Why has Zcash (ZEC) become a safe haven during bear markets?

TechFlow Selected TechFlow Selected

Why has Zcash (ZEC) become a safe haven during bear markets?

Zcash's mission is more focused and more radical.

Author: Naly

Translation: TechFlow

Summary

Zcash (ZEC) can be seen as the invisible version of Bitcoin.

It has the same supply cap, the same halving mechanism, and the same deflationary structure—but it is private.

As institutions, governments, and native crypto users increasingly view Bitcoin as a sovereign store of value, the world is beginning to recognize the need for a second dimension of money—one that is not only scarce and self-sovereign but also permissionless and privacy-preserving.

In this rapidly advancing world of AI surveillance, programmable money, account freezes, and cashless control systems, Zcash offers a second dimension of monetary freedom—not just scarcity, but protection.

This report will explore in depth Zcash’s core concept as the “invisible Bitcoin” and why it may be one of the most asymmetric investment opportunities in crypto today.

Key Highlights:

-

A fixed-supply, Bitcoin-like monetary system, yet two halving cycles behind in maturity.

-

Rooted in deep cypherpunk heritage, including cryptographic setup involving Edward Snowden.

-

Easy to grasp even without technical knowledge: the idea of invisible money is intuitively powerful.

-

Regaining attention from institutions and thought leaders like Naval Ravikant, driven by the growing importance of financial privacy rather than hype.

This report breaks down the investment case for Zcash across eight key areas:

-

Philosophy

-

Origin Story

-

Technical Advantages

-

Competitors

-

Tokenomics

-

Macro Relevance

-

Risks and Challenges

-

Investment Thesis

1. Philosophy

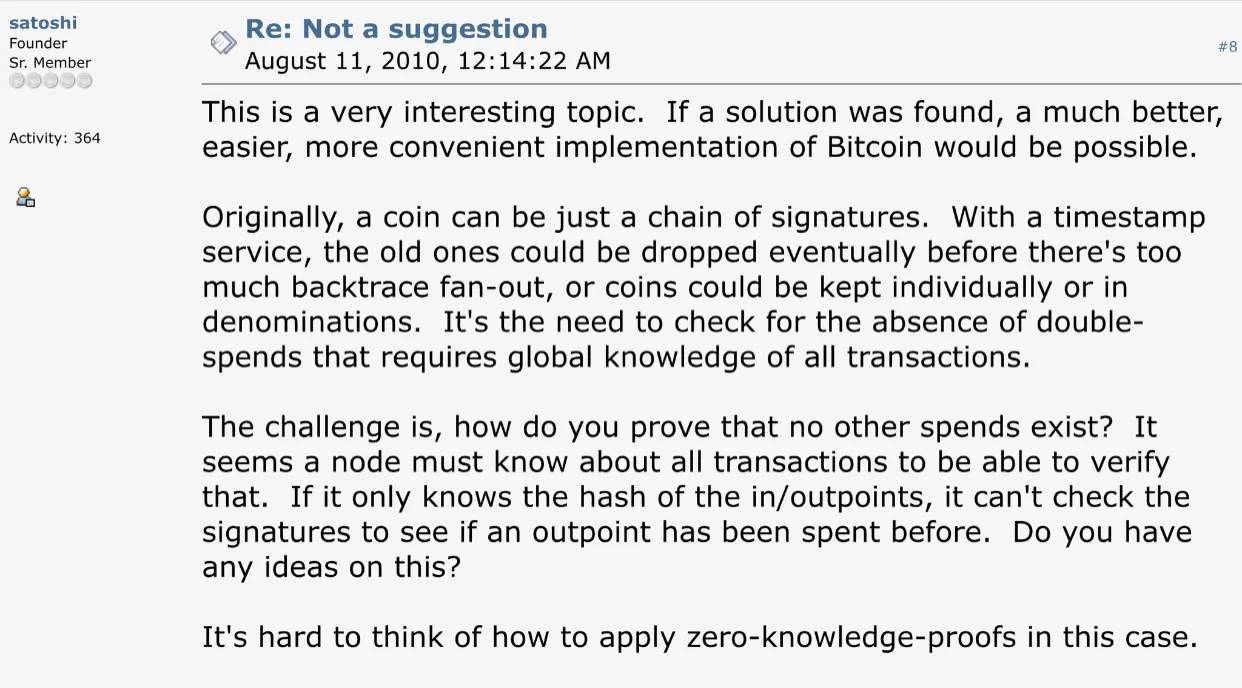

Zcash was not created to compete with Bitcoin, but to complete what Bitcoin lacks. Bitcoin grants monetary sovereignty; Zcash grants monetary privacy. It extends Satoshi’s design into the domain—privacy—that Bitcoin could never fully achieve.

From Bitcoin’s earliest days, privacy has been recognized as one of its fundamental weaknesses. Hal Finney—one of the first people to run Bitcoin and the recipient of Satoshi’s first transaction—was acutely aware of this. He warned that while Bitcoin’s transparent ledger excels at verifiability, it inevitably undermines fungibility, as coins can be traced and distinguished by their history. For Finney and early cypherpunks, this undermined the very essence of digital cash.

Hal Finney was active in cypherpunk mailing lists during the 1990s, where concepts like zero-knowledge proofs and cryptographic anonymity were first discussed as tools for personal autonomy. He believed future digital currencies needed both verifiability and privacy.

Years later, Zooko Wilcox—another veteran cypherpunk and early Bitcoin contributor—set out to solve this problem. Together with a world-class cryptography team, he co-authored the academic proposal Zerocoin, aiming to add full transaction privacy to Bitcoin. When core Bitcoin developers rejected integrating it, the team decided to build a new protocol from scratch.

This protocol became Zcash, launching in 2016. Its founding principle was simple yet radical: privacy is the default. Not a privilege or an optional feature, but a fundamental property of sound money.

Privacy has long been misunderstood as secrecy or concealment. In reality, privacy is about dignity, autonomy, and the freedom to choose who sees your information. It is the silent foundation of self-sovereignty.

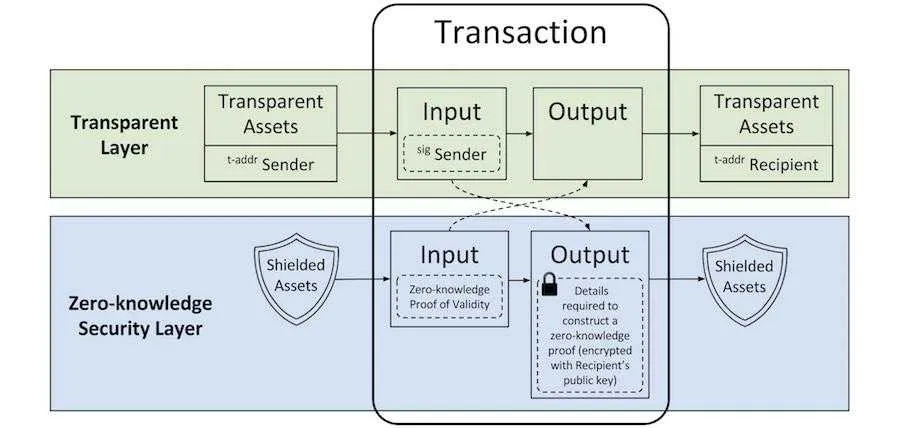

Bitcoin achieves censorship resistance through decentralization; Zcash goes further by enabling financial invisibility. Using zero-knowledge proofs (Zero-Knowledge Proofs), Zcash allows users to verify transactions without revealing sender, receiver, or amount—enabling value transfer on a public blockchain without exposing identity or activity.

This innovation made Zcash the first project to deploy zk-SNARKs in a permissionless blockchain, a milestone that shaped the broader field of zero-knowledge cryptography. Even today, Zcash remains one of the few Layer-1 protocols where privacy is a built-in, foundational attribute rather than an add-on layer.

Zcash’s origin story bridges two eras: the cypherpunk roots of Bitcoin and the cutting edge of modern cryptography. It represents the maturation of ideas first envisioned by Satoshi, Hal Finney, and the early internet builders: privacy is not a bug to fix, but a right to protect.

2. Origin Story

At Zcash’s inception, generating cryptographic parameters was required to enable shielded transactions. However, if these parameters were compromised, undetectable coin inflation could theoretically occur. To mitigate this risk, the Zcash team orchestrated one of the most compelling launch events in cryptocurrency history—the “Ceremony.”

The Ceremony was a globally distributed multi-party computation event conducted under extreme operational security. Each participant operated in isolated environments, using air-gapped devices, and destroyed all cryptographic materials after completing their task. The goal was to ensure no single party—or even multiple colluding parties—could reconstruct the key.

Edward Snowden participated under a pseudonym, only revealing his involvement in 2022. As a symbolic figure in the digital privacy movement, his participation further cemented the Ceremony’s place in crypto history.

Radiolab’s coverage of the event reads like science fiction:

-

Wizard hats

-

Paper maps, no GPS

-

Hardware burned in campfires

-

Randomly selected hotels, TVs removed

-

Laptops slept under pillows

-

Batteries removed mid-call

Bitcoin has the Genesis Block; Zcash has the Ceremony.

Bitcoin records history; Zcash encrypts history.

If you believe privacy is a collective right, then Zcash is where that belief begins. And in narrative-driven markets, this matters deeply. Memes and origin stories are not distractions from fundamentals—they are vessels of belief, and belief drives network effects.

3. Technology

Zcash was the first project to implement zero-knowledge succinct non-interactive arguments of knowledge (zk-SNARKs) on a permissionless blockchain. While zk-rollups have gained popularity in recent years, Zcash deployed zero-knowledge cryptography in production back in 2016.

The core of zero-knowledge cryptography is that one party can prove something is true without revealing any underlying data. In traditional blockchains like Bitcoin and Ethereum, verifying transactions requires publicly disclosing sender, receiver, and amount—all permanently recorded on a transparent public ledger.

Zcash offers a fundamentally different model. With zk-SNARKs, users can prove transaction validity without revealing any details. This isn’t a blurred overlay or an optional privacy tool—it’s a foundational feature, cryptographically enforced and embedded in the protocol.

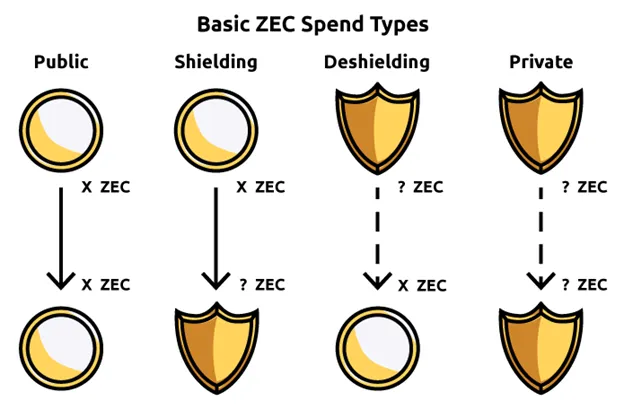

Zcash supports two types of addresses: transparent addresses (t-addresses), which function like Bitcoin, and shielded addresses (z-addresses), which offer full privacy. Funds can freely move between these two pools. This flexibility and the integration of the shielded pool make Zcash structurally distinct from nearly every other blockchain.

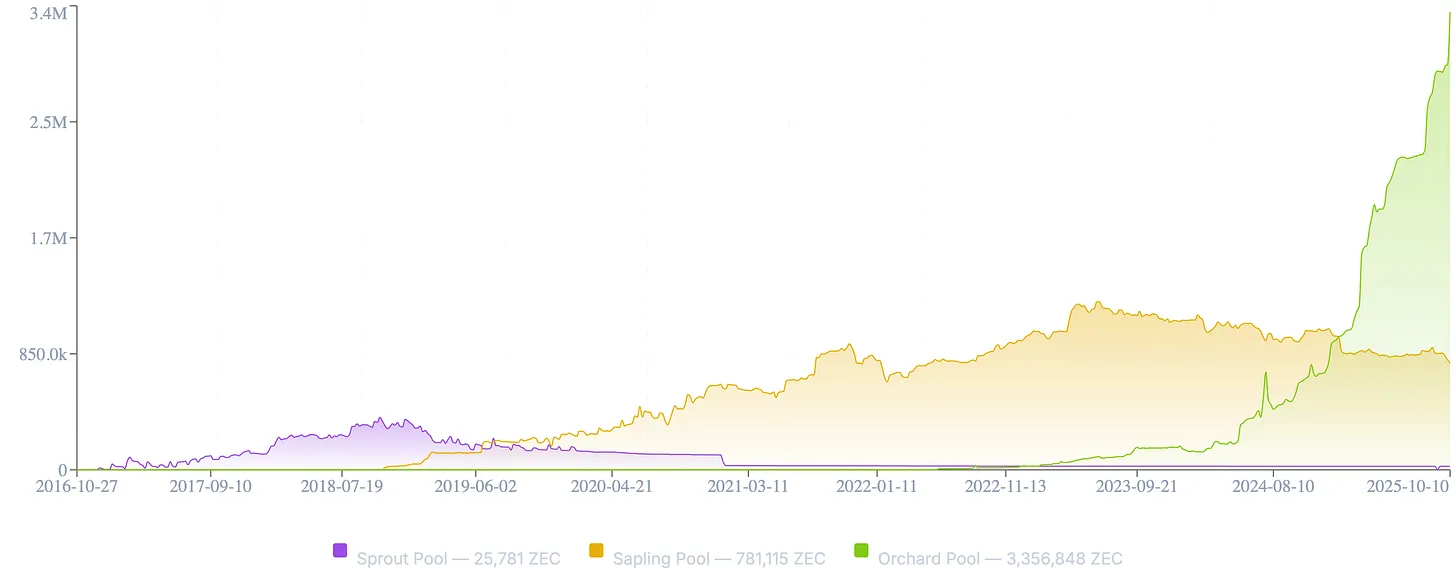

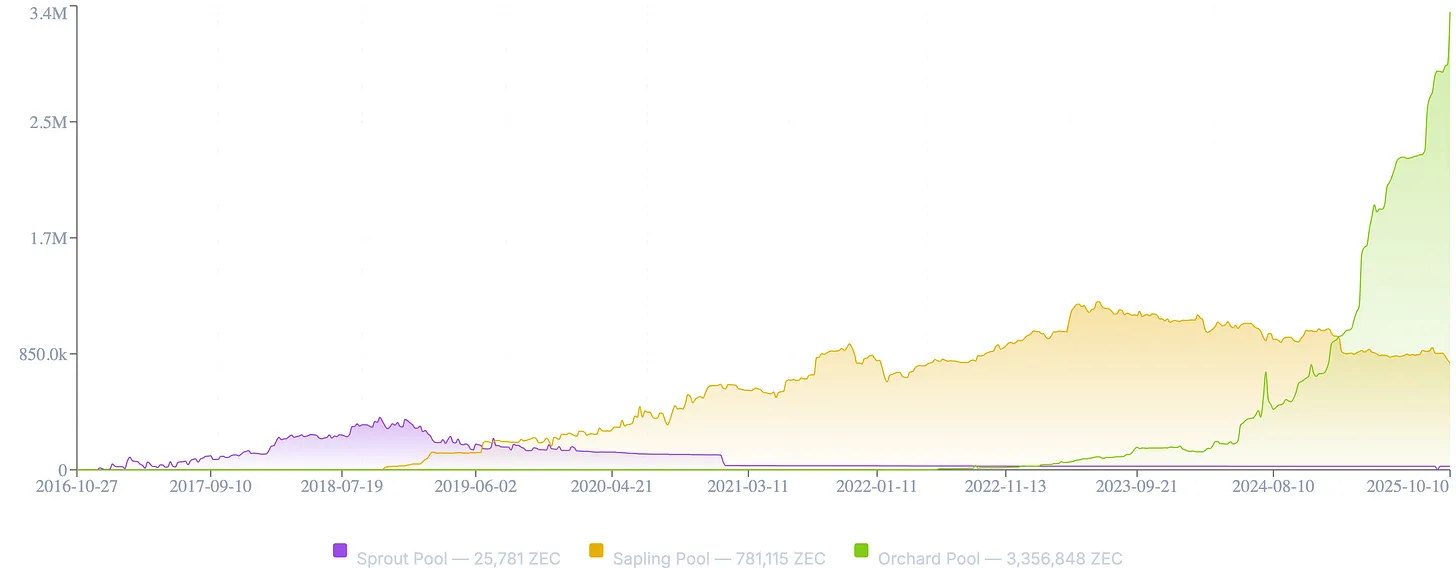

ZEC network privacy scales with liquidity in the Shielded Pool: like a crowd, the larger it grows, the harder it becomes to identify individuals within it.

Despite its technical strength, critics have pointed out that shielded transactions historically accounted for only a small fraction of overall network activity, leaving shielded users with a “smaller crowd to hide in.” Partly due to limited wallet support, usability hurdles, and relatively high computational requirements for generating zk-SNARK proofs.

At times, fully shielded ZEC transfers dipped below 5%. However, this trend is reversing. Recent upgrades to the proof system and new tools like the Zashi wallet have made shielded transactions more accessible. According to Zcash Foundation data, over 70% of active wallets now support shielded transactions, and daily shielded transaction volume is rising rapidly.

Today, over 25% of circulating ZEC is already in the shielded pool—and this number is climbing quickly. The distinction is crucial: privacy alone isn’t enough. For scalable adoption, privacy must be usable. Over the past decade, Zcash has focused on building cryptographic foundations; now, it’s beginning to build the user interfaces that will bring it mainstream.

4. Competitors

Before diving into Zcash’s tokenomics, it’s important to clarify its uniqueness within the broader landscape of digital asset privacy. In today’s market, Zcash faces few real competitors.

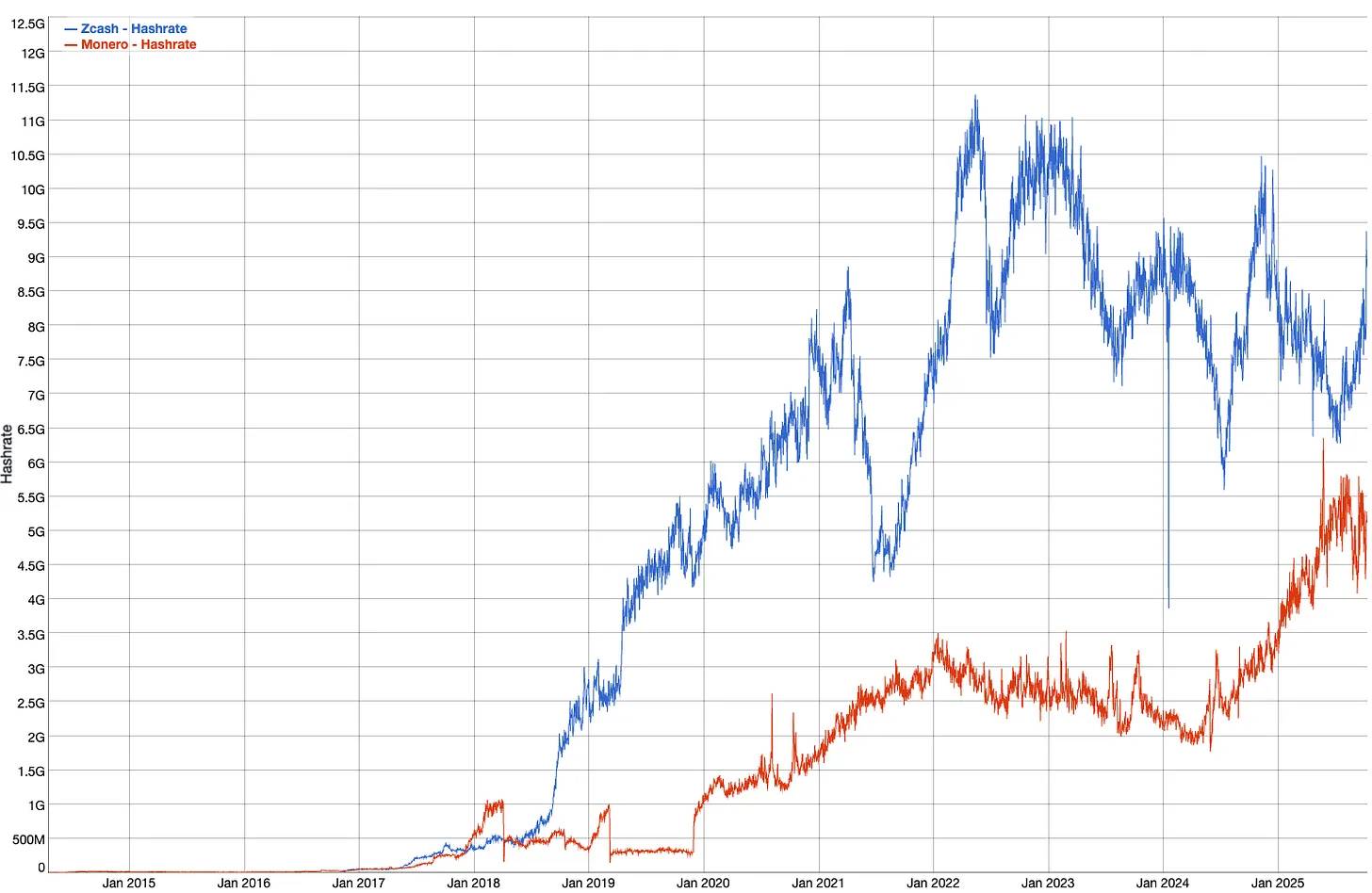

Monero is widely used but relies on ring signatures—a powerful technique that nonetheless exposes certain statistical and heuristic vulnerabilities. Even Monero’s own developers acknowledge these limitations and are exploring integration of zero-knowledge systems to enhance privacy. Additionally, Monero carries reputational baggage, often associated with darknet markets and unregulated activity.

Moreover, Monero is no longer listed on major exchanges like Coinbase, Binance, and Kraken, while Zcash remains freely tradable on these platforms. The reason? Monero’s privacy is absolute and thus non-compliant; Zcash’s privacy is optional—users can choose transparent or shielded transactions.

As Helius’ Mert observed:

“Zcash is dual-mode—you can choose to shield or not shield your assets.

If you want privacy to truly go mainstream, you need a system that can withstand real-world scrutiny.”

It is precisely this balance between privacy and compliance that gives Zcash a sustainable path forward. Its architecture enables selective disclosure via viewing keys, allowing users to share transaction data with auditors, regulators, or trusted third parties when necessary. In short, it offers privacy that operates within the system, not outside it—a prerequisite for broad adoption.

However, framing Zcash and Monero simply as competitors misses the point. The real challenge isn’t which privacy asset wins, but whether privacy itself can remain a pillar of the digital economy. Both ecosystems advance the field. Yet from design and adoption perspectives, Zcash’s hybrid model of privacy and compliance makes it far more likely to achieve mainstream and institutional integration.

Ethereum-based privacy protocol Tornado Cash was once a promising project, but it revealed the limits of systems with no regulatory adaptability. Sanctioned and dismantled by authorities, its developers face prosecution and its smart contracts are under intense scrutiny. The message is clear: privacy without resilience or adaptability cannot survive.

In contrast, Zcash implements privacy at the protocol level via zero-knowledge proofs—a method cryptographically stronger than ring signatures or mixer-based approaches. It combines mathematical rigor with practical flexibility, offering privacy that can coexist with transparency when needed. This combination of technical robustness and legal survivability is Zcash’s unique advantage.

Additionally, Zcash’s concept is exceptionally easy to understand: it’s the “invisible Bitcoin”—same supply cap, same halving model, same deflationary architecture, but with shielding. From adoption and investment standpoints, this narrative simplicity is invaluable.

Zcash began as a cryptographic experiment and is now maturing into a sovereign, private, programmable financial system. At a time of pervasive surveillance, programmable money, and geopolitical instability, it occupies a unique position.

5. Tokenomics

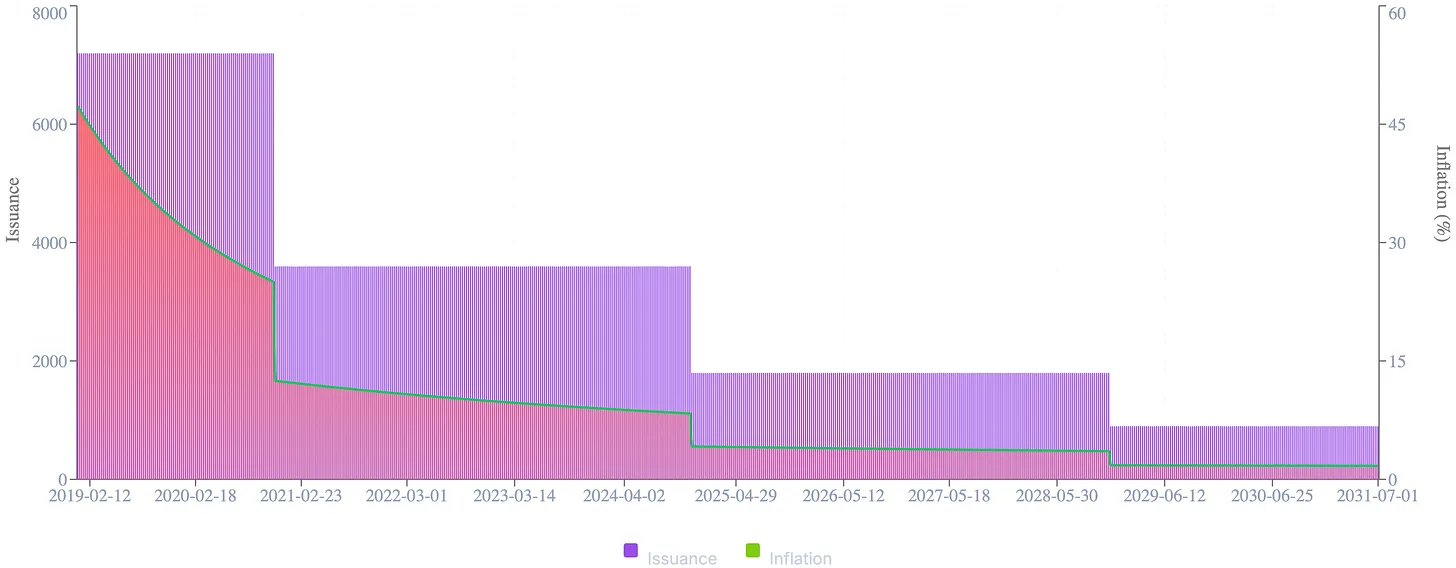

In the post-ETF era, institutions are familiar with Bitcoin’s halving cycle and fixed supply—making Zcash’s design appear like an asymmetric gift.

As Bitcoin’s model—fixed supply, four-year halvings, predictable scarcity—has become consensus among institutional investors, an asset with similar traits but enhanced with privacy represents a logical evolution.

Zcash fully replicates Bitcoin’s monetary architecture:

-

21 million maximum supply

-

Halving approximately every four years

-

Higher initial issuance

-

No ICO, no pre-mine, no VC allocations

This is Bitcoin’s scarcity model—but “invisible.”

But the critical difference is: ZEC’s halving cycle is two cycles behind. This lag means it follows the same monetary curve, but at an earlier stage of maturity.

This cycle differs in scale of capital entering the market. Those accumulating Bitcoin today are no longer retail speculators or crypto-native funds, but trillion-dollar asset managers, pension allocators, and sovereign entities seeking exposure to hard digital assets. The arrival of spot ETFs has institutionalized Bitcoin’s narrative, opening floodgates for traditional capital that now views programmable scarcity as a legitimate asset class.

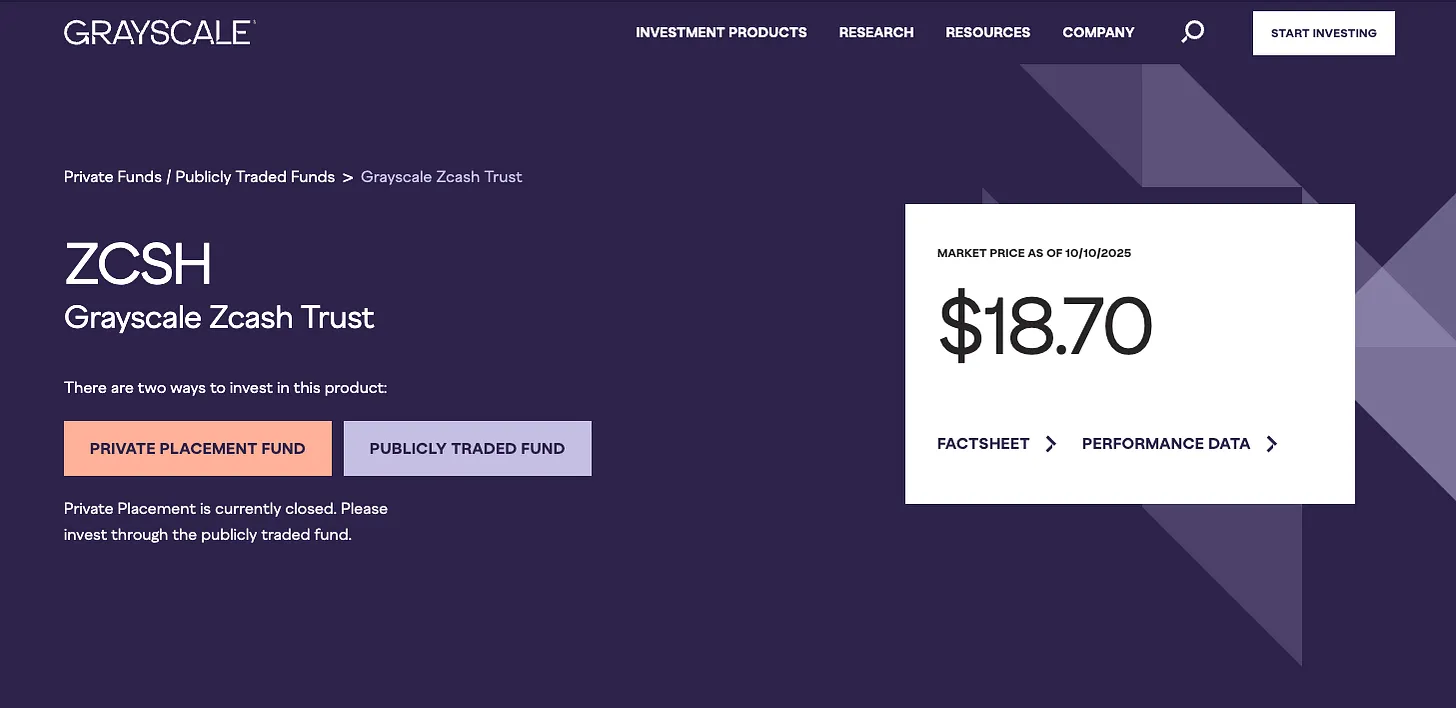

Figure: Grayscale Zcash Trust

Many asset allocators missed Bitcoin’s early stages and are unlikely to repeat that mistake. As institutional investment expands beyond Bitcoin, ZEC’s Bitcoin-like supply mechanics, regulatory acceptability, and clear narrative make it a natural secondary allocation.

ZEC offers the same mathematical scarcity as Bitcoin, plus an added dimension: invisibility. For large asset managers who recognize both the power and risks of transparency, even a small allocation to ZEC represents positioning for the next phase of the digital asset cycle.

Zcash launched in 2016, and its early market dynamics were shaped by a steep emission curve and the absence of presales or VC allocations. With supply concentrated among miners, selling pressure was immense. Price collapsed from initial speculative highs, holders diversified, and the asset entered a prolonged accumulation phase.

Today, these dynamics have reversed.

-

Circulating supply: ~16.3 million ZEC

-

Max supply: 21 million

-

Market cap: ~$4.46 billion, all-time high, despite price ($272) still below peaks from 2017, 2018, and 2021.

This divergence is critical. ZEC’s early high inflation kept price charts flat for years, but with supply growth now significantly slowed, market cap reveals the real trend—a steady structural rise echoing Bitcoin’s post-halving inflection points.

Figure: ZEC Market Cap (log scale)

Trading volume is surging (~$1.28B daily), and large players appear to be quietly accumulating. During the largest liquidation storm in crypto history—over $19B in forced liquidations—ZEC was one of the few assets to rise in price, clearly signaling accumulation.

On-chain data confirms this underlying shift:

-

Active addresses and privacy wallet usage are steadily increasing.

-

Over 70% of ZEC wallets now support z-address (privacy address) functionality.

-

Shielded pool transaction counts, flat for years, are now growing exponentially.

-

Holder distribution remains clean and organic: no pre-mine, founder rewards fully vested, long-term believers hold most supply.

From an investment perspective, this is a textbook asymmetric setup: fundamentals strengthening, supply curve tightening, market cap quietly hitting new highs, and the narrative—the “invisible twin of Bitcoin”—regaining resonance. This isn’t speculation—it’s repricing. The market is beginning to rediscover Zcash’s true value.

6. Macro Relevance

Zcash cannot be evaluated in isolation. Only against the backdrop of accelerating digitization, expanding surveillance, and deepening macroeconomic fragility does its significance emerge.

In most developed nations, public trust in institutions is eroding. Sovereign debt is unsustainable, fiscal deficits are structural, and central banks—constrained by politics and leverage—have fewer tools left. Inflation is no longer a temporary shock but a policy.

In this environment, Bitcoin has emerged as a primary hedge against currency debasement, offering protection as a modern reserve asset for those seeking shelter from fiat dilution. Yet every Bitcoin transaction, wallet balance, and sovereign purchase is visible on-chain. Bitcoin’s transparency ensures supply integrity but exposes holder privacy.

In short, Bitcoin hedges inflation—but not surveillance.

As physical cash disappears and central bank digital currencies (CBDCs) approach deployment, the ability to transact privately shifts from a right to a privilege. Zcash restores that right—not through policy, lobbying, or permission—but through code.

The past decade has shown that financial infrastructure is no longer neutral. Payment systems are weaponized, protesters are de-banked, foreign reserves are frozen, and entire groups are excluded from global finance with a few keystrokes.

Scenarios once considered dystopian are now standard policy.

Zcash offers an alternative. It is not a platform for speculation or yield, nor a base layer for NFTs or gaming. Its purpose is simpler: protect the privacy and fungibility of money itself. By enabling programmable private transactions at the protocol level, Zcash ensures financial freedom doesn’t vanish as money becomes fully on-chain.

The macro trends are clear: surveillance will intensify, censorship will expand, and demand for escape from fully transparent financial systems will grow. Individuals, businesses, and even institutions operating in adversarial jurisdictions will seek tools that allow value to move invisibly. Zcash may not be the only answer, but it is one of the few trustworthy, technically mature, and ideologically aligned solutions.

As Bitcoin enters the institutional realm—absorbed into ETFs, custody solutions, and sovereign portfolios—Zcash holds another front: individual autonomy. It is the quiet complement to Bitcoin’s public role, the invisible layer protecting the privacy Bitcoin never intended to provide.

In a world where every transaction leaves a trace, the right to financial invisibility may become the most valuable asset of all.

7. Risks and Resistance

Despite Zcash’s strong cryptography and clear philosophical foundation, it faces real-world challenges. The very features that make Zcash compelling—privacy guarantees, ideological purity, and technical ambition—also pose barriers to adoption, usability, and regulatory acceptance.

Regulatory pressure is the most persistent risk. While Zcash has avoided the fate of Tornado Cash—sanctioned and dismantled—it remains in a legal gray area. Privacy assets are often portrayed as tools for illicit finance, despite insufficient evidence. This perception has led to Zcash delistings in key markets like South Korea and the UK. If U.S. regulators take a stricter stance on private transactions or broaden anti-money laundering (AML) enforcement, ZEC accessibility could shrink significantly.

Usability is another hurdle. Zcash’s zero-knowledge architecture is advanced but not always user-friendly. Privacy wallets, viewing keys, and private transactions often require higher technical literacy than average users possess. While tools like Zashi have improved UX, widespread adoption demands seamless integration into mobile apps, multi-asset wallets, and payment systems. For privacy to scale, it must become effortless.

Internal ecosystem coordination also presents challenges. The coexistence of Electric Coin Company (ECC) and Zcash Foundation sometimes leads to fragmented roadmaps and inconsistent messaging. As the Crosslink upgrade approaches, close collaboration between these entities will be essential to maintain trust and drive progress.

Zcash’s dual-pool model—offering both transparent and privacy addresses—provides flexibility at a cost. Since privacy is optional rather than default, only part of the network enjoys full anonymity. If adoption of privacy addresses fails to grow alongside price (though it currently is), this split could weaken overall network privacy and undermine one of its core differentiators.

Additionally, Zcash operates in an increasingly competitive zero-knowledge technology landscape. Since its launch, zk-rollups, modular privacy layers, and Ethereum-integrated architectures have drawn significant attention and capital away from dedicated privacy chains. While few alternatives match Zcash’s maturity or mission purity, they compete for developer mindshare and capital.

Yet none of these risks are fatal. Each represents an execution challenge, not a structural flaw. Zcash’s future does not depend on redefining its mission, but on executing it precisely—clarifying its narrative, uniting its community, and relentlessly improving its product.

The battle for privacy won’t be won by ideology alone. It will be won through usability, legality, and sustained belief in the right to transact freely.

8. Investment Thesis

Figure: Grayscale ZEC Investment Case

Zcash represents a rare investment opportunity: a structurally scarce, cryptographically verified, and market-tested asset trading far below its intrinsic value.

Unlike most digital assets driven by narrative, Zcash’s value stems from its design. Built on scarcity, grounded in proven cryptography, and increasingly recognized as what it always aimed to be—the cornerstone of digital currency privacy.

The case for investing in ZEC rests on three pillars: timing, conviction, and design.

Timing: Zcash’s halving cycle lags Bitcoin by two rounds. Its monetary curve mirrors Bitcoin’s but at an earlier maturity stage. Its most recent halving occurred in November 2024—a pivotal moment in its issuance schedule—reducing annual inflation from 12.5% to ~4.2%. This places ZEC on the same structural trajectory that preceded Bitcoin’s breakout phases. Bitcoin struggled to sustain $1,000 before its second halving; afterward, programmed scarcity drove market dynamics. Today, Zcash stands at the same juncture. The next halving will reduce issuance to ~2%, followed by sub-1% inflation, gradually converging with Bitcoin’s long-term monetary model.

This shift occurs amid macro conditions increasingly favorable to hard, self-custodied assets. In an era of surveillance, capital controls, and programmable money, privacy combined with scarcity is becoming a unique asset class. Few assets combine credible monetary design, established history, and structural scarcity at such an early stage of awareness.

Conviction: Zcash carries no venture capital baggage, no ICO legacy, no speculative capital driving short-term narratives. Its issuance was transparent and limited, its distribution organic. Those who held ZEC through years of neglect deeply understand the protocol’s meaning. They are not yield chasers or hype followers, but builders, cryptographers, and early adopters of freedom-enabling technology. This foundation makes Zcash more resilient in downturns and more explosive when narratives shift.

Design: Zcash is not an app chain, a Layer-2, or a DeFi toolkit. It is money—pure, private, programmable money. This simplicity gives it clarity and staying power, standing out in a market saturated with complexity. It speaks a language institutions and individuals alike can understand: it’s Bitcoin’s architecture, but invisible.

Market Asymmetry and Portfolio Positioning

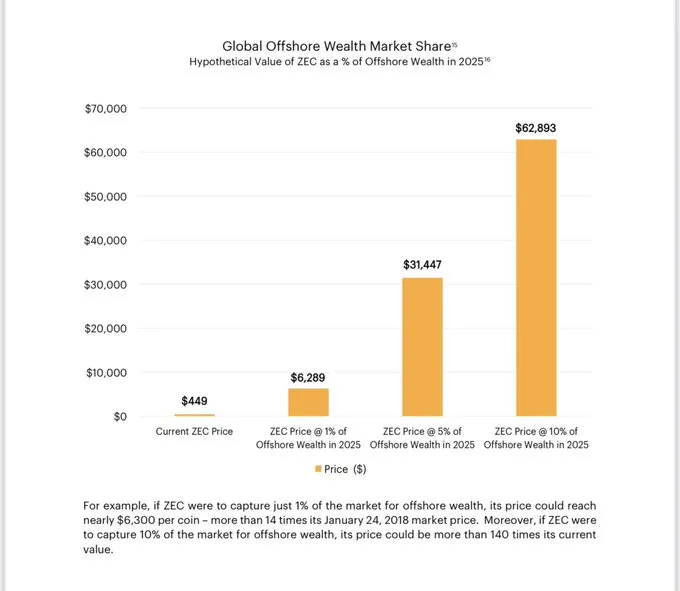

This section draws on analysis by Frank Braun, whose research at the intersection of offshore wealth and digital privacy assets provides excellent quantitative context for understanding Zcash’s opportunity.

Global assets are estimated at ~$100 trillion. Gold’s market cap is $2.7 trillion, Bitcoin’s is $2.3 trillion—about 8.5% of gold’s value and just 0.2% of global assets. In contrast, the entire privacy coin sector has a total market cap of just $12.6 billion.

This gap is especially stark when compared to the estimated $10 trillion in undeclared offshore wealth—roughly 1% of global assets. The entire market value of privacy coins represents less than 0.1% of this offshore pool.

Historically, real estate has been the primary vehicle for storing hidden wealth—offering opacity and yield. But this channel is closing. Global anti-money laundering (AML) regimes, stricter reporting standards, and digital oversight are making cross-border real estate and corporate structures increasingly transparent. As capital seeks new forms of self-custodied, censorship-resistant storage, programmable privacy networks like Zcash may become the digital alternative.

From a portfolio construction standpoint, ZEC can play two unique roles. It serves as a hedge against central bank digital currencies (CBDCs), capital controls, and the pervasive data capture of modern finance—and as a high-beta, asymmetric bet on the return to crypto’s founding ideals: self-custody and privacy as pillars of sovereignty.

Demand potential is enormous. If privacy assets capture just 1% of global offshore wealth, ZEC’s implied valuation could approach $6,000 per coin. At 5%, over $30,000; at 10%, over $60,000. These are not predictions, but frameworks—highlighting structural asymmetry in a world where financial invisibility is vanishing.

Institutional inflows remain early, but attention is shifting. After years of neglect, Zcash is re-entering conversations among influential investors and developers. Figures like Naval Ravikant and Balaji Srinivasan have publicly emphasized its role as the “invisible Bitcoin”—a scarce crypto asset built for the age of financial surveillance.

Zcash isn’t for everyone—and it doesn’t need to be. It doesn’t aim to compete with Bitcoin, but to complement it; to represent the invisible asset in a portfolio where others define visibility.

In a digital world moving toward total traceability, the most rebellious investment may no longer be leverage or yield—but privacy itself.

Conclusion

Zcash is not just another digital asset. It does not compete on transaction throughput, modular composability, or total value locked, nor does it aim to be a general-purpose decentralized finance infrastructure. Zcash’s mission is more focused—and more radical.

It exists to defend financial autonomy in an age of total visibility.

In a world where data is currency, surveillance is infrastructure, and financial transparency is no longer a choice, Zcash offers an alternative. It brings cryptographic cash to the digital age—an asset whose value transcends codebase, issuance curve, or cryptographic design. Its true worth lies in what it protects: individual autonomy in an increasingly transparent financial system.

For years, Zcash was overlooked by the market. Not because it failed, but because it refused to compromise. It held fast to an idea the market wasn’t ready to accept. That is changing. Demand for private money is rising, technological tools are maturing, and threat models are expanding.

Zcash’s success does not depend on mass adoption. It only needs to matter to those who value privacy. In a world where privacy is no longer the default, these people include not just activists or dissidents, but a growing number of ordinary citizens who recognize financial surveillance as a reality. For them, Zcash is not merely a speculative asset, but a safeguard against a future where every transaction, behavior, and association is recorded and analyzed.

Someday, invisible money may become indispensable. And when that day comes, Zcash won’t need to evolve to fit the times. It will already be what the world needs.

If you’d like to explore this topic further, the following resources offer excellent insights into Zcash, privacy technology, and the macro environment shaping digital sovereignty:

Disclaimer: The above does not constitute any financial advice. This is solely my personal opinion and how I’ve chosen to navigate these changes. Everyone’s situation is different—please conduct independent research, think critically, and make decisions that suit your own circumstances.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News