Global payment convergence: What is Web3 doing beyond the mainstream narrative, from Tokyo to Nigeria?

TechFlow Selected TechFlow Selected

Global payment convergence: What is Web3 doing beyond the mainstream narrative, from Tokyo to Nigeria?

Payments are the starting point for stablecoins, and "global payments" represent their broader future as global financial infrastructure.

By: Web3 Farmer Frank

The concept of "financial inclusion" is something you often have to experience firsthand to truly understand.

Recently, I’ve been in Japan. As someone long accustomed to a QR code-driven payment ecosystem back home, I did feel the burden of carrying too much cash, the wear and tear of swiping cards, and the hassle of setting up and topping up a Suica card (the pain of Android users). Still, I always had Alipay and Visa/Mastercard as fallbacks—payment never became unmanageable.

But when we shift our map slightly southward—to Africa, Southeast Asia, Latin America—the situation changes entirely. In many of these countries, payment isn’t just a tool; it’s a “survival skill”:

Bank card penetration is extremely low. Many people don’t even have bank accounts. Small cross-bank transfers come with high fees, unstable settlement, or simply no commonly used banks offering cross-border services. Even where such services exist, international transfer costs are often shockingly high.

In these regions, “payment itself” is no longer an assumed utility like water or electricity—it becomes a privilege.

1. The World Is Folded: From Tokyo to Lagos

Living in East Asia (e.g., China, Japan) or the West, our perception of payments is often one of “overabundance.”

The seamless flow of WeChat Pay, the omnipotence of Alipay, or even the tap-and-go convenience of Suica in Japan make us believe that moving money should naturally be this easy.

But the world isn’t flat—financial experiences are folded across different populations.

Like the physically segregated three spaces in the sci-fi novel *Beijing Folding*, global finance also has deep, seemingly insurmountable divides. While people in the first space debate which DeFi protocol offers double-digit APY, those in the third space worry daily about how to safely bring their hard-earned income home.

Interestingly, against this backdrop, a counterintuitive truth often goes unnoticed: despite Africa's stereotypical image of being “backward,” if you look closely at emerging markets like Nigeria, you’ll find that people aren’t disinterested in digital payments—they’re held back by infrastructure.

According to the latest data from the Central Bank of Nigeria (CBN), internet transfers account for a staggering 51.91% of transactions by volume, while POS transactions take up 28.53%, together exceeding 80%. Meanwhile, ATM cash withdrawals—which we might assume would dominate—account for only 2.21%.

This indicates Nigerians already heavily rely on digital payments, especially direct bank transfers. In essence, this is because physical banking infrastructure—like branches—is actually more costly and harder to deploy than electronic banking alternatives.

As a result, in places like Nigeria, you don’t need to teach someone what an “e-wallet” is or how to use it—due to real-world pressures, they’ve already grown accustomed to using phones for nearly all transfers, much like how Axie Infinity found its base in Southeast Asia.

The only remaining pain point is “connectivity.” For a freelancer in Lagos, Nigeria, or a worker abroad sending remittances home, waiting 15 minutes or longer, along with layered exchange rate losses, remains a significant black box.

They depend heavily on digital payments, yet lack stable, low-cost, globally connected payment infrastructure. It is precisely under these conditions that Web3 offers the first real glimpse of a new path—one independent of the traditional banking system.

2. Web3 Payments Should Encircle Cities from the Countryside

This is why I’ve long believed that the revolutionary potential and immense momentum of Web3 and stablecoins in marginalized regions like Africa and Latin America—through a strategy of encircling cities from the countryside—has long been overlooked by mainstream narratives.

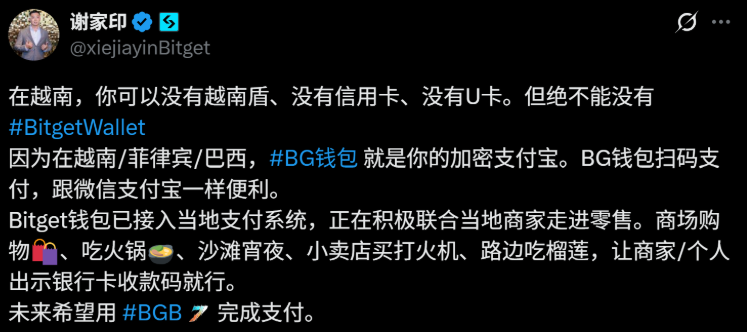

A recent video showing Xie Jiayin using stablecoins to pay in Vietnam sparked widespread discussion. Honestly, it struck me deeply.

The key moment was seeing a direct payment made via cryptocurrency wallet transfer—without going through a U-card intermediary.

While such QR-based transfers are common in China, they rely on highly mature, closed-loop systems like Alipay and WeChat—a unique product of China’s context and two decades of internet development, difficult to replicate elsewhere.

The model shown in the video is fundamentally different: scanning a VietQR code in Vietnam using Bitget Wallet. Though the front-end feels just like Alipay, behind the scenes, the transaction occurs via Solana network crypto transfer, instantly converted into fiat through middleware protocols before reaching the merchant’s account.

The crucial difference lies in “reproducibility”—this Vietnamese model could theoretically be replicated in any country with a local instant payment system.

Especially in developing regions like Africa and Latin America, where smartphones and e-wallets are somewhat普及, but traditional financial infrastructure remains inadequate.

This reveals a core user demand: users don’t care about ERC-20 or gas fees—they only care whether they can “pay by scanning a code.”

If we trace the evolution of stablecoins in Web3 payments, we’ve roughly gone through three phases:

-

On-chain-only transfers: A toy for tech enthusiasts—nearly unusable in daily life beyond NFTs and DeFi;

-

The “U-card” era: Using card issuers to load crypto onto Visa/Mastercard. Useful, but comes with high barriers (complex KYC, expensive issuance, high fees), and essentially still serves traditional card networks;

-

Direct-to-bank integration: Connecting on-chain wallets, stablecoin assets, and merchant收款 directly, bypassing issuing banks and card networks—this is currently the most exciting frontier;

Payment giants have already started voting with their actions.

From Circle launching programmable wallets and CCTP (cross-chain USDC transfer) to global payment leader Stripe acquiring Bridge, a stablecoin API provider, for $1.1 billion last year, efforts are clearly focused on advancing toward this third stage.

The recent launch of Nigeria bank transfer functionality on Bitget Wallet, powered by Aeon Pay’s backend, offers a “third option” beyond major banks and P2P:

-

Decentralized and no KYC: Unlike traditional exchanges requiring complex identity verification, preserving the censorship-resistant nature of Web3 wallets;

-

Lightning-fast experience: Compared to 10–15 minutes on P2P markets, direct transfers complete within 5–10 seconds;

-

Low-risk channel: Funds go directly into the banking system through compliant payment gateways instead of passing through unknown individual P2P merchants, greatly reducing the risk of frozen accounts;

This means Web3 wallets are no longer just asset browsers—they’re beginning to directly connect via API to national central bank payment systems (such as Nigeria’s NIBSS Instant Payment).

From this perspective, U-cards—which currently dominate the landscape—will inevitably be replaced. Traditional financial institutions will increasingly integrate into Web3 payment flows and use cases, directly linking user wallets, merchant collections, and fund deposits/withdrawals through bank accounts, payment channels, and clearing systems—all while maintaining compliance.

3. The Ultimate Form of PayFi: When Wallets Become “Invisible Banks”

This leads to a critical practical question: Web3 doesn’t need to reinvent physical payment networks today—it needs wallets to “infiltrate” existing ones.

I’ve always believed the ultimate form of PayFi may be a purely on-chain payment network that completely bypasses Visa/Mastercard—and even SWIFT:

-

Merchants: Accept stablecoin payments directly, without mandatory conversion to fiat;

-

Users: Send transactions directly from non-custodial wallets, self-custody funds, with instant on-chain settlement;

-

Backend: Supported by compliant stablecoin issuers and on-chain clearing networks, eliminating reliance on Visa/Mastercard or SWIFT, thus removing traditional intermediaries’ tolls;

But this remains an ideal. Before such a full transformation of the payment system, the most viable, realistic, and sustainable path forward is still connecting stablecoin payment gateways directly to local banking networks.

After all, TradFi excels in compliance, regulatory frameworks, account structures, and risk control, while Crypto offers inherent advantages in asset openness, global liquidity, and trustless execution. Only by combining both can we achieve the optimal balance of “compliance” and “flexibility” today.

In fact, this trend is already underway.

Take Bitget Wallet’s implementation in Nigeria: strip away the “Crypto” technical layer, and what you’re left with is essentially an offshore banking app with global liquidity.

Imagine a regular user in Lagos opening Bitget Wallet—not just gaining access to an on-chain asset management tool, but a super-powered Alipay that lets them hold USD (in stablecoins) and instantly send money to the corner store owner (into a local bank account) in seconds.

This could very well be the early prototype of a killer PayFi application in emerging markets.

Objectively speaking, only when Web3 wallets can seamlessly connect through compliant channels to real-time national payment systems (like Nigeria’s NIBSS, Brazil’s PIX, India’s UPI) can this system hope to truly bypass the high cost and inefficiency of the traditional SWIFT system.

In the near future, products like Bitget Wallet might even surpass existing cross-border solutions like Airwallex and Wise in both cost and user experience.

Final Thoughts

Payments are the starting point for stablecoins, and “global payments” represent their broader future as global financial infrastructure.

Vietnam’s QR payment integration, Nigeria’s off-chain bank transfer deployment—these are precisely where stablecoins can play a greater role: not by replacing banks, but by filling the gaps that banks cannot cover.

I hope more wallets and Web3 projects will continue experimenting and diving deeper into these complex local environments.

Only then will “global payments” cease to be just a narrative and become a tangible, visible reality.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News