Up 408% over the past three months! Is DeFi token growth sustainable?

TechFlow Selected TechFlow Selected

Up 408% over the past three months! Is DeFi token growth sustainable?

Over the past three months, 10 DeFi tokens have outperformed Bitcoin and the broader cryptocurrency market, but is this sustainable?

Over the past three months, DeFi (decentralized finance) protocol tokens have surged in value far outpacing the broader cryptocurrency market.

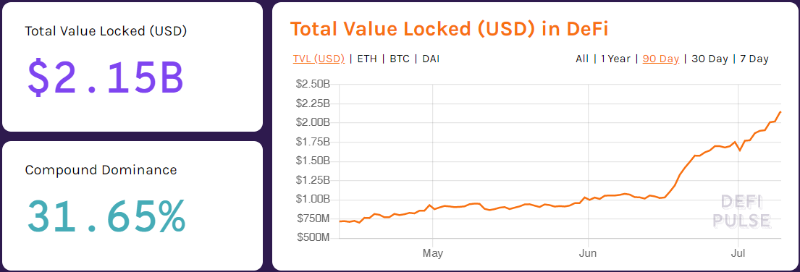

The total value of assets locked in current DeFi applications (TVL) has exceeded $2 billion, with $1 billion of that amount flowing in during just three weeks in June this year! More importantly, according to a report by Messari, DeFi platforms are now collectively distributing $25 million worth of assets to users each month for free. All of this is tied to the so-called "Yield Farming" phenomenon. Essentially, liquidity mining involves maximizing the use of crypto assets such as BAT and USDT through lending and borrowing.

Above: Trend in the total value of assets locked in DeFi protocols. Source: DeFipulse

Therefore, in just the past three months, these DeFi protocol tokens have experienced sharp growth. This may not be like the heyday of 2017, but it is a thriving new industry.

The Boom of DeFi Tokens

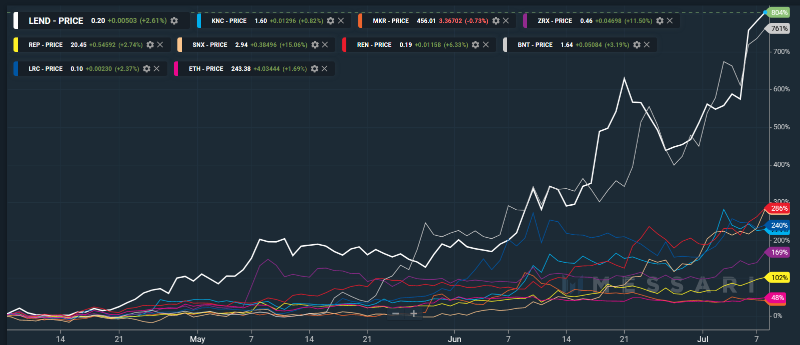

Data from Messari shows that since April 8, the price increases of 10 DeFi tokens have ranged between 41% and 804% (see chart below). Meanwhile, Bitcoin and the overall cryptocurrency market grew only 27% during the same period.

Above: The gains of 10 DeFi protocol tokens over the past three months have surpassed those of the broader crypto market. Source: Messari

LEND, the native token of the Aave lending protocol, saw an impressive 804% increase over the past three months. According to data from DeFi Pulse, Aave is currently the fourth-largest existing DeFi protocol, with more than $150 million worth of assets locked at the time of writing—representing the total amount lent on the Aave platform.

In the three months since April 8, the value of LEND rose from $0.022 to $0.199. This rise continues a recent upward trend for LEND, which has gained a record 1,127% since January this year.

Above: LEND prices increased by 804% since April and by 1,227% since January. Source: CoinMarketCap

The second-best performing DeFi token after LEND in Messari's data is Bancor (BNT). Bancor is an Ethereum-based exchange protocol that enables users to trade tokens in a non-custodial manner using liquidity pools. Since April 8, BNT's price has skyrocketed from $0.191080 to $1.65, an incredible 761% increase.

Bancor offers interest rewards to contributors of liquidity pools. While Bancor has its own website and decentralized exchange (DEX), the protocol is also used by many other exchanges, such as the decentralized exchange 1inch.exchange.

Ren (REN) is the next strongly performing protocol token, growing 286% over the past three months. Ren is an open, permissionless protocol designed for cross-chain transfer of cryptocurrencies. Given that Ren aims to bring blockchain interoperability into the DeFi space, perhaps REN’s growth signals that investors are not only capturing DeFi tokens themselves but also those playing roles at deeper technical levels.

In addition, Synthetix (SNX), Kyber Network (KNC), and Loopring (LRC) achieved record-breaking gains ranging from 220% to 280%.

Synthetix is an Ethereum-based protocol for issuing synthetic assets and also serves as a trading platform for these synthetics. Synthetic assets simulate real-world assets (such as USD, BTC, ETH, XAU, etc.). Users mint synthetic assets (like sUSD, sBTC, sETH, sXAU) by staking the protocol’s native token SNX, allowing them to trade or arbitrage these assets without actually holding the underlying asset (e.g., BTC).

Kyber Network is an Ethereum-based decentralized on-chain liquidity exchange protocol. According to Etherscan data, it is currently the third-largest decentralized exchange by trading volume. Loopring is also a decentralized exchange (DEX) that recently attracted attention due to its successful implementation of a new Ethereum scaling solution called ZK-rollups.

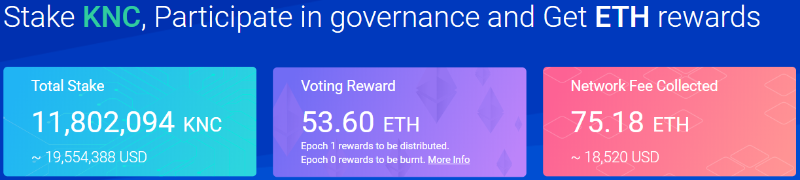

Notably, Kyber Network launched its Katalyst upgrade and KyberDAO governance platform this past Tuesday, enabling KNC token holders to stake and vote on governance proposals to earn ETH rewards.

Within just one day after the Katalyst launch, nearly $18 million worth of KNC tokens were staked into KyberDAO, demonstrating strong user demand for this DeFi product. At the time of writing, 11,802,094 KNC tokens have been staked, valued at over $19.5 million, as shown in the chart below:

Source: https://kyber.org/vote

Year-to-date, the price of the KNC token has increased nearly 800%, reaching an all-time high of $1.84 on July 3. However, unlike the governance tokens COMP from the DeFi lending platform Compound and BAL from Balancer, the value of KNC has not sharply spiked following the Katalyst upgrade and the introduction of KyberDAO staking rewards.

Other DeFi tokens that have outperformed the market in recent months include 0x (ZRX) and Augur (REP), rising 169% and 102% respectively. Additionally, MakerDAO (MKR) and Ethereum’s native token ETH saw more modest growth of 43% and 45% respectively.

In mid-June, the governance token COMP issued by the Ethereum-based lending platform Compound ignited widespread enthusiasm across the crypto space for liquidity mining.

Within less than a week of its launch, COMP propelled this decentralized lending protocol to the top of the DeFi sector in terms of token valuation, while also securing a dominant share of the total value of crypto assets locked within the protocol. Liquidity mining itself isn't a new concept, but the frenzy around COMP turned it into a meme known as “yield farming.”

When Compound launched its native governance token COMP in mid-June, it initially traded at around $30. However, fueled by market hype, the altcoin quickly surged 1000%, reaching an all-time high of $350. Since then, this ERC20 token has sharply corrected. According to data from CoinMarketCap , at the time of writing, the cryptocurrency trades around $180. That represents about a 50% drop from its peak—an erosion that occurred within just two weeks. See chart below:

Above: Price movement of the COMP token since its launch. Source: CoinMarketCap

Much of COMP’s decline occurred after it was listed on Coinbase. Analysts noted that because Coinbase was one of the first “mainstream” crypto exchanges to list COMP, it became a preferred venue for many COMP holders to sell their tokens. Investors in this cryptocurrency could face further losses, with analysts suggesting this DeFi token may be fundamentally overvalued. Yet even after falling 50% from its peak, COMP remains a high-market-cap cryptocurrency.

The dramatic surge in native DeFi tokens and the increasing number of leveraged positions are driving DeFi forward, but it should be noted that this booming sector also comes with growing risks.

As Compound, Balancer, and Kyber Network begin operating through decentralized governance, competition has begun. Can the growth of these DeFi tokens continue? Which DeFi protocol communities will successfully guide their platforms through the wild world of crypto toward mainstream adoption? We’ll have to wait and see.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News