The Hidden Narrative Behind ZEC's Surge: The Migration of Safe Havens for "Chen Zhi and Qian Zhimin Types"

TechFlow Selected TechFlow Selected

The Hidden Narrative Behind ZEC's Surge: The Migration of Safe Havens for "Chen Zhi and Qian Zhimin Types"

Bitcoin is insurance against fiat; Zcash (ZEC) is insurance against Bitcoin.

Author: Wenser, Odaily Star Daily

The U.S. government shutdown has finally ended amid widespread attention, but market sentiment has not recovered accordingly.

The crypto market has not seen the anticipated "bad news exhausted" rebound; instead, it remains dominated by a downtrend: BTC briefly fell below $90,000, ETH dropped below $2,900, and a broad market selloff has become the defining feature of the current market. Only privacy-focused assets like ZEC have defied the trend, carving out an exceptionally strong independent performance.

Meanwhile, two major cases that shook the industry are unfolding simultaneously: 127,000 BTC held by Chen Zhi, the alleged figurehead of the "Crown Prince Group," was seized by the U.S. government; Qian Zhimin, the mastermind behind the Blue Skies Greed scheme involving over 40 billion yuan in illegal fundraising, was captured after seven years on the run, with more than 60,000 BTC under her control now in legal limbo.

Beneath these two incidents lies a domino effect—the censorship resistance and anonymity of Bitcoin are facing unprecedented skepticism from tech enthusiasts, purists, and even mysterious darknet whales.

When real-world authoritarian power collides head-on with decentralized technology ideals, the outcome is far from romantic, prompting idealists to reflect: judging by the ultimate ownership of BTC assets, nation-states emerge as the final victors.

This forces the crypto industry to revisit an old question: if BTC can no longer fulfill the role of a "censorship-resistant currency," what will be the next symbol of privacy and on-chain asset storage? The market may already have an answer—ZEC, rising逆势 during this period, is emerging as the right "version solution."

ZEC’s significant surge may not be the result of manipulative schemes but rather reflects genuine long-term demand from large investors. This conclusion is supported by multiple narratives and data dimensions.

When Authoritarian Power Punctures the Illusion of Censorship Resistance: BTC Is No Longer a Noble “Safe Haven” Asset

One direct reason for the renewed faith in ZEC as a “privacy coin” lies in the hidden implications revealed by the two recent high-profile “large BTC asset seizures”: Bitcoin’s censorship resistance and anonymity are undergoing severe scrutiny.

First, consider the case of Chen Zhi, leader of the Crown Prince Group, involving $15 billion in illicit funds.

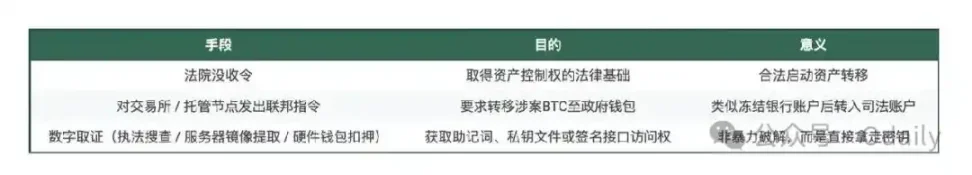

U.S. judicial and intelligence agencies demonstrated a complete operational process for handling on-chain assets: on-chain identification → financial blockade → judicial takeover. This represents a seamless integration of “on-chain tracking capabilities” with “traditional legal authority”:

Step 1: On-chain Tracking—Identifying the “Funds Container.” Bitcoin's anonymity is often misunderstood. In reality, its blockchain is a public ledger where every transaction leaves a trace. The Chen Zhi group attempted to launder money using the classic “spray-and-funnel” method: dispersing funds from a main wallet into numerous intermediate addresses like water from a sprinkler, then reaggregating them into a few core addresses. While seemingly complex, frequent “scatter-converge” patterns create unique graph signatures. Analytics firms (e.g., TRM Labs, Chainalysis) used clustering algorithms to map the “funds reflux,” proving all these scattered addresses pointed back to one controlling entity—the Crown Prince Group.

Step 2: Financial Sanctions—Cutting Off “Liquidity Channels.” After identifying the assets, U.S. authorities imposed dual financial sanctions: Treasury Department (OFAC) sanctions blacklisted Chen Zhi and related entities, prohibiting any U.S.-regulated institution from transacting with them. FinCEN Section 311 designated key entities as “primary money laundering concerns,” cutting off access to the U.S. dollar clearing system. Although the BTC remained under private key control on-chain, their most critical value attribute—the ability to convert into USD—was frozen.

Step 3: Judicial Takeover—Completing “Ownership Transfer.” The final confiscation did not rely on brute-force private key cracking. Instead, law enforcement obtained “signing rights” through legal procedures (e.g., court orders), meaning they acquired seed phrases, private keys, or gained control of hardware wallets, enabling them to initiate valid transactions transferring BTC to government-controlled addresses. However, how exactly the U.S. government accessed the private keys in Chen Zhi’s case remains undisclosed, leading some in the community to speculate—based on prior security breaches at Lubian.com—that authorities exploited such vulnerabilities. Once the transaction was confirmed on the blockchain, “legal ownership” and “on-chain control” were unified.

The ownership of these 127,271 BTC officially transferred from Chen Zhi to the U.S. government in both technical and legal terms. This coordinated action clearly demonstrates: before state power, “on-chain assets are inviolable” is not absolute.

$15 Billion BTC Asset Transfer Process

This incident was further detailed in a technical溯源 analysis report released by China's National Computer Virus Emergency Response Center, which described this “largest virtual asset seizure in history” as a “classic black-on-black operation orchestrated by a state-level hacking group.” In the dark forest of crypto, alongside North Korea’s Lazarus Group, the “U.S. team” operates silently as “on-chain special forces.”

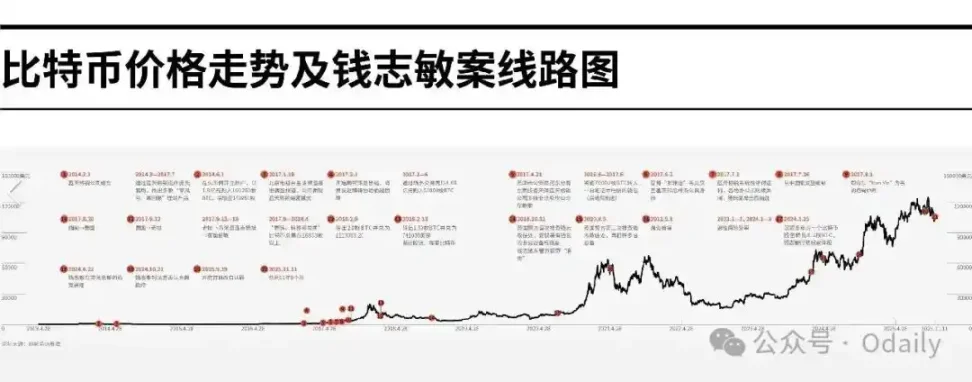

Compared to Chen Zhi’s gradual expansion across Southeast Asia, Qian Zhimin—the central figure in the 60,000 BTC money laundering case—has an even more legendary and convoluted story.

According to Caixin, she first learned about Bitcoin in 2012, aspiring “to one day hold 210,000 BTC—1% of total supply.” She nearly achieved this: between June 2014 and June 2017, Qian directed associates to purchase 194,951 BTC at an average price of just 2,815 RMB per coin (exact methodology unknown). By the time she was sentenced in the UK this November, Bitcoin had surged 266-fold to 750,000 RMB per coin.

Diaries written by Qian Zhimin between May and July 2018 reveal a “six-year plan” from 2018 to 2023, aiming to “retire at 45” and “rebuild a digital empire.” She planned to maintain “at least three identities,” including citizenship in St. Kitts and Nevis and “two European countries (one unknown to others but allowing free movement in Europe),” plus two long-term leased “safe havens” in Europe.

To support this, she anchored nearly all major expenses to Bitcoin. Her diary noted plans to sell at least 4,000 BTC at ~$6,800 each in 2018 for immigration, property, and team-building; up to 1,500 BTC at $8,200 in 2019; and around 1,750 BTC at $9,500 in 2020 for investing in exchanges and cultivating connections. She projected Bitcoin would stay between $40,000–55,000 from 2021 onward, forming the basis for grand projects like a “digital bank,” “family fund,” and even building her own kingdom.

Timeline Diagram of Qian Zhimin Case

Between late 2016 and 2017, Qian stored over 70,000 BTC in a laptop wallet (Odaily Star Daily note: another 120,000+ BTC details remain undisclosed). Police diaries indicate she “lost 20,008 BTC.” Combined with over 18,833 BTC circulated, transferred, or exchanged during her time in the UK, British police recovered approximately 61,000 BTC, along with BTC and XRP worth 67 million pounds.

Qian’s eventual capture stemmed from UK police monitoring suspicious wallet addresses and linking Binance KYC data to her associate “Seng Hok Ling” (Lin Chengfu), tracing both on-chain and off-chain activity. In April 2024, Qian was arrested while sleeping in a York Airbnb apartment.

This again underscores: while assets may exist on blockchain, humans cannot escape physical existence—and off-chain spaces fall squarely under state jurisdiction.

Imagination vs Reality

These two cases, involving over 180,000 BTC, force the market to reassess the real limits of Bitcoin’s “censorship resistance” and “anonymity” narratives. Indeed, with BTC ETFs approved, deep institutional involvement, and increasing regulatory demands for transparency, Bitcoin’s early narrative centered on anonymity and anti-censorship has gradually faded from mainstream discourse.

Now, ZEC—the standard-bearer of “PoW privacy coins”—has become the new “Promised Land” in the eyes of many Bitcoin OGs, purists, and tech enthusiasts.

Privacy BTC Is Dead, Privacy Coin ZEC Rises: The Market Reprices a New Safe Haven Asset

If ZEC’s “second wind” initially relied on endorsements from crypto figures like Naval, 0xmert, Arthur Hayes, and Ansem during its rise from $60 to over $100, its buyer base has since shifted beyond short-term speculation to include Bitcoin OG whales and purists with genuine privacy needs as it surpassed $200, $400, and $700.

ZEC Price Trend Over the Past Month

Specifically, ZEC—centered on the concept of a “privacy coin”—offers several advantages:

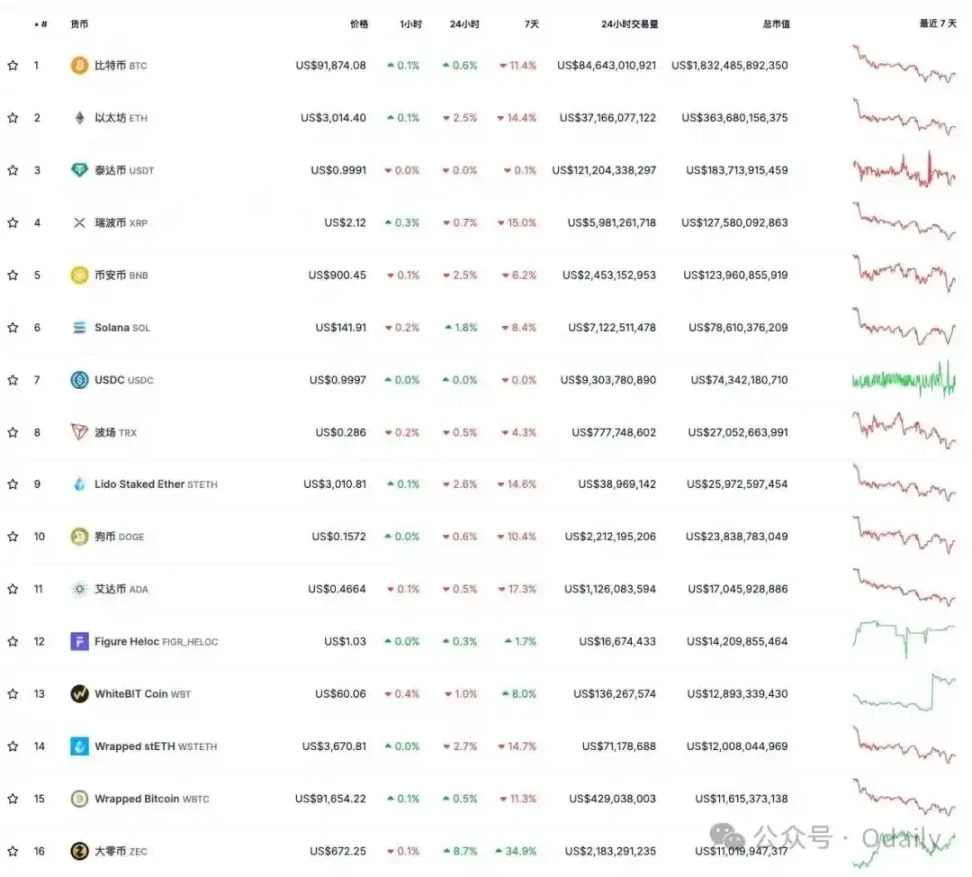

First, ample liquidity via major CEXs. According to Coingecko, ZEC’s 24-hour trading volume exceeded $2.26 billion at the time of writing, with Binance and Coinbase ranking first and second, accounting for over 33% and nearly 11% of volume respectively. In today’s liquidity-constrained market, this unique “CEX positioning” provides ZEC with a robust platform for capital inflow and counter-trend growth.

Second, real market demand driven by its differentiated “shielded pool” (anonymous privacy pool). Data shows Zcash (ZEC)’s shielded supply approached 5 million tokens on November 3; at the time of writing, it remains above 4.82 million, about 30% of circulating supply. On-chain activity includes over 26,000 transactions and more than 2,200 shielded transactions in the past 24 hours—indicating stable and active real-world adoption.

Third, relatively stable token circulation and smaller market cap compared to other major cryptocurrencies. Per Coingecko, ZEC’s circulating supply is nearly 16.4 million, with a market cap of ~$1.1 billion, ranking 16th overall. Excluding stablecoins and wrapped tokens like USDT, USDC, stETH, wstETH, WBTC, ZEC ranks 11th—offering greater upside potential than many multi-billion-dollar-cap peers.

Fourth, stronger compliance posture and lower regulatory pressure. Unlike controversial privacy coins like XMR and DASH, which faced legal battles, ZEC—as a mainstream PoW privacy coin—has no direct conflict with regulators. Its PoW mechanism also enhances censorship resistance. Combined with Electric Coin Co. (ECC)’s Q4 2025 roadmap, ZEC holds technical advantages. Additionally, ZEC’s optional privacy mode allows institutions to comply with reporting requirements, making it acceptable to regulators—unlike XMR.

Fifth, ZEC’s established ecosystem and highly technical, hacker-oriented community. As the origin of ZK-Rollup technology, ZEC’s community includes many tech leaders, crypto OGs, and prominent angel investors—such as Cobie (who claims to have held ZEC since 2016) and Gemini co-founder Tyler Winklevoss (who called ZEC “the most undervalued cryptocurrency” in 2021).

Combining these five strengths, ZEC naturally becomes the top choice for BTC whale holders, purists, and censorship-resistant asset advocates seeking to migrate sensitive holdings. Multiple data points confirm this.

Analyzing ZEC Market Performance Through Trading Data: From Real Adoption to Mainstream Focus

In our previous article “Buying ZEC to Dump BTC? Four Industry Truths Behind the Privacy Coin Surge” (https://www.odaily.news/zh-CN/post/5207240), we analyzed possible reasons for the privacy coin sector’s recovery. ZEC’s performance this month reaffirms that its rally is driven by both market sentiment and real adoption—not pump-and-dump manipulation.

ZEC Becomes a Concentrated Futures Holding: 24-Hour Volume Second Only to BTC and ETH

Per Coinglass, ZEC’s total liquidation in the past 24 hours exceeded $72.88 million, with $69.3 million from longs—ranking third only to BTC and ETH in liquidation volume.

ZEC Ranks Third in “Futures Liquidation Chart”

Moreover, ZEC futures trading volume and open interest remain consistently high: at the time of writing, 24-hour volume exceeds $6.6 billion; open interest surpasses $1.2 billion.

ZEC Futures Data Leads by a Wide Margin

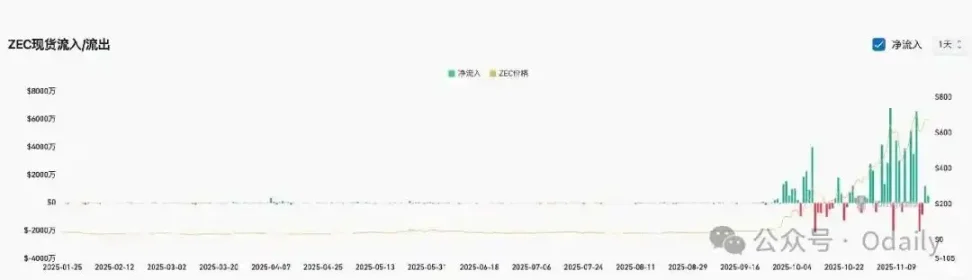

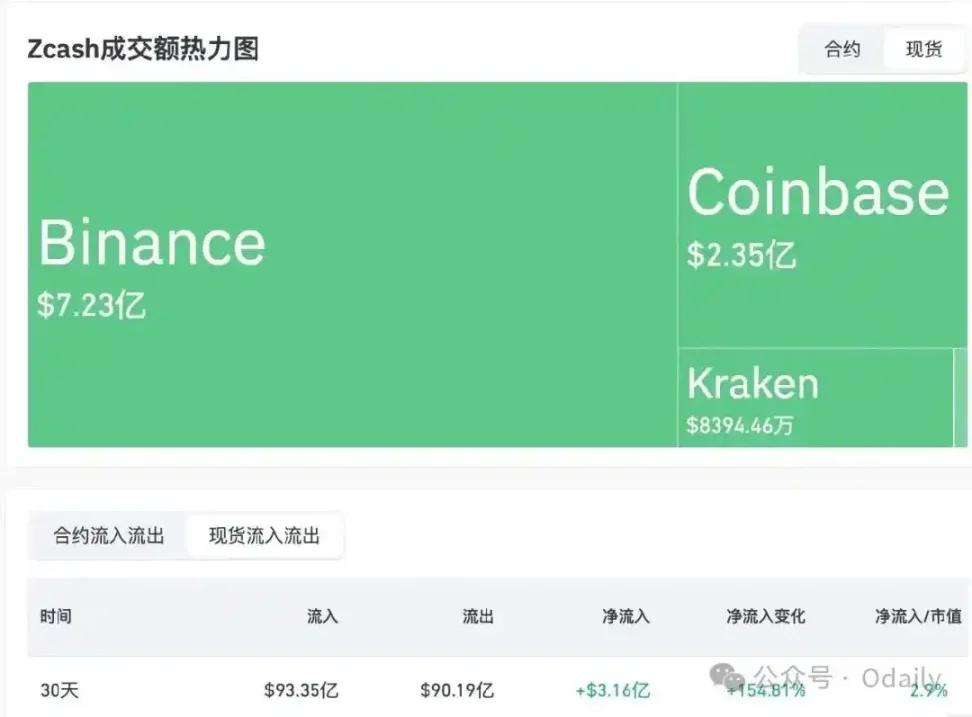

On the spot side, ZEC maintains net inflows on major CEXs: over the past 50 days since October 1, ZEC had only 15 days of net outflows; in the past 30 days, net inflow reached ~$316 million; over 50 days, ~$419 million. Within 24 hours, ZEC’s spot volume on Binance exceeded $720 million with a gain over 21%; on Coinbase, volume topped $230 million with a 17% increase.

ZEC Spot Inflow/Outflow Statistics

ZEC Spot Trading Heatmap and 30-Day Data

Behind ZEC’s Price Surge: From BTC Pair Volume to Broad Market Hype

Beyond overall volume, examining BTC trading pairs reveals two phases in ZEC’s rise:

Phase 1: Before November 7, BTC pair volume steadily increased. When ZEC broke its yearly high of $700, BTC-denominated trading volume briefly exceeded 110 BTC—showing continued significant BTC-to-ZEC trades.

Phase 2: After November 7, ZEC emerged as one of the few bright spots in a bearish market, amplified by the Chen Zhi and Qian Zhimin cases and BTC ETF outflows, shifting market attention toward widespread enthusiasm.

ZEC/BTC Trading Pair K-Line Chart

Looking back, after a slow climb in October, ZEC’s November ascent became much steeper—affected by broader market trends but also highlighting ZEC’s real utility and capacity to absorb large capital flows.

Especially after the first week of November, following intense media coverage of these events, Bitcoin’s privacy and censorship resistance were further questioned. Conversely, ZEC’s “privacy coin” attributes regained strong recognition in the crypto market.

In the second week of November, discussions around “BTC no longer private” exploded on X. On November 14, Delphi Digital’s Simon published a definitive piece arguing that “ZEC has succeeded BTC as a privacy-preserving, self-sovereign store of value.”

Thus, after over a month of development amid industry-wide downturn, ZEC formally entered the mainstream narrative. Traders who previously sold ZEC at $300–$400 began aggressively repurchasing, marking the first wave of “consensus-driven buying.” Key market features included:

• ZEC frequently posted daily gains of 20–30%, topping CEX gain charts;

• Multiple crypto OGs declared “BTC privacy is dead; ZEC is the true heir to privacy coins,” including BitMEX co-founder Arthur Hayes, who announced on November 7 that ZEC had become the second-largest liquid holding in his family office Maelstrom Fund, after BTC; on November 16, he launched a “meme creation campaign” to boost ZEC ecosystem engagement, calling ZEC his “top Christmas wish”;

• Privacy coins like XMR and DASH saw modest follow-on rallies;

• Natural buy-side orders appeared across CEX order books including Binance, Coinbase, and OKX.

Even Google Trends for “Zcash” and “ZEC” spiked 200–300%; more importantly, ZEC’s fundamental demand, emotional resonance, and active trading attracted significant capital attention. As mentioned earlier, Gemini co-founder Tyler Winklevoss contributed substantial buy-side volume.

ZEC Treasury Company Formation: Targeting Ownership of at Least 5% of Supply

On November 12, Nasdaq-listed Leap Therapeutics announced it purchased 203,775.27 ZEC tokens at an average price of $245 per token, rebranded as Cypherpunk Technologies Inc., and secured $58.88 million in private funding led by Winklevoss Capital.

On November 18, Cypherpunk Technologies Inc. (Nasdaq: CYPH) announced an additional $18 million purchase of 29,869.29 ZEC (Zcash) at an average price of $602.63. Combined with its prior $50 million ZEC acquisition, Cypherpunk now holds 233,644.56 ZEC at an average cost of $291.04.

This acquisition brings the company’s share of the Zcash network to 1.43%. Focused on privacy and self-sovereignty, Cypherpunk views Zcash as “the asset form of digital privacy” and a hedge against Bitcoin’s transparency and financial infrastructure, especially in an AI-rich future. The company recently appointed Will McEvoy of Winklevoss Capital as Chief Investment Officer (CIO) and board member. Its goal is to eventually hold at least 5% of total ZEC supply, advancing its Zcash-centered digital asset treasury strategy.

Whether ZEC can become another crypto asset widely adopted by Wall Street and crypto capital, as BTC once was, may soon attract widespread attention as its value continues to be recognized.

Conclusion: Is ZEC the “Privacy Insurance for BTC”? Perhaps It’s Even More

We are not encouraging investors to chase ZEC at highs. What we present is an objective analysis based on public data, market structure, and demand—which suggests that ZEC’s long-term trend may still have room to continue.

In the article “Why Naval Says: Zcash Is Insurance Against Bitcoin’s Privacy Flaws?” (https://www.odaily.news/zh-CN/post/5207299), Max Wong of IOSG Ventures detailed ZEC’s price rise and underlying technical mechanisms. His core argument echoes what Silicon Valley investor Naval said when first endorsing ZEC: “Bitcoin is insurance against fiat; Zcash (ZEC) is insurance against Bitcoin.”

Today, beyond serving as a privacy-enhancing complement to BTC, ZEC is increasingly seen by some market participants as the next bearer of the “censorship-resistant asset” narrative.

As the 21st century reaches its quarter mark, the value of freedom may no longer be defined solely by compliant, institutionally-backed BTC, but rather by technologies still focused on privacy and sovereignty. From this perspective, ZEC’s resurgence acts like a “sovereignty signal,” reigniting market discourse.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News