Cryptocurrency market faces broad sell-off—what's behind this downturn?

TechFlow Selected TechFlow Selected

Cryptocurrency market faces broad sell-off—what's behind this downturn?

The crypto market is truly beset by troubles on all sides, completely stacked with "negative buffs."

Author: Glendon, Techub News

Since Bitcoin lost the $90,000 mark on February 25, triggering a broad downturn across the cryptocurrency market, the行情 has been like sliding down a slide—falling continuously. In the early hours of today, Bitcoin briefly dropped to around $82,200, hitting its lowest level since November 12, 2024; Ethereum also fell to approximately $2,100, erasing all gains made since August 2024.

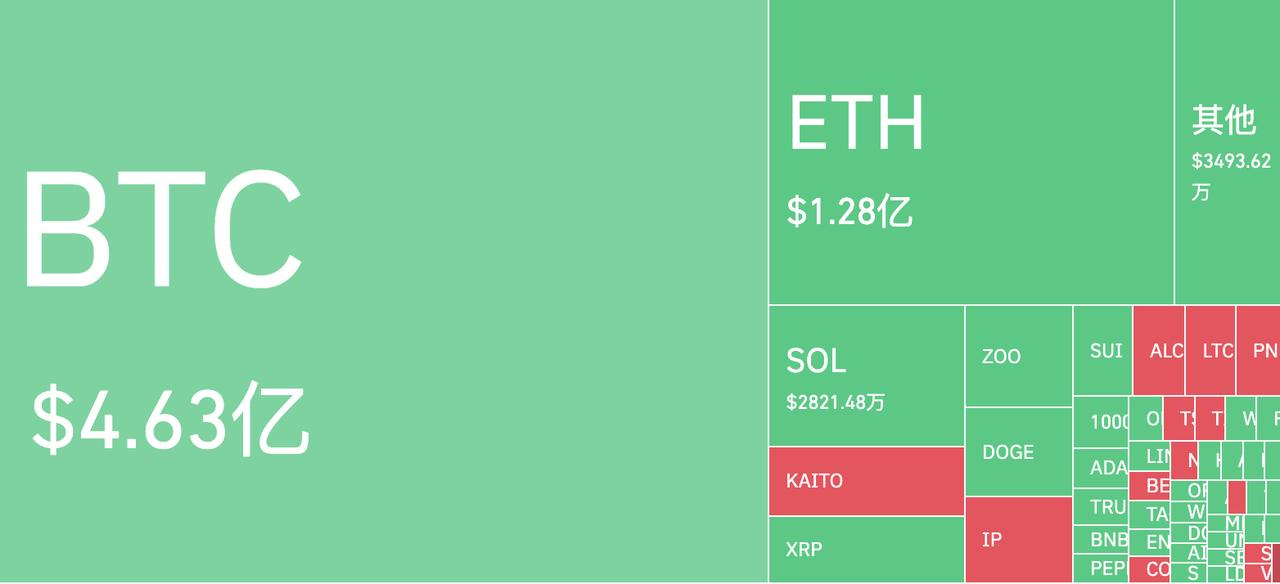

According to Coinglass data, at the time of writing, total liquidations across the market exceeded $772 million in the past 24 hours, with Bitcoin and Ethereum accounting for 60% and 17% respectively. Meanwhile, long positions in numerous altcoins were collectively wiped out over the past few days.

With market sentiment remaining in "extreme fear," despite the substantial declines in Bitcoin and Ethereum, there is still no sign of stabilization. So the question arises: what caused this sharp drop in the crypto market?

Basing on multiple factors and analysis, the author believes this market crash may be a "panic stampede" resulting from the convergence of multiple negative forces.

Macroeconomic and Policy Factors

On a macro level, the situation can be viewed in conjunction with uncertainties surrounding Trump's recent policy moves, the U.S. stock market bubble, and fading hopes for Federal Reserve rate cuts.

Although Trump has publicly expressed support for Bitcoin as a "strategic reserve asset," he has not actively advanced any specific cryptocurrency policies since taking office. In fact, prior to his inauguration, market optimism had already driven prices to their peak based on investor expectations. As Trump continues pushing forward tariff plans—such as imposing higher import tariffs on goods from Mexico and Canada—analysts suggest these actions have raised public concerns about trade wars, increasing risk aversion and prompting investors to offload high-risk assets like Bitcoin.

Additionally, state-level Bitcoin-related legislative efforts have begun encountering obstacles. Currently, over 30 U.S. states have introduced bills related to strategic Bitcoin reserves or digital asset investments. However, some state governments have rejected such proposals. The most impactful case was the South Dakota legislature effectively killing—by delaying—the bill that would allow state investment in Bitcoin. Around the same time, similar strategic Bitcoin reserve bills in Montana and Wyoming were also rejected.

These developments highlight discrepancies between the Trump administration and state-level policies. Investors suddenly realized that passing Bitcoin legislation might not be as smooth as they had imagined. Repeated disappointments have inevitably weakened confidence in the Trump government's so-called "crypto-friendly" promises.

On another front, the U.S. stock market bubble and the indefinite delay of Fed rate cuts are also affecting the cryptocurrency market.

According to reports from First Financial News, by February 26, U.S. stocks had experienced four consecutive days of sell-offs, with major tech growth stocks plunging from their highs, posting cumulative losses ranging from 10% to 35%. Analysts note that this selling pressure on overvalued tech stocks is gradually spreading into the crypto space. Fears of a U.S. equity market collapse have led to sharply reduced risk appetite, causing capital to flee volatile assets such as Bitcoin and Ethereum. At the same time, the Federal Reserve shows no immediate intention to cut interest rates. In this high-rate environment, the U.S. dollar’s appeal as a global reserve currency has strengthened, leading some funds to flow back from crypto and other risk assets into dollar-denominated assets.

Cryptocurrency Market Laden With “Negative Buffs”

The cryptocurrency market has recently faced both internal and external challenges, piling up numerous “negative buffs.”

Since February this year, spot Bitcoin ETFs have suffered severe “bloodletting.” As a key channel for institutional inflows, their fund flow data is one of the crucial indicators influencing market confidence. However, throughout February, spot Bitcoin ETFs have seen nearly continuous net outflows, including several days with outflows exceeding $100 million.

According to iChaingo data, from February 18 to 26 (U.S. Eastern Time), U.S. spot Bitcoin ETFs recorded seven consecutive days of net outflows. On February 25 alone, net outflows reached as high as $1.14 billion—setting a new record for the largest single-day net outflow since the ETFs’ launch—clearly reflecting institutional investors’ bearish short-term outlook.

In comparison, while Ethereum spot ETFs have performed slightly better than Bitcoin ETFs, they still experienced five consecutive days of net outflows from February 20 to 26. Yet, Ethereum faces additional headwinds beyond this.

In reality, Ethereum has long been stuck in a scalability crisis, which is a primary reason for its relatively weak price performance over the past two months. Ethereum plans to alleviate scaling issues through the Pectra upgrade, but the rollout has not gone smoothly. According to CoinDesk, the Pectra upgrade activated on the Holesky testnet but ultimately failed to finalize. To date, Ethereum’s official team has not disclosed the reasons behind the testnet’s failure.

Moreover, Solana, once riding high on the meme coin wave, has recently suffered multiple setbacks. Amid successive blows from meme coins such as TRUMP (linked to Trump) and LIBRA (promoted by Argentina’s president), the perceived value of the meme coin market has significantly diminished. Many investors have lost interest in meme coins, and numerous analyses suggest that the meme coin craze may be nearing its end. As a result, the meme coin ecosystem—Solana’s main driver—has entered a depressed phase.

Even more concerning, Solana is approaching its largest-ever SOL token unlock “storm.” According to Cointelegraph, over 11.2 million SOL tokens (worth approximately $2 billion) will be unlocked on March 1, undoubtedly adding further downward pressure on SOL’s price. Crypto analyst Artchick.eth noted, “Over the next three months, more than 15 million SOL (around $2.5 billion) are expected to enter circulation.” Affected by this, SOL briefly dropped to around $130, marking its lowest point since September 18, 2024.

Frequent Hacker Attacks

In the late night of February 21, cryptocurrency exchange Bybit was hacked, resulting in the theft of over 400,000 ETH and stETH (totaling over $1.5 billion in value)—the largest theft in crypto history. This incident reignited concerns over cryptocurrency security and triggered massive panic-driven sell-offs among investors. Although Bybit worked hard to minimize the fallout, the enormous amount of stolen Ethereum undoubtedly became a “landmine” impacting market dynamics.

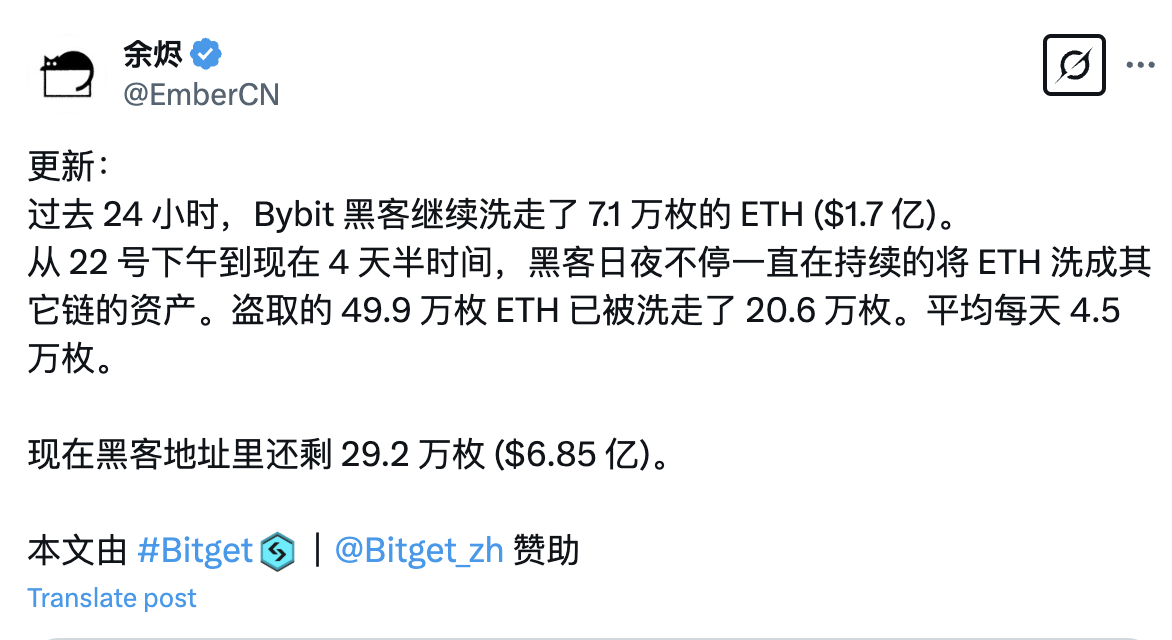

At the time of writing, according to monitoring by X user Yujin, the address marked as the Bybit hacker laundered approximately 71,000 ETH (worth about $170 million) in the past 24 hours. So far, around 206,000 ETH have been laundered, while the hacker’s address still holds 292,000 ETH (worth approximately $685 million). Previously, Yujin indicated the hacker is expected to convert the remaining ETH into other assets (such as BTC, DAI, etc.) within half a month.

Besides Bybit, stablecoin payment platform Infini was also hacked on February 24, losing nearly $50 million in crypto assets. Although the stolen amount is much smaller compared to the Bybit incident, the consecutive string of hacking events has not only shaken investor confidence but also directly impacted market conditions.

In summary, this downturn is not merely a market correction but a comprehensive reaction to institutional fund withdrawals, macroeconomic and policy impacts, hacking incidents, and bursting bubbles. The author believes that fundamentally, the sustained rally in Bitcoin and other cryptocurrencies since late 2024 had accumulated significant profit-taking positions. Since early February, Bitcoin’s price has continued to fluctuate between $90,000 and $100,000 without breaking resistance levels, and lacking major positive catalysts, even without significant negative news, profit-taking alone could exert immense downward pressure on prices.

However, although the market is currently hit by multiple adverse factors, it is still too early to declare the “bull market over.”

Yu Jianing, co-chair of the Blockchain Committee at China Association of Communications Industry, said in an interview with Beijing Business Today: “The current downturn is likely a technical correction rather than a long-term trend reversal.” The author believes that in the short term, we should remain cautious about further downside risks triggered by sell-offs, but from a medium- to long-term perspective, market cleansing could lay the foundation for a new cycle. Furthermore, if the Trump administration introduces concrete cryptocurrency policies or if strategic Bitcoin reserve bills pass in various U.S. states, it could bring unpredictable momentum to the entire cryptocurrency market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News