When belief becomes a cage: the sunk cost trap in the age of crypto

TechFlow Selected TechFlow Selected

When belief becomes a cage: the sunk cost trap in the age of crypto

You'd better honestly ask yourself: which camp are you in? Do you like cryptocurrency?

Author: Evanss6

Translation: AididiaoJP, Foresight News

At any time in the past, when talking about cryptocurrency, this might have been solid advice: HODL Bitcoin, or stick with major coins, do some staking, try new products with rewards, avoid blowing up on derivatives—this way you probably already made money. Underlying this are two core beliefs: Bitcoin will become a more mainstream non-sovereign store of value; smart contracts will become the infrastructure of finance.

I won't go into how these views have been validated, because we need to talk about this "prison." Just two facts:

Bitcoin ETFs have attracted $49 billion in inflows, Ethereum ETFs $4.3 billion, while more altcoin ETFs are just getting started. Michael Saylor personally bought over $40 billion worth, and many companies are gradually accumulating as well.

Robinhood just announced it will build an EVM chain using Arbitrum's tech stack as the backend financial infrastructure for its platform, and will launch crypto’s most popular product: perpetual contracts.

Cryptocurrency is becoming more and more like traditional finance. Purchased through brokerage accounts by the previous generation, promoted by Larry Fink, adopted technologically by companies like Robinhood. What many of us imagined ten years ago is now coming true.

So what exactly is the "sunk cost prison"?

In short, it's persisting with something because of past investments. This can manifest in many ways: your skills, investments you're still holding, relationships, the job you're afraid to quit, or spending all your time on cryptocurrency.

-

"I don't want to leave her because our past runs too deep."

-

"I don't want to switch careers because I've already spent so much time on this."

-

"I don't want to sell Ethereum because I bought early and it's treated me well."

These are all examples of the sunk cost fallacy. Failing to recognize this mindset is self-sabotage, causing you to continue doing things you inwardly know are no longer beneficial.

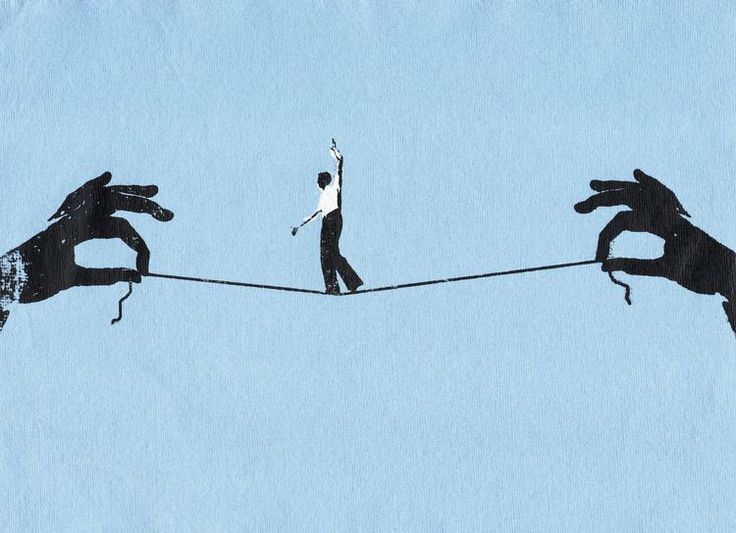

The sunk cost prison is the modern version of Plato's cave allegory.

The prisoners only know the shadows on the wall, unaware of where they come from or that a larger world exists outside.

In Plato’s allegory, the prisoners stay in the cave because they mistake shadows for reality, unaware of a "truer" world outside. In the modern version, we stay not out of ignorance, but because we’ve invested too much in the shadows. That job no longer suitable, the career path no longer believed in, the identity built through long hours and silent endurance—these are all costs paid. The more time, education, reputation invested, the harder it becomes to leave. The illusion is no longer just external—it’s internalized as duty, logic, and "the reasonable thing to do."

But freedom isn’t cheap. Escaping the sunk cost prison means admitting what you’ve built may no longer serve you. Past efforts cannot justify staying. Like the prisoner turning toward the light, it requires not just courage, but betraying the part of yourself that was overly loyal to past commitments. The hardest part isn’t seeing the truth—it’s saying goodbye to the self that stayed too long, believed too deeply, and paid the price for the prison.

My Experience

I myself stayed in the prison for a long time.

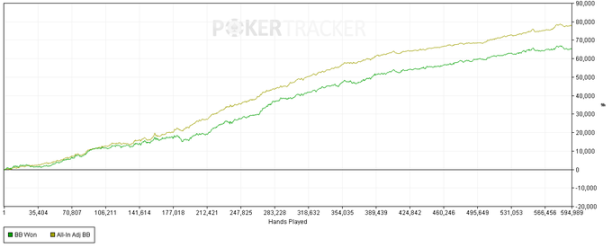

I fell in love with poker as a teenager. In the back row of high school classes, I’d always be calculating expected value on my notebook, not listening or taking notes. Within two years, I moved from $0.01/$0.02 micro-stakes games to high-stakes tables. Over time, I grew to dislike playing, treating it only as a way to earn money, always thinking “I’ll quit in another two or three years.”

But ten years passed, and nothing changed. I kept playing, kept winning, yet always felt the money wasn’t enough “to do something else.” Worse, I didn’t even know what else I could do. And I saw clearly: poker is a declining game—I had to work harder and harder just to keep up. But I told myself I should continue because I’d spent so much time becoming good at it, the returns were better than other options, I had no viable alternatives, and no time to think—just maintaining consistent wins at high-stakes online tables was exhausting enough: studying strategies, finding the right games, avoiding cheating, guarding against shady platforms…

To be honest, this “can’t easily switch careers because it pays” is a privileged problem. But as I found it increasingly hard to identify better industries, I knew my time was running out.

First Encounter with Cryptocurrency

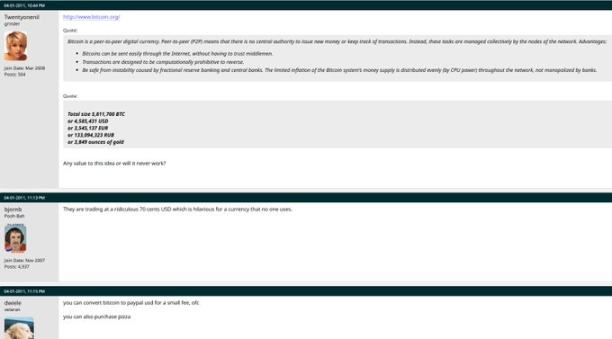

I got into cryptocurrency early due to my prior career. In 2012, I first read about Bitcoin on a poker forum called TwoPlusTwo. At the time, the forum’s dedicated Bitcoin section had already been active for over a year.

The first reply was funny: “This thing is now worth 70 cents—a currency nobody uses reaching this price? LOL.” The second replied that you could actually exchange it for USD or buy pizza with it—the early use cases of what would later become a $2 trillion asset. Scrolling down a few more posts:

“Truly missed an era.” Anyway, I noticed it because some poker sites started adopting it. At the time, I thought its $2 billion market cap was absurd. If it were only usable in black or gray markets, maybe it justified that; if it went mainstream, its value would multiply exponentially.

By 2016–17, as my investments became significant, I spent increasing amounts of time on cryptocurrency—especially ICOs. This diversion of time was my first step toward escaping the prison. But it wasn’t until DeFi took off in 2020 and started generating real profits that I truly jumped in.

Back then, I didn’t understand trading at all—I had to learn on the fly. I studied economics and math in college, but the only thing I really mastered was poker. Fortunately, poker is excellent training for trading: it gives relentless real-time feedback on decisions, forces risk management, correct pricing, overall strategy formulation, and builds emotional resilience and soft skills to endure bad luck—all essential for independent trading.

In the end, I’m deeply grateful and lucky that between 2013 and 2019, I spent so much time exploring these curiosities, positioning myself perfectly when opportunities arose. If I had focused solely on poker during those years, I might have played better—but following my instincts to plan a transition or exit, I was truly fortunate.

How does this "prison" apply today?

In recent years, financial nihilism in the crypto community has become increasingly evident. More and more people no longer believe in the idealistic visions they once held upon entering. The goal has shifted to “making money,” going all-in, working relentlessly, earning enough, then “exiting.”

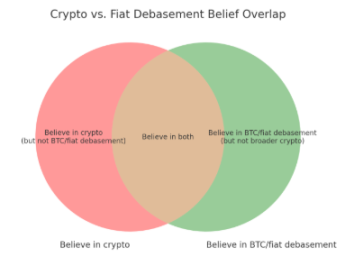

Roughly four camps exist:

-

Green camp (believes in Bitcoin, not other cryptocurrencies)

-

Red camp (believes in cryptocurrencies, not Bitcoin)

-

Brown camp (believes in both)

-

White camp (believes in neither)

Add two conditions to each camp, and you get eight total:

-

(a) Believes there’s still upside potential worth risking for

-

(b) Believes the upside has already been captured by early buyers

I believe only those in 2(a) should dedicate their full time to cryptocurrency. If you’re in 1(b), 2(b), 3(b), or 4(b), you should start allocating time and planning your exit. If you’re in 1(a) or 4(a), just hold Bitcoin and don’t pay too much attention to the rest. Those in 3(a) can hold some Bitcoin and other assets, splitting time and energy between crypto and non-crypto pursuits. If you’ve seen my account and posts, you can probably tell that after being mostly in 2(a) from 2015 to 2023, I’m now somewhat wavering between 1(a), 3(a), and 3(b).

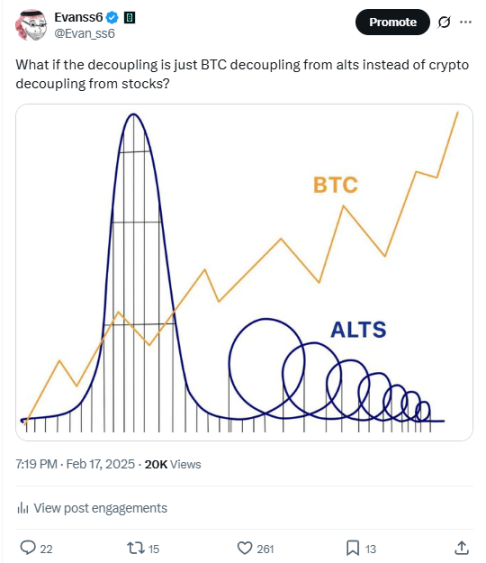

Let’s talk about the red camp. Staying here over the past few years has been painful.

We’re essentially in a situation where Bitcoin dominance keeps rising, despite broader adoption across the crypto ecosystem. Even if you accurately predicted Ethereum ETFs would see over $4 billion in net inflows, anticipated giants like Robinhood would adopt its technology, foresaw Trump winning, reforming the SEC, ending OCP2.0, and creating a pro-crypto environment—since the day ETFs launched, your Ethereum investment has still declined. Yet today, Ethereum trades around $2,600, delivering 2,000x to 8,600x gains for investors since 2015.

So the Answer

I suspect whether “endurance,” as Mippo said in the tweet at the beginning of this article, is truly the right path or the biggest opportunity. Everything you dreamed of has either already happened or is underway. In 2017, if Robinhood had announced development on Ethereum, the token price would have immediately surged 10%. Now it’s different. The move today is to buy HOOD stock. I believe there are still opportunities in crypto, but the trend of opportunities being captured by non-crypto assets (stocks) or insiders (teams/private investors—look at Celestia Finance) is unfriendly to dreamers. If you truly want to “endure,” you must either invest early in such projects or build them yourself. So Mippo isn’t wrong—solving real problems in crypto remains an opportunity. But don’t assume that just because crypto technology is becoming widespread, current token prices will necessarily rise (especially compared to other assets you could invest in).

Unless you’re a true red camp diehard in 2(a), “enduring” means choosing to stay in the cave watching shadows, while those outside are already building AI and robotics.

You should honestly ask yourself: Which camp are you in? Do you enjoy cryptocurrency? Regardless, try to develop skills that are useful elsewhere, just in case it doesn’t work out—you’ll have an exit path. At minimum, you won’t be unhappy from spending all your time on something you’re already tired of. And if you’re wrong, you’ll at least have a soft landing.

The door to the sunk cost prison isn’t locked—what traps you is only your own mind. All you need to do is occasionally open the door and walk out. Life is beautiful, and the world is full of possibilities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News