Conversation with Multicoin: Layer2 Cannot Scale Ethereum, Bullish on Filecoin

TechFlow Selected TechFlow Selected

Conversation with Multicoin: Layer2 Cannot Scale Ethereum, Bullish on Filecoin

L2 has limitations in inheriting L1 security.

In the latest episode of the Empire podcast, MultiCoin's two founding partners, Kyle Samani and Tushar Jain, were invited as guests.

During the podcast, they discussed MultiCoin’s collaboration with FTX and shared their latest views on Solana, stating that they do not believe Solana is entirely dependent on FTX.

MultiCoin expressed strong interest in the intersection of artificial intelligence and cryptocurrency, identifying three key areas with potential opportunities, including token incentives for human feedback in reinforcement learning.

Additionally, MultiCoin remains skeptical of the mainstream narrative around Layer 2 scaling for Ethereum, pointing out limitations in how L2s inherit L1 security, along with concerns about speed and time sensitivity. Finally, MultiCoin expressed bullish sentiment toward Filecoin.

Below are detailed notes from the podcast, jointly compiled by TechFlow and ChatGPT.

MultiCoin’s Relationship with Sam Bankman-Fried and FTX

-

MultiCoin did not invest in FTX’s seed round but later participated in subsequent funding rounds and invested in FTX US. They also invested in Serum ($SRM).

-

MultiCoin first realized something was wrong during the Breakpoint conference in Lisbon. At the time, they held a positive view of FTX and its CEO, Sam Bankman-Fried, suspecting only maturity mismatches or capital being tied up in margin positions—not fraud or insolvency. Kyle criticized the lack of transparency and governance controls within FTX, which enabled fraud, and suggested exchanges should operate more like DeFi protocols with real-time transparency to prevent similar incidents in the future.

-

The bankruptcy trustee is working to liquidate assets and repay creditors, though it remains uncertain whether funds withdrawn before bankruptcy will be clawed back. So far, lawyers have taken $30 million from these funds.

-

The FTX collapse posed significant challenges for the MultiCoin team, but they managed to retain staff and continue operations.

-

While some LPs were upset, most understood the situation, maintained a long-term investment perspective, and recognized the risks associated with the fund.

Betting on Solana

-

Looking back, MultiCoin acknowledged they could have better managed their Solana position, but emphasized the importance of focusing on the long term rather than over-indexing on cost basis.

-

Many believe FTX served as Solana’s business development (“BD”) arm, but MultiCoin disagrees with this characterization.

-

FTX invested in various exchanges, core infrastructure, and NFT projects to serve its own interests and expand across multiple domains.

-

According to Tushar, blockchain BD is overrated—bottom-up approaches (hackathons, crypto-native teams, etc.) are more effective. He believes it's crucial to back teams capable of maintaining strength through market volatility, rather than flashy corporate partnerships.

MultiCoin’s Investment Philosophy

-

Kyle believes a good investor should help entrepreneurs solve problems and develop strategy, not just write blog posts ("hype essays"). He argues venture firms must maintain open minds and invest in strange new ideas, demonstrating willingness to explore unconventional concepts.

-

Tushar notes that investing across every platform effectively creates an index product rather than generating alpha. Being contrarian and correct is essential. Larger funds make achieving outsized returns harder, but they also offer greater opportunity and influence.

-

Tushar says the most valuable thing a VC can do for founders is tell them when they're making critical mistakes. Founders should evaluate VCs based on their interactions with portfolio companies, not hierarchical relationships.

The Intersection of AI and Cryptocurrency

-

Kyle believes the convergence of AI and crypto could produce major winners. He identifies three meaningful areas at this intersection: Airbnb for GPUs, token-incentivized reinforcement learning, and authenticity of digital assets.

(1) Repurposing GPUs from computers worldwide for training and large-scale computation could help alleviate GPU shortages from major cloud providers;

(2) Leveraging human feedback (RLHF) with token incentives can facilitate large-scale reinforcement learning in verticals such as medicine, law, and finance;

(3) Authenticity of digital assets can verify unedited images or those generated using specific skills.

-

Building a great product that users love is key to success—relying solely on marketing tactics like airdrops isn’t enough.

DeFi Challenges

-

Tushar finds DeFi exciting but acknowledges the current difficulty in attracting new users at scale.

-

To increase DeFi adoption, more users need to pay on-chain fees—whether via payroll or other on-chain financial services. The focus should be on getting more people to transact on-chain; once a tipping point is reached, DeFi becomes significantly more compelling.

-

Gaming can serve as a major catalyst for people to earn money and join blockchains, although investors recognize it's difficult to predict which games will succeed.

Decentralized Sequencers and EVM

-

Tushar finds Coinbase’s Base L2 exciting but has concerns about regulation and centralized sequencers.

-

Decentralized sequencers are technically challenging and may introduce engineering complexities similar to those of L1s.

-

Kyle opposes the premise that Layer 2s are the solution to Ethereum’s scalability issues. While L2s reduce gas costs per transaction, they don’t accelerate execution speed or increase TPS.

-

He points out that BNB Chain highlights the limitations of increasing EVM gas limits without breaking past ~500 TPS.

-

In an L2-dominated ecosystem, L1s might be overvalued while L2s are undervalued, shifting MEV and dynamic gas pricing to L2s. According to him, if the future is dominated by EVM-based L2s, shorting L1s and going long on L2s could be a strategic move, despite valuation differences.

Limitations of Layer 2

-

Kyle notes that in early-stage, high-risk crypto experiments, speed often takes precedence over security.

-

Tushar argues that the idea that L2s fully inherit L1 security is too broad. While L2s inherit certain types of security (e.g., double-spend protection), they do not inherit L1’s censorship resistance—an important issue for users concerned about transaction blocking and censorship.

-

In Tushar’s view, crypto’s core value proposition lies in permissionless access—anyone can use and verify the chain without needing approval.

-

He suggests comparing validator costs between Ethereum L1 and Solana L1 may not be the best benchmark, since Ethereum’s vision involves conducting transactions via L2s. However, setting up L2 validator nodes for rollups is significantly more expensive than running Solana validators, though this data remains private for now.

-

MultiCoin holds assets in both Ethereum and Solana, with a higher allocation in Solana.

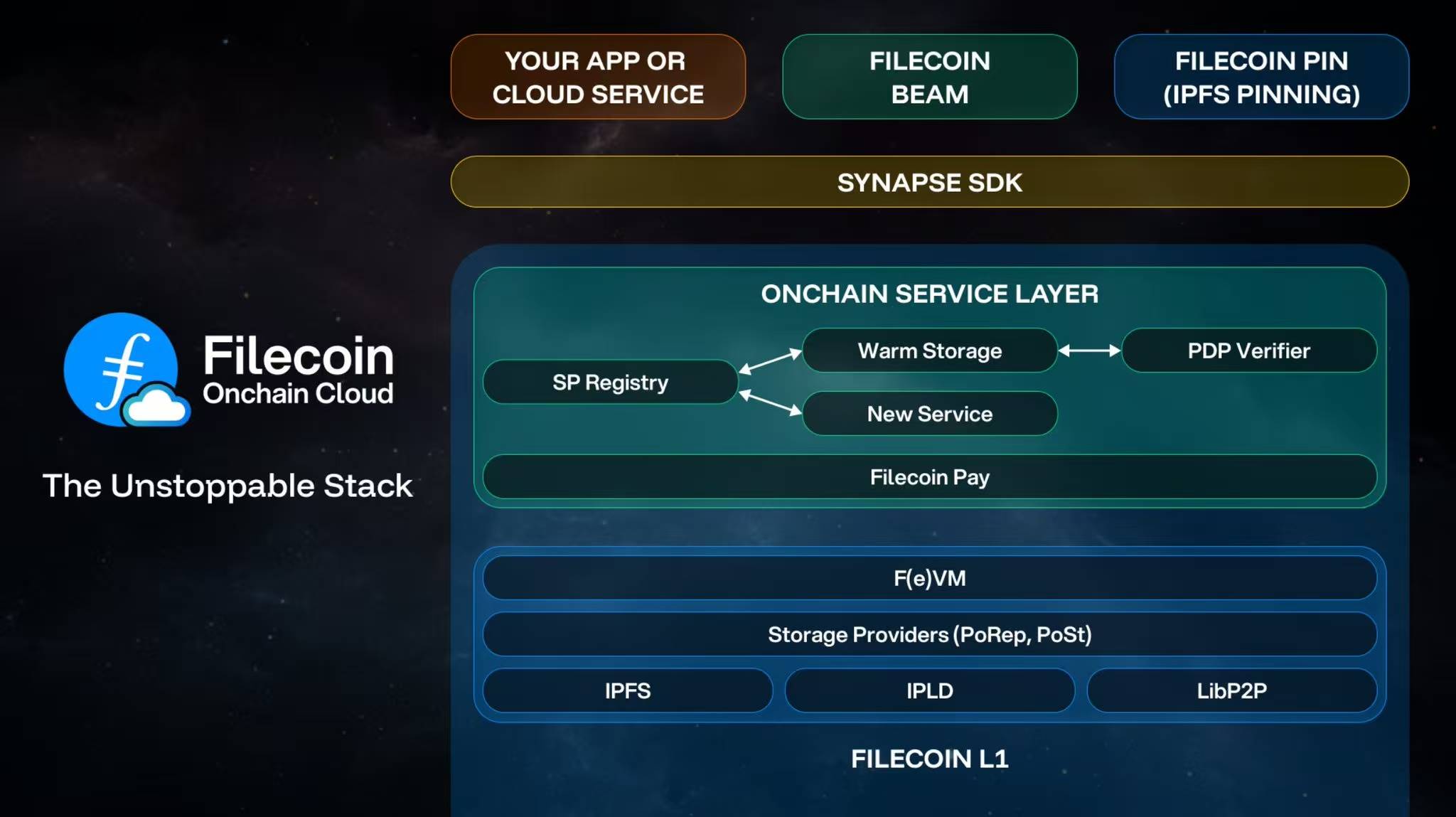

Bullish on Filecoin

-

Kyle believes Filecoin has evolved into a meaningful ecosystem on par with Ethereum and Solana.

-

The launch of the Filecoin Virtual Machine (FVM) introduced programmable payments for storage, retrieval, bandwidth, and computation, making Filecoin programmable.

-

The native Filecoin retrieval market launched in January. Though currently in play-money test mode, it will eventually support real payments and enable exciting applications.

-

When asked about differences between Arweave and Filecoin, Kyle noted that MultiCoin considered Arweave’s simplicity back in 2019 but now sees Filecoin as a superset of Arweave, offering greater optionality and configurability due to its parameterization capabilities—allowing developers to customize parameters like number of replicas, unlike Arweave’s fixed single-parameter model.

-

He believes Filecoin and Arweave may coexist for a long time, but Filecoin offers greater flexibility and broader potential use cases due to its higher configurability.

BTC

-

Tushar believes Bitcoin’s main advantage over other L1 assets is mindshare dominance. Early traditional investors saw Bitcoin as digital gold, but he now believes Ethereum has caught up in terms of liquidity and recognition.

-

He thinks other smart contract platforms like Solana may eventually join Bitcoin and Ethereum, adding more utility and attracting more users.

-

They advise young people entering crypto to follow their instincts and go against the grain—even if it means occasionally making public mistakes.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News