Interview with Kyber Network's Marketing Lead: How Can a Veteran DEX Regain Its Glory?

TechFlow Selected TechFlow Selected

Interview with Kyber Network's Marketing Lead: How Can a Veteran DEX Regain Its Glory?

If you look at many DeFi platforms, you'll find that a lot of their use cases heavily rely on new token hype, inflationary economics, and unlimited issuance plans. However, we don't have any of these.

Written by: 2LAMBROZ.ETH

Compiled by: TechFlow

Kyber is one of the oldest DEXs, advised by Vitalik and raised $52 million in 2017. Analyst 2LAMBROZ interviewed Imran Mohamad on topics including:

-

Kyber's journey from inception to today;

-

How to handle smart contract risks;

-

Building total value locked (TVL) and trading volume;

-

The impact and future of $CRV in the DEX space.

Brief Introduction

I'm Imran Mohamad, Head of Marketing at Kyber Network.

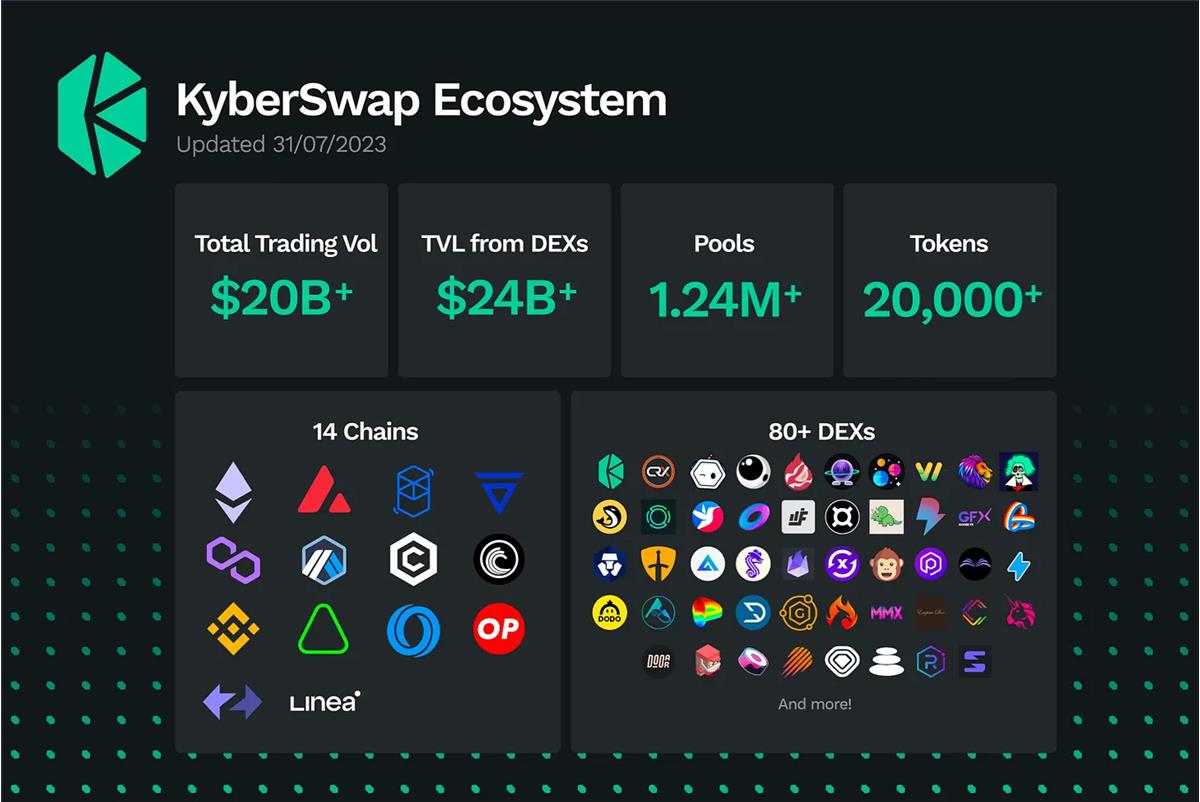

KyberSwap is our decentralized exchange aggregator and all-in-one DeFi platform, operating across 14 chains. We are strong advocates for decentralization.

I was drawn to cryptocurrency and blockchain because I believe they can create a fairer, more efficient, trustless system that provides equal access and autonomy for everyone, thereby preserving human freedom. To realize this vision, we need open public blockchains and financial building blocks—DeFi protocols like KyberSwap are precisely constructing these foundations.

Kyber’s Development Journey

Dr. Loi Luu and Victor Tran founded Kyber Network in 2017. They began their research in 2016, when Dr. Luu was pursuing his Ph.D. in blockchain technology in Singapore.

During his studies, he encountered blockchain and Ethereum, and his work became one of the most referenced and cited research pieces in the field of blockchain and cryptography—a status it still holds today.

This inspired them to tackle the problem of liquidity aggregation in decentralized finance.

The rationale was simple: without sufficient or accessible liquidity, users would have poor experiences. Solving liquidity issues is critical to attracting mainstream adoption and driving widespread use of DeFi, blockchain, and cryptocurrencies.

Thus, Kyber Network launched in 2017 with support from Ethereum co-founder Vitalik Buterin, who served as founding advisor.

Thanks to this, we successfully raised $52 million through an ICO in 2017.

Kyber Network became one of the early pioneers of DeFi platforms—even before DeFi Summer.

We were among the first to offer on-chain swaps, create a liquidity protocol, and involve DAO governance. We also played a key role in industry collaborations, including launching Wrapped Bitcoin, enabling users to trade Bitcoin on-chain for the first time.

Today, we've evolved into KyberSwap—an advanced decentralized exchange aggregator and integrated toolset.

Users can now swap tokens at favorable prices, earn attractive yields, and utilize limit orders to buy low and sell high—all without paying gas fees or suffering slippage.

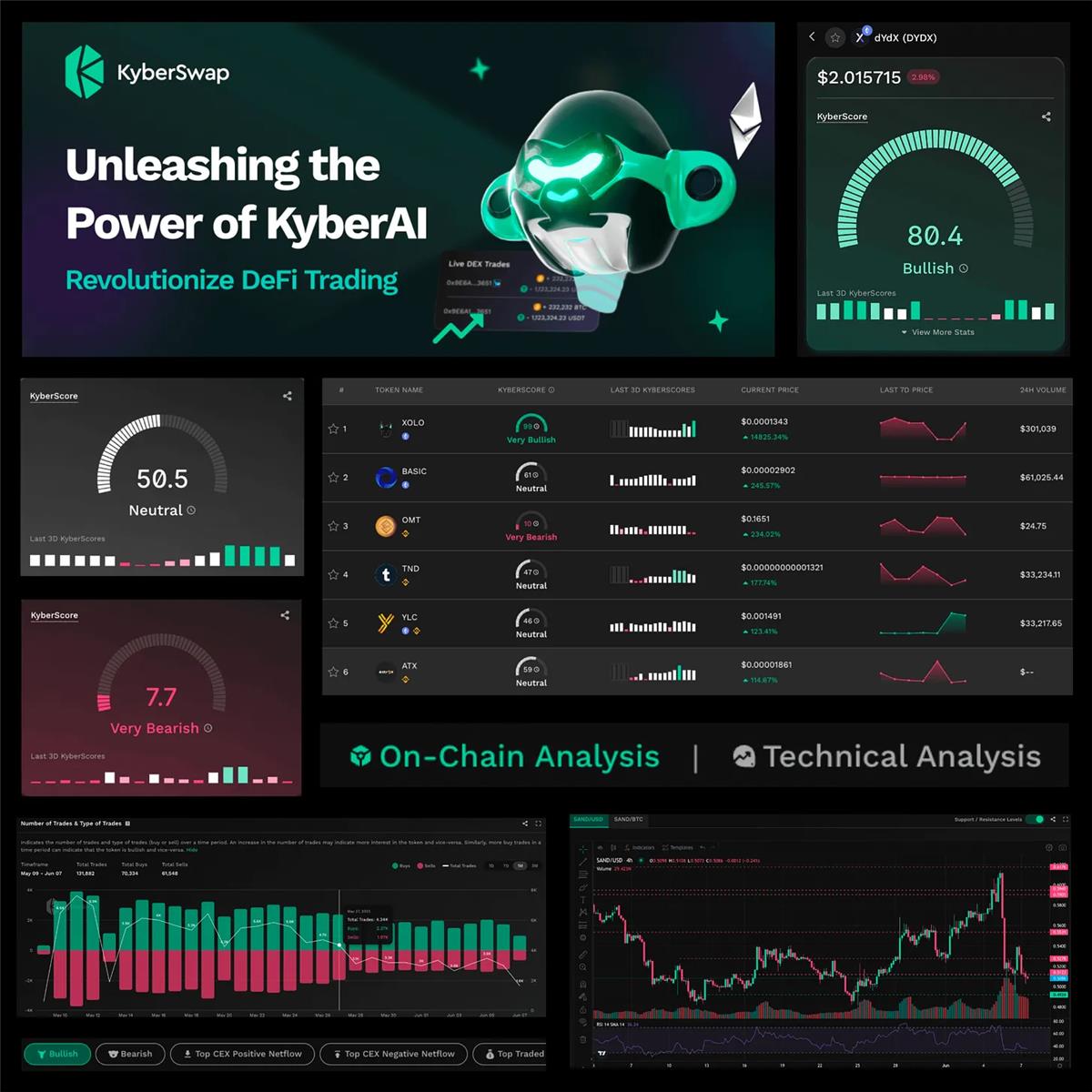

Additionally, our first AI and machine learning tool, Kyber AI, provides real-time bullish and bearish ratings for 4,000 tokens in DeFi.

Currently in free beta testing, this tool aims to become the most powerful and user-friendly all-in-one decentralized trading and DeFi platform, designed to attract more users into DeFi and become the world’s most widely used DeFi platform.

Smart contract risk has always been one of the biggest challenges in DeFi. Based on your experience, what are the best ways to prevent, manage, or recover from such risks?

Avoiding smart contract risk isn't easy. First, all smart contracts are built by developers or smart contract engineers.

Therefore, having a capable team that understands the end goal, maintains high standards, possesses technical expertise, and shares common values around usability, security, and scalability is crucial.

At Kyber Network, we're fortunate to have an excellent team of developers, quality assurance researchers, and product experts. We invest significant time and effort to ensure we build high-quality code from the ground up.

We submit our protocols like KyberSwap Elastic to independent auditing firms such as ChainSecurity for smart contract audits. Moreover, we regularly update these audits to comply with the latest security standards.

Close collaboration with stakeholders—including partners, users, and community developers—is essential to ensuring smart contracts operate as intended and remain free of vulnerabilities.

We actively encourage users to report bugs and recently launched a public bug bounty program to incentivize such reports.

By combining a strong team, rigorous processes, smart contract audits, and stakeholder engagement,

we aim to establish a solid foundation for mitigating smart contract risks.

In the unfortunate event of an issue or vulnerability, acting swiftly and decisively is critical to minimizing or eliminating potential damage. We take such matters seriously and have demonstrated this in the past. For example, when we discovered an issue with the KyberSwap Elastic protocol, we immediately notified users to remove their liquidity worth $108 million.

Fortunately, no funds were lost, and we quickly improved and fixed the code. Within two months, we relaunched the protocol, which has since recovered about 45% of its initial value.

This proactive, transparent, and fast-response approach differentiates us from most protocols that struggle to recover from such incidents.

To further strengthen our commitment to security, our DAO allocates part of its funds as a security fund to pay bug bounties and provide compensation or reimbursement in case of incidents.

This ensures we are financially prepared to face unexpected challenges.

In summary, our multi-step approach to smart contract risk management starts from day one, continues through regular audits and active stakeholder engagement, and persists after incidents to maintain trust and reputation.

What different strategies has your team adopted to rebuild Kyber’s trading volume and TVL?

Certainly. Currently, KyberSwap’s total TVL is around $60 million.

Since 2018, DeFi has grown rapidly. There was a time when we were the top-ranked decentralized exchange (DEX).

However, during DeFi Summer, many new protocols emerged. Ultimately, Uniswap became the leading DEX in terms of TVL. Like many other protocols, we’ve all been striving to figure out how to increase trading volume and total value locked.

We need to view this as a flywheel: users provide liquidity, swap tokens, profit from the protocol, talk about it, and refer others. This cyclical nature needs continuous momentum.

I believe much of our success hinges on how well we kickstart this flywheel. So, how do we achieve that? Is it simply through incentives?

If you look at many DeFi platforms, you’ll find heavy reliance on new token hype, inflationary economics, and unlimited issuance plans. We don’t have those.

We’ve been in this space for over six years—any short-lived token hype disappeared years ago. Moreover, our token supply is fixed, so we cannot mint tokens endlessly. The DOLL token has specific utility and must be used practically.

Given these constraints, we need a highly pragmatic approach to building this flywheel. Our focus should be on creating outstanding, sticky products that differentiate us from competitors. Our starting point should be figuring out what makes KyberSwap unique.

Our collaboration with projects in the ecosystem and extensive marketing efforts set us apart.

We participate in various liquidity mining campaigns, trading events, on-chain quests, AMAs, learn-to-earn programs, blog posts, video demos, and KOL partnerships.

Not many decentralized exchanges do this consistently—the strength of our ecosystem strategy is vital to our positioning in the industry.

Our efficient aggregator is integrated into numerous dApps, trading platforms, GameFi platforms, and DeFi wallets. This expands our ecosystem footprint and, most importantly, increases trading volume in our pools.

As of today, in the space of decentralized exchanges and aggregators, we are considered a challenger. In terms of 24-hour fees, we remain within the top 10 protocols, excluding L1 and L2 networks.

On various L2 networks like Polygon, Arbitrum, Optimism, and Celo, we typically rank in the top three to five for both 24-hour trading volume and TVL.

To further support this flywheel, we offer incentives to liquidity providers. They can earn not only trading fees but also mining rewards across many chains and pools.

This provides users with higher yields, making them more inclined to become liquidity providers on KyberSwap. Additionally, we offer other incentives such as trading campaigns, on-chain tasks, and limited-edition NFTs to recognize and reward user participation.

Our ultimate goal is to become the go-to brand people think of first when they consider decentralized exchanges and DeFi platforms.

We strive to be present wherever possible—whether at major conferences, AMAs, interviews, co-marketing with creators and media platforms, or providing content across all major crypto news and update channels.

What impact do you think the CRV incident will have on the DEX space?

The CRV incident suddenly became something that should shake the foundation of DeFi. Many protocols and projects have liquidity or some form of connection with Curve, directly or indirectly.

After experiencing this recent event, confidence in decentralized finance is undoubtedly shaken.

That’s why DeFi teams and builders need to work together to find ways to strengthen each other and the entire industry. As the saying goes, “We’re still early, everyone’s a friend,” and I believe this is something all builders must uphold.

Even when Kyber Network faced its own issues, we had to communicate and rely on many other partners—including centralized exchanges, other DeFi participants, crypto forensics firms, and many others—to identify the root cause of each issue.

Therefore, cooperation in this area is crucial for us.

I believe this incident once again highlights an important notion: first, we need better design, better risk assessment, and better checks and balances in building DeFi, and we must always maintain a strong pursuit of improvement and plugging any possible loopholes.

For any leading protocol, failing to focus on improving these vulnerabilities would be a mistake. Thus, it reminds us that as builders, we must remain vigilant, study all possible risks, and continuously strive to improve. Moreover, welcoming and adopting feedback and reports from partners, community members, white-hat developers, etc., is also critical.

What’s your outlook on the future of the DEX space?

That’s a great question. I think many decentralized exchanges are trying to build a better flywheel.

What I mean is traditionally, you’d think of a DEX as a place where you add liquidity and swap from pools.

And largely, you’ll find these exchanges competing purely based on the efficiency of their AMM or order book systems.

However, when we think about decentralized exchanges, we approach it from the user’s perspective. As a user, am I specifically looking for a DEX, or do I just want a platform where I can do everything I need?

That’s our approach. Users want a platform that’s easy to use, has the features they need, and exceeds typical expectations of a DEX or aggregator.

The first thing we’re working on is building a user-friendly, seamless, and fast exchange covering the use cases and chains users need.

We operate on 14 chains, offer cross-chain swaps, and enable the cheapest and possibly fastest method to transfer USDC across chains in DeFi today.

Users can perform low-slippage, capital-efficient swaps in our pools using our aggregator.

We’ve also introduced limit orders, allowing users to buy low and sell high, set target prices, and execute gas-free, slippage-free swaps at their convenience.

We continue building more use cases, IP, and technology that go beyond typical expectations of a DEX and aggregator.

We see another value-add in that DeFi can be complex.

For average users, unless they’re experts with years of experience in DeFi, navigating thousands of tokens can be overwhelming.

To address this, we created KyberAI—a tool currently in free beta registration.

It empowers any user in crypto to leverage AI to filter all information in DeFi and make better, faster decisions.

KyberAI analyzes over 21 billion lifetime trading volumes, using machine learning algorithms that consider on-chain and technical signals affecting future token prices, to determine whether approximately 4,000 tokens are likely to rise or fall (bullish or bearish).

To my knowledge, no other crypto tool currently offers this level of advantage. For professional traders, it serves as an additional filter to enhance trading decisions.

Any alpha for the community?

The primary goal for the community is always to use KyberSwap for your DeFi and trading needs. Of course, our users who used Kyber’s products on Arbitrum received allocations in the Arbitrum token airdrop.

You can also earn numerous liquidity mining rewards through our campaigns, on-chain quests, and trading events, as well as collectibles including limited-edition NFTs.

My advice is, holding KyberSwap NFTs will always pay off.

Beyond using KyberSwap to swap at favorable rates and earn good yields, there are many direct incentives from Kyber—some from our partners, some from airdrops and rewards we receive from Layer 1 and Layer 2 chains.

What does it take to succeed in crypto?

We often joke that being in crypto is like riding a rollercoaster—you need to find a stable source to stay in the race.

Every day might feel like a sprint, but in reality, it’s a marathon. If your heart rate hits 140 or 150 beats per minute every day, you’ll burn out. So, I believe stability is crucial in crypto—avoid making irrational or emotional decisions. Patience is a virtue.

Yet, there are many paths to success in crypto. Clearly, some prefer trading, others holding, some mining, and others combining multiple strategies. It depends on your goals and risk tolerance.

So, before copying and pasting any strategy or tactic you hear on Crypto Twitter, it’s vital to understand yourself. Aligning with the right influencers—whether the right accounts, media, founders, or friends—is key to building a supportive network.

I think all these factors matter because there are certainly life-changing opportunities in crypto. But you don’t want to make a reckless mistake due to impulsiveness and lose everything. What matters is progressing step by step.

I’m not just an investor in this industry—I work in it and speak with many participants, whether they’re traders, creators, or project team members. Therefore, I believe engaging deeply pays off in gaining alpha and acquiring vast knowledge and insights from industry experts. It has greatly benefited my personal growth as well.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News