Beyond Trading: How Sun Wukong Creates a Value Loop for SUN with Real Money

TechFlow Selected TechFlow Selected

Beyond Trading: How Sun Wukong Creates a Value Loop for SUN with Real Money

After the noise of traffic and narratives fades, only projects that can clearly and fairly return growth dividends to users will survive cycles and build truly robust moats.

The battle for decentralized contract exchanges has entered a white-hot phase. Initially, Hyperliquid's "airdrop wealth effect" sparked widespread interest and interaction with decentralized contract exchanges. Subsequently, various platforms launched their own native tokens through TGEs, and the capital's enthusiasm for new narratives once drove an across-the-board rally in the sector. However, as market conditions cooled, these wealth effects gradually faded, shifting the competitive focus toward fundamental capabilities such as liquidity, depth, and capital efficiency. Yet, optimizing these foundational aspects enhances users' trading experience but cannot directly deliver value or generate wealth effects for users in the short term.

With the disappearance of early-stage benefits, even leading players in the sector have not escaped user attrition. Therefore, to maintain a foothold in the market, platforms must genuinely implement concrete measures that effectively reward users.

Sun Wukong creates real value for SUN through buybacks and burns

As a latecomer in the decentralized derivatives space, the Sun Wukong platform has demonstrated remarkable growth momentum within just two months by deploying a precisely differentiated strategy. By offering zero gas fees and the lowest trading fees across the network, it directly addresses the biggest pain point for high-frequency traders. At the same time, leveraging the robust ecosystem of TRON, it provides diverse high-yield financial products, establishing a solid foundation for user retention.

The recently launched limited-time "trade-to-earn" campaign marks a strategic evolution from mere product optimization to active value creation. The campaign features: full fee rebates plus additional SUN token rewards (maker orders receive 110% rebate, taker orders receive 107%). This not only incentivizes trading activity with real monetary rewards but also deeply links the platform’s fee income to the value growth of its native token SUN. By publicly committing to use revenues for buying back and burning SUN tokens, Sun Wukong is transforming a short-term marketing initiative into a powerful engine driving long-term, sustainable value circulation within its ecosystem—thereby fundamentally establishing sustainable value expectations for SUN.

You can envision a clear chain of events:

You execute a trade on the Sun Wukong platform and pay minimal transaction fees.

The platform pools these fee revenues and uses them to purchase SUN tokens on the open market.

The acquired SUN tokens are immediately sent to a burn address.

As trading continues, the buyback-and-burn mechanism steadily reduces the total supply of SUN, with increasing scarcity directly boosting SUN’s value. This significantly strengthens holders’ sense of belonging and confidence, further aligning the interests of users, the platform, and the token.

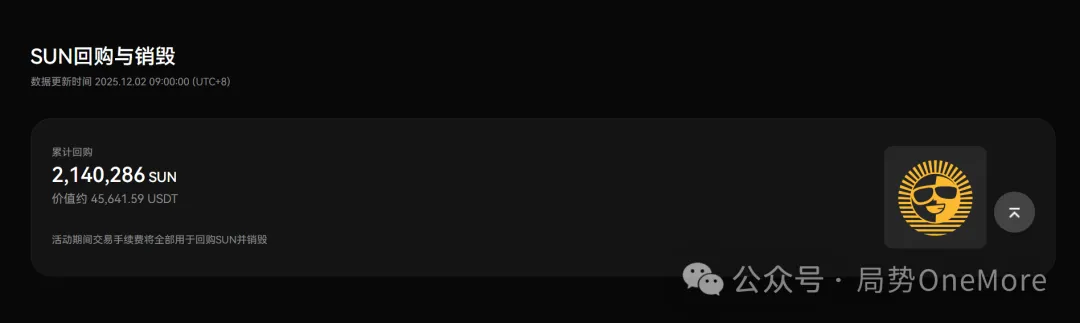

To date, according to official data, the number of SUN tokens repurchased stands at 2,140,286.

Dual empowerment: From user retention to ecosystem trust

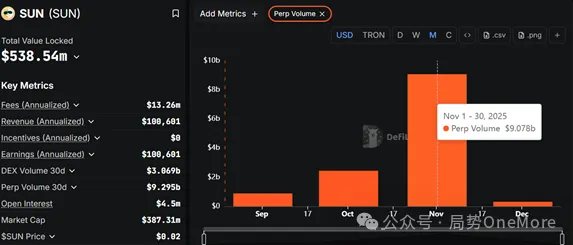

In the short term, Sun Wukong’s generous incentives have attracted a massive influx of traders, bolstering liquidity depth for targeted trading pairs and directly increasing the platform’s derivatives trading volume. According to DeFiLlama data, in November, Sun Wukong achieved a derivatives trading volume of $9.078 billion, a 271% increase compared to October.

In the medium term, users transition from being mere "reward hunters" to habitual users through frequent trading, allowing the platform to accumulate genuine liquidity and trading depth.

In the long run, when users recognize that every trade they make contributes to the deflationary pressure on SUN, their role evolves from simple "platform users" to "ecosystem co-builders." This deep alignment of interests and sense of ownership represents the best defense against user attrition.

Therefore, paying attention to SUN is not merely about tracking a token’s price fluctuations—it signifies a broader trend: beyond the noise of traffic and narratives, only projects that can clearly and fairly return growth dividends to their users will survive market cycles and build truly durable moats.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News