Good news fades—so who's selling in this crypto sell-off?

TechFlow Selected TechFlow Selected

Good news fades—so who's selling in this crypto sell-off?

Why continue selling off in the face of bad news, yet fail to rebound when good news emerges?

Author: Jeff Dorman, CFA

Translation: TechFlow

This Is Probably the Bottom of Risk

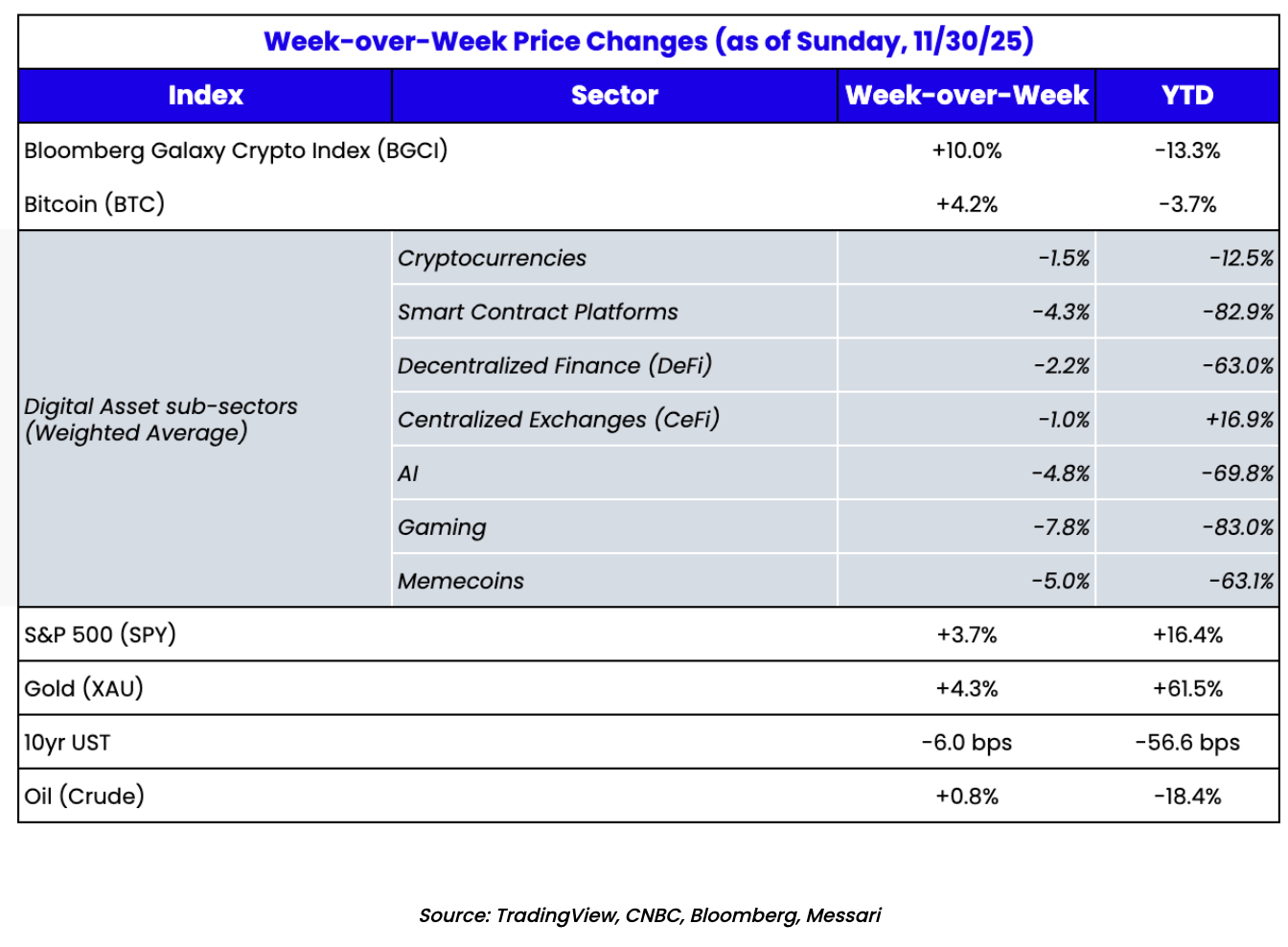

Digital asset markets have declined in 7 of the past 8 weeks, briefly rebounded during Thanksgiving week, then plunged again Sunday night when Japanese markets opened (Nikkei down, yen bond yields up).

Although the initial crypto sell-off began on October 10 due to issues at exchanges like Binance—three weeks before the Federal Open Market Committee (FOMC) meeting—much of November’s weakness was later attributed to Chairman Powell’s hawkish comments.

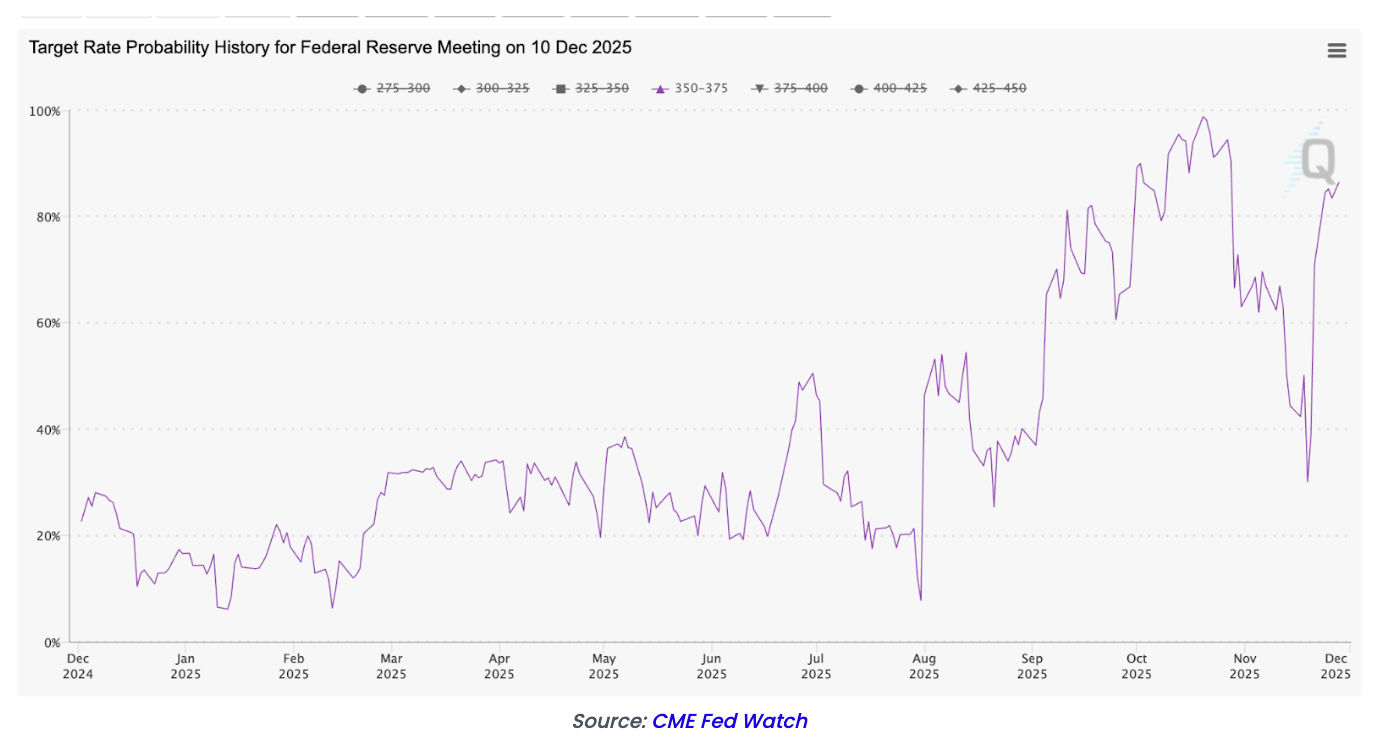

December rate cut expectations dropped sharply throughout November, from nearly 100% probability to as low as 30%. This led both stock and crypto markets to trend lower all month.

But in the final week of November, something interesting happened. Core Producer Price Index (PPI) inflation fell to 2.6%, below the expected 2.7%. Additionally, limited labor market data released after the government shutdown showed signs of slowing momentum, possibly nearing collapse.

December rate cut odds quickly rebounded to near 90%, stocks surged, ending November in positive territory. Moreover, President Trump hinted he already knew who his next Fed Chair would be, leading markets to almost fully price in Kevin Hassett.

Hassett is known for aligning with the Trump administration by supporting faster rate cuts, and he is also a classic macroeconomic optimist.

Why are digital assets continuing to sell off on bad news, yet failing to rally on good news?

I don’t know either.

We’ve seen similar periods before, such as May–June 2021 and April 2025, when all bullish factors were aligned but prices remained unresponsive.

Yet this time feels different. Investment interest in most digital assets now appears extremely low, yet no one we’ve spoken to can clearly explain why. This is markedly different from previous episodes.

In the past, whether preceding or following major downturns, we could usually identify reasons through conversations with other funds, exchanges, brokers, and industry leaders. So far, however, this sell-off lacks a clear rationale.

Recently, Bill Ackman commented that his investments in Freddie Mac and Fannie Mae suffered due to their perceived correlation with crypto prices. While fundamentally unjustified—given these assets follow entirely different investment logic—it makes sense if you consider the growing overlap between traditional finance (TradFi), retail investors, and crypto investors.

The once relatively isolated crypto industry is now increasingly intertwined with other sectors. Long-term, this is undoubtedly positive (after all, it's unreasonable for any segment of finance to remain completely isolated), but in the short term, it creates significant problems—crypto assets appear to be the first sold in any diversified portfolio.

It also explains why participants within the crypto world struggle to understand the source of the selling—likely because the selling isn’t coming from within the ecosystem at all. The crypto world is highly transparent, sometimes overly so, while traditional finance remains a “black box.”

And right now, that “black box” is driving capital flows and market activity.

Possible Explanations for Crypto Market Weakness

Beyond the obvious reasons (lack of education and abundant low-quality assets), there must be better explanations for why the crypto market has entered such a severe downward spiral.

We’ve long believed that for an asset to hold value, it must possess some combination of financial value, utility value, and social value. The biggest issue facing most digital assets is that their value stems primarily from social value—the hardest of the three to quantify.

In fact, in an article earlier this year where we conducted a breakdown valuation analysis of Layer 1 blockchain tokens (such as ETH and SOL), we found their financial and utility value components to be relatively small, while the social value component had to be inferred.

Therefore, when market sentiment is low, tokens relying heavily on social value should fall significantly (and indeed, most do—Bitcoin, L1 tokens, NFTs, and memecoins). Conversely, assets more dependent on financial and utility value should perform better—while some do (e.g., BNB), most don’t (e.g., DeFi tokens and PUMP). That seems odd.

You might expect reinforcements to emerge and support prices, but that hasn't been common. In fact, the opposite occurs—we see more investors entering weak markets, anticipating further declines, even if based solely on market trends and technical analysis.

Our friends at Dragonfly (a well-known crypto venture firm) did publish a thoughtful piece defending the valuation of Layer 1 tokens, indirectly influenced by our earlier split-valuation analysis of L1s. Dragonfly essentially supports the conclusion in the last two paragraphs of our article—that valuations based purely on current income and utility are meaningless, because eventually all the world’s assets will run on blockchain rails.

This doesn’t mean any single L1 token is cheap, but collectively, the total value of all blockchains may be undervalued, and betting on any one L1’s success is ultimately a probabilistic bet.

In other words, instead of focusing on current usage, think bigger about the industry’s future trajectory. And they’re right. If prices continue falling, I expect more such “defense” pieces to emerge.

Of course, no crypto sell-off is complete without attacks on MicroStrategy (MSTR) and Tether. Despite repeatedly debunking concerns about MSTR (they will never be forced sellers), attacks persist. Tether-related fear, uncertainty, and doubt (FUD) have been more timely. Within weeks, narratives shifted from “Tether raising $20 billion at a $500 billion valuation” to “Tether being insolvent.”

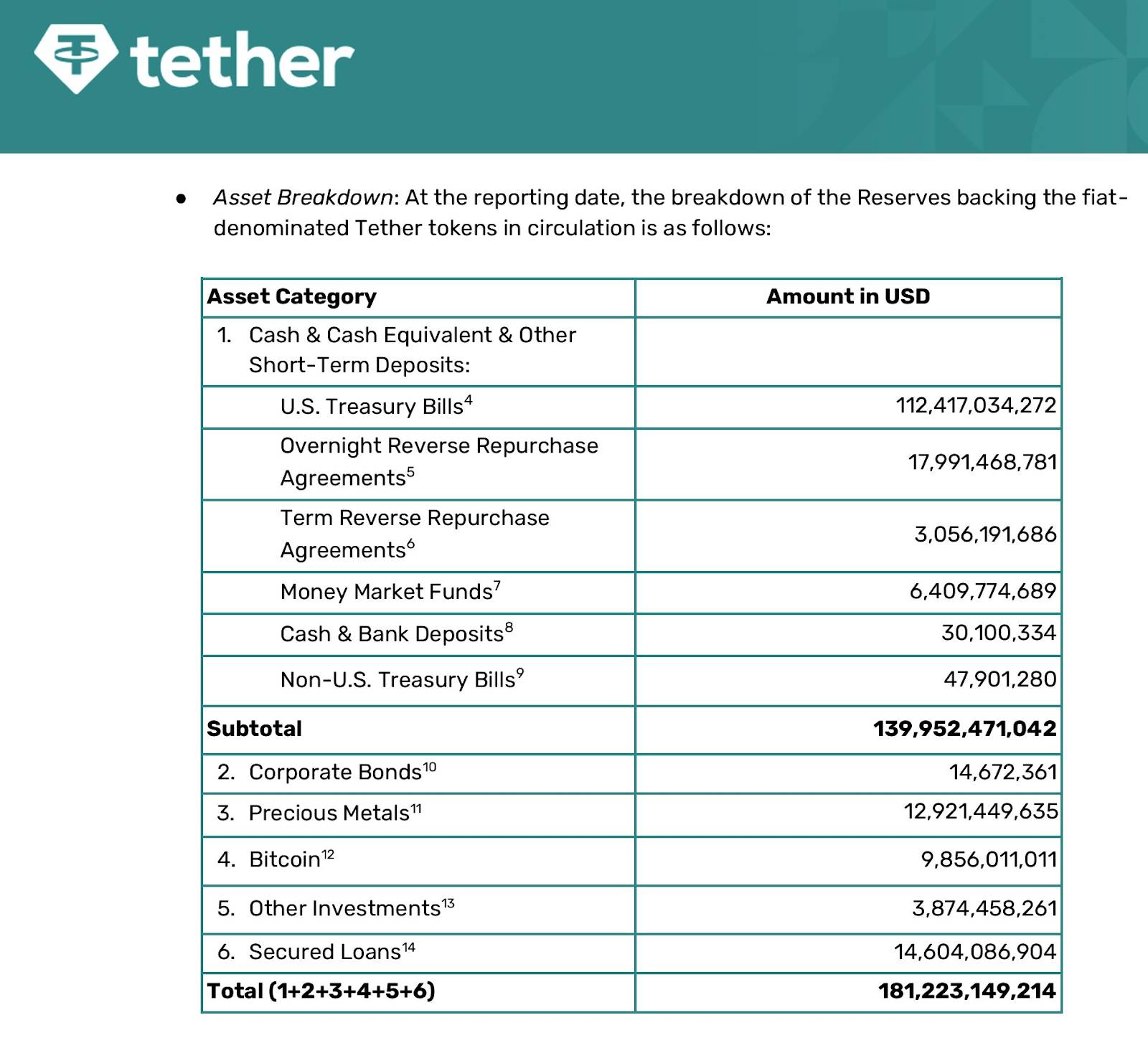

S&P recently downgraded Tether’s rating to junk status, while Tether’s latest audit report (as of September 30, 2025) shows its dollar-pegged stablecoin is backed 70% by cash and cash equivalents, and 30% by gold, Bitcoin, corporate loans, and equity buffers.

I suppose this scares people, although it seems perfectly reasonable for a private company operating without regulatory constraints on asset composition. Certainly, being fully collateralized in cash is far safer than how the entire fractional reserve banking system operates. But until the GENIUS ACT passes, I won’t attempt to compare USDT to banks.

However, I’d argue there’s no plausible scenario where over 70% of USDT is redeemed overnight—the only situation where liquidity issues could arise. Thus, any concern about liquidity is absurd. Solvency, however, is another matter.

If their 30% holdings (including Bitcoin, gold, and loans) incur losses, they would need to tap into other parent company assets not explicitly backing USDT. Given the parent company’s profitability, this shouldn’t be a major issue, and I doubt any serious investor views it as one.

Still, Tether CEO Paolo Ardoino had to address it. USDT didn’t depeg even slightly—because it wasn’t an issue—but perhaps it sparked some market anxiety?

My only question is: if the market wants you to hold only cash and cash equivalents, and Tether earns over $5 billion annually just from government interest (at 3–4% yield on $180 billion in assets), why hold those other investments at all?

So, once again, looking back, we can at least try to rationalize parts of the market decline. Yet this persistent weakness still leaves us puzzled.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News