Filecoin Bear: Prone to Collapse, Overvalued, High Policy Risks

TechFlow Selected TechFlow Selected

Filecoin Bear: Prone to Collapse, Overvalued, High Policy Risks

After the Filecoin hype fades, all that will remain is a trail of skeletons.

To be blunt, the author believes that: Filecoin is prone to collapse in the short term and unlikely to achieve real-world adoption in the long term.

Constrained by already-sold mining machines and a two-year delay in mainnet launch, Filecoin has been abandoned by early believers and has become a game for only a few financial consortia.

For a long period after Filecoin’s mainnet goes live, its community will be dominated by speculation. Eventually, as speculators fail to find buyers and face losses from machine sell-offs and crashing coin prices, Filecoin’s real-world implementation will be undermined.

Moreover, large companies such as Huawei and JD.com applying IPFS will consume Filecoin's market share.

Additionally, due to China's content censorship policies, Filecoin—marketed with decentralized storage—faces potential bans, and Chinese Filecoin mining farms/pools will bear the consequences.

After the hype around Filecoin fades, all that will remain are countless casualties.

Can Filecoin Achieve Real-World Adoption?

Before discussing Filecoin, let’s first ask: What exactly is Filecoin?

In fact, many people confuse Filecoin with IPFS.

IPFS is the InterPlanetary File System—a protocol network.

Since its release in January 2015, IPFS has operated stably for four years. Currently, hundreds of applications run on IPFS, supported by millions of nodes worldwide. Companies like Google and JD.com have begun adopting IPFS technology.

According to disclosed data, by June 2017, over 5 billion unique content files had been stored on the IPFS network, with data continuing to grow steadily.

Filecoin, however, is a blockchain project. Announced to launch its mainnet in June 2018, it has experienced multiple delays and has faced persistent criticism over performance issues.

IPFS is like a bustling highway, while Filecoin is a foal gasping before even being born.

IPFS technology has already achieved real-world use, but Filecoin remains unproven. This is the key difference between them.

The current wave of intense promotion mostly revolves around Filecoin.

Unlike other speculative crypto projects, Filecoin innovates by linking to physical hardware—allowing investors to speculate on mining machines or cloud computing power even before the mainnet launches. Public figures indicate that top manufacturers’ sales have exceeded 1 billion RMB.

As widely known, Filecoin has created a group of millionaires. But can an unaunched Filecoin sustain such wealth?

Filecoin’s primary application is cloud storage.

In terms of storage functionality, Filecoin offers nothing different from Amazon or Alibaba Cloud—and the latter enjoy far greater scale and technical cost advantages.

Although Filecoin claims benefits such as data immutability and privacy protection, under existing regulations these very features become major obstacles to its development. This point will be elaborated in the next section.

Recently (July 3), JD.com announced its investment in IPFS.

JD.com’s Wireless Treasure is a router equipped with NAS (Network Attached Storage) functionality. It features a monetization system based on P2P, which requires integration with IPFS.

In short, Wireless Treasure uses users' idle bandwidth resources to "mine". The project lead stated that valuable files and data would be distributed and cached across Wireless Treasure devices to create valuable products, noting: “By leveraging IPFS technology, total storage costs are extremely low while data value is exceptionally high.”

Most Filecoin supporters fail to realize that these tech giants are not just adopters of IPFS—they are also competitors to Filecoin.

Readers familiar with Filecoin should recognize that what JD.com’s Wireless Treasure aims to do closely resembles Filecoin’s intended applications.

Compared to Filecoin’s perpetually delayed mainnet, JD.com holds three key advantages: e-commerce traffic, JDCoin to insulate risk, and superior technical cost efficiency.

In contrast, beyond repeated postponements, Filecoin’s performance is heavily questioned. As a public blockchain aiming for decentralized storage, it remains largely unfinished.

What Filecoin intends to do, big tech firms have already started doing. The areas where big tech cannot operate are where Filecoin might thrive—but those spaces come with risks and traps.

Filecoin’s core use case targets commercial storage customers. Regardless of whether performance keeps up at launch, clearly these internet companies hold a significant edge in ease and efficiency of promotion.

Currently, for a considerable time after mainnet launch, FIL’s price performance and liquidity levels will be insufficient to support a healthy, functioning storage market.

Filecoin’s Copyright Crisis

When new users open Filecoin-related apps or forums, they are unlikely to be impressed by their rudimentary interfaces.

The Chinese IPFS community IPFS.GUIDE is flooded with pirated movies and suffers from extremely low user engagement.

Launched in March 2018, IPFS.GUIDE reportedly became the first Chinese IPFS application, archiving thousands of short videos.

Some forum users claim that if user numbers continue rising at this pace, replacing Baidu Netdisk as the next resource distribution platform is only a matter of time.

Others share my concern: Will it get blocked?

The site’s IP address is located in China and lacks an operating ICP license, making it easy to take down. In response, officials said they would quickly move servers overseas.

Though hosted abroad, the actual controllers may still be based in China—a common scenario in similar cases.

Dtube is a video app built on IPFS—an open-source, decentralized video platform hosted on Steem, where uploaded videos are stored via IPFS protocols.

Opening Dtube reveals a website nearly identical to YouTube. However, both content volume and traffic are orders of magnitude smaller than YouTube: no comments, no likes, subscription counts typically in single digits.

Since 2020, YouTube has aggressively removed cryptocurrency-related content. Dtube was seen as a potential replacement, but its tiny traffic makes that impractical.

You might argue these examples have nothing to do with Filecoin, but these IPFS applications could eventually rely on Filecoin and be incentivized using FIL tokens.

In summary, Filecoin-related infrastructure is still in its infancy—lacking users and filled with pirated content.

Yet, within Filecoin supporter circles, pirated files are sometimes reframed as “copyright freedom.” For example, Juan Benet, IPFS’s founder, wrote a script in 2018 specifically to download YouTube videos and upload them onto the IPFS network.

Are Filecoin believers really capable of restoring the glory of P2P websites through decentralized networks?

Technically, decentralized networks reduce the attack surface for censorship. Compared to HTTP, IPFS enables permanent, immutable, undeletable, and shareable information storage.

But practically, this is almost impossible today.

Xunlei’s rise relied on weak copyright awareness in early internet days. Today, such an environment no longer exists. With increasingly mature copyright laws and content controls, these platforms are gradually fading.

In 2006, after facing copyright lawsuits, eDonkey paid $30 million in damages and ceased further development. Later, eDonkey’s founder Jed McCaleb founded Mt.Gox and Ripple.

In December 2013, Sohu, Youku, Tencent Video, and LeTV formed a new anti-piracy alliance, held a high-profile press conference, and publicly accused KuaiBo of infringement. By April the following year, KuaiBo shut down its servers.

According to Bloomberg, EU police recently dismantled a streaming network supporting cryptocurrency payments for TV and movies, involving over 2 million users and leading to 11 arrests across Spain, Denmark, and Sweden.

In China, the founder of D-site was recently arrested on suspicion of copyright infringement.

The main reason IPFS content platforms haven’t yet faced legal action is their small scale. Once they grow, someone will pay the price.

Growth versus freedom—this is the binary paradox facing IPFS and Filecoin. Otherwise, how can Filecoin compete against established internet giants?

Nevertheless, Filecoin does retain certain advantages in decentralized cloud storage.

Jiang Zhuoer of BTC.TOP stated that information freedom through decentralized storage represents a crucial and strongly demanded need—following Bitcoin’s monetary freedom and Ethereum’s equity freedom.

But storing content inherently invites stricter content regulation.

Filecoin’s Policy Risks

Filecoin’s greatest risk lies in policy exposure.

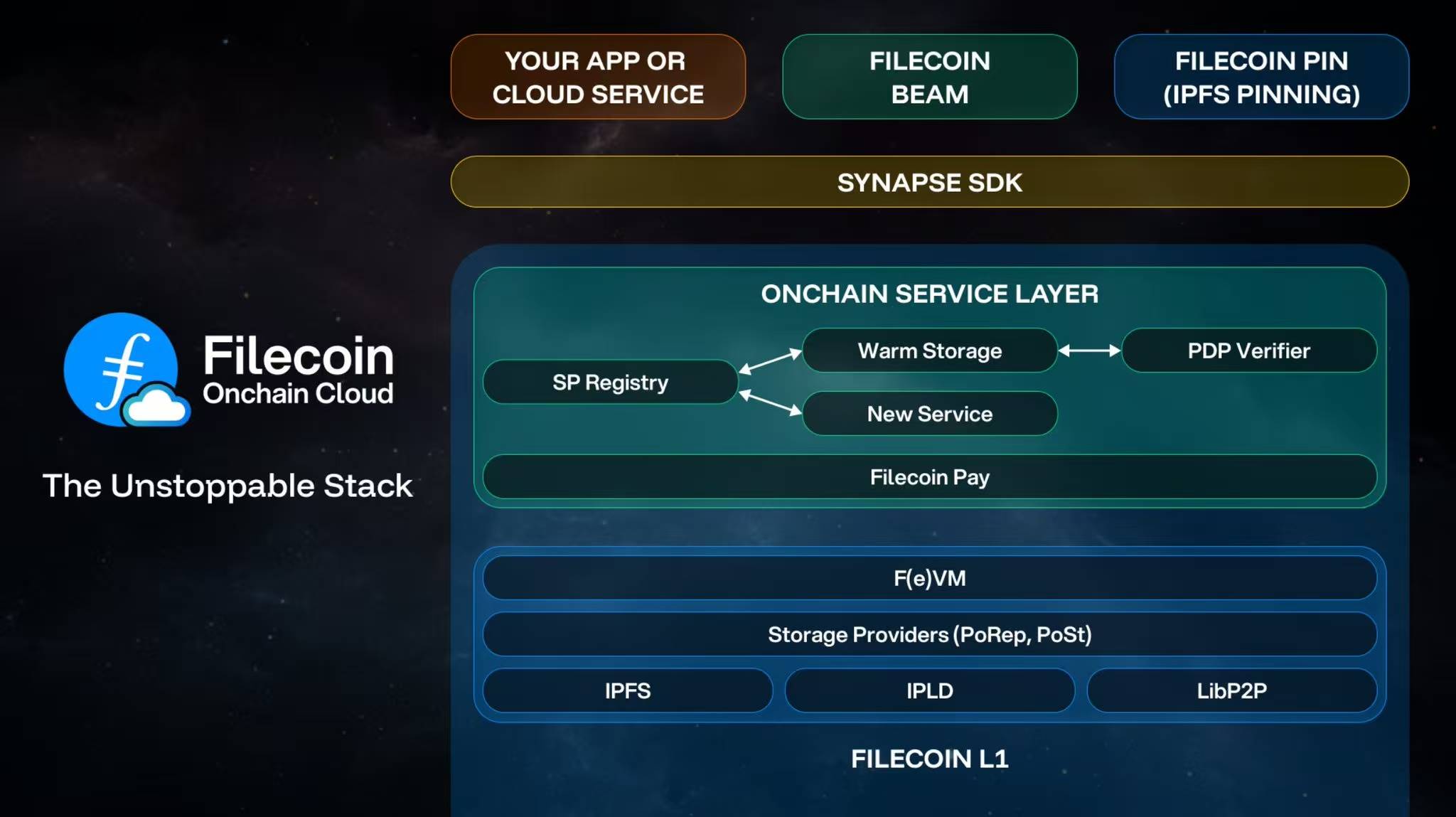

According to the Filecoin whitepaper, Filecoin operates two markets—storage and retrieval—functioning as two decentralized exchanges. No central entity manages these exchanges; transactions are transparent, and anyone can participate anonymously.

As a decentralized storage network, Filecoin offers anonymity and privacy protection—ideal for gray areas like adult content industries.

Filecoin cannot control or monitor user behavior, creating major regulatory challenges for governments worldwide.

On Filecoin’s node map browser, the brightest and densest cluster is in China.

In June this year, two young Chinese developers were arrested for archiving deleted articles on GitHub, charged with “picking quarrels and provoking trouble.”

If users attempt to store files on Filecoin or IPFS networks in the future, compliance with China’s online storage regulations will become a serious issue.

In January 2018, Apple announced that iCloud services in mainland China would be operated by Guizhou Cloud Big Data. Under China’s Cybersecurity Law, judicial and national security agencies may require network operators to provide “technical support and assistance.”

Will Filecoin follow iCloud’s path in the future?

Beyond local regulation, how will the Chinese government handle scenarios where “data is stored abroad but accessed domestically”? These situations are commonplace on IPFS and Filecoin.

Previously, to resist Spanish government censorship, the Catalan government used IPFS to upload previously banned websites and made them publicly accessible.

In today’s increasingly tense global climate, cross-border information exchange and oversight will grow stricter—TikTok serves as a clear precedent.

Once an incident occurs on Filecoin, someone must bear responsibility. Due to blockchain’s anonymity and decentralization, tracing file uploaders is nearly impossible—leaving domestic mining farms in China likely to shoulder liability.

Filecoin mining nodes involve data transmission and content distribution, requiring licenses such as IDC (Internet Data Center), CDN (Content Delivery Network), ISP (Internet Access Services), and IP VNP (Internet Virtual Private Network).

Take CDN: a caching-based content delivery network that allows users to access content nearby, reducing congestion and improving response speed. The most famous historical user of CDN was KuaiBo.

Apart from a few leading mining farms, most Filecoin mining operations lack these licenses. Some even claim to host their farms overseas.

Should any storage incident occur, these domestic mining farms and pools will face severe consequences.

In response, Filecoin supporters argue: Technology is not guilty. Technology leads, law follows.

The last time “technology is not guilty” was claimed was during the KuaiBo trial. On September 24, 2014, Beijing police indicted KuaiBo on charges of “spreading obscene materials for profit.” Previously, Shenzhen authorities had fined KuaiBo 2.6 billion RMB.

Some suggest that Filecoin’s real-world adoption will naturally bring forth numerous applications and service providers. Regular users wanting to store files on Filecoin would go through intermediaries. Regulators could simply target application layers and supervise service providers—a feasible content control strategy: “Whoever owns the node is responsible; whoever distributes bears responsibility.”

The official team has responded to such concerns.

A user asked the Filecoin team: How does the Filecoin network handle content removal requests (e.g., child pornography)? If I am a storage provider, what is my liability?

The official reply stated that the network cannot delete files from participants’ computers, but they are developing tools to help users control what types of data they choose to store locally.

However, the author believes none of the above proposals offer real solutions. As noted on Filecoin’s website, data is stored globally—"as data flows across the world, access is continuously optimized."

Under current conditions, how can the Chinese government regulate or constrain U.S.-based storage providers?

From the author’s observation, most Filecoin investors overlook underlying policy risks, focusing only on returns and profits.

Before the entire Filecoin network matures and stabilizes, FIL’s token price will be the sole support for miners and secondary-market investors. Early miner rewards primarily come from block rewards, during which most stored data will be fabricated “fake” storage.

Compared to other cryptocurrencies, Filecoin’s biggest innovation is its binding to physical mining hardware—creating room for institutional speculation.

Today, there are at least 200–300 Filecoin mining machine vendors in China, with top manufacturers achieving sales exceeding 1 billion RMB.

The author heard that last month, one Filecoin mining vendor sold 50 million RMB worth of equipment at a single expo in Huizhou. Another vendor closed a 60 million RMB deal, earning the CEO a direct reward of an apartment.

Filecoin Is Overvalued

Filecoin was first proposed in 2014 and officially launched fundraising and publicity in July 2017.

Filecoin aims to monetize the data from these applications: “Through incentive mechanisms and economic models similar to Bitcoin, more people will be encouraged to set up nodes and adopt IPFS.”

By the end of August 2017, Filecoin completed its global crowdfunding, raising $257 million on CoinList—all from U.S. citizens.

Statistics show that Filecoin is expected to mint approximately 34.11 million coins per month in the first six months, totaling 365.13 million FIL in the first year. Block rewards decrease over time, halving completely by Year 6.

At the current FIL futures price ($15), the total market cap of first-year FIL output reaches $5.475 billion. Just considering this $5.475 billion in circulating supply, Filecoin would rank 5th in cryptocurrency market capitalization—right after XRP.

Industry leaders claim this is the next Ethereum-level investment opportunity. But pause and reflect: Do you really believe Filecoin can surpass Ethereum?

Regardless of your answer, the market has already priced in optimistic expectations: yes.

At a futures price of $15, Filecoin’s fully diluted market cap reaches $21 billion—surpassing Ethereum and approaching Bitcoin.

Thus, some Filecoin mining machine sellers claim that, ignoring electricity and maintenance costs, a 248,000 RMB mining rig can break even in just three months—at today’s FIL futures price (~1,050 RMB).

And so, mining machines sell out, and salespeople earn commissions as high as 25%. Hype builds upon hype, pushing Filecoin higher. What many don’t realize is that mining machine companies simply buy hardware, assemble it into so-called miners, and mark up prices 2x to 5x.

Let’s cool down: Do you really think Filecoin can challenge Baidu Cloud’s position within two years?

In Q4 last year, Baidu Cloud held 8.8% of the domestic cloud market. Recently, Goldman Sachs valued Baidu Cloud (including Duer Smart Speaker and cloud services) at 4 billion RMB.

Filecoin has neither data nor content—it’s merely a prematurely marketed concept, yet its valuation has reached 210 billion RMB.

According to Bao Er Ye Guo Hongcai’s exaggerated estimate, Filecoin mining machine sales alone have reached $11 billion.

But guess where that $11+ billion went after mining vendors completed sales and cashed out?

Beyond hardware costs and initial investments, much of that money likely flowed into stocks, real estate (like the aforementioned rewarded apartment), luxury goods—with only a small fraction remaining tied to FIL’s token price.

When the mainnet launches, who will support FIL’s price floor? Not users lacking any practical use, nor miners who’ve already cashed out, nor investors whose wallets are already drained.

Even Bao Er Ye admitted his belief in the “essence of profit”: capturing the juiciest profits during the first wave of opportunity.

He added: The first year after Filecoin’s launch is the golden period—what happens after that, no one knows.

In summary, IPFS technology works, but Filecoin cannot compete with internet giants. Filecoin once promised everyone could mine, carrying great hopes, but now it has become a game for a few powerful groups and a graveyard for most others.

In my view, Filecoin is currently just a speculation-driven blockchain project with severe bubble characteristics. Cloud computing power carries high default risks (a topic for another article). Please stay vigilant and invest cautiously.

References:

1. "How Will 30 Million JD.com Wireless Treasure Units Help Bring IPFS Into Every Home?", IPFS.CN

2. "IPFS/Filecoin: One Side a Vast Ocean, the Other Side Financial Enlightenment", BlockVC Industry Research

3. "IPFS vs Filecoin: How Should Developers Choose?", Dong Tianyi

4. "IPFS Data Security: Will It Be Regulated in China?", Anhui Binhe Cloud Intelligence

5. "Shock! Can Filecoin Enable Pornography Industries?", IPFS Force Zone

*TechFlow reminds all investors to beware of chasing inflated prices. The views expressed herein do not constitute any investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News