Bloomberg: Stablecoins may not help the U.S. escape its debt and deficit quagmire

TechFlow Selected TechFlow Selected

Bloomberg: Stablecoins may not help the U.S. escape its debt and deficit quagmire

Most analysts believe the stablecoin market will certainly expand under the gradually emerging regulatory framework over the next year, but forecasts vary widely.

By Ye Xie & Anya Andrianova, Bloomberg

Translated by Felix, PANews

A landmark U.S. stablecoin law is sparking intense debate on Wall Street over whether these digital assets can meaningfully strengthen the dollar’s status and become a significant source of demand for short-term U.S. Treasury bills (T-bills).

Despite differing views, strategists from firms including JPMorgan Chase, Deutsche Bank, and Goldman Sachs agree that regardless of how optimistic President Donald Trump and his advisers are about stablecoins as a new pillar of American finance, it's too early to call them a "game changer." Some also see risks.

"The projected scale of the stablecoin market is exaggerated," said Steven Zeng, Deutsche Bank’s U.S. market strategist. "Everyone is watching, but no one is making directional bets. There’s considerable skepticism."

Stablecoins are digital tokens pegged in value to traditional currencies—most commonly the U.S. dollar—and are far less volatile than market-driven cryptocurrencies like Bitcoin. They serve as cash substitutes on blockchains, used for digital storage of funds like bank accounts, real-time transfers, or trading.

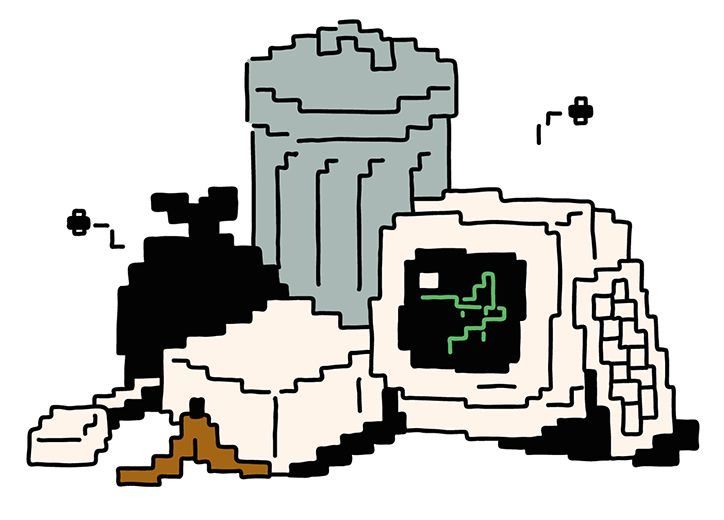

Since the so-called Genius Act—a stablecoin bill—officially took effect in July, industry supporters have hailed it as a breakthrough that will pave the way for broader financial system adoption of dollar-denominated digital currencies. Last month, Treasury Secretary Scott Bessent estimated the legislation could grow the dollar stablecoin market from its current size of about $300 billion to $3 trillion by 2030.

Under the new law, stablecoin issuers must fully back dollar stablecoins with 100% reserves in short-term Treasuries and other cash equivalents. Bessent believes the anticipated surge in stablecoin-driven demand will allow the Treasury to issue more short-term debt, reducing reliance on long-term bonds and easing pressure on mortgage rates and other borrowing costs tied to long-term benchmarks.

"The Treasury cares about borrowing costs," said Robert Tipp, chief investment strategist and head of global bonds at PGIM Fixed Income. "Stablecoins can play a role in that process."

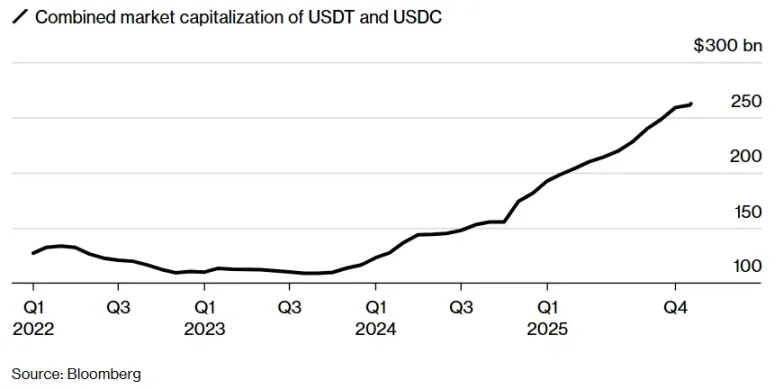

Dollar stablecoins—primarily Tether’s USDT and Circle’s USDC—already hold about $125 billion in U.S. Treasuries, approaching 2% of the short-term T-bill market at year-end 2023 (according to a study by the Federal Reserve Bank of Kansas City in August). Data from the Bank for International Settlements shows these issuers bought around $40 billion in short-term Treasuries last year alone. Still, compared to U.S. money market funds, which hold about $3.4 trillion in Treasuries, stablecoins remain minor players.

Tether and Circle token supply surged over the past year

Most analysts agree the stablecoin market will expand under the regulatory framework taking shape over the next year, but forecasts vary widely. JPMorgan expects the market to grow up to $700 billion in the coming years, while Citigroup offers an optimistic projection as high as $4 trillion.

"Certainly, we’ve seen a lot of positive momentum over the past year," said Teresa Ho, head of U.S. short-term strategy at JPMorgan. "But the pace of growth—I don’t think it will reach $2 trillion, $3 trillion, or $4 trillion within just a few years."

The crypto industry’s ultimate goal is to make stablecoins mainstream payment tools, directly challenging the traditional banking system. Smaller banks worry about deposit outflows leading to tighter credit; larger banks plan to launch their own stablecoins to profit from interest on reserves.

Currently, stablecoins are mostly used for cryptocurrency trading, and recent market volatility highlights how quickly sentiment can shift, potentially triggering capital outflows. Even if the most bullish growth projections materialize, the actual boost to Treasury demand could fall well short of expectations.

Net Effect Zero?

Skeptics note stablecoin inflows mainly come from four sources: government money market funds, bank deposits, physical cash, and overseas demand for dollars.

Stablecoin issuers still represent a small share of bondholders—still minor players.

Treasury holdings by stablecoin issuers as of December 2024

Given the Genius Act prohibits stablecoins from paying interest, yield-seeking investors have little incentive to move money out of savings accounts or money market funds, limiting potential growth. Moreover, even if investors do shift funds from money market instruments—the largest current buyers of short-term Treasuries—the net effect could be zero: not creating new demand for T-bills, but merely changing the identity of holders.

"I’m skeptical," said Brad Setser, senior fellow at the Council on Foreign Relations. "If stablecoin demand surges, some existing Treasury holders may be crowded out and turn to alternatives, such as other short-term securities."

Stephen Miran, White House chief economist and current Federal Reserve governor, acknowledges domestic demand for stablecoins may be limited, but sees the real opportunity abroad—where investors may accept zero yield in exchange for exposure to dollar assets.

Fed Governor Stephen Miran believes dollar-denominated stablecoins will attract overseas demand

In a recent speech, Fed Governor Miran linked the potential impact of stablecoins to the Fed’s quantitative easing programs and the global “savings glut” that significantly depressed interest rates.

Standard Chartered estimates that capital flows into stablecoins could cause about $1 trillion in outflows from banks in developing countries by 2028. This scenario would almost certainly prompt regulators in those countries to restrict stablecoin adoption. Institutions like the European Central Bank are developing their own digital currencies to compete with private dollar stablecoins.

"If capital controls limit access to traditional dollars, they may apply equally to dollar stablecoins," wrote Goldman Sachs analysts Bill Zu and William Marshall.

The Fed Factor

Another factor potentially undermining stablecoins’ impact on Treasury demand may be the Federal Reserve itself. CIBC strategist Michael Cloherty notes that if stablecoins "lock up" circulating dollars—which appear as liabilities on the Fed’s balance sheet—the Fed would need to shrink its asset holdings accordingly, including its $4.2 trillion Treasury portfolio. That means "much of" the Treasury demand generated by stablecoins might simply replace Fed holdings.

Heavy reliance on short-term debt also carries costs: reduced predictability in government financing, more frequent debt rollovers, and increased vulnerability to shifts in market conditions. And any changes won’t happen overnight.

Deutsche Bank’s Zeng estimates stablecoins could grow by $1.5 trillion over the next five years, funded by outflows from domestic and overseas pools. This would generate about $200 billion in incremental annual Treasury demand—a substantial sum, but negligible relative to the U.S. government’s massive borrowing needs. Federal debt has ballooned beyond $30 trillion and is projected to grow another $22 trillion over the next decade.

"I wouldn’t get overly excited about the dollar and U.S. Treasuries just because the government might have a new idea," said Steven Barrow, head of G10 strategy at Standard Bank in London. "It’s wrong to say stablecoins solve nothing—but the real concern is they ‘won’t get you out of the debt and deficit swamp.’"

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News