Rocket launches, squeezing miners, Ponzi schemes... How does the overseas community view Filecoin?

TechFlow Selected TechFlow Selected

Rocket launches, squeezing miners, Ponzi schemes... How does the overseas community view Filecoin?

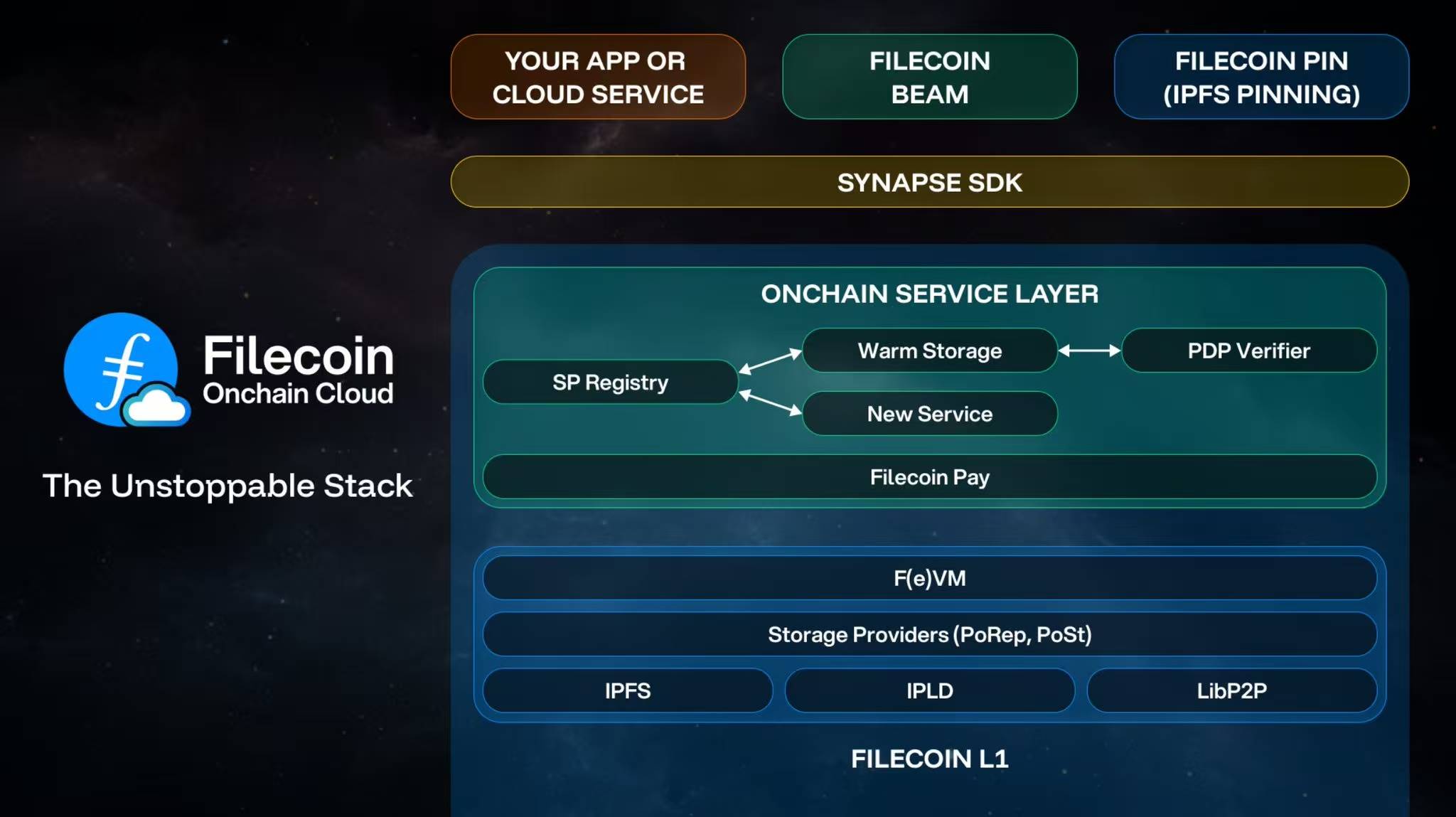

The common mistake of Filecoin and EOS is imposing significant infrastructure costs on the founding miners.

Less than a week after its mainnet launch, Filecoin's token FIL is experiencing a sharp plunge in both price and public sentiment.

According to CoinGecko data, FIL has dropped 72%, falling from its peak of $114.32 on October 16 to the current price of $32.05.

It’s not just the price—Filecoin is also facing a public relations disaster.

Chinese miners and investors have been locked in endless debates over Filecoin’s economic model, criticizing the “inhumane” upfront pledge requirements and questioning large official transfers. Some Chinese participants have even initiated a fork project.

On the other hand, while enthusiasm runs high in China, overseas interest in Filecoin remains lukewarm.

Ethereum co-founder Vitalik Buterin only briefly mentioned Filecoin when discussing EIP-1559, while Andrew Kang, partner at Mechanic Capital, went further, calling Filecoin a Ponzi scheme on a thousand-fold scale.

So how does the international crypto community really view Filecoin? Why is it hot in the East but cold in the West? TechFlow interviewed and compiled perspectives from the global crypto community to understand Filecoin’s overseas reception.

Angel Investor WhalePanda: FIL Will Keep Falling

Filecoin’s token distribution resembles that of ZCash, with a recent example being Grin—very limited supply in the first few hours/days, with the earliest unlock period being six months.

The price will start from its peak and enter an endless sell-off phase that could last for years.

I recall that the FIL private sale price was $0.50 with a 12-month vesting period, while the ICO price with a 6-month unlock was $2.36.

For about three years after the private sale, the OTC market price hovered around $2–3, until a few months ago. Then prices surged, driven largely by demand from China—by July, 6-month unlocked tokens were selling for $7–8, rising to $25 just a week or two before launch.

Most private and public sale participants sold their tokens/accounts before mainnet launch because we all knew how this would end.

A significant portion of the token economy consists of pre-mined allocations for miners, which shouldn’t come as a surprise to them... However, seeing 1.5 million FIL immediately transferred to exchanges post-launch is truly dark.

I expect FIL to experience daily crashes for at least the next year.

Blockchain Investor The Crypto Dog: A Scam Targeting Retail Investors

As far as I understand, Filecoin is hyped in China because miners have sunk massive costs into hardware.

Since they’ve already spent the money, they need FIL to become valuable so they can eventually exit and recoup their investment.

Thus, those in power go to great lengths to create FOMO and hype, so that the Chinese crypto community can sustain the miners. In Chinese, this is called: "scalping retail investors" (cutting leeks).

We in the West don’t have a large Filecoin mining community, so no one is telling us to buy FIL/IPFS.

Mechanism Capital Partner Andrew Kang: A Ponzi Scheme

Filecoin mining is a Ponzi scheme scaled up by a factor of 1,000, and the Chinese传销-style organizations selling Filecoin mining machines have been outcompeted by the U.S.-based Filecoin team.

In China, over a billion dollars have been spent purchasing Filecoin mining equipment. Over 100 million dollars worth of FIL has been bought OTC by Chinese institutions from Western ICO investors.

Either this is one of the greatest feats of economic engineering in cryptocurrency history, or Filecoin needs better economic advisors.

Huobi Capital’s Celia Wan: The Sunk Cost Fallacy

Lately, I’m often asked why Chinese people are so obsessed with Filecoin?

— It’s the sunk cost fallacy.

Imagine you own a bunch of Filecoin mining rigs and have already sunk a lot of money into them. Now you need actual FIL tokens as collateral to mine more FIL.

Tell me what you’d do?

Investor Anish Agnihotri: Filecoin Is Cheaper Than Amazon for Storage

When Filecoin launched its mainnet, I was curious about the real cost of storing data on the network, so I spent two hours setting up a website.

Note: Website data shows that the cost of storing 1GB is $0.052. In comparison, storing the same amount of data on Amazon is 5.3 times more expensive. However, currently only 3,371GB of data has been stored across 2,500 transactions, costing 2.85 FIL.

Tron Founder Justin Sun: Condemns Filecoin

Is this a scam? 1.5 million FIL, priced at $200 each at the peak, amounted to $300 million. Now the price is below $60—a 70% drop. No lock-up, no public disclosure, nothing announced to the public. How much did you dump, Juan Benet? Is this acceptable?

Transferring everything to exchanges without community consent. Investors, especially those in the U.S., should ensure accountability under SEC protection.

15% allocated to Protocol Labs Genesis, linearly vested over 6 years. 5% allocated to the #Filecoin Foundation Genesis, also linearly vested over 6 years. Founders’ shares should follow vesting rules—these are legal agreements signed with all FIL SAFT investors.

Everyone—including miners, investors, and founders—should adhere to linear vesting rules. Violating these rules carries serious legal and compliance consequences. Do you really think such dumping is acceptable?

Filecoin founder Juan Benet speculated that Sun’s comments were motivated by plans to fork Filecoin opportunistically. He added: “Justin Sun is no savior to anyone—just ask Hive. If he indeed proceeds with a fork, here’s my advice to miners considering joining: Look back at all projects related to Tron—Are you sure you want to become victims of a scam project? Good luck!”

Media personality James Spediacci jokingly remarked that Sun is already planning to copy-paste the Filecoin whitepaper, lead Chinese miners in a rebellion to fork Filecoin, and name it “JustFiles.”

Blockstack Co-founder Muneeb: Stands By Filecoin

I'm excited about Filecoin’s mainnet launch. Here are some of my reflections on Filecoin.

Summer 2014, Mountain View, California. Juan (Filecoin’s founder) was deeply immersed in building IPFS. At the time, Juan was part of the Y Combinator incubator. During a group meeting, YC partners told Juan to stop coding and write the Filecoin whitepaper first. Juan disappeared for two weeks. Our group (we were batch mates in YC S14) met every other Tuesday to give updates. Finally, Juan returned with the Filecoin whitepaper.

YC Demo Day was in August, and back then few investors understood crypto. It felt like Filecoin and Blockstack were speaking French while everyone else spoke English. Fortunately, institutions like Union Square Ventures and Winklevoss Capital existed—they recognized our potential.

Juan was among the first to focus on IPFS—the interface for peer-to-peer storage. Developers loved it; you could see rising engagement on GitHub.

Fast forward to 2017, when crypto gained popularity. A new Filecoin paper emerged. There wasn’t a platform like CoinList yet, so Juan built a fundraising portal on AngelList, raising nearly $200 million in token sales. (A few months later, Blockstack raised about $50 million using the same CoinList platform.)

Juan went back to work. His belief was clear: launching a blockchain is like rocket science—you must get it right. It’s complex, but the opportunity in decentralized storage is enormous.

Filecoin’s testnet took off in China. Around $100 million worth of storage hardware hummed across the testnet. What once seemed like fantasy during YC was now inching toward reality. The key idea: buying hardware and directly converting it into cryptocurrency.

As a friend, peer, and investor, I firmly believe Filecoin will succeed. Some may lose their dreams—but Juan isn’t one of them.

Investor Nico Deva: The Highly Anticipated Filecoin Has Become a Shitshow

After a $200 million ICO and three years of development, Filecoin has transitioned from calibration net to mainnet at block 148,888. Within 24 hours of mainnet launch, most miners began striking, talking about failure and forking.

Why?

Filecoin is extremely complex, requiring high-end hardware including a minimum of 128GB RAM. A single mining rig can cost up to $40,000 (including hosting and maintenance), and a standard 350TB Filecoin miner costs at least $20,000.

Additionally, you must stake FIL—an intended security measure, but a flawed one since no miner starts with FIL. Miners must purchase FIL to ramp up to full capacity, otherwise they’re stuck at 1/7th of their potential output.

In China, miners are furious—do a quick napkin math: your mining equipment requires at least $20,000 in hardware, and now you're forced to buy even more tokens.

Currently, total network capacity is around 600PiB. Based on 4,200PiB of installed hardware, this represents roughly $240 million worth of hardware—not including pending installations. This isn’t market valuation—it’s real money, real servers—and this is a conservative estimate.

Miners invested heavily in hardware early on, but due to mandatory FIL purchases, they cannot scale up production.

Meanwhile, although all tokens are supposedly subject to vesting periods ranging from 6 months (shortest) to 6 years (team), 1.5 million FIL were transferred to Huobi and OkEx.

Miners provided tremendous support to the Filecoin team during development, only to be crushed now. The highly anticipated Filecoin launch has turned into a shitshow—deeply disappointing.

FIL004, a Filecoin Improvement Proposal, aims to change the miner unlock ratio from 100% to 75%. This proposal has already been adopted.

In short, miners have been severely hit, Slack channels are filled with complaints, and Filecoin seems busy ignoring them.

Storecloud Founder McCoy: Costs Shifted Onto Miners

Filecoin and EOS share a common flaw: imposing massive infrastructure costs onto founding miners.

If the settlement layer’s economic incentives and security provide value to founding miners, they should be required to do more work and bear the burden of upgrading the “computer.”

*TechFlow reminds all investors to beware of chasing high prices. The views expressed in this article do not constitute any investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News