WLFI's Massive Purchase of EOS: Web3 Banking Renaissance or Echoes of Speculation?

TechFlow Selected TechFlow Selected

WLFI's Massive Purchase of EOS: Web3 Banking Renaissance or Echoes of Speculation?

WLFI's investment is seen as a recognition of Vaulta's potential and could drive a short-term rise in EOS.

Author: Luke, Mars Finance

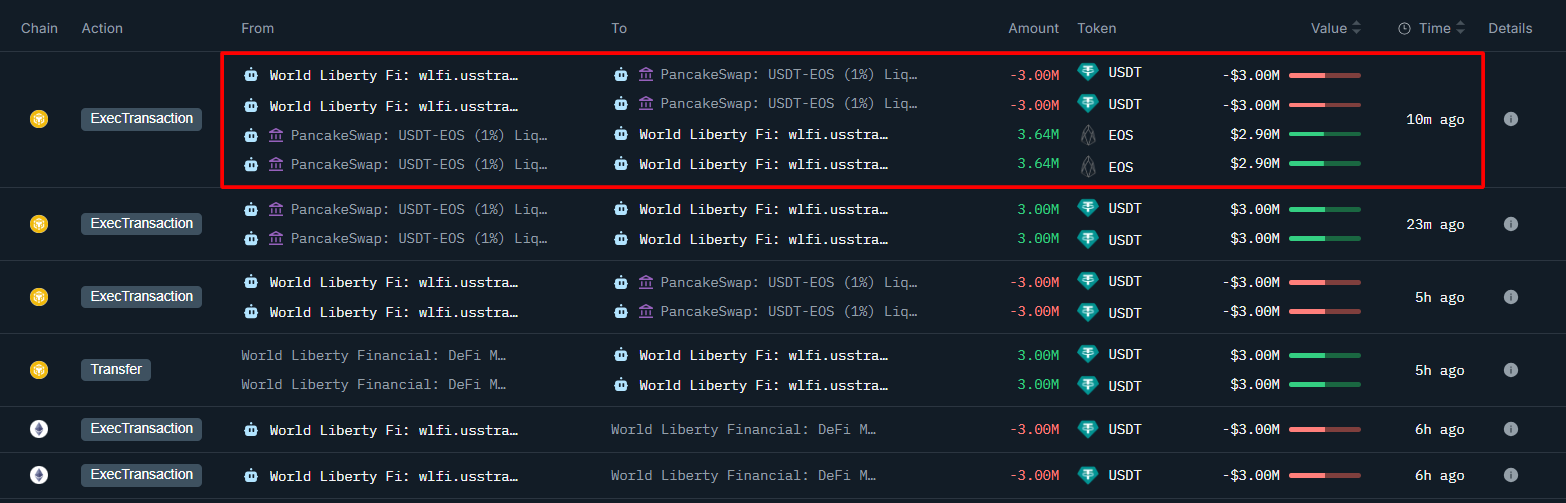

On May 16, 2025, blockchain data monitoring platform Onchain Lens revealed major news: World Liberty Financial (WLFI), a decentralized finance (DeFi) project backed by the Trump family, purchased 3.63 million EOS at $0.825 per token for 3 million USDT (approximately $3 million) just 10 minutes prior. Some exclaimed: "The Trump family strikes again—will EOS take off?" Others scoffed: "Just another round of hype."

This transaction was not an isolated event. Just over a month earlier, on April 1, while the crypto market was in disarray and altcoins plunged 20%-50%, EOS surged more than 30% against the trend under its new identity as Vaulta, a "Web3 bank," breaking above $0.80. Now, WLFI's high-profile entry has added fuel to EOS's comeback narrative. What is driving this blockchain "old horse" to stir waves repeatedly from the depths? Why did WLFI choose EOS as its investment target? Let us revisit EOS’s ups and downs, unpack Vaulta’s transformation logic, and uncover the deeper meaning behind this $3 million transaction.

The Twisted Seven-Year Journey of EOS: From ICO Frenzy to Rock Bottom

EOS’s story began in 2017, an era when gold seemed to lie everywhere in the crypto world. As cheers still echoed for Bitcoin surpassing $10,000, EOS stormed into the market touting “millions of TPS (transactions per second)” and “zero fees.” Founder Dan Larimer was hailed as a “tech prophet,” and Block.one raised $4.2 billion through a year-long ICO—the most extravagant fundraising record in blockchain history. In spring 2018, EOS soared from $5 to $23, briefly ranking among the top five cryptocurrencies by market cap. The race for 21 supernodes burned hot, community enthusiasm ran high, and it felt as though the future of blockchain had already been rewritten.

But the glory was short-lived. While EOS’s DPoS (Delegated Proof-of-Stake) mechanism improved transaction efficiency, it drew widespread criticism for being highly centralized. The 21 nodes were controlled by exchanges, rendering retail voting meaningless. A farce involving chain-based arbitration freezing accounts shattered trust. Technically, the promise of “millions of TPS” became a joke—the mainnet peaked at only over 4,000 TPS, far below advertised claims. Its complex RAM and CPU resource model led to high transfer costs, creating a disastrous developer experience. By 2022, EOS’s DApp ecosystem had nearly collapsed, with fewer than 50,000 active users and a total value locked (TVL) of just $174 million—dwarfed by Ethereum ($60 billion) and Solana ($12 billion).

Block.one’s actions further extinguished community hope. The $4.2 billion from the ICO was invested in assets like Bitcoin (currently holding 160,000 BTC worth about $16 billion) and U.S. Treasuries—almost entirely unrelated to the EOS ecosystem. In 2019, Block.one was fined $24 million by the SEC for illegal ICO practices but offered no meaningful compensation to the community. On X, angry users mocked: "Block.one isn't a blockchain company—it's Buffett in the crypto world." EOS’s market cap plummeted from $18 billion to under $800 million by 2025, slipping out of the top 100 rankings. Once dubbed the “Ethereum killer,” it had become a marginal player.

Vaulta’s Transformation: Ambition and Controversy of a Web3 Bank

Just as EOS appeared headed for oblivion, a community-led counterattack brought a turnaround. In 2021, the EOS Network Foundation (ENF), led by Yves La Rose, took control of the project and sidelined Block.one with support from 17 nodes, launching a self-rescue mission. On March 18, 2025, EOS rebranded as Vaulta, positioning itself as a “Web3 banking operating system,” aiming to reinvent wealth management, consumer payments, investment portfolios, and insurance via blockchain. This shift not only powered EOS’s 30% rally during the April 1 bear market—pushing prices past $0.80—but also laid the groundwork for WLFI’s investment.

Vaulta retains EOS’s C++ smart contracts and decentralized RAM database, enhanced with cross-chain interoperability (IBC), aiming to bridge traditional finance and DeFi. ENF injected vitality into the ecosystem through a series of innovations:

-

Revival of the RAM Market: EOS’s RAM (memory resource), due to its scarcity, became an invisible backbone of the ecosystem. Vaulta optimized resource allocation by introducing the XRAM mechanism, allowing users to stake tokens for RAM and share gas fees denominated in BTC. By March 2025, demand for RAM surged with new projects; some users earned substantial BTC dividends via XRAM staking. On X, one user joked: "RAM feels more like an asset than EOS itself."

-

exSat’s Bitcoin Narrative: Launched in 2024, exSat uses EOS’s RAM to store Bitcoin UTXO data, aiming to speed up BTC transactions and enable DeFi applications. By March 2025, exSat had locked 5,413 BTC and achieved a TVL of $587 million—far exceeding EOS mainnet’s $174 million—and emerged as the ecosystem’s “new engine.” Yet concerns remain about exSat’s technical stability and regulatory compliance, with skeptics questioning whether it’s merely “promising the moon for BTC.”

-

1DEX and RWA Strategy: 1DEX is Vaulta’s decentralized exchange, aiming to fill DeFi gaps, but criticized as “half-baked” due to poor EVM compatibility and inadequate documentation. Vaulta also plans to offer real-world asset (RWA) tokenization—such as real estate and stocks—to attract institutional capital.

Vaulta’s transformation has sparked polarized reactions. Optimists argue that the Web3 bank aligns with the crypto industry’s push toward regulation, and innovations like RAM and exSat have revived EOS. Pessimists doubt Vaulta’s technical foundation can compete with Ethereum or Solana, calling the overhaul a potential “rebrand to rug pull.” On X, one user quipped: "From Ethereum killer to Bitcoin sidekick, now aspiring banker—what a versatile chain."

Why Did WLFI Bet on EOS? A Mix of Strategy and Speculation

WLFI’s purchase of 3.63 million EOS with 3 million USDT occurred amid the buzz around Vaulta’s transformation. Combined with its DeFi strategy and the Trump family’s brand power, this move reflects multiple strategic considerations.

First, Vaulta’s technical features closely align with WLFI’s dollar-pegged stablecoin USD1. USD1 aims to deliver low-cost, high-efficiency DeFi services, and Vaulta’s high throughput (one block per second), near-zero transaction fees, and EVM compatibility make it an ideal deployment platform. Compared to Ethereum’s high gas fees and Solana’s network instability, Vaulta offers greater reliability for USD1’s cross-chain transactions and liquidity pools. Additionally, Vaulta’s RAM market provides efficient solutions for USD1’s smart contracts and data storage. Analysts on X speculate WLFI may plan to deploy USD1-related lending or payment protocols on exSat, expanding the stablecoin’s use cases.

Second, EOS’s low valuation presents a speculative opportunity. In May 2025, EOS traded around $0.825—near historic lows, with a low price-to-earnings ratio. The 30% surge triggered by Vaulta’s rebranding and exSat’s growing TVL ($587 million) provided upward momentum. WLFI’s purchase matched prevailing market prices, suggesting a cautious build-up via public or OTC markets. If Vaulta’s Web3 bank narrative continues gaining traction, EOS could rebound to $1.40 or higher, delivering strong returns. The Trump family’s brand amplifies the investment’s market impact—echoing EOS’s 2018 “rescue rally”—and users on X are already predicting: "WLFI’s entry might ignite retail FOMO; EOS could hit $1 soon."

Moreover, Vaulta’s exSat and RWA initiatives offer synergistic opportunities for WLFI. exSat supports Bitcoin DeFi via EOS RAM, aligning with USD1’s cross-chain goals. RWA tokenization of real estate and equities opens doors for WLFI’s wealth management ambitions. WLFI might gain priority rights to RWA offerings or co-develop products with Vaulta. Its recent $2 billion deal with Abu Dhabi’s MGX shows a global partnership drive, and Vaulta’s international community could unlock emerging market opportunities.

The policy backdrop of Trump’s second term (starting 2025) further bolsters WLFI’s confidence. Proposed legislation like the GENIUS Act and the “Strategic Crypto Reserve” initiative could create favorable conditions for Vaulta’s Web3 banking model. As the Trump family’s flagship project, WLFI strengthens its market position through the EOS investment while leveraging Vaulta’s transformation to reinforce its image as a “Made-in-America” blockchain brand. On X, one user commented: "WLFI buying EOS is like Trump endorsing Vaulta—a dual signal of politics and markets."

Market Impact and Risks

WLFI’s investment in EOS could spark a short-term market frenzy. Though 3 million USDT isn’t massive in scale, the Trump family’s spotlight might push EOS to $1.0–$1.40, amplifying trading volume and FOMO. Long-term, if WLFI and Vaulta achieve deep collaboration in USD1, exSat, or RWA, they could revitalize the EOS ecosystem and draw back developers and users. However, challenges remain unavoidable: Vaulta’s execution hurdles (technical stability, compliance) and fierce competition (from Ethereum, Solana). EOS’s historical baggage—the trust crisis stemming from Block.one—and controversies over WLFI’s conflicts of interest (with the Trump family reportedly profiting ~$400 million) could invite regulatory scrutiny and increase investment risk.

For investors, EOS’s low valuation and Vaulta’s narrative offer short-term speculation opportunities. The BTC payouts from XRAM and growth of exSat add appeal. But long-term prospects require caution—Vaulta’s execution capability and ability to rebuild trust will be decisive.

Conclusion

EOS’s seven-year journey—from the glory of a $4.2 billion ICO to a 90% market cap collapse—is a tale of rise and fall in blockchain history. Vaulta’s pivot to a Web3 bank has breathed new life into this “old horse,” with innovations in RAM, exSat, and RWA enabling EOS to rise against the tide in the 2025 bear market. WLFI’s $3 million purchase of EOS signals both recognition of Vaulta’s technological potential and a bold move by the Trump family in the crypto arena. This investment may boost EOS in the short run and pave the way for USD1’s expansion, but its ultimate success hinges on Vaulta’s execution and restoration of trust.

The crypto赛道 never lacks drama. EOS, once the “Ethereum killer,” returns to center stage as Vaulta. WLFI’s arrival acts like a flare, igniting market imagination. Will the destination be a rebirth of Web3 banking—or just another echo of speculation? Time will tell. For investors facing this “old horse,” whether to ride the wave or stay rational may require a heart strong enough to endure the ride.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News