A Closer Look at Filecoin's Staking Economics: Building a Trustless Market and FIL Lending Ecosystem

TechFlow Selected TechFlow Selected

A Closer Look at Filecoin's Staking Economics: Building a Trustless Market and FIL Lending Ecosystem

FIL lending is essentially advancing cash by leveraging miners' future reward accruals, thereby making FIL mining more capital-efficient.

Author: Sid, IOSG Ventures

TL,DR;

-

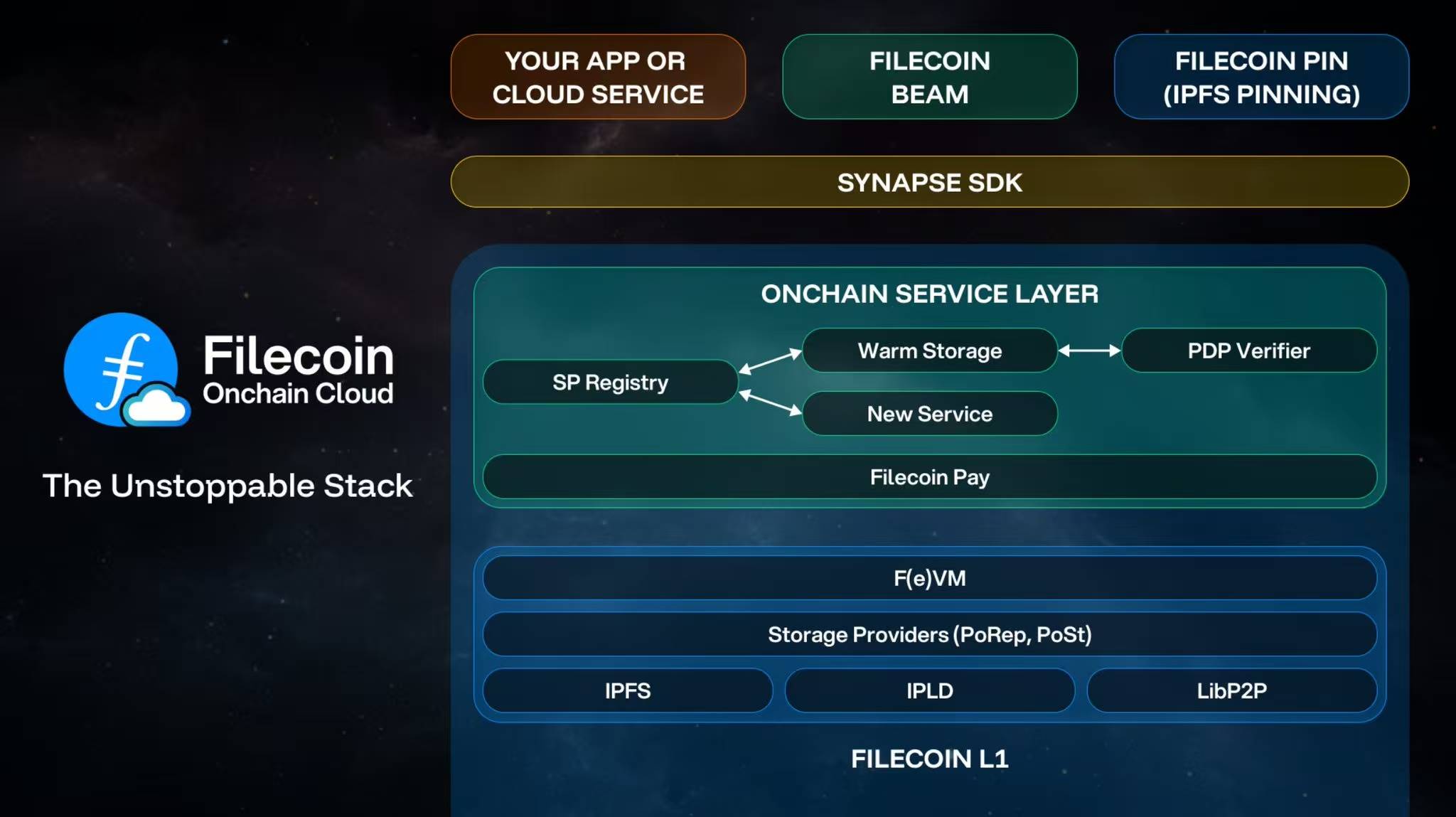

The programmable layer on FIL, i.e., FVM, enables the construction of trustless markets;

-

This requires a market currently existing off-chain—bringing FIL lending on-chain, where retail FIL holders stake their FIL and miners borrow FIL from pools;

-

FIL lending essentially allows miners to receive cash advances based on future reward accruals, making FIL mining more capital-efficient;

-

In protocol design, clear trade-offs must be made between centralization, capital efficiency, and security;

-

The scale of the FIL lending market will gradually shrink over time, but factors such as the introduction of stablecoins can unlock opportunities for building unique applications atop these protocols;

Introduction

Launching a programmable layer on a battle-tested blockchain is often an exciting event. When Bitcoin introduced Stacks (STX), it sparked a new paradigm within its community.

A similar scenario unfolded with Filecoin's launch of FVM. The robust Filecoin community can now view its vision through a completely different lens. Many longstanding challenges in the ecosystem are now solvable. Creating trustless markets via programmability is a key piece of this puzzle.

Liquid staking on Filecoin was the first "Request-for-build" published by the Protocol Labs team and received significant attention. To understand this, let’s first explore how Filecoin economics work.

How Filecoin Incentives Work

Unlike Ethereum validators, there is no one-time staking mechanism in Filecoin. Whenever a miner provides storage to clients, they must pledge FIL tokens as collateral. This pledge secures the storage deal and ensures that the sealed data remains stored on the miner's hardware. This structure guarantees that miners store client data for the agreed duration, in return receiving block rewards. Rewards are distributed via Proof-of-Spacetime (PoSt), where miners earn incentives by proving they have correctly stored client data.

Miners are selected as leaders through a mechanism called DRAND. DRAND selects leaders based on initial criteria and the percentage of raw byte power controlled by each miner.

To increase their chances of being selected as a leader and earning block rewards, miners must continuously grow their raw byte power (RBP). This helps them subsidize their storage costs.

Although many factors affect the supply of these incentives, for storage providers/miners aiming to maximize profits, the key is maximizing RBP and attracting more (and renewing past) deals.

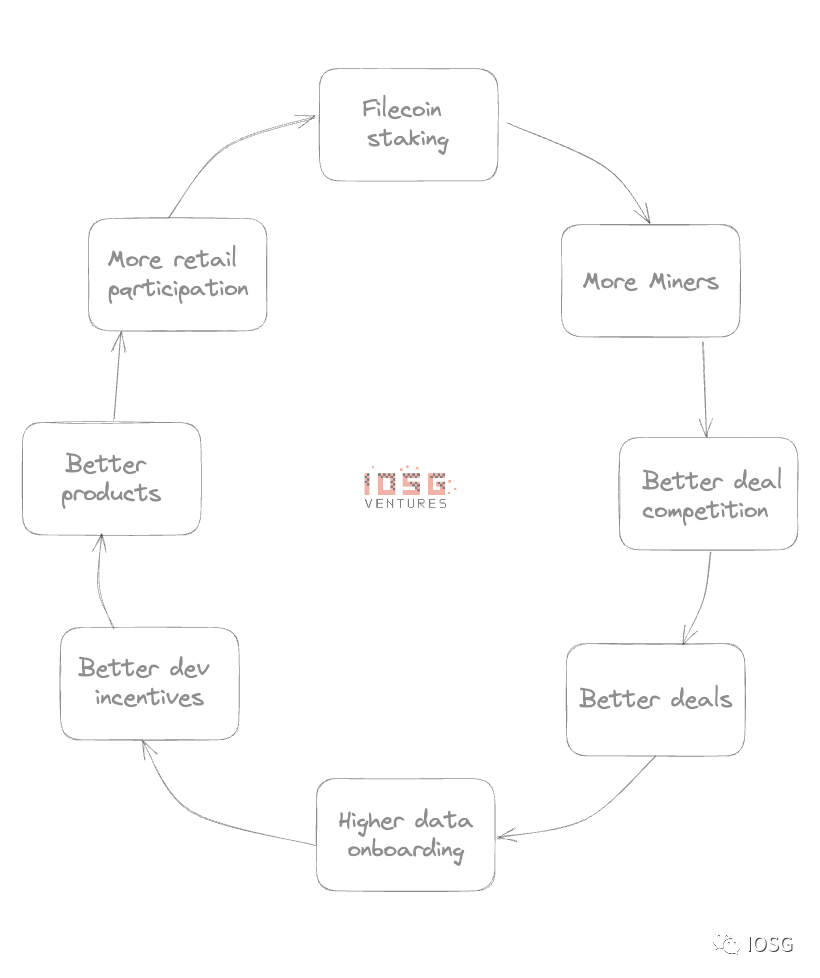

This creates a positive feedback loop for the Filecoin network.

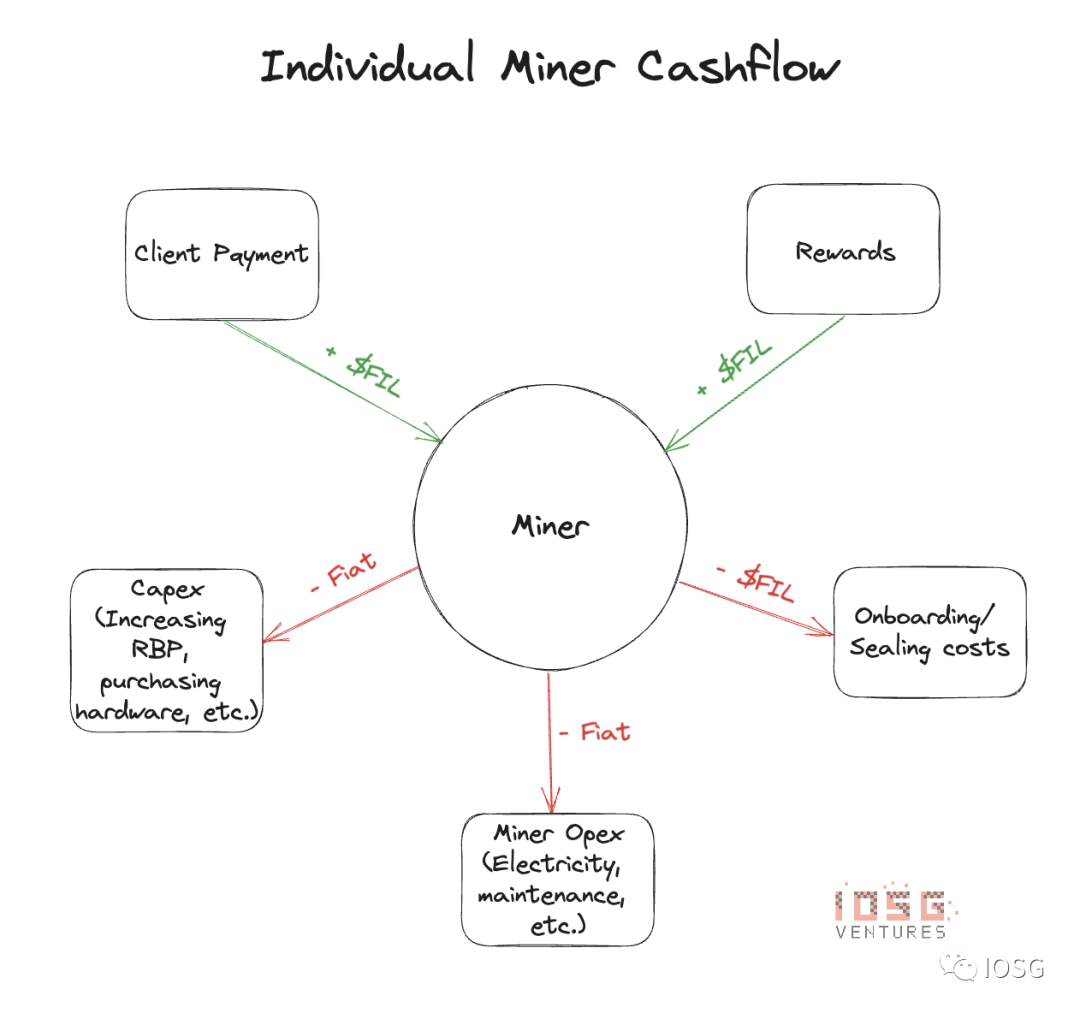

Economics of Miners

When miners receive block rewards, these rewards are not immediately liquid. Only 25% of the reward is liquid; the remaining 75% unlocks linearly over 180 days (~6 months). This presents a problem for miners. What should be operational income becomes delayed receivables, only accessible after attracting (or renewing) storage deals.

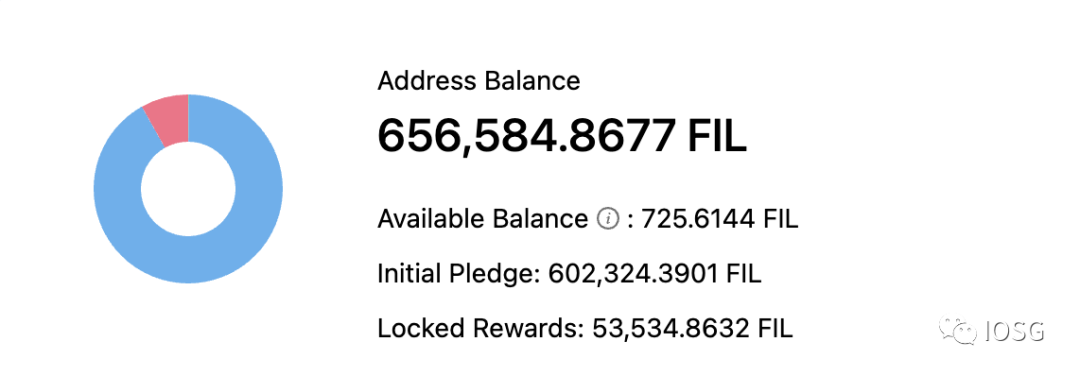

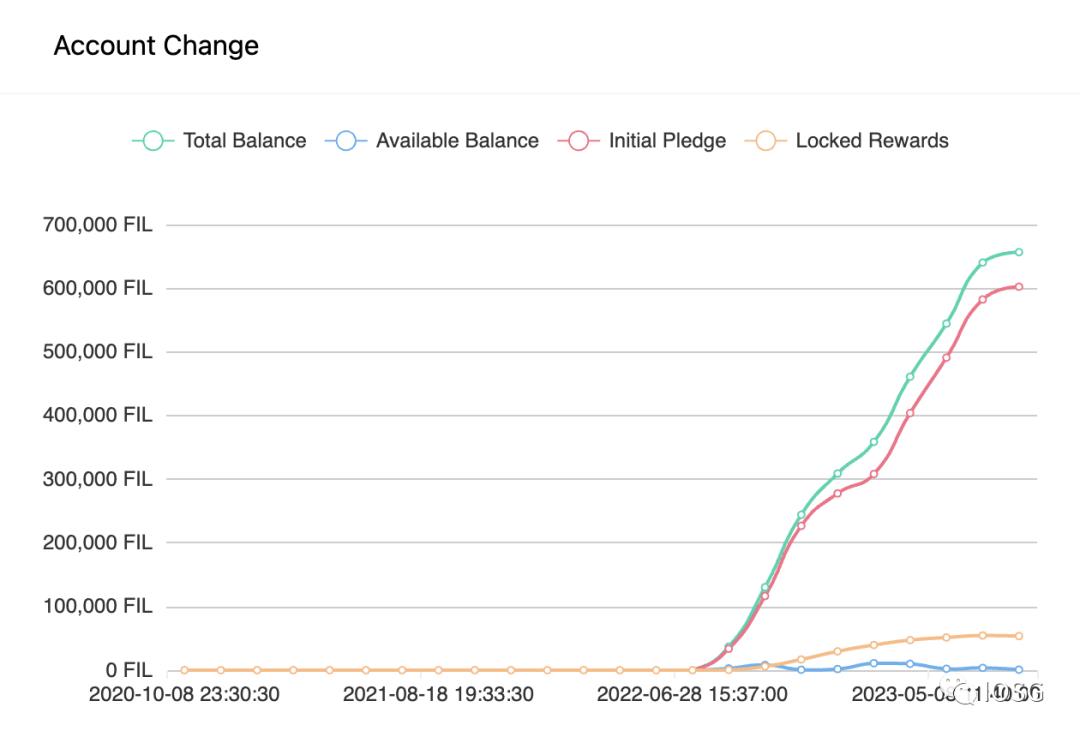

Let’s examine the balances of top-ranked miners on the network (as of August 6, 2023).

From the charts, we see that miners actually have only about 1% of their rewards (i.e., operating income) in liquid form. If a miner wants to do any of the following:

-

Pay operating expenses

-

Upgrade hardware

-

Cover maintenance fees

-

Attract or renew deals

They would need to borrow fiat currency or FIL tokens from third parties to cover these "delayed" payments.

Currently, many storage providers (miners) in the network rely on CeFi lenders like DARMA Capital and Coinlist. As these are loan products, storage providers must undergo KYC and rigorous audits to borrow FIL.

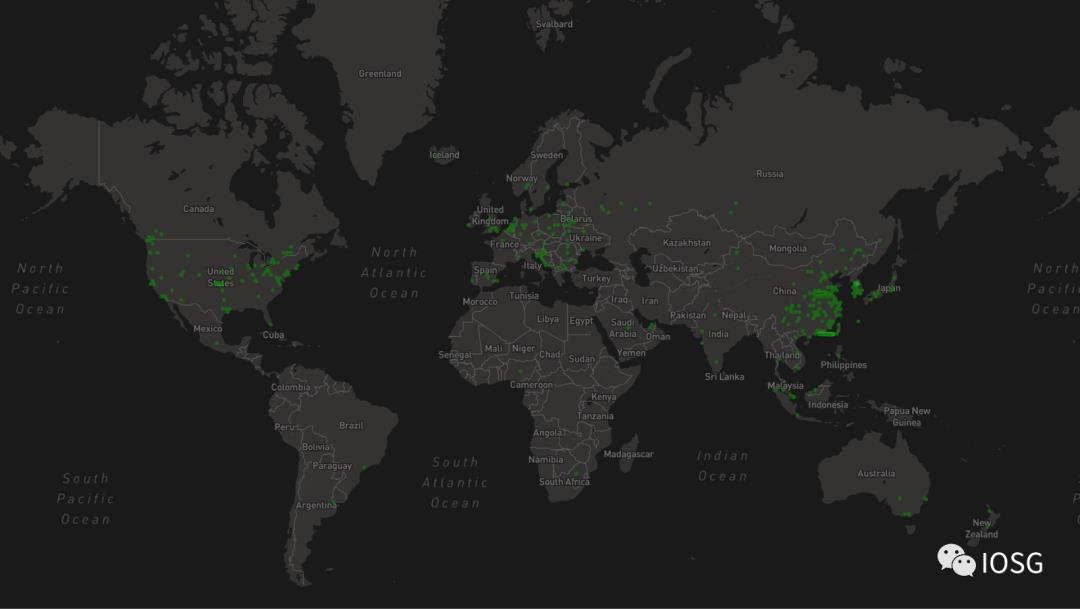

Looking at the map below, we see high concentration of Filecoin miners in Asia, while centralized service providers are primarily located in Western regions. It is difficult for them to offer favorable FIL loans to Asian miners, and most Asian miners/storage providers cannot access these services.

This not only hinders new miners from joining but also limits existing miners’ growth to the size of these CeFi lenders' FIL pools.

So why not borrow fiat from banks? Given FIL’s volatility, borrowing fiat introduces additional capital management challenges for miners.

To solve this, a market is needed connecting FIL borrowers (miners) and lenders (FIL holders).

Filecoin Staking

With the launch of FVM, this market concept becomes feasible. FIL lenders/stakers can now put their idle FIL tokens to work, while miners borrow from these pools—permissioned or permissionless—all managed by smart contracts.

Many players in the ecosystem are already building such markets, with launches expected in the coming months.

Although these are often called staking protocols, in business nature they are closer to lending protocols.

Key features of such FIL lending products include:

1. Lenders stake idle FIL tokens and receive “liquid staking” tokens in return.

2. Borrowers (miners) can draw funds from the pool based on collateral in their miner actor (essentially initial pledge + locked rewards).

3. Borrowers pay interest periodically (e.g., weekly) by transferring their miner’s “OwnerID” to the smart contract.

4. Lenders earn interest (minus protocol fees) as annual percentage yield (APY), claimable via rebasing or value-accruing tokens.

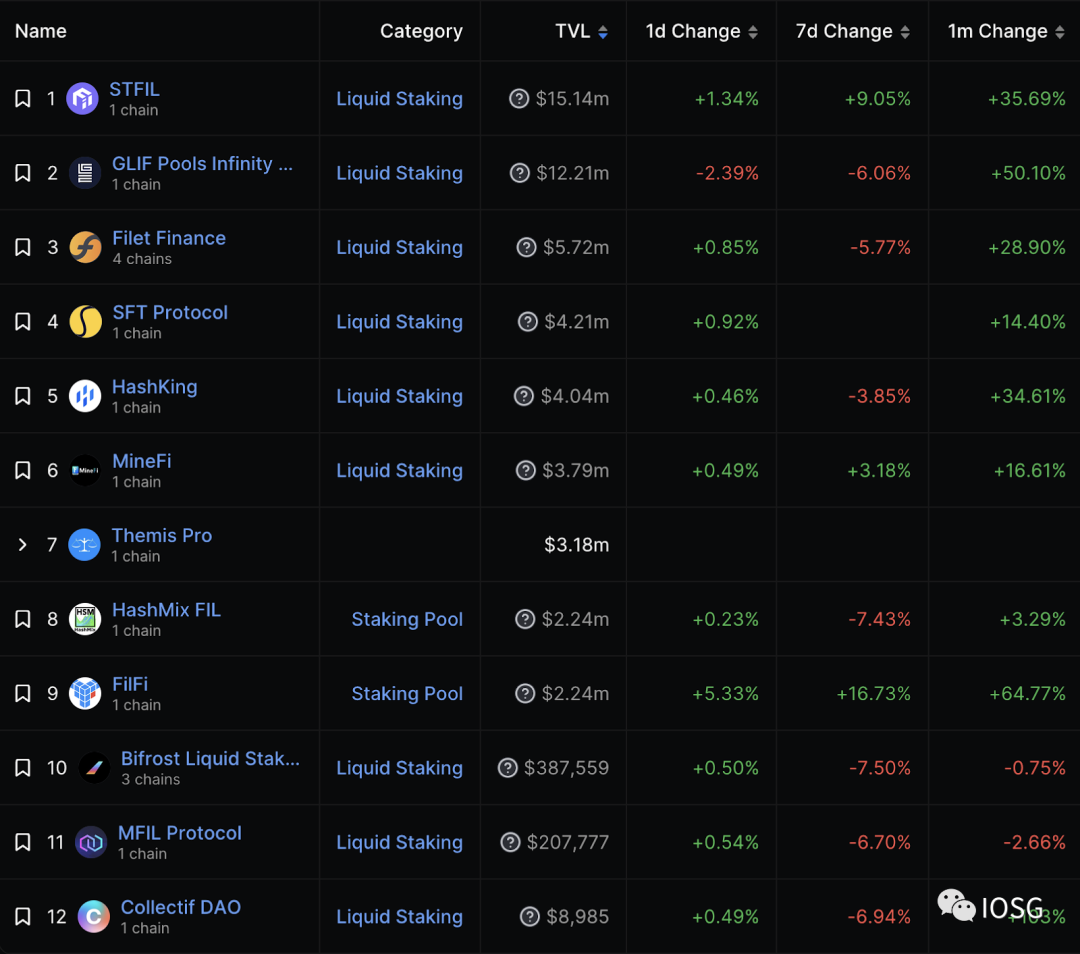

Existing participants in the ecosystem include:

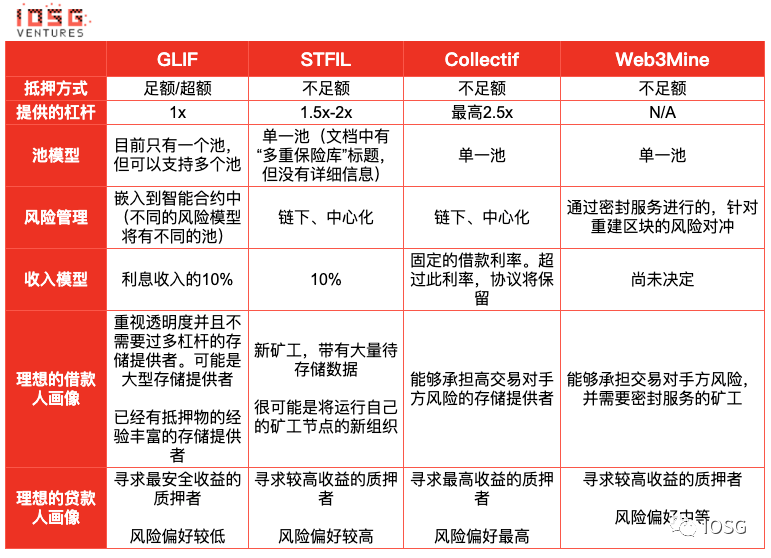

Different liquid staking protocols take varying approaches to lending:

Over-collateralized / Fully-collateralized vs. Under-collateralized

In over-collateralized or fully-collateralized models, the debt-to-equity ratio is always ≤100%. For example, if my miner balance is 1000 FIL, I can borrow up to 1000 FIL (subject to protocol rules). This can be easily enforced in smart contracts with built-in default protection, offering greater transparency and security for stakers (lenders). A key advantage is enabling permissionless borrowing. In this case, the product resembles Aave/Compound rather than Lido or RocketPool.

In under-collateralized models, lenders assume risk managed by the protocol. Risk modeling here involves complex math that cannot be fully embedded in smart contracts and must be handled off-chain, sacrificing transparency. However, due to leverage, the system is more capital-efficient for borrowers. The more permissionless the leverage, the higher the risk for lenders, requiring a robust dynamic risk management model operated by protocol developers.

Trade-offs include:

-

Capital efficiency vs. staker risk

-

Capital efficiency vs. transparency

-

Lender risk vs. borrower accessibility

Single Pool vs. Multi-Pool

Protocols may choose multi-pool designs, allowing lenders to stake FIL in different pools with varying risk parameters. This enables on-chain risk management but fragments liquidity. In single-pool models, risk must be managed off-chain. Overall, trade-offs remain similar to those above.

Trade-off: Liquidity fragmentation vs. risk management transparency

Risks

In over-collateralized models, even if a miner is slashed multiple times, once the debt-to-equity ratio hits 100%, the position is liquidated, protecting stakers.

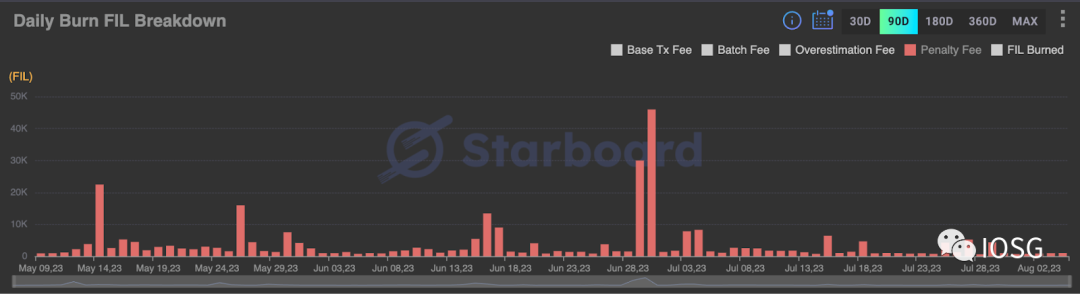

In under-collateralized models, if a borrower fails to prove storage, penalties apply—more common in Filecoin than PoS systems. This reduces collateral value and increases borrower leverage. Clearing thresholds must be set very carefully in such models.

Filecoin miner penalty (90 days)

Comparison of Market Participants

What about Ethereum staking/lending protocols entering the market?

In the Filecoin ecosystem, unlike Ethereum, node operators (miners/validators/storage providers) have far greater responsibilities beyond uptime. They must self-market to become Storage Providers (SPs), regularly upgrade hardware to support more storage, sealing, maintenance, and data retrieval. For SPs, Filecoin storage and reward mining is a full-time job.

Unlike Ethereum validators, Filecoin does not have one-time staking. Every time a storage provider offers storage, they must pledge tokens to seal storage deals and keep them on their hardware. Providing storage on Filecoin is highly capital-intensive, deterring many new miners from joining and discouraging existing ones from contributing.

Given that borrowers are limited to miners, establishing borrower trust will be a labor-intensive process for newcomers in the Filecoin ecosystem.

Due to Filecoin’s unique mechanics, Ethereum staking or even lending protocols cannot easily deploy on FVM.

Protocol Economics

Is there enough FIL supply for lending?

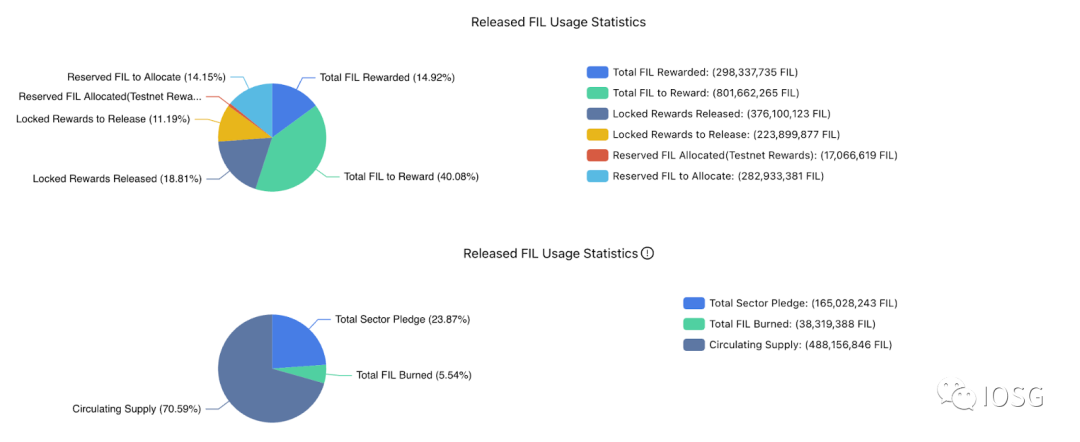

As of August 6, 2023, approximately 264.2 million FIL tokens are in circulation, not committed as storage pledges or pending release rewards—this represents the total FIL potentially available for lenders to stake into pools.

Is there sufficient borrowing demand?

While FIL borrowing is crucial for miners, what exactly are they borrowing against? In over-collateralized models, they’re receiving early payouts on locked rewards; in under-collateralized models, they’re advancing against future rewards.

From the chart above, total locked rewards amount to ~223 million FIL, indicating supply can meet demand. The demand-to-supply ratio is nearly 84%, showing balanced power dynamics—neither side can strongly pressure the other on interest rates/APY.

What lies ahead?

Estimating future FIL borrowing demand equates to forecasting future reward releases.

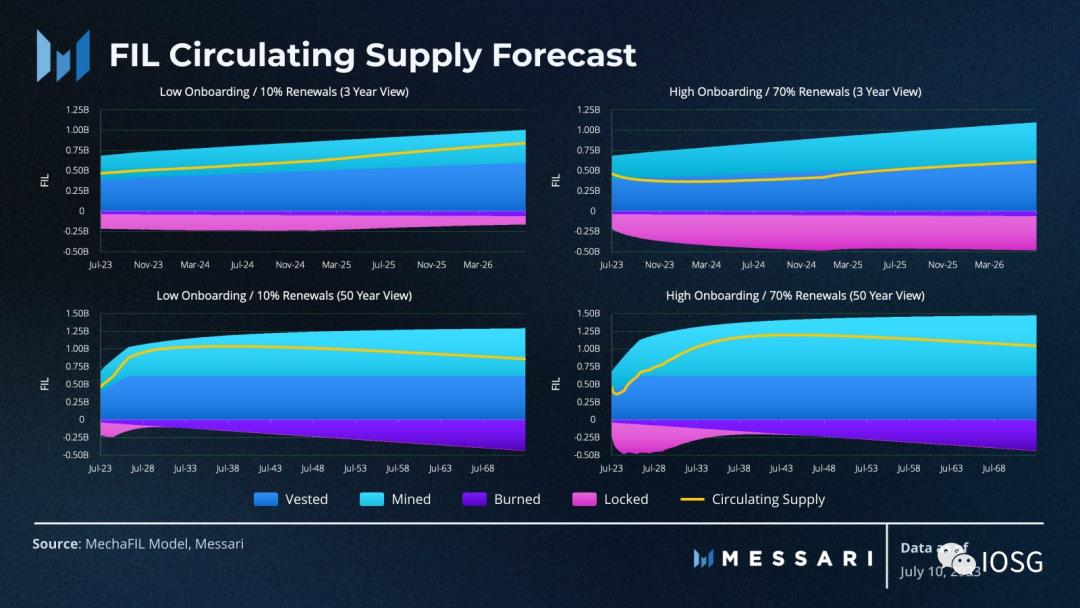

Messari analysts simulated FIL circulating supply projections over 3 years and 50 years under various scenarios.

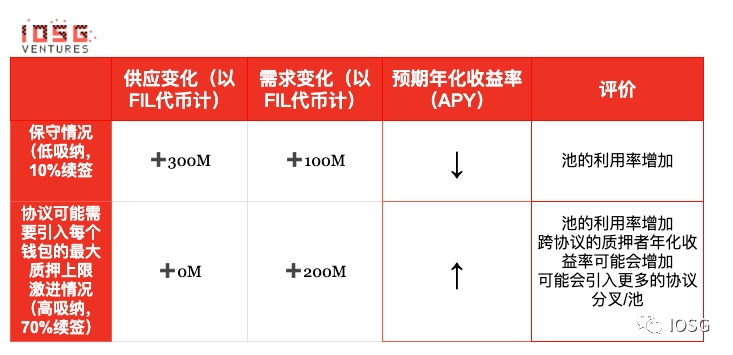

According to the top-left chart, in a conservative scenario with low data onboarding and only 10% of deals renewed, newly released rewards over the next 3 years will approach 100 million FIL. In an aggressive case—high data onboarding and 70% renewal rate—additional rewards could reach ~200 million FIL.

Thus, the market size is expected to range between 100–200 million FIL over the next three years. At current FIL price ($4.16 on Aug 6), the total addressable market (TAM) for lending could be $400M–$800M. This represents the borrower-side TAM.

On the supply side, conservative estimates project ~300 million FIL generated, while aggressive cases simulate circulating supply remaining similar to today. Why? Because more deals onboarding and renewing mean more FIL locked as storage collateral.

In aggressive cases, demand may exceed supply, leading to higher interest rates in this competitive landscape.

If demand for data storage outpaces growth in circulating supply, FIL token price will rise, creating further borrowing demand in FIL terms.

Potential Future Directions for This Model

Across different designs, a winner-takes-all outcome isn't inevitable. Long-term, protocols with the safest architecture typically win (e.g., Lido in Ethereum), measured by Total Value Locked (TVL). Rather than optimizing for 2–3% higher yields, I favor safer structures—and believe FIL holders will prioritize capital safety over marginally higher returns.

This holds true even after accounting for penalties miners incur for failing to prove storage over time.

From the borrower (miner) perspective, miners can source loans from different protocols for varied purposes. If a miner has ample collateral and doesn’t need leverage for operations, the safer over-collateralized model works best. But if I’m a new miner needing to pledge large amounts of storage, I might borrow from under-collateralized pools.

Analyzing the models above, we observe:

In Filecoin, staking plays a vital role in bridging the supply-demand gap for FIL tokens. FVM has recently launched, enabling lending markets. Despite real needs, FVM’s arrival may be too late for many FIL staking/lending protocols, as declining mining rewards make this a niche market.

However, compelling use cases may emerge atop these staking protocols. With stablecoins introduced, rewards could function as forward cash contracts—similar to Alkimiya’s model on Ethereum. This could inject new capital into the Filecoin ecosystem and boost TVL across these protocols.

Ethereum and Filecoin differ in technology, miners, developers, applications, and communities. Especially for staking, since each miner is “non-fungible,” driving borrower demand requires business development efforts, and success correlates with the protocol’s reputation within the community.

Filecoin staking is a critical solution to bring more miners into the system, enable fragmented capital to participate operationally, create stronger economic incentives, attract more developers to build useful products, and establish a virtuous cycle.

Conclusion

Many challenges remain in the Filecoin ecosystem, but we believe the Protocol Labs team is moving in the right direction toward their vision of storing humanity’s data in efficient systems.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News