Espresso Co-Founder's Decade-Long Crypto Journey: I Set Out to Overturn Wall Street's Flaws, But Witnessed a Casino-Like Transformation

TechFlow Selected TechFlow Selected

Espresso Co-Founder's Decade-Long Crypto Journey: I Set Out to Overturn Wall Street's Flaws, But Witnessed a Casino-Like Transformation

Everything you've been hoping for may have already arrived, just not in the form you imagined.

Author: Jill Gunter, Co-founder of Espresso

Translation: Luffy, Foresight News

Ten years ago, I began my career in the crypto industry because, to me, it was the most fitting and immediate tool for addressing the problems I had witnessed during my brief time working on Wall Street.

I found that the current state of the financial system gives rise to three major societal ills—challenges which I firmly believe cryptographic technology can overcome.

1) Poor Monetary Management

Hugo Chávez caused Venezuela's inflation rate to surge beyond 20,000%

My career began as a bond trader focused on Latin American sovereign debt, where I directly experienced hyperinflation and capital controls in countries like Venezuela and Argentina. The arbitrary decisions of national leaders stripped entire generations of their livelihoods and savings, widened sovereign bond spreads dramatically, and shut these nations out of global capital markets. This systemic injustice inflicted upon individuals has been—and remains—a tragedy.

Of course, Hugo Chávez and Cristina Fernández de Kirchner (former presidents of Venezuela and Argentina, respectively) are not the only "villains" in this story.

2) Financial Barriers on Wall Street

Remember the 2011 protests occupying Zuccotti Park in Manhattan, New York?

I joined Wall Street several years after the 2008 financial crisis. Before starting, I had read Michael Lewis’s *Liar’s Poker*, expecting the book’s depiction of 1980s Wall Street speculation to be an outdated stereotype. I also knew that the Dodd-Frank Act had passed the year before, a legislative overhaul meant to eliminate reckless trading culture from Lower Manhattan desks.

Institutionally, rampant speculative behavior did subside, and directional trading desks were largely dismantled. But if you knew where to look, the gambling culture never truly disappeared. Many of the leaders who remained after the 2008 purge were young traders who had taken over their bosses’ risk positions at market bottoms and then rode Ben Bernanke’s quantitative easing all the way to massive profits. What kind of incentive does that set for a new generation of trading “stars”? Even having lived through crisis, these newcomers were taught one clear lesson: betting the firm’s balance sheet could still make your career.

During my first year on Wall Street, I walked past the “Occupy Wall Street” protesters every day. The longer I stayed, the more I sympathized with the movement—they wanted to dismantle Wall Street’s privilege and end a system where ordinary people bore the cost when elites gambled recklessly.

I agreed with their cause but not their methods. Passing through the protest camps was never dramatic; their actions weren’t particularly effective. They held signs declaring themselves the “99%,” but they lacked a clear idea of what they actually wanted from the “1%.”

To me, the answer was obvious: the problem wasn’t just that Wall Street loved to gamble, but that it had access to a “casino,” investment opportunities, and insider information completely off-limits to ordinary people—while the public footed the bill whenever Wall Street lost.

This couldn’t be fixed simply by adding more rules to Wall Street. The core solution was to create a level playing field for everyday people.

3) Opaque and Outdated Financial Systems

As early as 2012, I realized that upgrading the underlying infrastructure was essential to driving finance toward greater openness, fairness, transparency, and inclusivity.

As a junior trader in the trading room, I spent hours each day after market close calling back offices to reconcile trades, chasing bonds that should have settled weeks earlier, and verifying that no counterparty risk existed across derivatives positions.

How could these processes still not be fully digitized?

Sure, many steps appeared digital on the surface—we used computers and electronic databases. But all these databases required manual updates. Keeping records synchronized across parties was a massive, costly, and often opaque undertaking.

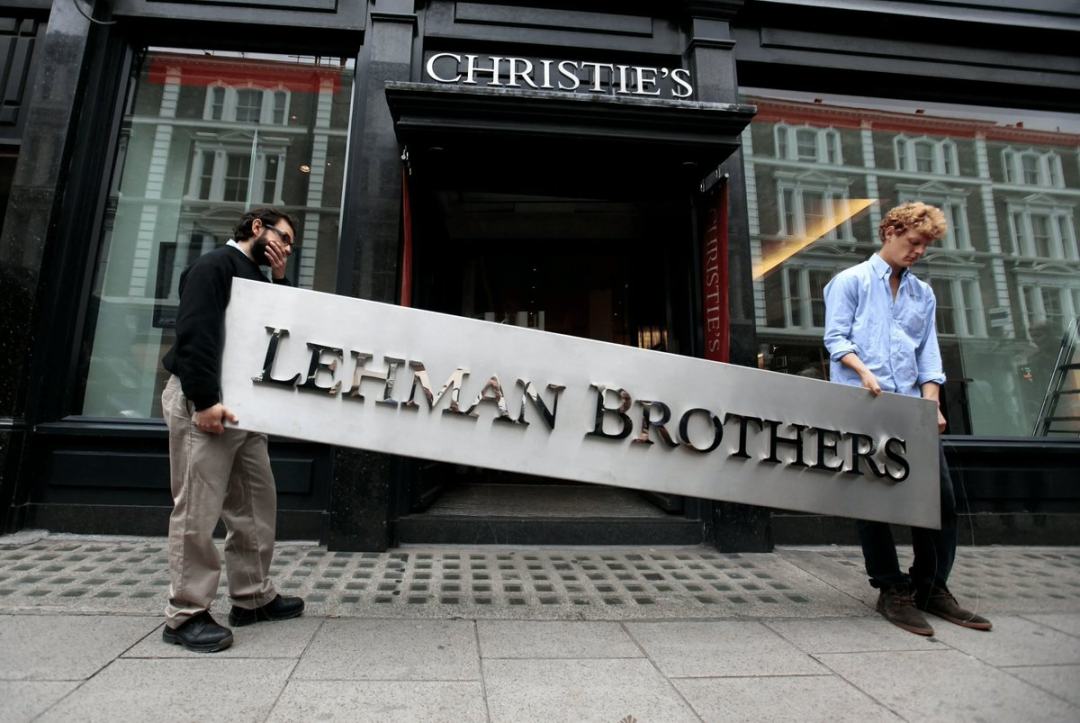

I still remember one thing: even four years after Lehman Brothers’ collapse, Barclays—the bank that acquired its assets—still couldn’t accurately determine Lehman’s true asset and liability positions. It sounds absurd, but consider conflicting or incomplete database records, and it makes perfect sense.

Bitcoin: A Peer-to-Peer Electronic Cash System

Bitcoin is just so cool.

It’s an asset immune to manipulation and independent of monetary policy, like gold; its issuance and circulation allowed average people worldwide a ten-year window to adopt it as an investment vehicle before institutions could move in at scale; and it introduced blockchain—a new type of database that anyone can run and update directly, eliminating the need for clearing, settlement, or reconciliation.

Bitcoin was—and still is—the antidote to my disillusionment with Wall Street. People use it to hedge against inflation and capital controls; it enables the “99%” to invest ahead of Wall Street; and its underlying technology holds the potential to replace the opaque, inefficient systems banks rely on, building a new digital, transparent infrastructure.

I had to drop everything and join this mission. But back then, skepticism was everywhere. The most common criticism was, “Isn’t this just what drug dealers use?” In 2014, outside of dark web markets like Silk Road, Bitcoin had almost no real-world applications. Refuting such criticisms was incredibly difficult—you had to really stretch your imagination to see its potential.

For years, I agonized, wondering if this technology would ever truly materialize… Then suddenly, the entire world started paying attention, projecting their own fantasies onto the technology.

The Peak of Hype

For years I’d hoped people would recognize the potential of blockchain technology—but in 2017, I unexpectedly became a skeptic within the industry, and the feeling was complicated.

Partly because I was immersed in Silicon Valley’s tech ecosystem, and partly due to the zeitgeist, everyone suddenly wanted to launch a blockchain project. When someone pitched me a “blockchain + journalism” startup idea, or I saw headlines like “Blockchain Enters Dentistry,” I couldn’t help thinking, “No, that’s not how this works at all!”

Still, most of these people weren’t trying to run scams, launch vaporware projects, sell tokens to retail investors, or pump meme coins. They genuinely believed in the technology’s broad potential—yet their enthusiasm was both misleading and irrational.

From 2017 to 2018 marked the peak of industry-wide hype.

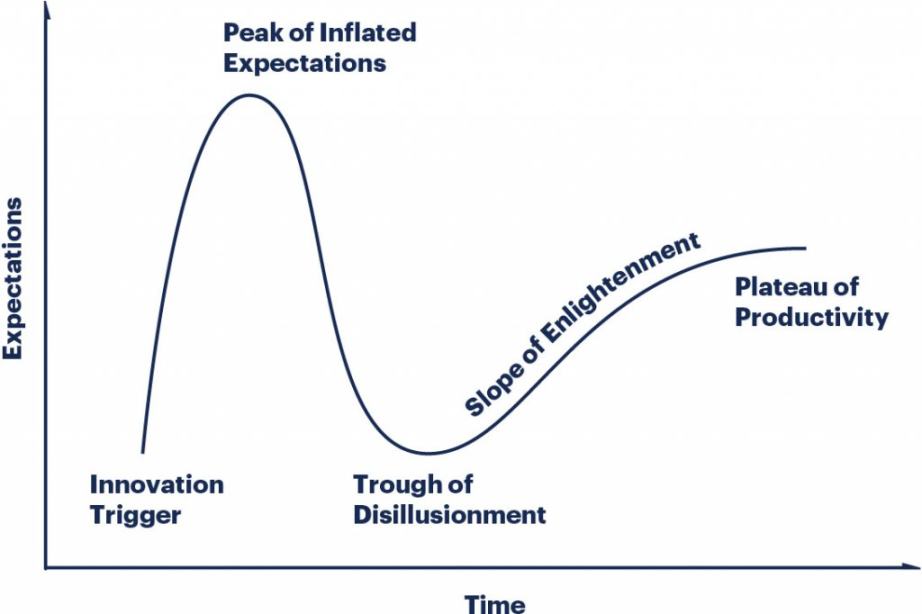

Gartner Hype Cycle for Emerging Technologies

The cryptocurrency and blockchain industry didn’t steadily climb the “slope of enlightenment” as Gartner’s classic hype cycle model promised. Instead, it swung wildly between frenzy and disillusionment every three to four years.

To understand why, we must recognize a key fact: although blockchain is a technology, it is deeply tied to crypto assets—an asset class with extremely high beta and volatility, making it highly sensitive to macroeconomic shifts. Over the past decade, macro conditions have fluctuated intensely: zero interest rates drove risk appetite up, fueling crypto booms; trade wars reduced risk appetite, leading to declarations of crypto’s “death.”

Making matters worse, regulatory environments in this emerging sector have also been volatile. Combined with catastrophic events like Terra/Luna and FTX that wiped out billions, the industry’s extreme volatility is hardly surprising.

Remember, We All Want to Change the World

Staying committed to this industry—whether building projects, investing, writing commentary, or other work—is incredibly hard.

Everyone knows startups are tough, but launching one in crypto is especially grueling. Market sentiment and funding climates swing unpredictably; product-market fit is unclear; legitimate founders face investigations or even imprisonment; and you’re forced to watch as a presidential candidate launches a token scam, destroying the industry’s already fragile mainstream credibility… It’s maddening.

So I completely understand why someone might feel, after eight years in the space, that their life has been wasted.

https://x.com/kenchangh/status/1994854381267947640

The author of this tweet admits he thought he was joining a revolution, only to realize he helped build a giant casino—and regrets enabling the “gamification” of the economy.

But remember, no countercultural movement is perfect. Every revolution comes with costs, and any transformation involves growing pains.

Elizabeth Warren and the Occupy Wall Street movement tried to shut down Wall Street’s casino—but meme stocks, altcoin rallies, prediction markets, and perpetual futures DEXs have brought that same casino directly to the masses.

Is that a good thing? Honestly, I’m not sure. Most of my time in crypto has felt like we’re just rebuilding consumer protection frameworks. Yet many existing consumer protection rules are either outdated or misleading, so perhaps breaking boundaries again is a positive step. If my original goal was to create a level playing field, then yes—we’ve made progress.

This shift is a necessary stage in reforming the financial system. If you want to fundamentally change who benefits from finance and how, you inevitably end up “gamifying” the economy.

Progress Report

It’s easy to feel disillusioned; staying optimistic is hard.

But if I assess today’s industry against the goals I had when I started, I’d say overall progress is decent.

On poor monetary management: we now have Bitcoin and other sufficiently decentralized cryptocurrencies that serve as viable alternatives to fiat—resistant to seizure and devaluation. With privacy coins, assets can even become untraceable. This is tangible progress in human freedom.

On Wall Street’s monopoly: yes, the casino has been “democratized”—now it’s not just Wall Street that can blow itself up with leveraged bets on junk assets! Seriously though, I believe society is progressing toward less paternalistic control over how ordinary people take financial risks. After all, we’ve always allowed people to freely buy lottery tickets, yet denied them access to some of the best-performing stock investments of the past decade. The early retail investors in quality assets like Bitcoin and Ethereum show us what a more balanced world could look like.

On outdated, opaque database systems: the financial industry is finally taking better technical solutions seriously. Robinhood has adopted blockchain as the underlying technology for stock trading products in the EU; Stripe is building a new global payment system on crypto rails; stablecoins have become mainstream.

If you entered this space for the revolution, take a closer look: everything you hoped for may already be here—just not in the form you imagined.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News