"Old money" floods into the market, crypto is losing its monopoly on getting rich quick

TechFlow Selected TechFlow Selected

"Old money" floods into the market, crypto is losing its monopoly on getting rich quick

The baby boomer generation is pushing cryptocurrency back to fundamentals.

Author: Evanss6

Translated and edited by TechFlow

TechFlow Intro: Cryptocurrencies were once the sole battlefield for chasing “100x, 1000x” returns—so-called Moonshots. But with the massive entry of traditional financial institutions (Boomers) in 2024, this landscape has been completely upended. Prominent crypto researcher Evanss6 points out that cryptocurrencies have not only lost their monopoly on outsized returns but have also been forced to adopt traditional finance’s valuation framework—the discounted cash flow (DCF) model.

As high-multiple returns are now equally attainable in AI, semiconductors, and space technology, fundamentally weak altcoins are being gradually abandoned by the market. This article delves deeply into the paradigm shift from “emotion-driven” to “fundamentals-driven” investing, spotlighting how protocols like Hyperliquid and LayerZero are redefining crypto asset value through real cash flows.

Full Text Below:

Cryptocurrency hasn’t lost its advantages—but it has lost its monopoly. That “Moonshot”-style return curve—once almost exclusive to crypto—is now ubiquitous: in semiconductors, AI infrastructure, storage, space, and whatever narrative next lands on the Trump administration’s agenda. Sharp capital, which used to rotate exclusively among crypto assets, has learned how to pivot elsewhere after observing the shift in the extraction pipeline. Meanwhile, DATs (Direct-to-Token protocols) and Boomers are draining supply and locking up the 1000x returns OGs once dreamed of. And when these Boomers arrive, they bring their DCF models with them.

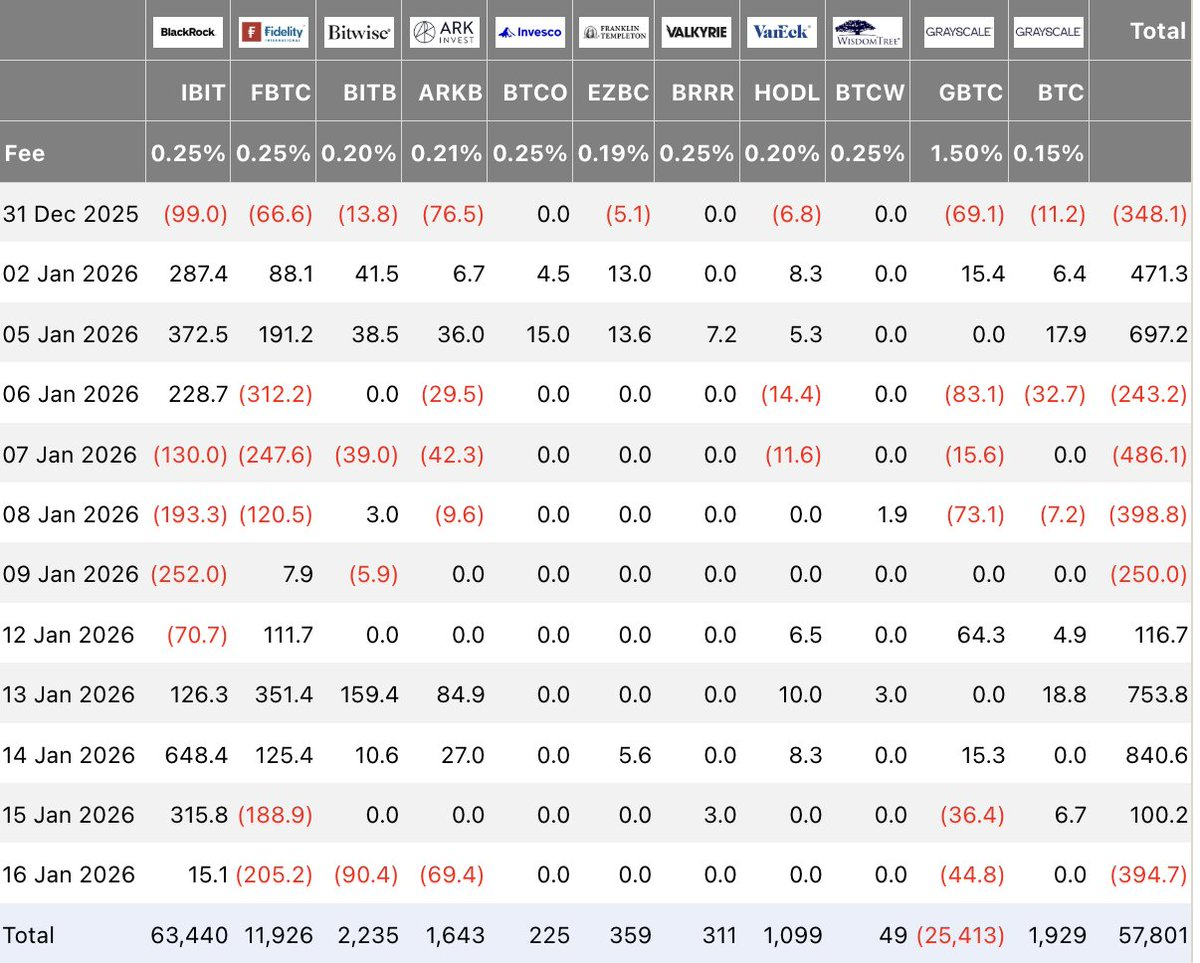

The overwhelming trend in crypto over the past few years has been steadily increasing financialization and deeper integration with traditional finance (TradFi). Yet for dreamers who entered Bitcoin and crypto several cycles ago, this level of adoption once felt like a fantasy drawn in the sky. They spoke of pensions, corporations, and sovereign nations accumulating—early players fantasized about dumping their chips into those hands. BlackRock launched the most successful ETF ever, attracting over $63 billion in inflows within two years.

Caption: BTC ETF inflow data provided by Farside

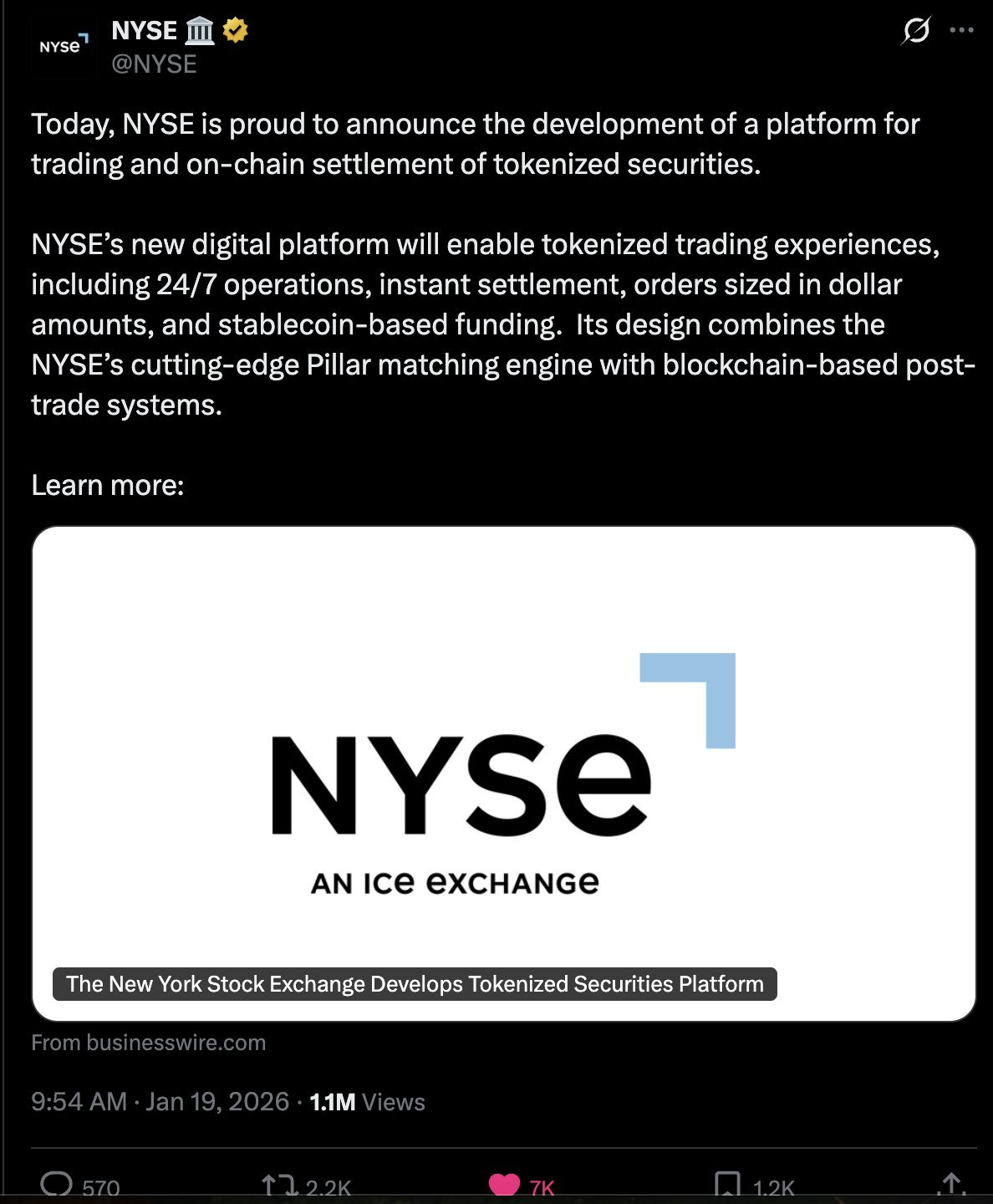

When Ethereum and smart contracts emerged in 2015, the focus shifted from “Who will buy?” to “How do we build an entirely new financial system on the crypto rails?” Though crypto funded countless ideas over the years—and most collapsed in one way or another—the single most coherent idea remained backend financial infrastructure, i.e., decentralized finance (DeFi). To cut a long story short: ten years later, every major institution is participating—and deepening and expanding their services continuously. Just yesterday, the New York Stock Exchange (NYSE/ICE) announced it’s building a platform for 24/7 trading of tokenized securities backed by instant settlement and stablecoin funding.

Caption: NYSE, under ICE, plans to launch 24/7 trading on crypto infrastructure

In the 2012–2016 era, tokens were relatively scarce and initial valuations extremely low. So if you picked correctly—and truly were at the earliest stage—you stood to gain enormous upside. That asymmetry was the biggest draw. As more people heard success stories, they rushed in, hoping to strike gold in this modern-day gold rush.

Crypto Has Grown Up

This transformation is evident in many ways—including price volatility and market sentiment. Most notably, altcoin performance this cycle has been deeply disappointing compared to prior cycles.

There are many reasons: lowered barriers to token launches (via launchpads), escalating extraction games (low float, high fully diluted valuation dynamics), and a shifting zeitgeist where people no longer feel compelled to bid for such narratives. I’ve covered these in prior pieces: “No PvE, Only I Love You” and “The Sunk Cost Cage.” Links below for reference.

“The Sunk Cost Cage”: https://x.com/Evan_ss6/status/1940886721723302015

“No PvE, Only I Love You”: https://x.com/Evan_ss6/status/1935733564227616812

As a result, we see very few successes outside major coins. The most notable exception is Hyperliquid, delivering massive returns to its early community—and serving as the quintessential example of the “Return to Fundamentals” I’ll discuss shortly. Despite surging from $0 to a $24B fully diluted valuation (FDV)/$8B circulating market cap, Hyperliquid today remains nearly 60% off its all-time high. Its key success drivers include:

- Real, incentive-free demand for its product (perpetuals). Users find strong liquidity highly useful for both speculation and hedging.

- An exceptionally well-built product.

- Correspondingly, the product generates substantial fees (users willingly pay for it).

- A distinctive, sound tokenomics design (no investors, team lockups).

- Revenue from the product directly benefits token holders via buybacks.

I’ve long held the view that any crypto product trades at a 10x–10,000x premium versus its Web2 or TradFi counterpart—simply because it’s crypto.

My argument is that Boomers’/TradFi’s adoption, combined with the deteriorating outlook for 99% of altcoins, ushers in an era where altcoins must compete on traditional business metrics—like cash flow—rather than vibes or hope and dreams. The premium conferred merely for being “crypto-native” has eroded dramatically—and that’s a good thing.

Stock Markets and Rotating Bubbles

While crypto was once the primary arena for asymmetric upside, we’re witnessing a clear migration toward equities—and many crypto natives have fully pivoted their attention to traditional markets. It’s hard to blame them. Consider these accessible success stories everyone can participate in:

Caption: Asymmetric upside captured by retail investors in NVDA, CVNA, SMCI, and SNDK

As speculative capital flows into domains offering better risk:return profiles than altcoins—many AI-related stocks and precious metals—it’s unsurprising that fewer funds chase altcoins. Bubble chasers—or what GCR once termed the “Generation Moonshot”—increasingly find they can ride rotating bubbles comfortably from their personal brokerage accounts.

Caption: The rules clearly changed about a year after the GameStop saga

While calling these altcoins “potentially worthless” isn’t strictly accurate, the underlying point stands: large swaths of participants are simply trying to chase “the fastest horse” for rapid capital accumulation and compounding—not disciplined, research-driven bets à la Bogleheads.

The stock market’s growing gamification, attention economy dynamics, and narrative-driven behavior further compel the altcoin ecosystem to compete on real fundamentals—like earnings. Crypto is no longer the hot industry vacuuming up all speculative, bubble-chasing capital—relative to AI, robotics, and space. Most things will gradually go to zero and be discarded, as capital’s willingness to support them wanes. Only a select few will survive by achieving sustainable profitability.

The Shift

All of this signals that we need a different approach to crypto trading and investing than the one employed by most people (even successful ones) between 2009 and 2021. The broader logic is that deeper TradFi integration is driving crypto’s “Boomerification.” In a world where you can trade BTC, ETH, SOL, gold, NVDA, TSLA, GOOG, and any other NYSE-listed stock from a single account, what truly matters—beyond non-sovereign store-of-value (SoV) tokens—is assets capable of generating sustainable fee revenue to justify their valuations.

The existence of such assets validates the 2015–2018 thesis: backend financial infrastructure is an excellent use case for smart contracts. If you still believe in that logic, focusing on the “picks and shovels”—i.e., infrastructure providers enabling that evolution—makes sense. Just as you might invest in Interactive Brokers (IBKR), you can invest in crypto products and protocols that earn fees from trading-related activity.

These opportunities are far from small. If you foresee a future where finance fully migrates onto crypto rails, many crypto protocols remain tiny relative to that potential.

I’ve identified four verticals worth exploring for investment opportunities: (1) Exchanges, (2) Lending, (3) RWAs (Real World Assets), stablecoins, and tokenized assets (especially equity), and (4) Interoperability.

I won’t elaborate on (1) and (2), as they’re self-evident—and the players and protocols involved (e.g., Binance, Bybit, Coinbase, Hyperliquid, Lighter; Aave, Maker, Morpho) are widely understood and more mature. But I will detail the opportunities in (3) and (4).

RWAs, Stablecoins, and Tokenized Assets

Stablecoins have garnered massive attention in recent years. With the Market Structure Bill expected to pass sometime this year, numerous players are vying for a slice of the rapidly growing stablecoin trend. Many crypto natives lament their difficulty accessing exposure to this trend—especially since top-tier opportunities (notably Tether and Circle) aren’t easily accessible.

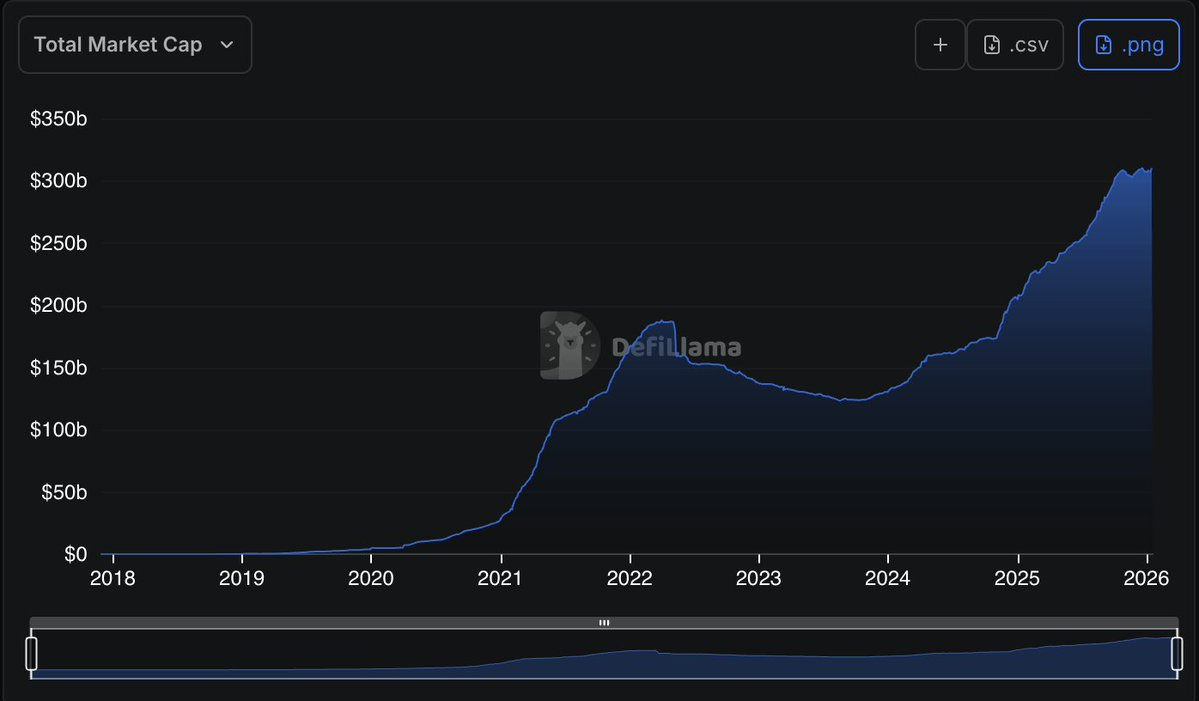

Caption: Stablecoin market cap grew from near-zero in 2018 to $311B

Another project I find especially intriguing is Superstate, founded by Compound’s Robert Leshner. Regrettably, I currently hold no position in it. I find it unique and compelling because it has built both technical and compliance infrastructure to issue genuine tokenized equities on Ethereum and Solana—rather than some random wrapper asset. This would allow companies to issue real equity on crypto rails—even opening the door to IPOs or other fundraising events. Coupled with strong investors/partners and deep crypto-native leadership, this model should position Superstate as a key player in this space over the coming years.

Interoperability & LayerZero ($ZRO)

Overall, this is a largely forgotten sector. Yet as every institution rolls out its own products—from stablecoins to exchanges, ETFs, and structured products—a dominant standard will be needed to make everything work seamlessly for users.

Most of the information below appears in this podcast: Podcast Link

Though other interoperability protocols exist, LayerZero and its Omnichain Fungible Token (OFT) standard dominate across virtually all key metrics.

Starting purely from a technical standpoint—it broke out of consolidation, rebounded strongly after a pullback test, setting up a solid move toward $2.30–$2.50. It shows robust local strength, was one of only a handful of tokens up this week, and fully recovered losses during last night’s BTC crash from $95K to $92K—which dragged down the broader altcoin market. Derivative funding rates are negative—likely due to spot buying from buybacks, Labs, and long-term holders.

Caption: Higher time frame (HTF) chart

Caption: 4-hour chart

One of the most common problems in the altcoin ecosystem is continuous selling pressure (“blading”) from investors, team members, and foundations as tokens unlock—driving prices lower. LayerZero’s situation is uniquely different:

- Clean Token Distribution: They let investors who wanted out exit cleanly. For example, a16z bought an additional $55M of tokens in 2025 and relocked them for three years.

- Buybacks: LayerZero Labs—an independent entity self-funded by features that benefit the LayerZero network—has bought back tokens and placed them on its balance sheet ($10M in November, with commitments to scale further).

- No Discount Sales: They’ve conducted zero DATs (Direct-to-Token sales/discounts), simply because they refuse to sell at current prices—let alone at a discount. Insiders have sold little to none; instead, actual insider accumulation has replaced persistent selling pressure.

- Product Unification: LayerZero recently unified its product line by acquiring Stargate, its cross-chain bridge. Stargate’s revenue is now being used to buy back $ZRO.

- Strong Cash Flow: Buybacks currently represent 50% of revenue—but will reach 100% in months. Founders forecast $100M annualized revenue by year-end (see ~36-minute mark in the above podcast). Given the current market cap, even half that figure is highly compelling. Detailed buyback disclosures are publicly recorded here: [Buyback Record Link].

- New Growth Levers: All new product lines will feed $ZRO buybacks. Founders hint at multiple R&D initiatives that could generate nine-figure annual recurring revenue (ARR). Additionally, something major is coming—though unspecified, the podcast hints it may involve TradFi, with an announcement planned for February 10th, following 2.5 years of development.

Caption: Announcing an announcement—pure crypto style

- Fee Switch: LayerZero’s fee switch vote reopens in June. It may not pass this time—but imagine a future where every LayerZero message carries a tiny fee, scaling massively across billions of transactions. This would add a new source of buyback capital.

- Macro Logic: My core thesis is “crypto’s Boomerification”—its convergence with TradFi. LayerZero holds absolute market share in interoperability. I view interoperability as the obvious “picks and shovels” play for the fully Boomerified crypto future I anticipate. It also enjoys stablecoin correlation.

- Flywheel Effect: Compared to current circulating supply and minimal insider selling, the buyback flywheel will soon become extremely pronounced. Token unlocks have had no price impact for months.

Reset

For better or worse, crypto is far less exciting than before. Memecoins and alternative L1s lack the momentum seen in 2021–2024. Even excellent perpetual DEXes seem stuck in a familiar “euthanasia rollercoaster” pattern.

Caption: Each cycle peaks lower than the last

There may still be undiscovered gems (perhaps something AI-native) worth watching—but my base case is less romantic. Next-generation successful crypto products will hold zero appeal for “trench rats” who hail every new hype cycle (Meta) as salvation. They’ll be boring—but attractive to Boomers, because they generate revenue. That’s what happens when Boomers show up: they don’t buy vibes—they buy cash flow. In such a world, the only rational allocation is toward non-sovereign SoV contenders (BTC + perhaps privacy coins) and industry “picks and shovels” that benefit from trading and related activity.

The “Generation Moonshot” hasn’t vanished—just gone quiet. They’ll only reemerge when crypto proves itself again through something genuinely novel and useful.

Disclosure: This article does not constitute investment advice nor an endorsement of any product or project. At the time of writing, the author holds positions in $ZRO and $HYPE, as well as various private investments. All positions are subject to change.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News