Wintermute Market Watch: Sell-off is a macro reshuffle, crypto fundamentals remain intact

TechFlow Selected TechFlow Selected

Wintermute Market Watch: Sell-off is a macro reshuffle, crypto fundamentals remain intact

Position adjustments have made the market clearer, but market sentiment stability still depends on the performance of major cryptocurrencies.

Author: @Jjay_dm

Translation: TechFlow

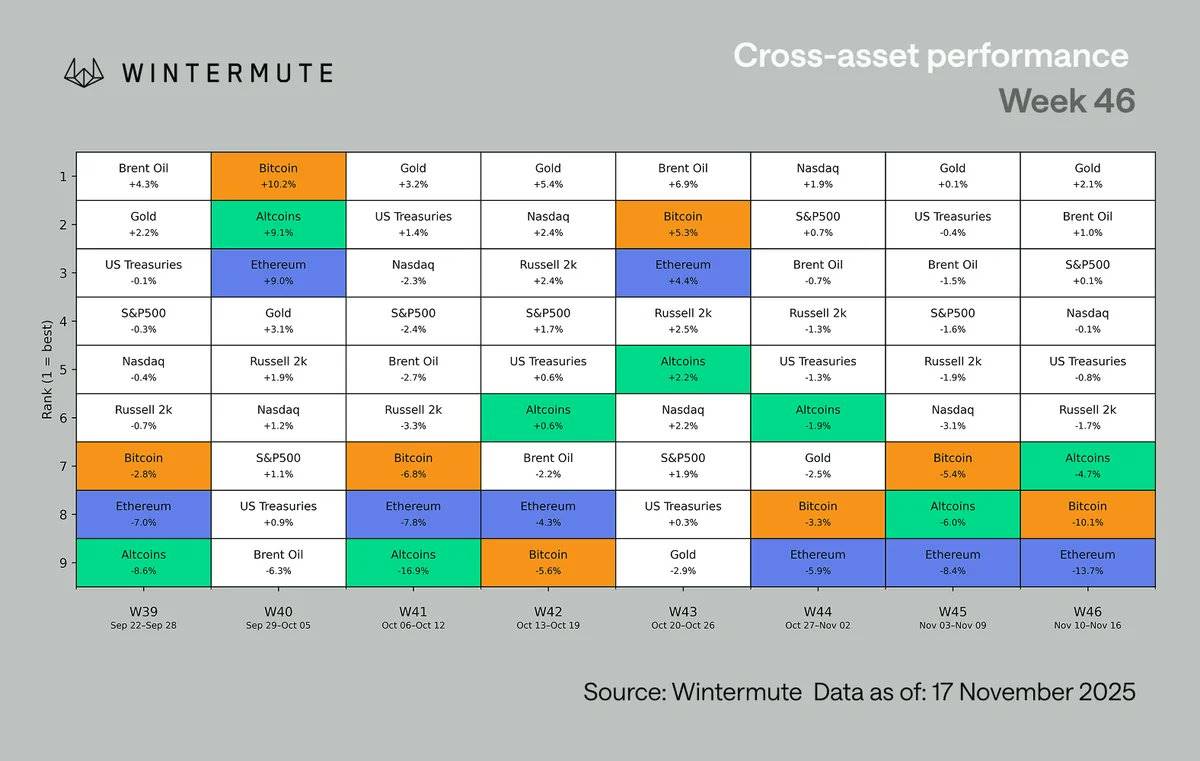

Last week's market sell-off was primarily driven by repricing of rate cut expectations, not structural collapse. Current positions have largely been unwound, and global easing policies continue. Bitcoin (BTC) needs to regain stability within its range to improve broader market sentiment.

Macro Update

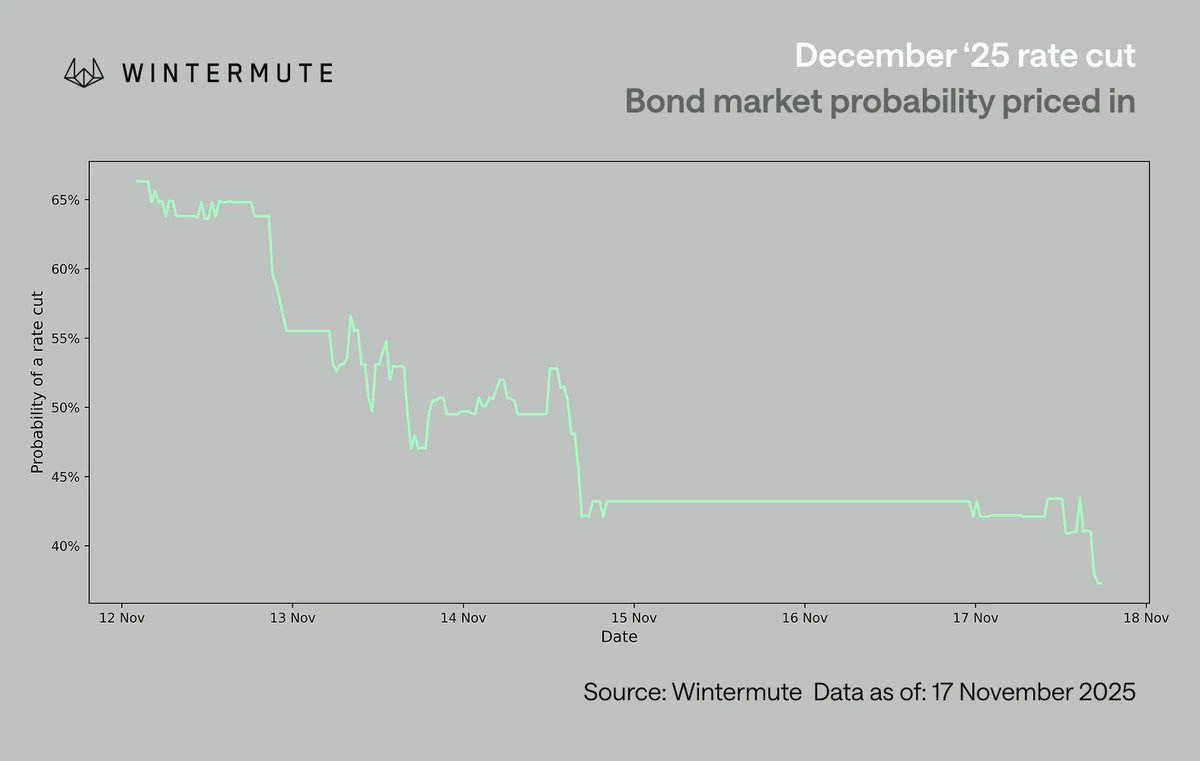

Last week’s market focus centered on digesting the sudden repricing of December rate cut expectations. The probability of a rate cut dropped sharply from around 70% to 42% within a single week—a shift amplified by the absence of other macro data. Fed Chair Powell stepped back from his previously near-certain stance on a December rate cut, forcing investors to reassess individual FOMC members’ views and revealing that rate cuts are not consensus. Markets reacted swiftly: U.S. risk assets weakened, and cryptocurrencies—being the most sentiment-sensitive risk assets—were hit especially hard.

Among asset classes, digital assets remain at the bottom in performance. This underperformance is nothing new; since early summer, crypto has trailed behind equities, partly due to its persistently negative skew relative to stocks. Notably, Bitcoin (BTC) and Ethereum (ETH) have actually underperformed the broader altcoin market—an unusual pattern during downturns. Two main factors explain this:

-

Altcoins had already been declining for some time;

-

A few sectors (such as privacy coins and fee-switching mechanisms) continued to show localized strength.

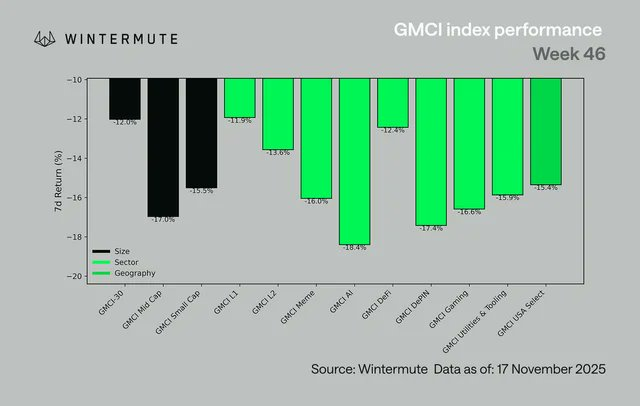

From an industry perspective, performance was broadly negative. The GMCI-30 index (@gmci_) fell 12%, with most sectors dropping between 14% and 18%. Leading the decline were artificial intelligence (AI), decentralized physical infrastructure networks (DePIN), gaming, and meme coins. Even typically more resilient categories such as Layer 1s (L1s), Layer 2s (L2s), and decentralized finance (DeFi) showed widespread weakness. This market move reflected broad risk aversion rather than sector rotation.

The chart above uses Monday-to-Monday data, which explains differences from the first chart.

Bitcoin (BTC) has once again fallen below the $100,000 mark—the first time since May. Prior to last week, BTC had successfully defended the $100,000 level twice (on November 4 and 7), even briefly rebounding to $110,000 early in the week. However, this rebound quickly faded during U.S. trading hours, with hourly candles showing a clear selling pressure pattern—each time U.S. markets opened, selling emerged, ultimately breaking $100,000 after two tests.

Part of the pressure came from whales reducing holdings. Typically, fourth-quarter to first-quarter selling is seasonal, but this year the trend started earlier, partly because many traders expect the four-year cycle to bring a weaker year. This expectation is self-fulfilling, as participants de-risking early amplify market volatility. Importantly, there has been no real fundamental collapse—pressure has been U.S.-driven and macro-induced.

Repricing of rate cut expectations is the more reasonable driver. After Fed Chair Powell pulled back on comments about a December rate cut, U.S. traders began closely analyzing individual FOMC members’ views. U.S. desks gradually lowered their expectations for a December cut—from around 70% down to the low 60% range—and global markets only later caught up to this shift. This also explains why the strongest selling pressure occurred during U.S. trading hours from November 10 to 12, even though rate cut probabilities still hovered in the mid-60% range.

While rate cut expectations have impacted short-term sentiment, the overall macro environment has not deteriorated. The global easing cycle continues:

-

Japan is preparing a $110 billion stimulus package

-

China continues loose monetary policy

-

The U.S. quantitative tightening (QT) program will end next month

-

Fiscal channels remain active, such as the proposed $2,000 stimulus plan

Current market moves are more about timing than direction—how quickly liquidity will be released and how soon it will impact speculative risk assets. For now, the crypto market is almost entirely macro-driven, lacking new data to stabilize rate cut expectations, remaining in reactive mode rather than constructive buildup.

Our View

The macro backdrop remains supportive, and position adjustments have cleared the market landscape, but sentiment stability still requires confirmation from major cryptocurrencies.

This sell-off resembles a macro-driven shock rather than a structural collapse. Positions have been cleaned out, U.S.-led pressure is well understood, and cyclical whale behavior along with year-end liquidity trends adequately explain the volatility.

The overall context remains constructive: global easing continues, the U.S. QT program ends next month, fiscal channels remain active, and liquidity is expected to improve in Q1 next year. What’s missing is confirmation from major coins. Unless Bitcoin (BTC) regains the upper end of its range, market breadth may remain limited and narratives difficult to sustain. This macro environment does not resemble a prolonged bear market. As markets are macro-driven, the next catalyst is more likely to come from policy and rate expectations rather than internal crypto flows. Once major coins regain momentum, a broader market recovery becomes possible.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News