will succeed remains uncertain—but one thing is clear: the EOS brand is set to vanish from the stage of history.

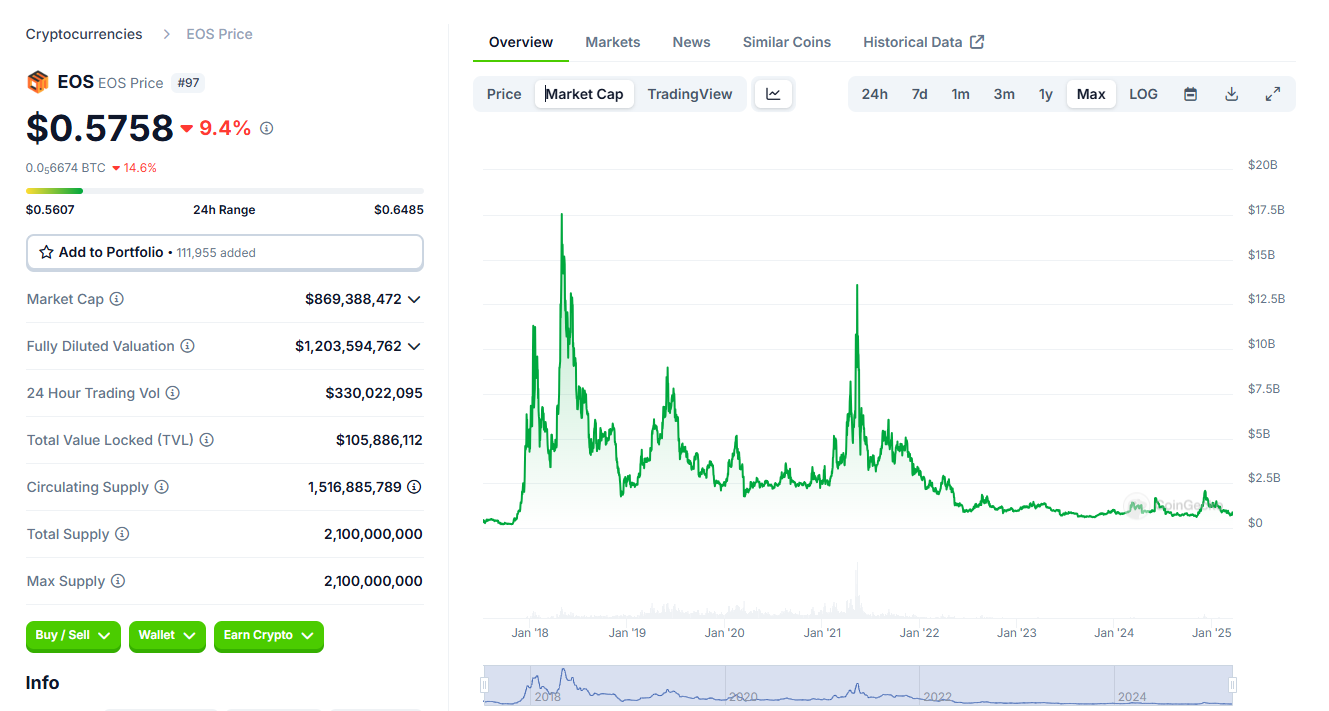

For early adopters of crypto, EOS’s decline is poignant. In 2017, EOS raised $4 billion through its ICO, setting a record in crypto history. At that time, Solana’s founder was still struggling to secure funding, ultimately raising just $3.17 million in seed capital.

By 2018, EOS reached peak influence following its mainnet launch—mirroring today’s narrative of Solana challenging Ethereum. Back then, many believed EOS would become the new king of blockchains. Its price surged to an all-time high of $15.60, with a market cap nearing $18 billion, ranking third globally. Today, EOS’s market cap stands at just $870 million, placing it 97th in rankings.

The biggest reason for this dramatic downfall lies in the inaction of Block.one, the entity behind the massive fundraising. All official projects launched by the team failed to gain traction. After co-founder Daniel Larimer stepped down as CTO of Block.one, community trust in EOS evaporated.

Although the EOS Network Foundation was later established and introduced multiple economic adjustments and infrastructure upgrades in 2024, none managed to reignite market interest. It wasn’t until late 2024, with the launch of exSat, that EOS saw unexpected success in contributing to the Bitcoin ecosystem. Ironically, the EOS network never included exSat’s metrics in its own ecosystem reports—suggesting a deliberate separation from the start. Perhaps this Vaulta upgrade isn’t a sudden pivot, but a long-planned transition.

The EOS brand has lost all residual value, which explains why the Foundation chose such a radical break (even if “Vaulta” isn’t necessarily more intuitive or memorable).

One famous saying once echoed across the EOS community: “You’ll never see EOS below $100 again.” Now, with this rebranding, that statement has finally come true—but not due to price appreciation. This time, it’s because EOS itself will disappear entirely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News