McKinsey's重磅 report: Defining 13 frontier technologies for the next five years

TechFlow Selected TechFlow Selected

McKinsey's重磅 report: Defining 13 frontier technologies for the next five years

"The future competition will no longer be about breakthroughs in individual technologies, but rather competition between ecosystems, talent systems, and values."

From the roar of steam engines to the silent revolution of the internet, waves of technology have continuously reshaped the world's landscape without notice.

Today, we stand on the brink of an even more powerful technological transformation—artificial intelligence has begun to "think," robots are stepping beyond factory walls, semiconductors are becoming the "new oil" of the intelligent era, and space is transforming from an unreachable dream into a new commercial frontier.

Looking at the present moment, which technologies will define the next five or even ten years?

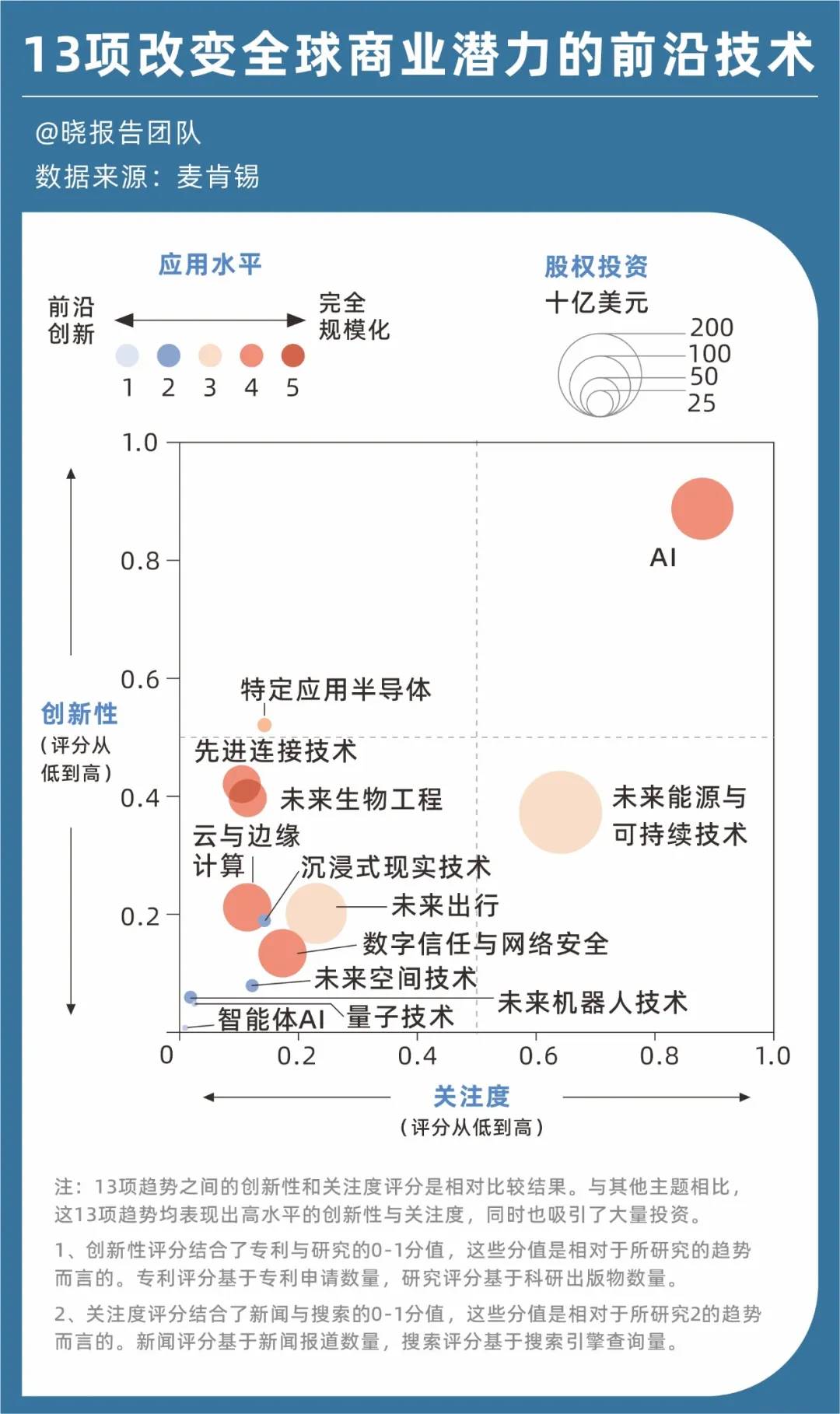

McKinsey’s recently released report, Technology Trends Outlook 2025, attempts to answer this question by identifying 13 cutting-edge technological trends with the potential to transform global business. It maps out a development blueprint for these technologies across four dimensions: innovation, attention, capital investment, and application level.

Overall, capital is highly concentrated in fields transitioning from technological breakthroughs to deep application phases—AI, future energy and sustainability, and future mobility—among which AI leads significantly in both attention and innovation.

In contrast, technologies such as application-specific semiconductors, advanced connectivity, future bioengineering, cloud and edge computing, digital trust, and cybersecurity, while less hyped than AI, have quietly become the "infrastructure" underpinning the digital society, approaching large-scale deployment.

Meanwhile, immersive reality, future space, future robotics, quantum technologies, and AI agents remain in incubation stages, yet their revolutionary potential is already emerging. For example, AI agents became one of the fastest-growing trends this year, attracting $1.1 billion in equity investment in 2024, a 1562% year-on-year increase.

A visitor experiences the Yungang Grottoes through AR glasses

In fact, regardless of the specific trend, each technology will reshape industries and has become an indispensable competitive asset for nations and enterprises alike.

In China, these technologies have been included in the national priority roadmap for future industries targeting 2035, with clear development goals established. Taking future space as an example, the Chinese market size is expected to exceed 800 billion yuan by 2030, with key directions including manned low-altitude flight, deep-space, deep-earth, and deep-sea exploration, and polar development.

Here, we summarize the key insights and data from McKinsey’s report to discuss the latest advancements, development trends, and talent demands in these technologies.

13 Tracks and Trillion-Dollar Opportunities

Facing these 13 cutting-edge technologies, McKinsey categorizes them into three groups based on their intrinsic "character": the AI Revolution, Computing & Connectivity Frontiers, and Advanced Engineering.

These three categories can be seen as responsible for "thinking," "connecting," and "acting," respectively. They permeate and stimulate each other, continuously shaping a complete picture of the technological wave over the next decade.

◎ First, the AI Revolution, encompassing AI and AI agents. As AI’s influence expands, it's notable that AI costs are plummeting—prices for certain inference tasks have dropped by 900 times within a single year.

Regarding these two sub-technologies, McKinsey views AI not only as a revolutionary and strategic technological innovation but also as an accelerator for progress in other domains and a catalyst for new "business opportunities" at intersections—for instance, AI being a key driver for application-specific semiconductors.

The other trend, AI agents, is this year’s rising star, rapidly becoming a critical direction in enterprise and consumer technology. An AI agent acts like a "virtual colleague," autonomously planning and executing multi-step tasks.

Currently, major companies are either adding agent capabilities to existing AI products or developing entirely new task-specific applications, making rapid progress especially in areas with strong training datasets like software coding and mathematics.

The market has caught on. MarketsandMarkets forecasts that the AI agent market will surge from $5.1 billion in 2024 to $47.1 billion by 2030, growing at a compound annual rate of 44.8%.

◎ Second, Computing & Connectivity Frontiers—these serve as the "skeleton" of AI and the digital world, including application-specific semiconductors, advanced connectivity, cloud and edge computing, immersive reality, digital trust & cybersecurity, and quantum technologies.

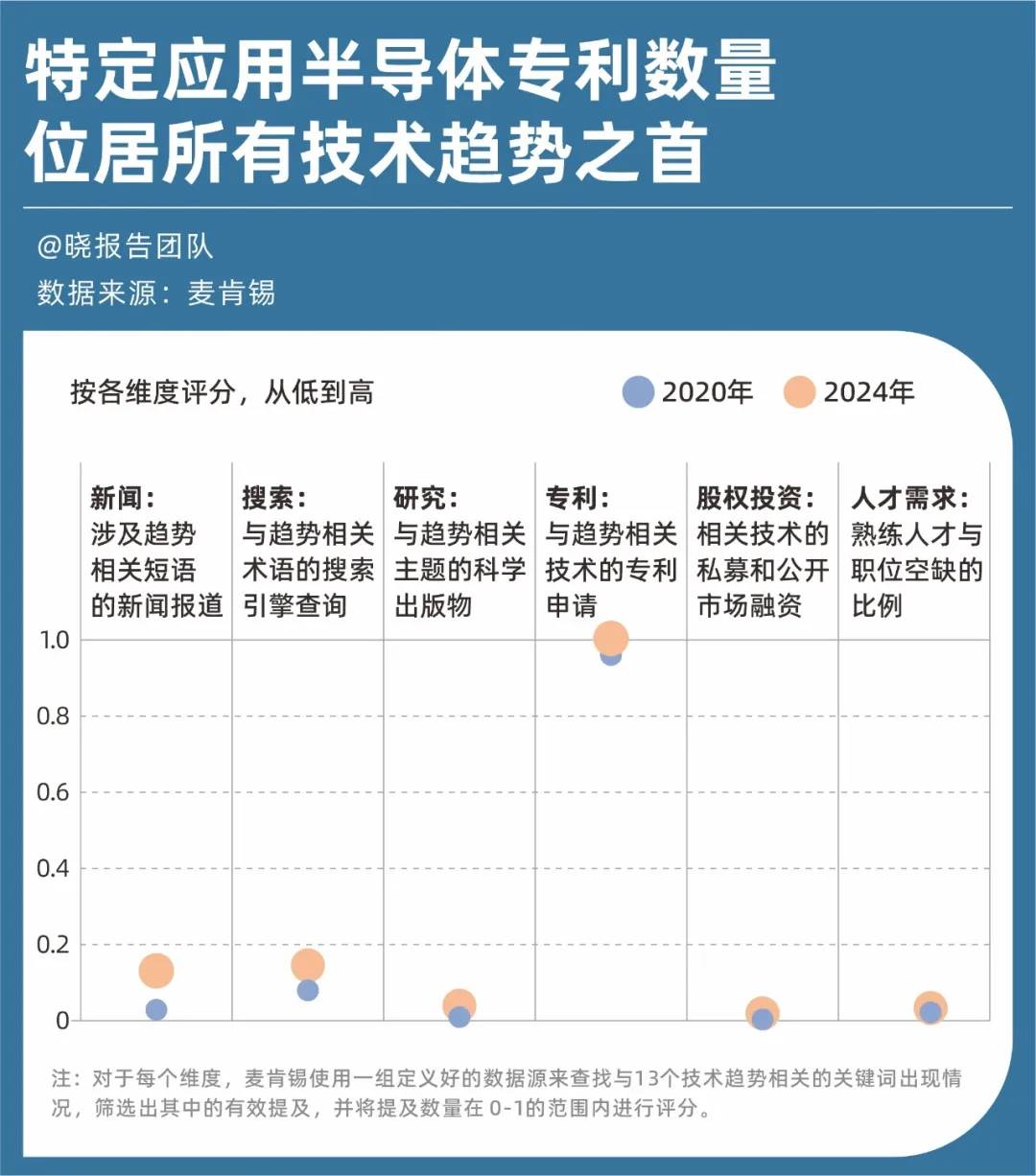

Among them, application-specific semiconductors are highlighted as another crucial trend in the report. Chips tailored for specific AI tasks are becoming the tech industry’s "new oil"—leading all technology trends in patent volume and attracting $7.5 billion in investment last year.

At the same time, AI’s growth drives insatiable demand for computing power, met by cloud and edge computing. McKinsey research indicates that by 2030, global demand for data center capacity could approach nearly three times current levels, with about 70% driven by AI workloads.

Additionally, in advanced connectivity, 5G now covers 2.25 billion users globally, with China leading in standalone 5G network deployment, while 6G is already underway, incorporating new capabilities like sensing. In immersive reality, AR/VR is expanding beyond gaming into healthcare and industrial design, with devices like Apple Vision Pro and Meta Quest redefining human-computer interaction. In quantum technology, despite its early stage, giants like Google, IBM, and Microsoft have achieved key breakthroughs in error correction and stability.

These technologies resemble ancient Silk Road stations and roads—they don’t directly produce goods, but they determine the scale and boundaries of commerce.

◎ Third, Advanced Engineering, including future robotics, future mobility, future bioengineering, future space, and future energy & sustainability. These embody digital capabilities, bringing technology out of screens and into the physical world.

Over the past sixty years, robots have gradually become fixtures in advanced manufacturing, with over four million industrial robots currently operating in environments like automotive plants. Meanwhile, accelerated by AI, physical robotics have recently entered broader domains such as airports, large stores, and restaurants. McKinsey partner Ani Kelkar predicts that by 2040, the market size could reach approximately $900 billion.

In future mobility, China’s electric vehicle market grew逆势 by 36%, while autonomous driving, drone delivery, and air taxis are moving from concept to pilot programs—and even commercial deployment. The commercial drone delivery market is projected to reach $29 billion by 2034, growing at a compound annual rate of 40%.

Future bioengineering leverages technologies like gene editing and synthetic biology to improve health and human performance, reshape food value chains, and create innovative products. For example, CRISPR gene-editing technology received FDA approval for the first time, and AI is drastically reducing the cost and time of new drug development. The 2024 Nobel Prize in Chemistry was awarded to three researchers who used AI to predict existing protein structures and design new ones.

In future energy and sustainability, China not only dominates global photovoltaic manufacturing but also accounts for 60% of global hydrogen electrolyzer capacity. Additionally, nuclear energy is gaining attention for its ability to provide stable baseload power, with 31 countries committing to triple global nuclear capacity by 2050.

Six Key Trends Behind These Technologies

Beyond the 13 technological trends, McKinsey identifies six overarching trends in the report that serve as directional guidance for monitoring these frontiers.

① Rise of Autonomous Systems

Systems are no longer just executing commands—they can learn, adapt, and collaborate.

When AI agents can autonomously plan workflows, when robots can adapt to unfamiliar environments, and when self-driving cars navigate complex urban traffic, we must reconsider: where does human uniqueness lie? The answer may lie in creativity, ethical judgment, and strategic vision—qualities machines struggle to replicate.

② New Human-Machine Collaboration Models

Human-machine interaction is entering a new phase characterized by more natural interfaces, multimodal inputs, and adaptive intelligence, blurring the line between "operator" and "co-creator."

From immersive training environments and haptic robotics to voice-driven "copilots" and sensor-equipped wearables, technology is responding more precisely to human intent and behavior. This evolution shifts the human-machine relationship from "machines replacing humans" to "machines enhancing human" capabilities.

③ Challenges of Scaling Applications

The surging demand for compute-intensive workloads—especially from AI agents, future robotics, and immersive reality—is placing new pressure on global infrastructure. Yet realities persist: strained power supply, fragile chip supply chains, and lengthy data center construction cycles…

This means scaling cutting-edge technologies requires not only solving technical architecture and efficient design issues but also navigating complex real-world challenges in talent, policy, and execution. It reminds us that the prosperity of the digital world depends on the support of the physical world.

④ Regional and National Competition

Undeniably, control over key technologies has become a focal point of global competition. Rivalry between China and the U.S. in chips, AI, and quantum computing is intensifying, while Europe seeks to establish its digital sovereignty through regulations like the AI Act.

Technology is no longer a borderless public good—it is now a cornerstone of national security and a symbol of economic sovereignty. This dynamic challenges global tech cooperation but also creates opportunities for regions to develop distinctive strengths.

⑤ Parallel Development of Scale and Specialization

Innovations in cloud services and advanced connectivity are driving both scale and specialization. On one hand, general-purpose model training infrastructure is rapidly expanding within massive, energy-intensive data centers. On the other, innovation at the "edge" is accelerating, embedding low-power technologies into smartphones, vehicles, home control systems, and industrial equipment.

This dual-track development yields both large language models with staggering parameter counts and increasingly rich domain-specific AI tools capable of running in nearly any scenario.

⑥ Necessity of Responsible Innovation

As technologies grow more powerful and personalized, trust is becoming a critical threshold for adoption. Companies face increasing pressure to demonstrate that their AI models, gene-editing techniques, or immersive platforms are transparent, fair, and accountable.

Ethics is no longer just the right choice—it’s a strategic lever in deployment that can accelerate or hinder scale-up, investment decisions, and long-term impact.

Where Are Capital and Talent Flowing?

Finally, let’s examine the "prospects" and "talent landscapes" of these cutting-edge technologies—where capital and talent are heading.

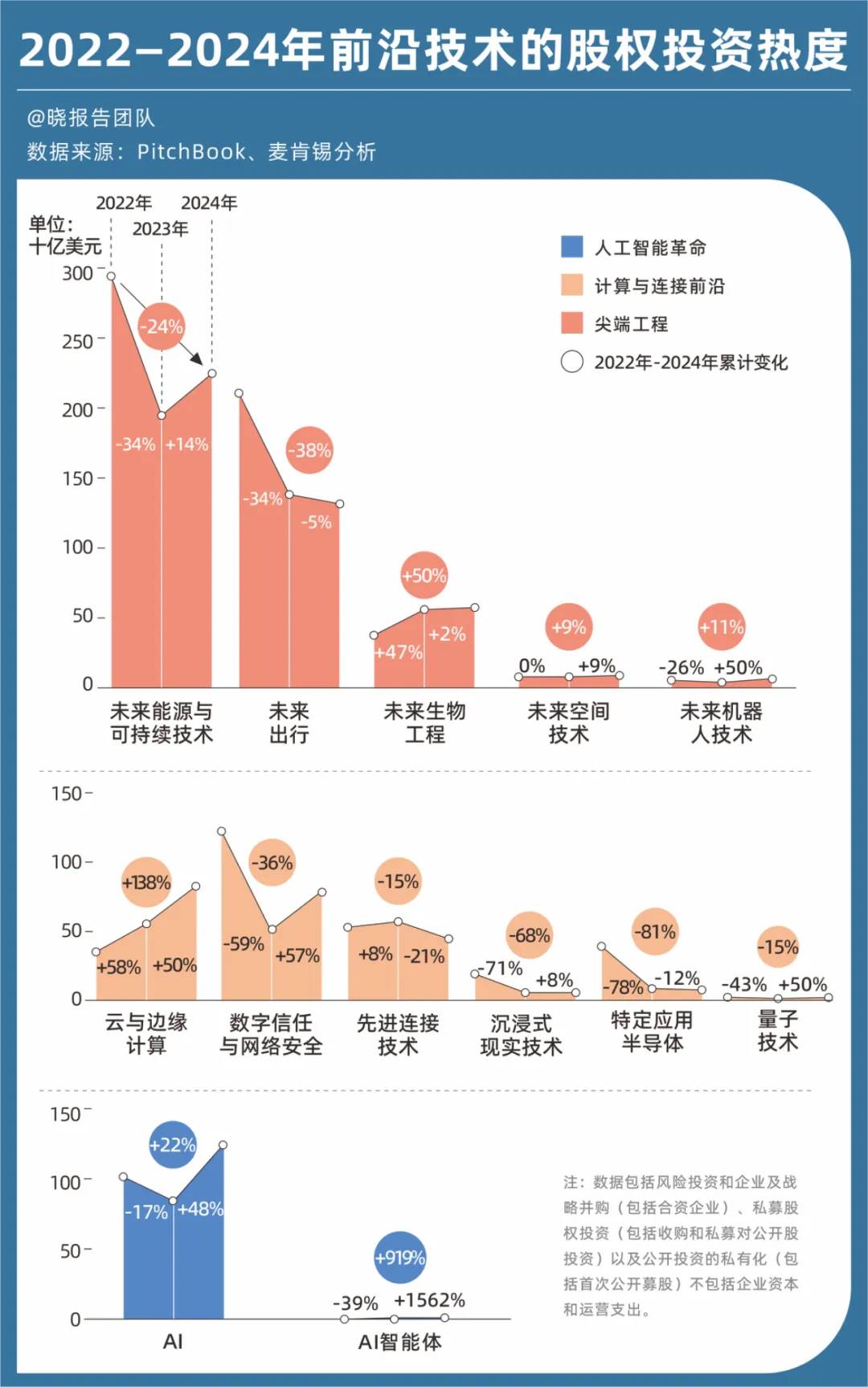

In 2024, investment in these 13 technologies warmed up, with AI and cloud & edge computing standing out in both investment scale and growth rate.

In terms of absolute capital concentration, the top five most "capital-intensive" technologies in 2024 were: future energy & sustainability ($223.2 billion), future mobility ($131.6 billion), AI ($124.3 billion), cloud & edge computing ($80.8 billion), and digital trust & cybersecurity ($77.8 billion).

In growth momentum, AI agent technology is "on fire," with investments soaring 1562% in 2024. Future bioengineering and cloud & edge computing achieved consecutive two-year financing growth. Investments in AI and future robotics, after brief declines, rebounded in 2024 to levels higher than two years prior.

Notably, in parallel with capital flows, a quiet war for talent has already begun.

According to the report, job demand increased in six of the 13 technologies in 2024. Demand for AI agent roles surged 985%, while AI and application-specific semiconductor roles grew 35% and 22%, respectively. Software engineers emerged as the most sought-after role.

Significantly, the talent skill demand ratio reveals a harsh truth: technology is evolving far faster than talent can be cultivated. In the hottest fields—AI and application-specific semiconductors—the talent supply-demand imbalance is particularly acute.

AI has the most urgent need for data scientists, with a talent ratio of just 0.5 (two jobs competing for one candidate), meaning every company is vying for people skilled in Python data processing and model building. In application-specific semiconductors, the situation is even more extreme—experts proficient in GPU architecture and machine learning hardware have a supply-demand ratio as low as 0.1, equivalent to ten positions waiting for one qualified individual.

Cross-disciplinary fields like future robotics and future bioengineering demand a new breed of "cross-domain talent." Future robotics requires mechanical engineers alongside AI and software engineering experts, with an AI-skilled talent ratio of 0.2. In future bioengineering, someone who can design a robotic arm and program it for intelligent grasping is even rarer.

In future energy & sustainability and future space—fields representing humanity’s future—the "talent shortage" is even more pronounced. Talent with "green skills," such as expertise in clean energy and sustainable development, has a supply-demand ratio below 0.1—meaning fewer than one qualified applicant per ten related positions. While overall job numbers in future space are adjusting downward, demand for software engineers and Python experts remains strong due to the massive volume of satellite data requiring daily processing and analysis.

These figures suggest that pure coding skills are no longer sufficient. Composite talent combining "technology + context," "software + hardware," and "algorithms + ethics" will be the scarcest resource over the next decade.

Conclusion

Looking back, standing at the threshold of this great technological era, China occupies a complex and delicate position.

At the application level, our achievements are remarkable: extensive 5G coverage, high EV penetration, dominance in photovoltaic manufacturing, and leadership in commercial drone applications—all tangible "Chinese advantages." Yet at the foundational level, vulnerabilities persist in "chokepoint" areas such as semiconductor manufacturing, core AI models, quantum computing, and original biopharmaceutical technologies.

The greatest insight from McKinsey’s report may be this: future competition will no longer hinge on isolated technological breakthroughs, but on ecosystems, talent systems, and values.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News