Thoughts at the End of 2025: Code, Power, and Stablecoins

TechFlow Selected TechFlow Selected

Thoughts at the End of 2025: Code, Power, and Stablecoins

Stablecoins are faster, cheaper, and can access markets that traditional fintech has struggled to reach for years.

Author: Stepan | squads.xyz

Translation & Compilation: BitpushNews

By 2025, one thing has become clear: stablecoins are here to stay, and their underlying infrastructure will serve as the foundation upon which financial services are built over the next decade.

As this year draws to a close, I’ve been reflecting on where we stand, what 2025 has taught us, and where things are headed. Below are my observations on the state of the stablecoin economy as we head into 2026.

A few upfront notes:

-

Claude and Deni also contributed to this article.

-

Squads is a fintech company, not a bank or digital asset custodian.

-

Nothing in this article constitutes financial advice.

-

The charts and images in this article were generated by Nano Banana, styled after the Tom Sachs aesthetic I deeply admire.

Data Overview

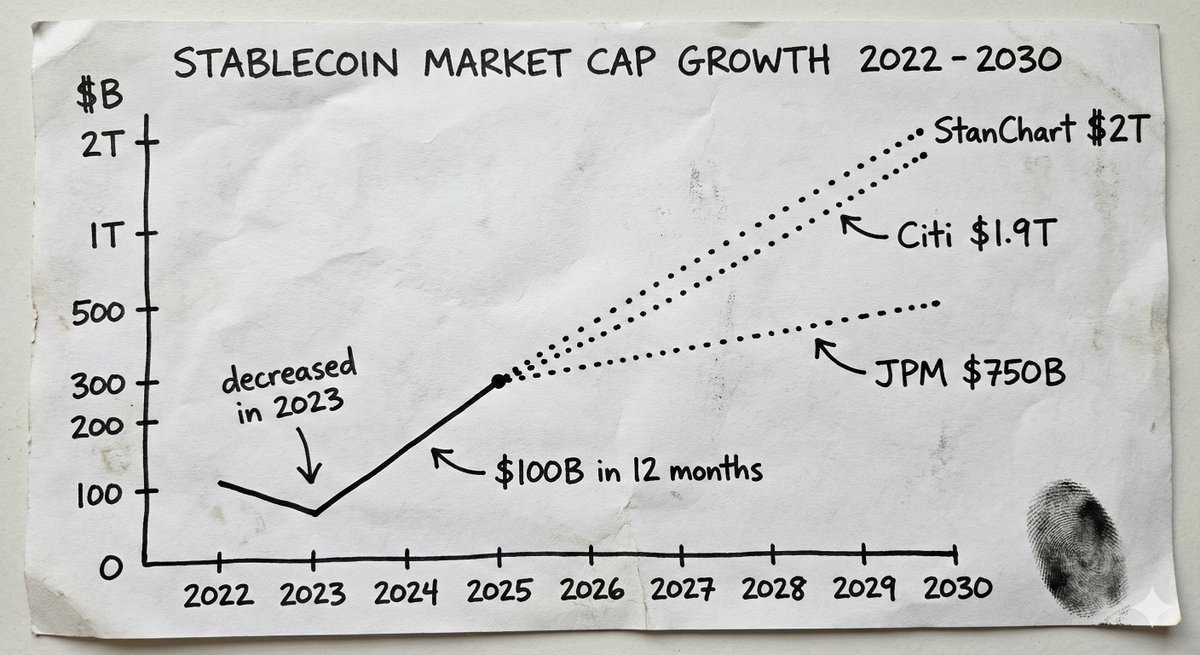

In 2025, the stablecoin market surpassed $300 billion in size, up from $205 billion at the beginning of the year. In under twelve months, nearly $100 billion in new supply was added.

For comparison: in all of 2024, total supply grew by $70 billion, while 2023 actually saw a decline.

These projections reflect strong institutional conviction. JPMorgan forecasts that stablecoin market cap could reach between $500 billion and $750 billion in the coming years. Citi’s base case projects $1.9 trillion by 2030. Standard Chartered predicts $2 trillion by 2028. Today, stablecoin issuers rank among the top ten holders of U.S. Treasury securities globally.

This is no longer primarily a crypto story. It’s a story about money. And the infrastructure, services, and product layers capturing this growth will become one of the most valuable areas to build over the next decade.

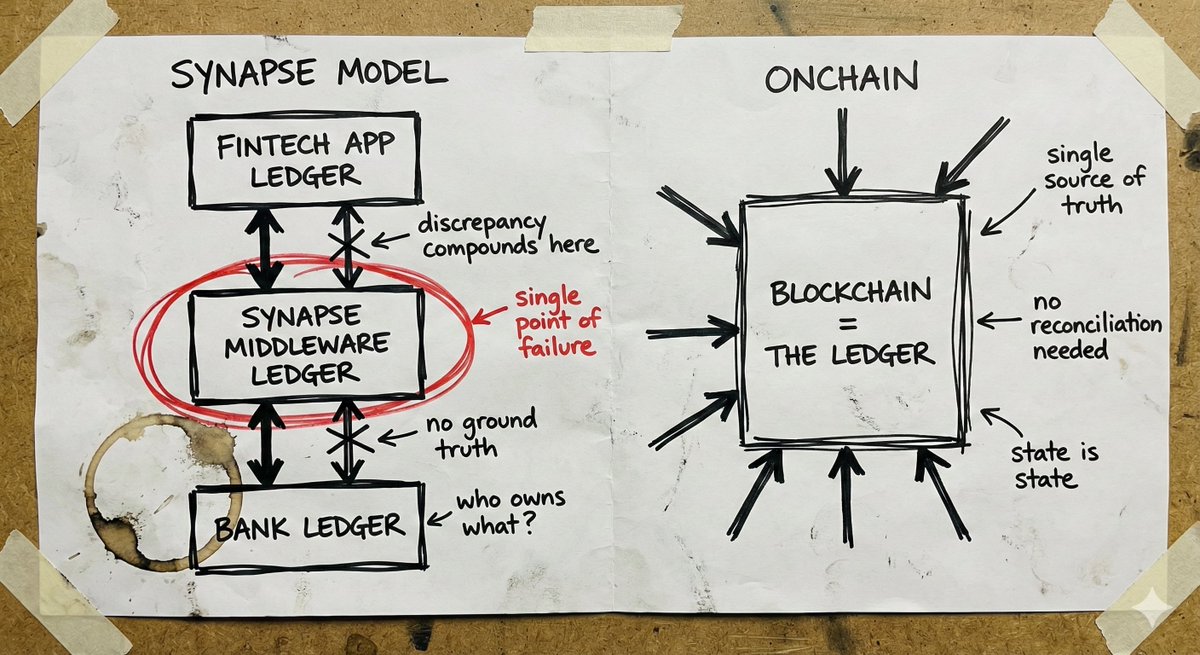

What We Learned From the Synapse Incident

Part of what’s driving this shift is a growing recognition that stablecoin infrastructure offers fundamentally different trust assumptions. It’s not just that building on stablecoins is cheaper and faster (though it is), but rather that you’re trusting math and code—not centralized entities making “trust me” promises about where your money is.

To understand why this matters, look at what happened with Synapse.

Synapse Financial Technologies was once the poster child for banking-as-a-service (BaaS). Backed by top-tier investors, it connected over 100 fintech partners to FDIC-insured banks, serving around 10 million end users. Its value proposition was elegant: fintechs could access banking services without becoming banks; banks could gain distribution without building apps; consumers got modern experiences with traditional protections.

In April 2024, Synapse filed for Chapter 11 bankruptcy. Over 100,000 people lost access to their funds. A court-appointed trustee found a shortfall of $65–96 million between what customers were owed and what banks actually held. At a December 2024 hearing, the trustee (a former FDIC chair) compared the situation to her father losing his life savings during the breakup of Yugoslavia.

The root cause was a failure in middleware accounting and reconciliation. Synapse was responsible for tracking asset ownership between fintechs and banks. When the system broke down, there was no auditable “source of truth.” Banks blamed each other. Fintechs had no direct claim to customer funds. Ordinary people watched their savings vanish into bureaucratic uncertainty.

Crypto has had its own catastrophic failures: FTX, Celsius, Terra/Luna. But these stemmed from centralized custodians making risky bets with deposited assets. They failed for the same reason as Synapse: opaque systems where no one could see what was really happening—until it was too late.

The lesson from both traditional fintech and crypto failures is the same: when you can’t see where the money is, you can’t know whether it’s safe.

Self-Custody and the Insurance Question

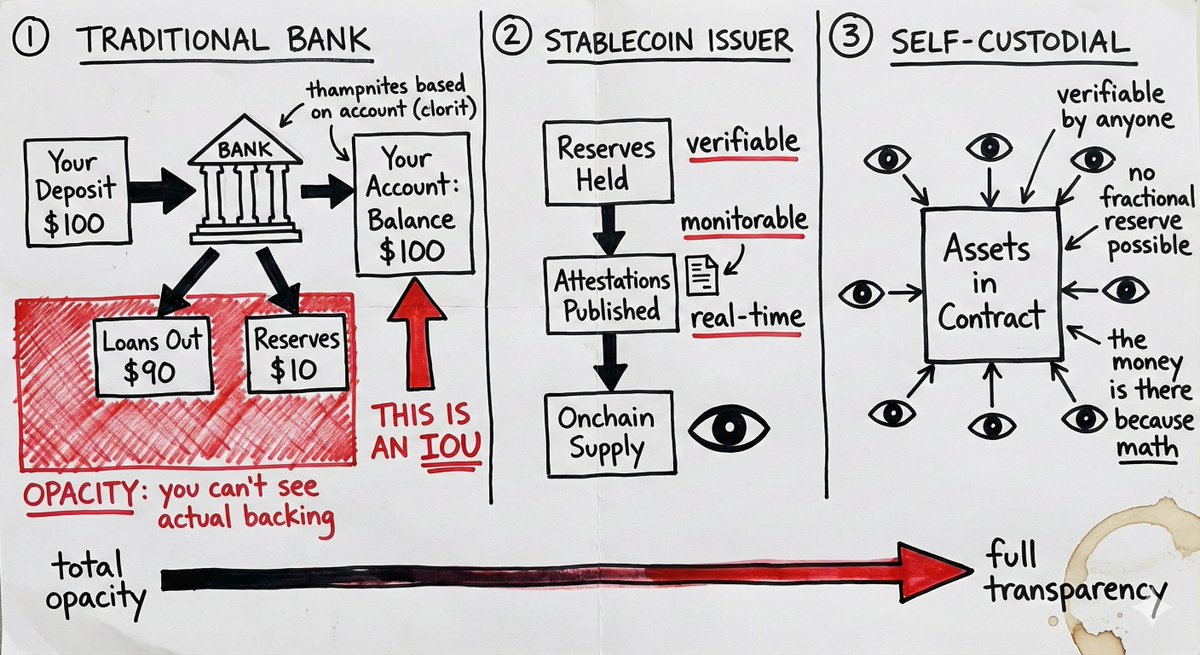

Self-custodied stablecoin accounts change the risk model in a way that makes FDIC insurance less necessary across many use cases.

Traditional banking operates on fractional reserves. When you deposit money, the bank lends out most of it, keeping only a fraction on hand. Your “balance” is just an IOU. If enough people demand withdrawals at once, or if the bank’s loans go bad, the money isn’t there. FDIC insurance protects against this failure mode. It’s insurance against the bank mismanaging your money.

Self-custodied stablecoin accounts work differently. Assets exist in smart contracts. At any moment, anyone can verify that the funds are there—not as an IOU, not as a claim on fractional reserves, but as actual assets under user control. There’s no counterparty risk from lending decisions made by a bank.

But this argument often misses a key point: stablecoins themselves carry issuer risk. A smart contract full of USDC won’t help you if Circle faces regulatory trouble or a run on its reserves. Holding USDT is essentially a bet on Tether’s reserve management. Self-custody eliminates intermediary risk, but not issuer risk.

The difference is that issuer risk is monitorable. You can inspect proof of reserves. You can observe on-chain flows. You can diversify across issuers. Traditional bank risk, by contrast, hides inside institutional black boxes—until disaster strikes.

This doesn’t mean self-custody suits everyone. Large institutions may still need regulatory frameworks and insurance products. But for many use cases, a self-custody model with monitorable issuer risk is preferable to an opaque institutional trust model that requires insurance as a backstop.

Global Reach and the Last-Mile Problem

Stablecoins offer something traditional fintech cannot: true global reach from day one.

A wallet works anywhere. Smart contracts don’t care which jurisdiction their users are in. Transactions between stablecoins are inherently borderless. For businesses paying remote contractors, managing funds across entities, or settling with suppliers who accept stablecoins, this infrastructure works instantly and globally.

Contrast this with traditional international expansion: you need local banking partners, local licenses (often multiple per business line), local compliance teams, local legal entities. Each country is effectively a new startup. This is why most digital banks either operate domestically or take years to expand into just a few markets.

Revolut has been at it for nearly a decade and still lacks full coverage.

The bottleneck for stablecoin infrastructure is the “last mile”: connecting to fiat. On- and off-ramps still require local licenses and local partners. You can’t fully escape this.

But there’s a world of difference between “we need to solve fiat connectivity in this market” and “we need to rebuild the entire banking tech stack from scratch in this market.” The last mile is modular. You can partner with local coordination providers for fiat exchange without rebuilding core infrastructure from the ground up. You can reach much of the world via stablecoin rails, then incrementally plug in fiat partners where needed.

Traditional fintech can’t launch unless it builds the full stack in each market. Native stablecoin companies are global from birth, solving last-mile issues incrementally as demand arises. This is a fundamentally different expansion equation.

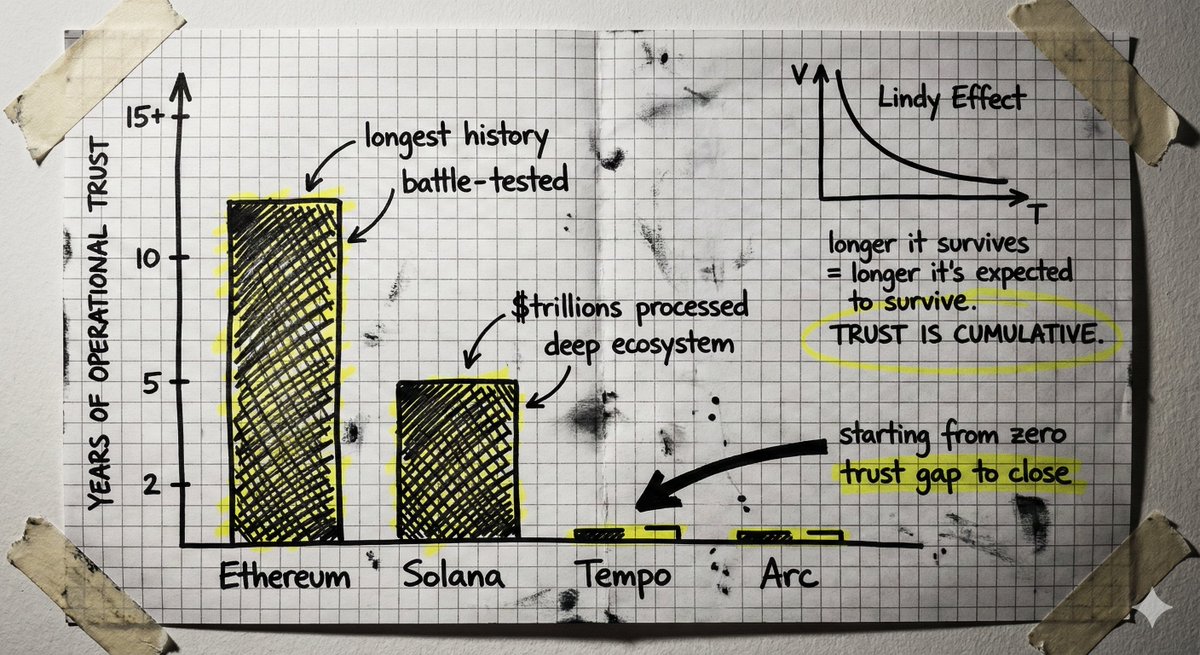

The Battle for Purpose-Built Blockchains

Well-funded teams are building new blockchains specifically for stablecoin payments. The core idea: existing blockchains are optimized for trading, not payments, and purpose-built infrastructure can deliver better throughput, lower latency, and compliance tools tailored to payment-specific needs.

It’s a reasonable thesis, advanced by smart people. Stripe and Paradigm are building Tempo; Circle is building Arc.

But there’s a counterargument worth considering.

Building a new Layer 1 from scratch means rebuilding trust from zero. Blockchains are trust machines, and trust is accumulated through runtime. It comes from years without catastrophic failures, from securing billions without vulnerabilities, from developer ecosystems that deeply understand edge cases, from code hardened by attacks. This is the Lindy effect applied to infrastructure.

Mature chains have this accumulated trust. Solana has processed trillions in transaction volume, with robust tooling, wallets, bridges, and integrations. Ethereum’s operational history is even longer. The question is whether the gap between current chains and payment-specific requirements is larger than the trust deficit new chains must overcome.

There’s also neutrality to consider. Chains controlled by large payment companies embed those companies’ interests into their architecture, regardless of how “neutral” they position themselves. Building on truly neutral public infrastructure offers different guarantees.

Agentic Finance

Today, when people talk about Agentic Finance, they often imagine intelligent agents managing your financial life: making investment decisions, managing portfolios, optimizing your entire financial existence on your behalf.

That’s not the real opportunity—yet, at least.

The real opportunity lies in the mundane and tedious. It’s about letting agents handle routine financial workflows currently requiring human intervention: monitoring invoices, matching them to purchase orders, initiating payments, processing reimbursements, executing recurring transactions. Not replacing human judgment in high-stakes decisions, but automating time-consuming, operationally heavy tasks.

The problem is: how do agents actually move money?

Traditional payment channels are designed for humans. They assume a person with credentials initiates transactions. Giving agents bank login credentials is both a security nightmare and a compliance violation. Agents can hallucinate, be manipulated, or make mistakes at machine speed.

This is where stablecoin rails and smart contracts become essential. Agents don’t get credentials—they get a set of constrained permissions coded into a smart contract: maximum of X dollars per transaction, only to pre-approved addresses, only at certain times or for specific purposes. These constraints are enforced by code. An agent architecturally cannot exceed its authority because those limits are part of its design.

The verifiable, bounded, transparent trust assumptions offered by blockchains are exactly what’s needed when software moves money autonomously. Traditional systems require you to trust the agent won’t misbehave. Smart contract systems make misbehavior impossible within defined constraints.

This doesn’t eliminate all problems. What happens when an agent makes a mistake within its allowed parameters? Who’s liable when an agent approves an invoice that technically meets all coded rules but is actually fraudulent? These questions need answers.

But this starting point—architectural enforcement of permission boundaries—is native to blockchain systems and extremely difficult to retrofit onto traditional rails. Autonomous finance will arrive. And the infrastructure that makes it safe will necessarily be stablecoin-native.

Reflections on Security

The stablecoin gold rush is attracting teams with wildly different security mindsets. For some of them—and unfortunately, their customers—this won’t end well.

A pattern is emerging: move fast, acquire users, figure out hard problems later. Teams use fuzzy definitions of “self-custody” to obscure actual trust models. They rush integrations without proper security or vendor reviews. They cut corners on key management. They treat operational security as a cost center.

Some of this is understandable. The market moves quickly. Competitive pressure is intense. Spending X extra months getting security right might mean a competitor captures the market.

That trade-off makes sense in most industries. But not in financial infrastructure.

Building a bank—or anything bank-like—means earning trust over decades, not quarters. It means managing risk conservatively, even if more aggressive approaches could grow faster. It means creating systems capable of handling edge cases no one anticipated.

The teams that will win in 2026 and beyond are those with deep domain expertise and a security-first mindset.

The Privacy Puzzle

One of my contrarian views: so far, privacy in crypto has largely been a checkbox concern. Lack of real privacy hasn’t hindered trading, DeFi, or speculation. The ecosystem has mostly functioned well with pseudonymous addresses and public transaction histories.

But this will change as stablecoin infrastructure brings real commercial and productive economic activity on-chain.

When real companies use stablecoin rails for treasury operations, privacy becomes critical. Competitive intelligence leakage is a real issue: your suppliers, customers, cash flows—all visible to anyone willing to look. No serious company wants its financial operations exposed to competitors, and no CFO will move significant treasury activity onto a rail where every transaction is publicly analyzable.

This is a problem we need to solve today, before it becomes a bottleneck for future adoption.

The good news is that stablecoin privacy doesn’t require the full cypherpunk vision to be realized. We don’t need complete anonymity. We need selective disclosure—a fundamentally different goal.

Selective disclosure means proving what needs to be proven without exposing everything else. Proving you have sufficient funds without revealing your balance; proving a transaction is compliant without exposing counterparty details; proving your identity meets requirements without submitting documents. The asset owner sees everything, the system verifies what’s needed for compliance, and everyone else sees only what’s deliberately disclosed.

We have the technology to solve this. I’ve spoken with many outstanding teams building excellent privacy infrastructure.

The issue is that the technology is early. These codebases are large, hard to audit, difficult to formally verify, and untested in production. They require entirely different trust and security assumptions than the infrastructure we’ve already built. The crypto ecosystem spent years hardening core protocols, accumulating the kind of operational trust that only comes from surviving attacks and edge cases. Adding new, unproven privacy layers risks undermining that foundation.

The real challenge is adding privacy without major security compromises. That may mean embedding privacy deeper into Layer 1 protocols or finding ways that don’t rely on massive trust in novel cryptographic systems.

Looking Ahead

The 2025 stablecoin growth story has largely been about taking what fintech already has and running it on better infrastructure: payments, yield, spending, card services. Think global Mercury, or Revolut on-chain. That’s good. It’s faster, cheaper, and can reach markets that would take traditional fintech years to enter.

But what stablecoin rails unlock is far bigger than just doing the same things more efficiently. You get programmable money. You gain access to an internet capital market where genuinely novel financial primitives are being built daily. You get the ability for agents to manage funds under real guarantees—not just trust that they won’t misbehave.

This is our chance to rethink what financial services should really look like.

I don’t yet see enough teams pursuing this. The opportunity is right in front of us, yet most players in the space are still just running 2015 fintech playbooks on new rails. I hope to see that change in 2026.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News